Xero Bundle

How Does Xero Revolutionize Small Business Accounting?

Xero, a global leader in cloud-based Xero SWOT Analysis, has fundamentally changed how small businesses manage their finances. Founded in 2006, this New Zealand-based company offers intuitive Xero accounting software, empowering millions worldwide with streamlined financial tools. With a substantial subscriber base and impressive financial growth, Xero's impact on the business landscape is undeniable.

This comprehensive exploration delves into the core mechanics of Xero, examining its features, benefits, and how it drives success for small businesses. From its Xero software capabilities to its strategic maneuvers, we'll uncover the key elements that make Xero a pivotal player in the world of cloud accounting. Learn how Xero's reporting and analytics, along with its integration capabilities, can transform your business's financial management.

What Are the Key Operations Driving Xero’s Success?

Xero creates and delivers value through its cloud-based accounting software platform, primarily designed for small to medium-sized businesses (SMBs), as well as accountants and bookkeepers. The platform simplifies financial tasks, improves cash flow, and provides actionable insights for informed decision-making. Its core offerings include tools for managing invoicing, payments, bank reconciliation, expense tracking, inventory, payroll, and real-time financial reporting.

The company's core operations revolve around technology development, maintaining a robust cloud infrastructure, and fostering a comprehensive ecosystem. This approach ensures that Xero remains competitive and adaptable to the evolving needs of its users. The platform's focus on automation, including bank feeds, invoicing, and reconciliation, saves time and reduces errors.

Xero's value proposition centers on providing accessible, scalable, and automated accounting software solutions. This empowers SMBs and their advisors to manage finances efficiently, gain real-time insights, and make data-driven decisions. The company's commitment to innovation and integration further enhances its appeal to a wide range of businesses.

Xero offers a suite of tools designed for comprehensive financial management. These include invoicing and payment processing, automated bank reconciliation, expense tracking, and inventory management. The platform also provides payroll integration and real-time financial reporting capabilities.

Xero's operations are centered on technology development and maintaining a robust cloud infrastructure. This includes frequent software updates and new feature releases. The company also focuses on integrating with third-party business apps to streamline workflows.

Distribution is predominantly digital, relying on its cloud infrastructure. Partnerships, particularly with accounting and bookkeeping firms, are crucial for recommending and implementing Xero. The company's user-friendly interface makes complex accounting accessible.

Xero provides significant customer benefits such as improved data consistency, reduced human error, faster financial insights, and lower operational costs. Its focus on automation saves time and resources for users. The platform's scalability adapts to businesses as they grow.

Xero's key features include automated bank reconciliation, invoicing, and expense tracking, which streamline financial management. The platform's integration capabilities with various third-party apps enhance its functionality. Xero's commitment to innovation, such as the recent improvements to its mobile app and invoicing, keeps it competitive in the market.

- Cloud-Based Accessibility: Access your financial data anytime, anywhere.

- Automation: Automated bank feeds, invoicing, and reconciliation save time.

- Integration: Seamlessly integrates with hundreds of apps for a streamlined workflow.

- User-Friendly Interface: Designed to be easy to use, even for those without an accounting background.

Xero SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Xero Make Money?

The primary revenue stream for Xero stems from subscription fees associated with its cloud-based accounting software. This model provides a predictable income stream, allowing the company to forecast and manage its finances effectively. The company has successfully built a strong foundation on subscription-based revenue.

For the fiscal year ending March 31, 2025, Xero reported total operating revenue of NZ$2.1 billion (US$1.26 billion). This represents a significant increase of 23% compared to the previous year, demonstrating the company's growth and market adoption. The Annualized Monthly Recurring Revenue (AMRR) also saw substantial growth, reaching NZ$2.4 billion (US$1.4 billion), a 22% increase.

The company's financial performance reflects its ability to attract and retain customers, as well as its success in monetizing its services. The consistent growth in both total revenue and AMRR highlights the strength of Xero's business model and its position in the cloud accounting market.

Xero utilizes a tiered pricing model to cater to various business needs and sizes. This approach enables the company to capture a broader market segment by offering different features and pricing structures. In July 2024, Xero introduced new streamlined business plans, including Ignite, Grow, and Comprehensive, and enhanced its Ultimate plan, integrating more key features directly into the plans rather than as separate add-ons. This shift, which is expected to be completed by March 2025, also included price adjustments for equivalent plans.

