Synchronoss Bundle

How is Synchronoss Revolutionizing Cloud Solutions?

Synchronoss Technologies is reshaping the digital landscape, offering cutting-edge personal cloud solutions to telecom giants worldwide. With the unveiling of its AI-powered Personal Cloud platform at CES 2025, Synchronoss is poised to redefine user experiences. This strategic shift positions the Synchronoss SWOT Analysis as a key player in a rapidly evolving market.

This exploration delves into the core of the Synchronoss sales strategy and Synchronoss marketing strategy, revealing how the Synchronoss company is navigating the complexities of the telecommunications sector. We'll examine its Synchronoss business model, Synchronoss product offerings, and Synchronoss market analysis to understand its approach to customer acquisition strategies and revenue generation strategies. Furthermore, we'll analyze the Synchronoss competitive landscape analysis and its innovative digital marketing initiatives, including its go-to-market strategy and the effectiveness of its marketing campaign examples.

How Does Synchronoss Reach Its Customers?

The sales strategy of the company, primarily revolves around a business-to-business (B2B) model, focusing on telecommunications companies and large enterprises as its main customers. This approach involves direct sales teams and strategic partnerships to distribute its solutions, which include personal cloud storage, advanced messaging, and digital identity management. These solutions are offered as white-label platforms, enabling service providers to integrate them seamlessly under their own brand, crucial for scaling and deep integration.

The company's sales channels have evolved to emphasize long-term, high-value contracts. In 2024, these efforts led to significant contract renewals, with over 90% of the projected 2025 revenue already secured through contracts with global Tier 1 customers. This strategy ensures a stable revenue stream and strengthens its market position. The focus on these key partnerships is a core element of the company's distribution strategy, allowing it to reach millions of end-users through established carrier networks.

The company's sales and marketing approach is designed to maximize market reach and adapt to varying market needs. The introduction of the 'Capsyl' offering, a new turn-key personal cloud platform, demonstrates a strategic move to expand its reach. This platform is designed to target smaller and international operators without extensive customization, potentially diversifying revenue beyond its primarily U.S.-reliant base. The company's ability to secure and renew contracts with major telecom providers is a key indicator of its success and market position.

The company utilizes direct sales teams to engage with telecommunications companies and other large enterprises. Strategic partnerships are also crucial for distribution, enabling the company to reach end-users through established carrier networks. This approach allows for deep integration of its white-label solutions into clients' existing service offerings.

The company offers its solutions, such as personal cloud storage and advanced messaging, as white-label platforms. This allows service providers to offer these solutions under their own brand, facilitating seamless integration and broader market reach. This approach is key to scaling and ensuring deep integration into clients' service offerings.

The company focuses on securing long-term, high-value contracts, which are central to its sales strategy. In 2024, key contract renewals resulted in over 90% of projected 2025 revenue being under contract. These renewals, such as the three-year extension with a major U.S. telecom provider, underscore the company's commitment to stability.

The launch of the 'Capsyl' offering, a turn-key personal cloud platform, is designed to expand market reach. This platform targets smaller and international operators, reducing the need for extensive customization. This strategic shift aims to diversify revenue beyond its primarily U.S.-reliant base, adapting to varying market needs.

The company's partnerships with major telecom providers like AT&T, Verizon, and SoftBank are foundational to its distribution strategy. These partnerships enable it to reach millions of end-users indirectly through established carrier networks. These collaborative efforts are essential for the company's market penetration and revenue generation strategies.

- The company's solutions reach millions of end-users through established carrier networks.

- Secured contract renewals with major telecom providers, ensuring continued service.

- The 'Capsyl' platform targets smaller and international operators.

- The company's target market includes telecommunications companies and large enterprises.

