Oracle Bundle

How Does the Oracle Company Thrive in Today's Tech Landscape?

Oracle, a titan in the tech world, has revolutionized how businesses manage data and operate in the cloud. From its humble beginnings in 1977, Oracle has grown into a global force, serving nearly all of the Fortune 500. Understanding the inner workings of the Oracle SWOT Analysis is essential for anyone looking to understand its market position.

With a staggering $53 billion in revenue in fiscal year 2024, the Oracle company demonstrates its powerful influence. Its strategic shift to a cloud-centric model, particularly with Oracle cloud infrastructure, has fueled impressive growth, positioning it to capitalize on the booming cloud market. This exploration will dissect the Oracle business model, its diverse Oracle products and Oracle services, and its strategic moves, offering a comprehensive view of this industry leader and answering questions like "How does Oracle make money?" and "What is Oracle known for?".

What Are the Key Operations Driving Oracle’s Success?

The Oracle company creates value by providing a comprehensive suite of integrated cloud services, database management systems, and enterprise applications. These offerings are designed to help businesses manage their operations and data efficiently. Key components include Oracle Cloud Infrastructure (OCI), Platform as a Service (PaaS), Software as a Service (SaaS) applications such as Fusion Cloud ERP and NetSuite Cloud ERP, and traditional database software. This diverse portfolio addresses a wide range of business needs, contributing to its strong market position.

Oracle's core operations revolve around continuous technology development, a global network of data centers, and robust sales and customer service channels. The company's integrated approach simplifies IT infrastructure and reduces complexity for enterprises. This operational model supports a broad spectrum of customers, from startups to large enterprises and government agencies, leveraging its expertise in handling sensitive data and navigating complex regulatory environments.

The Oracle business model focuses on delivering end-to-end solutions. This approach allows the company to provide seamless integration across its products and services. Oracle's commitment to innovation and customer satisfaction has solidified its position in the tech industry. For example, Oracle's revenue in fiscal year 2024 was approximately $50.0 billion, demonstrating its financial strength and market influence.

OCI provides a broad set of cloud services, including computing, storage, networking, and databases. It is designed to support a wide range of workloads. OCI's architecture is built for high performance, security, and cost-effectiveness, making it a strong choice for enterprises.

Oracle's database offerings are known for their reliability, scalability, and security. They support various data types and workloads. The database services are available on-premises, in the cloud, and in hybrid environments, providing flexibility to customers.

Oracle offers a comprehensive suite of SaaS applications, including ERP, HCM, and CRM solutions. These applications help businesses manage their core functions. The SaaS applications are designed to be user-friendly and easily integrated.

Oracle provides a range of services, including consulting, support, and managed services. These services help customers implement and manage Oracle products. The services are designed to ensure customer success and maximize the value of Oracle's offerings.

Oracle's operational uniqueness lies in its integrated approach, offering end-to-end solutions that simplify IT infrastructure and reduce complexity. The company's supply chain is supported by numerous data centers worldwide, ensuring effective demand fulfillment. Partnerships with industry giants like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) are integral to Oracle's multi-cloud strategy, expanding its reach.

- Global Data Centers: Oracle operates numerous data centers worldwide, ensuring high availability and performance.

- Strategic Partnerships: Collaborations with major cloud providers enhance flexibility and interoperability.

- Autonomous Capabilities: Self-managing, self-securing, and self-repairing features within OCI and Oracle applications minimize downtime.

- Customer Focus: Oracle's support and consulting services help customers implement and manage their products effectively.

Oracle SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Oracle Make Money?

The Oracle company generates revenue through a diversified set of streams, with a strong emphasis on cloud services and license support. This strategy has positioned the company as a key player in the tech industry. Understanding these revenue streams is crucial for assessing the Oracle business model and its financial health.

In fiscal year 2024, Oracle's total revenue reached approximately $53 billion, with the 'Cloud Services and License Support' segment contributing the majority. This segment includes cloud services revenue (IaaS plus SaaS) and cloud license and on-premise license support. The company's approach to monetization includes subscription agreements, tiered pricing, and cross-selling its integrated solutions.

The company's strong performance in cloud services, particularly in Cloud Infrastructure (IaaS) and Cloud Application (SaaS), showcases its adaptability. The significant remaining performance obligations (RPO) further highlight the company's strong future revenue prospects. Analyzing these elements provides insights into how Oracle products and services drive its financial performance.

