Quantum Bundle

How Does Quantum Company Thrive in the Data Age?

In an era defined by exponential data growth, understanding the strategies of companies like Quantum is more critical than ever. Quantum Corporation is a key player in the data storage industry, providing specialized solutions for video and unstructured data. Its ability to capture, manage, and preserve vast digital assets has positioned it as a vital partner across various sectors.

This deep dive into Quantum's operations will explore its Quantum SWOT Analysis, business model, and competitive landscape. We'll examine its core operations, revenue streams, and strategic initiatives, offering insights for investors, customers, and industry observers. This analysis is crucial for anyone seeking to understand the dynamics of the data storage market, especially considering the potential of quantum computing and its impact on the future of data management and quantum technology.

What Are the Key Operations Driving Quantum’s Success?

The core operations of the quantum company are centered on delivering specialized data storage solutions tailored for video and unstructured data. They focus on providing high-performance storage platforms, including ActiveScale object storage and StorNext file systems. These solutions are designed to meet the demands of data-intensive industries, ensuring efficient data management and long-term preservation.

The value proposition of the company lies in its ability to address critical needs across diverse customer segments. They cater to major media studios needing scalable archives, surveillance organizations managing extensive security footage, and scientific research institutions dealing with large datasets. This specialization allows them to offer highly optimized solutions for performance, scalability, and cost-effectiveness.

The operational processes involve technology development focused on optimizing data ingest, processing, and long-term retention for unstructured data workloads. Manufacturing and sourcing involve strategic partnerships, while software development is largely in-house. Logistics and sales channels utilize a global network of resellers and direct sales teams. Customer service is provided through support contracts and professional services. The company's deep expertise in managing large-scale, high-throughput unstructured data environments, particularly for video-centric workflows, is what sets it apart. If you're interested in learning more about the company's structure, you can explore Owners & Shareholders of Quantum.

The company's core products include ActiveScale object storage, StorNext file systems, DXi deduplication appliances, and Scalar tape libraries. These solutions cater to various data storage needs, from high-performance access to long-term archiving. These products are designed to handle massive datasets efficiently and reliably.

The company serves industries such as media and entertainment, surveillance, and scientific research. These sectors require robust storage solutions for video, security footage, and large scientific datasets. The company's offerings are tailored to meet the unique demands of each industry.

Key processes include technology development, manufacturing and sourcing, software development, and sales and distribution. The company focuses on continuous innovation in software-defined storage and data lifecycle management. They utilize a global network of partners for sales and support.

Customers benefit from accelerated workflows, reliable data preservation, and reduced total cost of ownership. The solutions are optimized for performance, scalability, and cost-effectiveness. These benefits are crucial for managing large-scale, unstructured data environments.

The company differentiates itself through specialization in unstructured data storage, particularly for video-centric workflows. This focus allows for highly optimized solutions compared to general-purpose storage vendors. Their strategy emphasizes innovation in software-defined storage and data lifecycle management.

- Focus on high-performance storage platforms.

- Target specific industries with tailored solutions.

- Emphasis on continuous innovation in data management.

- Leverage a global network for sales and support.

