Siili Bundle

Who Really Owns Siili Company?

Understanding a company's ownership structure is crucial for investors and strategists alike. It reveals insights into a company's direction, potential risks, and overall stability. This analysis dives deep into the ownership of Siili Solutions, a leading technology and software development firm. Discover the key players and their influence on Siili SWOT Analysis.

This exploration of Siili Company ownership will examine its evolution from its founding in Helsinki, Finland, to its current status as a publicly listed entity. We'll uncover the major shareholders, analyze the impact of key personnel, and assess how the ownership structure has shaped Siili Group's trajectory. Learn about the Siili Solutions owner and how it impacts the company's strategic decisions and financial performance. The Siili Solutions ownership structure is key to understanding the company's future.

Who Founded Siili?

The genesis of the company, now known as Siili Solutions Plc, traces back to its founding in 2005. Initially, the company operated as a small engineering firm. While specifics about the founders, their initial equity distribution, and exact shareholding percentages at the outset are not readily available in the provided information, the foundation was laid during this period.

By 2011, before the initial public offering, the company had a shareholder base of approximately 30 individuals. This early phase was crucial in shaping the company's trajectory, setting the stage for its expansion and evolution within the technology sector. The early ownership structure was likely influenced by the company's initial focus and growth strategy.

In 2010, Seppo Kuula assumed the role of CEO. At that time, the company employed around 65 experts. Kuula's leadership was instrumental in shifting the company's focus from basic resources to digital system integration. This strategic shift led to a remarkable 70% revenue growth in his first year. This period of transformation and expansion likely had a significant impact on the company's ownership landscape.

The company started as a small engineering firm in 2005. The exact details of the founders and their initial equity are not available in the provided data.

By 2011, before the IPO, Siili Solutions had approximately 30 shareholders. This indicates a period of growth and investment before going public.

Seppo Kuula became CEO in 2010, a pivotal moment for the company. His leadership was key in transforming the company's offerings.

Under Kuula's leadership, Siili Solutions saw a 70% revenue increase in his first year. This growth likely influenced the company's ownership structure.

The company shifted from basic resources to digital system integration. This change was a key factor in driving growth and attracting investors.

The company's early growth and strategic reorientation influenced its ownership landscape. The company's early backers played a crucial role.

Understanding the early ownership structure of Siili Solutions provides insights into its initial growth and strategic direction. The company's transition from a small engineering firm to a digital system integrator, led by Seppo Kuula, marked a significant period of expansion. The exact details of the founders and their initial equity are not available, but the company's growth trajectory is well documented. For more information on the company's target market, read this article: Target Market of Siili.

- The company was founded in 2005.

- By 2011, there were approximately 30 shareholders.

- Seppo Kuula became CEO in 2010.

- The company experienced 70% revenue growth in Kuula's first year.

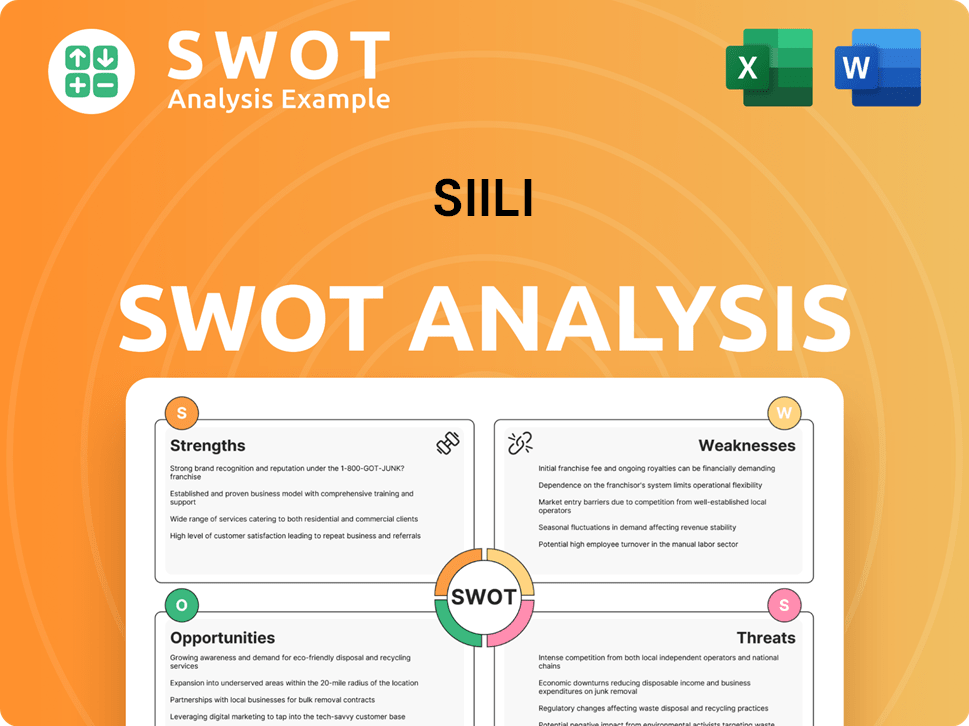

Siili SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Siili’s Ownership Changed Over Time?

