Shari’s Management Corp. (aka Shari’s Restaurants) Bundle

Can Shari's Restaurants Rebound?

Shari's Management Corp., the parent company of Shari's Restaurants, once a beloved Pacific Northwest staple, now faces a pivotal moment. Founded in 1978, the Shari’s Management Corp. (aka Shari’s Restaurants) SWOT Analysis reveals the complex challenges and opportunities confronting this iconic restaurant chain. With a history of 24-hour service and comfort food, understanding the current state of Shari's company is essential for anyone interested in the evolving restaurant industry.

This analysis aims to dissect the inner workings of Shari's Restaurants, exploring its business model, franchise operations, and the strategic shifts necessary for survival. We'll examine the factors contributing to its recent struggles, including restaurant closures and financial difficulties. By understanding the company's core operations, revenue streams, and competitive landscape, we can gain valuable insights into the future of Shari's and the broader casual dining market.

What Are the Key Operations Driving Shari’s Management Corp. (aka Shari’s Restaurants)’s Success?

Shari's Management Corp., operating as Shari's Restaurants, generates value through its family-style restaurant chain. It offers a diverse menu, including breakfast, lunch, and dinner, with a strong emphasis on pies and desserts. The company aims to provide a welcoming dining experience, focusing on 'Northwest Fresh' and locally sourced ingredients to enhance its brand value.

The core of Shari's business model revolves around providing high-quality meals at reasonable prices, available 24 hours a day. This operational strategy is supported by efficient supply chain management and a focus on customer satisfaction. Shari's Restaurants' ability to adapt to market changes and customer preferences is crucial for its continued success in the competitive restaurant industry.

As of 2024, Shari's operates approximately 89 locations, leveraging its scale to secure favorable supplier deals. This helps maintain efficient distribution networks, providing a competitive edge. The company has also innovated its menu and service models, including 'Shari's 2.0' restaurant design, which improved kitchen efficiency and service speed by 40%. The company has also introduced new menu items, including plant-based options like Impossible Sausage.

Shari's Restaurants' menu features a wide variety of options to cater to diverse tastes. The all-day breakfast menu is a key product strategy, drawing a broad customer base. The focus on signature items and a family-friendly atmosphere differentiates Shari’s Management Corp. (aka Shari’s Restaurants) in the casual dining market.

Supply chain management is critical for Shari's, especially with rising food costs. The restaurant industry saw a 5.8% increase in food costs in 2024. Shari's leverages its scale to negotiate favorable deals with suppliers. The 'Shari's 2.0' design has improved kitchen efficiency and speed of service.

Shari's value proposition centers on comfort food and pie specialization, attracting a loyal customer base. The all-day breakfast menu is a significant product strategy, appealing to a broad audience. This focus differentiates Shari's within the competitive casual dining market.

- Family-friendly dining experience.

- Emphasis on 'Northwest Fresh' and locally sourced ingredients.

- Signature pies and desserts.

- 24-hour service at many locations.