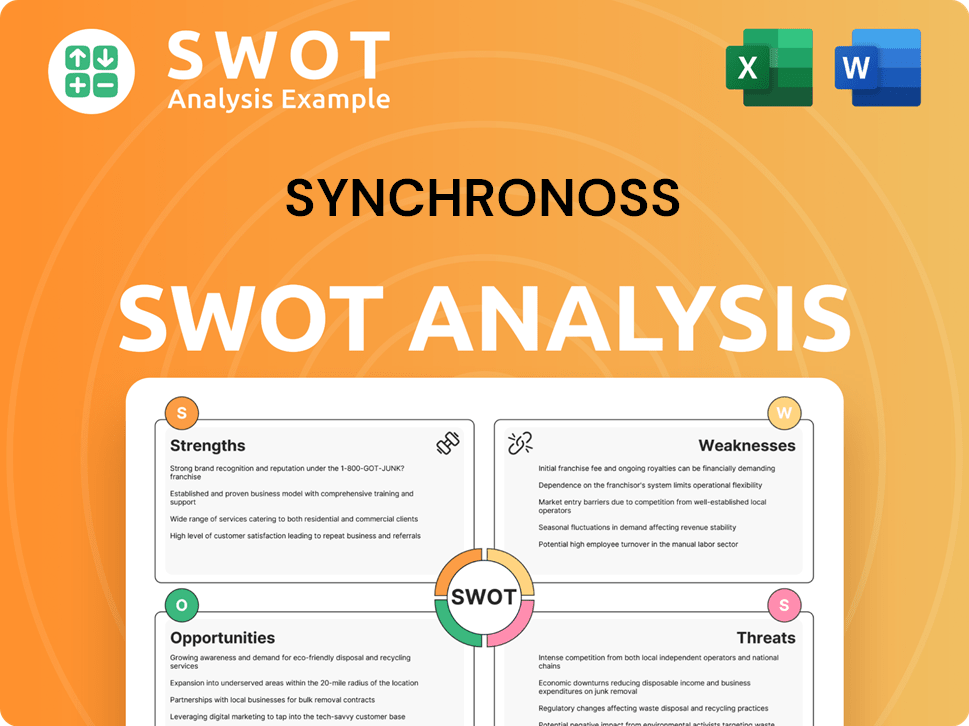

Synchronoss SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Synchronoss Use?

The marketing tactics employed by Synchronoss are heavily geared towards digital strategies, focusing on data-driven insights and customer segmentation within its business-to-business (B2B) model. Their approach aims to create awareness, generate leads, and ultimately drive sales by highlighting the value of their white-label cloud services for service providers.

Content marketing plays a pivotal role, with Synchronoss providing strategic planning and execution insights, partner and channel development guidance, and market positioning strategies for cloud services. This approach underscores their commitment to showcasing how their offerings can improve customer satisfaction and retention for service providers. The company's emphasis on digital integration, including optimizing the buy-flow for cloud services during device purchases, further enhances the customer experience.

Synchronoss's marketing efforts are designed to empower service providers to establish meaningful connections with their subscribers, leveraging digital tools to streamline onboarding and engagement. This includes the use of AI-powered tools within their Personal Cloud platform, such as for photo editing and optimization, demonstrating an innovation-driven marketing strategy. Participation in industry events like CES 2025 for product launches serves as a significant marketing and awareness-building tactic.

Synchronoss prioritizes digital marketing, using data-driven strategies to reach its target audience. This includes optimizing customer touchpoints and streamlining the purchase process for cloud services.

Content marketing is a core component of Synchronoss's approach. They provide insights on strategic planning, partner development, and market positioning for cloud services to build thought leadership.

Synchronoss focuses on enhancing customer satisfaction and retention for service providers. They aim to empower these providers to create strong subscriber connections through their services.

The company integrates AI-powered tools into its Personal Cloud platform. This includes features like photo editing, which highlights their commitment to innovation.

Synchronoss actively participates in industry events like CES 2025. This helps in product launches and increases brand visibility within the target market.

Data analytics is crucial for understanding subscriber behavior and preferences. This allows for tailored services and improved customer engagement, a key aspect of their Synchronoss marketing strategy.

