UniCredit Bundle

How Well Does UniCredit Understand Its Customers?

In the ever-evolving world of finance, grasping UniCredit SWOT Analysis is crucial for success. Understanding the intricacies of customer demographics and target markets is paramount for a banking giant like UniCredit. This knowledge shapes everything from product development to strategic expansion, ultimately dictating its ability to thrive in a competitive landscape.

UniCredit's success hinges on its ability to accurately define and serve its UniCredit target market. This involves a deep dive into customer demographics, including UniCredit customer profile, analyzing factors like UniCredit customer age range, UniCredit customer income levels, and UniCredit geographic customer distribution. By understanding the diverse needs of its UniCredit clients through detailed UniCredit market analysis and employing sophisticated banking customer segmentation strategies, UniCredit aims to tailor its services and maintain a competitive edge in the European financial market.

Who Are UniCredit’s Main Customers?

Understanding the Growth Strategy of UniCredit requires a close look at its diverse customer base. UniCredit's customer demographics are broad, encompassing both individual consumers (B2C) and businesses (B2B). This diverse approach allows it to offer a wide range of financial products and services, catering to various needs and preferences within its target market.

In the B2C sector, UniCredit's customer profile includes individuals and families. These customers utilize retail banking services such as checking and savings accounts, mortgages, and personal loans. The bank's customer segmentation strategy considers factors like age, income, and occupation to tailor its offerings effectively. Younger customers may prioritize digital banking, while older, more affluent clients might seek wealth management solutions.

For B2B clients, UniCredit serves businesses of all sizes, including SMEs and large corporations. Corporate banking services, including financing and working capital solutions, are provided. Investment banking services, such as M&A advisory, are also available. UniCredit's focus on Central and Eastern Europe (CEE) highlights a significant segment of businesses in emerging markets, often requiring support for international expansion and cross-border transactions. UniCredit's Q1 2024 results suggest robust engagement with these diverse customer groups.

UniCredit's B2C customers vary in age, income, and occupation. Younger customers often prefer digital banking, while older clients may seek personalized financial advice. The bank's customer acquisition strategies are designed to attract diverse customer segments. The bank's customer relationship management systems help to manage and understand customer needs.

The B2B segment includes SMEs and large corporations. SMEs often need tailored financing, while large corporations seek sophisticated solutions. UniCredit's market analysis includes a focus on emerging markets, especially in CEE. The bank's customer value proposition for businesses includes comprehensive financial services.

UniCredit uses various segmentation strategies to target its market effectively. These strategies consider factors such as customer age range, income levels, and geographic distribution. The bank's ideal customer persona varies depending on the specific product or service. Customer retention strategies are also in place to maintain customer satisfaction.

UniCredit is investing in digital channels to attract tech-savvy customers. The bank is also focusing on sustainability, which appeals to customers who prioritize environmental and social factors. These initiatives are part of UniCredit's customer acquisition strategies. Customer satisfaction factors include digital convenience and personalized services.

UniCredit's primary customer segments include retail customers and businesses of varying sizes. The bank's focus on digital transformation and sustainability indicates a shift towards attracting tech-savvy and environmentally conscious customers. The strategy to optimize operations and capital allocation has likely led to a more refined targeting of profitable customer segments.

- Retail Banking: Individuals and families using services like current accounts and mortgages.

- Corporate Banking: SMEs and large corporations needing financing and other financial solutions.

- Digital Customers: Those who prioritize digital banking and mobile access.

- Wealth Management Clients: Affluent customers seeking personalized financial advice.

