Rollins Bundle

How Does Rollins Company Conquer the Pest Control Market?

Rollins, Inc., a titan in the pest control industry, boasts a market cap exceeding $20 billion, a testament to its enduring success. With 2023 revenues hitting $2.96 billion, a notable 13.9% increase year-over-year, Rollins Inc. demonstrates its robust financial health. Operating under well-known brands like Orkin and Terminix, Rollins pest control provides essential services globally, protecting homes and businesses.

This deep dive into Rollins Company will dissect its operational strategies, exploring how it generates revenue and maintains its market leadership. From understanding its Rollins SWOT Analysis to examining its service delivery, this analysis is crucial for investors, customers, and industry professionals alike. We'll explore questions like: How does Rollins Company handle pest control, and what services does Rollins Inc offer?

What Are the Key Operations Driving Rollins’s Success?

Rollins Inc. excels in providing comprehensive pest and termite control services, catering to residential, commercial, and industrial clients. Their core offerings are built around thorough inspections, targeted treatments, and ongoing preventative maintenance. These services are crucial for protecting property, ensuring public health, and maintaining sanitary environments.

The operational framework at Rollins is designed to be both standardized and adaptable to specific local needs. This involves a network of highly trained technicians who use integrated pest management (IPM) techniques. These techniques combine chemical treatments with non-chemical methods, habitat modification, and client education. Their supply chain focuses on acquiring effective and environmentally responsible pest control products and equipment. Rollins utilizes a vast distribution network, primarily through its owned and franchised branches, to ensure widespread service availability.

Customer service is a key differentiator for Rollins, emphasizing responsiveness and building long-term client relationships. The company's value proposition is rooted in its established brand reputation for reliability, effectiveness, and customer trust, which translates into recurring revenue and strong customer retention. Rollins's commitment to quality and customer satisfaction has solidified its position in the industry.

Rollins offers a wide array of services, including pest control and termite control, designed for homes, businesses, and industrial sites. These services are essential for protecting properties and maintaining health standards. They use advanced techniques to manage and eradicate pests, ensuring effective and lasting results.

Rollins employs highly trained technicians who use Integrated Pest Management (IPM) strategies. This approach combines chemical and non-chemical methods for effective pest control. Their operational processes are standardized yet adaptable to regional needs, ensuring efficient service delivery.

Rollins emphasizes customer service, building strong, long-term relationships. They are committed to responsiveness and ensuring customer satisfaction. This focus on customer needs helps maintain high retention rates and brand loyalty.

The value proposition of Rollins is built on its reputation for reliability and effectiveness. They aim to provide trustworthy and efficient pest control services. This reputation supports recurring revenue and strong customer retention, making them a leader in the industry.

Rollins Inc. distinguishes itself through its comprehensive service offerings and customer-centric approach. The company's focus on Integrated Pest Management (IPM) and its extensive network of branches contribute to its market leadership. Rollins's commitment to innovation and customer satisfaction sets it apart from competitors like Terminix.

- Extensive Service Network: Rollins operates through a vast network of owned and franchised branches, ensuring widespread service availability.

- Integrated Pest Management (IPM): Rollins employs IPM techniques, combining chemical and non-chemical methods for effective pest control.

- Customer Retention: The company's focus on customer service and reliability leads to high customer retention rates.

- Brand Reputation: Rollins has built a strong brand reputation over decades, based on trust and effectiveness.

