Grupo De Inversiones Suramericana Bundle

Who Does Grupo SURA Serve?

In the dynamic world of finance, understanding your customer is paramount. For Grupo de Inversiones Suramericana (Grupo SURA), a leading Latin American investment manager, knowing its customer demographics and target market is key to navigating the ever-changing financial landscape. This analysis delves into the evolution of SURA's customer base, from its origins in Colombia to its expansive presence across Latin America, exploring the diverse segments it serves.

From its early focus on the Colombian market to its current pan-Latin American reach, Grupo SURA's Grupo De Inversiones Suramericana SWOT Analysis reveals a strategic evolution in its customer demographics and target market analysis. This shift reflects not only geographic expansion but also a deeper understanding of market segmentation and the specific needs of various demographic groups. This exploration of SURA company's customer base provides critical insights into its ability to adapt and thrive in a competitive environment, serving a diverse range of clients with tailored financial solutions.

Who Are Grupo De Inversiones Suramericana’s Main Customers?

Understanding the primary customer segments of Grupo SURA involves analyzing both its Business-to-Consumer (B2C) and Business-to-Business (B2B) operations. The company, through its subsidiaries, serves a diverse range of clients across Latin America. This includes individuals and businesses, each with unique needs and financial profiles. A detailed target market analysis reveals the breadth of SURA's customer base.

In the B2C segment, the company focuses on individuals at various life stages and income levels. This includes young professionals, families, and those planning for retirement, with a growing emphasis on digital engagement. On the B2B side, SURA provides financial solutions to small and medium-sized enterprises (SMEs) and large corporations across various industries. This dual approach allows SURA to capture a significant share of the market.

The company's customer base is spread across countries like Colombia, Mexico, Chile, and Peru, reflecting the diverse economic landscapes of the region. The shift towards a younger, more digitally-inclined customer base has led SURA to invest in digital channels. This helps meet evolving demands and reflects broader trends in financial services across Latin America. For a broader view, you can explore the Competitors Landscape of Grupo De Inversiones Suramericana.

The B2C segment includes individuals aged 25-65, with a focus on digital natives. Income levels range from middle to high, varying by region. The customer demographics are diverse, reflecting the economic variety across Latin American countries.

B2B clients include SMEs and large corporations across industries like manufacturing, retail, and technology. These business clients have varied sizes, revenues, and employee numbers. The company provides group insurance, employee benefits, and corporate investment services.

Market segmentation allows SURA to tailor its products and services to meet specific customer needs. The company focuses on both individual and corporate clients. This approach helps in effective target market analysis.

SURA is investing in digital channels to meet the needs of a younger, more digitally-inclined customer base. This includes personalized financial advisory services. This shift is driven by increased financial inclusion and the digital transformation of financial services.

SURA's customer base is characterized by varied income levels and life stages. Digital engagement is a key focus, with investment in digital channels. The company’s strategic focus indicates significant growth potential in both individual wealth management and corporate solutions.

- Individuals aged 25-65 with diverse income levels.

- SMEs and large corporations across various sectors.

- Emphasis on digital channels and personalized services.

- Growing focus on financial inclusion and digital transformation.