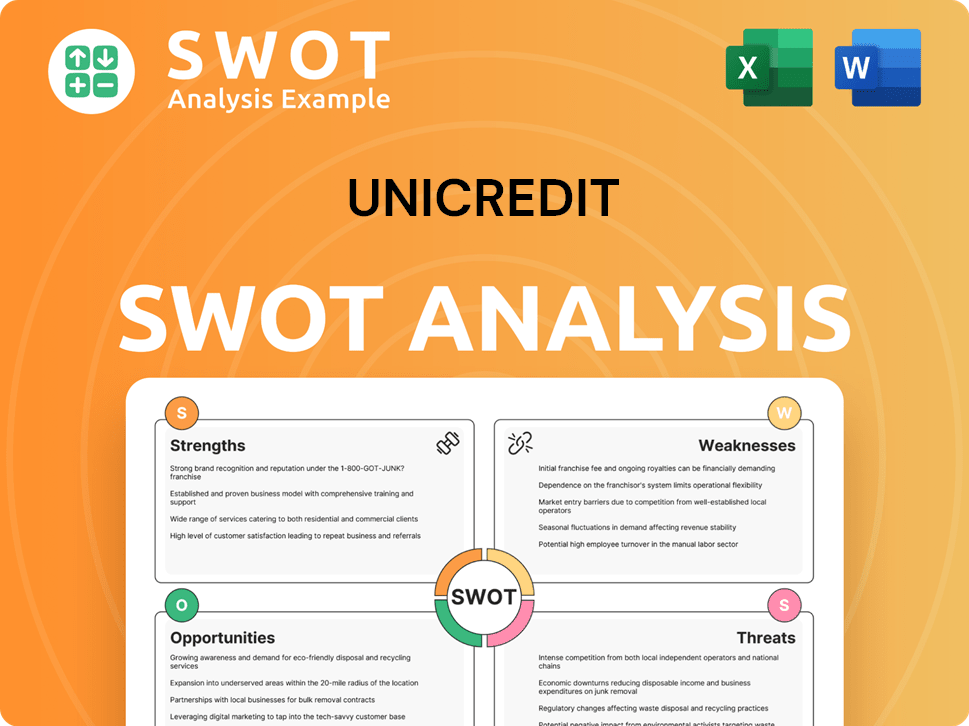

UniCredit SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do UniCredit’s Customers Want?

Understanding the needs and preferences of customers is crucial for the success of any financial institution. For UniCredit, this involves a deep dive into the diverse requirements of its retail and corporate clients. This customer-centric approach allows the bank to tailor its products and services, ensuring customer satisfaction and loyalty.

The bank's ability to adapt to changing customer behaviors, such as the increasing reliance on digital banking, is a key factor in maintaining a competitive edge. By analyzing customer demographics and market trends, UniCredit can proactively address emerging needs and preferences. This proactive approach is essential for retaining existing customers and attracting new ones.

UniCredit's customer profile is shaped by the varying needs of its retail and corporate segments. Retail customers prioritize convenience, security, and personalized financial advice. Corporate clients, on the other hand, seek efficient financing solutions, risk management tools, and reliable international banking services.

Retail customers value convenience, security, and personalized financial advice. They increasingly prefer online and mobile banking for day-to-day transactions. Decision-making is influenced by interest rates, fees, and the ease of digital channels.

Digital self-service is preferred for routine tasks, while human interaction is desired for complex financial decisions. Loyalty is driven by positive experiences and consistent service quality. The bank's understanding of their financial goals is also a key factor.

Corporate clients require efficient financing, risk management, and international banking services. They seek tailored lending, support for international trade, and treasury solutions. Industry expertise, competitive pricing, and integrated financial solutions are crucial.

Common pain points addressed include complex cross-border transactions and access to capital. Product development is influenced by feedback and market trends, leading to digital banking innovations. Sustainable finance and tailored risk management are also important.

UniCredit focuses on digital transformation to enhance customer experience and improve efficiency. This includes providing seamless digital access to services across all segments. The bank aims to support the real economy.

The bank develops products to meet the financing and investment needs of its customers. This includes home loans for individuals and trade finance for businesses. UniCredit's ability to adapt to market changes is crucial.

UniCredit's customer demographics and target market are diverse, requiring a segmented approach to meet varied needs. The bank's customer relationship management (CRM) strategies are critical for maintaining customer satisfaction.

- Customer Segmentation: UniCredit segments its market based on needs, behaviors, and demographics to tailor its offerings effectively.

- Digital Banking: Investment in digital platforms is crucial, with mobile banking users increasing year over year.

- Personalized Services: Offering tailored financial advice and solutions enhances customer loyalty.

- Data Analysis: Utilizing customer data to understand spending habits and preferences is vital.

- Regulatory Compliance: Navigating the complexities of different markets requires a strong focus on compliance.

