Siili Bundle

How Does Siili Company Thrive in the Tech World?

Siili Solutions, a prominent player in the digital transformation arena, is leveraging the power of AI to reshape how businesses operate. With a focus on innovation, Siili offers a wide array of services, including software development and IT services, to help clients stay ahead. This analysis explores Siili's strategic initiatives and financial performance to understand its position in the market.

In the ever-evolving landscape of Siili SWOT Analysis, understanding the operational dynamics of Siili Group is essential. From its core software development processes to its strategic focus on digital transformation, Siili's approach offers insights into its ability to navigate market challenges. Examining Siili's recent financial results, including its Q1 2025 performance, provides a deeper understanding of its growth trajectory and strategic priorities within the competitive IT services sector.

What Are the Key Operations Driving Siili’s Success?

The core operations of Siili Solutions revolve around delivering end-to-end digital solutions. This includes design, development, and ongoing management, with a strong emphasis on AI-powered digital development. Their services are designed to help clients achieve growth, efficiency, and a competitive edge through digital transformation. They focus on providing services to large enterprises and the public sector.

Key offerings from Siili Group include advisory services for digital business and AI adoption, data and AI solutions, continuous services, e-commerce and portals, design services, cloud solutions, custom development, embedded solutions, and intelligent automation. Their operational processes are built on a foundation of combining strong software development, AI, and industry expertise. This unique combination allows them to accelerate development cycles for customers and enhance their own productivity.

The company's approach is unique because it blends human creativity with AI expertise and industry knowledge. This is demonstrated by their new Advisory service, launched in March 2025, which aims to bridge the gap between organizational transformation and AI implementations, providing a holistic approach to AI transformation. They also focus on rapid prototyping and collaborative approaches to ensure faster time-to-market and new business opportunities for clients. Siili's commitment to continuous evolution of digital assets through AI-powered continuous services further highlights its unique operational effectiveness.

Siili provides a range of IT services. These include advisory services, data and AI solutions, and custom software development. They also offer continuous services and cloud solutions to support clients.

A core aspect of Siili Company is helping clients with digital transformation. This involves using AI to improve efficiency and gain a competitive advantage. Their approach includes rapid prototyping and collaborative methods.

Siili Group operates in key markets. These include Finland, the Netherlands, the United Kingdom, and Germany. They also expand their skill base in Eastern European countries.

The value proposition of Siili Company is to deliver innovative solutions. They blend human creativity with AI expertise and industry knowledge. This approach helps clients achieve their goals.

What sets Siili Company apart is its ability to combine human creativity with AI expertise. This approach leads to innovative solutions and faster time-to-market. They focus on continuous evolution of digital assets through AI-powered services.

- Advisory services launched in March 2025 demonstrate a holistic approach to AI transformation.

- Emphasis on rapid prototyping and collaborative methods.

- Continuous services powered by AI to evolve digital assets.

- Expansion of skill base in Eastern European countries.

