Petco Health and Wellness Company Bundle

How Does Petco Thrive in the Pet Care Industry?

Petco Health and Wellness Company, Inc. (Nasdaq: WOOF) is a leading force in the pet care sector, consistently innovating to meet the evolving needs of pet parents. With over 1,500 Petco locations across the U.S., Mexico, and Puerto Rico, the company offers a comprehensive suite of Petco services, from essential supplies to specialized care. As of June 5, 2025, Petco demonstrated resilience, reporting $1.5 billion in net sales for Q1 2025, despite a challenging market.

This exploration dives deep into Petco's operational strategies, revenue streams, and competitive advantages, offering crucial insights for investors and industry analysts. Understanding the company's commitment to Petco Health and Wellness Company SWOT Analysis is vital for assessing its potential. Whether you're researching Petco products

, exploring Petco pet care

options, or investigating Petco's adoption process

, this analysis provides a comprehensive view of its business model and future prospects. We will also explore questions such as "How does Petco's health insurance work

" and "Petco vet services near me

" to give you a complete picture.

What Are the Key Operations Driving Petco Health and Wellness Company’s Success?

Petco Health and Wellness Company, creates value by offering a comprehensive range of pet care solutions. These solutions are designed to improve the lives of pets and their parents. The company's core offerings include a wide variety of products and services, catering to diverse customer segments that prioritize pet health and well-being.

The company's operations are built around a multi-channel business model. This model seamlessly integrates over 1,500 physical pet care centers across the U.S., Mexico, and Puerto Rico with a dynamic online platform (petco.com and the Petco app). This omnichannel approach allows customers flexibility in how they shop and access services. Operational processes include strategic sourcing of high-quality products, leveraging partnerships with leading pet food brands and veterinary service providers, and efficient logistics to ensure product availability.

Petco's operations are unique because of its full-spectrum approach to pet wellness. This approach differentiates it from competitors. Key elements include on-site veterinary services, personalized pet care advice from knowledgeable staff, and community-driven initiatives like in-store adoption events. The company's core capabilities translate into customer benefits by providing a one-stop destination for all pet needs, fostering customer loyalty, and promoting responsible pet ownership. You can learn more about their strategies in this article about Marketing Strategy of Petco Health and Wellness Company.

Petco offers a wide range of products and services. These include premium pet food and supplies, grooming, training, and veterinary services. The company focuses on providing a comprehensive ecosystem for pet care.

Petco operates through a multi-channel business model. This includes physical stores and an online platform. This allows customers to shop and access services in various ways.

Petco distinguishes itself through its full-spectrum approach to pet wellness. This includes on-site veterinary services and personalized pet care advice. The company also focuses on community-driven initiatives.

Customers benefit from a one-stop destination for all their pet needs. This fosters customer loyalty and promotes responsible pet ownership. In 2024, Petco facilitated the adoption of over 400,000 animals through its in-store events and partnerships.

Petco's value proposition centers on providing a comprehensive pet care experience. It aims to meet all pet-related needs in one place. This approach enhances customer convenience and satisfaction.

- Premium products and services.

- Convenient omnichannel shopping.

- Expert advice and support.

- Community involvement and adoption events.

Petco Health and Wellness Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Petco Health and Wellness Company Make Money?

The revenue streams and monetization strategies of the Petco Health and Wellness Company are designed to ensure financial stability and promote growth. The company employs a multifaceted approach, leveraging both product sales and service offerings to cater to the comprehensive needs of pet owners. This strategy allows Petco to capture a significant share of the pet care market.

The primary revenue source for Petco comes from the direct sale of pet products. These products are available through their retail stores and e-commerce platform. In addition, Petco generates significant income through its services segment, which includes grooming, training, and veterinary care, reflecting a growing trend in pet wellness and lifestyle services.

Furthermore, Petco strategically uses partnerships and collaborations with pet brands and suppliers to enhance its product offerings. The company also provides a rewards program to incentivize repeat purchases and customer loyalty. For more details on Petco's overall strategy, you can read about the Growth Strategy of Petco Health and Wellness Company.

