UniCredit Bundle

How Does UniCredit Thrive in the European Banking Sector?

UniCredit, a leading European bank, recently achieved its best quarterly results ever, with a remarkable €2.8 billion net profit in Q1 2025, showcasing its robust financial health. This impressive performance highlights UniCredit's significant influence within the European banking sector and its capacity for sustained growth. Understanding the inner workings of this financial institution is crucial for investors and industry observers alike.

UniCredit's success, marked by 17 consecutive quarters of profitable growth and a market-leading Return on Tangible Equity (RoTE) of 22% in Q1 2025, underscores its effective operational model. To gain deeper insights, consider exploring a comprehensive UniCredit SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. This analysis helps in appreciating UniCredit’s strategic trajectory and its role in shaping the future of European banking, offering valuable insights into its operations and financial performance.

What Are the Key Operations Driving UniCredit’s Success?

UniCredit, a prominent European bank, delivers value through a wide array of banking services. It serves individuals, families, and businesses across key markets like Italy, Germany, Austria, and Central and Eastern Europe. Its operations span retail banking, corporate banking, investment banking, and wealth management, providing comprehensive financial solutions.

The UniCredit company streamlines its processes, focusing on bringing decision-making closer to clients. This approach is supported by common product factories, procurement, and technology, enabling economies of scale across its 13 banks in Europe. Digital transformation, including a strategic partnership with Google Cloud, enhances service delivery and client experience.

UniCredit operations are designed to support diverse offerings, leveraging a pan-European network and a capital-light business model. The bank's integrated supply chain and distribution networks across Europe ensure consistent service. Its core strengths, such as financial stability and a diversified product portfolio, differentiate it from competitors. These capabilities translate into tailored financial solutions, empowering clients to progress, as seen in initiatives like 'UniCredit for CEE 2025'. For a deeper understanding of its origins, you can explore the Brief History of UniCredit.

UniCredit offers a wide range of financial services, including retail banking, corporate banking, investment banking, and wealth management. These services are tailored to meet the diverse needs of individuals, families, and businesses. The bank's offerings are designed to provide financing, investment, and risk management solutions.

The bank focuses on operational efficiency through simplification and streamlining. This includes common product factories, procurement, and technology to achieve economies of scale. Decision-making is brought closer to clients, enhancing responsiveness and service quality. Digital transformation and technology development are key to improving service delivery.

UniCredit's value proposition centers on providing tailored financial solutions and empowering clients. This is achieved through strong financial strength, a diversified product portfolio, and a widespread international presence. Initiatives like 'UniCredit for CEE 2025' demonstrate its commitment to supporting micro and small businesses.

UniCredit is actively pursuing digital transformation to enhance its services. The strategic partnership with Google Cloud is a prime example of this effort. This focus on technology aims to improve client experience and streamline operations. Digital initiatives are key to the bank's future growth and efficiency.

UniCredit distinguishes itself through several key strengths. These include a strong financial foundation and a diversified product portfolio. Its widespread international presence further enhances its ability to serve clients across different markets.