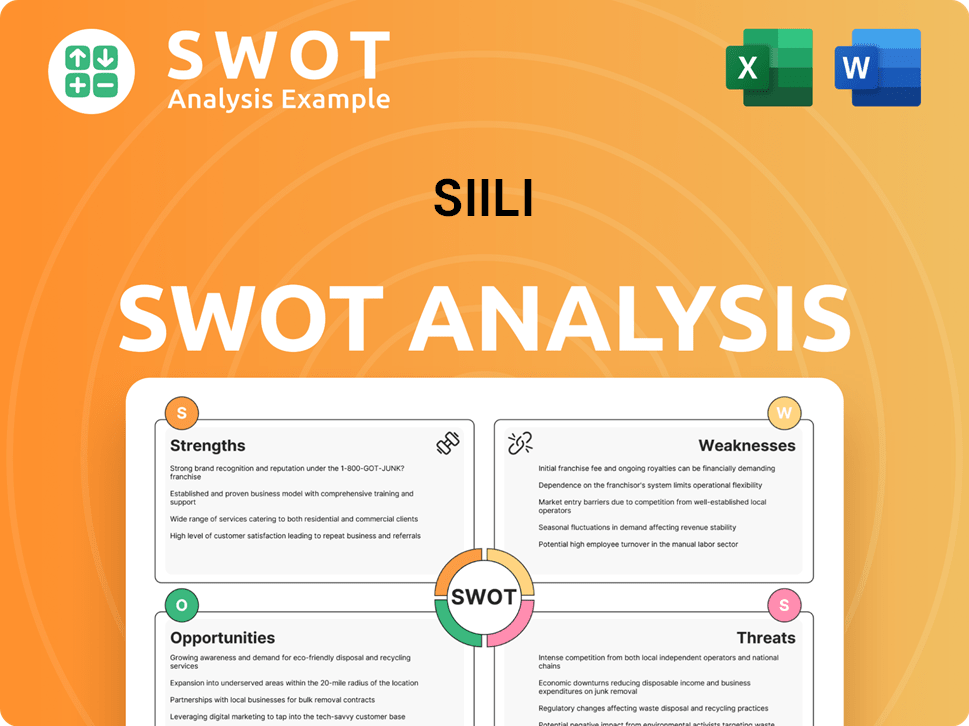

Siili SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Siili Make Money?

The core of how the Siili Solutions operates revolves around its revenue streams and monetization strategies. The Siili Group generates revenue through a variety of IT services, with a focus on digital transformation and software development. The company's financial performance and strategic direction are shaped by these revenue-generating activities.

Siili Solutions offers a range of services, including custom software development, technology consulting, and data and AI solutions. These services are the primary drivers of revenue. The company's approach involves project-based work, ongoing service agreements, and strategic partnerships to generate income.

In 2024, the Siili Company's total revenue was approximately EUR 112 million, reflecting a 9% year-on-year decrease. However, in the first quarter of 2025, revenue slightly increased to EUR 29.9 million, a 0.3% rise compared to the previous year. The company aims for a 20% annual revenue growth, with organic growth contributing about half of this target.

Siili Solutions generates revenue through digital transformation projects, custom software development, and technology consulting. Data and AI solutions and continuous services also contribute to the revenue streams.

The company focuses on project-based work, ongoing service agreements, and strategic partnerships. Expansion of the data and AI business is a key focus, aiming to be a preferred partner in Generative AI transformation.

Total revenue in 2024 was approximately EUR 112 million. In Q1 2025, revenue reached EUR 29.9 million. The company targets a 12% adjusted EBITA margin for 2025-2028.

The share of international operations in the Group's revenue increased to 29% in 2024. This indicates a growing international presence and expansion of Siili Group's global footprint.

Acquisition of Integrations Group Oy strengthens the company's position in the data and generative AI market. The company is focusing on becoming a key player in the Generative AI transformation space.

Siili Solutions aims for a 20% annual revenue growth. The company is focused on both organic growth and strategic acquisitions to achieve its financial goals.

The company's financial performance and strategic initiatives are central to its operations. Siili Solutions is focused on expanding its data and AI business, aiming to be a preferred partner for clients in Generative AI transformation. The acquisition of Integrations Group Oy is a strategic move to strengthen its position in the growing data and generative AI market. To understand the competitive landscape, you can read more about the Competitors Landscape of Siili.

- Revenue in 2024: Approximately EUR 112 million.

- Q1 2025 Revenue: EUR 29.9 million.

- Targeted Annual Revenue Growth: 20%.

- Adjusted EBITA Target: 12% of revenue for 2025-2028.

- International Operations Share in 2024: 29%.

