Pets at Home Group Bundle

How is Pets at Home Revolutionizing the Pet Care Industry?

Pets at Home Group Plc, a leading force in the UK's pet care sector, recently showcased impressive financial results, achieving a 14% increase in pretax profit to £120.6 million for the fiscal year ending March 27, 2025. This performance highlights the company's robust business model and strategic adaptation within a dynamic market. But what exactly makes Pets at Home tick, and how does it consistently deliver strong results?

This in-depth analysis explores the Pets at Home Group SWOT Analysis, revealing the intricacies of its operations and financial strategies. From its extensive range of pet supplies and veterinary services to its innovative approach to pet grooming and online shopping, we'll dissect how Pets at Home has become a one-stop destination for pet owners. Discover the secrets behind Pets at Home's success, including its customer service, delivery options, and the impact of its loyalty program, all while examining its financial performance and future outlook.

What Are the Key Operations Driving Pets at Home Group’s Success?

The core operations of Pets at Home Group revolve around providing a comprehensive pet care platform. This platform caters to a wide range of pet owners across the UK, offering an integrated ecosystem of products and services. Their business model focuses on delivering a seamless omnichannel experience to meet the diverse needs of pet owners.

The company's value proposition centers on being a one-stop shop for pet owners, encompassing a vast retail selection of pet supplies and essential services. This includes pet food, toys, bedding, and accessories, alongside pet grooming and veterinary care. The operational strategy emphasizes efficiency and customer engagement, supported by a robust supply chain and a strong loyalty program.

The company's success is driven by its integrated approach, combining retail locations with in-store vet practices and grooming salons. This model provides convenience and expert advice, fostering strong customer relationships. The company's focus on community engagement, such as initiatives like 'VIP Lifelines' for pet charities, further enhances its market differentiation.

The company offers a wide array of pet supplies, including food, toys, and accessories. The product range caters to various pet types, ensuring comprehensive coverage. The vast selection aims to meet all pet owners' needs, positioning it as a leading provider of pet supplies.

Veterinary services are a key component, with many stores housing vet practices. Pet grooming services are also available, providing a complete care package. These services enhance customer loyalty and drive additional revenue streams.

The company operates an omnichannel strategy, with physical stores and a growing e-commerce platform. This approach ensures accessibility and convenience for customers. Approximately 30% of sales come from their e-commerce platform.

The 'Pets Club' loyalty program is a significant part of the customer engagement strategy. It has 8.2 million active members. The program provides valuable data for personalized offerings and improved customer engagement.

The company's operations are optimized through a centralized distribution network and a robust supply chain. They source products from over 500 suppliers, mitigating supplier bargaining power. Technological advancements, such as investments in a new digital platform, enhance the customer experience.

- The company's integrated "store-in-store" model, including vet practices and grooming salons, offers a convenient one-stop shop.

- Their focus on expert advice and community initiatives like 'VIP Lifelines' strengthens customer relationships.

- The omnichannel approach, combining physical stores and e-commerce, ensures accessibility and convenience.

- The 'Pets Club' loyalty program with 8.2 million members provides valuable customer data.