Synchronoss's marketing strategy includes several key tactics designed to reach its target audience and drive sales. These tactics are essential for the

- Digital Marketing: Focus on SEO, paid advertising, and email marketing to enhance online presence and reach.

- Content Marketing: Create valuable content to attract and engage potential customers, showcasing expertise in cloud services.

- Customer Segmentation: Tailor marketing messages and product offerings to specific customer segments to increase relevance.

- Partnerships: Collaborate with other companies to expand market reach and offer integrated solutions.

- Product Innovation: Introduce new features and technologies, such as AI-powered tools, to stay competitive and meet evolving customer needs.

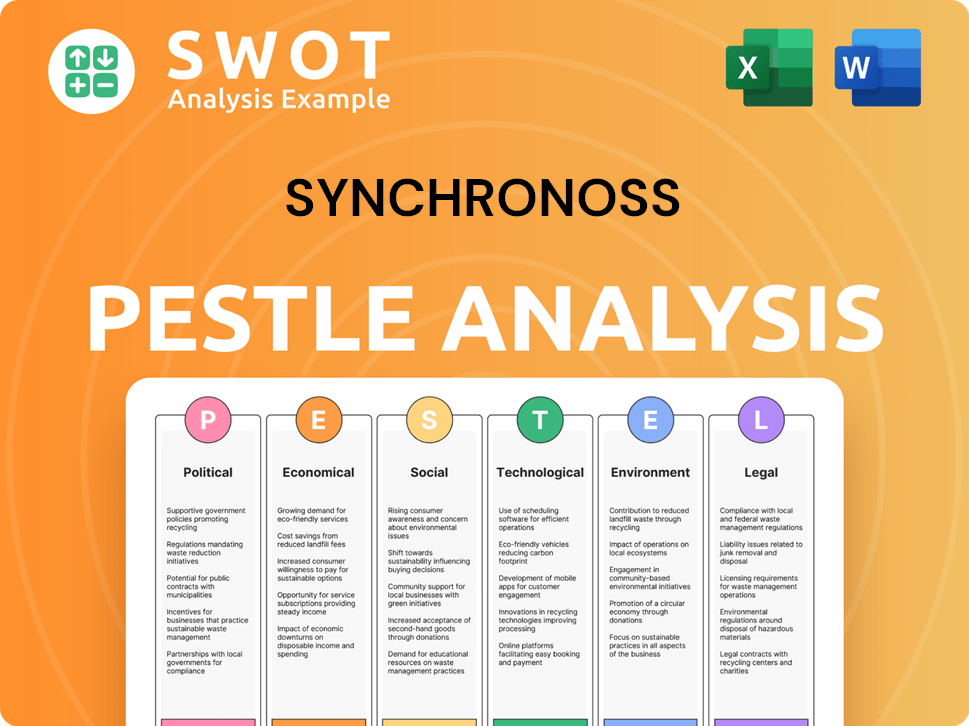

Synchronoss PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Synchronoss Positioned in the Market?

The brand positioning of the company, a global leader, focuses on its role in personal cloud platforms, empowering telecommunications firms and other businesses. This strategy aims to help clients establish meaningful connections with their subscribers. Their core message revolves around simplifying onboarding, boosting subscriber engagement, and ultimately enhancing revenue, cutting costs, and accelerating time-to-market for its clients. This approach is a key part of the overall Revenue Streams & Business Model of Synchronoss.

The company emphasizes trust and reliability, with millions of subscribers trusting them to safeguard their digital content. This trust is crucial for maintaining customer loyalty and driving long-term value. The company differentiates itself through its white-label SaaS cloud platform, enabling service providers to offer branded personal cloud solutions. This unique selling proposition focuses on increasing average revenue per user (ARPU) and reducing churn.