- The Early Plan is designed for sole proprietors and new businesses, offering basic features.

- The Growing Plan provides unlimited invoicing and bill management, suitable for expanding businesses.

- The Established Plan offers comprehensive features, including multi-currency support, project tracking, and advanced analytics, catering to larger businesses.

- This tiered approach allows Xero to offer scalable solutions, accommodating businesses as they grow and require more advanced features.

Average revenue per user (ARPU) is a crucial metric for Xero, and it has shown significant growth. In FY25, ARPU increased by 15% to NZ$45.08 (US$27.05). This growth is attributable to a combination of factors, including an improved product mix, pricing adjustments, and the continued expansion of payments services. You can learn more about Xero's features and benefits from resources like this article.

- The Xero ecosystem, including connected apps and payment services, plays a vital role in revenue generation.

- The strategic acquisition of Syft Analytics demonstrates Xero's commitment to expanding its capabilities while maintaining a focus on core accounting functions.

- The company's ability to integrate with other applications enhances its value proposition and attracts a wider customer base.

Xero PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Xero’s Business Model?

Xero has achieved significant milestones and strategic shifts that have shaped its trajectory in the accounting software market. A key development was the unveiling of its 'Winning on Purpose' strategy for FY25-27 in February 2024. This strategy focuses on customer-centric solutions, capital efficiency, and technological innovation, aiming to solidify Xero's position in the cloud accounting space. The company's financial performance has been robust, with operating income increasing by 42% in FY25, demonstrating its ability to navigate market challenges.

The 'Win the 3x3' approach is central to Xero's strategy, concentrating on providing winning solutions for accounting, payroll, and payments, in its core markets: Australia, the UK, and the US. Operational adjustments, such as a 15% headcount reduction in FY23, were part of a broader effort to enhance the organization's focus and performance. These strategic moves highlight Xero's commitment to adapting to market dynamics and improving operational efficiency.

Xero's competitive advantages are multifaceted, setting it apart in the crowded field of Xero accounting software providers. Its user-friendly interface makes accounting accessible to a broad audience, including those without formal accounting training. The platform's automated bank feeds and customizable reporting further enhance its appeal, providing businesses with efficient and insightful financial management tools.

Xero's intuitive design simplifies accounting tasks, making it accessible to non-accountants. This ease of use is a key differentiator, attracting small businesses and individuals. The platform's automated features further streamline financial management.

Xero offers unlimited users across its pricing plans, unlike some competitors like QuickBooks. This feature is particularly beneficial for businesses with in-house accounting teams. It fosters collaboration and comprehensive financial oversight.

Xero boasts a vast ecosystem of connected apps and integrations with banks and financial institutions. This integration provides a comprehensive suite of solutions. It enhances the functionality and versatility of the platform.

Xero continually enhances its platform with new features, such as online bill payment functionality launched in April 2025. The introduction of the 'Xero Simple' plan for UK sole traders demonstrates its responsiveness to market demands. These enhancements help maintain its competitive edge.

Xero is actively integrating Artificial Intelligence (AI) into its platform to improve efficiency and user experience. The development of 'Just Ask Xero' (JAX), a generative AI business companion, is a key initiative. JAX is designed to automate accounting tasks and provide personalized insights.

- JAX entered beta in 2024, initially focusing on invoicing, quotes, and contacts.

- Plans include expanding JAX to other areas like bills and cash flow forecasting.

- Xero is committed to responsible AI development.

- This strategic move positions Xero to leverage technological advancements for future growth.

Xero Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Xero Positioning Itself for Continued Success?

As of March 2025, Xero, a leading provider of Xero accounting software, holds a strong position in the small business accounting software market, especially in Australia and New Zealand. The company's global presence is significant, with approximately 4.4 million subscribers worldwide. Xero's customer retention is robust, as indicated by a low monthly churn rate of 1.03% (excluding removed idle subscriptions), showing strong customer loyalty.