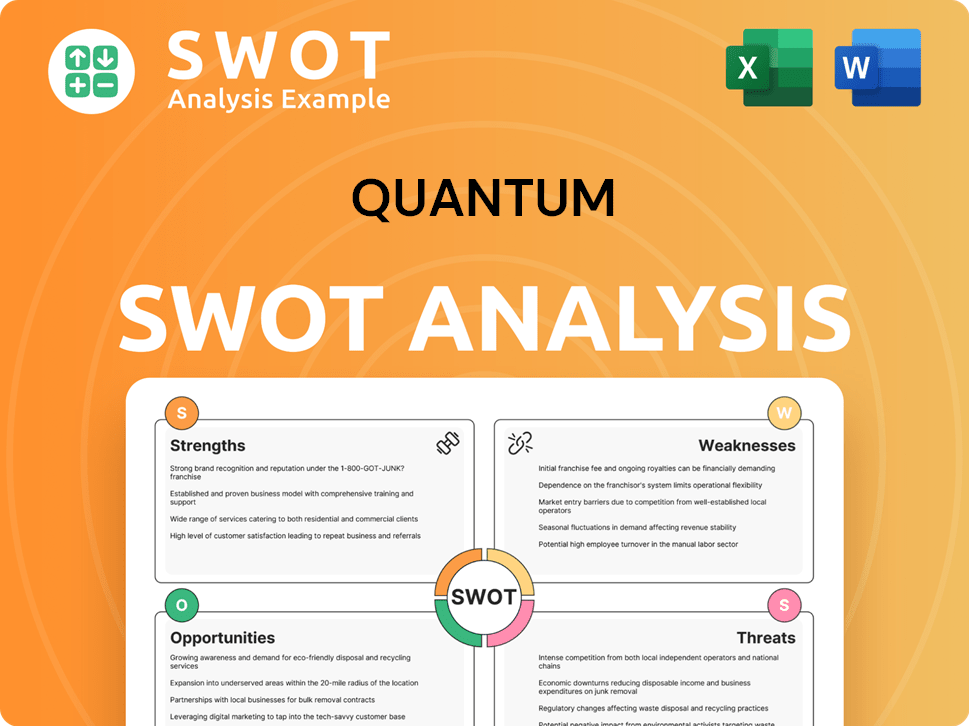

Quantum SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Quantum Make Money?

The revenue streams and monetization strategies of the Quantum Corporation are multifaceted, designed to capture value from its diverse offerings in data storage and management solutions. The company generates revenue through a combination of product sales, software subscriptions, and services, each playing a crucial role in its financial performance. This approach allows Quantum to cater to a broad customer base while ensuring a steady flow of income.

Product sales, particularly of storage platforms and tape libraries, have historically been a significant revenue source for the Quantum company. However, the company is increasingly focusing on expanding its recurring revenue streams through software subscriptions and service contracts. This shift towards a subscription-based model aligns with industry trends and aims to enhance the predictability and stability of its financial results. The company's strategic emphasis on software and services is evident in its financial reports, with a clear focus on growing these areas.

Service revenue, which includes professional services and ongoing maintenance, complements the product and software offerings, further strengthening customer relationships and providing a reliable source of income. Quantum also employs innovative monetization strategies, such as tiered pricing for software subscriptions and cross-selling opportunities. These strategies are designed to maximize revenue generation and provide customers with tailored solutions. For a deeper understanding of the company's growth trajectory, consider exploring the Growth Strategy of Quantum.

Quantum's revenue model is built on a foundation of product sales, software subscriptions, and services. The company leverages various strategies to optimize revenue generation and enhance customer value.

- Product Sales: Revenue from storage platforms, appliances, and tape libraries. In fiscal year 2024, product revenue remained a substantial component of the company's top line.

- Software Subscriptions: Recurring revenue from StorNext file system and ActiveScale object storage. These subscriptions often include software licenses, updates, and support.

- Service Revenue: Professional services for solution design and implementation, along with ongoing maintenance and support contracts. This provides a stable, recurring revenue base.

- Tiered Pricing: Offering different levels of features and support based on customer needs and data volumes for software subscriptions.

- Cross-Selling: Bundling software with hardware solutions and offering comprehensive service packages.