- Strong Financial Stability

- Diversified Product Portfolio

- Widespread International Presence

- Focus on Client Empowerment

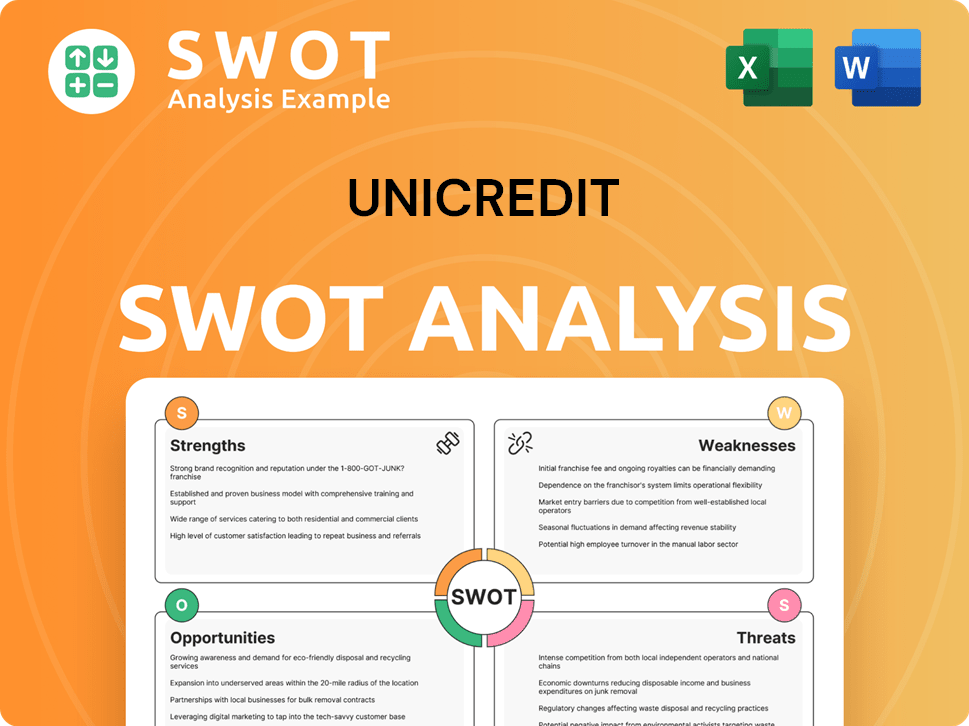

UniCredit SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UniCredit Make Money?

The UniCredit company generates revenue through a diverse range of banking activities, ensuring a robust financial foundation. This includes net interest income, fees, and trading income, all contributing to its overall profitability. The UniCredit operations are strategically designed to maximize income streams and adapt to market dynamics.

In Q1 2025, UniCredit demonstrated strong financial performance, with total revenues reaching €6.5 billion. This reflects the bank's effective strategies in generating income from various sources and its ability to capitalize on market opportunities. A key aspect of its strategy is the shift towards recurring income streams.

The bank's monetization strategies involve a focus on recurring income streams, with fees now accounting for 35% of total revenue in Q1 2025. This shift enhances the stability and predictability of its earnings. Further, UniCredit provides tailored financing solutions, such as the 'UniCredit for CEE 2025' initiative, which offers €2.3 billion in financing for micro and small businesses.

UniCredit's revenue streams are diversified, with net interest income and fees being major contributors. The bank also focuses on tailored financing solutions and aims for shareholder distributions above 2024 levels. The bank's full-year 2024 results showed net revenues increasing to €24.2 billion, up 4% year-on-year.

- Net Interest Income (NII): In Q1 2025, NII reached €3.5 billion, a significant portion of total revenue.

- Fees: Fees contributed €2.3 billion in Q1 2025, marking an 8.2% year-over-year increase.

- Trading Income: Trading income was €0.6 billion in Q1 2025, up 19.9% year-over-year, driven by strong client activity.

- Tailored Financing: Initiatives like 'UniCredit for CEE 2025' provide targeted financing to support specific sectors.

- Shareholder Distributions: UniCredit aims for distributions to shareholders above 2024 levels, with a cash dividend increased to 50% of net profit from 2025.