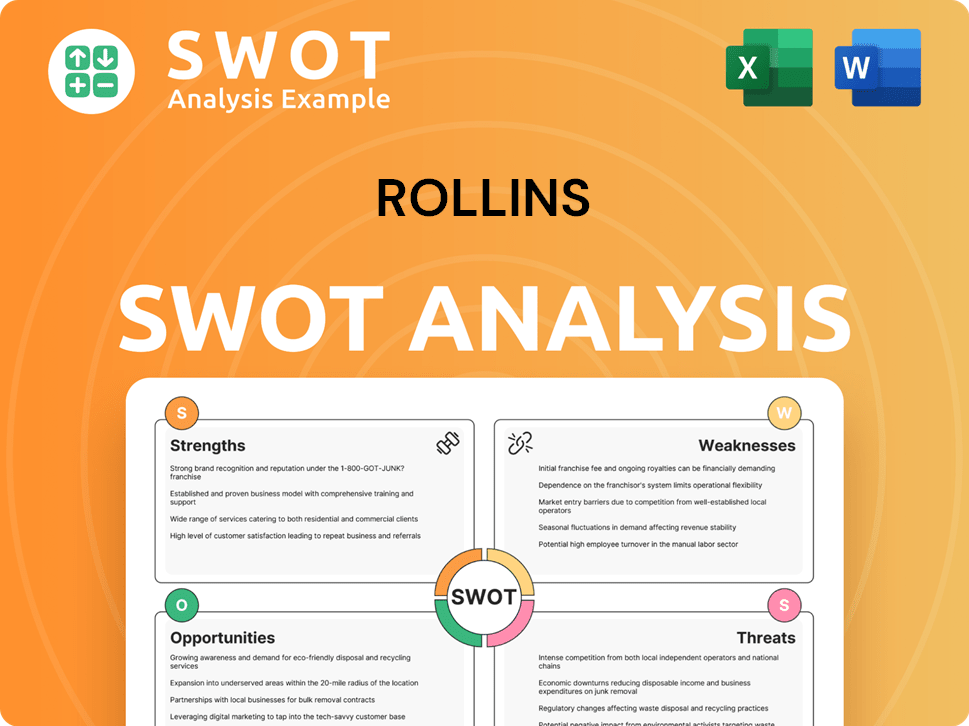

Rollins SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Rollins Make Money?

Rollins Inc. generates revenue mainly through its pest and termite control services. These services are divided into residential and commercial segments. The company's financial success is largely built on a recurring revenue model, where customers pay for ongoing pest management and preventative treatments.

In 2023, Rollins reported total revenues of approximately $2.96 billion, showing significant growth. This growth is supported by long-term service agreements and high customer renewal rates. The acquisition of Terminix in 2022 significantly expanded Rollins' market presence, particularly in the residential sector.

The revenue streams are primarily from residential pest control, followed by commercial services and termite control. Rollins uses various monetization strategies, including tiered pricing, bundled service packages, and add-on services for specialized pest issues. For more details, you can read the Brief History of Rollins.

Rollins leverages several strategies to generate revenue and maintain a strong market position. These strategies include:

- Recurring Revenue Model: The subscription-like model provides a stable revenue stream, reducing vulnerability to economic fluctuations.

- Service Segmentation: Revenue is generated from residential, commercial, and termite control services.

- Tiered Pricing and Bundled Services: Offers different service levels and packages to cater to various customer needs and increase revenue.

- Strategic Acquisitions: The acquisition of Terminix expanded the customer base and service offerings.

- Customer Retention: High renewal rates among the customer base demonstrate the effectiveness of the monetization approach.

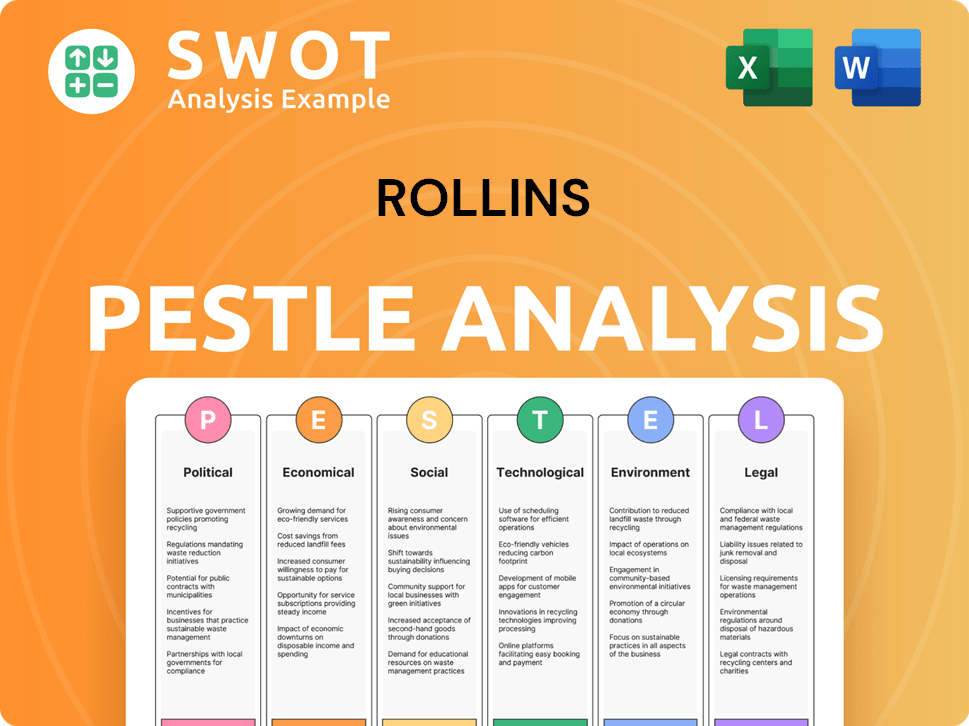

Rollins PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Rollins’s Business Model?

