Arab National Bank Bundle

How is Arab National Bank Redefining Banking in the Digital Age?

Established in 1979, Arab National Bank (ANB) has evolved from its roots to become a major player in the Middle East banking sector. With a strategic shift towards digital transformation, ANB is not just keeping pace with the times; it's setting the standard. Explore how ANB leverages its Arab National Bank SWOT Analysis to navigate the competitive landscape and drive growth.

This exploration delves into the core of ANB's Arab National Bank sales strategy and Arab National Bank marketing strategy, dissecting how they've adapted to the digital era. From understanding ANB sales and marketing tactics to analyzing their brand positioning, we'll uncover the secrets behind ANB's success in the Saudi Arabian banking sector. This analysis will provide actionable insights for anyone looking to understand the future of ANB financial services and the broader Banking sector marketing.

How Does Arab National Bank Reach Its Customers?

The Arab National Bank sales strategy is built on a multi-channel approach, combining traditional and digital methods. This strategy aims to meet the needs of a diverse customer base, including individuals, businesses, and institutions. The bank's approach to ANB sales and marketing focuses on leveraging both physical and digital channels to enhance customer experience and drive growth within the Saudi Arabian banking sector.

ANB's sales channels include a widespread network of physical branches and ATMs across Saudi Arabia. These channels provide direct customer service and support. Complementing this physical presence is a strong emphasis on digital channels, such as the company website and mobile banking applications. This digital transformation is a key part of ANB marketing strategy, reflecting the increasing demand for digital banking services.

The bank has significantly invested in digital adoption to meet the expectations of tech-savvy customers, aligning with Saudi Arabia's goal for cashless payments to constitute 70% of total transactions by 2025. The ANB financial services are increasingly accessible through its mobile banking app, which offers a wide range of services, including account management, transfers, and bill payments. This digital focus has resulted in benefits such as an 80% reduction in branch turnaround times and a cost-to-income ratio of 33.24% as of January 2025.

ANB maintains an extensive network of branches and ATMs throughout Saudi Arabia. These physical locations offer direct customer service, support for various banking needs, and facilitate face-to-face interactions. This network is essential for serving a diverse customer base, including those who prefer traditional banking methods.

ANB heavily invests in digital channels, including its website and mobile banking applications. The mobile app provides a wide array of services such as account management, transfers, bill payments, and digital card issuance. This digital focus aims to meet the needs of tech-savvy customers and aligns with the broader trend towards digital banking.

ANB forms strategic partnerships to expand its reach and enhance service offerings. For example, in January 2024, ANB signed an agreement with Saudi EXIM Bank to provide guarantees for Small and Medium Enterprises (SMEs) to obtain financing for export transactions. These collaborations support business growth and enhance customer value.

ANB's international remittance arm, TeleMoney, joined Thunes' Direct Global Network in September 2024. This partnership expands its cross-border payment capabilities to digital wallets and bank accounts in Asia and Africa. This move supports ANB's global reach and enhances its service offerings for international transactions.

ANB's sales strategy includes key initiatives to enhance its market position. These initiatives focus on digital transformation, strategic partnerships, and customer-centric services. The bank's approach involves leveraging technology, forming alliances, and improving customer experience to drive growth and maintain a competitive edge in the banking sector marketing.

- Digital Transformation: Continuous updates to the mobile banking app and website to improve user experience.

- Strategic Partnerships: Collaborations with other financial institutions to expand service offerings.

- Customer-Centric Services: Focus on providing convenient and accessible banking solutions.

- Market Expansion: Expanding services through partnerships, such as TeleMoney joining Thunes.

