TaskUs Bundle

How Does TaskUs Thrive in the Digital Age?

TaskUs, Inc. is making waves in the outsourced digital services realm, fueled by impressive growth and strategic AI advancements. Its Q1 2025 earnings reveal a compelling performance, with a significant year-over-year revenue increase, highlighting its growing influence in a market hungry for digital solutions. This success story demands a closer look at how this leading TaskUs SWOT Analysis can provide valuable insights.

With a global footprint spanning 12 countries and a workforce of approximately 61,400, understanding the TaskUs company structure is key. Its focus on AI-driven services, experiencing over 50% year-over-year growth, solidifies its position as a leader in the BPO industry. This analysis will explore the TaskUs business model, its diverse revenue streams, and its competitive landscape, providing crucial insights for investors and industry observers alike. The company also offers various customer service solutions.

What Are the Key Operations Driving TaskUs’s Success?

The core of the TaskUs business revolves around delivering outsourced digital services and customer experience solutions, primarily for tech-focused companies. The TaskUs company focuses on helping clients represent, protect, and grow their brands through a range of services. These services are categorized into Digital Customer Experience (DCX), Trust & Safety, and AI Services, showcasing the company's commitment to supporting its clients' diverse needs.

TaskUs operates using a cloud-based infrastructure, combining human expertise with advanced technology, including significant investments in AI and generative AI. This approach is evident in its AI operations support, data collection and annotation, and AI safety solutions. The company has a global presence, with a workforce of 61,400 employees across 28 locations in 12 countries, facilitating diverse talent pools and localized support.

TaskUs's value proposition lies in its specialization in complex service needs and its commitment to 'Ridiculously Good Outsourcing.' This translates into customer benefits such as enhanced customer support, robust content moderation, and cutting-edge AI operations. The company's recognition as a Leader in Everest Group's Trust + Safety Services PEAK Matrix for three consecutive years further underscores its operational excellence and differentiation in the market. If you're interested in learning more about the people behind the company, you can explore the details at Owners & Shareholders of TaskUs.

TaskUs offers Digital Customer Experience (DCX), Trust & Safety, and AI Services. These services are designed to meet the evolving needs of its clients. The company's focus is on helping businesses represent, protect, and grow their brands.

TaskUs emphasizes operational excellence through process optimization and AI-driven automation. This approach enhances service delivery. The company's global presence supports diverse talent pools and localized support.

TaskUs serves fast-growing sectors such as social media, e-commerce, and FinTech. The company's supply chain and partnerships involve working with various tech platforms. Cross-selling to existing clients is a key operational strategy.

TaskUs leverages AI across its operations, including AI operations support and AI safety solutions. The Agentic AI practice integrates AI into customer support. Internally, TaskGPT is used for HR and training functions.

TaskUs focuses on providing exceptional customer service and leveraging AI to enhance its offerings. The company's commitment to 'Ridiculously Good Outsourcing' sets it apart in the BPO industry.

- 55% of Q4 2024 signings came from new clients.

- Multi-service clients contributed to 29% year-over-year revenue growth.

- TaskUs is recognized as a Leader in Everest Group's Trust + Safety Services PEAK Matrix.

- The company uses AI-driven automation to enhance service delivery.

TaskUs SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TaskUs Make Money?

The TaskUs company generates revenue primarily through its outsourced digital services and next-generation customer experience solutions. The company's business model revolves around providing specialized services across three main areas: Digital Customer Experience (DCX), Trust & Safety, and AI Services. This strategy allows TaskUs to cater to a diverse clientele and adapt to evolving market demands.

In the first quarter of 2025, TaskUs reported total revenues of $277.8 million, reflecting a substantial 22.1% year-over-year growth. This growth underscores the company's strong performance and its ability to capture market share. The company's ability to secure new client wins, including a U.S. healthcare payer and a social media client that could become a top-20 account in 2025, further diversifies and strengthens its revenue base.

