Pets at Home Group Bundle

Who Really Owns Pets at Home?

Ever wondered who steers the ship at the UK's leading pet care provider? Understanding the Pets at Home Group SWOT Analysis reveals crucial insights into its strategic direction, particularly when considering its complex ownership structure. From its IPO in 2014 to its current standing on the London Stock Exchange, the evolution of Pets at Home's ownership is a fascinating story. This exploration will uncover the key players and pivotal moments that have shaped this retail giant.

Delving into the Pets at Home ownership reveals a shift from private equity to public shareholders, significantly impacting its operational strategies. The Pets at Home parent company structure and the influence of its Pets at Home shareholders are critical factors in understanding its market position. This analysis will explore the Pets at Home company structure, providing valuable context for investors and business strategists alike, and clarifying the dynamics of who owns Pets at Home.

Who Founded Pets at Home Group?

The story of Pets at Home begins in 1991, when Anthony Preston opened its first store in Chester, UK. This marked the beginning of what would become a significant player in the pet care industry. The early years saw the company evolve, setting the stage for its future growth and expansion.

Before founding Pets at Home, Preston's background included a stint with 3i, followed by a role in his family's cash and carry business. The company's initial incorporation as R & B Pet Supplies Limited in June 1984, later changed its name to John Preston Estates Limited in October 1989, and then to Pets at Home Ltd in March 1991, reflected its early development.

While the specifics of the initial ownership structure are not publicly available, the company's trajectory involved key investments and acquisitions that shaped its ownership landscape. These early moves were critical in building Pets at Home's integrated model.

In December 1995, 3i Group plc made an investment in Pets at Home. This early investment helped fuel the company's expansion plans.

Pets at Home acquired Petsmart UK in December 1999. This acquisition added 140 stores under the Pets at Home brand.

Companion Care in-store vet practices were introduced through a joint venture. This marked the beginning of the integration of veterinary services.

In March 2004, Pets at Home took a 90% holding in Companion Care (Services) Ltd. This solidified the company's control over its veterinary services.

These early agreements and acquisitions laid the groundwork for Pets at Home's integrated pet care model.

These early moves set the stage for subsequent ownership changes. The company's evolution reflects its growth and adaptation within the pet care market.

Understanding the early ownership and the evolution of the Pets at Home group provides context for its current structure. The company's journey from a single store to a major player in the pet care industry involved strategic investments and acquisitions. For a deeper dive into the company's marketing strategies, consider reading about the Marketing Strategy of Pets at Home Group.

- Anthony Preston founded Pets at Home in 1991.

- Early investment from 3i Group plc in December 1995.

- Acquisition of Petsmart UK in December 1999 expanded the store network.

- Introduction of Companion Care vet practices through a joint venture.

- Pets at Home took a 90% holding in Companion Care (Services) Ltd in March 2004.

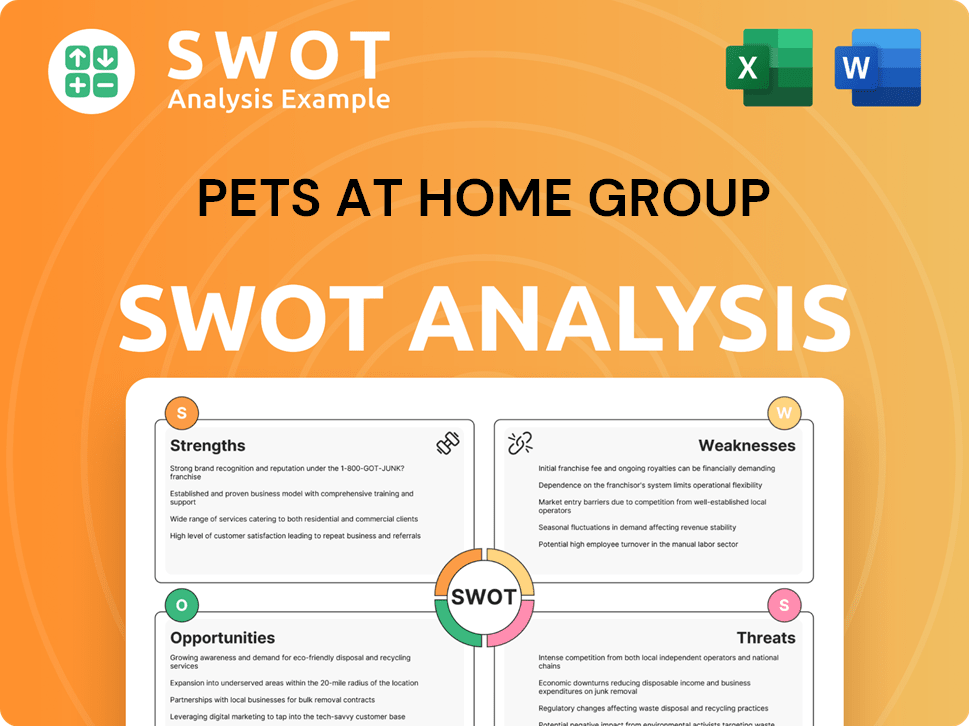

Pets at Home Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Pets at Home Group’s Ownership Changed Over Time?

