Rollins Bundle

Who Really Calls the Shots at Rollins Company?

Ever wondered who truly steers the ship at Rollins, Inc., a titan in the pest control industry? Understanding the Rollins SWOT Analysis can be a great start. Unveiling the Rollins ownership structure is crucial for anyone looking to understand its strategic direction and future potential. From its humble beginnings to its current status as a publicly traded entity, Rollins' story is a fascinating study in corporate evolution.

This exploration of Rollins ownership will reveal the key players influencing the company's trajectory. We'll examine the roles of Rollins shareholders, the impact of institutional investors, and the enduring influence of the Rollins family. Discover how these elements shape the company's performance and its standing in the Rollins pest control market, providing valuable insights for investors and stakeholders alike.

Who Founded Rollins?

The foundation of Rollins, Inc., now a major player in pest control, traces back to 1948. O. Wayne Rollins established the company, initially focusing on radio broadcasting. This early phase set the stage for the company's future expansion and strategic shifts.

The pivotal moment came in 1964 when Rollins, Inc. acquired Orkin Exterminating Company. This acquisition marked a significant pivot towards the pest control industry, which would become the company's core business. The early ownership structure was primarily held within the Rollins family.

During the initial private phase of Rollins, Inc., the Rollins family maintained a dominant ownership position. While specific equity splits are not publicly available for this period, the family's control was key in guiding the company's strategic direction. This concentrated ownership facilitated swift decision-making.

Early financial backing came primarily from family members and close associates. These initial investors provided the necessary capital and strategic guidance to launch the company.

The company's growth was largely driven by its operational success and strategic acquisitions. These acquisitions, such as Orkin, expanded the company's market reach.

The enduring influence of the Rollins family suggests a carefully managed succession and ownership transfer within the family. This ensured long-term stability and continuity.

No significant early ownership disputes or buyouts have been widely reported. This indicates a unified vision focused on long-term growth.

O. Wayne Rollins's entrepreneurial spirit and strategic foresight were key. The concentrated control within the family enabled swift decision-making.

Detailed information on early angel investors or specific shareholding percentages during the initial private phase is not publicly available. The company's early financial details remain private.

The early history of Rollins, Inc., is characterized by family control and strategic acquisitions. The focus on pest control, initiated by the Orkin acquisition, solidified the company's direction. The Rollins family's concentrated ownership played a crucial role in the company's early success and strategic decisions. For more insights into the company's history, you can read this article about Rollins Company history.

- Rollins Company was founded in 1948 by O. Wayne Rollins.

- The acquisition of Orkin in 1964 marked a major shift into pest control.

- The Rollins family maintained a dominant ownership position in the early years.

- Growth was fueled by operational success and strategic acquisitions.

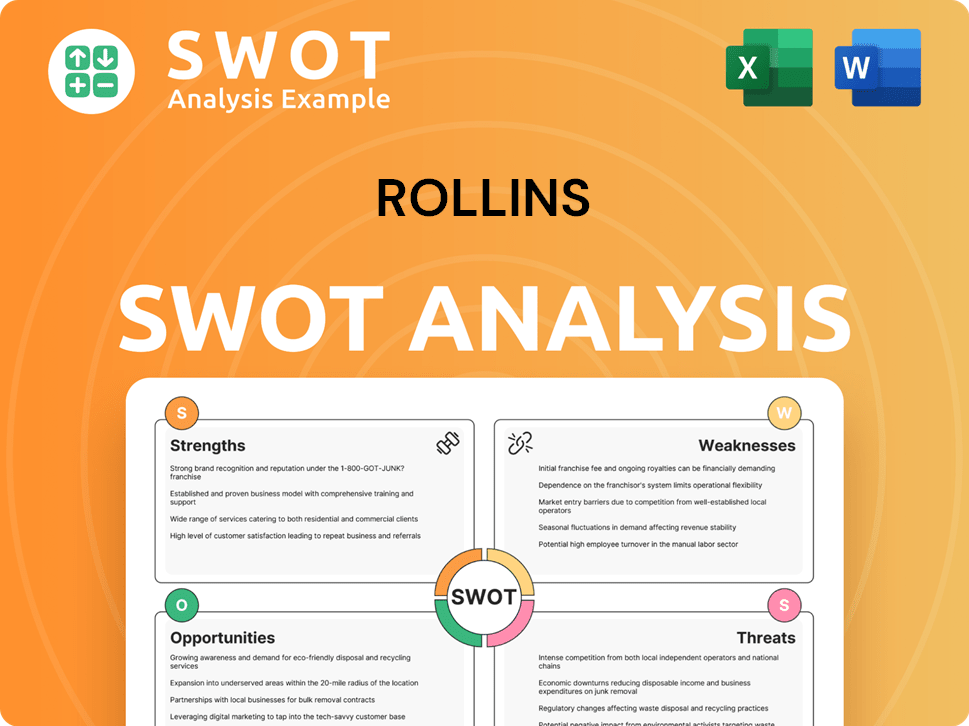

Rollins SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Rollins’s Ownership Changed Over Time?