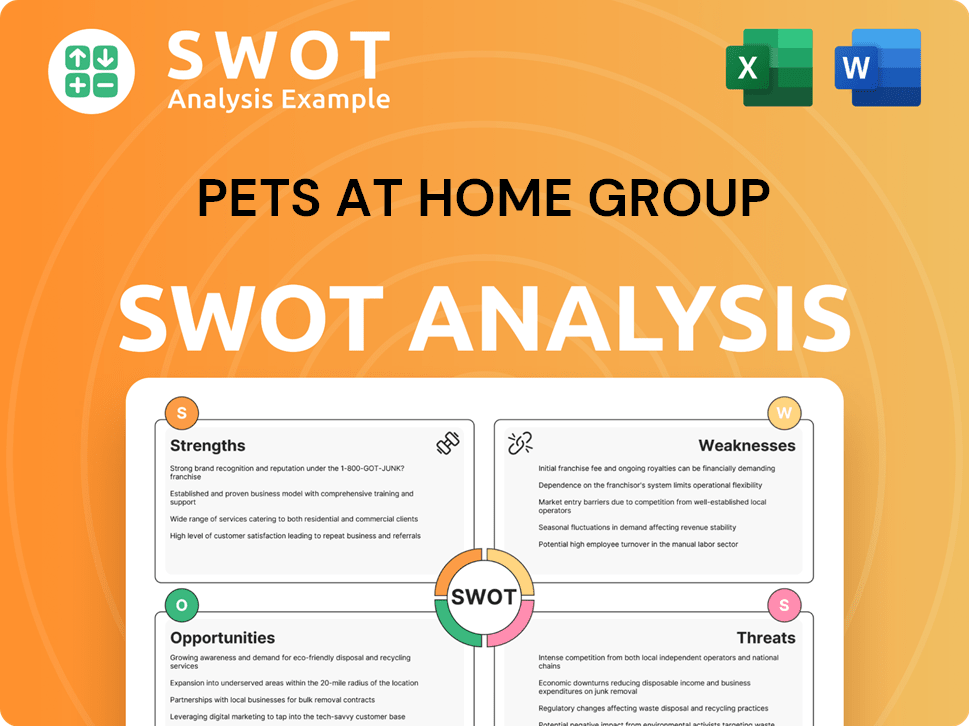

Pets at Home Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pets at Home Group Make Money?

The Pets at Home Group operates a diversified business model, generating revenue through multiple channels within the pet care industry. This approach allows the company to cater to a wide range of customer needs, from pet food and supplies to veterinary and grooming services. The company's financial performance reflects the success of its integrated strategy, with consumer revenue showing growth despite challenges in the retail sector.

The company's revenue streams are designed to capture various aspects of pet ownership, providing a comprehensive suite of products and services. This strategy is supported by strong customer loyalty programs and a focus on increasing the 'share of wallet' among its existing customer base. The following sections will delve into the specific revenue streams and monetization strategies employed by the company.

For the financial year ending March 27, 2025, the company reported a total statutory revenue of £1.482 billion, with consumer revenue reaching £1.96 billion. This reflects the company's strong position in the pet care market and its ability to adapt to changing consumer behaviors. Understanding the revenue streams and monetization strategies is key to appreciating the Pets at Home business model.

The Pets at Home Group generates revenue through several key streams, encompassing various aspects of pet care. These streams are designed to provide a comprehensive offering to pet owners, driving customer loyalty and repeat business. The following points detail the primary revenue streams:

- Retail Sales: This includes the sale of pet supplies, such as food, toys, bedding, and accessories, both in physical stores and online through Pets at Home online shopping. While overall group revenue remained largely flat, retail consumer revenue saw a slight decline of 1.8% in FY25.

- Vet Group Services: This segment provides veterinary services, including general care and telehealth. The Vet Group demonstrated strong growth, with consumer revenue increasing by 13.0% to £655.1 million in FY25, driven by higher visits and average transaction values. This segment now contributes more than half of the Group's underlying pre-tax profit.

- Grooming Services: Offered in many pet care centers, these services include full dog grooms, bath and blow dries, and nail clipping.

- Subscriptions: Subscription revenues, including Flea & Worm, Easy Repeat, Complete Care, and Vac4Life plans, are a growing part of the business, representing 10% of consumer revenue in FY24. The launch of the new digital platform has particularly boosted subscriptions.

- Insurance Commissions: The company also offers pet insurance products, with plans to invest £3 million in a new insurance proposition.

The company employs various monetization strategies to maximize revenue and customer engagement. These strategies are designed to increase the 'share of wallet' and drive customer loyalty. The following points detail the key monetization strategies:

- Tiered Pricing: Premium services, such as grooming and veterinary care, often feature tiered pricing options.

- Value Bundles: Bundling products and services together to offer customers added value.

- Membership Discounts: The 'Pets Club' loyalty program, with 8.2 million active members, allows customers to earn points and receive exclusive offers.