The contribution of each service line to total revenue has seen shifts, with AI Services emerging as the fastest-growing segment. In Q1 2025, AI Services revenue grew over 50% year-over-year. Trust + Safety services also maintained significant growth, exceeding 30% year-over-year for the fifth consecutive quarter. Digital Customer Experience expanded at a mid-teens pace in Q1 2025. For the full year 2024, TaskUs's total revenue reached $995 million, with Digital Customer Experience growing by 8.5%, Trust & Safety by 34%, and AI Services by 31%. The company projects its AI services to contribute between 20% and 30% of total revenue growth in 2025.

TaskUs employs several monetization strategies to maximize revenue and profitability. These strategies include leveraging specialized services for clients with complex needs and expanding relationships with both large tech platforms and enterprise clients. A significant portion of its bookings, 83% in Q3 2024, comes from new wins with existing clients, indicating a strong cross-selling strategy. The company has also been diversifying into countercyclical sectors like healthcare and traditional banking, anticipating growth in these areas by 2025. Furthermore, TaskUs aims to drive incremental efficiency through operational optimization and AI-driven automation, which can contribute to margin expansion over time, with a target of approximately 21% adjusted EBITDA margins for the full year 2025. For a deeper understanding of the company's journey, you can explore the Brief History of TaskUs.

- Focus on AI Services: Rapid growth in AI Services, with projections for significant revenue contribution in 2025.

- Client Retention and Expansion: High percentage of bookings from existing clients indicates successful cross-selling and client retention.

- Sector Diversification: Expansion into healthcare and traditional banking to mitigate risks and capture new growth opportunities.

- Operational Efficiency: Implementation of AI-driven automation and operational optimization to enhance margins.

TaskUs PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TaskUs’s Business Model?

The TaskUs company has achieved significant milestones and undertaken strategic moves that have shaped its operations and financial performance. A key focus in 2024 was returning to revenue growth, a goal accomplished in Q2 2024 by achieving year-over-year growth. The company saw accelerating double-digit growth in the latter half of 2024.

In Q4 2024, TaskUs reported record revenue of $274.2 million, marking a 17.1% year-over-year increase, and full-year 2024 revenue reached $995 million. A pivotal strategic move has been the company's strong pivot to AI services, which is now its fastest-growing segment, with over 50% year-over-year growth in Q1 2025.

The company has expanded its global footprint, now operating with 61,400 workers across 28 locations in 12 countries. The upcoming acquisition by Blackstone, valued at approximately $2.3 billion, is expected to close in late 2025, providing greater flexibility for high-risk, high-reward initiatives.

Achieved year-over-year revenue growth in Q2 2024. Reported record revenue of $274.2 million in Q4 2024, a 17.1% increase year-over-year. Full-year 2024 revenue reached $995 million.

Strong pivot to AI services, with over 50% year-over-year growth in Q1 2025. Expanded its global footprint to 61,400 workers across 28 locations in 12 countries. Pending acquisition by Blackstone for approximately $2.3 billion, expected to close in late 2025.

The company's competitive advantages stem from its specialized services, particularly in content moderation and compliance, where competition is limited. TaskUs has faced operational and market challenges, including margin pressures. The company's recognition as a Leader in Everest Group's Trust + Safety Services PEAK Matrix for the third consecutive year highlights its operational excellence.

- Focus on AI-driven solutions like generative AI data curation and AI consulting.

- Emphasis on operational optimization and AI-driven automation to improve margins.

- Expansion into new markets and investment in Agentic AI technologies.

- Successful expansion of the client base, with 55% of Q4 2024 signings from new clients. Read more about the Target Market of TaskUs.

TaskUs Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TaskUs Positioning Itself for Continued Success?

The TaskUs company holds a significant position in the outsourced digital services and next-generation customer experience industry, especially for fast-growing tech firms. Its recognition as a Leader in Everest Group's Trust + Safety Services PEAK Matrix for three years underlines its operational excellence in a specialized area with less competition. As of March 31, 2025, the company operates in 28 locations across 12 countries, with a workforce of approximately 61,400 employees.

Despite its strong market position, TaskUs faces risks such as client concentration, relying heavily on large tech platforms vulnerable to economic and regulatory pressures. Furthermore, cash flow metrics softened in Q1 2025, with Free Cash Flow declining 54.2% year-over-year to $21.8 million, and the Adjusted EBITDA-to-FCF conversion rate dropping to 36.8%. The pending acquisition by Blackstone introduces regulatory scrutiny and potential delays.

