Magellan Bundle

Who Really Controls Magellan Aerospace?

Unraveling the ownership of a company is crucial for understanding its trajectory. Magellan Aerospace, a global player since 1997, is a key entity in the aerospace sector, designing and manufacturing critical components. Its ownership structure, a blend of institutional and individual investors, is a key factor in its operational strategies and market performance. Understanding the ownership of Magellan company is key.

This deep dive into Magellan SWOT Analysis will explore the evolution of Magellan company ownership, from its inception to the present day. We'll examine the influence of key shareholders and the impact on the company's strategic direction. Discover the answer to "Who owns Magellan?" and gain insights into the company's responsiveness to market demands and its long-term goals, exploring the Magellan company owner and the Magellan company ownership structure.

Who Founded Magellan?

The formation of Magellan Aerospace in 1997 stemmed from a merger, rather than a traditional startup. This means identifying singular 'founders' with initial equity splits is less straightforward. The early ownership structure was a consolidation of the shareholdings of the merging entities, Fleet Aerospace and Magellan Aerospace Limited.

Detailed information about specific individual founders' equity percentages at the very beginning of the consolidated Magellan Aerospace in 1997 is not readily available as a simple percentage breakdown for a few individuals. The early ownership was distributed among the shareholders of Fleet Aerospace and Magellan Aerospace Limited based on the merger agreement terms.

Early backers included the existing institutional and individual investors of the merging companies. There is no public record of angel investors or friends and family acquiring stakes during the initial phase. Agreements like vesting schedules or buy-sell clauses, common in startups, were superseded by the corporate governance and shareholder agreements of the publicly traded entities involved in the merger.

The 1997 merger created a new entity, making traditional founder equity splits less applicable. Ownership was a consolidation of existing shareholders from Fleet Aerospace and Magellan Aerospace Limited.

Early ownership was distributed among the shareholders of the merging companies. The merger agreement determined the distribution of shares in the new company.

Early investors were primarily the institutional and individual investors of the merging entities. No specific angel investors are publicly documented during the initial phase.

Vesting schedules and buy-sell clauses were replaced by corporate governance rules. These rules were already in place due to the merging companies being publicly traded.

Ownership disputes were resolved during merger negotiations. The resulting ownership reflected the agreed-upon terms of consolidation.

The merger aimed to create a stronger, more diversified aerospace company. The distribution of control resulted from valuations and negotiations.

The Magellan company ownership structure evolved from the merger of Fleet Aerospace and Magellan Aerospace Limited. The Magellan company owner at the time of the merger was a collective of shareholders from the merging entities. Understanding the Magellan company history involves recognizing that the initial ownership was a consolidation of existing shareholders. For more insights into the company's strategic direction, consider reading about the Target Market of Magellan.

The formation of Magellan Aerospace involved a merger, which shaped its early ownership structure. The ownership was distributed among the shareholders of the merging companies, not a few individual founders.

- The initial ownership structure came from the merger of Fleet Aerospace and Magellan Aerospace Limited.

- Early investors were the existing shareholders of the merging entities.

- Agreements common in startups were replaced by corporate governance rules.

- Ownership disputes were resolved through the merger negotiations.