The evolution of Rollins Company's ownership structure is a key aspect of its corporate journey. The company's transition to a publicly traded entity on January 1, 1968, was a pivotal moment, opening the doors for wider public investment. While the exact initial market capitalization isn't readily available in public records, this move significantly impacted the ownership dynamics, diluting the direct holdings of the founding family, though they maintained considerable influence.

Over the years, the shareholder composition of Rollins Inc has evolved substantially. Institutional investors, mutual funds, and index funds have steadily increased their stakes. As of March 31, 2025, institutional ownership accounts for approximately 78.9% of the company's shares, highlighting the significant role these entities play in the company's financial landscape. This shift reflects a broader trend of institutional involvement in publicly traded companies, influencing corporate governance and strategic direction.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Allowed broader public investment, diluting family ownership. | January 1, 1968 |

| Institutional Investment Growth | Increased institutional ownership, influencing corporate governance. | Ongoing |

| Family Holdings Adjustments | Dilution of family percentage ownership through market activity. | Ongoing |

The major stakeholders of Rollins Inc include a diverse group of institutional investors and the Rollins family. Prominent institutional investors such as The Vanguard Group, BlackRock Inc., and State Street Corporation consistently rank among the top shareholders. These firms' investments reflect confidence in Rollins's market position and financial performance. The Rollins family, through trusts and direct holdings, continues to hold a notable stake, ensuring their ongoing influence on the company's governance and strategic decisions. As of December 31, 2024, R. Randall Rollins and Gary W. Rollins, collectively held a significant portion of the company's voting stock. This blend of institutional and family ownership shapes the company's approach to long-term value creation and capital allocation.

The ownership structure of Rollins Inc has evolved significantly since its IPO in 1968, with a shift towards substantial institutional investment. Understanding the ownership dynamics is key to assessing the company's strategic direction and financial health.

- The Vanguard Group, BlackRock Inc., and State Street Corporation are among the top institutional holders.

- The Rollins family maintains a significant influence through trusts and direct holdings.

- Institutional ownership accounted for approximately 78.9% of shares as of March 31, 2025.

- The company's stock symbol is ROL.

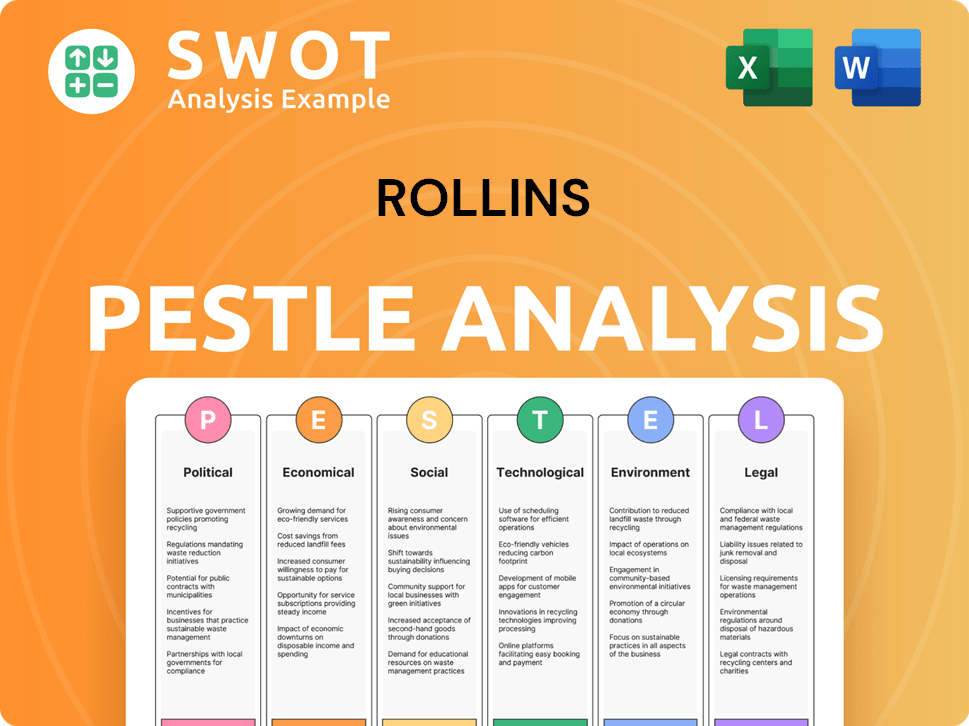

Rollins PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Rollins’s Board?