The revenue model is diversified, with key components contributing to overall financial performance. The direct sales of pet products, including food, supplies, toys, and accessories, form a significant portion of the revenue. Services, such as grooming, training, and veterinary care, are also important revenue drivers, especially with the increasing focus on pet wellness.

- Petco products include a variety of items, focusing on premium and health-conscious options.

- Petco services accounted for approximately 20% of total revenue in 2023, showing growth in Q1 2025 despite overall sales declines.

- Petco saw services specifically up 10% in Q2 2024, driven by vet hospitals, mobile clinics, and grooming.

- Strategic partnerships with pet brands and suppliers also contribute to revenue.

Petco Health and Wellness Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Petco Health and Wellness Company’s Business Model?

Petco Health and Wellness Company has been undergoing strategic shifts to optimize its operations and enhance profitability. In 2024, the company took steps to streamline its physical footprint, closing a net of 25 locations. This move aligns with broader retail trends and a focus on hybrid and digital-first models. The company is also implementing a multi-phase strategy for 2025 to drive sustainable growth.

Financially, Petco demonstrated resilience, achieving $50 million in positive free cash flow in 2024, which improved its cash balance to $182 million. This financial performance supports the company's strategic initiatives and investments in its future growth. The company is aiming for annualized gross run-rate cost savings of $150 million by the end of fiscal year 2025.

The company is focused on strengthening its fundamentals, implementing operational improvements, and returning to sustainable growth. This strategic approach aims to leverage Petco's existing strengths and capitalize on emerging opportunities in the pet care market. The company is currently in Phase 2 of its strategy, focusing on merchandising excellence, enhancing customer experience, driving efficiencies, and increasing the productivity of its services offerings.

Petco closed a net of 25 locations in 2024 to optimize its store portfolio. The company is planning to close an additional 20 to 30 net locations in 2025. The company achieved $50 million in positive free cash flow in 2024.

Petco is implementing a three-phase strategy for 2025. Phase 1 involved building out its senior leadership team. Phase 2 emphasizes merchandising excellence, enhanced customer experience, driving efficiencies, and increasing the productivity of its services offerings. The company is focused on achieving annualized gross run-rate cost savings of $150 million by the end of fiscal year 2025.

Petco's competitive advantages include a diverse product range, knowledgeable staff, and convenient services. Strong brand recognition and a loyal customer base also contribute to its edge. Petco services such as grooming, training, and veterinary care add value to the customer experience.

The ultimate goal is to return to offense and drive sustainable profitable growth over the long term in Phase 3, which is expected to begin in late 2025. This phase will focus on omnichannel capabilities and digital experiences, and scaling its membership program in 2026. Petco is strategically positioning itself for future growth.

Petco's competitive advantages stem from its diverse product range, expert staff, and convenient services, including grooming, training, and veterinary care. These offerings differentiate Petco from online-only retailers and enhance the customer experience. The company is strategically implementing a multi-phase plan, including optimizing its store portfolio and focusing on digital and omnichannel capabilities.

- Diverse product range, including food, toys, accessories, and healthcare products.

- Knowledgeable staff that provides expert advice.

- Convenient services such as grooming, training, and veterinary care.

- Strong brand recognition and a loyal customer base.

Petco Health and Wellness Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Petco Health and Wellness Company Positioning Itself for Continued Success?

The Petco Health and Wellness Company holds a significant position in the pet industry, distinguishing itself through a comprehensive approach to pet care. This involves integrating retail, in-store services, and digital platforms. While facing competition from other retailers and e-commerce giants, its unique value proposition, including on-site veterinary services and personalized pet care advice, helps maintain its market standing.

The pet care industry is projected to reach $200 billion in sales by the end of this decade, driven by long-term trends of humanization and premiumization of pets. This growth presents opportunities for Petco Company to expand its market share and enhance its service offerings. For more insights, you can explore the Growth Strategy of Petco Health and Wellness Company.

Petco is a leading player in the pet industry, offering a wide range of products and services. They compete with other pet retailers and online platforms. Their integrated approach to pet wellness, including retail and in-store services, sets them apart.

