Wacker Neuson Bundle

How Does the Wacker Neuson Company Build Its Success?

Wacker Neuson, a global powerhouse in light and compact equipment, is a key player in industries like construction and agriculture. With a diverse product portfolio, the company's influence is felt across multiple sectors. In 2024, Wacker Neuson Group generated substantial revenue, highlighting its market presence. Understanding Wacker Neuson SWOT Analysis is crucial for grasping its strengths and opportunities.

Delving into Wacker Neuson's operations reveals insights into the heavy machinery market and German engineering excellence. The company's strategic initiatives, including 'Fit for 2025', showcase its proactive approach to navigating market challenges and improving financial performance. Exploring the Wacker Neuson company's history and product range provides a comprehensive understanding of its market position and future prospects. Knowing how Wacker Neuson manufactures equipment is key.

What Are the Key Operations Driving Wacker Neuson’s Success?

The core of Wacker Neuson's operations revolves around creating and delivering value through its range of light and compact equipment. This equipment serves professional users across multiple sectors, including construction, landscaping, agriculture, and municipal services. The company's product portfolio is extensive, featuring concrete technology, compaction equipment, worksite technology, and various construction machines.

Wacker Neuson's value proposition centers on enhancing customer productivity, efficiency, and safety. They achieve this through innovation, holding over 350 patents, particularly in zero-emission solutions and digitalization. This commitment to innovation, combined with a global presence, allows them to offer superior products and services.

The company's operational processes are multifaceted, encompassing manufacturing, sourcing, technology development, logistics, sales, and customer service. Manufacturing occurs at eight locations across North America, Europe, and Asia. These facilities support a global network of approximately 7,000 sales and service stations, ensuring wide accessibility and efficient spare parts service.

Wacker Neuson's product range includes concrete technology, compaction equipment, worksite technology, pumps, power generation, and construction equipment. Construction equipment includes excavators, dumpers, loaders, and telehandlers. This diverse offering allows the company to cater to various customer needs within the construction and related industries.

Wacker Neuson has a strong global presence, with manufacturing facilities in North America, Europe, and Asia. Their extensive sales and service network, comprising approximately 7,000 stations worldwide, supports their global operations. This widespread network ensures that customers have access to products, parts, and services.

Innovation is a key driver for the Wacker Neuson company, with over 350 patents. The company focuses on zero-emission solutions and the digitalization of construction equipment. This commitment to technological advancement helps them stay ahead of the competition and meet evolving customer needs.

Wacker Neuson focuses on increasing productivity, efficiency, and safety for its customers. Their equipment is designed to meet the demands of various industries, including construction, landscaping, and agriculture. These benefits are achieved through a combination of innovative products, a strong global presence, and a commitment to customer service.

Wacker Neuson's operations are characterized by manufacturing, sourcing, technology development, logistics, sales, and customer service. The company's commitment to innovation, with over 350 patents, is a key differentiator. Their extensive global network supports their operations and ensures customer satisfaction.

- Manufacturing in North America, Europe, and Asia.

- A global network of approximately 7,000 sales and service stations.

- Focus on zero-emission solutions and digitalization.

- Emphasis on customer productivity, efficiency, and safety.

