Teleperformance Bundle

How Does Teleperformance Thrive in the BPO World?

Teleperformance, a global powerhouse in business process outsourcing (BPO), has reshaped how businesses interact with their customers. Founded in 1978, this French multinational has become a dominant force, serving diverse sectors like technology, finance, and healthcare. With impressive 2024 revenues of €10.28 billion, the Teleperformance SWOT Analysis is crucial for understanding its strategic positioning.

The Teleperformance company's success stems from its ability to deliver exceptional customer experiences across various channels. Its strategic acquisitions, like Majorel and ZP Better Together, and its ongoing investment in AI partnerships demonstrate its commitment to innovation. Understanding the intricacies of Teleperformance's operations, from its call center services to its global presence, is vital for investors, business strategists, and anyone interested in the evolution of the outsourcing industry. This exploration will provide insights into how Teleperformance business continues to adapt and lead in the competitive landscape.

What Are the Key Operations Driving Teleperformance’s Success?

The Teleperformance company creates value by providing digital business services, mainly focusing on enhancing customer experience management. Its core services encompass customer acquisition, customer care, technical support, debt collection, and social media services. These services cater to various customer segments across industries like banking, retail, technology, and healthcare.

The operational processes are multifaceted, leveraging human empathy and advanced technology. Teleperformance uses a global network of contact centers, including domestic and offshore locations, and has increased work-at-home programs. The company emphasizes digital strategies, intelligent automation, and advanced analytics, using AI and machine learning to accelerate resolution and optimize the customer lifecycle.

A key aspect of Teleperformance's approach is its 'high-tech high-touch' model, which balances technology with human interaction. This enables efficient handling of routine tasks through automation while allowing human agents to focus on complex customer issues, ensuring personalized service. The company's training programs, which included over 60,000 AI and emotional intelligence training programs for managers in 2024, ensure its workforce delivers superior customer experiences.

Teleperformance offers a wide range of services, including customer care, technical support, and debt collection. These services are designed to meet the diverse needs of clients across various industries. The company’s focus is on delivering high-quality customer experiences through both digital and human interactions.

Teleperformance operates in nearly 100 countries, with a diverse workforce of multilingual experts. This global footprint allows the company to provide services in multiple languages and time zones. The company's extensive network supports its ability to deliver consistent service quality worldwide.

The company uses cutting-edge technology, including AI and machine learning, to improve customer service. This includes the use of predictive analytics in debt collection and the implementation of omnichannel digital solutions. These technologies help to optimize customer interactions and enhance efficiency.

Teleperformance invests in its employees through extensive training programs, including AI and emotional intelligence training. This commitment to employee development ensures that its workforce is well-equipped to handle complex customer issues and deliver superior service. The company's focus on training is a key differentiator.

Teleperformance's operational model is built on a blend of human interaction and advanced technology. This 'high-tech high-touch' approach aims to balance efficiency with personalized service. The company's global presence and diverse workforce enable it to serve a wide range of clients across various industries. For a deeper understanding of how Teleperformance compares to its rivals, consider exploring the Competitors Landscape of Teleperformance.

- Global Network: Operates in nearly 100 countries, ensuring broad service coverage.

- Digital Transformation: Utilizes AI and machine learning to improve customer interactions.

- Employee Training: Provides extensive training programs to enhance service quality.

- Customer Focus: Prioritizes customer experience through personalized and empathetic service.

