Shari’s Management Corp. (aka Shari’s Restaurants) Bundle

Who Really Calls the Shots at Shari's Restaurants?

Unraveling the ownership of Shari's Management Corp., the parent company of Shari's Restaurants, is key to understanding its past, present, and future. The sudden closure of numerous Shari's locations in late 2024 highlights the critical link between ownership decisions and the restaurant's operational health. This exploration delves into the Shari’s Management Corp. (aka Shari’s Restaurants) SWOT Analysis, and the evolution of its ownership structure.

From its humble beginnings in Oregon to its expansion across multiple states, the story of Shari's Restaurants is a testament to the American dream, and the challenges faced by the casual dining industry. Understanding the current ownership, including the parent company and key stakeholders, is crucial to assessing the brand's strategic direction. This analysis will answer questions such as: Who is the current owner of Shari's Restaurants and What companies own Shari's Restaurants?

Who Founded Shari’s Management Corp. (aka Shari’s Restaurants)?

The story of Shari’s Restaurants ownership began in Hermiston, Oregon, in 1978. It was a family affair, with Ron and Sharon 'Shari' Bergquist at the helm, setting the foundation for what would become a well-known chain.

Ron, an architect, designed the distinctive hexagonal buildings, while Sharon focused on the menu, especially comfort food and pies. This early period established the brand's identity and set the stage for future growth.

The initial ownership of Shari's Restaurants was held by its founders, Ron and Sharon Bergquist. They operated the business for the first seven years, shaping its core values and operational strategies.

In 1985, Ron Bergquist sold the chain to StratAmerica. At the time, the company had 33 restaurants.

This sale marked the transition from founder ownership to external investment. It was a strategic move for expansion.

The company was sold again in 1992 to the Battistone Financial Group. This continued the trend of ownership changes.

By March 1999, Fairmont Capital Inc. acquired Shari's for $60 million. This acquisition marked a significant milestone.

At the time of the Fairmont Capital Inc. acquisition, Shari's had 96 locations across seven states and 4,000 employees.

Annual revenue reached $128 million at the time of the Fairmont Capital Inc. acquisition. This demonstrates the company's financial performance.

The early years of Shari's saw a transition from its founding family to various investment groups. This indicates a strategic focus on growth and expansion through external capital. The changes in Shari's Management Corp owner

reflect the company's journey.

- The initial ownership was with Ron and Sharon Bergquist.

- StratAmerica acquired the chain in 1985.

- Battistone Financial Group acquired the company in 1992.

- Fairmont Capital Inc. acquired Shari's in March 1999.

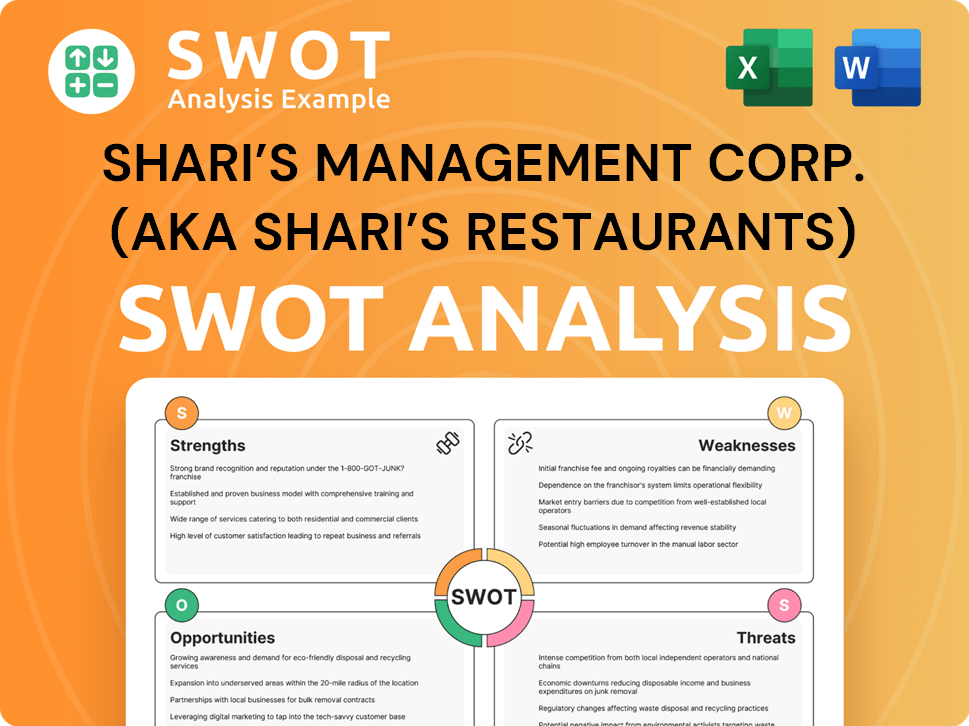

Shari’s Management Corp. (aka Shari’s Restaurants) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Shari’s Management Corp. (aka Shari’s Restaurants)’s Ownership Changed Over Time?