The operational and financial trajectory of Rollins Company has been significantly shaped by strategic decisions and key milestones. A pivotal move was the acquisition of Terminix Global Holdings in 2022, a deal valued at approximately $6.7 billion. This acquisition significantly broadened Rollins' market presence, particularly in the residential pest control sector, solidifying its position as a dominant industry player.

Rollins has consistently pursued a growth strategy centered on acquiring smaller pest control businesses. These acquisitions are then integrated into its existing network, allowing Rollins to leverage its operational expertise and achieve greater economies of scale. This approach has enabled the company to expand its service offerings and geographic reach effectively.

Despite operational challenges, such as adapting to evolving regulations and managing supply chain dynamics, Rollins has maintained agility through its robust operational framework and decentralized branch management structure. The company's competitive advantages are multifaceted, including a strong brand portfolio and an extensive geographic footprint.

The acquisition of Terminix in 2022 was a landmark event, significantly expanding Rollins' market share. This strategic move allowed Rollins Inc to consolidate its position in the pest control industry. The integration of Terminix enhanced Rollins' service capabilities and customer base.

Rollins Company focuses on acquiring smaller pest control businesses to expand its reach. The company integrates these acquisitions into its network, optimizing operations. This strategy allows Rollins to leverage its expertise and achieve economies of scale.

Rollins benefits from a strong brand portfolio, including Orkin and Terminix, which fosters customer trust. Its extensive geographic footprint provides a broad customer base and diversified revenue streams. The company also benefits from economies of scale in purchasing and marketing.

Rollins faces challenges related to evolving regulations for pest control products. Managing supply chain dynamics for equipment and chemicals is another operational hurdle. Despite these challenges, Rollins maintains agility through its robust framework.

Rollins' competitive advantages include its strong brand recognition, extensive geographic reach, and commitment to customer service. The company's focus on technician training and customer retention further strengthens its position. Rollins continues to adapt to new trends, such as increasing demand for eco-friendly pest control solutions.

- Brand Recognition: Orkin and Terminix are well-known brands, fostering customer trust.

- Geographic Footprint: Operations across North America, Australia, and Europe provide a diversified customer base.

- Customer Retention: High customer retention rates are supported by technician training and service quality.

- Sustainability: Investment in eco-friendly solutions aligns with market trends.

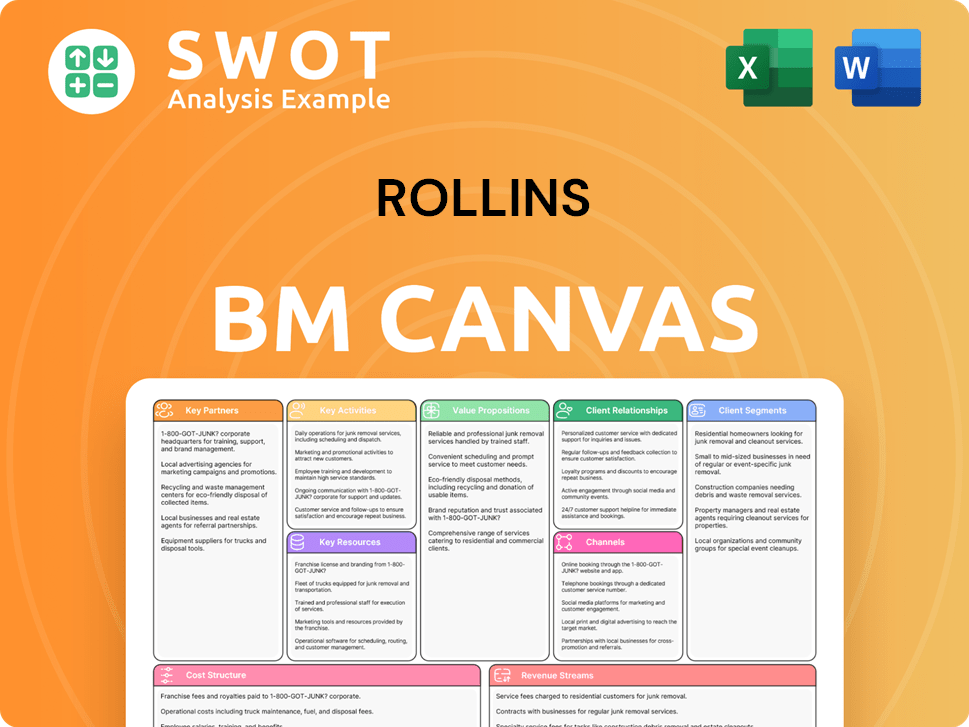

Rollins Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Rollins Positioning Itself for Continued Success?