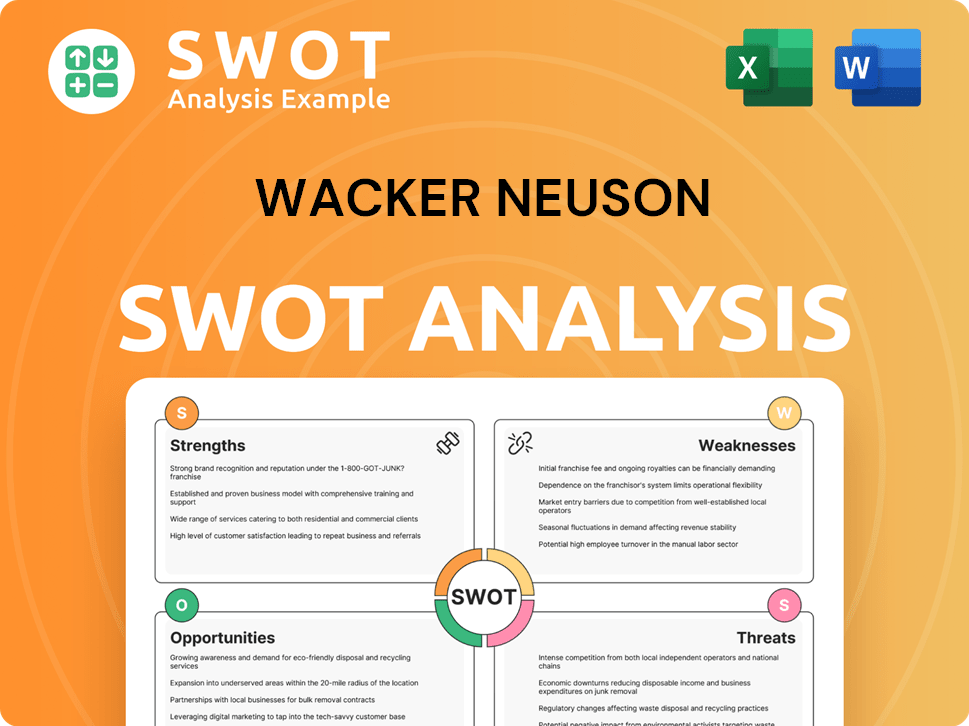

Wacker Neuson SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wacker Neuson Make Money?

The primary revenue streams for the Wacker Neuson company are derived from the sale of light and compact equipment. These include construction equipment and heavy machinery. Additional revenue is generated through services like repair, spare parts sales, and equipment rentals.

For the fiscal year 2024, Wacker Neuson reported a total revenue of EUR 2,234.9 million. This represents a 15.8% decrease compared to the EUR 2,654.9 million in the previous year. The company's monetization strategies are further enhanced by a broad product portfolio and a range of services.

The company's strategic initiatives, such as the 'Fit for 2025' measures, are designed to strengthen sales and optimize production capacities. These efforts are focused on enhancing revenue generation and overall profitability. The company's commitment to innovation, including zero-emission machines, is expected to drive future sales growth.

The Europe region (EMEA) contributed the largest share of total revenue, accounting for 77.5% in 2024.

The Americas region saw a 19.0% decline in revenue, while the Asia-Pacific region experienced a 30.9% decrease.

The Americas region represented 20.2% of total revenue, and Asia-Pacific accounted for 2.3%.

Wacker Neuson is focusing on innovative solutions like zero-emission machines, which could drive future sales growth.

The 'Fit for 2025' measures focus on strengthening sales and optimizing production capacities.

Services such as repair, spare parts, and rental contribute to the company's revenue streams.

Wacker Neuson's revenue model is built on a diverse product range and comprehensive services. The company's focus on German engineering and quality, combined with strategic initiatives, aims to sustain and grow its market position. For more insights into the company's background, you can read this Brief History of Wacker Neuson.

- Sales of light and compact construction equipment.

- Provision of repair services and spare parts.

- Equipment rental services.

- Focus on zero-emission machines for future growth.

- Implementation of 'Fit for 2025' measures to boost sales and production.