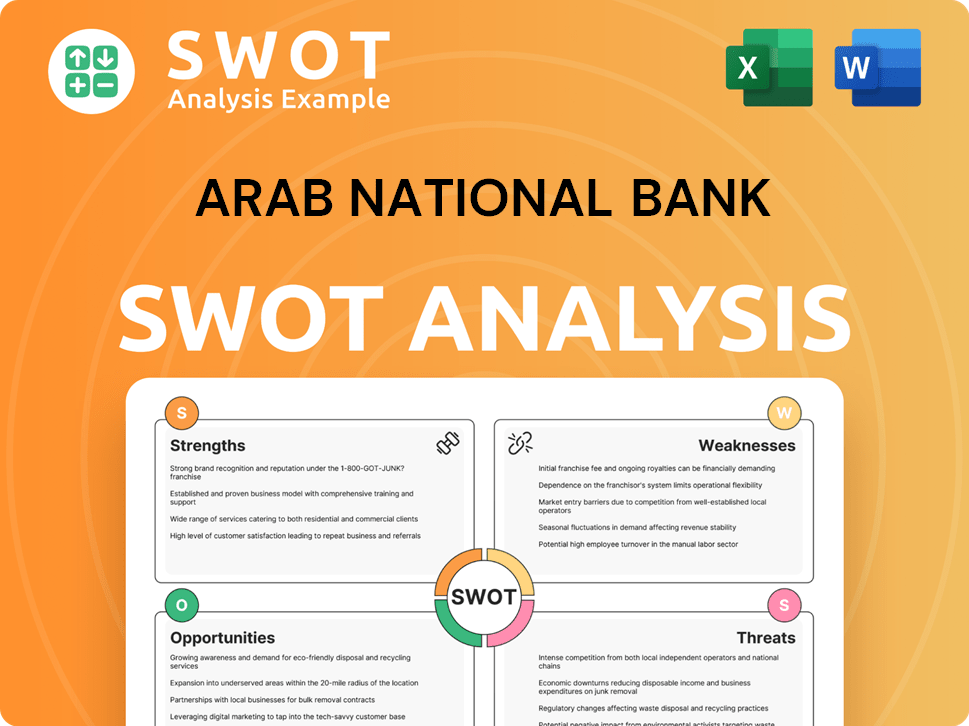

Arab National Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Arab National Bank Use?

The Owners & Shareholders of Arab National Bank employs a multifaceted approach to sales and marketing, blending digital and traditional methods to boost brand recognition, generate leads, and boost sales. This strategy is crucial in the competitive Saudi Arabian banking sector. The bank's tactics are designed to reach a broad audience, including younger generations, and to provide personalized customer experiences.

ANB's sales and marketing strategy is heavily influenced by data analytics and technological advancements. This data-driven approach allows for tailored offerings based on customer demographics and financial needs. The bank's investment in IT infrastructure, including upgrades to its core banking system and the use of AI, reflects its commitment to innovation and efficiency.

The bank's focus on customer value management and personalization, as seen in its partnership with Finshape in January 2024, underscores its dedication to meeting diverse customer needs. This comprehensive strategy is essential for ANB to maintain its market share and foster growth in the dynamic financial landscape.

ANB utilizes digital channels extensively. Content marketing is a key component, with initiatives like the 'ANB Verse' metaverse experience. The bank leverages its website and mobile applications for product and service access.

Traditional media channels, such as TV, radio, and print, are typically used for broader reach and brand building. These channels help ANB maintain a strong presence in the market.

Customer segmentation programs are used to tailor offerings based on demographics and income. This consumer-focused approach ensures that ANB's services meet varied customer needs.

ANB emphasizes personalization through partnerships, such as the January 2024 collaboration with Finshape. This allows for customized banking experiences and relevant offers.

Significant investments in IT infrastructure, including upgrades with Infosys Finacle, enhance scalability and flexibility. AI, Cloud, and big data analytics are used to improve service levels.

ANB aims to become an 'AI-first organization' by deploying AI-ML models for customer insights and risk management. This reflects a strong focus on digital and data-driven strategies.

The ANB sales and marketing strategy integrates various elements to achieve its goals. These include digital marketing, traditional media, data-driven customer segmentation, and technological innovation.

- Digital Marketing: Content marketing, website, and mobile applications, social media, and influencer partnerships.

- Traditional Media: TV, radio, and print media are used for broader reach and brand building.

- Data-Driven Marketing: Customer segmentation based on demographics and income.

- Personalization: Leveraging data analytics for customized banking experiences.

- Technological Advancements: Upgrading core banking systems and using AI, Cloud, and big data analytics.

