Grupo De Inversiones Suramericana Bundle

How is Grupo SURA Redefining Sales and Marketing in Latin America's Financial Sector?

Founded in 1944, Grupo de Inversiones Suramericana has undergone a remarkable transformation, evolving from its insurance roots to become a focused financial powerhouse. This strategic pivot, including the divestment of Grupo Nutresa and a sharpened focus on insurance, asset management, and banking, sets the stage for an in-depth exploration of their evolving sales and marketing strategies. Discover how Grupo SURA is navigating the dynamic Latin American market and capitalizing on significant growth opportunities.

With a strategic focus on financial services across Latin America, Grupo SURA's Grupo De Inversiones Suramericana SWOT Analysis provides critical insights into its sales strategy and marketing approach. This analysis examines how the company leverages its investments in Suramericana, SURA Asset Management, and Bancolombia to reach over 73.6 million clients. The company's commitment to sustainable value and community development further shapes its approach to sales and marketing, making it a compelling case study in business strategy.

How Does Grupo De Inversiones Suramericana Reach Its Customers?

The sales and marketing strategy of Grupo de Inversiones Suramericana (Grupo SURA) centers on a multi-channel distribution model. This approach combines digital and traditional methods to reach its target audience. Key to this strategy is the effective use of its subsidiaries, including Suramericana, SURA Asset Management, and Bancolombia, across several Latin American countries.

Grupo SURA's sales channels are designed to provide a wide range of financial products and services. They leverage direct sales teams, physical locations, and digital platforms. This comprehensive strategy allows Grupo SURA to serve a large customer base, with SURA Asset Management alone serving nearly 20 million clients.

The company has been strategically evolving its sales approach, with a strong focus on digital adoption and omnichannel integration. This includes significant investments in digital projects to enhance customer experience and streamline sales processes. The integration of digital solutions has resulted in substantial gains, such as a 44% reduction in client turnover for SURA Asset Management.

Grupo SURA's sales strategy relies heavily on its subsidiaries, such as Suramericana and SURA Asset Management. These entities operate across multiple countries including Colombia, Mexico, and Chile. The subsidiaries use direct sales teams and physical locations to engage with customers and offer services.

Digital transformation is a key focus for Grupo SURA, with projects aimed at digitizing pensions and revamping sales strategies. This digital shift has led to significant improvements, including the acquisition of 2.3 million new customers for SURA Asset Management. Suramericana is also expanding its digital solutions.

Strategic partnerships and exclusive distribution deals play a crucial role in Grupo SURA's growth. The company's investment in Bancolombia, a leading bank, provides a key channel for reaching a broad customer base. These alliances are focused on delivering value to customers.

Grupo SURA aims to increase insurance penetration in the Latin American market by strengthening its distribution channels. This includes optimizing existing channels and exploring new opportunities. The diversified portfolio allows for balanced diversification across various business types.

Grupo SURA's sales strategy includes a multi-channel approach, emphasizing digital adoption and strategic partnerships. The company focuses on leveraging its subsidiaries and expanding its digital solutions to enhance customer engagement and market reach. This strategy is supported by a diversified portfolio.

- Utilizing a network of subsidiaries for direct sales.

- Implementing digital transformation to improve customer acquisition.

- Forming strategic alliances for wider market reach.

- Focusing on achieving greater insurance penetration.

For more insights into the business model and revenue streams, you can explore the Revenue Streams & Business Model of Grupo De Inversiones Suramericana.

