Magellan Bundle

How Does Magellan Company Thrive in Aerospace?

Magellan Aerospace stands as a pivotal player in the global aerospace landscape, but how does it function at its core? From designing and engineering to manufacturing, the company's influence is felt across commercial, military, and space sectors. Investors and industry watchers alike need to understand the inner workings of this complex organization. Unraveling the operational framework of Magellan SWOT Analysis is key to grasping its market position.

Magellan Company's success hinges on its ability to deliver high-precision components and innovative solutions, a testament to its sophisticated machining and assembly capabilities. Understanding how Magellan GPS operates, with its roots in GPS navigation and satellite navigation, is crucial for anyone interested in the company's strategic direction. This deep dive into Magellan Aerospace's business model will reveal the secrets behind its revenue generation and sustained industry presence, offering a comprehensive view of its operations.

What Are the Key Operations Driving Magellan’s Success?

The core operations of the company center around the design, manufacture, and supply of highly engineered aerospace components and assemblies. Its offerings are diverse, including components for aeroengines and aerostructures used in commercial and military aircraft, as well as advanced products tailored for space applications. The company's focus on precision and quality is evident in its advanced manufacturing techniques, which include precision machining, complex assembly processes, and rigorous quality control measures.

The value proposition of the company lies in its ability to provide integrated solutions, spanning the entire lifecycle from initial design and engineering to manufacturing and aftermarket support. This approach is supported by a supply chain deeply embedded within the aerospace ecosystem. The company leverages strategic partnerships and distribution networks to ensure timely delivery and adherence to stringent industry standards. This blend of technological expertise and vertical integration allows the company to deliver high-complexity, high-value components, resulting in enhanced performance, reliability, and cost-efficiency for its customers.

The company's primary offerings include components for aeroengines and aerostructures. These are essential for both commercial and military aircraft. They also provide advanced products tailored for space applications.

The company utilizes advanced manufacturing techniques. These include precision machining and complex assembly processes. Rigorous quality control is a key part of their operations.

The company offers integrated solutions from design to aftermarket support. They provide enhanced performance, reliability, and cost-efficiency. Their supply chain is deeply embedded within the aerospace ecosystem.

The company serves a diverse customer base. This includes major aerospace OEMs, prime contractors, and airlines globally. They have a wide reach across the aerospace industry.

The company distinguishes itself through technological expertise and vertical integration. They focus on high-complexity, high-value components. Their approach results in enhanced performance and cost-efficiency for customers.

- Technological Expertise: Advanced manufacturing capabilities and engineering.

- Vertical Integration: Control over the entire production process.

- High-Value Components: Focus on complex, critical parts.

- Strategic Partnerships: Collaborations to ensure timely delivery.

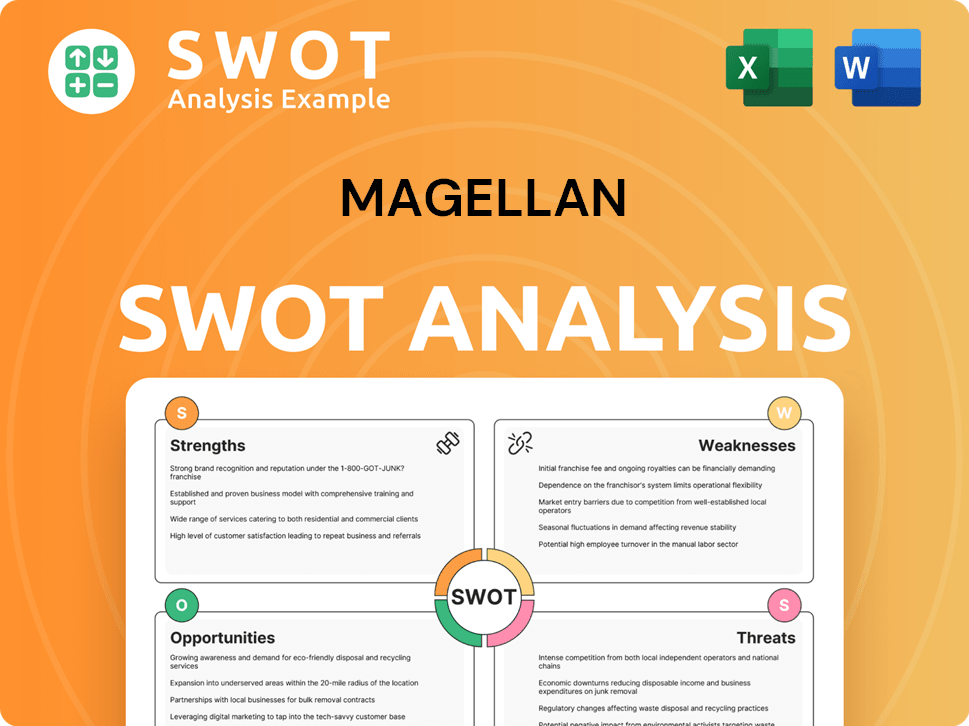

Magellan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Magellan Make Money?