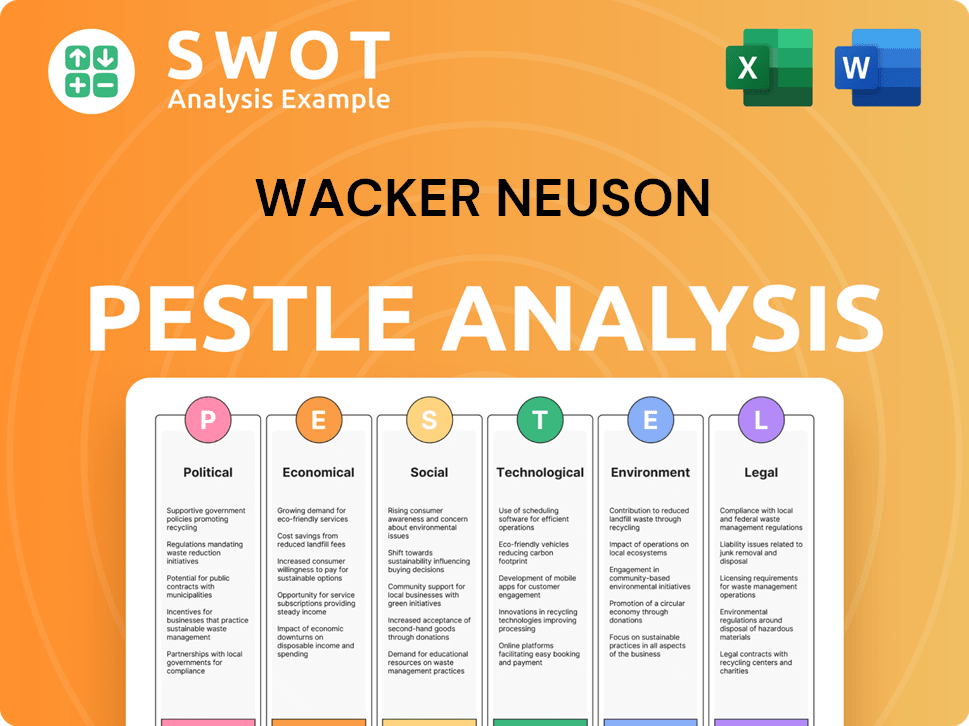

Wacker Neuson PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Wacker Neuson’s Business Model?

The Wacker Neuson company, a prominent player in the construction equipment sector, has a rich history dating back to 1848. This long-standing tradition forms a solid foundation for the company's operations. As a global leader in the manufacturing of construction equipment and heavy machinery, Wacker Neuson consistently adapts to market changes and technological advancements.

In 2024, Wacker Neuson faced a challenging economic environment, which led to strategic adjustments. The company implemented the 'Fit for 2025' measures to address these challenges, aiming to strengthen sales and reduce costs. These moves included optimizing production and reducing inventories, reflecting a proactive approach to navigate economic fluctuations.

Wacker Neuson has demonstrated its capacity to adapt and innovate. The company focuses on sustainability and technological advancements. The company's commitment to innovation is evident in its new product launches, which emphasize efficiency and technological progress.

Founded in 1848, Wacker Neuson has a long history in the construction equipment industry. The company has grown significantly over the years, expanding its product range and global presence. The company's ability to adapt to market changes has been crucial to its longevity and success.

In 2024, Wacker Neuson introduced the 'Fit for 2025' measures to address economic challenges. These measures focused on strengthening sales, reducing costs, and optimizing production. The company's strategic moves also included reducing headcount and inventories to improve efficiency.

Wacker Neuson's competitive advantages include brand strength and technological leadership. The company's focus on zero-emission solutions and digitalization sets it apart. The company's global presence and diversified customer base also contribute to its competitive edge.

Despite a challenging economic climate, Wacker Neuson achieved significant financial milestones in 2024. The company improved its free cash flow, reaching EUR 184.6 million. This improvement reflects the effectiveness of the strategic measures implemented by the company.

Wacker Neuson demonstrates resilience and adaptability in the construction equipment market. The company's strategic initiatives and focus on innovation position it for future growth. The company continues to invest in its 'Strategy 2030' to drive sustainability and technological advancements.

- Wacker Neuson's history dates back to 1848, establishing a strong foundation.

- The 'Fit for 2025' measures aim to strengthen sales and reduce costs.