This segment is the primary revenue driver for Oracle, accounting for approximately 74% of total revenue in fiscal year 2024. For Q3 FY2025, revenues in this segment were up 10% year-over-year in USD, and up 12% in constant currency, to $11.0 billion.

In Q3 FY2025, this revenue stream grew by 49% year-over-year to $2.7 billion. For Q1 FY2025, it increased by 45% year-over-year to $2.2 billion, demonstrating significant growth in this area.

Cloud Application (SaaS) revenue increased by 9% year-over-year to $3.6 billion in Q3 FY2025. In Q1 FY2025, it was $3.5 billion, up 10% year-over-year.

Fusion Cloud ERP (SaaS) revenue saw a 16% year-over-year increase to $0.9 billion in Q1 FY2025, showcasing strong demand for its SaaS solutions.

NetSuite Cloud ERP (SaaS) revenue grew 20% year-over-year to $0.9 billion in Q1 FY2025, indicating robust growth in this segment.

Oracle's RPO surged 62% year-over-year to $130 billion in Q3 FY2025, indicating strong future revenue visibility and a growing trend of customers opting for larger, longer contracts. This backlog is expected to drive a 15% increase in overall revenue for fiscal year 2026.

Besides cloud services, Oracle generates revenue from various other sources. These include software licensing, hardware sales, and services. The 'Cloud License and On-Premise License' segment generated about 10% of total revenue in fiscal year 2024. Hardware products contributed around 6% of total revenue, and services accounted for approximately 10%.

- Oracle cloud services are a significant part of the revenue, with IaaS and SaaS offerings being key drivers.

- Oracle database products and related services continue to be essential components of the business.

- Oracle services, including support and consulting, contribute a considerable portion of the revenue.

- The company's approach includes subscription agreements and tiered pricing models. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Oracle.

Oracle PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Oracle’s Business Model?

The journey of the Oracle company has been marked by significant milestones and strategic shifts, most notably its aggressive pivot toward a cloud-centric business model. This transformation has involved substantial investments and acquisitions, positioning the company to compete in the evolving technology landscape. Understanding the evolution of Oracle's business model provides key insights into its current market position and future prospects.

A pivotal move was the acquisition of Cerner in 2022, which expanded Oracle's presence in the healthcare IT sector. This strategic expansion aimed to enhance its product offerings and drive growth in a key market. The company has also faced operational challenges, such as managing increased capital expenditures required for its cloud and AI initiatives. Despite these challenges, Oracle is focused on building additional cloud capacity and addressing a backlog of orders.

A key strategic move has been the formation of multi-cloud partnerships with industry leaders like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS). These collaborations enable customers to access Oracle database services within these other cloud environments, broadening Oracle's reach and customer base and ensuring ecosystem-wide flexibility. For more information about the Oracle target market, please read this article: Target Market of Oracle.

Key milestones include the acquisition of Cerner in 2022, which expanded the company's presence in healthcare IT. Other milestones include the formation of multi-cloud partnerships with industry leaders. These partnerships have broadened the company's reach and customer base.

Strategic moves include the formation of multi-cloud partnerships with Microsoft Azure, Google Cloud, and AWS. Oracle is also heavily investing in AI and machine learning. These moves aim to integrate generative AI capabilities into its offerings.

Oracle's competitive advantages stem from its enterprise expertise, particularly in databases, with a market share of approximately 28% in 2023. Oracle's cloud offerings are often more competitively priced than major cloud providers, especially for AI training. The company is heavily investing in AI and machine learning.

Oracle plans to double its capital expenditure in fiscal year 2025 compared to fiscal year 2024. In Q1 2024, Oracle's cloud revenue was up 46%. The company's total revenue for fiscal year 2023 was approximately $50 billion.

Oracle's competitive advantages include its enterprise expertise and strong position in the database market. Its cloud offerings are often more competitively priced than those of major competitors. The company is heavily investing in AI and machine learning, integrating generative AI capabilities into its products.

- Strong position in the database market.

- Competitive cloud pricing, especially for AI training.

- Focus on industry-specific cloud solutions.

- Multi-cloud partnerships.

Oracle Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Oracle Positioning Itself for Continued Success?

The Oracle company holds a strong position in the tech industry, particularly in the database software market. Its cloud infrastructure segment is growing, driven by increasing demand for AI-related services. The company serves a global customer base, including a significant portion of the Global Fortune 500 companies.