The evolution of Siili Company ownership reflects its growth from a smaller entity to a publicly traded firm. Initially listed on Nasdaq First North in 2012, the company later transitioned to the Nasdaq Helsinki Main Market in April 2016. This move provided access to greater liquidity and helped stabilize stock prices. By the end of 2016, the company had expanded significantly, employing over 550 people across Europe and the US, with a shareholder base exceeding 3,500 institutional and retail investors. This expansion and shift in listing venue were key events impacting the Siili Solutions owner structure.

As of December 31, 2024, the total shares in Siili Solutions Plc registered in the Trade Register were 8,140,263. The company held 27,954 of its own shares. The combined holdings of the Board of Directors and Management Team amounted to 25,291 shares, with an entity controlled by a Board member holding a significant 1,301,267 shares. The ownership structure highlights the involvement of key personnel and the distribution of shares among various stakeholders, providing insight into Siili shareholders.

| Ownership Aspect | Details | As of December 31, 2024 |

|---|---|---|

| Total Shares in Trade Register | 8,140,263 | |

| Company's Own Shares | 27,954 | |

| Shares Held by Board and Management | 25,291 | |

| Shares Held by Entity Controlled by Board Member | 1,301,267 |

The Siili Group also implemented the SiiliX Share savings plan in 2018, enabling over 300 employees to become shareholders. This program encourages employee investment in company shares, fostering a stronger link between employees and shareholders. This initiative is part of the Siili Solutions ownership structure and aligns with the company's growth strategy, as detailed in the Growth Strategy of Siili.

The ownership structure of Siili has evolved significantly since its initial listing.

- The company's transition to the Nasdaq Helsinki Main Market improved liquidity.

- Key personnel hold a significant portion of shares, aligning interests.

- The employee share savings plan strengthens the connection between employees and shareholders.

- Understanding the ownership structure is crucial for assessing the company's direction.

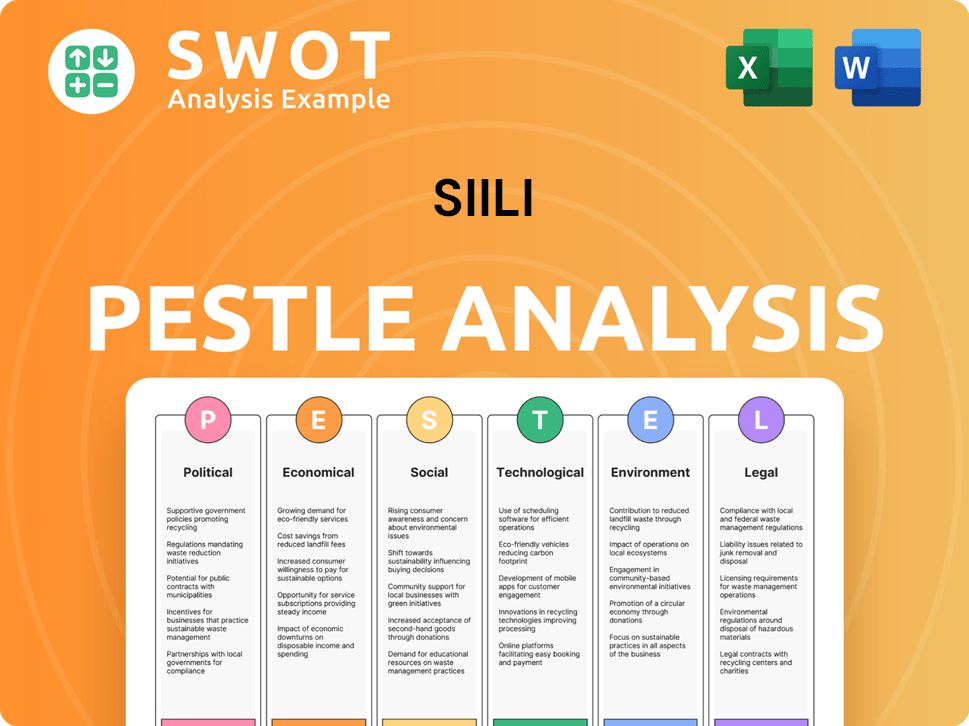

Siili PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Siili’s Board?

