Scout24 Bundle

How Does the Scout24 Company Thrive?

Scout24 SE, a digital powerhouse based in Germany, has consistently reshaped the online marketplace landscape, particularly in real estate and automotive sectors. Witnessing its fourth consecutive year of double-digit revenue growth in 2024, the company's financial prowess is undeniable. But how does Scout24 SWOT Analysis reveal the secrets behind its success?

This exploration into how Scout24 works will dissect its core operations and the Scout24 business model. We'll examine its leading online platforms, including ImmobilienScout24 for real estate and AutoScout24 for automobiles, and delve into how Scout24 generates revenue through subscription-based services and data-driven innovation. Understanding Scout24's strategic moves is key to grasping its future potential and its impact on the evolving digital marketplace.

What Are the Key Operations Driving Scout24’s Success?

The core operations of the Scout24 company revolve around its digital platforms, primarily ImmobilienScout24 and AutoScout24. These platforms serve as online marketplaces, connecting various user segments such as property seekers, real estate agents, and car buyers and sellers. Scout24 focuses on providing efficient and user-friendly services within the real estate and automotive sectors.

The value proposition of Scout24 lies in its ability to connect all market participants through integrated digital products and processes. This strategy enhances the user experience and provides valuable data-driven insights. The company's dedication to innovation and data-led services, such as Living+ and Buyer+, highlights its shift towards a comprehensive transaction platform.

The company's strategy emphasizes interconnectivity, aiming to connect all market participants—seekers, homeowners, and professional customers—through integrated digital products and processes. This involves enriching listings with value-added content and data to facilitate optimal decision-making for users and providing real estate agents with a wide array of digital solutions to drive their business. The company is also expanding its Homeowner ecosystem, allowing owners to manage their properties digitally.

ImmobilienScout24 and AutoScout24 are the primary platforms. ImmobilienScout24 focuses on real estate in Germany. AutoScout24 operates as an online car marketplace across Europe.

Technology development and digital platform management are central. The focus is on interconnectivity to link all market participants. This includes enriching listings with data and providing digital solutions for agents.

Strong brand and extensive data create barriers to entry. The shift is from a listing portal to an integrated real estate transaction platform. Acquisitions enhance transaction enablement and valuation solutions.

In Q1 2025, Scout24 demonstrated strong financial results. The company achieved an 18% EBITDA growth and a 1.1 percentage point margin expansion. This indicates improved operational efficiency and scalability.

The Scout24 business model leverages its strong brand and data assets to create value. Its focus on subscription-based innovation and data-led services sets it apart. This shift enhances the user experience and provides valuable data-driven insights.

- Comprehensive online marketplaces for real estate and automotive.

- Integrated digital products connecting all market participants.

- Data-driven services for optimal decision-making.

- Strong financial performance with EBITDA growth and margin expansion.

Scout24 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Scout24 Make Money?

The Scout24 company generates revenue through a combination of subscription-based services and transaction enablement, catering to both professional (B2B) and private (B2C) customers. This multifaceted approach allows the company to tap into diverse revenue streams, driving growth and market penetration. The Scout24 business model is designed to provide value to both sides of the marketplace, ensuring sustained financial performance.

In 2024, the company's total revenue reached EUR 566.3 million, reflecting an impressive 11.2% growth. The first quarter of 2025 saw revenues increase by 15.8% to EUR 157.6 million, with organic growth at 12.1%, showcasing the company's strong financial trajectory. This consistent growth highlights the effectiveness of Scout24's services and monetization strategies.

The company's monetization strategies are continuously enhanced through product innovation and an 'interconnectivity strategy' to drive growth and efficiency. The company has successfully executed its strategy, resulting in continued margin expansion. To learn more about the company, you can read about Owners & Shareholders of Scout24.

The Professional segment, accounting for 73% of revenue in Q1 2025, relies heavily on subscription revenues. The Private segment contributed 27% to the Group's revenue in Q1 2025. Understanding these segments is key to comprehending how Scout24 works.

- In Q1 2025, professional segment revenue increased by 16.2% to EUR 115.3 million, with subscription revenues up 15.0% to EUR 82.8 million. Transaction enablement revenue in Q1 2025 grew by 25% to EUR 27.2 million.

- The average number of professional customers grew by 5.9% to 25,601 in Q1 2025, with average revenue per user (ARPU) increasing by 8.6%.

- For the full year 2024, private segment subscription revenues increased by 25.2% to EUR 90.3 million. In Q1 2025, total revenue in the Private segment increased by 14.9% to EUR 42.3 million.

- Subscription revenues in the Private segment increased by 26.3% to EUR 25.8 million, driven by strong demand for Plus products. The subscriber base grew by 19.8% year-on-year, reaching 495,150 customers, and ARPU increased by 5.4%.

Scout24 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Scout24’s Business Model?

The Scout24 company has achieved significant milestones, demonstrating robust growth and strategic adaptability in the digital marketplace sector. The company's trajectory is marked by consistent revenue increases and strategic expansions, reinforcing its position as a key player in the real estate and automotive classifieds markets. Understanding how Scout24 works involves recognizing its evolution from a traditional classifieds platform to an integrated service provider.

A cornerstone of Scout24's success has been its consistent financial performance. The company has seen double-digit revenue growth for four consecutive years, with 2024 revenues reaching EUR 566.3 million, an 11.2% increase. This financial momentum is fueled by a growing customer base and the success of its subscription-based services, which are central to its business model. This financial growth is a testament to its effective strategies and market positioning.