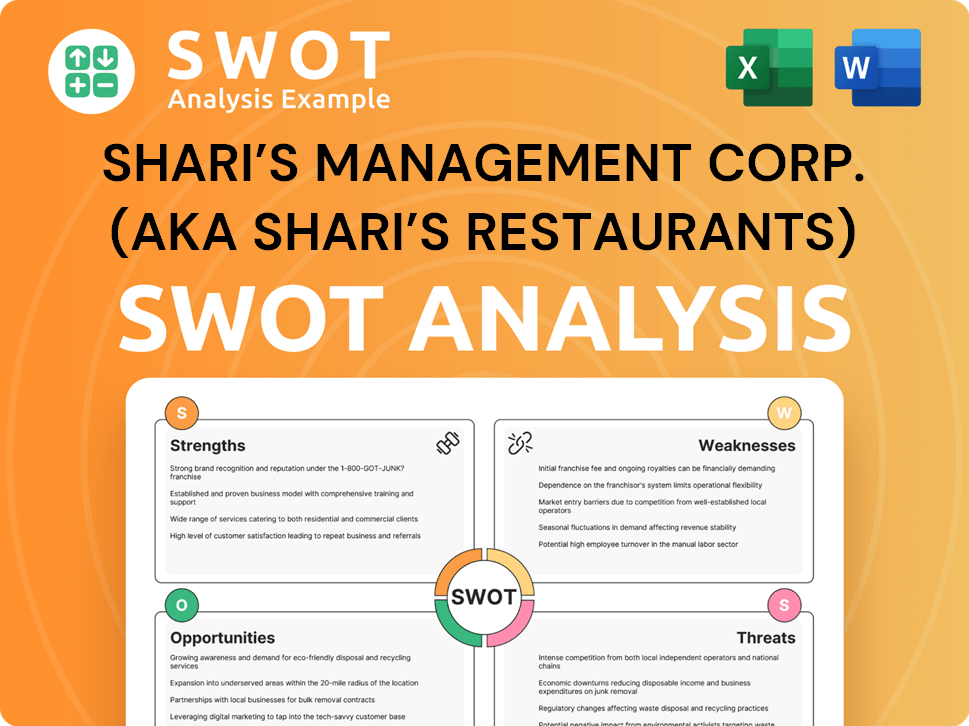

Shari’s Management Corp. (aka Shari’s Restaurants) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Shari’s Management Corp. (aka Shari’s Restaurants) Make Money?

The primary revenue stream for Shari's Management Corp., operating as Shari's Restaurants, comes from its restaurant sales. These sales encompass a broad menu, including breakfast, lunch, and dinner items, along with their well-known pies and desserts. The company aims to maximize revenue through diverse offerings and strategic initiatives.

While specific recent revenue figures for Shari's are not publicly available, the family dining segment, where Shari's operates, is projected to generate roughly $100 billion in revenue for 2024. Dessert sales, particularly pies, previously constituted 15% of Shari's total revenue, highlighting the importance of this segment.

Shari's has also explored other avenues for revenue generation, including online services and virtual brands. The online food delivery market is estimated to reach $46.8 billion in 2024, presenting a significant opportunity for expansion. To learn more about the target demographic, read this article about the Target Market of Shari’s Management Corp. (aka Shari’s Restaurants).

Shari's has implemented several strategies to boost its revenue and adapt to market changes. These include:

- Video Lottery Gaming: In Oregon, Shari's participated in video lottery gaming, generating over $34 million in revenue in 2023 and earning $7.45 million in commissions. However, the Oregon Lottery ended these operations at Shari's locations in early 2024, impacting revenue.

- Virtual Brands: The company launched virtual brands, such as Coco's Famous Hamburgers, operating from existing locations to maximize kitchen space and expand off-premise business.

- Online Services: With the online food delivery market growing, Shari's aims to capture a share of this market through delivery and takeout options.

- Franchise Operations: Shari's also utilizes franchise operations as a part of its business model.

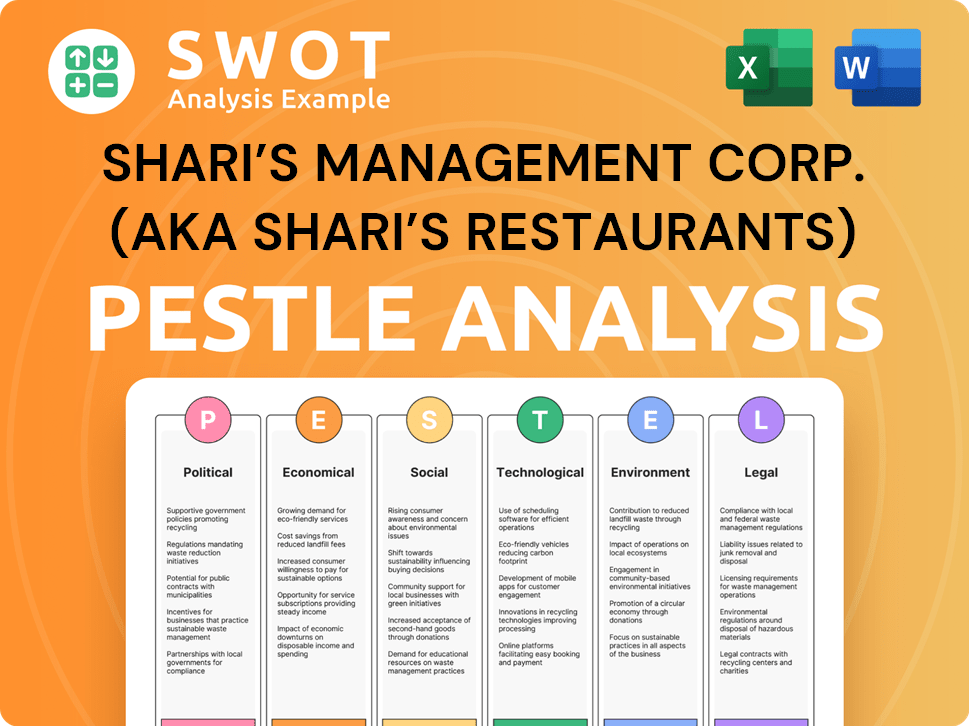

Shari’s Management Corp. (aka Shari’s Restaurants) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Shari’s Management Corp. (aka Shari’s Restaurants)’s Business Model?