- 'Lifelines' Initiative: Customer purchases contribute to donations for pet charities, fostering loyalty and engagement.

- Cross-selling and Upselling: Focusing on increasing the average transaction value by offering additional products and services.

For further insights into the competitive environment, consider exploring the Competitors Landscape of Pets at Home Group, which provides a detailed analysis of the industry.

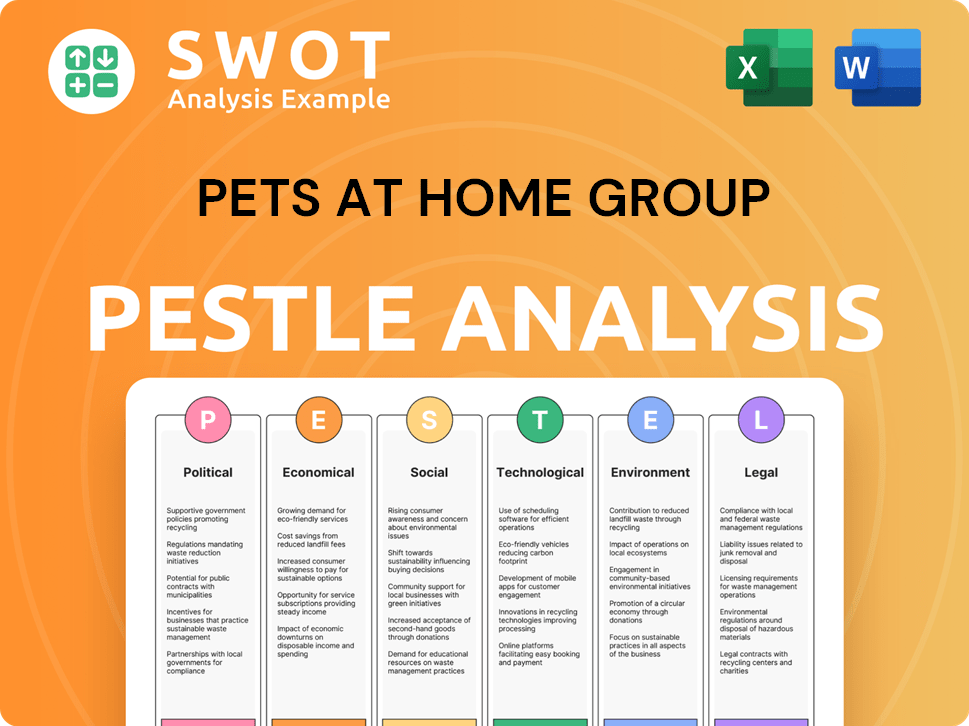

Pets at Home Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Pets at Home Group’s Business Model?

The evolution of Pets at Home Group has been marked by significant strategic shifts, transitioning from a retail and veterinary presence to a comprehensive pet care platform. Key milestones have shaped its operational and financial performance, including substantial investments in infrastructure and digital capabilities. These moves are designed to bolster omnichannel experiences and drive future growth within the pet care sector.

A major focus has been on enhancing its operational efficiency and customer experience. The completion of two significant investment programs in FY25, optimizing the distribution network and replatforming its digital infrastructure, underscores this commitment. Furthermore, the expansion of its veterinary services, with plans for more than 10 new vet practices and 15 extensions in FY26, highlights its dedication to comprehensive pet care.

The launch of a unified 'Pets' brand in FY24 consolidated all products and services under one master brand, streamlining the customer experience. Despite facing operational challenges, including a subdued UK consumer backdrop and the normalization of pet ownership after the pandemic boom, Pets at Home has shown resilience. The company's strategic moves and brand consolidation are key to its ongoing success.

The company completed major investment programs in FY25, optimizing its distribution network and replatforming its digital infrastructure. Expansion of veterinary services is ongoing, with plans for new practices and extensions in FY26. The unified 'Pets' brand launched in FY24, consolidating all products and services.

Focus on enhancing omnichannel capabilities and driving growth through digital infrastructure. Expansion of veterinary services reflects a commitment to comprehensive pet care. Continuous investment in the digital platform enhances the integrated consumer experience.