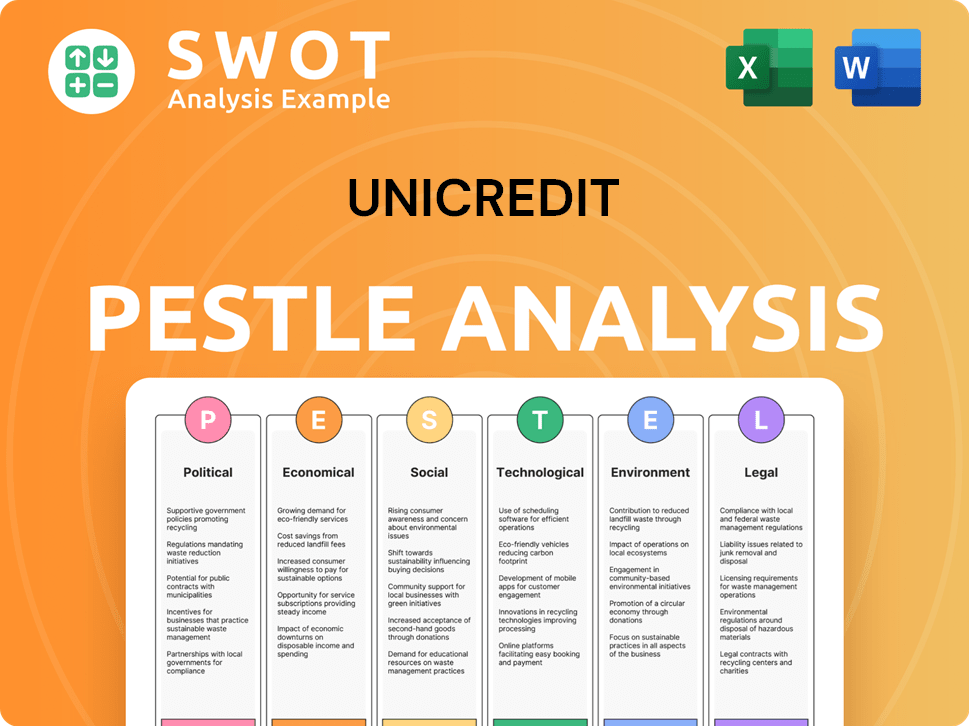

UniCredit PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped UniCredit’s Business Model?

The UniCredit company has consistently demonstrated its ability to achieve significant milestones and adapt strategically within the dynamic financial landscape. The successful completion of the UniCredit Unlocked 2021-2024 strategic plan showcases the bank's operational prowess, delivering impressive financial results, including a Return on Tangible Equity (RoTE) of 17.7% and a net profit of €9.7 billion in 2024.

This success has paved the way for the 'Unlocking Acceleration' strategy from 2025 to 2027, which aims to build on this momentum. The new strategy targets a net profit trending towards €10 billion by the end of 2027, alongside annual capital distributions exceeding 2024 levels. These strategic moves are pivotal in shaping UniCredit's future, reinforcing its position as a leading European bank.

Addressing operational challenges, such as the complex macroeconomic environment, is a key focus. The bank is concentrating on cost discipline and strengthening its lines of defense. The cost-to-income ratio stood at an industry-leading 35.4% in Q1 2025, reflecting effective cost management and operational efficiency.

UniCredit's accomplishments are marked by the successful execution of the UniCredit Unlocked plan, which exceeded initial targets. The bank's financial performance in 2024, including a RoTE of 17.7%, highlights the effectiveness of its strategic initiatives. The transition to the 'Unlocking Acceleration' strategy from 2025 to 2027 signifies a commitment to sustained growth.

UniCredit is actively pursuing strategic acquisitions and partnerships to expand its market reach and enhance its service offerings. The acquisition of Aion Bank and Vodeno in March 2025 is a prime example of this strategy. The ongoing integration of Alpha Bank Romania into the UniCredit Group is another key move, aimed at driving quality growth.

UniCredit's competitive advantages include a strong international presence across Europe, a diversified product portfolio, and robust financial strength. The bank's commitment to innovation, particularly through its partnership with Google Cloud, enhances its ability to offer cutting-edge solutions. The focus on client-centric solutions and ESG commitments further strengthens its market position.

UniCredit's financial performance is a testament to its strategic execution and operational efficiency. The bank's net profit of €9.7 billion in 2024 and a cost-to-income ratio of 35.4% in Q1 2025 underscore its financial health. The 'Unlocking Acceleration' strategy aims to build on this success, targeting a net profit trending towards €10 billion by the end of 2027.