Shari's Management Corp., known for its family-style dining, has a history marked by acquisitions and strategic shifts. Founded in 1978, the restaurant chain has navigated various ownership changes and market challenges. The company's journey includes expansions, brand refreshes, and adaptations to evolving consumer preferences.

The company's strategic moves have been aimed at revitalizing its brand and expanding its market presence. However, it has also faced significant operational and financial hurdles. The following sections detail key milestones, strategic initiatives, and the competitive landscape of this restaurant chain.

The evolution of Shari's Management Corp. reflects the dynamic nature of the restaurant industry. The company's story is one of adaptation, challenges, and efforts to maintain a competitive edge in a changing market.

In 1978, Shari's Restaurants was established in Hermiston, Oregon. Fairmont Capital Inc. acquired the company in 1999 for $60 million, when it had 96 locations. Circle Peak Capital later acquired it in 2005.

In 2009, Shari's expanded by acquiring and converting Baker's Square restaurants in Northern California. Sam Borgese became CEO in 2017, leading the purchase of Coco's and Carrows in 2018. The 'Shari's 2.0' brand refresh included updated designs and menu changes.

The COVID-19 pandemic severely impacted the business, leading to closures and financial strain. In 2024, the Idaho State Tax Commission filed six liens against Shari's Management Corp. for approximately $220,000 in unpaid taxes. All Oregon locations closed in October 2024.

Shari's historically relied on brand recognition, comfort food, and 24-hour service. However, the 'outdated business model' of family-style dining has been a weakness. Financial instability and negative publicity have eroded its market presence. Read more about the Marketing Strategy of Shari’s Management Corp. (aka Shari’s Restaurants).

Recent financial data indicates significant challenges for Shari's Restaurants. The company has faced multiple lawsuits for unpaid debts and taxes, reflecting its financial instability. The closure of all Oregon locations in October 2024 further underscores the operational difficulties.

- The Idaho State Tax Commission filed liens for approximately $220,000 in unpaid taxes in 2024.

- The company has experienced a decline in the total number of locations.

- The 'outdated business model' is a key weakness.

- The brand's reputation has been negatively impacted by financial issues and negative publicity.

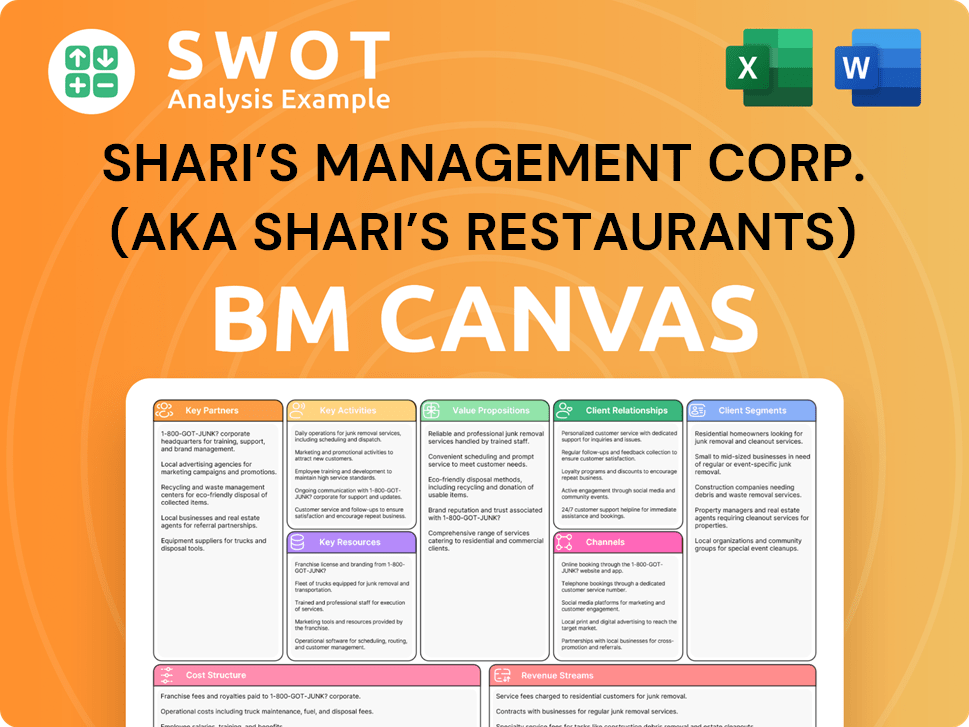

Shari’s Management Corp. (aka Shari’s Restaurants) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Shari’s Management Corp. (aka Shari’s Restaurants) Positioning Itself for Continued Success?