Despite its market strength, Xero faces several risks. Increased competition from established players and emerging solutions poses a constant challenge. The need to adapt to technological advancements, data security concerns, regulatory changes, and economic uncertainties, including inflation and interest rate fluctuations, also present potential hurdles. These factors could impact subscriber growth and revenue.

Xero is a top player in the Xero accounting software market, particularly strong in Australia and New Zealand. Its customer base is substantial, with 4.4 million subscribers globally as of March 2025. The company demonstrates high customer retention, with a monthly churn rate of 1.03%.

Xero faces competition from established and emerging solutions. Technological changes, data security, and regulatory changes are key concerns. Economic factors, such as inflation and interest rates, can impact subscriber growth.

Xero's future is focused on customer-centric solutions and capital allocation. The company is expanding its AI capabilities, including the 'Just Ask Xero' (JAX) initiative. Expansion into new markets and ARPU growth are also key strategies.

Xero's strong financial position, with $1.95 billion in reserves, supports future investments. The company aims to improve product velocity and deliver more value through its '3x3 strategy'. Leadership is optimistic about digitizing small and medium-sized businesses globally.

Xero's 'Winning on Purpose' strategy for FY25-27 focuses on customer-centric solutions and efficient capital allocation. The company is investing heavily in AI, including the 'Just Ask Xero' (JAX) initiative. Xero is also expanding globally and focusing on increasing Average Revenue Per User (ARPU).

- Expansion of AI capabilities to automate accounting tasks.

- Continued global expansion into new markets and customer segments.

- Focus on increasing Average Revenue Per User (ARPU), with a 15% increase in FY25.

- Leveraging a strong cash position of $1.95 billion for future investments.

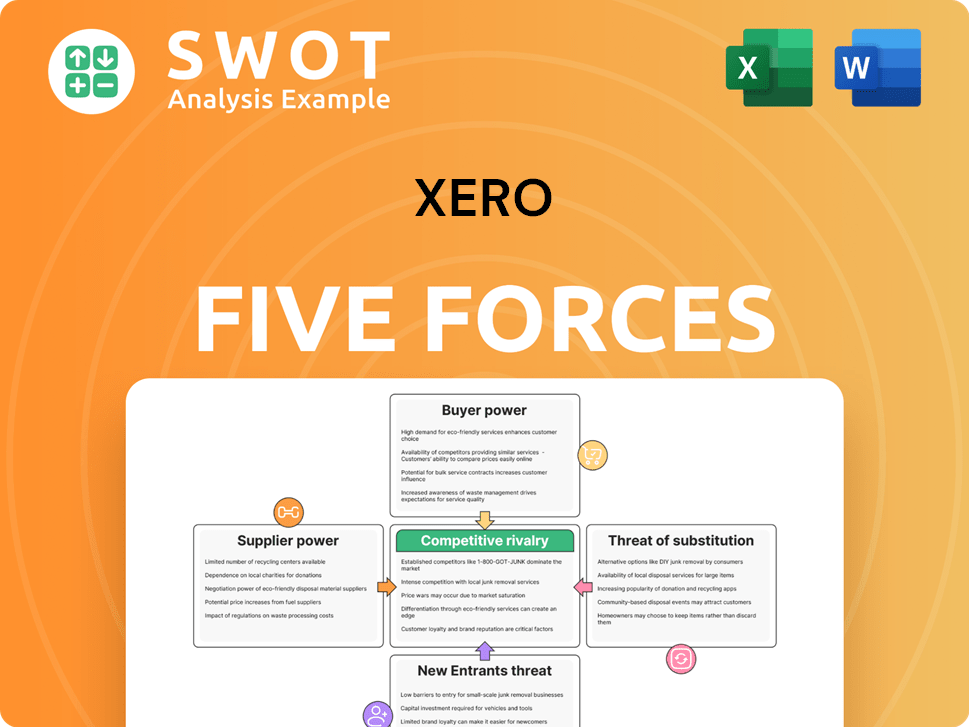

Xero Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Xero Company?

- What is Competitive Landscape of Xero Company?

- What is Growth Strategy and Future Prospects of Xero Company?

- What is Sales and Marketing Strategy of Xero Company?

- What is Brief History of Xero Company?

- Who Owns Xero Company?

- What is Customer Demographics and Target Market of Xero Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.