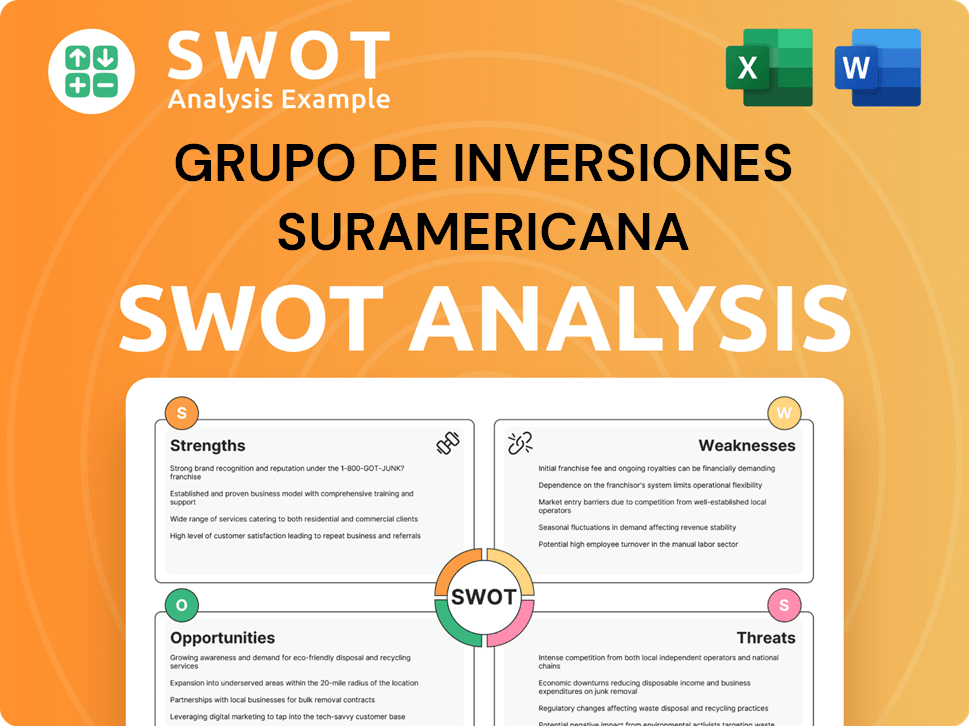

Grupo De Inversiones Suramericana SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Grupo De Inversiones Suramericana’s Customers Want?

Understanding the needs and preferences of customers is crucial for Grupo SURA. The company focuses on providing financial security and wealth creation solutions tailored to different customer segments. This approach allows the company to meet the diverse needs of its clients effectively.

For individual customers, the primary drivers include life events and financial goals, prompting a demand for personalized insurance and investment products. Business clients, on the other hand, prioritize risk management and employee well-being. Grupo SURA leverages customer feedback and market trends to develop innovative products and services.

The decision-making process for customers often involves trust, product clarity, and competitive returns. Grupo SURA addresses common pain points, such as complex financial jargon, by simplifying information and enhancing access to financial advisors. This customer-centric approach helps the company maintain its market position.

Individual customers of Grupo SURA are driven by life events such as starting families or planning for retirement. They seek tailored insurance products and investment solutions to secure their financial future. These customers often prioritize trust and product clarity when making financial decisions.

Business clients prioritize risk management, employee well-being, and efficient capital management. They seek robust insurance solutions and attractive employee benefit packages. These clients value the quality of customer service and the responsiveness of claims processing.

Key motivations for customers include financial security, wealth creation, and personalized service. Psychological drivers such as peace of mind and long-term financial stability are also significant. Aspirational drivers often center on achieving specific financial goals.

Grupo SURA uses customer feedback and market trends to influence product development. This includes developing more flexible insurance policies and innovative investment products. The company aims to align its offerings with sustainable investing principles.

Marketing and product features are tailored by segment, with digital campaigns targeting younger demographics. Mobile-friendly interfaces and dedicated corporate relationship managers cater to the needs of large enterprises. This segmentation strategy enhances customer engagement.

Customer loyalty is heavily influenced by the quality of customer service and responsiveness in claims processing. The perceived value of financial advice also plays a crucial role. Grupo SURA focuses on providing excellent service to retain customers.

Analyzing the customer demographics and target market is essential for Grupo SURA's success. The company's approach to understanding its clients, as detailed in a Brief History of Grupo De Inversiones Suramericana, ensures that its products and services meet the evolving needs of its diverse customer base. This customer-centric strategy supports the company's growth and market share in the competitive financial services sector.

Understanding customer needs and preferences is crucial for Grupo SURA's success. The company focuses on providing financial security and wealth creation solutions tailored to different customer segments. This approach allows the company to meet the diverse needs of its clients effectively.

- Financial Security: Customers seek products that provide a sense of financial stability.

- Wealth Creation: Investment solutions aimed at growing wealth and achieving financial goals.

- Personalized Service: Tailored advice and products that meet individual needs.

- Trust and Clarity: Transparent and trustworthy financial products.

- Competitive Returns: Investments that offer attractive returns.