The ownership of Shari's Management Corp., also known as Shari's Restaurants, has seen significant changes since its inception. Initially acquired by Fairmont Capital Inc. in 1999, the chain was later purchased by Circle Peak Capital in December 2005 for approximately $80 million. This acquisition involved Circle Peak, its co-investors, and Shari's management, collectively owning the entire company. Key financial partners in this transaction included Falcon Investment Advisors and Sankaty Advisors LLC, with additional funding from entities such as Capital Source Finance LLC and Magnetar Capital LLC.

In 2016, CapitalSpring, a private investment firm specializing in the restaurant industry, acquired Shari's. CapitalSpring managed around $1.3 billion in assets and had investments in over 50 restaurant brands. However, CapitalSpring later exited its investment. The ownership then transitioned to Gather Holdings LLC, led by Samuel Borgese, who became CEO in September 2017. Gather Holdings LLC currently serves as the parent company for both Shari's Restaurants and Coco's Restaurants. Further expanding its portfolio, Shari's, under Gather Holdings, acquired Coco's and Carrows in September 2018.

| Year | Ownership Change | Key Players |

|---|---|---|

| 1999 | Acquired by Fairmont Capital Inc. | Fairmont Capital Inc. |

| 2005 | Acquired by Circle Peak Capital | Circle Peak Capital, Falcon Investment Advisors, Sankaty Advisors LLC |

| 2016 | Acquired by CapitalSpring | CapitalSpring |

| 2017 | Ownership shifts to Gather Holdings LLC | Gather Holdings LLC, Samuel Borgese (CEO) |

| 2023 | Investment by MGG Investment Group LP | MGG Investment Group LP |

In June 2023, Gather Holdings announced that affiliates of MGG Investment Group LP made an undisclosed investment in 42 of Shari's Oregon-based restaurants. This investment aimed to provide capital for post-pandemic recovery, particularly leveraging MGG's expertise in video lottery gaming operations within those locations. This continued reliance on private equity highlights the ongoing efforts to navigate financial challenges and support operational needs. For more detailed insights, consider reading this article about Shari's Management Corp. (aka Shari’s Restaurants) by [Company Name].

Shari's Restaurants' ownership has evolved through several private equity firms.

- Circle Peak Capital, CapitalSpring, and Gather Holdings LLC have all played significant roles.

- MGG Investment Group LP invested in 2023 to support recovery efforts.

- The current ownership structure reflects a dynamic approach to financing and operational support.

- Understanding the ownership history is crucial for assessing the company's financial health and strategic direction.

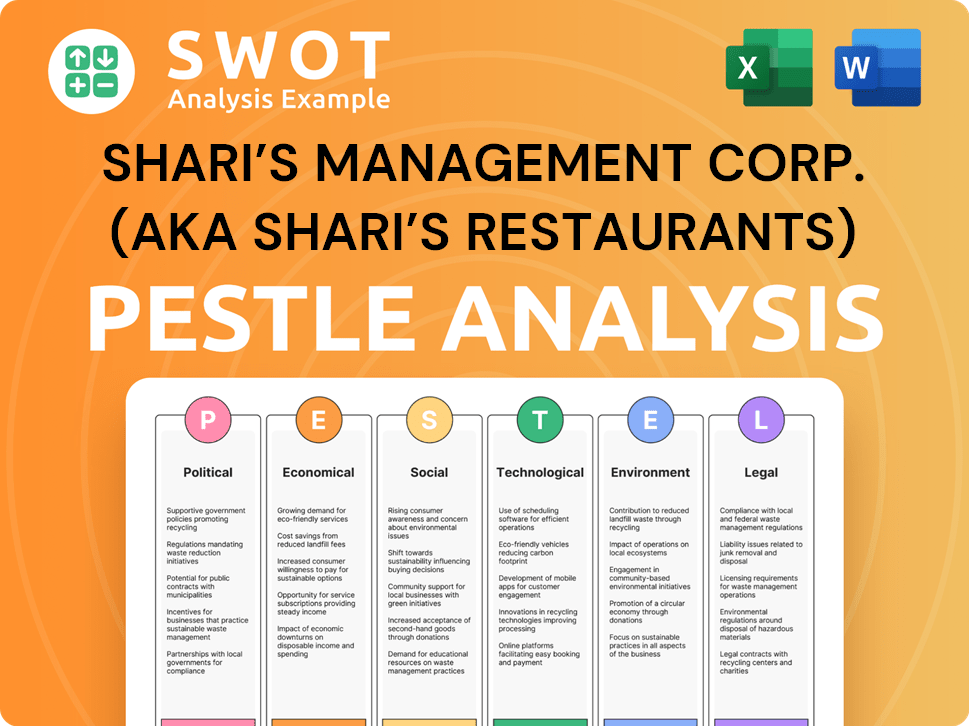

Shari’s Management Corp. (aka Shari’s Restaurants) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Shari’s Management Corp. (aka Shari’s Restaurants)’s Board?