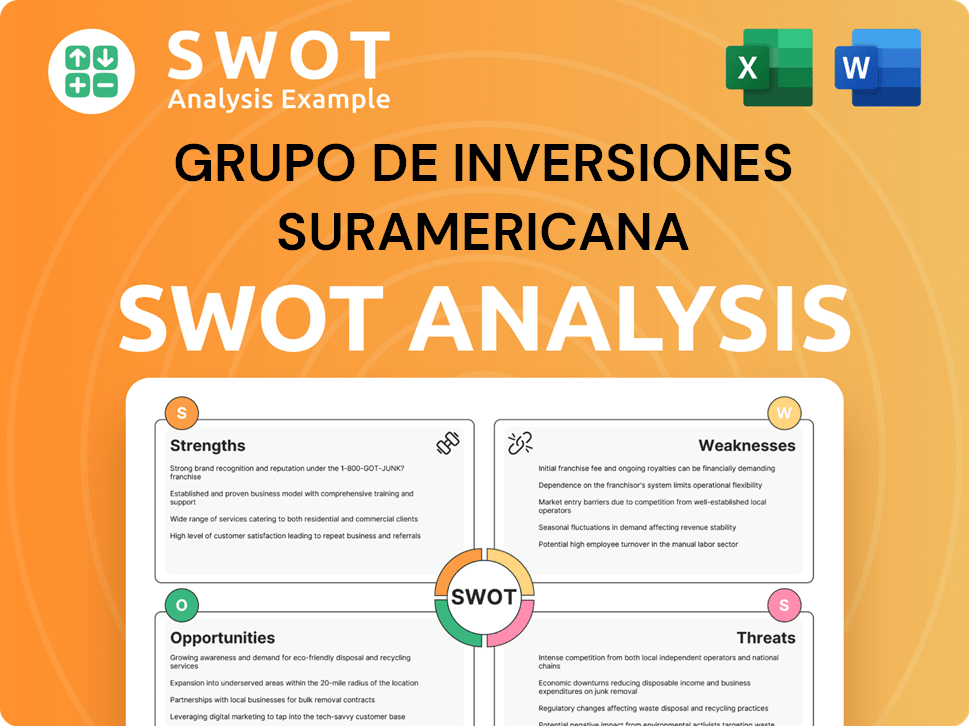

Grupo De Inversiones Suramericana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Grupo De Inversiones Suramericana Use?

The marketing tactics of Grupo de Inversiones Suramericana (Grupo SURA) are designed to build brand awareness, generate leads, and boost sales through a blend of digital and traditional methods. Their approach emphasizes financial education and digital transformation, using various channels to reach a broad audience. The company's strategy is also heavily influenced by data-driven insights to anticipate customer needs and offer tailored solutions.

Suramericana, a subsidiary of Grupo SURA, focuses on market development, particularly in regions like Mexico and Brazil. They offer diversified products and solutions, with a focus on mobility and business solutions. This approach is supported by optimizing operations, leveraging their knowledge, track records, and leading brands to reach new market segments. This includes a commitment to financial inclusion initiatives to reach populations with limited access to financial services.

Grupo SURA's digital marketing efforts include content marketing, providing financial education programs, and insights into personal finance. For instance, SURA Asset Management offers programs like the 'School of personal finance' in countries such as Peru, Colombia, and Mexico. The company also uses digital channels for software development, production, operation, maintenance, and commercialization.

Grupo SURA leverages digital channels for various activities, including content marketing and the development of software systems. This includes investor relations platforms and news centers to communicate with stakeholders.

The company provides financial education programs and insights into personal finance to strengthen the financial capabilities of individuals and businesses. 'School of personal finance' is an example in countries like Peru, Colombia, and Mexico.

Grupo SURA uses data-driven marketing, customer segmentation, and personalization to anticipate customer needs and offer tailored solutions. This includes focusing on market development with diversified products and solutions.

Suramericana focuses on market development with diversified products and solutions, especially in territories like Mexico and Brazil through mobility and business solutions. This aims at reaching new market segments.

The company is committed to financial inclusion initiatives, particularly in 2024, to reach populations with access barriers to the financial system. This demonstrates a segmented approach.

Suramericana's strategic vision for 2025 includes expanding digital solutions and consolidating its technology-driven operating model. This indicates a growing reliance on digital areas.

Grupo de Inversiones Suramericana's sales and marketing approach is multifaceted, focusing on digital channels, content marketing, and data-driven strategies to reach its target audience effectively. This approach is crucial for the company's growth and market positioning.

- Digital Transformation: Expanding digital solutions and consolidating a technology-driven operating model, as planned for 2025.

- Content Marketing and Education: Providing financial education programs and insights to enhance customer financial capabilities.

- Market Development: Focusing on growth in key regions such as Mexico and Brazil through diversified products and solutions.