Shari's Management Corp., operating as Shari's Restaurants, competes within the casual and family dining sector. The restaurant chain has experienced a decline in its market position, particularly in the Pacific Northwest. As of June 2025, the company has only 10 locations remaining across Washington, California, and Idaho, a significant reduction from its peak of approximately 105 locations.

The future for Shari's company faces several challenges. Intense competition, fluctuating food and labor costs, and changing consumer preferences are major hurdles. The restaurant industry is dynamic, and Shari's must adapt to maintain its position.

Shari's Restaurants operates within the competitive casual and family dining industry. The company's regional presence in the Pacific Northwest has diminished due to closures. The restaurant chain now operates with a significantly reduced number of locations.

Key risks include intense competition, rising food and labor costs, and changing consumer preferences. Economic downturns and legal challenges also impact the company. The loss of video lottery revenue has further complicated its financial situation.

The future outlook for Shari's Restaurants appears uncertain due to ongoing financial instability and a shrinking footprint. Menu innovation and service improvements are crucial for attracting customers. Adapting to current consumer trends is essential for survival.

Shari's faces challenges like financial woes and the need to adapt its business model. Opportunities exist in menu innovation and strategic rebuilding of its market presence. The company must address its financial problems to sustain its business.

The casual dining sector saw a 15% increase in demand for healthier options in 2024, indicating a shift in consumer preferences. The National Restaurant Association projected a 5.4% increase in food costs for 2024, impacting profit margins. The company's focus on pies and comfort food, along with attempts at menu innovation, have been part of its strategy.

- Intense competition from other restaurant chains.

- Rising operational costs, including food and labor.

- Changing consumer preferences towards healthier options.

- Economic downturns and fluctuating consumer spending.

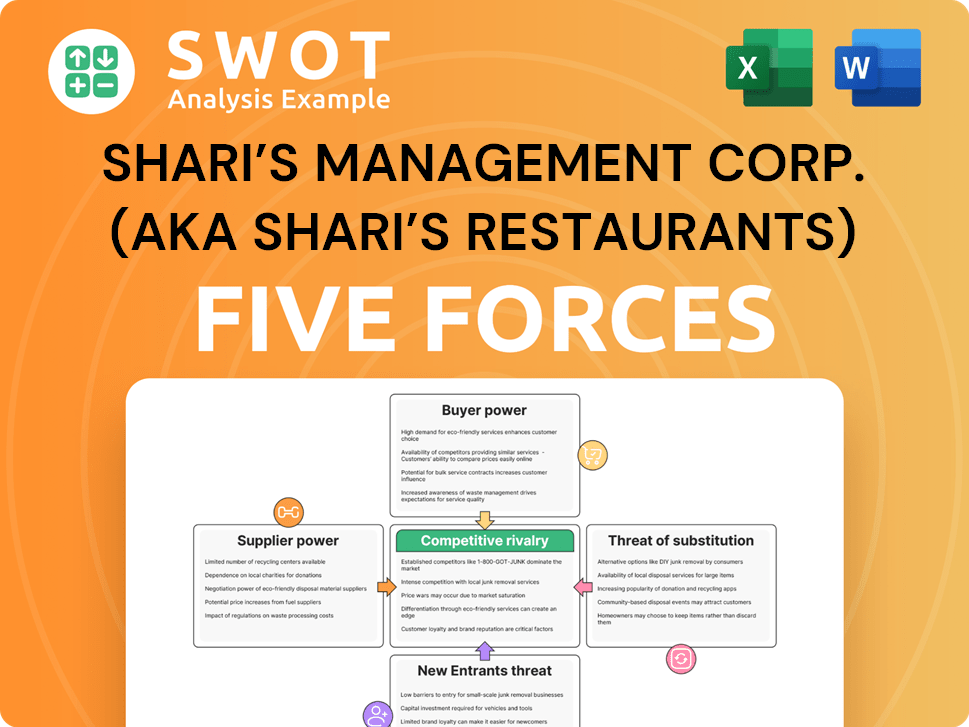

Shari’s Management Corp. (aka Shari’s Restaurants) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Competitive Landscape of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Growth Strategy and Future Prospects of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Sales and Marketing Strategy of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Brief History of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- Who Owns Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Customer Demographics and Target Market of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.