The Board of Directors significantly influences the governance of Siili Solutions Plc. In January 2025, the Shareholders' Nomination Board proposed five members for election to the Board of Directors at the Annual General Meeting in 2025. The Annual General Meeting took place on April 8, 2025.

Key individuals in the leadership of Siili Solutions include Harry Brade as Chairman of the Board and Tomi Pienimäki as CEO. Other important roles are filled by Aleksi Kankainen as CFO, Taru Salo as Chief People Officer, Maria Niiniharju as Vice President - Private Business, and Andras Tessenyi as CEO of Supercharge. Independent Directors include Jesse Maula, Katarina Cantell, and Henna Makinen.

| Position | Name | Title |

|---|---|---|

| Chairman of the Board | Harry Brade | Chairman |

| CEO | Tomi Pienimäki | CEO |

| CFO | Aleksi Kankainen | CFO |

Siili Solutions has a single series of shares, with all shares carrying equal rights. This structure implies a one-share-one-vote principle, ensuring each share has the same voting power. The Board of Directors makes decisions on the terms for repurchasing and/or accepting the company's own shares, which can be used for acquisitions, optimizing the capital structure, or for incentive programs. To learn more about the company's background, you can read Brief History of Siili.

Understanding the Siili Company ownership structure is crucial for investors. The board's decisions on share repurchases and the one-share-one-vote system are key aspects of Siili Solutions owner dynamics. Knowing who owns Siili and the Siili shareholders is essential for making informed decisions.

- The Board of Directors plays a vital role in governance.

- All shares have equal voting rights.

- Share repurchases can influence ownership.

- Key personnel are central to the company's direction.

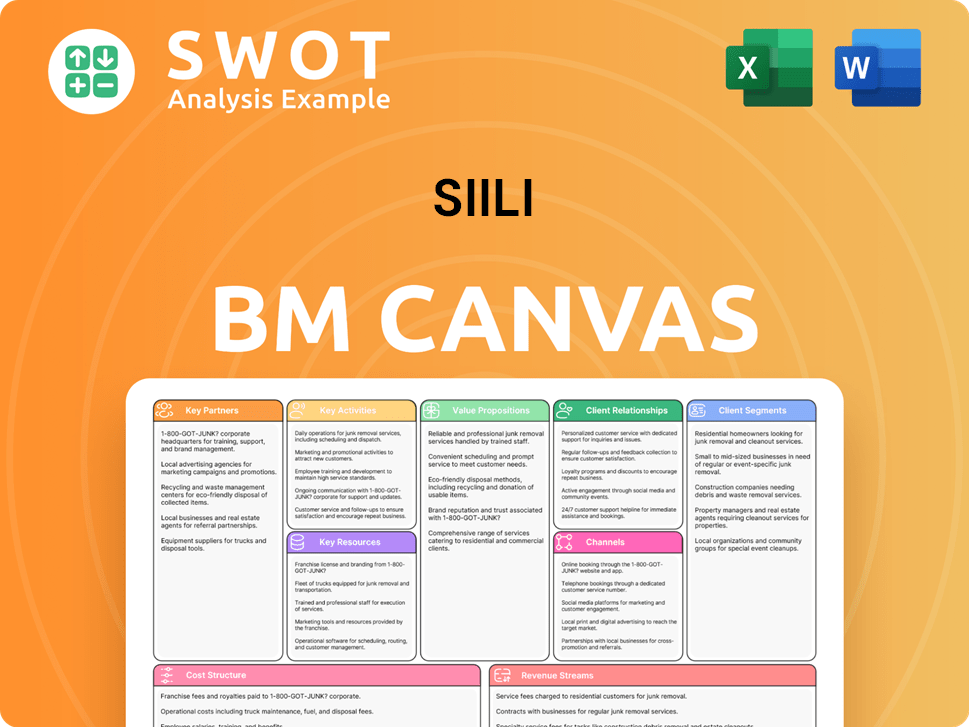

Siili Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Siili’s Ownership Landscape?

Over the past few years, the ownership profile of the Siili Company has seen several strategic shifts. In December 2023, the company's Board of Directors approved a new plan for its employee share savings plan, SiiliX Share, aiming to increase employee integration into the ownership structure. More than 300 employees have already become shareholders through this program, indicating a commitment to broad-based ownership. These initiatives reflect a broader trend towards employee participation in the company's success.