The Magellan Company generates revenue primarily through various streams, focusing on the aerospace and defense sectors. Its monetization strategy involves a blend of product sales, long-term contracts, and service offerings. While specific financial details for 2024 or 2025 are not available in public summaries as of the latest information, the company's revenue model is designed for stability and growth.

A significant portion of Magellan Company's revenue comes from selling aeroengine and aerostructure components. These components are crucial for aircraft manufacturing and maintenance. The company also supplies advanced products to the military and space markets, which often involves long-term contracts and specialized technology.

Aftermarket services, including maintenance, repair, and overhaul (MRO), also contribute to the revenue streams. This diversification helps Magellan Company manage risks associated with market fluctuations, ensuring a more consistent financial performance.

The sale of aeroengine and aerostructure components forms a major revenue stream. These components are essential parts of aircraft, ensuring a steady demand from the aerospace industry.

Advanced products for military and space applications contribute significantly to revenue. These programs often involve long-term contracts, providing a stable revenue base.

Maintenance, repair, and overhaul (MRO) services generate additional revenue. This includes servicing components and providing support for the installed base, ensuring recurring income.

Licensing proprietary technologies also contributes to revenue. This allows the company to capitalize on its innovations and expand its market reach.

The company relies on long-term contracts with major aerospace manufacturers and defense contractors. These contracts provide a stable foundation for revenue generation.

Revenue streams are diversified across commercial and military aerospace sectors. This diversification helps mitigate risks associated with cyclical downturns in either market.

The monetization strategies of the Magellan Company are centered on securing long-term contracts and diversifying revenue streams. This approach helps to ensure financial stability and resilience. For more insights, you can explore the Growth Strategy of Magellan.

- Focus on long-term contracts with major aerospace and defense clients.

- Diversify revenue streams across commercial, military, and space sectors.

- Leverage proprietary technologies through licensing agreements.

- Expand aftermarket services to support the installed base of components.

- Invest in research and development to maintain a competitive edge in the market.

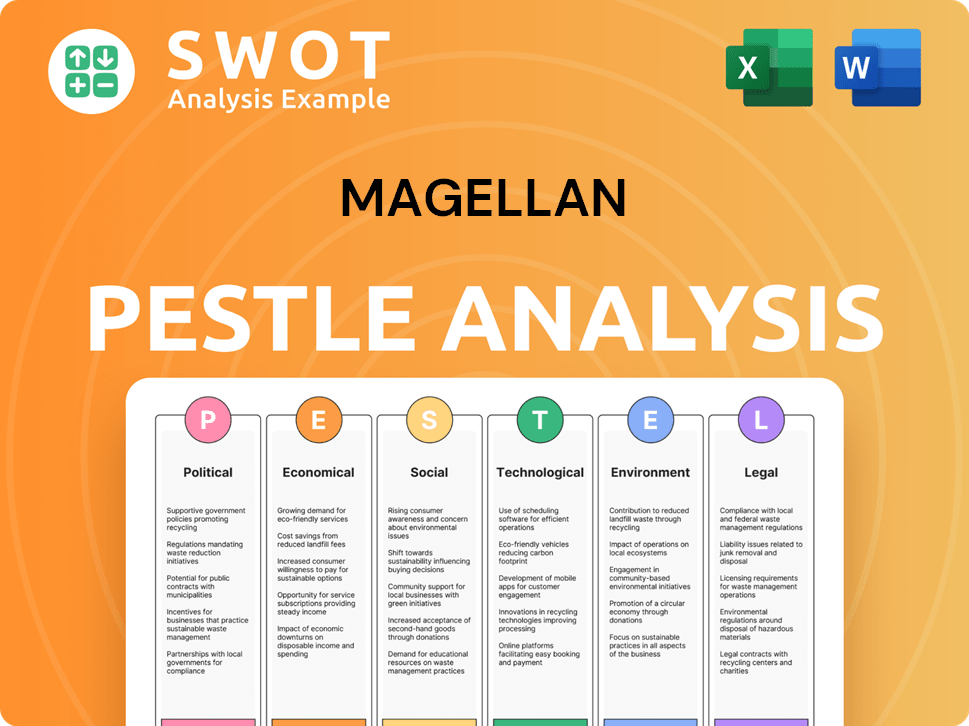

Magellan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Magellan’s Business Model?

