Macromill Bundle

Who Really Owns Macromill?

Unraveling the Macromill SWOT Analysis, a leading market research firm, is essential for any investor or strategist. Understanding the intricacies of Macromill's ownership structure offers critical insights into its strategic direction and future potential. From its inception to its current standing, the evolution of Macromill's ownership tells a compelling story of growth and adaptation.

This exploration into Macromill's ownership will delve into the company's Macromill company history, examining key Macromill investors, and shedding light on the current Macromill shareholders. Discovering who owns Macromill is key to understanding its market position and anticipating its strategic moves. This deep dive will provide valuable context for anyone seeking to understand the Macromill ownership landscape.

Who Founded Macromill?

The origins of the Macromill company trace back to its founding in 2000. While specific details about the initial share distribution among the founders are not publicly available, the company was established by Scott Ernst, who later became CEO and representative director, and Tetsuya Hori, along with other individuals.

In the early stages of a company like Macromill, it's common for founders to hold a significant portion of the shares. This reflects their initial investment of capital, time, and intellectual property. These initial shareholdings are often subject to vesting schedules.

Buy-sell clauses are also typical in early agreements, which dictate how shares can be transferred, especially if a founder leaves. This helps maintain control and stability within the company as it grows. Early backing from angel investors or friends and family is also a common characteristic of startup funding.

Scott Ernst, as CEO, and Tetsuya Hori were key figures in Macromill's early days. Their leadership was crucial in shaping the company's direction.

Early funding often comes from angel investors or family and friends. This initial capital is essential for getting operations off the ground and fueling early growth.

Vesting schedules are used to ensure founders stay committed. This means they gradually earn full ownership of their shares over time.

These clauses help manage share transfers, especially if a founder departs. They help maintain control and stability within the company.

The founders' vision was to revolutionize market research using online panels and data technologies. This vision shaped the initial distribution of control.

The initial ownership structure aimed to ensure that strategic decisions aligned with the founders' long-term goals for the company.

Understanding the Brief History of Macromill provides context for its ownership structure. Early ownership typically involves founders and initial investors.

- Founders typically held a significant portion of shares.

- Vesting schedules were likely in place to retain founders.

- Buy-sell agreements helped manage share transfers.

- Early funding rounds provided capital for initial operations.

Macromill SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Macromill’s Ownership Changed Over Time?

The evolution of Macromill's ownership is marked by key events that have shaped its current structure. A significant milestone was its initial public offering (IPO) on the Tokyo Stock Exchange, which transitioned the company from private to public ownership. Further illustrating the dynamic nature of its ownership, the company was taken private in 2014 through a management buyout (MBO) by Bain Capital, before subsequently being relisted. This cycle highlights the influence of private equity in restructuring and repositioning the company within the market.

As of early 2024, the major shareholders of Macromill include a diverse group of institutional investors and corporate entities. The ownership structure reflects a typical distribution seen in publicly traded companies. These shifts in major shareholding directly impact company strategy and governance, as large institutional investors often exert influence through their voting power and engagement with management and the board of directors. The presence of such diverse stakeholders indicates a matured ownership profile compared to its early days. Understanding Macromill ownership is crucial for investors and stakeholders.

| Shareholder | Approximate Shareholding (as of March 31, 2024) | Notes |

|---|---|---|

| BCJ-32 | Significant | Associated with Bain Capital |

| Various Trust Banks and Investment Funds | Notable Percentages | Institutional Investors |

| Other Institutional Investors | Various | Diverse portfolio managers |

The ownership structure of the Macromill company has evolved significantly. As of March 31, 2024, key stakeholders include entities like BCJ-32, linked to Bain Capital, holding a substantial share, alongside other major institutional investors. This mix of shareholders influences the company's strategic direction and governance. Understanding the dynamics of the Macromill shareholders is essential for anyone interested in the company's performance and future.

Macromill's ownership has transitioned from private to public and back, influenced by private equity. The current ownership structure includes a mix of institutional investors and corporate entities.

- Bain Capital has played a significant role in the company's ownership history.

- Institutional investors hold notable shares, impacting company strategy.

- The ownership profile reflects a matured, publicly traded company.

- Understanding the major stakeholders is crucial for assessing the company's direction.