The company faces risks like weaker consumer spending, especially on discretionary items. Execution challenges in turnaround efforts and macroeconomic pressures also play a role. Costs related to strategic repositioning and tariffs also impact financial performance.

Petco is focusing on strategic initiatives to improve profitability and strengthen its financial health. The company projects a revenue decline in the low single digits for fiscal year 2025. They aim for adjusted EBITDA to range from $375 million to $390 million.

Petco aims to expand gross margin rates each quarter and leverage selling, general, and administrative (SG&A) expenses to enhance earnings power. They target a debt-to-EBITDA leverage ratio below two times. The company is confident in achieving double-digit adjusted EBITDA growth in 2025.

For fiscal year 2025, Petco anticipates a revenue decline in the low single digits. The company projects adjusted EBITDA to be between $375 million and $390 million, indicating a projected increase over 2024. Petco is focused on strengthening retail fundamentals and increasing productivity of its services offerings, including Petco services.

- Emphasis on expanding gross margin rates each quarter.

- Leveraging SG&A expenses to enhance earnings power.

- Targeting a debt-to-EBITDA leverage ratio below two times.

- Confident in achieving double-digit adjusted EBITDA growth in 2025.

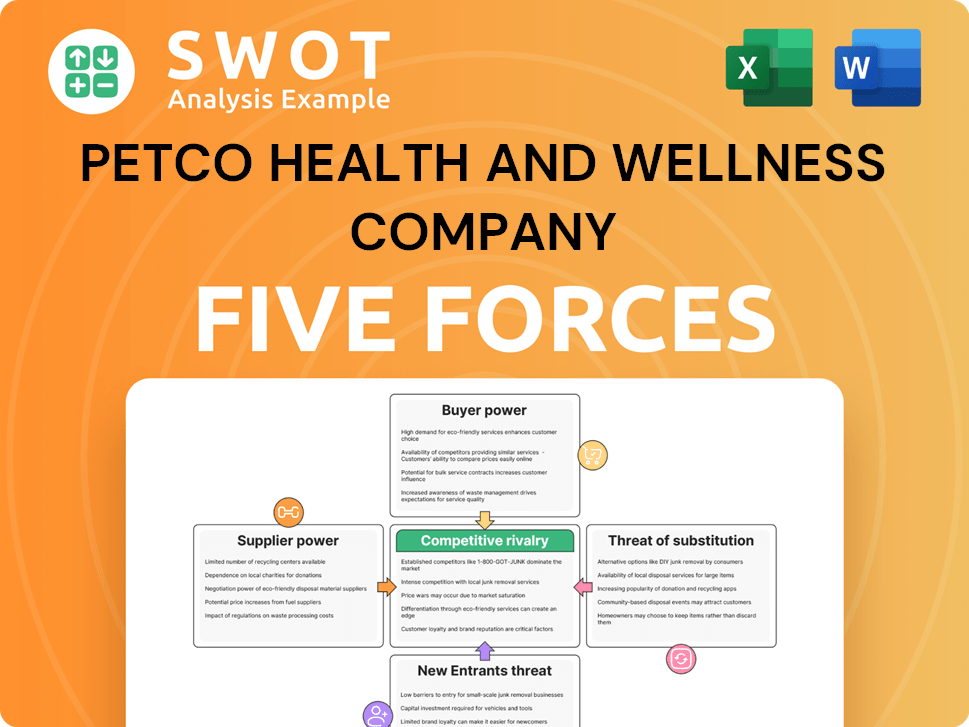

Petco Health and Wellness Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petco Health and Wellness Company Company?

- What is Competitive Landscape of Petco Health and Wellness Company Company?

- What is Growth Strategy and Future Prospects of Petco Health and Wellness Company Company?

- What is Sales and Marketing Strategy of Petco Health and Wellness Company Company?

- What is Brief History of Petco Health and Wellness Company Company?

- Who Owns Petco Health and Wellness Company Company?

- What is Customer Demographics and Target Market of Petco Health and Wellness Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.