- Customer Segmentation: Targeting specific populations, including those with limited access to financial systems, through financial inclusion initiatives.

- Data-Driven Decisions: Utilizing data and customer insights to tailor solutions and improve operational efficiency.

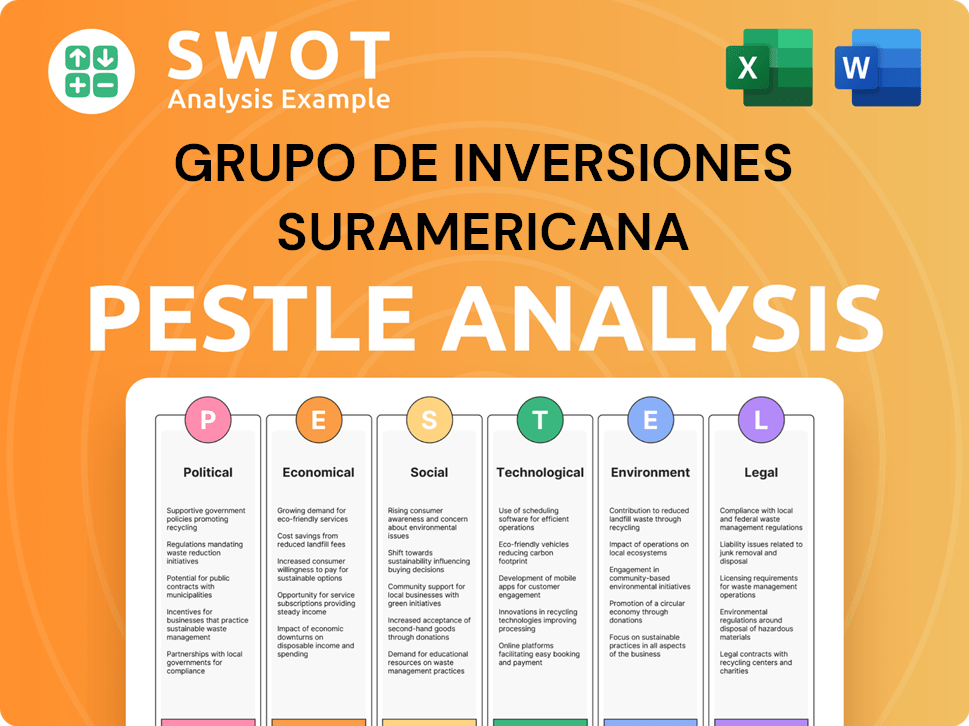

Grupo De Inversiones Suramericana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Grupo De Inversiones Suramericana Positioned in the Market?

Grupo SURA strategically positions itself as a leading Latin American investment manager, emphasizing a long-term vision focused on financial services like insurance, asset management, and banking. This Owners & Shareholders of Grupo De Inversiones Suramericana commitment is reinforced through its inclusion in the Dow Jones Sustainability World Index, communicating a strong message of responsibility and value creation beyond financial returns.

The brand's identity communicates stability, expertise, and a forward-thinking approach, aligning with its focus on managing financial, social, human, and natural capital. This holistic approach aims to resonate with a diverse audience of investors and stakeholders who value both financial performance and societal impact. The company's visual identity and tone of voice likely reflect these core values.

Grupo SURA distinguishes itself through its strong regional presence and leadership in key financial sectors. Suramericana, for example, is recognized as the fourth-largest insurance group in Latin America, and the number one insurance company in Colombia, with leading positions in Chile and Uruguay as of 2024. SURA Asset Management is a regional leader in pension savings and a prominent player in investment solutions.

Grupo SURA's strong presence in Latin America is a key differentiator. This regional focus allows for a deep understanding of local markets and customer needs, enhancing its investment and service offerings. Suramericana's leading positions in multiple countries underscore this advantage.

The company offers a wide range of financial products and services, including insurance, asset management, and banking. This diversified portfolio allows Grupo SURA to cater to various financial needs of its clients, providing integrated solutions. This strategy is designed to attract a broader customer base.

Grupo SURA's inclusion in the Dow Jones Sustainability World Index highlights its commitment to environmental, social, and governance (ESG) factors. This focus is increasingly important to investors and stakeholders, enhancing the company's brand image and attracting socially responsible investments.