The history of the company is marked by significant achievements and strategic shifts. These have included acquisitions that have expanded its capabilities and market reach, as well as responses to operational challenges such as supply chain disruptions. The company's evolution reflects its adaptation to the dynamic aerospace industry.

Strategic moves have been crucial for the company's growth. This includes expanding its presence in key geographic regions and diversifying its product portfolio. The company has also focused on optimizing its inventory management and strengthening supplier relationships to navigate operational challenges.

The company's competitive advantages stem from its deep technical expertise, established relationships, and a reputation for producing high-quality components. The company continues to adapt to new trends by investing in research and development and aligning its product offerings with evolving industry needs.

The company has achieved several key milestones throughout its history, including significant acquisitions. These acquisitions have helped to broaden its product offerings and strengthen its market position. The company has also expanded its manufacturing capabilities.

Strategic moves have been essential for the company's growth and adaptation to market changes. These moves have included expanding into new geographic markets and forming strategic partnerships. The company has also invested in new technologies to remain competitive.

The company's competitive edge is based on its technical expertise and strong customer relationships. It has a reputation for producing high-quality products. The company's ability to innovate in manufacturing processes and materials technology provides a sustained edge.

The company has adapted to new trends by investing in research and development. It focuses on lightweight materials and fuel-efficient aircraft. This helps the company meet the evolving needs of the aerospace industry.

The company's financial performance has been influenced by its strategic decisions and market dynamics. The company's ability to adapt to changing market conditions and maintain strong customer relationships has been critical. For a deeper dive into the company's ownership structure and financial details, consider exploring Owners & Shareholders of Magellan.

- The company’s revenue has shown growth, reflecting its successful market strategies.

- Investments in research and development have supported its competitive edge.

- Strategic partnerships have expanded its market reach and capabilities.

- The company has maintained a strong position in the aerospace market.

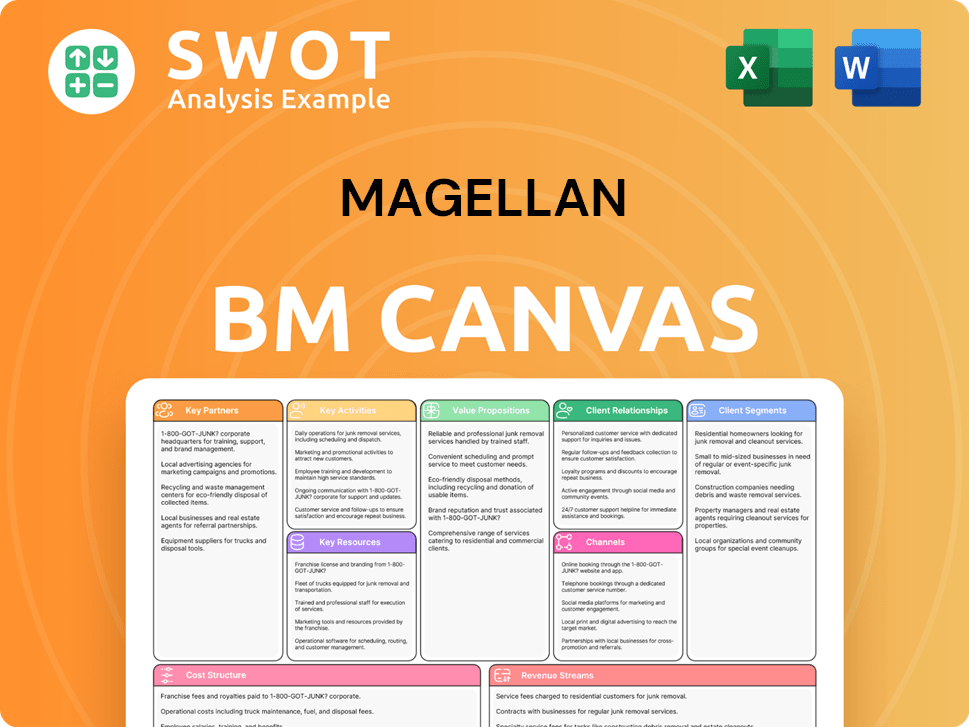

Magellan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Magellan Positioning Itself for Continued Success?

The position of the company within the aerospace manufacturing industry is significant, acting as a key supplier to major original equipment manufacturers (OEMs) and defense organizations. Its market share is supported by long-term customer relationships and its specialization in high-precision, complex components. The company's operations are influenced by both commercial and defense sectors, making it subject to the cyclical nature of aerospace and geopolitical factors.