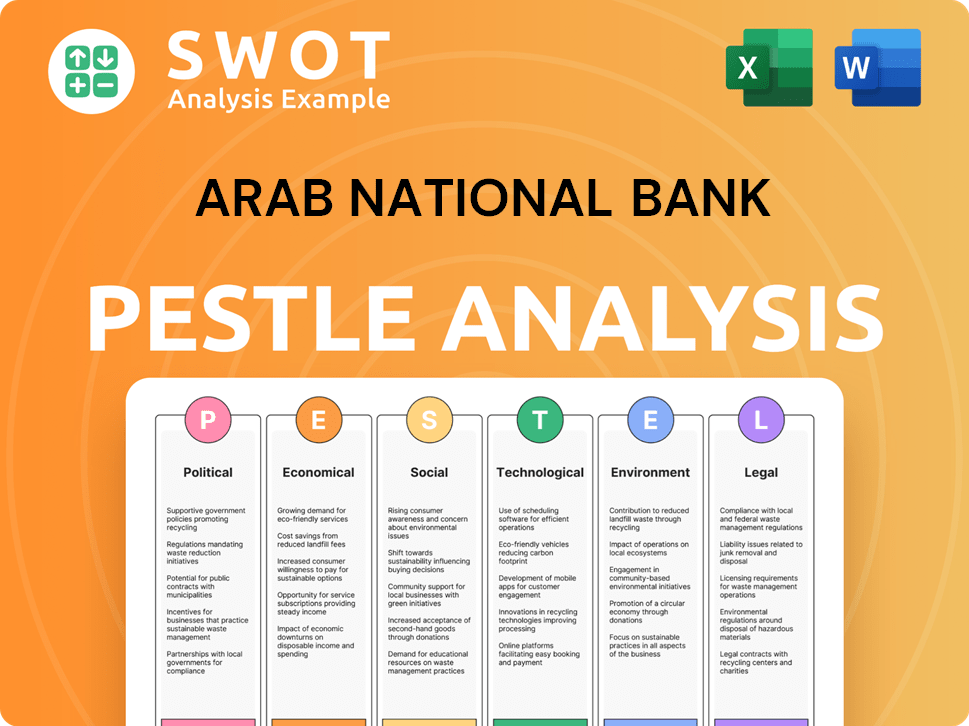

Arab National Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Arab National Bank Positioned in the Market?

The brand positioning of Arab National Bank (ANB) centers on innovation, growth, and its connection to Saudi Arabian heritage. ANB has undergone a brand revamp and corporate identity launch, aiming to shift market perception towards 'Faster and Simpler' banking solutions. This strategic shift aligns with its broader digital transformation efforts, modernizing financial interactions for its customers.

ANB differentiates itself by providing a comprehensive banking experience supported by cutting-edge digital solutions. It caters to a diverse customer base, including individuals, SMEs, corporate and institutional clients, and government entities. The bank focuses on customer-centricity, offering tailored solutions to meet individual financial needs, with a strong emphasis on digital accessibility and convenience.

While specific brand perception data for ANB is not extensively detailed, its affiliate, Arab Bank, has received significant recognition. For instance, Arab Bank was named 'Best Bank in the Middle East 2024' by Global Finance for the ninth consecutive year. This suggests a regional reputation for excellence within the broader Arab banking sector. ANB's strategic collaborations, such as the partnership with IDEMIA Secure Transactions to launch the first card with Braille printing technology in Saudi Arabia in February 2024, demonstrate a commitment to inclusivity and innovation.

ANB emphasizes digital banking solutions to enhance customer experience. This includes an updated mobile app and collaborations to improve digital services. The bank's digital focus aims to provide faster and simpler banking solutions, aligning with modern customer expectations.

ANB focuses on customer-centricity by offering tailored financial solutions. This approach adapts to individual financial needs and preferences. The bank aims to build strong customer relationships through personalized services and support.

ANB is committed to innovation, as demonstrated by its partnership with IDEMIA. This collaboration resulted in the launch of the first card with Braille printing technology in Saudi Arabia in February 2024. This initiative highlights ANB's dedication to inclusivity and technological advancement.

ANB strives for brand consistency across its physical and digital touchpoints. This approach ensures a unified customer experience across all channels. Consistent branding helps build trust and recognition in the competitive banking sector.

ANB's sales and marketing strategy is shaped by several key differentiators. These include a strong focus on digital banking, customer-centric solutions, and a commitment to innovation. These elements work together to create a compelling brand identity in the competitive Saudi Arabian banking sector.

- Digital Banking Solutions: ANB leverages technology to provide faster and simpler banking services.

- Customer-Centric Approach: Tailored financial solutions meet individual needs.

- Innovation and Inclusivity: Partnerships like the Braille card demonstrate ANB's commitment.

- Brand Consistency: Maintaining a unified brand experience across all touchpoints.