The current board of directors of Rollins Inc plays a key role in the company's governance and reflects its ownership structure. As of early 2025, the board includes a mix of independent directors and those with ties to the Rollins family or significant shareholder interests. For instance, Gary W. Rollins serves as Chairman of the Board, representing the continued influence of the founding family. Other board members include individuals with extensive experience in finance, operations, and corporate governance, many of whom are independent directors intended to provide objective oversight. Understanding the composition of the board is crucial for investors looking at Rollins ownership and its strategic direction.

The board's composition and the influence of the Rollins family are vital aspects of understanding the company's operational and financial strategies. The presence of independent directors helps ensure a balance of perspectives, while the family's involvement provides a degree of continuity and long-term vision. This structure is designed to foster both stability and innovation within Rollins Company. The board's decisions have a direct impact on the company's performance and its ability to navigate the competitive landscape of the pest control industry.

| Board Member | Title | Affiliation |

|---|---|---|

| Gary W. Rollins | Chairman of the Board | Rollins Family |

| Other Members | Various | Independent/Financial/Operational Experts |

| Independent Directors | Various | Provide objective oversight |

The voting structure of Rollins, Inc. is primarily based on a one-share-one-vote principle for its common stock. However, the Rollins family maintains outsized control through their significant aggregate shareholdings. While there are no publicly disclosed dual-class shares or golden shares that grant disproportionate voting rights to specific entities, the sheer volume of shares held by the Rollins family and associated trusts provides them with considerable voting power, allowing them to significantly influence key corporate decisions, including the election of directors and major strategic initiatives. This concentration of voting power is a key factor for anyone analyzing Rollins stock.

The Rollins family's substantial ownership stake provides them with considerable voting power.

- This influence allows them to significantly impact key corporate decisions.

- The structure supports a cohesive decision-making process.

- The focus is often on long-term stability and growth.

- This stability is reflected in the company's performance and governance.

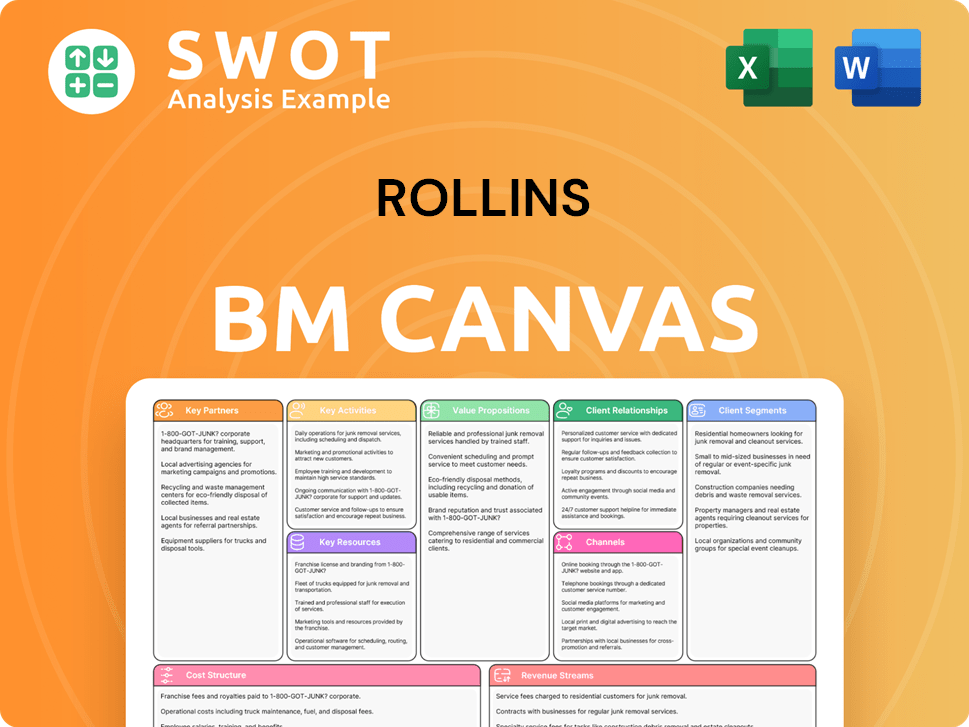

Rollins Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Rollins’s Ownership Landscape?