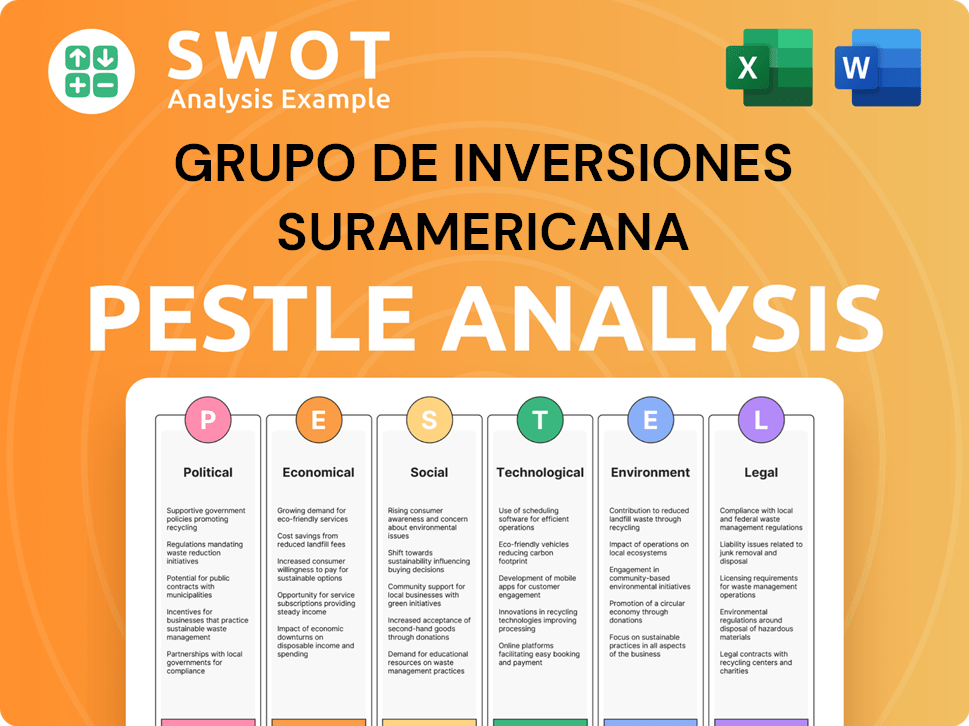

Grupo De Inversiones Suramericana PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Grupo De Inversiones Suramericana operate?

Grupo SURA's geographical market presence is predominantly focused on Latin America, establishing it as a key investment manager in the region. Its operations are strategically distributed across several countries, including Colombia, Mexico, Chile, Peru, and El Salvador. These markets are crucial for the company's growth and market share, supported by strong brand recognition through its subsidiaries.

In Colombia, as its home market, Grupo SURA has a deeply-rooted presence across all its business lines. Mexico, through its investment in SURA Asset Management, is a significant market for pensions and asset management. Chile and Peru are also important markets for insurance and asset management, each with unique customer demographics and regulatory environments. The company consistently evaluates its portfolio and market opportunities to maintain and expand its geographical footprint.

The company's approach involves adapting its offerings and marketing strategies to suit the specific needs of each market. This includes adjusting insurance products to comply with local regulations, tailoring marketing campaigns to resonate with local cultures, and forming strategic partnerships with local financial institutions. For a deeper understanding of their strategic moves, consider reading about the Growth Strategy of Grupo De Inversiones Suramericana.

Grupo SURA employs market segmentation to target specific customer demographics. This involves dividing the market into distinct groups based on factors like age, income, and financial goals. This allows for customized product offerings and marketing strategies.

Understanding customer demographics is crucial for SURA's success. The target market includes individuals and businesses with varying needs for insurance, asset management, and retirement plans. Demographic data, such as age and income levels, influences product preferences and purchasing power.

A thorough target market analysis helps Grupo SURA tailor its products and services. The analysis includes evaluating market size, growth potential, and competitive landscape in each region. This data-driven approach supports informed decision-making.

SURA's strategy focuses on adapting to the diverse needs of its customer base across Latin America. This involves offering a range of financial products and services. The company aims to maintain a strong presence in key markets.