The company's strategic moves, particularly its 'interconnectivity strategy,' aim to transform its business model beyond traditional classifieds. This involves enriching listings with value-added content and data, providing agents with digital solutions, and developing a homeowner hub for digital property management. The company also made strategic acquisitions to bolster its offerings, such as bulwiengesa AG in December 2024 and IMMOunited in March 2025, expanding its data and valuation services.

Surpassing 25,000 professional customers and over 470,000 private customers by Q4 2024. Consistent double-digit revenue growth for four consecutive years. Strategic acquisitions to enhance data and valuation services.

Implementation of the 'interconnectivity strategy' to merge data with listings. Focus on subscription-based innovation like Living+ and Buyer+ solutions. Integration of AI to enhance personalization and customer experiences.

Dominant market position and strong brand recognition. Extensive data assets and deep integration within the German real estate market. Disciplined execution leading to improved operating leverage.

EBITDA growth of 18% and a 1.1 percentage point margin expansion in Q1 2025. Revenue growth driven by B2B and B2C subscription products. Strong pricing power due to market dominance.

The company's competitive advantages are rooted in its dominant market position, strong brand recognition, and extensive data assets. These factors create significant barriers to entry for competitors and support its pricing power. The integration of AI enhances personalization and customer experiences.

- Dominant market position in Germany.

- Strong brand recognition and extensive data assets.

- Focus on subscription-based innovation.

- Disciplined execution leading to improved operating leverage.

Scout24 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Scout24 Positioning Itself for Continued Success?

The Scout24 company maintains a strong position in the German online real estate market. As of Q1 2025, it reportedly holds a market share of approximately 30%. This leadership is supported by a strong brand, valuable data assets, and deep integration, which create significant barriers to entry for potential competitors.

Despite its market dominance, Scout24 faces several risks. These include potential regulatory changes, new competitors, technological disruptions, and shifts in consumer preferences. Broader market conditions, such as interest rate impacts and affordability challenges in the rental market, also present challenges, although transaction volumes are gradually recovering.

Scout24 is the market leader in the German online real estate sector. Its strong brand and extensive data assets support its leading position. This dominance allows the company to maintain pricing power and expand its margins.

The company faces risks from regulatory changes, new competitors, and technological shifts. Economic factors like interest rates and affordability in the rental market pose additional challenges. These factors could impact the company's financial performance.

Scout24 aims to sustain profitability through strategic initiatives and innovation. The 2025 guidance projects revenue growth of 12-14%. Investments in AI and technology are central to its future product strategy.

Analysts anticipate Scout24's revenues to reach approximately EUR 640.1 million in 2025. Earnings per share are projected to increase by 29% to EUR 3.07. The company plans a 10% dividend increase for 2024.

Scout24 is focusing on its interconnectivity strategy to transform its business. This involves integrating data and AI to improve matchmaking and enhance the customer experience. The company's commitment to shareholder value is demonstrated through dividend increases.

- Focus on AI and technology investments.

- Expand services beyond classifieds.

- Enhance customer experience through data integration.

- Increase shareholder value.

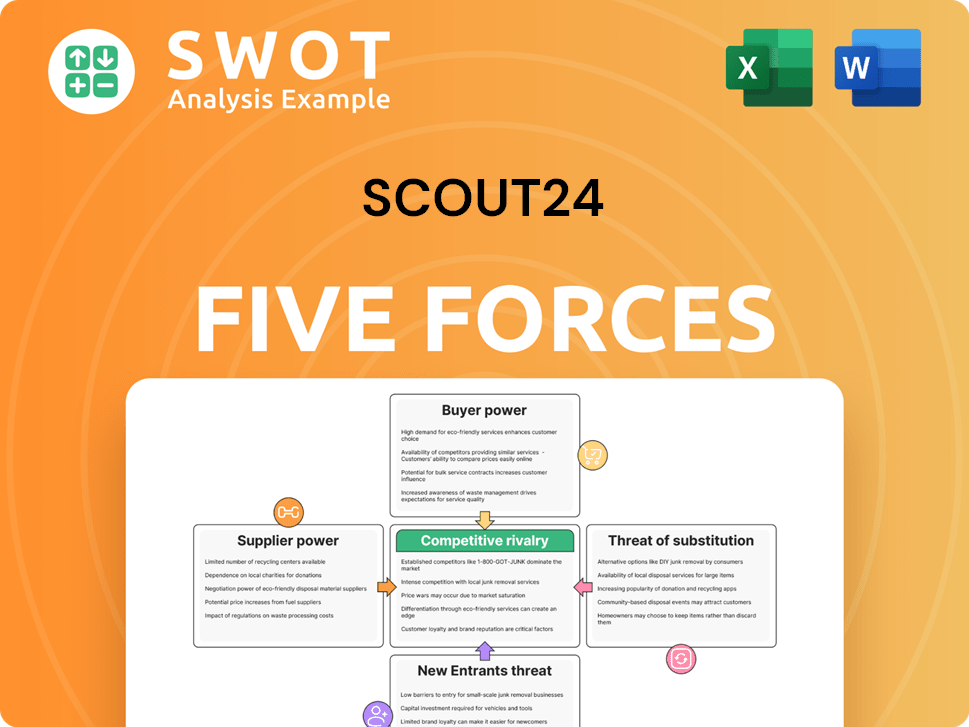

Scout24 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Scout24 Company?

- What is Competitive Landscape of Scout24 Company?

- What is Growth Strategy and Future Prospects of Scout24 Company?

- What is Sales and Marketing Strategy of Scout24 Company?

- What is Brief History of Scout24 Company?

- Who Owns Scout24 Company?

- What is Customer Demographics and Target Market of Scout24 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.