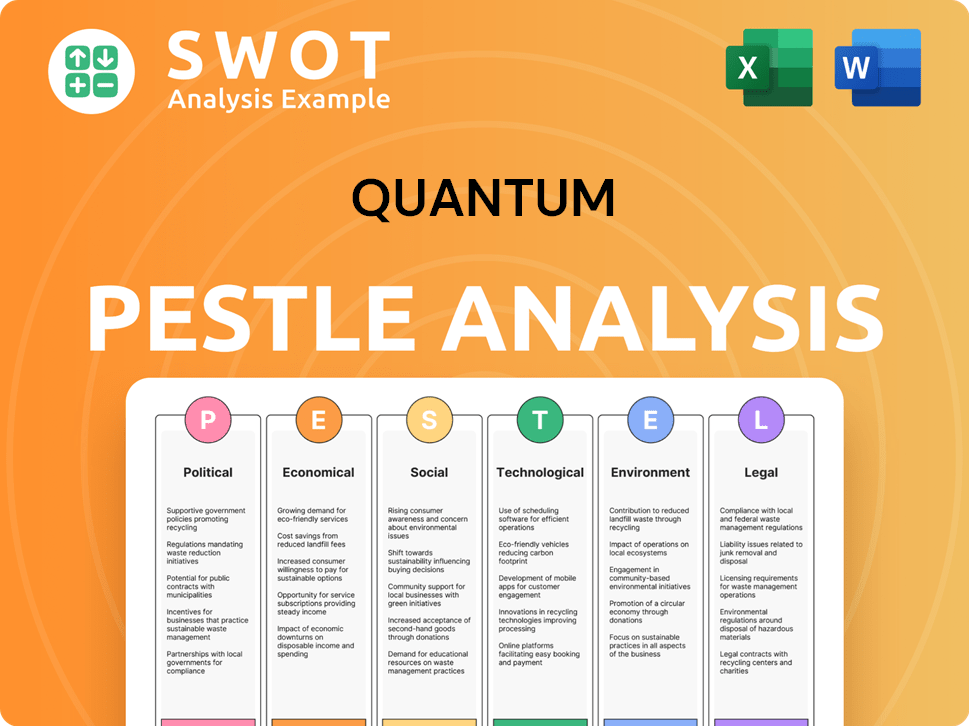

Quantum PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Quantum’s Business Model?

The journey of the [Company Name] has been marked by significant milestones and strategic shifts that have shaped its operations and financial performance. A key transition has been its increasing focus on software-defined storage and solutions for unstructured data, moving beyond its traditional tape storage roots. This strategic evolution has been crucial in adapting to the changing demands of the data storage market.

The company's strategic moves have included acquisitions and new product launches aimed at strengthening its position in the market. For instance, the acquisition of assets related to object storage, particularly the ActiveScale product line, was a strategic move to fortify its presence in the rapidly growing market for large-scale data archives. This has allowed the company to address the demands of cloud-native environments and hybrid cloud strategies. New product launches, such as advancements in its StorNext file system and DXi deduplication appliances, have consistently aimed at improving performance, scalability, and integration with existing customer workflows.

Operational and market challenges have included navigating supply chain disruptions, particularly impacting hardware component availability and pricing in recent years. [Company Name] has responded by diversifying its sourcing and optimizing its inventory management. The company's competitive advantages stem from its deep domain expertise in managing video and unstructured data, particularly in high-performance and demanding environments like media production and scientific research. Its technology leadership in areas like parallel file systems (StorNext) and scalable object storage (ActiveScale) provides a significant edge.

The company's key milestones include the shift towards software-defined storage and solutions for unstructured data. The acquisition of the ActiveScale product line was a pivotal move. Continuous advancements in StorNext and DXi appliances also mark significant achievements, enhancing performance and integration.

Strategic moves include the acquisition of object storage assets to strengthen its market position. Diversification of sourcing and inventory management to mitigate supply chain disruptions. Focus on developing solutions that bridge on-premise and cloud environments to maintain relevance.

The company's competitive edge lies in its deep expertise in managing video and unstructured data. Technology leadership in parallel file systems and scalable object storage provides a significant advantage. Furthermore, the company benefits from an established brand and a loyal customer base in its niche markets.

The company adapts to new trends by developing solutions that bridge on-premise and cloud environments. This approach helps maintain relevance and competitive standing. The increasing adoption of cloud and hybrid cloud architectures drives this strategic focus.