The company's emphasis on digital transformation ensures a modern and consistent customer experience across various channels. This includes online platforms, mobile applications, and digital marketing initiatives. Digital advancements are key to improving customer engagement and operational efficiency.

Grupo SURA continuously adapts its strategies to respond to shifts in consumer sentiment and competitive threats. This includes anticipating risks and opportunities and adapting business models to drive future growth. For instance, Suramericana plans to strengthen its distribution channels in 2025.

- Insurance Penetration: Increasing the reach of insurance products through enhanced distribution networks.

- Value Proposition: Diversifying the range of insurance offerings to meet evolving customer needs.

- Sustainability Rankings: Maintaining high standards in sustainability to enhance brand perception.

- Corporate Governance: Improving corporate governance practices as recognized by Merco Colombia.

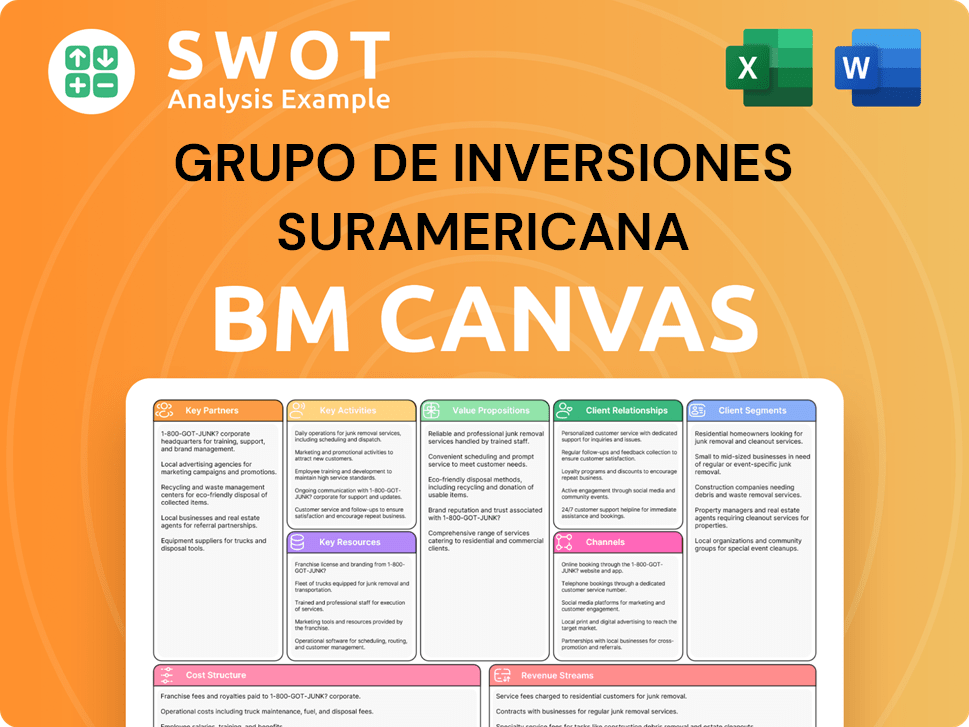

Grupo De Inversiones Suramericana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Grupo De Inversiones Suramericana’s Most Notable Campaigns?

The sales and marketing strategy of Grupo de Inversiones Suramericana, an investment company, is characterized by a focus on strategic initiatives that drive both operational efficiency and market expansion. Key campaigns are designed to align with the company's long-term goals, including streamlining its structure and enhancing its digital capabilities. These efforts are central to the company's approach to customer acquisition and brand building.

A significant aspect of its sales strategy involves digital transformation across its subsidiaries, particularly in asset management and insurance. These initiatives are aimed at improving customer experience and operational efficiency. Simultaneously, the company consistently focuses on financial inclusion and education, which supports long-term market development and customer loyalty. For a deeper understanding of the competitive environment, exploring the Competitors Landscape of Grupo De Inversiones Suramericana can provide valuable insights.