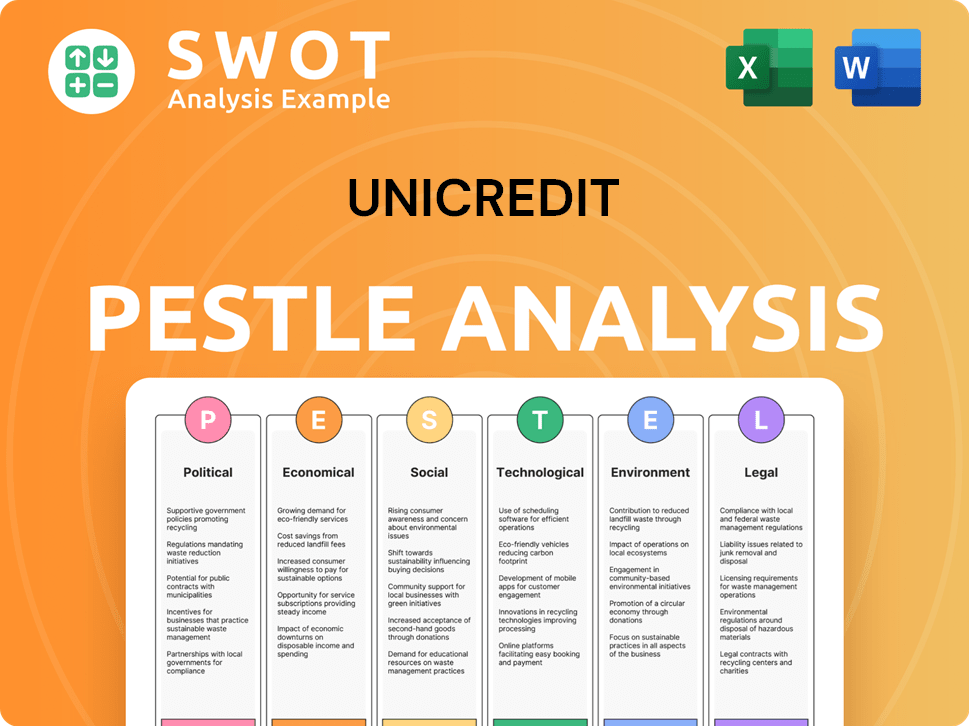

UniCredit PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does UniCredit operate?

The geographical market presence of UniCredit is primarily concentrated in Italy, Germany, Austria, and Central and Eastern Europe (CEE). These regions are crucial for the bank's operations, representing its core markets where it holds significant market share and brand recognition. UniCredit's strategic focus on these areas is evident in its operational and financial strategies, including product development and customer relationship management.

In Italy, UniCredit serves a diverse clientele, from individual customers to large corporations, solidifying its position as a leading banking group in its home market. Germany and Austria are also key strategic markets, where the bank has established robust corporate and investment banking franchises. These cater to both local businesses and international clients operating within these economic powerhouses. This focus is central to understanding the evolution of UniCredit.

The CEE region is a significant growth engine for UniCredit, with countries like Croatia, Czech Republic, Hungary, Romania, Serbia, and Slovenia contributing to its expansion. The bank adapts its offerings and marketing strategies to the varying economic development levels and customer demographics within these markets. This localized approach includes tailoring product features, pricing, and communication channels to resonate with local preferences and regulatory environments.

UniCredit's core markets include Italy, Germany, Austria, and CEE. These regions are vital for the bank's operations and strategic growth. The bank's presence in these areas is supported by its financial investments and operational strategies.

The CEE region shows diverse customer demographics, including varying age groups and income levels. UniCredit adapts its services to accommodate these regional differences. This includes tailoring digital banking solutions and maintaining traditional branch networks.

UniCredit adjusts its strategies based on local preferences and regulations. Digital banking solutions are promoted where smartphone penetration is high. Traditional branch networks are maintained where face-to-face interactions are preferred.

In Q1 2024, UniCredit demonstrated strong performance across all geographies. The CEE region is a key growth driver, with Italy, Germany, and Austria also contributing significantly. The bank's focus on digital transformation and network optimization supports its market position.

UniCredit employs various market segmentation strategies to target specific customer groups. This includes segmenting customers based on age, income, and banking habits. The bank customizes its products and services to meet the diverse needs of its clients.

The bank focuses on effective customer acquisition and retention strategies. This involves offering competitive products, personalized services, and robust customer relationship management. UniCredit aims to build long-term relationships with its clients.

Customer satisfaction is a key priority for UniCredit. Factors such as ease of use, competitive rates, and responsive customer service are crucial. The bank continually assesses and improves its services based on customer feedback.

UniCredit uses advanced customer relationship management (CRM) systems. These systems help the bank understand customer needs and preferences. Effective CRM supports personalized service and targeted marketing efforts.