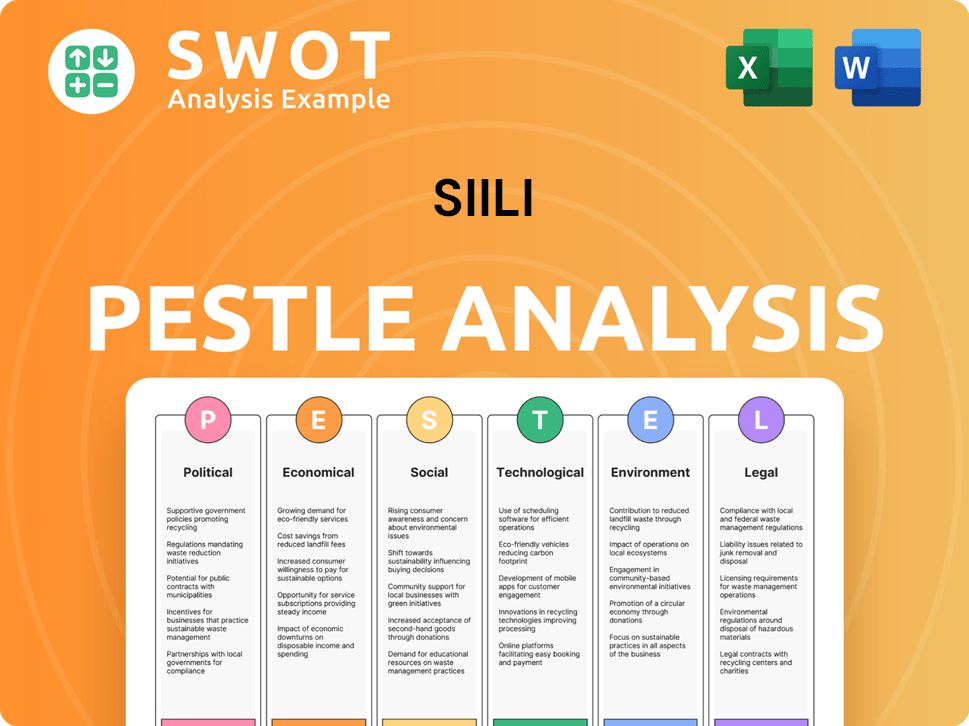

Siili PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Siili’s Business Model?

The evolution of Siili Solutions has been marked by significant milestones and strategic shifts, particularly in the recent past. The company has been actively adapting to market dynamics and technological advancements, focusing on areas like AI and digital transformation to maintain a competitive edge. This proactive approach has influenced its operational strategies and financial outcomes.

A critical strategic move for Siili Group was the integration of AI at the core of its business strategy in 2024. This involves a strong emphasis on growth in the data and AI sectors, aiming to become a leader in AI-powered digital development. This strategic pivot reflects the company's commitment to innovation and its response to the increasing demand for advanced digital solutions.

In January 2025, Siili Company acquired a majority stake in Integrations Group Oy, a strategic decision designed to enhance its presence in the data and generative AI market. This acquisition was a key move to expand its service offerings and market reach. Furthermore, the company has been making investments in employee training and recruitment to strengthen its AI capabilities.

In March 2025, Siili Solutions launched an Advisory service to accelerate clients' digital business and AI adoption. The acquisition of Integrations Group Oy in January 2025 expanded its data and generative AI market presence, contributing EUR 0.6 million to Q1 2025 revenue. By mid-2024, over 400 employees were trained in generative AI, and data/AI specialists increased by 43% year-on-year.

The company's strategic focus on AI and digital transformation is a key move. Cost-cutting measures, including workforce adjustments, are expected to yield €2.2 million in annual savings. The acquisition of Integrations Group Oy was a strategic move to expand its data and generative AI market presence.

Siili's competitive advantage lies in its ability to combine strong software development, AI, and industry expertise. Its focus on large enterprises and the public sector, along with an extensive partner network, provides a competitive edge. The company's focus on operational efficiency and growth in the Data and AI business, coupled with strengthening its competence profile, also contributes to its competitive advantage.