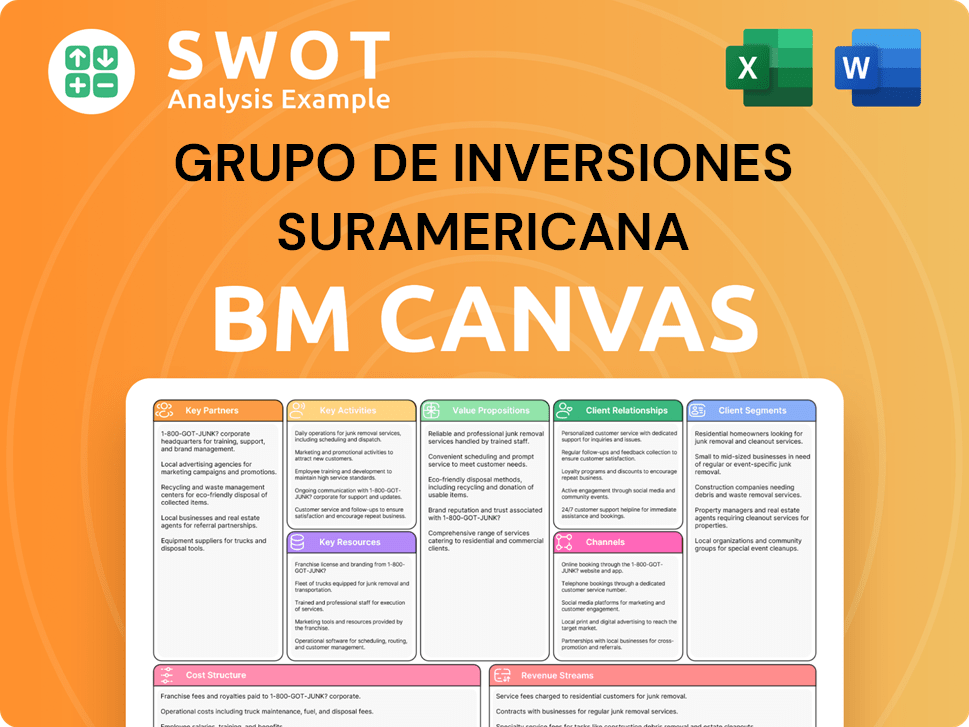

Grupo De Inversiones Suramericana Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Grupo De Inversiones Suramericana Win & Keep Customers?

Grupo SURA, a prominent player in the financial and insurance sectors, employs a multifaceted approach to both acquiring and retaining customers. Their strategies are carefully tailored to the diverse needs of their target market, leveraging a blend of traditional and digital channels to maximize reach and engagement. The company's focus on personalized experiences and robust after-sales service underscores its commitment to building long-term customer relationships.

Customer acquisition strategies involve a mix of digital and traditional marketing efforts. Digital advertising on platforms like social media and search engines is prominent, reflecting the increasing digital adoption across Latin America. Traditional media, such as television and print, remains relevant for broader brand awareness. Referral programs and partnerships also play a vital role in attracting new clients. Data analytics is increasingly used to identify and target specific customer segments, allowing for more personalized outreach.

Retention efforts are centered on enhancing customer lifetime value through loyalty programs, personalized services, and efficient after-sales support. Dedicated financial advisors cater to high-net-worth individuals and corporate clients, while AI-powered chatbots and self-service portals serve a broader customer base. After-sales service, including claims processing and investment support, is crucial for customer satisfaction. Data-driven strategies, such as CRM systems, segment the customer base to facilitate targeted campaigns and proactive engagement, like automated communications triggered by life events or financial milestones.

Digital advertising campaigns on social media and search engines are key to acquiring new customers. These campaigns are tailored to specific demographics and interests, ensuring relevant messaging. The use of data analytics allows for continuous optimization and improvement of ad performance.

Traditional media, such as television and print advertisements, is still used to build brand awareness. These channels are particularly effective for reaching a broader audience and reinforcing brand recognition. Strategic placement ensures maximum visibility within the target market.

Referral programs and partnerships with employers and professional associations are important for acquiring new clients. These programs leverage existing networks to reach potential customers. They often include incentives to encourage participation and referrals.

Data analytics is used to identify potential customer segments and personalize initial outreach. This involves analyzing customer data to understand preferences and needs. Personalized communications and offers improve engagement and conversion rates.

Loyalty programs, often embedded in the value proposition of consistent returns on investment products and reliable insurance coverage, are crucial for customer retention. These programs incentivize repeat business and build customer loyalty. They provide added value to existing customers.

Personalized experiences are a key retention strategy, with dedicated financial advisors for high-net-worth individuals and corporate clients. This includes tailored advice and support based on individual needs. It fosters strong customer relationships.

AI-powered chatbots and self-service portals are used to provide efficient support for routine inquiries. These tools improve customer service and reduce response times. They enhance the overall customer experience.

Efficient claims processing for insurance and responsive support for investment queries are paramount to customer satisfaction. This includes timely and accurate responses to customer inquiries. Strong after-sales service builds trust and loyalty.

Customer data and CRM systems are used to segment the customer base, allowing for highly targeted campaigns. This involves analyzing customer data to understand their needs and preferences. Segmented campaigns improve the effectiveness of marketing efforts.

Automated communications, such as those triggered by a customer's life stage or financial milestones, enhance customer engagement. These communications provide relevant information and offers based on customer needs. They keep customers informed and engaged.