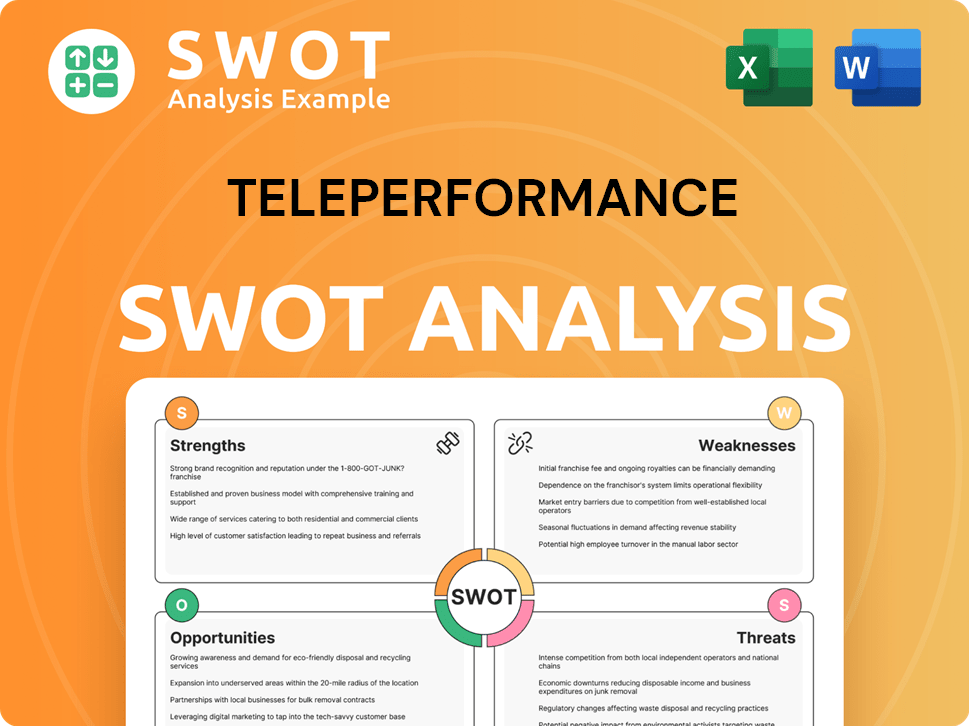

Teleperformance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Teleperformance Make Money?

The Teleperformance company generates revenue primarily through its digital business services. These services include customer acquisition, customer care, technical support, debt collection, and social media solutions. In 2024, the company's reported revenue reached €10.28 billion, reflecting a significant increase.

Revenue is categorized into 'Core Services & D.I.B.S.' and 'Specialized Services.' Core Services & D.I.B.S. contributed significantly to the revenue. Specialized Services, including interpreting and visa application management, also showed strong growth. The company's diverse service offerings and global presence support its revenue streams.

The company's monetization strategies are centered around service-based contracts for various BPO services. Its global presence, offering services from different locations, and work-at-home programs contribute to cost-effective solutions. Additionally, investments in AI and automation enhance efficiency and offer premium services. To learn more about its growth strategy, check out this article: Growth Strategy of Teleperformance.

The Teleperformance business model relies on providing outsourcing services. The company’s revenue streams are diversified across various services and geographical locations.

- In the first nine months of 2024, Core Services & D.I.B.S. generated €6.48 billion in revenue.

- Specialized Services saw a revenue of €1.489 billion for the full year 2024.

- The company uses its technology and global presence to offer flexible and cost-effective solutions to its clients.

- The acquisition of companies like Majorel and ZP Better Together has expanded its service offerings.

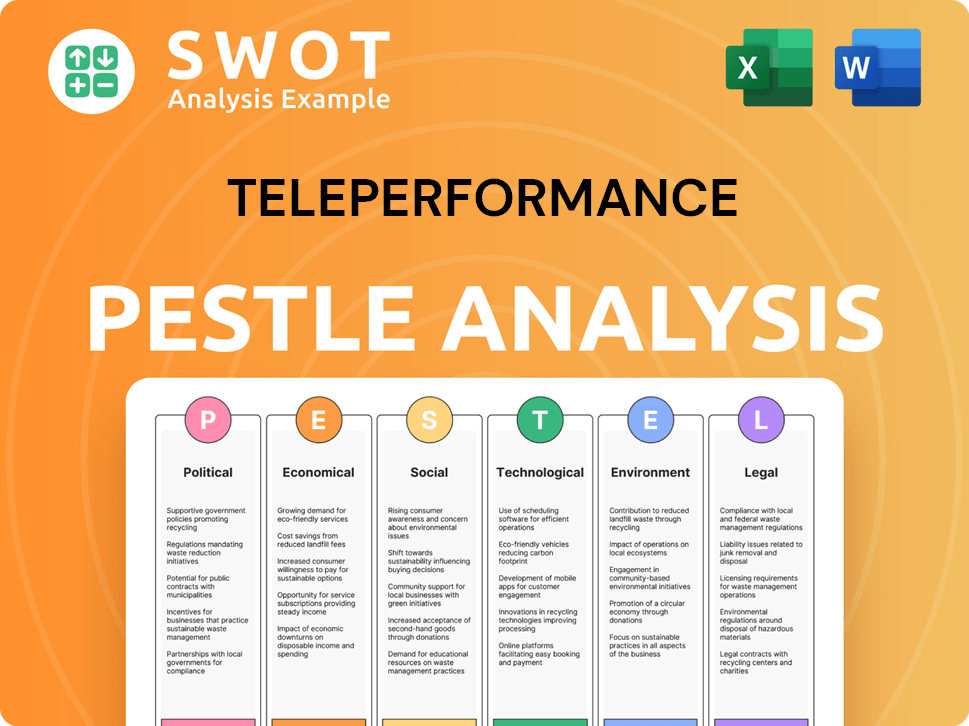

Teleperformance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Teleperformance’s Business Model?

