Stater Bros Bundle

How Does Stater Bros. Thrive in the Grocery Game?

Since 1936, Stater Bros. has been a Southern California staple, but how does this privately held grocery chain maintain its competitive edge? With 167 Stater Bros SWOT Analysis locations across seven counties as of April 2025, including a significant presence in the Inland Empire, the company has a strong regional footprint. They offer quality products and customer service, but what are the inner workings of this grocery giant?

This deep dive into the Stater Bros Company will explore its core operations, revenue streams, and strategic initiatives. We'll uncover how Stater Bros grocery store navigates the competitive landscape, examining its Stater Bros history and current performance. From Stater Bros online shopping options to its community involvement, we'll dissect the elements that contribute to its continued success, providing valuable insights for investors and industry watchers. Discover the answers to questions like "How to find Stater Bros near me?" and "What are Stater Bros store hours?"

What Are the Key Operations Driving Stater Bros’s Success?

The Stater Bros Company operates a significant network of supermarkets, primarily serving Southern California communities. As of late 2024, the company managed over 170 stores, focusing on a regional approach to tailor its offerings. This strategic focus allows Stater Bros grocery store to meet local demands effectively while maintaining operational efficiency.

The core value proposition of Stater Bros lies in providing a wide array of grocery items, including fresh produce, meats, bakery goods, and general merchandise. The company is known for its full-service meat departments, which account for a substantial portion of sales. Additionally, its private-label brands, which saw a 6.5% sales growth in 2024, contribute to customer loyalty and profitability.

Operational excellence at Stater Bros is evident in its commitment to fresh products and efficient logistics. The company's focus on customer service, highlighted by the 'G.O.A.T.' initiative, cultivates loyalty among its customer base. Leveraging technology, including Microsoft 365 and .NET, and the adoption of Afresh Technology in all produce departments as of January 2025, further enhances operational efficiency and customer experiences.

The company offers a diverse range of grocery items, including fresh produce, quality meats, and bakery items. They also provide dairy, deli, floral, frozen foods, and general merchandise. Liquor and seafood are also available, catering to a broad customer base.

Stater Bros emphasizes personalized customer service, fostering loyalty among its established customer base. The 'G.O.A.T.' (Greatest Of All Time) customer service initiative has positively impacted customer transaction counts. This focus on friendly staff and a welcoming atmosphere is a key differentiator.

Efficient operations are maintained through strategic partnerships and technological integrations. Expanded partnerships with IFCO enhance the use of reusable packaging containers (RPCs). Electronic Data Interchange (EDI) streamlines B2B communication with suppliers.

Stater Bros offers private-label brands, contributing to profitability and customer loyalty. These brands saw a 6.5% growth in sales in 2024. This growth indicates the success of these brands in meeting customer needs and preferences.

The company's operational strategies focus on freshness, efficiency, and customer satisfaction, which is a critical aspect of understanding the Target Market of Stater Bros.

- Sourcing fresh products through partnerships like IFCO, with over 80% of suppliers choosing RPCs.

- Utilizing EDI for seamless B2B communication to streamline operations.

- Implementing the 'G.O.A.T.' customer service initiative to enhance customer experience.

- Leveraging technology, including Microsoft 365, .NET, and Afresh Technology in produce departments.

Stater Bros SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stater Bros Make Money?

The primary revenue stream for the Stater Bros Company comes from direct sales within its supermarkets. These sales encompass a wide range of grocery items, including fresh produce, meat, bakery goods, dairy, and general merchandise. While specific 2024 or 2025 revenue figures are not publicly available, the company's annual sales exceeded $4 billion as of 2023.

Stater Bros grocery store utilizes several monetization strategies to boost profitability and customer engagement. This includes a focus on fresh produce and full-service meat departments, private-label brands, and expanding digital offerings. These strategies help to diversify revenue streams and enhance the overall shopping experience.

The company has expanded its digital presence to capitalize on the growing trend of online shopping. This includes an online grocery platform and digital sponsored product sampling programs. These initiatives aim to increase sales and enhance the personalized online shopping experience, contributing to the company's revenue growth.

Stater Bros generates revenue primarily through the sale of groceries and general merchandise in its stores. This includes a wide variety of products such as fresh produce, meat, bakery items, and more.