UniCredit's strategic initiatives are designed to strengthen its market position and drive sustainable growth. The bank is focused on expanding its presence through strategic acquisitions and partnerships, such as the acquisition of Aion Bank and Vodeno. These moves are aimed at enhancing its service offerings and market reach.

- The bank's international presence across Europe is a key competitive advantage.

- UniCredit's diversified product portfolio caters to a wide range of customer needs.

- Commitment to innovation and digital transformation, including partnerships, enhances its competitive edge.

- Focus on client-centric solutions and ESG commitments, aiming for 15% ESG lending and 50% ESG AuM stock share by 2025-2027.

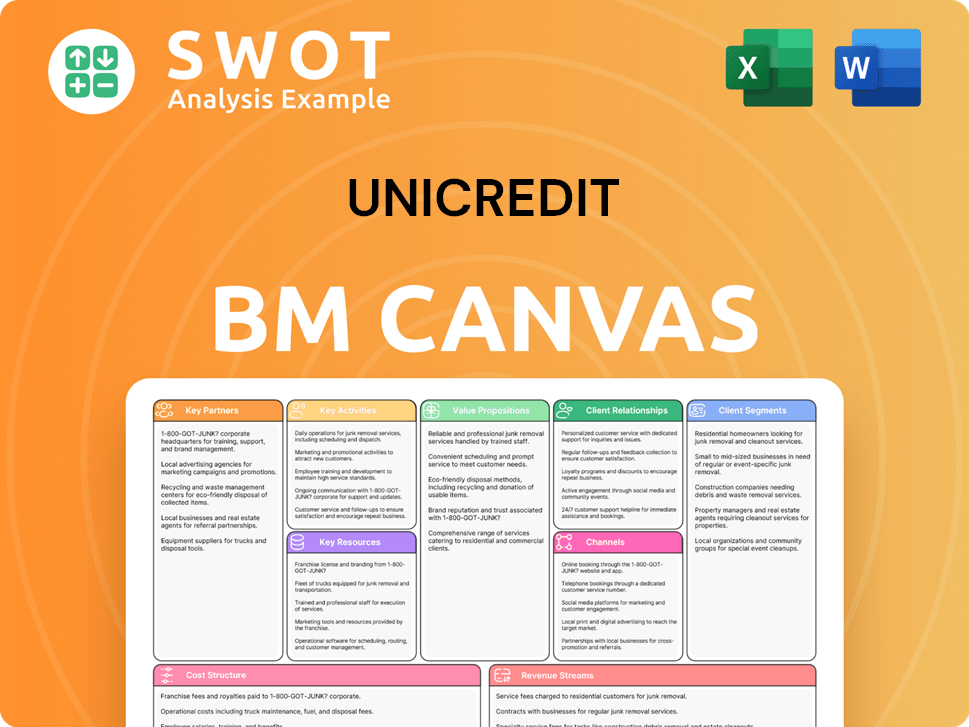

UniCredit Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is UniCredit Positioning Itself for Continued Success?

As a leading pan-European commercial bank, UniCredit holds a strong market position, with major operations in Italy, Germany, Austria, and Central and Eastern Europe. The UniCredit company demonstrated robust performance in Q1 2025, achieving a record net profit of €2.8 billion and a market-leading RoTE of 22%. This success is bolstered by a diverse product portfolio, a widespread international presence, and strong financial stability, solidifying its status as a key financial institution.

The UniCredit operations are subject to several risks, including geopolitical tensions, rising protectionism, and potential economic challenges in markets like Germany. Regulatory changes and technological disruptions continue to pose industry-wide considerations. To mitigate these risks, UniCredit maintains a focus on strong asset quality, a low cost of risk, and strategic overlays on performing exposures, ensuring resilience in a dynamic environment. Considering the Owners & Shareholders of UniCredit, the bank's strategic direction is crucial.