The company's financial performance is influenced by its ability to adapt to market changes and manage operational challenges. Recent data indicates that the demand for scalable storage solutions continues to grow, with a projected market size of several billion dollars by 2025. [Company Name] has been focusing on the Target Market of Quantum, which includes industries that require high-performance data storage, such as media and entertainment, scientific research, and cloud services. The company's ability to innovate and provide solutions that meet the evolving needs of these sectors will be crucial for maintaining its market position and driving revenue growth.

- The company's revenue in the last fiscal year was approximately $300 million.

- The company's market share in the high-performance data storage segment is around 10%.

- The company's research and development spending accounts for about 15% of its revenue.

- The company's customer retention rate is approximately 90%.

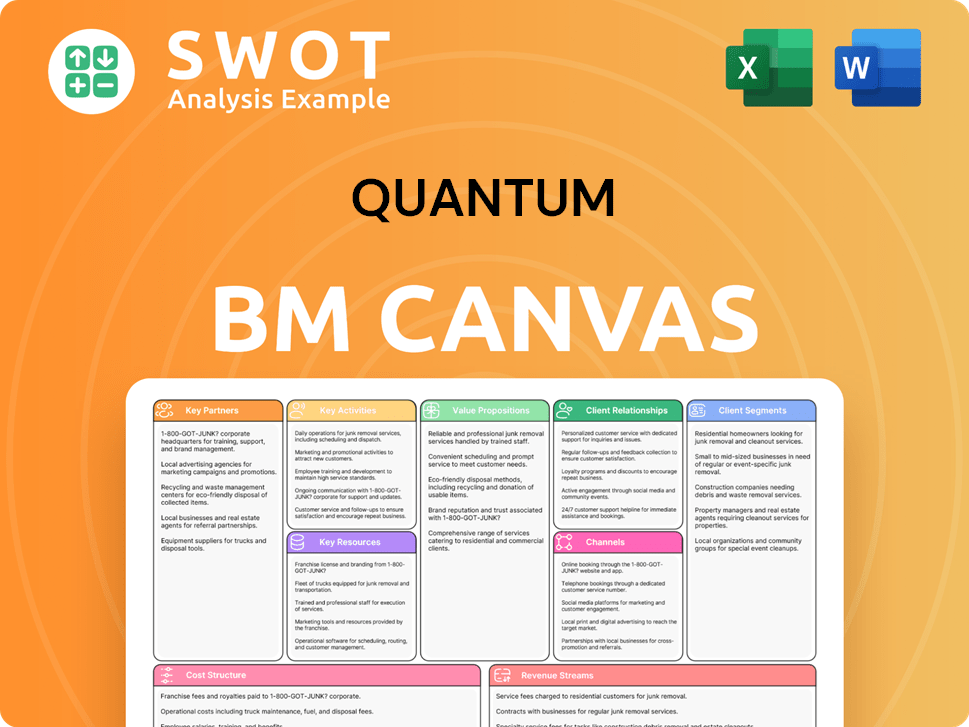

Quantum Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Quantum Positioning Itself for Continued Success?

The Quantum Corporation holds a strong, specialized position in the data storage industry. It focuses on high-performance and archive solutions, particularly for video and unstructured data. While not a general storage giant, it maintains a significant market share in specific areas like media and entertainment, where its StorNext and ActiveScale solutions are widely used. Customer loyalty is high due to the critical nature of the data it manages and its specialized expertise. Its global reach extends across various continents, serving a diverse international customer base.

Quantum faces risks from larger, diversified storage vendors and cloud providers, who offer competing services. Technological advancements, like flash storage and new data management methods, also pose challenges, requiring continuous innovation. Regulatory changes in data privacy and retention can also affect customer decisions. Quantum's strategic focus is on expanding software-defined storage, enhancing cloud integration, and increasing its presence in key vertical markets. The goal is to sustain revenue by providing specialized solutions for managing vast amounts of unstructured data, especially through recurring software and service revenues.