The customer value proposition for UniCredit includes a wide range of financial services. This includes offering competitive rates, innovative digital solutions, and a strong focus on customer service. The bank aims to provide comprehensive financial solutions.

UniCredit targets a diverse range of customers, from individuals to large corporations. The ideal customer persona varies by market. The bank tailors its services to meet the specific needs of each customer segment.

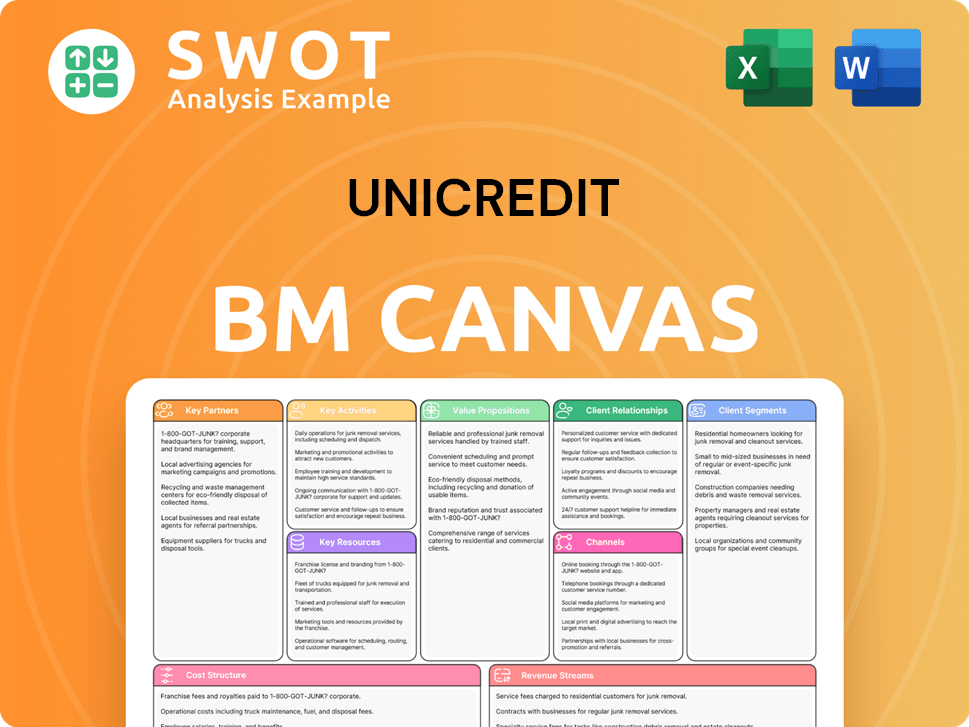

UniCredit Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does UniCredit Win & Keep Customers?

The bank employs a multi-faceted strategy for acquiring and retaining customers, utilizing a mix of digital and traditional channels. This approach is complemented by personalized experiences and robust loyalty programs designed to foster strong customer relationships. The strategies are continually refined, reflecting the evolving needs of the UniCredit customer profile and market dynamics.

For acquiring new customers, the bank leverages various marketing channels. Digital marketing, including search engine optimization (SEO), social media campaigns, and targeted online advertising, is crucial for reaching new customers, particularly younger demographics and digitally-savvy businesses. Traditional channels such as television advertisements, print media, and billboards are also used to build brand awareness and reach a broader audience. Referrals and partnerships, especially in the corporate banking sector, are also significant acquisition drivers.

Customer retention is heavily reliant on personalized experiences and after-sales service. The bank uses customer data and CRM systems to segment its customer base and deliver targeted communications and customized product offerings. The bank's ongoing digital transformation efforts aim at improving customer experience and retention by providing seamless, intuitive digital platforms.

Digital marketing campaigns are crucial for reaching younger demographics and digitally savvy businesses. This includes SEO, social media, and targeted online advertising. These efforts are designed to enhance the bank's online presence and attract new UniCredit clients.

Traditional channels such as television, print media, and billboards are still utilized to build brand awareness. This approach helps reach a broader audience, especially in areas with lower digital penetration. These methods remain important for maintaining a strong market presence.

Referrals and partnerships, especially in the corporate banking sector, are significant acquisition drivers. Leveraging existing client relationships and industry networks helps to expand the customer base. These programs are key in the UniCredit target market.

Sales tactics involve a consultative approach, where relationship managers engage with potential clients to understand their financial needs and offer tailored solutions. This is particularly true in corporate and wealth management segments. This strategy enhances customer satisfaction.