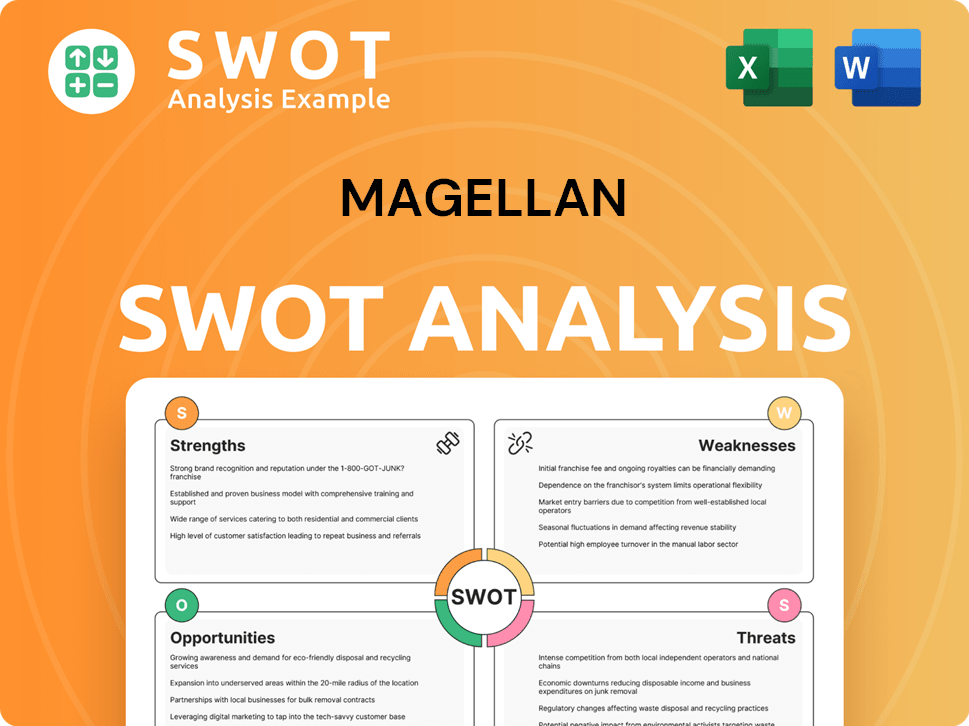

Magellan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Magellan’s Ownership Changed Over Time?

The evolution of Magellan Aerospace's ownership structure is primarily shaped by its status as a publicly traded entity. The company went public in 1997 following a merger, a pivotal event that established its presence on the Toronto Stock Exchange (TSX) under the ticker MAL. Since then, the ownership has been subject to the dynamics of the stock market, with fluctuations in market capitalization reflecting the aerospace sector's performance and investor sentiment.

As a publicly traded company, Magellan's ownership has seen continuous shifts. Institutional investors, mutual funds, and index funds typically hold a significant portion of the shares. These changes in ownership can influence the company's strategy and governance, as major shareholders often exert influence through their voting power and engagement with management and the board.

| Stakeholder | Percentage of Shares (as of March 2024) | Notes |

|---|---|---|

| RBC Global Asset Management Inc. | 6.26% | A major institutional investor. |

| Vanguard Group Inc. | 2.95% | Another significant institutional investor. |

| Mawer Investment Management Ltd. | 2.73% | An institutional investor. |

| BMO Asset Management Inc. | 2.05% | Institutional investor. |

Individual insiders, including the executive team and board of directors, also hold shares, although their collective percentage is typically smaller than institutional investors. For example, James S. Butyniec, President and CEO, held 0.17% of shares, and William A. Missimer, Chairman of the Board, held 0.09% as of March 2024.

Magellan Aerospace is a publicly traded company on the TSX under the ticker MAL.

- Institutional investors hold a significant portion of the shares.

- Major shareholders can influence company strategy and governance.

- Individual insiders also hold shares, though in smaller percentages.

- The ownership structure is subject to market dynamics.

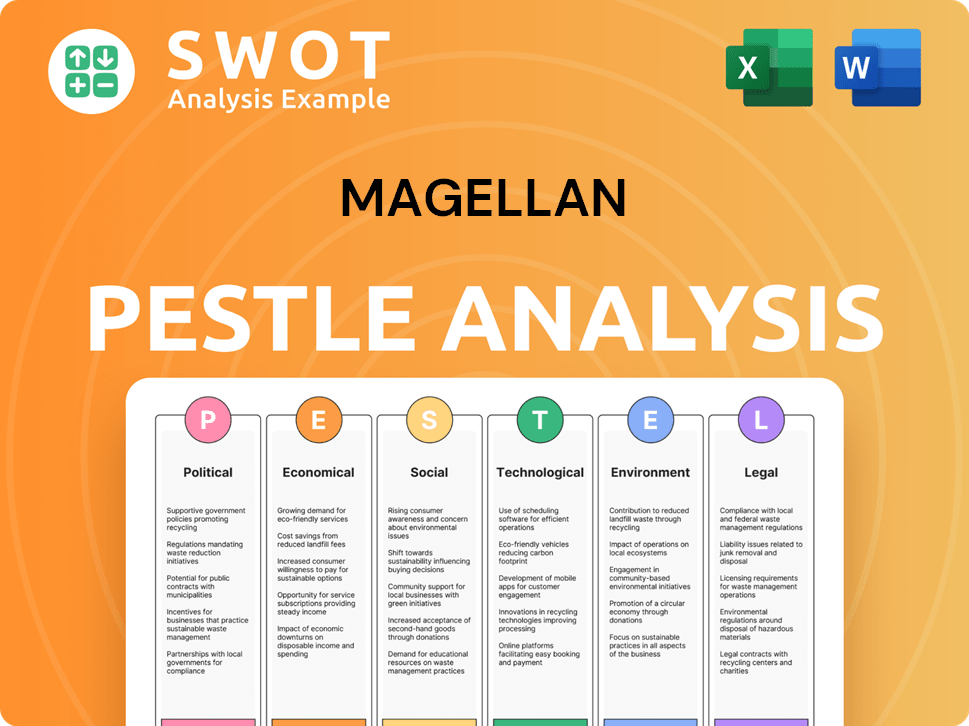

Magellan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Magellan’s Board?