The company emphasizes fresh produce and full-service meat departments, which are significant sales drivers. Meat sales accounted for approximately 20% of total grocery sales in 2024.

Private-label brands are a key revenue stream, contributing to higher profit margins and customer loyalty. Private-label sales grew by 6.5% in 2024.

Stater Bros has expanded its digital offerings, including an online grocery platform launched in 2021. This platform allows for online shopping and potential advertising revenue.

In September 2024, a digital sponsored product sampling program was launched. This program allows brands to target online shoppers with samples, aiming to increase sales.

Customer loyalty programs are utilized to boost sales. These programs contributed to a 7% increase in sales in 2024.

Stater Bros locations are focusing on strategic growth. In Q3 2024, sales increased by 2.8%, with new store openings projected to boost revenue by 4% in 2025. The company's financial performance is supported by a strong emphasis on direct product sales, fresh departments, private-label brands, and digital initiatives. To learn more about the financial structure, you can read about the Owners & Shareholders of Stater Bros.

Stater Bros employs several strategies to generate revenue and enhance customer engagement.

- Direct sales of grocery and general merchandise.

- Emphasis on fresh produce and full-service meat departments.

- Private-label brands to increase profit margins.

- Online grocery platform and digital advertising.

- Sponsored product sampling programs.

- Customer loyalty programs to boost sales.

Stater Bros PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stater Bros’s Business Model?

The evolution of the Stater Bros Company is marked by significant milestones and strategic shifts. Founded in 1936, the grocery chain rapidly expanded, opening its first large supermarket in Riverside in 1948. By 1981, the company operated 79 stores, generating sales of $475 million. A pivotal moment occurred in 1999 when Stater Bros acquired 43 Albertsons and Lucky supermarkets, significantly broadening its footprint.

The Stater Bros has navigated operational challenges, including internal theft and economic downturns. To address these issues, the company utilizes analytics platforms to monitor high-risk transactions and improve loss prevention. In response to rising inflation and competition, Stater Bros made the difficult decision in March 2025 to lay off 63 courtesy clerks at four locations to remain competitive. The grocery sector faces intense competition, with net profit margins averaging around 2-3% in 2024/2025.

The company's competitive advantages include strong brand loyalty and a commitment to quality fresh produce and meats. Strategic store locations, particularly in the Inland Empire, also contribute to its market share. Stater Bros also benefits from economies of scale, leveraging bulk purchasing and efficient distribution to lower costs. For an overview of the broader market, consider exploring the Competitors Landscape of Stater Bros.

Established in 1936, Stater Bros expanded significantly in its early years. The opening of the first large supermarket in Riverside in 1948 was a key step. The 1999 acquisition of 43 Albertsons and Lucky supermarkets was a major expansion.

The company is enhancing its online presence with an online grocery platform launched in 2021. A digital product sampling program was initiated in September 2024. In April 2025, Stater Bros expanded its partnership with IFCO for reusable packaging.

Strong brand loyalty and a focus on quality fresh produce and meats are key advantages. Strategic store locations, particularly in the Inland Empire, contribute to market share. Economies of scale from bulk purchasing and efficient distribution help lower costs.

The company addresses internal theft and fraudulent transactions with analytics platforms. Economic downturns and inflation pose threats to consumer spending. In March 2025, 63 courtesy clerks were laid off at four locations to manage costs.

The company is focused on continuous improvement. Stater Bros is investing in store upgrades and modern technology to improve customer satisfaction. The company is also working on enhancing its online shopping experience.

- Enhancing online grocery services.

- Expanding the use of reusable packaging.

- Investing in store improvements and technology.

- Focus on customer satisfaction.

Stater Bros Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stater Bros Positioning Itself for Continued Success?

The Stater Bros Company holds a strong position in the Southern California grocery market. As of 2024, it has approximately an 18% market share in the region. With a presence since 1936, the company has cultivated customer loyalty through quality products and service. The company operates 167 stores as of April 30, 2025, primarily in Southern California, with a significant presence in the Inland Empire.