The bank leverages customer data and CRM systems to segment its customer base. This enables targeted communications and customized product offerings, enhancing customer loyalty. This approach is central to the bank's customer relationship management.

Loyalty programs, though not always explicitly branded, are embedded in the form of preferential rates for long-term customers. Exclusive access to certain financial products and dedicated customer support are also provided. These programs are crucial for customer retention strategies.

The bank's ongoing digital transformation efforts aim at improving customer experience. This includes enhancing mobile banking apps, online portals, and introducing new digital services. These efforts are designed to simplify financial management.

The bank uses data analytics to understand customer behavior and preferences. This enables more effective targeting of marketing campaigns and personalized product recommendations. This approach is key to understanding the customer demographics.

The focus on operational efficiency and a strong capital position supports customer acquisition and retention. This enables the bank to invest in better technology and offer more competitive products. This approach is key to the bank's strategic plan.

Over time, the bank has increasingly shifted its strategy towards digitalization and customer-centricity. This has led to a greater emphasis on data analytics to understand customer behavior and preferences. This approach is crucial for the bank's success.

The bank's customer acquisition and retention strategies are multifaceted, focusing on both digital and traditional channels. These strategies are designed to reach a broad range of customers and build strong, lasting relationships. For a deeper understanding of the bank's financial model, consider reading about the Revenue Streams & Business Model of UniCredit.

- Digital marketing, including SEO and social media campaigns, is used to reach younger demographics.

- Traditional channels like television and print media build brand awareness across a wider audience.

- Referrals and partnerships, especially in corporate banking, drive customer acquisition.

- A consultative sales approach ensures tailored financial solutions.

- Personalized experiences and after-sales service are key for customer retention.

- Loyalty programs provide preferential rates and exclusive access to products.

- Ongoing digital transformation enhances customer experience.

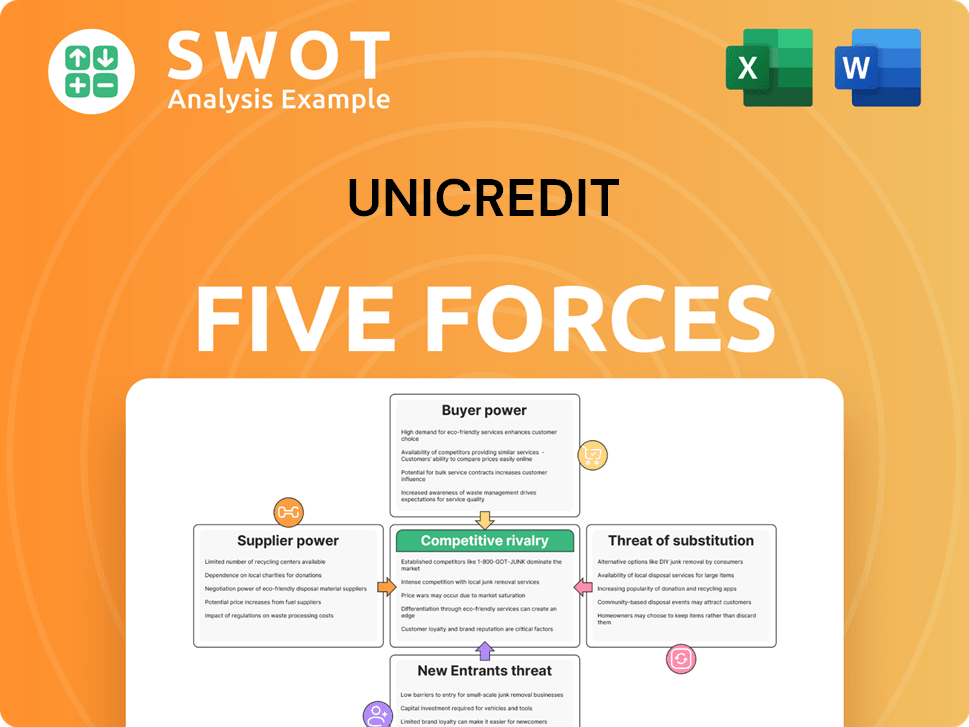

UniCredit Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniCredit Company?

- What is Competitive Landscape of UniCredit Company?

- What is Growth Strategy and Future Prospects of UniCredit Company?

- How Does UniCredit Company Work?

- What is Sales and Marketing Strategy of UniCredit Company?

- What is Brief History of UniCredit Company?

- Who Owns UniCredit Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.