Grupo SURA is significantly pivoting towards digital transformation. This includes investing in user-friendly mobile applications and online platforms. These improvements aim to enhance customer loyalty.

User-friendly mobile applications are a key part of SURA's digital strategy. They provide convenient access to services and information. This enhances the overall customer experience.

Online platforms are designed to improve accessibility and customer experience. They offer a range of self-service options and information. This helps reduce churn rates.

These digital initiatives aim to enhance customer loyalty. By providing convenient and accessible services, SURA hopes to retain customers. This increases the lifetime value of their customer base.

The digital transformation efforts are designed to reduce churn rates. By improving customer experience and providing better support, SURA aims to retain customers. This is crucial for long-term success.

The ultimate goal is to increase the lifetime value of their diverse customer base. This involves building long-term relationships and providing excellent service. This is essential for sustained growth.

Grupo SURA's approach to customer acquisition and retention is heavily informed by market segmentation and data analytics. They use demographic data to understand their customer base and tailor their strategies accordingly. This data-driven approach allows for more effective targeting and personalized customer experiences.

- Age Range: SURA's customer base spans a wide age range, from young professionals to retirees, reflecting the diverse range of financial products offered.

- Income Levels: The target market includes individuals and families across various income levels, with specific products designed to meet different financial needs.

- Geographic Location: SURA operates across multiple countries in Latin America, with strategies adapted to regional differences in demographics and market conditions.

- Digital Adoption: Given the increasing digital penetration in Latin America, SURA prioritizes digital channels for both acquisition and retention, including mobile apps and online platforms.

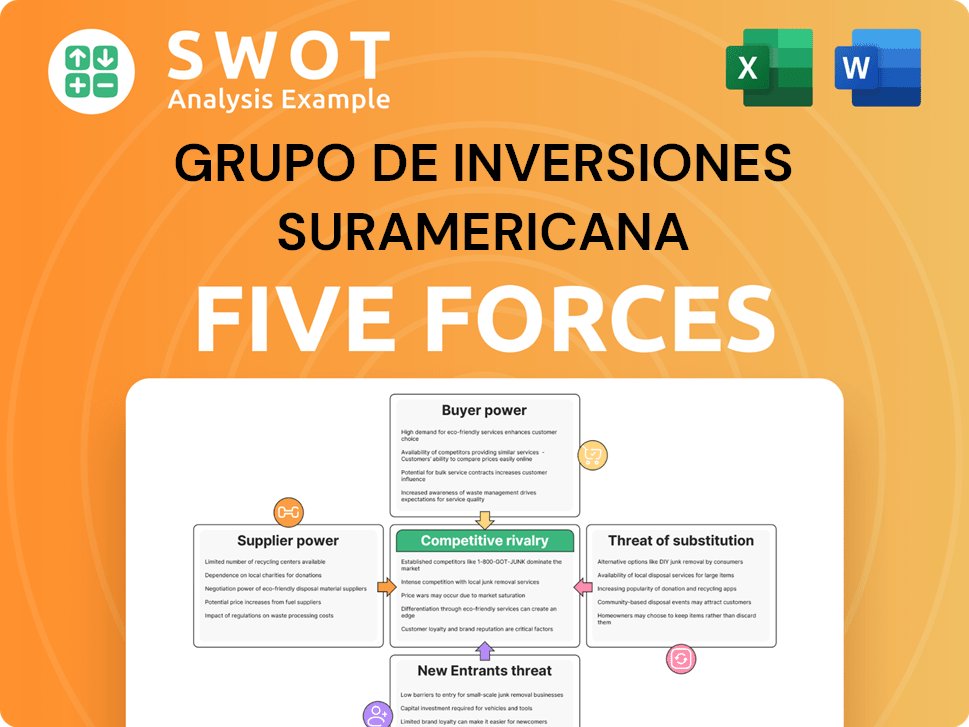

Grupo De Inversiones Suramericana Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grupo De Inversiones Suramericana Company?

- What is Competitive Landscape of Grupo De Inversiones Suramericana Company?

- What is Growth Strategy and Future Prospects of Grupo De Inversiones Suramericana Company?

- How Does Grupo De Inversiones Suramericana Company Work?

- What is Sales and Marketing Strategy of Grupo De Inversiones Suramericana Company?

- What is Brief History of Grupo De Inversiones Suramericana Company?

- Who Owns Grupo De Inversiones Suramericana Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.