The current Board of Directors for the Magellan company plays a vital role in its governance and strategic direction. As of April 2025, the board includes key figures such as William A. Missimer (Chairman), James S. Butyniec (President and CEO), Elena M. Amador, Albert E. Buskard, Richard H. Neveu, and John B. Walker. These individuals collectively oversee the company's operations, ensuring alignment with shareholder interests and long-term value creation. The presence of independent directors is a standard governance practice, designed to promote balanced decision-making within the company.

The board's composition reflects a mix of major shareholders, independent members, and executive leadership, which is typical for a publicly traded company. While specific details on which board members directly represent major shareholders are not always publicly detailed, the board's structure is designed to ensure comprehensive oversight of the company's activities in the aerospace industry. Understanding the board's composition is crucial for investors and stakeholders interested in the Brief History of Magellan and its future strategic direction.

| Board Member | Title | Role |

|---|---|---|

| William A. Missimer | Chairman | Oversees board activities |

| James S. Butyniec | President and CEO | Manages daily operations and strategic planning |

| Elena M. Amador | Director | Provides oversight and strategic guidance |

| Albert E. Buskard | Director | Provides oversight and strategic guidance |

| Richard H. Neveu | Director | Provides oversight and strategic guidance |

| John B. Walker | Director | Provides oversight and strategic guidance |

The voting structure for Magellan Aerospace shares generally follows a one-share-one-vote system. There are no publicly disclosed special voting rights or founder shares that would grant outsized control to specific individuals. This structure ensures that voting power is proportional to share ownership, promoting fairness and transparency in corporate governance. Recent governance activities have not included any widely reported proxy battles or activist investor campaigns that significantly shaped the company's decision-making, reflecting a stable environment focused on long-term value creation for all shareholders.

Understanding the board of directors is crucial for assessing the company's governance and strategic direction.

- The board includes a mix of major shareholders, independent members, and executive leadership.

- Voting rights are typically one-share-one-vote, ensuring proportional representation.

- The board's decisions focus on long-term value creation and strategic oversight.

- The company's governance structure promotes fairness and transparency.

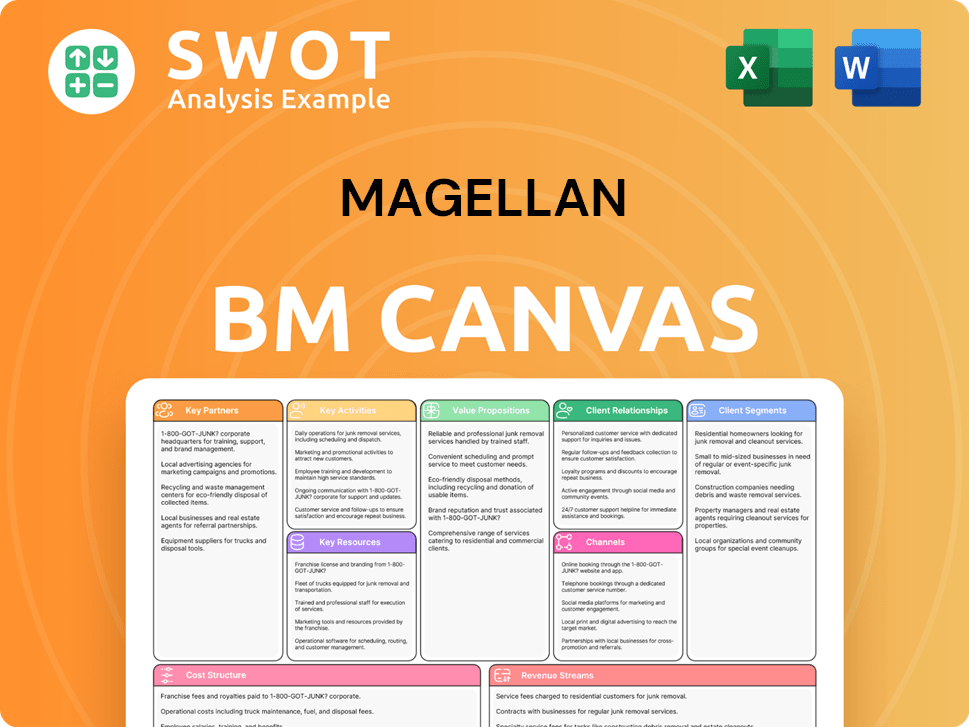

Magellan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Magellan’s Ownership Landscape?