The company appeals to its target audience through innovation, integrating artificial intelligence (AI) and machine learning into its solutions. This is evident in features like AI-enhanced photo editing. Technological advancements underscore its commitment to providing cutting-edge solutions that redefine how users connect with their digital world. Maintaining brand consistency across all communication channels is a priority, with a clear focus on the benefits for service providers and their end-users.

The company's sales strategy centers on its white-label SaaS cloud platform, which allows service providers to offer branded personal cloud solutions. This approach enables clients to increase ARPU and reduce churn. The sales process likely involves direct engagement with telecommunications companies and other businesses.

The marketing strategy focuses on highlighting the benefits of its personal cloud solutions, such as simplified onboarding and enhanced subscriber engagement. The company likely uses digital marketing initiatives to reach its target audience. Marketing campaigns may showcase AI-enhanced features.

The business model is based on providing a white-label SaaS cloud platform to service providers. This allows them to offer branded cloud solutions to their subscribers. Revenue is generated through subscription fees and potentially from value-added services.

The core product offering is a white-label personal cloud platform. This platform includes features such as secure storage, content management, and AI-enhanced services. The platform is designed to integrate seamlessly with existing service provider infrastructure.

The company operates in the personal cloud market, targeting telecommunications companies and other businesses. The market analysis involves understanding the needs of service providers and their subscribers. Competitive analysis helps identify opportunities and threats.

The competitive landscape likely includes other cloud storage providers and technology companies offering similar solutions. The company differentiates itself through its white-label approach and focus on the telecommunications sector. Partnerships and collaborations are essential.

Customer acquisition strategies involve direct sales efforts targeting telecommunications companies. Marketing campaigns highlight the value proposition of the white-label cloud platform. The focus is on demonstrating how the platform can increase ARPU and reduce churn.

Sales process optimization includes streamlining the sales cycle to improve efficiency. This involves using CRM systems and sales automation tools. The goal is to convert leads into clients effectively.

Marketing campaigns showcase the benefits of the personal cloud platform. These campaigns may include case studies, webinars, and digital advertising. The focus is on demonstrating how the platform enhances subscriber engagement.

The target audience is segmented based on the needs of telecommunications companies and their subscribers. This segmentation helps tailor marketing messages and sales efforts. The focus is on understanding the specific challenges and opportunities of each segment.

Revenue generation strategies include subscription fees from service providers. Value-added services, such as AI-enhanced features, may generate additional revenue. The focus is on maximizing ARPU and ensuring customer retention.

The go-to-market strategy involves direct sales and partnerships with telecommunications companies. Digital marketing initiatives support these efforts. The goal is to reach the target audience effectively and efficiently.