The Teleperformance company has marked significant milestones and strategic shifts that have reshaped its operational landscape and financial results. A key strategic move was the integration of Majorel, consolidated since November 1, 2023, which has notably contributed to the company's reported revenue growth in 2024. This integration is progressing as planned, with anticipated cost synergies of €150 million by 2025. Another important acquisition was ZP Better Together, a leader in language services for the deaf and hard of hearing community in the United States, completed in February 2025 and consolidated from February 1, 2025. This acquisition strengthens its Specialized Services segment.

The company has navigated market challenges, including economic volatility and the non-renewal of a significant visa application management contract, which affected Specialized Services growth in Q4 2024. Despite these hurdles, Teleperformance confirmed its annual financial targets for 2024, demonstrating resilience. The company's competitive advantages are diverse, encompassing a broad global presence with operations in nearly 100 countries, deep industry expertise, and strong client relationships. The company leverages cutting-edge technology, particularly in artificial intelligence and automation, to enhance customer interactions and streamline processes.

In 2025, Teleperformance plans to invest up to €100 million in AI partnerships, including a strategic alliance with Sanas, a real-time speech understanding provider, and new partnerships with Ema and Parloa. This investment highlights its commitment to accelerating AI development and reinventing digital business services. For more insights into the company's growth trajectory, consider exploring the Growth Strategy of Teleperformance. The company's focus on information security, including safe harbor certification and business continuity practices, also provides a competitive edge by building trust with clients handling sensitive data.

Teleperformance distinguishes itself through several key strengths that drive its success in the call center and outsourcing (BPO) industries. These include a vast global footprint, deep industry expertise, and strong client relationships. The company's ability to adapt to new trends, such as the shift towards digital channels and the increasing focus on hyper-personalization, is crucial for sustaining its business model.

- Global Presence: Operations in nearly 100 countries, providing extensive reach and scalability.

- Technological Innovation: Investment in AI and automation to enhance customer interactions.

- Client Trust: Strong focus on information security and data protection.

- Adaptability: Ability to evolve with market trends, including digital transformation.

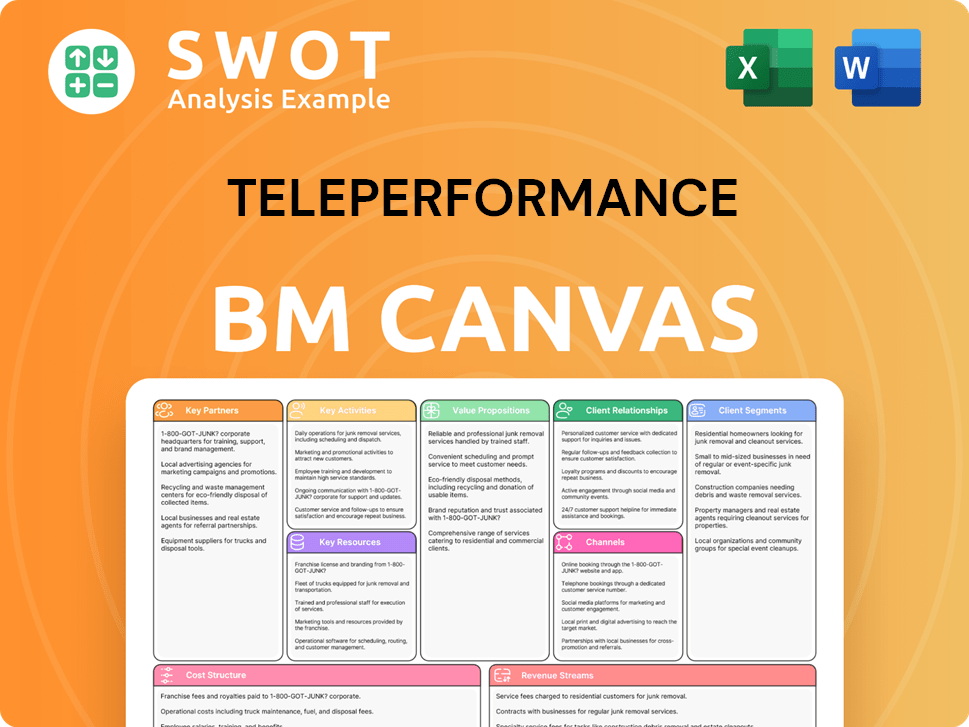

Teleperformance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Teleperformance Positioning Itself for Continued Success?