TaskUs is a leader in outsourced digital services and customer experience, particularly for tech companies. It has been recognized as a Leader in Everest Group's Trust + Safety Services PEAK Matrix. The company serves approximately 200 clients, with many generating over $1 million in revenue.

Client concentration is a key risk for TaskUs, as it depends on major tech platforms. Litigation costs and cybersecurity investments impact expenses. The Blackstone acquisition could face regulatory hurdles. The company's cash flow metrics softened in Q1 2025.

The company projects full-year 2025 revenue between $1.095 billion and $1.125 billion, targeting about 21% adjusted EBITDA margins. The company plans to accelerate its AI services. Diversification into healthcare and banking is part of the strategy. The acquisition is expected to help with investments and global expansion.

The company is focused on accelerating its AI services, which are expected to be the fastest-growing service line in 2025. TaskUs aims to take market share through operational excellence and expand its relationships with both big tech and enterprise clients.

The company's strategic initiatives include expanding AI services and diversifying into countercyclical sectors. The Blackstone acquisition is expected to support investments in technology and talent, facilitating global expansion, particularly in Europe and India. You can also read about the Growth Strategy of TaskUs.

- Sustaining growth momentum through AI services.

- Expanding relationships with both big tech and enterprise clients.

- Diversifying into healthcare and traditional banking.

- Achieving global expansion, particularly in Europe and India.

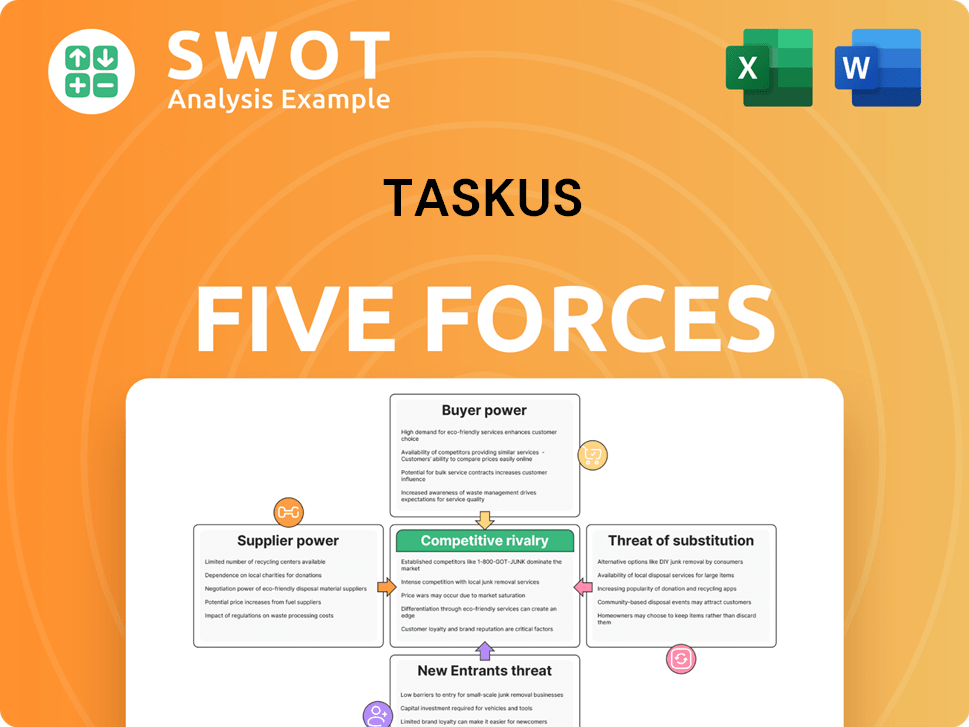

TaskUs Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TaskUs Company?

- What is Competitive Landscape of TaskUs Company?

- What is Growth Strategy and Future Prospects of TaskUs Company?

- What is Sales and Marketing Strategy of TaskUs Company?

- What is Brief History of TaskUs Company?

- Who Owns TaskUs Company?

- What is Customer Demographics and Target Market of TaskUs Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.