- The company's competitive edge comes from brand strength and technological leadership.

- In 2024, group revenue decreased by 15.8% to EUR 2,234.9 million.

- Free cash flow reached EUR 184.6 million by the end of 2024.

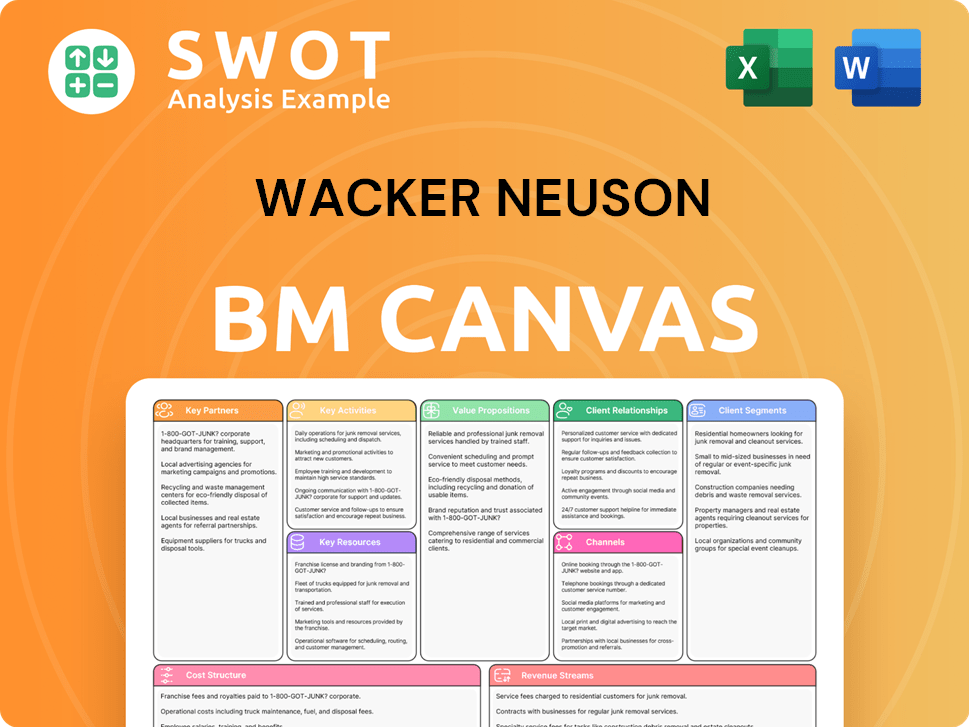

Wacker Neuson Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Wacker Neuson Positioning Itself for Continued Success?

As a prominent player in the global light and compact equipment market, Wacker Neuson, a German engineering company, holds a significant industry position. The company's shares are listed on the regulated Prime Standard segment of the Frankfurt Stock Exchange and are part of the SDAX index. In 2024, Europe (EMEA) remained its primary market, contributing 77.5% of the total revenue.

However, Wacker Neuson faces several risks and headwinds. These include economic downturns, geopolitical uncertainties affecting consumer behavior, and regulatory changes. In 2024, a decrease in order intake and full dealer stocks led to a 15.8% drop in group revenue compared to the previous year. These factors can significantly impact Wacker Neuson operations and financial performance.

Wacker Neuson is a leading manufacturer of light and compact construction equipment and heavy machinery. Its strong presence in Europe, particularly EMEA, highlights its strategic market focus. The company's listing on the Frankfurt Stock Exchange underscores its commitment to transparency and investor confidence.

Economic weakness and geopolitical instability pose significant risks to Wacker Neuson. Fluctuations in demand, especially in construction and agriculture, directly impact sales. Changes in regulations, along with competition and technological shifts, could also affect the company's operations.

Wacker Neuson anticipates a gradual stabilization in key markets for fiscal year 2025. Strategic initiatives like 'Strategy 2030' aim to boost profitability. The company is also investing in innovation, particularly in zero-emission solutions, and is looking forward to positive momentum from events like the bauma exhibition in April 2025.