The Teleperformance company holds a strong position in the global customer experience management sector, recognized as a leader in digital business services. It competes with other major players in the industry. The company's extensive global presence, operating in nearly 100 countries, supports its market share.

Despite its strong market position, the

Teleperformance is a leading global player in the customer experience management industry. It competes with companies such as Convergys, Sitel, and Alorica. The company's widespread global operations support its strong market position.

Key risks include potential price pressures due to AI and currency fluctuations. Non-renewal of major contracts can also affect revenue. The rapid evolution of AI and automation may lead to further margin pressures.

Teleperformance is targeting like-for-like growth between +3% and +5% in 2025. The company plans to invest significantly in AI partnerships, with a target of €100 million in 2025. The focus is on balancing technological advancements with human empathy for enhanced customer care.

The company is committed to diversifying service offerings and expanding into new markets. Data analytics will be leveraged for improved customer insights. Continued strong net free cash flow generation and deleveraging are also planned.

Teleperformance aims for like-for-like growth of +3% to +5% in 2025. The company plans to invest €100 million in AI partnerships in 2025. These initiatives are designed to support growth and enhance digital business services.

- Continued investment in AI to support growth.

- Expansion into new markets and diversification of services.

- Focus on balancing technology with human interaction.

- Commitment to strong net free cash flow and deleveraging.

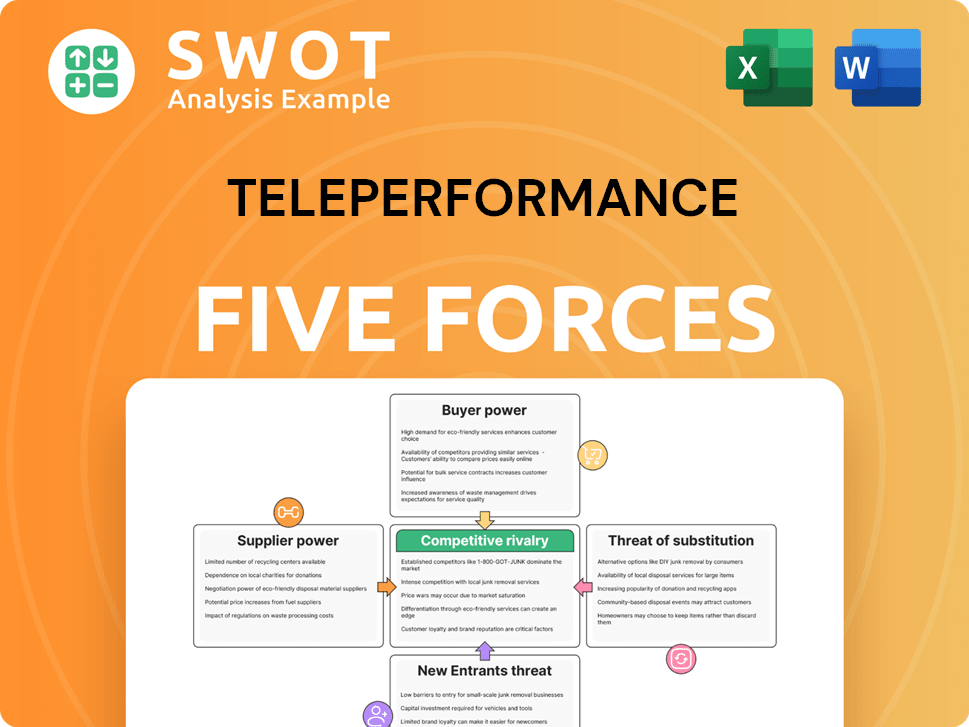

Teleperformance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teleperformance Company?

- What is Competitive Landscape of Teleperformance Company?

- What is Growth Strategy and Future Prospects of Teleperformance Company?

- What is Sales and Marketing Strategy of Teleperformance Company?

- What is Brief History of Teleperformance Company?

- Who Owns Teleperformance Company?

- What is Customer Demographics and Target Market of Teleperformance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.