The journey of Pets at Home, from its founding to its current status, showcases a dynamic evolution in its ownership structure. Initially, the company saw early investment and subsequent transitions to private equity ownership. A pivotal moment arrived in July 2004 when European private equity firm Bridgepoint Capital acquired a majority stake, marking a significant shift in the company's trajectory. This period under Bridgepoint saw considerable expansion, setting the stage for further developments.

The ownership narrative continued with the acquisition by Kohlberg Kravis Roberts (KKR) in January 2010, a US-based investment firm. KKR's tenure was marked by strategic growth initiatives. The Initial Public Offering (IPO) in March 2014 was a landmark event, as the company listed on the London Stock Exchange and became part of the FTSE 250 Index. This transition to a publicly traded entity broadened its shareholder base and influenced its strategic focus on omnichannel retail and integrated pet care services. KKR gradually divested its stake, completing the process by January 2018.

| Ownership Phase | Key Players | Significant Dates |

|---|---|---|

| Early Investment | 3i, Intermediate Capital Group plc | Prior to July 2004 |

| Private Equity (Majority Stake) | Bridgepoint Capital | July 2004 - January 2010 |

| Private Equity | Kohlberg Kravis Roberts (KKR) | January 2010 - March 2014 (IPO) |

| Publicly Traded | Institutional Investors, Mutual Funds, Individual Shareholders | March 2014 - Present |

As a publicly traded company, Pets at Home's ownership is now diversified among various institutional investors and individual shareholders. Neuberger Berman Group LLC held a 5.09% voting rights stake as of November 29, 2024. The total registered share capital comprised 464,860,259 ordinary shares as of July 31, 2024, decreasing to 459,491,054 ordinary shares by November 30, 2024. This shift from private equity to public ownership has provided access to capital markets and influenced the company's strategic direction. For more details on the company's financial performance, you can read about the Revenue Streams & Business Model of Pets at Home Group.

The ownership of Pets at Home has evolved significantly, from private equity firms to a publicly traded company.

- Bridgepoint Capital and KKR played crucial roles in the company's growth.

- The IPO in 2014 marked a major shift in the company's ownership structure.

- Ownership is now distributed among institutional and individual shareholders.

- Neuberger Berman Group LLC is a significant shareholder.

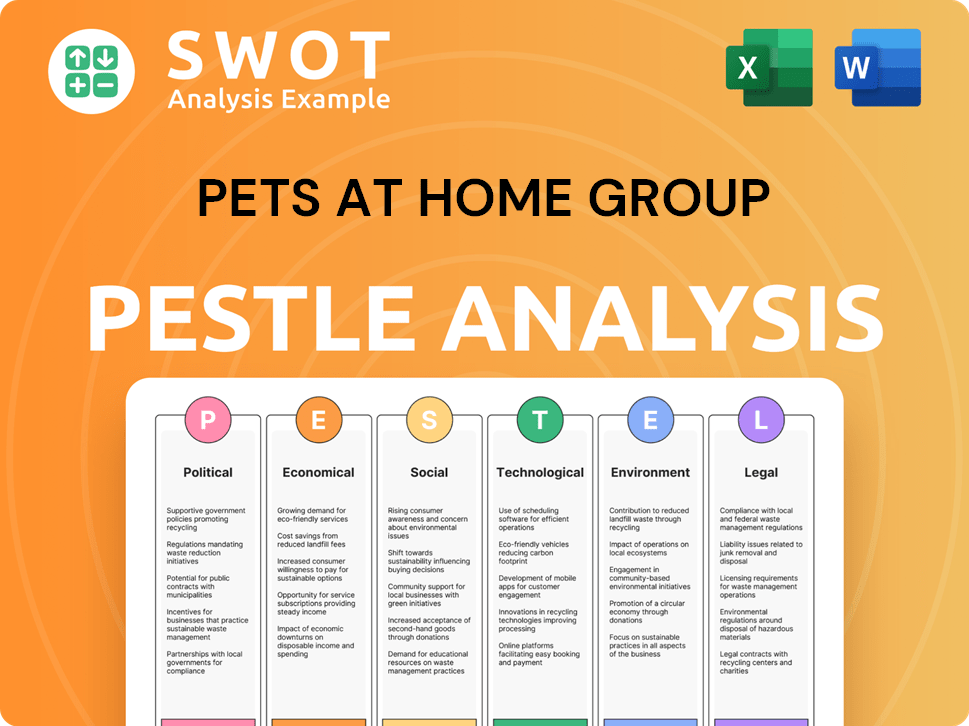

Pets at Home Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Pets at Home Group’s Board?