To better understand ANB's position within the competitive landscape, it's useful to examine the Competitors Landscape of Arab National Bank. This analysis provides insights into how ANB stacks up against its rivals and the strategies it employs to maintain a competitive edge.

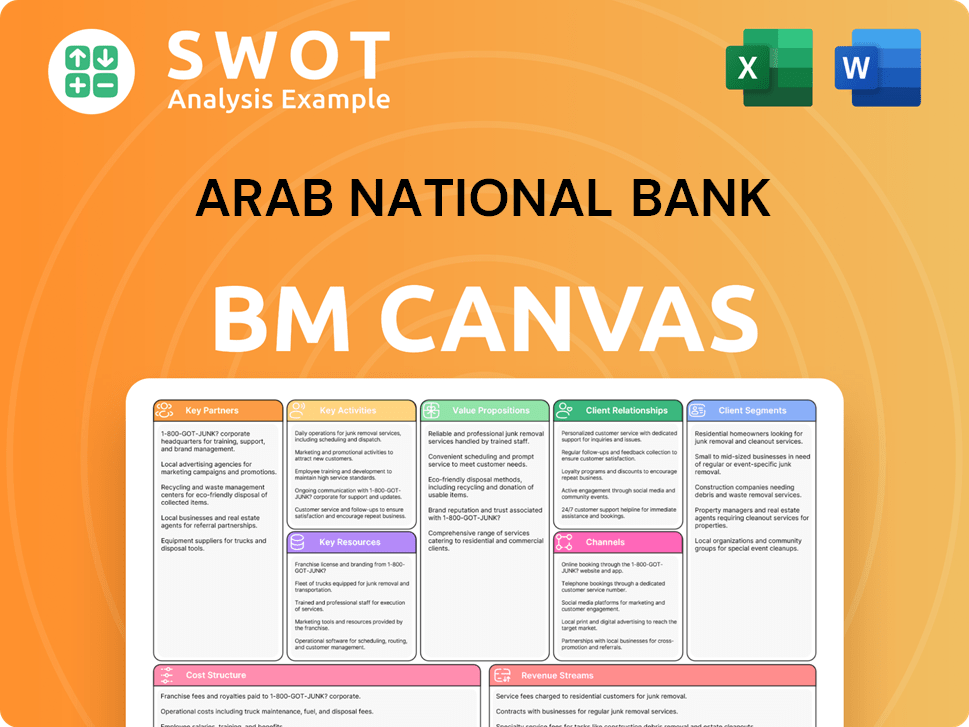

Arab National Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Arab National Bank’s Most Notable Campaigns?

The sales and marketing strategy of Arab National Bank (ANB) is marked by key campaigns designed to enhance its market position and customer engagement. These initiatives leverage digital innovation, strategic partnerships, and customer-centric approaches. ANB’s efforts are geared towards aligning with Saudi Arabia's Vision 2030, focusing on digital transformation and providing superior financial services.

ANB's marketing strategy emphasizes digital channels and innovative technologies to reach a broader audience and improve customer experience. This approach is crucial for maintaining competitiveness in the dynamic Saudi Arabian banking sector. ANB’s campaigns are designed to increase brand awareness and customer loyalty, contributing to its overall growth strategy, as highlighted in Growth Strategy of Arab National Bank.

These campaigns demonstrate ANB's commitment to innovation, customer service, and digital transformation, which are key elements of its sales and marketing strategy. By focusing on these areas, ANB aims to strengthen its position in the competitive financial market.

ANB launched 'ANB Verse' in 2024, an immersive metaverse experience focusing on financial education, particularly for entrepreneurs. This initiative utilizes virtual masterclasses and live streams to make complex payment strategies accessible. The objective is to redefine financial education and position ANB as a frontrunner in integrating advanced digital realities into banking.

In May 2024, ANB partnered with Saudia to introduce exclusive Visa Signature and Infinite credit cards tailored for AlFursan Loyalty Program members. This collaboration offers enhanced rewards and benefits, aiming to recognize customer loyalty and elevate their banking experience. This co-branding strategy extends reach and provides added value to specific customer segments.

ANB's digital transformation includes upgrading its core banking infrastructure with Infosys Finacle and partnering with companies like Riverbed. This initiative aims to enhance digital interfaces and ensure seamless service delivery. This broad initiative, driven by Saudi Arabia's Vision 2030, aims to lead the digital banking revolution in the Kingdom.