The 'unique proposition of products, services, and advice' sets it apart from competitors. Strong brand loyalty is cultivated through customer-centric services and programs like 'Pets Club', with 8.2 million active members. Economies of scale enable competitive pricing and strong supplier negotiating power.

The company faces a subdued UK consumer backdrop and a deflationary environment. The Competition & Markets Authority (CMA) investigation into veterinary services introduces uncertainty. Normalization of pet ownership after the pandemic boom presents challenges.

Pets at Home's competitive advantages are multifaceted, stemming from its integrated approach to pet care. Its unique offering of products, services, and advice provides a comprehensive solution that competitors struggle to match. The company's strong brand, fueled by customer-centric services and loyalty programs, fosters significant brand loyalty, as highlighted in the Target Market of Pets at Home Group.

- The joint venture model in its veterinary arm is a key differentiator, mitigating some of the CMA's concerns.

- The company continues to adapt by investing in its digital platform, enhancing the integrated consumer experience.

- Exploration of new ventures, such as its capital-light insurance proposition, demonstrates a forward-thinking approach.

- Reported revenues were approximately £1.48 billion in FY25.

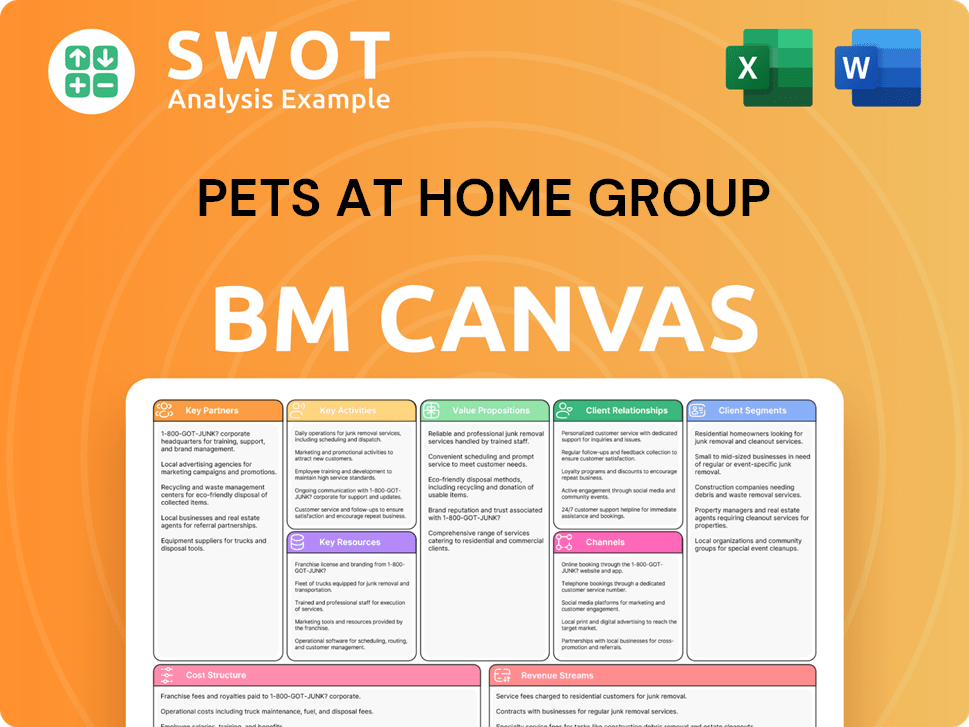

Pets at Home Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Pets at Home Group Positioning Itself for Continued Success?

The company, a leading player in the UK pet care market, holds a significant position. It operates as the UK's only comprehensive pet care provider, offering a wide range of products and services. This includes everything from pet supplies to veterinary care.

The company's future involves navigating risks such as consumer confidence and regulatory changes. Furthermore, it aims to capitalize on growth opportunities in the pet care market, aiming for mid-single-digit consumer revenue growth annually. The company is focused on strategic initiatives to ensure long-term profitability.