The current board of directors at Pets at Home Group Plc oversees the company's strategic direction and governance. As of the latest updates, Ian Burke holds the position of Chairman, while Lyssa McGowan serves as the Chief Executive Officer. Mr. Michael James Iddon is the Group CFO. The board is composed of both executive and non-executive directors, with the non-executive directors providing independent oversight and bringing external expertise. The board's composition reflects a commitment to sound corporate governance, ensuring a balance of perspectives in decision-making processes. Understanding the Competitors Landscape of Pets at Home Group helps to understand the market dynamics the board navigates.

The board's decisions are influenced by the interests of major shareholders, particularly institutional investors. While specific details on which board members directly represent major shareholders are not always publicly available, the presence of these institutional investors suggests their concerns are considered in board discussions and strategic planning. This structure aims to balance the interests of various stakeholders, ensuring the long-term success and sustainability of the company.

| Director | Position | |

|---|---|---|

| Ian Burke | Chairman | |

| Lyssa McGowan | Chief Executive Officer | |

| Mr. Michael James Iddon | Group CFO |

Pets at Home Group Plc operates on a one-share-one-vote basis, providing a clear and straightforward voting structure. As of May 28, 2025, the company had 459,491,054 ordinary shares of £0.01 each issued, with each share entitling the holder to one vote. This structure ensures that voting power directly corresponds to the number of shares held, preventing any single entity from gaining outsized control through special voting rights. The Annual General Meeting (AGM) is a key event for shareholder engagement, with the 2025 AGM scheduled for July 10, 2025. Shareholders can submit questions in advance and vote by proxy or in person. There have been no recent reports of significant challenges to the company's governance from proxy battles or activist investor campaigns.

The voting structure at Pets at Home ensures that each share holds equal voting power, promoting fairness. Shareholders can actively participate in the company's governance through AGMs. The 2025 AGM is scheduled for July 10, 2025.

- One-share-one-vote structure.

- AGM is a key forum for shareholder engagement.

- Shareholders can vote by proxy or in person.

- No recent proxy battles.

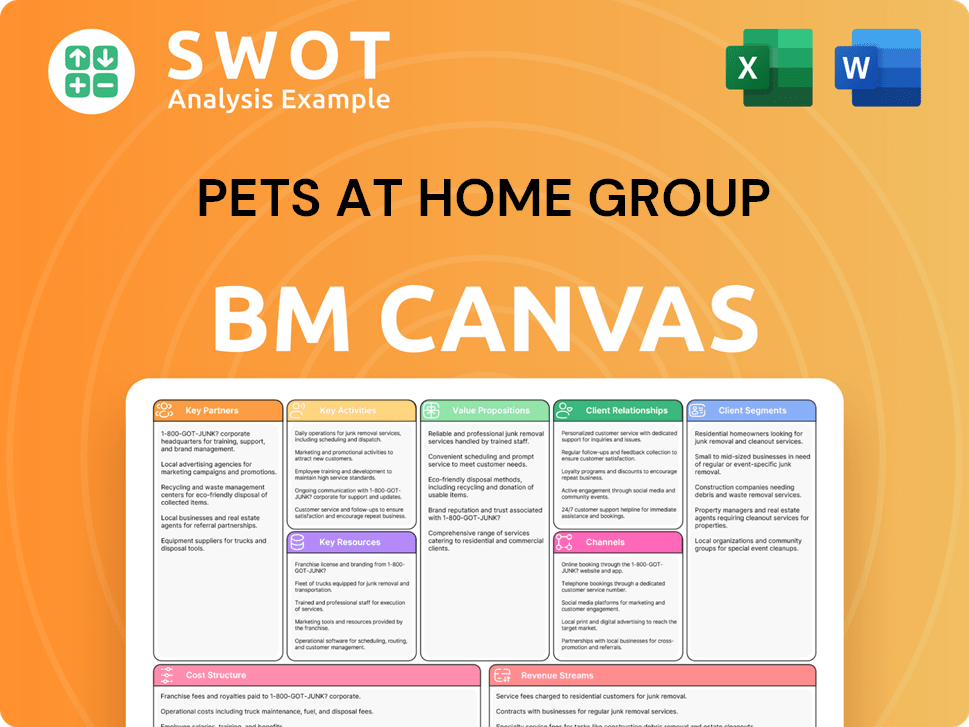

Pets at Home Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Pets at Home Group’s Ownership Landscape?