Over the past three to five years (2022-2025), Rollins Inc has continued its strategic acquisitions, integrating smaller pest control businesses. This approach, while contributing to growth, can result in minor share dilution, especially if acquisitions involve stock components. For example, in 2024 and early 2025, Rollins Inc completed several acquisitions to expand its geographical footprint and service offerings. This strategic move is a key aspect of understanding Rollins ownership and its growth trajectory.

Industry trends also play a role in the ownership structure. There's a general increase in institutional ownership across the market, and Rollins Inc is no exception, with institutional investors holding a significant majority of its shares. This trend often leads to a greater emphasis on environmental, social, and governance (ESG) factors and a focus on long-term sustainable growth. The Rollins family maintains a substantial and influential stake, which is a key factor in the company's strategic direction.

| Metric | Value (Approximate) | Source/Year |

|---|---|---|

| Institutional Ownership | Around 80% | Public Filings, 2024-2025 |

| Rollins Family Stake | Significant, but details are proprietary | Public Filings, 2024-2025 |

| Annual Revenue Growth (2024) | Approximately 7% | Company Reports, 2024 |

There have been no public announcements about significant ownership changes like secondary offerings or large-scale share buybacks. The company's leadership focuses on organic growth supplemented by strategic acquisitions, indicating a stable ownership outlook. The continued presence of the Rollins family in leadership and on the board suggests a commitment to the company's long-term vision.

Major shareholders of Rollins Inc include large institutional investors. The Rollins family also maintains a significant ownership stake. These shareholders influence the company's strategic direction.

Rollins continues to grow through strategic acquisitions of smaller Rollins pest control businesses. This strategy can lead to minor share dilution. Acquisitions are a key part of its expansion strategy.

The company's leadership has consistently focused on organic growth and strategic acquisitions. The Rollins ownership structure appears stable. There are no immediate plans for major ownership changes.

With increased institutional ownership, there's a greater emphasis on ESG factors. Rollins Inc is likely to focus on long-term sustainable growth. This trend influences the company's strategic decisions.

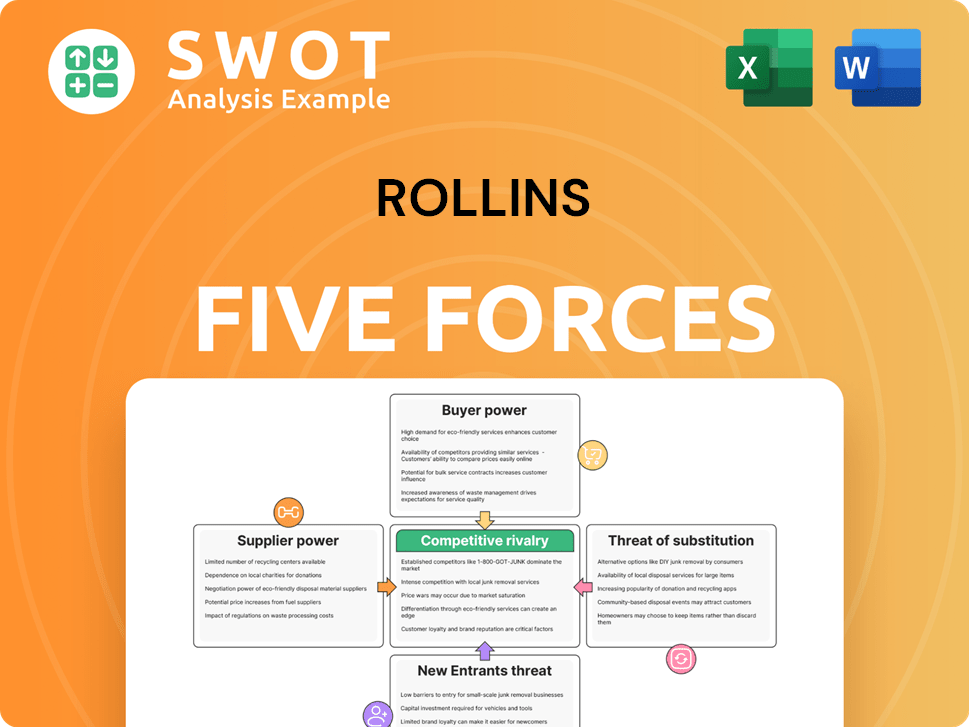

Rollins Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rollins Company?

- What is Competitive Landscape of Rollins Company?

- What is Growth Strategy and Future Prospects of Rollins Company?

- How Does Rollins Company Work?

- What is Sales and Marketing Strategy of Rollins Company?

- What is Brief History of Rollins Company?

- What is Customer Demographics and Target Market of Rollins Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.