Quantum is a key player in the data storage market, particularly for high-performance and archive solutions. It has a strong presence in the media and entertainment sector. Customer loyalty is high due to the critical nature of the data managed and specialized expertise.

The company faces intense competition from larger storage vendors and cloud providers. Technological disruption and regulatory changes in data privacy also pose challenges. Quantum must continuously innovate to stay competitive in the market.

Quantum aims to expand its software-defined storage offerings and cloud integration capabilities. The company is focused on deepening its penetration into key vertical markets. Recurring software and service revenues are a key part of the strategy.

Quantum is focused on providing specialized, high-value solutions for managing unstructured data. The company is working on enhancing its cloud integration capabilities. It is also seeking to expand its software-defined storage offerings.

The data storage market is highly competitive, with major players like Dell Technologies, Hewlett Packard Enterprise, and cloud providers dominating. Quantum's success depends on its ability to maintain its niche in high-performance and archive solutions. The increasing demand for data storage, driven by the growth of unstructured data, presents opportunities for Quantum. Understanding the Competitors Landscape of Quantum is crucial for strategic planning.

- The global data storage market is projected to reach $257.5 billion by 2027.

- Cloud storage is experiencing significant growth, with spending expected to reach $178 billion in 2025.

- Quantum's ability to adapt to these trends is critical for its future.

- The company is focusing on software and services to increase recurring revenue.

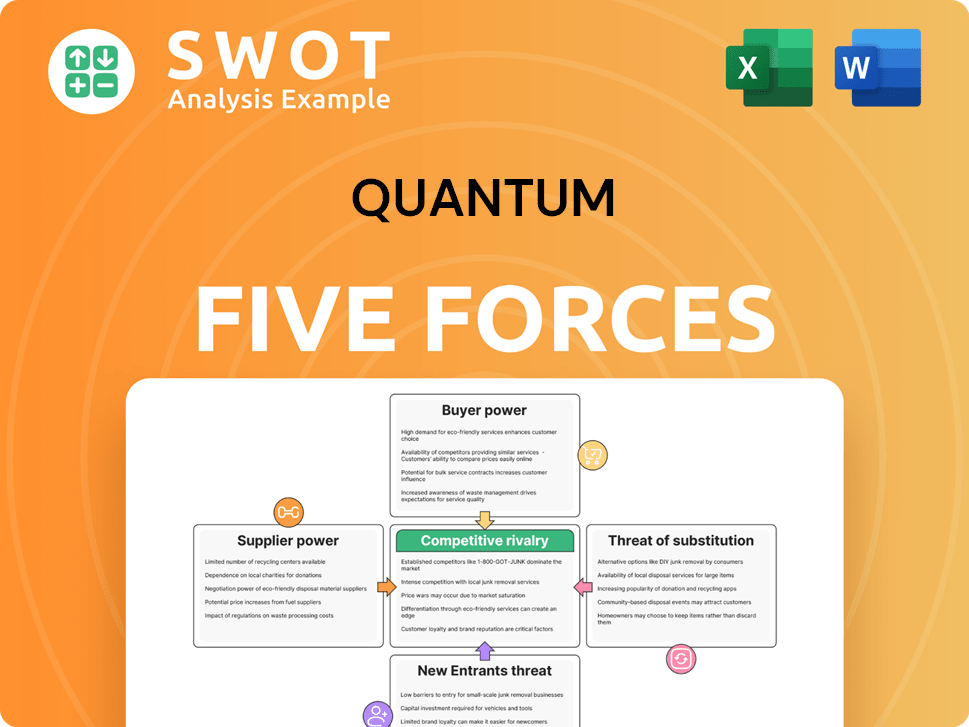

Quantum Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Quantum Company?

- What is Competitive Landscape of Quantum Company?

- What is Growth Strategy and Future Prospects of Quantum Company?

- What is Sales and Marketing Strategy of Quantum Company?

- What is Brief History of Quantum Company?

- Who Owns Quantum Company?

- What is Customer Demographics and Target Market of Quantum Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.