Several risks could affect the company's performance, including fluctuations in commercial aerospace demand, geopolitical instability, and the need for continuous technological advancements. Supply chain vulnerabilities and competition from other global aerospace manufacturers present ongoing challenges. The company's future outlook depends on its strategic initiatives, including investments in advanced technologies and expansion into high-growth areas like space.

The company holds a strong position as a supplier to major OEMs and defense organizations. Its focus on specialized components and long-term customer relationships supports its market share. The aerospace industry is competitive, requiring continuous innovation and efficiency to maintain its position.

Key risks include the cyclical nature of commercial aerospace, geopolitical impacts on defense spending, and the need for technological advancement. Supply chain disruptions and competition pose additional challenges. Economic downturns and changes in government spending can significantly affect the company's financial performance.

The company's future is tied to strategic initiatives, including investments in advanced manufacturing and expansion into space. It aims to capitalize on long-term growth trends in commercial and military aerospace. The increasing demand for new aircraft and maintenance provides opportunities for sustained revenue.

The company is focusing on advanced manufacturing technologies and operational efficiency. Expansion into higher-growth segments, such as the space sector, is a key strategy. Strategic partnerships and innovation are crucial for maintaining a competitive edge and capturing market opportunities.

The aerospace industry is expected to see continued growth, driven by increasing air travel and defense spending. The company's ability to adapt to technological changes and market demands is crucial. The demand for aircraft maintenance and upgrades provides a stable revenue stream.

- The commercial aerospace market is projected to grow, with forecasts indicating an increase in aircraft deliveries over the next decade.

- The defense sector is influenced by geopolitical factors, with spending patterns varying based on global events.

- Investments in research and development are essential for staying competitive in the rapidly evolving aerospace industry.

- The company's ability to secure and maintain long-term contracts with key customers is critical for financial stability.

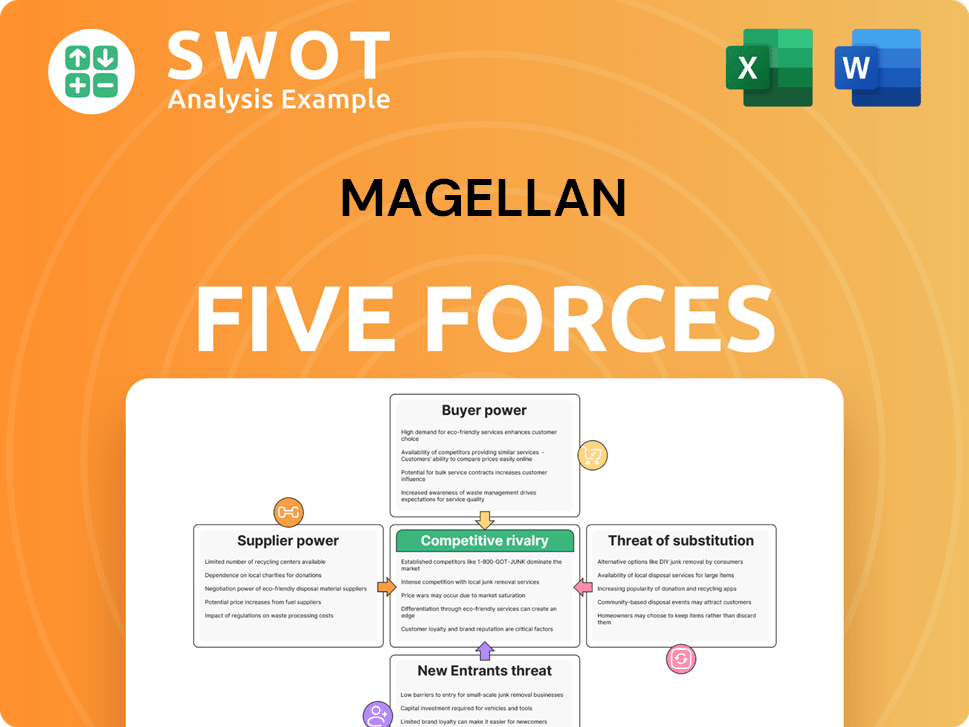

Magellan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Magellan Company?

- What is Competitive Landscape of Magellan Company?

- What is Growth Strategy and Future Prospects of Magellan Company?

- What is Sales and Marketing Strategy of Magellan Company?

- What is Brief History of Magellan Company?

- Who Owns Magellan Company?

- What is Customer Demographics and Target Market of Magellan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.