Over the past few years, the ownership profile of the Magellan company has shown ongoing activity, mirroring wider trends within the aerospace sector. The company's capital structure is consistently managed, though there haven't been any major share buybacks or secondary offerings that significantly shifted the ownership structure, according to recent reports. Mergers and acquisitions are common in the aerospace industry and have historically influenced ownership changes for Magellan Aerospace; for instance, the acquisition of Euravia Engineering & Supply Co. Ltd. in 2021, which involved capital allocation and potential minor shifts in ownership focus.

Leadership changes, such as the appointment of James S. Butyniec as President and CEO, can indirectly influence ownership trends. Industry trends indicate an increase in institutional ownership as large funds seek stable, long-term investments. The focus shifts towards institutional and strategic investor influence as founder dilution is a natural progression for mature public companies. Consolidation also plays a role, with larger entities acquiring smaller ones, leading to ownership shifts. There have been no recent public statements regarding significant ownership changes or privatization plans. The company continues to operate as a publicly traded entity, reflecting the diverse interests of the market. For more insights, see the Growth Strategy of Magellan.

| Aspect | Details | Recent Data |

|---|---|---|

| Ownership Type | Publicly Traded | Reflects diverse market interests |

| Key Events | Acquisitions, Leadership Changes | Euravia Engineering & Supply Co. Ltd. acquisition in 2021 |

| Industry Trends | Institutional Ownership, Consolidation | Increased institutional investment in aerospace |

The ownership of Magellan Aerospace is primarily influenced by market dynamics. The company's structure is shaped by ongoing strategic activities. Institutional investors play a key role in the company's ownership profile.

The ownership structure reflects the trends of the aerospace sector. Strategic acquisitions and leadership changes have a direct impact. The focus is on long-term investment with institutional investors.

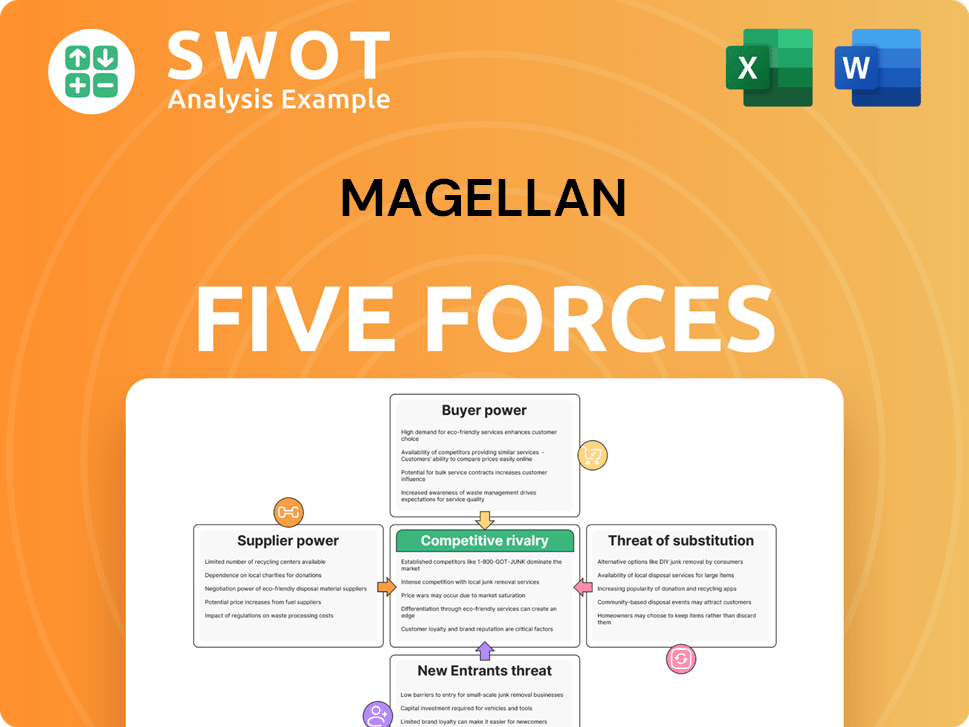

Magellan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Magellan Company?

- What is Competitive Landscape of Magellan Company?

- What is Growth Strategy and Future Prospects of Magellan Company?

- How Does Magellan Company Work?

- What is Sales and Marketing Strategy of Magellan Company?

- What is Brief History of Magellan Company?

- What is Customer Demographics and Target Market of Magellan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.