Rollins, Inc. holds a leading position in the global pest control industry. The company, through its brands like Orkin and Terminix, maintains a significant market share, especially in North America. Its extensive global presence, spanning North America, Australia, and Europe, reinforces its standing. This makes understanding the Marketing Strategy of Rollins crucial for investors and competitors alike.

Despite its strong market position, Rollins faces several risks. These include potential regulatory changes affecting pest control chemicals, competition from other pest control providers, and economic downturns. Looking ahead, Rollins is focused on strategic initiatives to drive growth and maintain its value proposition.

Rollins Inc. is a leader in the pest control services market. It competes with a few major players while maintaining a strong presence, particularly in North America. The company's brand portfolio, including Orkin and Terminix, contributes to its customer loyalty and market reach.

Rollins faces risks such as regulatory changes impacting pest control chemicals and methods. Competition from national and local providers could affect market share. Economic downturns could influence customer spending on services. These are potential factors that can influence the Rollins Company stock price.

Rollins is focused on integrating the Terminix acquisition and investing in digital technologies. The company aims to expand service offerings and continue growth through organic expansion and strategic acquisitions. These efforts are designed to boost revenue and shareholder value.

In 2024, Rollins reported revenue growth, driven by both organic expansion and acquisitions. The company's adjusted operating margin remained strong, reflecting its operational efficiency. Rollins continues to generate robust cash flow, supporting its strategic initiatives and shareholder returns.

Rollins is focused on several strategic initiatives to drive future growth and enhance shareholder value. These include integrating the Terminix acquisition to realize synergies and investing in digital technologies. Expansion of service offerings is also a key focus.

- Terminix Integration: Streamlining operations and leveraging combined resources.

- Digital Transformation: Enhancing customer experience and operational efficiency.

- Service Expansion: Addressing emerging pest challenges and broadening service offerings.

- Strategic Acquisitions: Identifying and integrating new businesses to expand market reach.

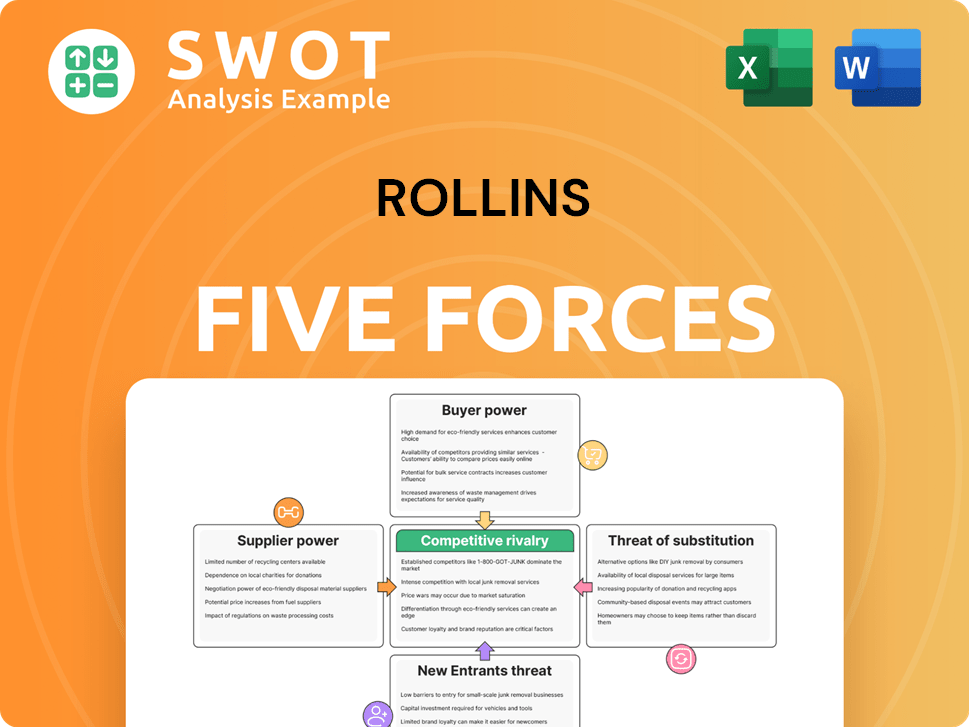

Rollins Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rollins Company?

- What is Competitive Landscape of Rollins Company?

- What is Growth Strategy and Future Prospects of Rollins Company?

- What is Sales and Marketing Strategy of Rollins Company?

- What is Brief History of Rollins Company?

- Who Owns Rollins Company?

- What is Customer Demographics and Target Market of Rollins Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.