In 2024, Siili Group faced market challenges, including sluggish market conditions and a decline in revenue. To address these challenges, the company implemented cost-cutting measures. The company's financial performance is closely tied to its ability to adapt to market changes and leverage its strategic investments in AI and digital transformation.

The company is concentrating on AI-powered digital development, data business growth, and strengthening its talent pool. Siili Solutions is focusing on operational efficiency and growth in the Data and AI business. The company is enhancing its competence profile through recruitment and human resources development.

- Focus on AI and digital transformation.

- Expansion of data and AI services.

- Cost-cutting measures and operational efficiency.

- Strengthening the talent base through training and recruitment.

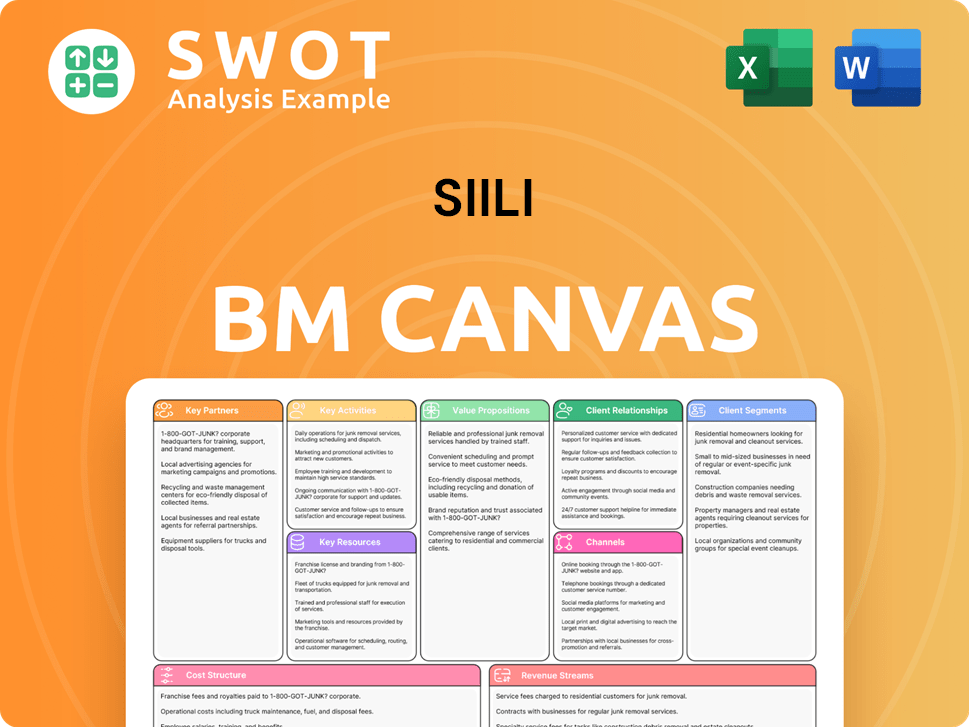

Siili Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Siili Positioning Itself for Continued Success?

Siili Solutions, operating as the Siili Group, is positioned as a frontrunner in the realm of AI-powered digital development, catering to major enterprises and the public sector across Finland, the Netherlands, the United Kingdom, and Germany. Although specific market share figures are not readily available, the company's strategic emphasis on artificial intelligence is designed to bolster its leadership in this area of technology. The company's focus on delivering solutions that yield tangible business outcomes and maintaining strong client relationships has fostered customer loyalty. You can find more information about the company in the Brief History of Siili.

Key risks that could affect Siili's operations include market volatility and fluctuating client demand, which are often tied to economic cycles. Challenging market conditions in 2024 led to a downturn in revenue and negatively impacted profitability. Additional risks stem from workforce dependency and the challenge of retaining talent in a competitive tech sector. Regulatory shifts and technological disruptions also pose inherent risks within the rapidly changing IT sector.