The company's commitment to financial education and inclusion initiatives also plays a crucial role in its marketing strategy. These programs aim to strengthen the financial capabilities of individuals and businesses, which, in turn, supports the company's brand and market presence. These broad educational campaigns contribute significantly to brand building and long-term market development.

Grupo SURA is undergoing a portfolio reorganization to concentrate on the financial sector. This involves divesting its stake in Grupo Nutresa and spinning off Grupo Argos. The objective is to streamline the shareholding structure and specialize more in its respective sectors. This strategic move is expected to increase the float of Grupo SURA shares.

Digital transformation efforts are ongoing across subsidiaries, particularly in SURA Asset Management and Suramericana. SURA Asset Management's digital projects aimed to digitize its pensions department and revamp its product sales strategy, gaining 2.3 million new customers. Suramericana's growth in 2024 is attributed to an operating model focused on operational efficiency and digital transformation.

The company consistently focuses on financial inclusion and education initiatives. These programs aim to strengthen the financial capabilities of individuals, entrepreneurs, and companies in the region. While direct sales lift metrics are not always quantified, these campaigns contribute to brand building and customer loyalty. This supports long-term market development.

Suramericana's growth in 2024, with revenues of USD 5.1 billion and a net profit of USD 186 million, demonstrates an operating model focused on operational efficiency. This includes market development and sustainable profitability. The pursuit of digital transformation is also a key factor in achieving these results.

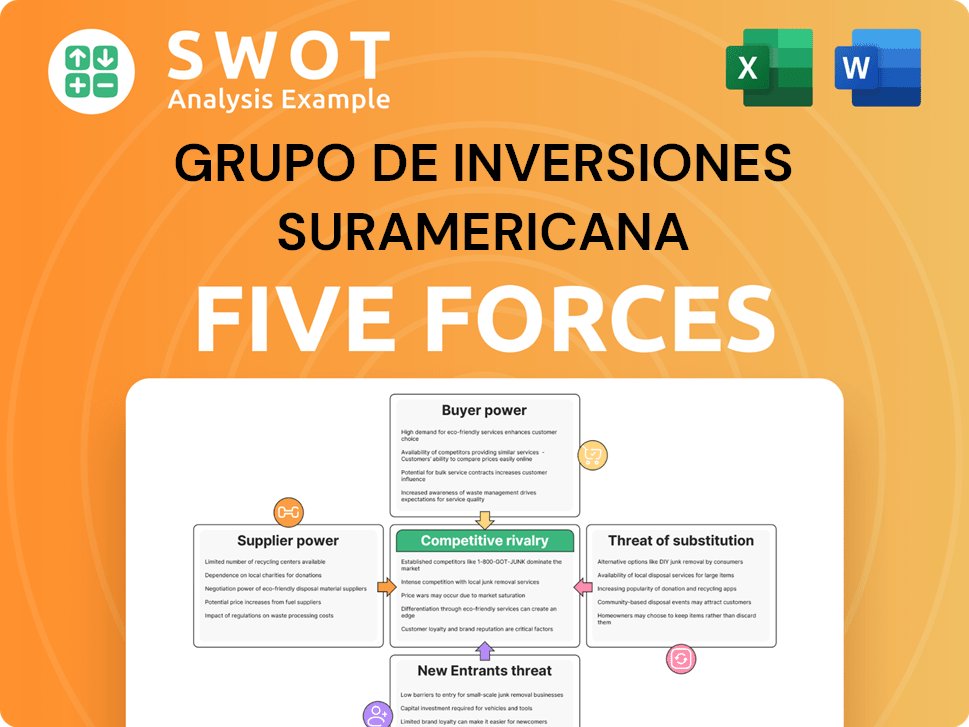

Grupo De Inversiones Suramericana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grupo De Inversiones Suramericana Company?

- What is Competitive Landscape of Grupo De Inversiones Suramericana Company?

- What is Growth Strategy and Future Prospects of Grupo De Inversiones Suramericana Company?

- How Does Grupo De Inversiones Suramericana Company Work?

- What is Brief History of Grupo De Inversiones Suramericana Company?

- Who Owns Grupo De Inversiones Suramericana Company?

- What is Customer Demographics and Target Market of Grupo De Inversiones Suramericana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.