However, Stater Bros grocery store faces several challenges. Intense competition from major chains and discounters puts pressure on profit margins, which typically average around 2-3% in the grocery sector. Economic downturns, inflation, and rising labor costs also pose significant threats. Furthermore, changing consumer habits, including the growth of online grocery shopping, present additional challenges to Stater Bros locations.

Stater Bros. Markets has a significant regional presence, holding approximately 18% of the Southern California market share as of 2024. The company's long-standing history and focus on quality products, like fresh produce and meats, contribute to its strong customer loyalty.

The company faces intense competition from national chains, discounters, and online retailers, impacting profit margins. Economic downturns, inflation, and rising labor costs pose additional challenges. Changing consumer shopping habits, including the rise of online grocery, present further threats.

Stater Bros. is expanding its e-commerce and digital offerings to capture the growing online grocery market. They are optimizing their supply chain and investing in store upgrades. Community involvement and employee well-being are also key focus areas for enhancing brand reputation.

The company is actively expanding its e-commerce platform, which launched in 2021, and has a product sampling initiative that began in September 2024. Stater Bros is optimizing its supply chain and operations, as evidenced by its expanded partnership with IFCO in April 2025.

To sustain growth, Stater Bros is focusing on several strategic initiatives. These include enhancing its digital presence and optimizing supply chain operations. The company's commitment to exceptional service is a key competitive advantage, as explored in detail in the Growth Strategy of Stater Bros article.

- Expansion of e-commerce and digital offerings, including online ordering and pickup.

- Optimization of supply chain and operations, such as the partnership with IFCO.

- Investments in store upgrades and technology, like the implementation of Afresh Technology.

- Emphasis on community involvement and employee well-being.

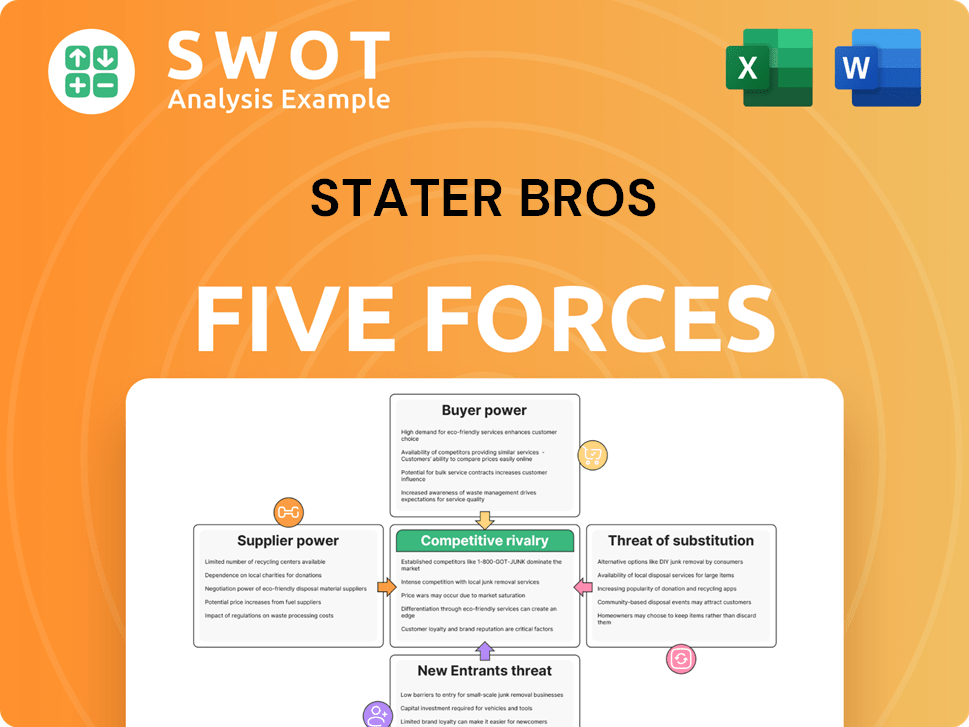

Stater Bros Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stater Bros Company?

- What is Competitive Landscape of Stater Bros Company?

- What is Growth Strategy and Future Prospects of Stater Bros Company?

- What is Sales and Marketing Strategy of Stater Bros Company?

- What is Brief History of Stater Bros Company?

- Who Owns Stater Bros Company?

- What is Customer Demographics and Target Market of Stater Bros Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.