The ownership structure of Shari's Restaurants is primarily controlled by Samuel Borgese through Gather Holdings LLC, the parent company. As the 'sole managing member' of Gather Holdings Guarantee LLC, Borgese holds significant decision-making power. This structure means that information about the board of directors and specific voting rights isn't publicly available like it would be for a publicly traded company. If you are interested in learning more about the company, you can read Brief History of Shari’s Management Corp. (aka Shari’s Restaurants).

MGG Investment Group LP, through its affiliates, invested in Shari's in June 2023, potentially influencing decisions, particularly concerning the 42 Oregon restaurants. Dale Stohr, a Managing Director at MGG, described their role as a 'capital partner,' suggesting a collaborative relationship with some influence. However, recent financial challenges, including lawsuits for unpaid rent and taxes, and significant debt to the Oregon Lottery, indicate that key decisions have been focused on addressing these financial pressures. The abrupt closure of all Oregon locations in October 2024 highlights the impact of these challenges on the company's operations.

| Key Players | Role | Influence |

|---|---|---|

| Samuel Borgese | Owner/CEO of Gather Holdings LLC | Significant control and decision-making power |

| MGG Investment Group LP (Affiliates) | Capital Partner | Influence, particularly in Oregon restaurant operations |

| Dale Stohr (MGG Managing Director) | Capital Partner | Collaborative, but influential role |

Due to the private nature of Shari's Management Corp., there are no public SEC filings providing detailed insights into the board structure, voting arrangements, or any recent proxy battles. The financial struggles, including over $900,000 in debt to the Oregon Lottery as of early 2025, have likely shifted the focus of the decision-making towards crisis management and financial recovery. The number of Shari's locations has fluctuated, with the closure of all Oregon locations in October 2024 impacting the total number of restaurants.

Samuel Borgese, through Gather Holdings LLC, primarily controls Shari's Restaurants.

- MGG Investment Group LP has a degree of influence.

- Financial difficulties have impacted decision-making.

- No public information on specific board structures.

- The closure of Oregon locations in October 2024 reflects the financial pressures.

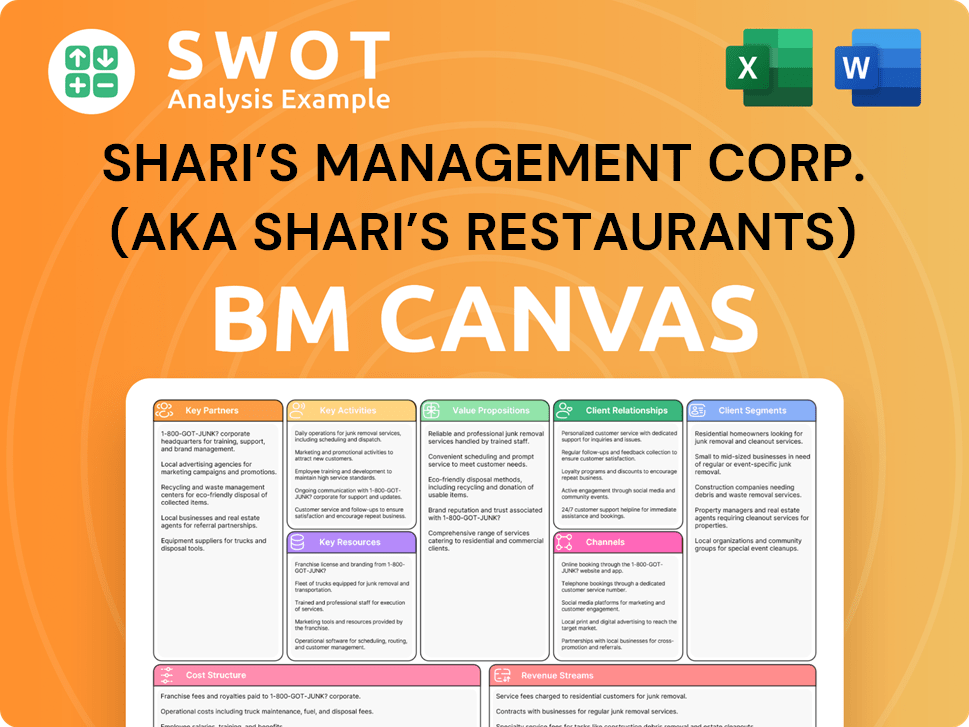

Shari’s Management Corp. (aka Shari’s Restaurants) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Shari’s Management Corp. (aka Shari’s Restaurants)’s Ownership Landscape?