For fiscal year 2025, Wacker Neuson expects stable revenue between EUR 2,100 million and EUR 2,300 million. The company projects an EBIT margin between 6.5% and 7.5%. These figures reflect the company's expectations for the coming year, despite current challenges.

Wacker Neuson is focused on its 'Strategy 2030,' targeting an 11% EBIT margin and EUR 4 billion in revenue. The company continues to invest in innovations, especially in zero-emission solutions and digitalization, to maintain its competitive edge. You can learn more about the competitive landscape of Wacker Neuson in the article Competitors Landscape of Wacker Neuson. The anticipated positive momentum from events like the bauma exhibition in April 2025 is also expected to contribute to its future success.

Wacker Neuson's strategy focuses on sustainable growth and innovation. Key initiatives include the 'Strategy 2030' plan, which sets ambitious financial targets. Investments in zero-emission solutions and digitalization are also critical for future success.

- Focus on 'Strategy 2030' for long-term growth.

- Investment in zero-emission solutions.

- Emphasis on digitalization across operations.

- Leveraging industry events like bauma.

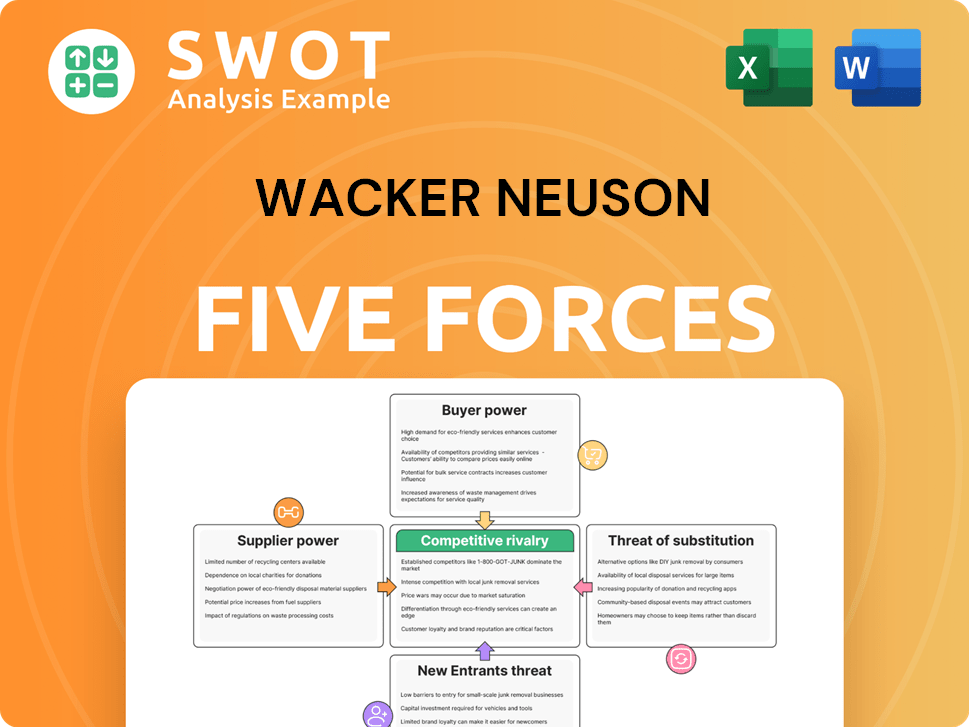

Wacker Neuson Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wacker Neuson Company?

- What is Competitive Landscape of Wacker Neuson Company?

- What is Growth Strategy and Future Prospects of Wacker Neuson Company?

- What is Sales and Marketing Strategy of Wacker Neuson Company?

- What is Brief History of Wacker Neuson Company?

- Who Owns Wacker Neuson Company?

- What is Customer Demographics and Target Market of Wacker Neuson Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.