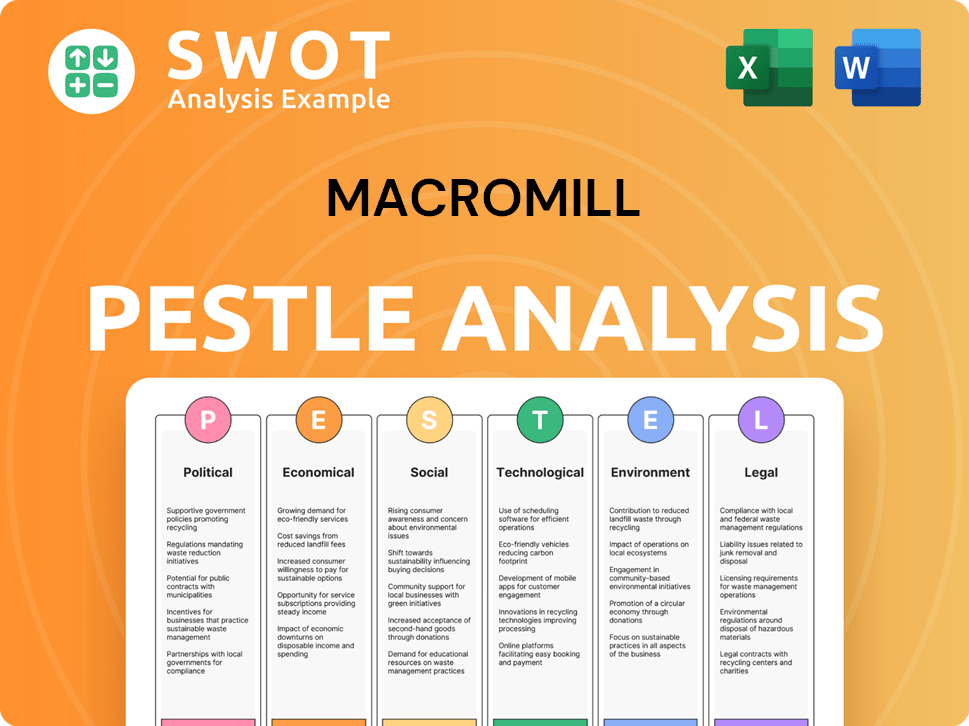

Macromill PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Macromill’s Board?

The board of directors at Macromill, Inc. oversees the company's strategic direction and governance. The composition of the board includes a mix of executive directors, who are involved in the company's daily operations, and independent outside directors, who provide objective oversight. The specific affiliations of board members with major shareholders are not always explicitly detailed in public reports. However, it's common for representatives from significant investors, such as private equity firms that have held substantial stakes, to be appointed to the board. Understanding the board's composition is essential for assessing Growth Strategy of Macromill and its alignment with shareholder interests.

The voting structure at Macromill typically follows a one-share-one-vote principle, which is standard for Japanese public companies. This ensures that voting power is directly proportional to shareholding. There are no publicly reported instances of dual-class shares or other arrangements that would grant outsized control to specific individuals or entities through special voting rights. Investors and governance watchdogs regularly scrutinize the board's composition and independence, which can impact decision-making within the company. This scrutiny is crucial for maintaining transparency and accountability.

| Board Member | Role | Affiliation (if known) |

|---|---|---|

| Tetsuya Sugiura | Representative Director, President and CEO | Executive Director |

| Yoshiaki Sugiura | Director | Independent Director |

| Hiroshi Nakano | Director | Independent Director |

The board's structure and the voting rights of Macromill shareholders are key factors in understanding the company's ownership and governance. The board's decisions are influenced by the interests of its shareholders, and the voting structure ensures that all shareholders have a proportional say in the company's direction. The company's financial performance and strategic decisions are significantly impacted by these factors, making them essential for investors and stakeholders to consider. The company's ownership structure is crucial for understanding its market position and future prospects.

The board of directors at Macromill includes executive and independent directors, ensuring a balance of operational expertise and objective oversight.

- Voting power is typically proportional to shareholding, with no known dual-class share structures.

- The board's composition and independence are regularly scrutinized by investors.

- Significant shareholders often have representation on the board.

- Understanding these elements is crucial for assessing the company's governance and strategic direction.

Macromill Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Macromill’s Ownership Landscape?

Over the past 3-5 years, the ownership of the Macromill company has evolved, reflecting broader industry trends and specific corporate actions. The market research and digital marketing sector has seen increased institutional ownership and consolidation. For the

As of March 31, 2024, major

| Shareholder Type | Shareholder | Approximate Holding (as of March 31, 2024) |

|---|---|---|

| Institutional Investors | The Master Trust Bank of Japan, Ltd. (Trust Account) | Significant |

| Institutional Investors | Custody Bank of Japan, Ltd. (Trust Account) | Significant |

| Other | Various Asset Management Firms | Variable |

The ongoing focus on leveraging online panels and data technologies suggests a continued need for capital and strategic alignment, which can influence future

Major institutional investors include trust banks and asset management firms. These entities hold significant stakes, influencing strategic decisions. Their continued presence indicates confidence in the company's future.

The company's strategic initiatives involve data technologies and online panels. This focus requires capital and strategic alignment. This may influence future ownership dynamics.

Industry trends show increased institutional ownership and consolidation.

Strategic partnerships and M&A are constantly evaluated. Future ownership may see further institutional investment. The

Macromill Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Macromill Company?

- What is Competitive Landscape of Macromill Company?

- What is Growth Strategy and Future Prospects of Macromill Company?

- How Does Macromill Company Work?

- What is Sales and Marketing Strategy of Macromill Company?

- What is Brief History of Macromill Company?

- What is Customer Demographics and Target Market of Macromill Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.