In January 2025, Siili Solutions acquired a 51% stake in Integrations Group Oy, with plans to acquire the remaining shares over time. Additionally, in May 2024, the company increased its ownership in its Hungarian subsidiary, Supercharge Kft, to 70%, with an option to acquire the remaining 30% in 2025–2026. These acquisitions are part of Siili Group's growth strategy, influencing its overall ownership structure and expanding its market presence. These moves demonstrate the company's proactive approach to expanding its business portfolio and market reach.

| Initiative | Date | Details |

|---|---|---|

| Employee Share Savings Plan (SiiliX Share) | December 2023 | New plan period (2024–2025) to integrate employees into the ownership structure. |

| Acquisition of Integrations Group Oy | January 2025 | Acquired a 51% stake. |

| Increased Ownership in Supercharge Kft | May 2024 | Increased ownership to 70%, with an option for the remaining 30% in 2025–2026. |

| Share Repurchase Program | May 26, 2025 | Buyback of up to 31,000 shares (less than 0.38% of current share capital). |

| Equity Buyback Plan | April 8, 2025 | Authorized a buyback plan for up to 814,000 shares (10% of issued capital). |

Siili Company ownership also includes share buyback programs, reflecting its capital management strategy. On May 26, 2025, a share repurchase program was announced to buy back up to 31,000 shares, representing less than 0.38% of its current share capital, primarily for its share-based incentive plans. Furthermore, an equity buyback plan for up to 814,000 shares (10% of issued capital) was authorized on April 8, 2025. These actions have implications for Siili shareholders and the company's capital structure. The company's leadership, including CEO Tomi Pienimäki and CFO Aleksi Kankainen, has also been involved in transactions involving Siili Solutions shares in May 2025. In March 2025, change negotiations were finalized, resulting in personnel reductions to align the competence profile with strategy and market demand, with estimated annual cost savings of EUR 2.2 million by the end of 2026.

The SiiliX Share program aims to increase employee ownership, with over 300 employees becoming shareholders. This initiative promotes employee engagement and aligns interests with the company's performance.

Recent acquisitions, such as the stake in Integrations Group Oy and the increased ownership in Supercharge Kft, demonstrate Siili's growth strategy and expansion into new markets. These moves contribute to the overall Siili Solutions owner profile.

Share repurchase programs, including the recent buyback of up to 31,000 shares, are used to manage capital structure. These programs can influence shareholder value and reflect the company's financial health.

Leadership transactions and cost-saving measures, such as personnel reductions, highlight the company's focus on strategic alignment and operational efficiency. These decisions impact the Siili Technologies's financial outlook.

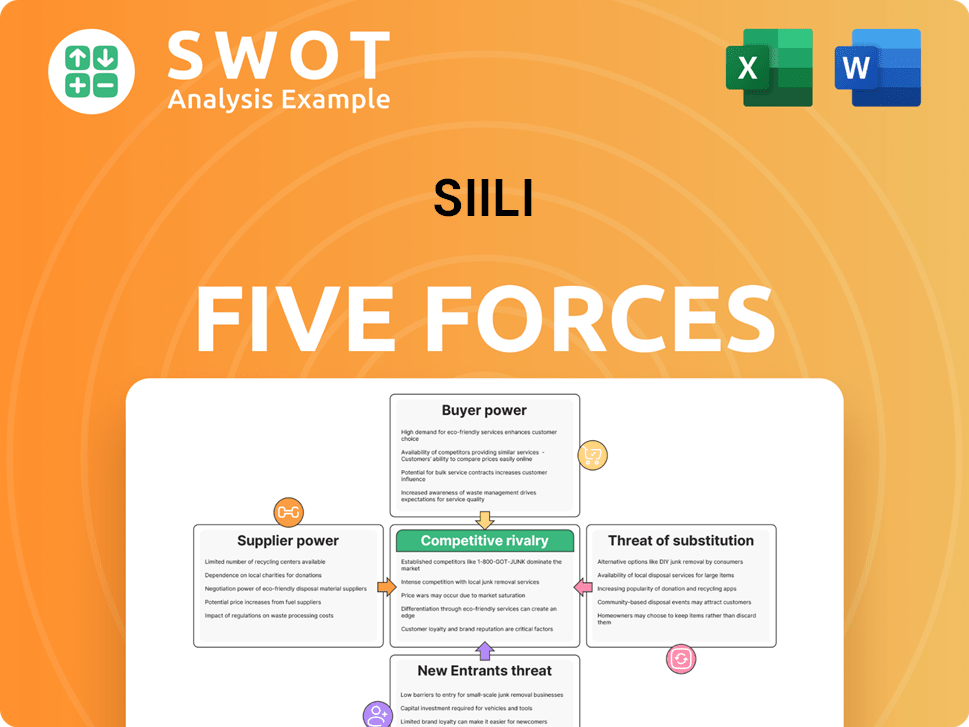

Siili Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Siili Company?

- What is Competitive Landscape of Siili Company?

- What is Growth Strategy and Future Prospects of Siili Company?

- How Does Siili Company Work?

- What is Sales and Marketing Strategy of Siili Company?

- What is Brief History of Siili Company?

- What is Customer Demographics and Target Market of Siili Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.