UniCredit is focused on its 'Unlocking Acceleration' strategy for 2025-2027. This strategy aims for a net profit of approximately €10 billion by the end of 2027. The bank plans to increase annual distributions to shareholders and enhance client relationships.

The bank intends to deepen relationships with small and mid-sized enterprises and private banking clients. UniCredit will also enhance its product offerings and continue simplifying its organization. The bank plans to accelerate technological initiatives.

UniCredit plans €2.5 billion in incremental IT investments over 2025-2027. The bank will pursue selectivity in inorganic opportunities that enhance standalone value. Potential acquisitions like Banco BPM and Commerzbank remain under consideration.

UniCredit's forward-looking perspective is coupled with a commitment to ESG principles. The bank aims to sustain and expand its ability to generate profit. The goal is to cement its position as the 'bank for Europe's future' through these initiatives.

UniCredit is prioritizing growth through enhanced client relationships, technological advancements, and strategic investments. The bank aims to increase profitability and shareholder value. ESG principles are central to the long-term strategy.

- Deepening client relationships, especially with SMEs and private banking clients.

- Accelerating technological initiatives with significant IT investments.

- Evaluating strategic acquisitions to enhance standalone value.

- Focusing on ESG principles to ensure sustainable growth.

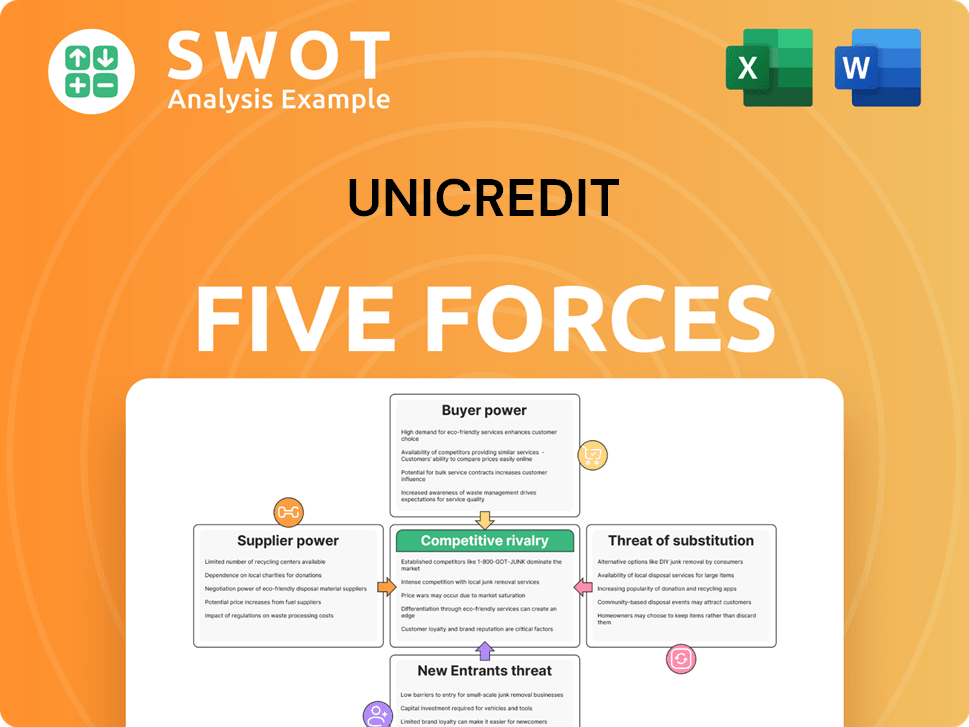

UniCredit Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniCredit Company?

- What is Competitive Landscape of UniCredit Company?

- What is Growth Strategy and Future Prospects of UniCredit Company?

- What is Sales and Marketing Strategy of UniCredit Company?

- What is Brief History of UniCredit Company?

- Who Owns UniCredit Company?

- What is Customer Demographics and Target Market of UniCredit Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.