In the past few years, the ownership profile of Pets at Home Group Plc has seen several shifts. The company has actively engaged in share buyback programs to manage its capital structure and potentially increase shareholder value. For example, a £25 million share buyback program started on June 9, 2025, which led to a reduction in the total number of ordinary shares. Following recent purchases, the total voting rights in the company were 459,211,054 as of June 12, 2025.

There have been discussions about potential mergers and acquisitions involving Pets at Home Group Plc. In 2024, the company was considered as a possible target for mergers and acquisitions, particularly by private equity firms. Although rumors linked the company to BC Partners in February 2025, it was reported that Pets at Home was not the target. These discussions reflect the ongoing interest in the pet care market and the potential for changes in ownership through consolidation. The Growth Strategy of Pets at Home Group highlights how the company has been adapting to market dynamics.

| Metric | Value | Date |

|---|---|---|

| P/E Ratio | 13.44 | May 2025 |

| Dividend Yield | 5.09% | May 2025 |

| Total Voting Rights | 459,211,054 | June 12, 2025 |

| Share Buyback Program | £25 million | June 9, 2025 |

The pet care market has seen significant growth driven by increased pet ownership and higher spending per pet. This trend has made the market appealing for institutional ownership. Pets at Home has focused on enhancing its integrated pet care platform, investing in digital infrastructure and data capabilities. The veterinary business has shown robust growth, contributing substantially to the group's underlying profit before tax. Despite challenges in the UK consumer market, the company anticipates gradual improvement in industry growth.

The company has been involved in share buyback programs, indicating efforts to manage capital and potentially boost shareholder value. Rumors of potential mergers and acquisitions also suggest interest from private equity firms.

The pet care market is growing due to increased pet ownership and spending. This has made the market attractive for institutional investors. The company is focused on strengthening its integrated pet care platform.

As of May 2025, the company's P/E ratio was 13.44, with a dividend yield of 5.09%. The veterinary business continues to drive significant profit growth.

Pets at Home is investing in digital infrastructure and data capabilities. The company is working on simplifying its distribution network to improve efficiency.

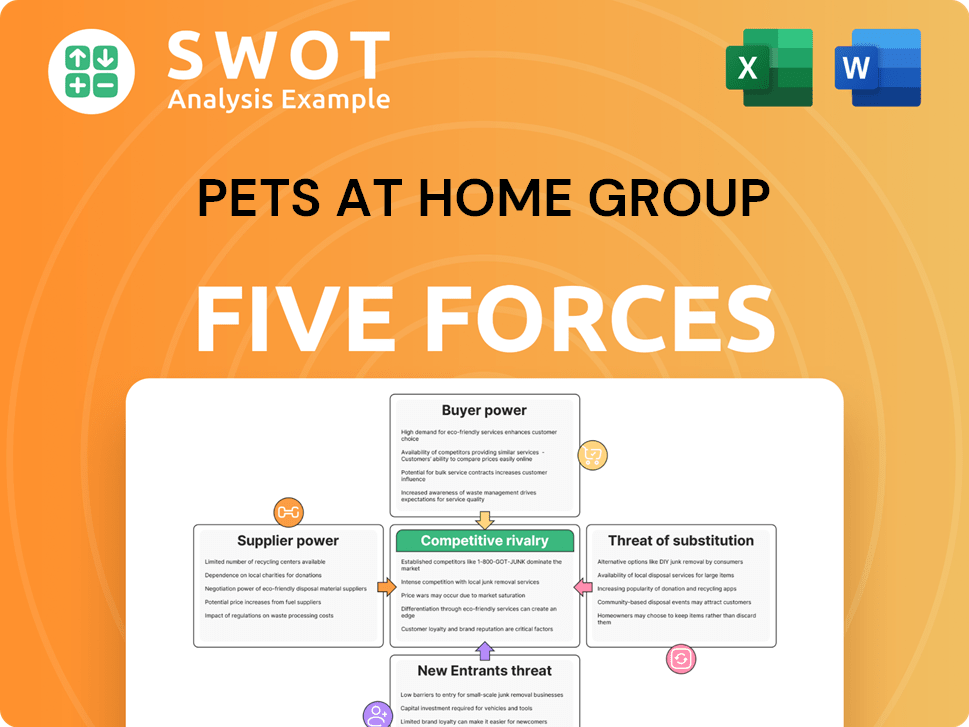

Pets at Home Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pets at Home Group Company?

- What is Competitive Landscape of Pets at Home Group Company?

- What is Growth Strategy and Future Prospects of Pets at Home Group Company?

- How Does Pets at Home Group Company Work?

- What is Sales and Marketing Strategy of Pets at Home Group Company?

- What is Brief History of Pets at Home Group Company?

- What is Customer Demographics and Target Market of Pets at Home Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.