The company has a strong market presence, holding a 24% share of the £7.2 billion UK pet care market. It operates over 450 pet care centers, providing a wide reach across the UK. The 'Pets Club' loyalty scheme, with 8.2 million members, supports customer retention and drives sales.

Key risks include a subdued UK consumer backdrop and the normalization of new pet ownership post-Covid. Regulatory changes, such as the CMA investigation into veterinary services, could impact the business model. The company also faces competition and technological disruption, requiring ongoing adaptation.

The company aims to grow consumer revenue at a mid-single-digit rate annually. Strategic investments in the digital platform are planned to boost omnichannel benefits. The company aims to open over 10 new vet practices and 15 extensions in FY26.

Underlying pre-tax profit for the group is projected to fall to between £115 million and £125 million in FY26 from £133 million in FY25. The company plans a £25 million share buyback program. The company expects to maintain capital discipline and a robust balance sheet.

The company is focused on expanding its veterinary services and insurance offerings to leverage its customer data. The pet care market is expected to gradually improve towards historic norms in 2025. The company's approach includes strategic investments in digital platforms and new vet practice openings to drive growth.

- Expansion of veterinary services through new practice openings and extensions.

- Investment in a new insurance proposition to capitalize on consumer data and brand recognition.

- Focus on maintaining a strong balance sheet and capital discipline.

- Emphasis on outperforming the UK pet care market's growth rate.

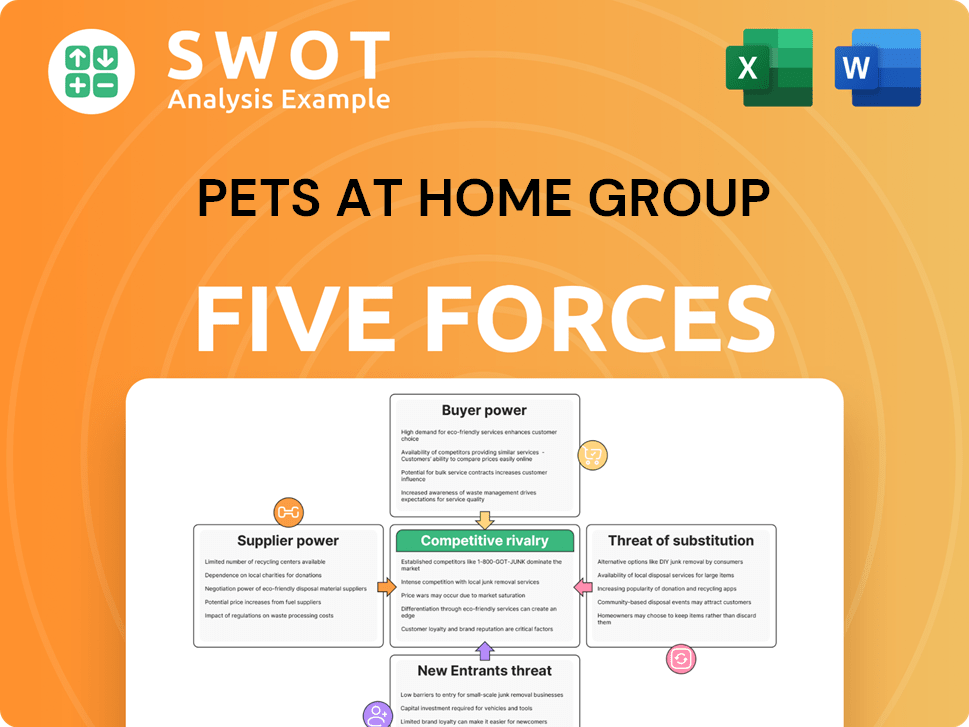

Pets at Home Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pets at Home Group Company?

- What is Competitive Landscape of Pets at Home Group Company?

- What is Growth Strategy and Future Prospects of Pets at Home Group Company?

- What is Sales and Marketing Strategy of Pets at Home Group Company?

- What is Brief History of Pets at Home Group Company?

- Who Owns Pets at Home Group Company?

- What is Customer Demographics and Target Market of Pets at Home Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.