The success of ANB Verse was acknowledged by the Middle East Technology Excellence Awards 2024, where ANB won in the Augmented Reality and Virtual Reality - Banking category. This signifies strong industry recognition for its innovative approach and effective marketing campaigns. This recognition validates ANB’s commitment to digital innovation.

ANB's sales strategy includes a focus on Small and Medium Enterprises (SMEs), providing tailored financial solutions and support. This approach is crucial for driving economic growth and capturing a significant market share. The bank offers specialized services designed to meet the unique needs of SME's.

ANB is at the forefront of the digital banking revolution in Saudi Arabia, investing heavily in digital platforms and mobile banking solutions. This includes enhancements to its mobile app and online banking portals. The goal is to provide customers with convenient, secure, and efficient banking experiences.

ANB places a strong emphasis on customer relationship management (CRM) to understand and meet the evolving needs of its customers. This involves personalized services, proactive communication, and feedback mechanisms. This customer-centric approach helps in building long-term relationships and enhancing customer loyalty.

ANB actively works on increasing its brand awareness through various marketing campaigns, sponsorships, and community engagement initiatives. These efforts aim to build a strong brand reputation and enhance its visibility in the market. Effective branding is vital for attracting new customers and retaining existing ones.

ANB invests in comprehensive sales team training programs to ensure its employees are equipped with the latest skills and knowledge. These programs focus on product knowledge, customer service, and sales techniques. Trained sales teams are essential for driving sales performance and achieving business goals.

ANB is focused on increasing its market share and achieving sustainable growth through strategic initiatives and customer acquisition strategies. This includes expanding its product offerings, entering new markets, and leveraging digital channels. The bank aims to be a leader in the Saudi Arabian banking sector.

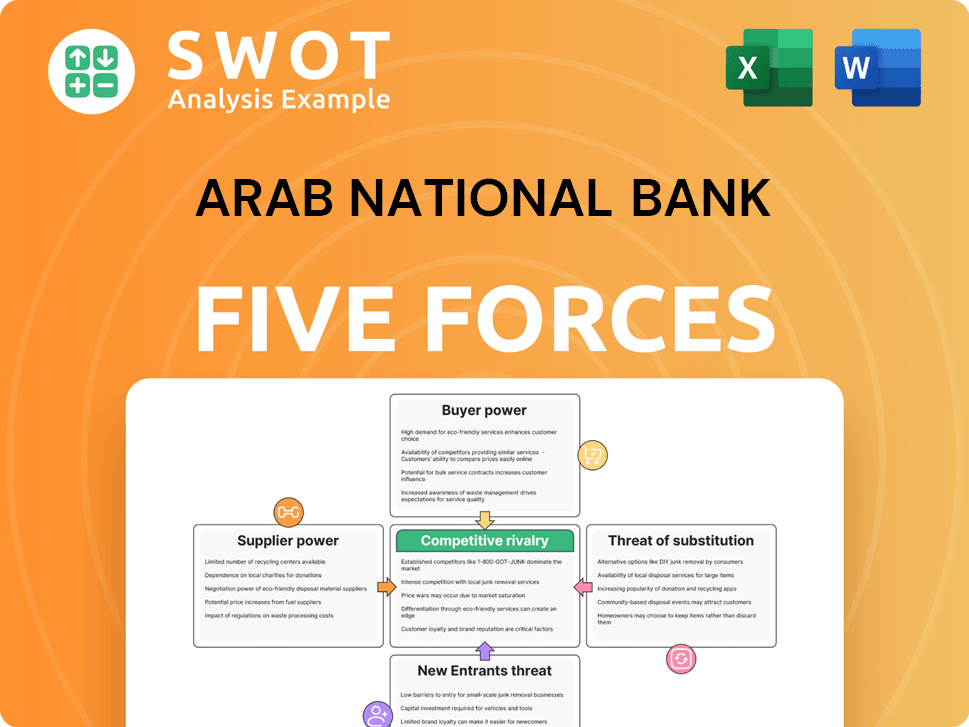

Arab National Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Arab National Bank Company?

- What is Competitive Landscape of Arab National Bank Company?

- What is Growth Strategy and Future Prospects of Arab National Bank Company?

- How Does Arab National Bank Company Work?

- What is Brief History of Arab National Bank Company?

- Who Owns Arab National Bank Company?

- What is Customer Demographics and Target Market of Arab National Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.