However, Oracle's business model faces risks such as intense competition and macroeconomic uncertainties. Despite these challenges, the company has an optimistic future outlook, with plans for expanding its cloud infrastructure and enhancing AI capabilities. Strategic initiatives and a strong remaining performance obligation support its ability to generate revenue in the evolving technology landscape.

In 2023, Oracle's database software market share was around 28%, expected to remain stable in 2024. Its cloud infrastructure market share was approximately 4.5% in 2023, with a projected increase to 5.1% by 2024. The company's global reach extends to over 175 countries, serving 98% of the Global Fortune 500 companies.

Key risks include strong competition from other cloud providers, execution challenges related to its cloud-based subscription model, and macroeconomic uncertainties. Currency fluctuations and rising operational costs have also contributed to slight earnings misses in recent quarters. Investors should also consider the ongoing Growth Strategy of Oracle.

The future outlook is optimistic, fueled by strong demand for cloud services and AI infrastructure. The company anticipates double-digit revenue growth for fiscal year 2025. Significant investments in cloud infrastructure expansion and AI capabilities are planned, with a doubling of capital expenditure in FY2025 compared to FY2024.

Strategic initiatives include multi-cloud adoption through partnerships and integrating AI into core applications. CEO Safra Catz has highlighted record sales contracts driven by AI demand. A substantial remaining performance obligation of $130 billion in Q3 FY2025 is expected to drive a 15% increase in overall revenue in the next fiscal year.

Oracle's competitive edge comes from its established database business and industry-specific solutions, which allow it to sustain and expand its revenue generation. The company's focus on AI and cloud services further strengthens its position.

- Strong database market share.

- Growing cloud infrastructure segment.

- Focus on AI integration.

- Extensive global presence.

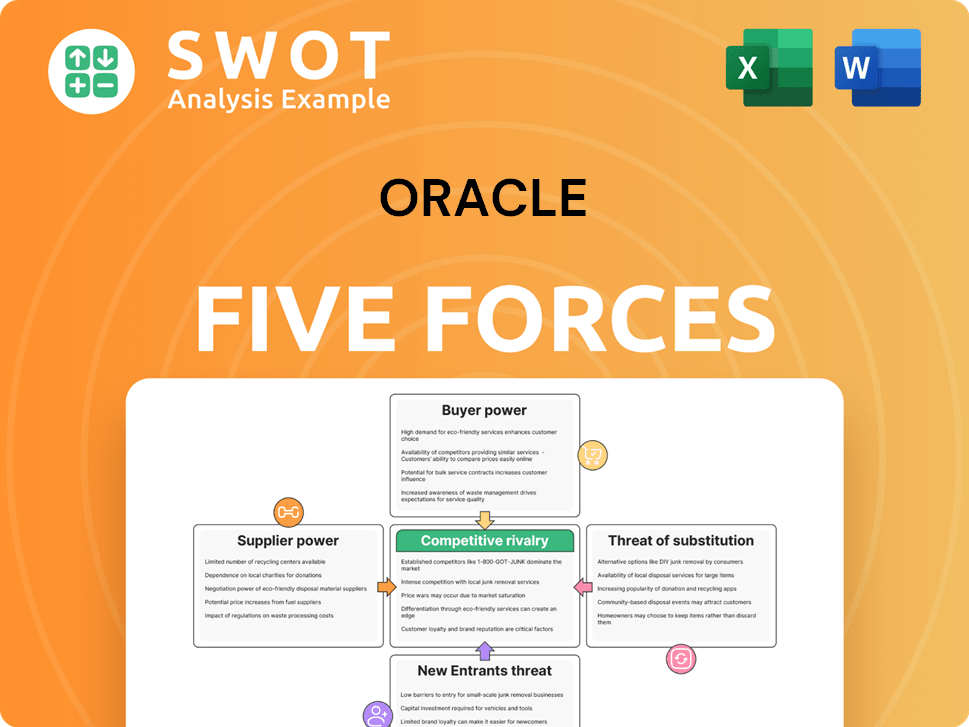

Oracle Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Oracle Company?

- What is Competitive Landscape of Oracle Company?

- What is Growth Strategy and Future Prospects of Oracle Company?

- What is Sales and Marketing Strategy of Oracle Company?

- What is Brief History of Oracle Company?

- Who Owns Oracle Company?

- What is Customer Demographics and Target Market of Oracle Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.