Over the past few years, significant financial distress has reshaped the ownership profile of Shari's Management Corp. A notable development was the investment from MGG Investment Group LP affiliates in June 2023, targeting the company's 42 Oregon-based restaurants. This investment aimed to support financial recovery, particularly leveraging MGG's expertise in video lottery gaming.

Despite this investment, Shari's has faced numerous restaurant closures and legal challenges. The company's struggles culminated in the closure of all 42 Oregon locations on October 20, 2024, due to financial problems, including owing the Oregon Lottery over $900,000 for video lottery machines. As of June 2025, Shari's operates only 10 locations across Washington, California, and Idaho. The current owner is Samuel Borgese.

| Year | Units | Sales |

|---|---|---|

| 2023 | 78 | $121.4 million |

| 2024 (Early October) | 49 | N/A |

| 2025 (June) | 10 | N/A |

Corporate filings show 'Shari's Non Oregon Holdings,' affiliated with Samuel Borgese, was registered in April 2024 and is involved in debt cases, suggesting a potential restructuring. Sales in 2023 were $121.4 million, a 7.5% decrease from the previous year, with the chain ending 2023 with 78 units, a 7.1% decline. The challenges include rising food and labor costs, projected to increase by 5.4% in 2024, and changing consumer preferences. For more insights, check out the Marketing Strategy of Shari’s Management Corp. (aka Shari’s Restaurants).

The current owner is Samuel Borgese, with financial backing from MGG Investment Group LP affiliates.

As of June 2025, there are only 10 locations operating in Washington, California, and Idaho.

Sales in 2023 were $121.4 million, a 7.5% decrease. The chain ended 2023 with 78 units, a 7.1% decline.

Rising food and labor costs, changing consumer preferences, and increased breach-of-contract lawsuits.

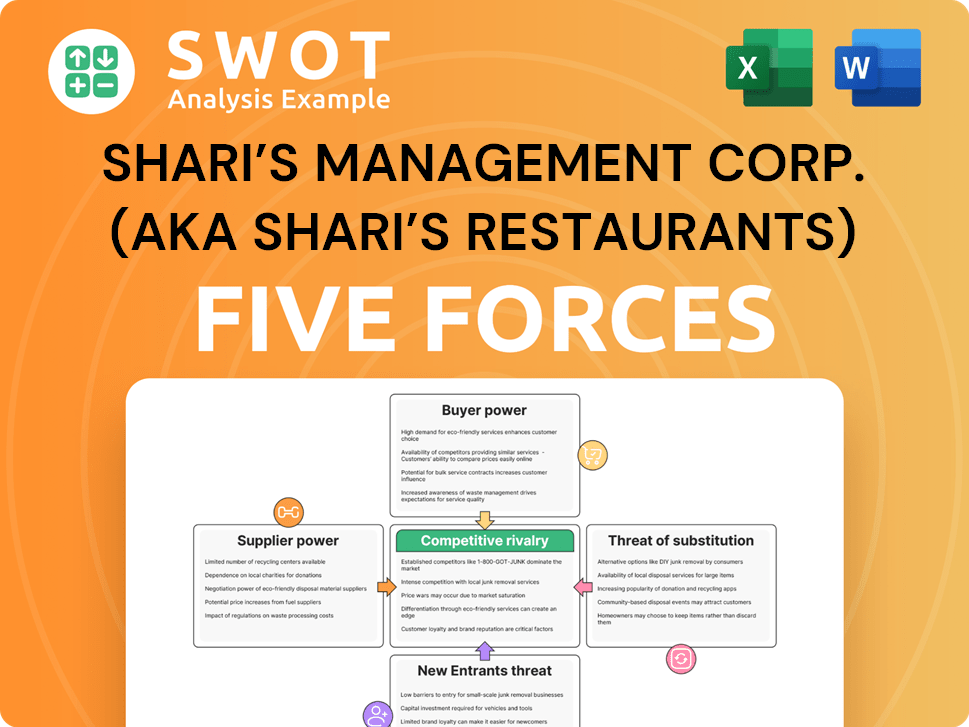

Shari’s Management Corp. (aka Shari’s Restaurants) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Competitive Landscape of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Growth Strategy and Future Prospects of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- How Does Shari’s Management Corp. (aka Shari’s Restaurants) Company Work?

- What is Sales and Marketing Strategy of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Brief History of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

- What is Customer Demographics and Target Market of Shari’s Management Corp. (aka Shari’s Restaurants) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.