Siili Solutions specializes in AI-driven digital development, serving large enterprises and the public sector. The company focuses on delivering solutions that drive real business outcomes. The company's strategic emphasis on artificial intelligence is designed to bolster its leadership.

Market volatility and client demand tied to economic cycles pose risks to Siili. Workforce dependency and retaining talent are also significant challenges. Regulatory changes and technological disruption are inherent risks in the IT sector. The challenging market conditions in 2024 led to a revenue decline.

Siili aims to scale its AI capabilities and enhance profitability through operational efficiency. The company's financial targets for 2025-2028 include an annual revenue growth of 20%, with about half being organic growth, and an adjusted EBITA of 12% of revenue. The company is committed to AI-driven growth and specialized services.

Siili's 2025 revenue guidance is between EUR 108-130 million, with an adjusted EBITA forecast of EUR 4.7-7.7 million. The company plans to scale its AI capabilities, enhance profitability through operational efficiency, and continue strengthening its data and AI expertise. These targets show the company's financial goals.

Siili is undertaking ongoing strategic initiatives to sustain and expand its ability to generate revenue. The company is focusing on enhancing its AI capabilities and improving operational efficiency. Siili's strong financial position is expected to fuel its future expansion and profitability.

- Scaling AI capabilities

- Enhancing profitability through operational efficiency

- Strengthening data and AI expertise

- Focusing on high-margin, specialized services

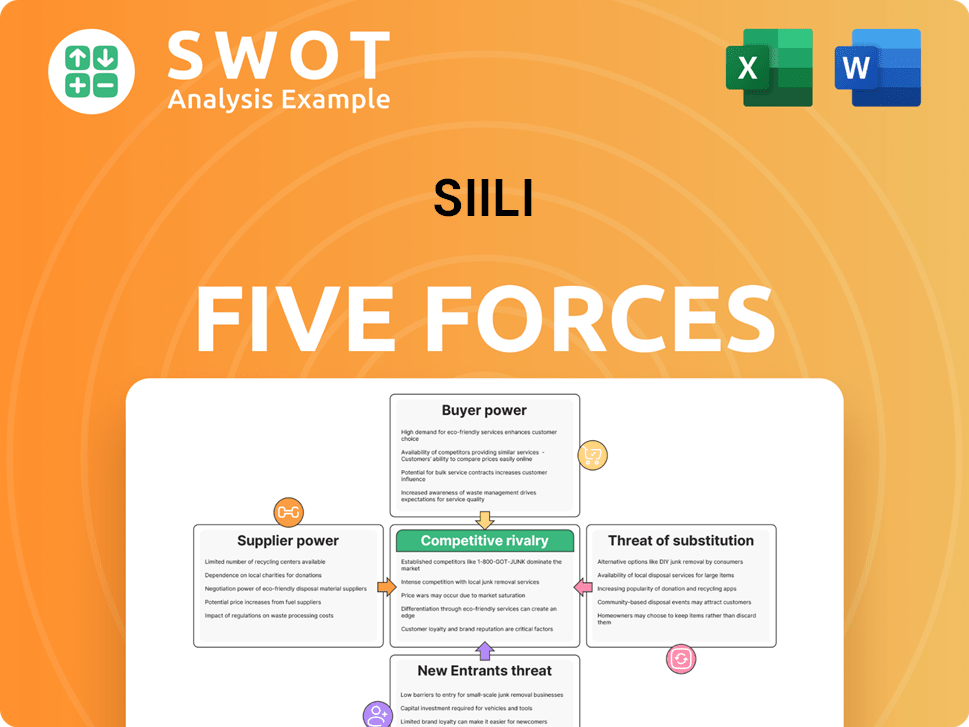

Siili Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Siili Company?

- What is Competitive Landscape of Siili Company?

- What is Growth Strategy and Future Prospects of Siili Company?

- What is Sales and Marketing Strategy of Siili Company?

- What is Brief History of Siili Company?

- Who Owns Siili Company?

- What is Customer Demographics and Target Market of Siili Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.