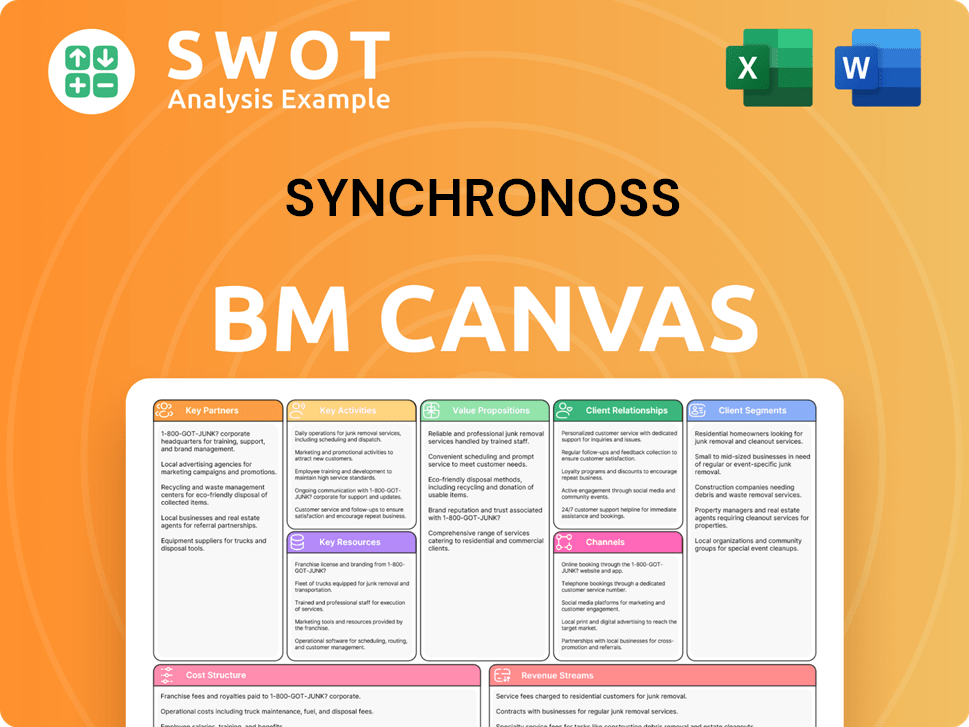

Synchronoss Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Synchronoss’s Most Notable Campaigns?

The recent campaigns of Synchronoss have been focused on product innovation and strategic alliances to strengthen its position in the cloud solutions market for telecommunications. A significant initiative was the launch of the next-generation Synchronoss Personal Cloud platform at CES 2025. This campaign showcased enhanced AI-powered tools for photo editing and optimization, along with improved security and storage capabilities. The primary channels used were industry events and press releases, targeting global carriers like AT&T, Verizon, and SoftBank, who already offer the Synchronoss Personal Cloud. These efforts are part of the overall Synchronoss sales strategy, aimed at expanding its market presence.

Another important aspect of the Synchronoss marketing strategy involved securing significant multi-year contract extensions with major telecom providers in 2024 and early 2025. These efforts, carried out through direct engagement and strategic announcements, aimed to secure recurring revenue and reinforce long-term client relationships. For example, a three-year contract extension with a major U.S. telecom provider ensured continued service to over 100 million subscribers. These initiatives are crucial for Synchronoss's business model, ensuring a stable revenue stream.

The success of these campaigns can be measured by the continued adoption by major carriers and the platform's ability to support over 11 million subscribers worldwide, processing over 50 million photos daily and managing 230 petabytes of storage. Recurring revenue accounted for 91.2% of total revenue in 2024 and is projected to be at least 90% in 2025. Synchronoss's strategic divestment of its Messaging and NetworkX businesses in late 2023 also served as a rebranding campaign, signaling a clear shift to a cloud-only enterprise, which was communicated to enhance profitability and streamline operations. For a deeper understanding of the company's growth trajectory, see Growth Strategy of Synchronoss.

The launch of the next-generation Synchronoss Personal Cloud platform at CES 2025 is a prime example of Synchronoss's focus on product innovation. This showcases the company's commitment to offering cutting-edge solutions. The campaign highlighted enhanced AI-powered tools and improved security.

Synchronoss continues to build strategic partnerships with major telecom providers. These partnerships are crucial for expanding market reach and ensuring long-term growth. Contract extensions with major providers demonstrate the value of Synchronoss's solutions.

Industry events and press releases are key channels for reaching the target audience. Synchronoss focuses on global carriers like AT&T, Verizon, and SoftBank. These channels are vital for Synchronoss's customer acquisition strategies.

Recurring revenue is a critical metric for Synchronoss's success. In 2024, recurring revenue accounted for 91.2% of total revenue. The company projects at least 90% recurring revenue for 2025. This highlights the company's revenue generation strategies.

The divestment of Messaging and NetworkX businesses in late 2023 was a strategic move. This signaled a shift towards a cloud-only enterprise. This rebranding campaign streamlined operations and enhanced profitability.

The Synchronoss Personal Cloud platform supports over 11 million subscribers worldwide. It processes over 50 million photos daily and manages 230 petabytes of storage. These metrics reflect the scale and impact of Synchronoss's product offerings.

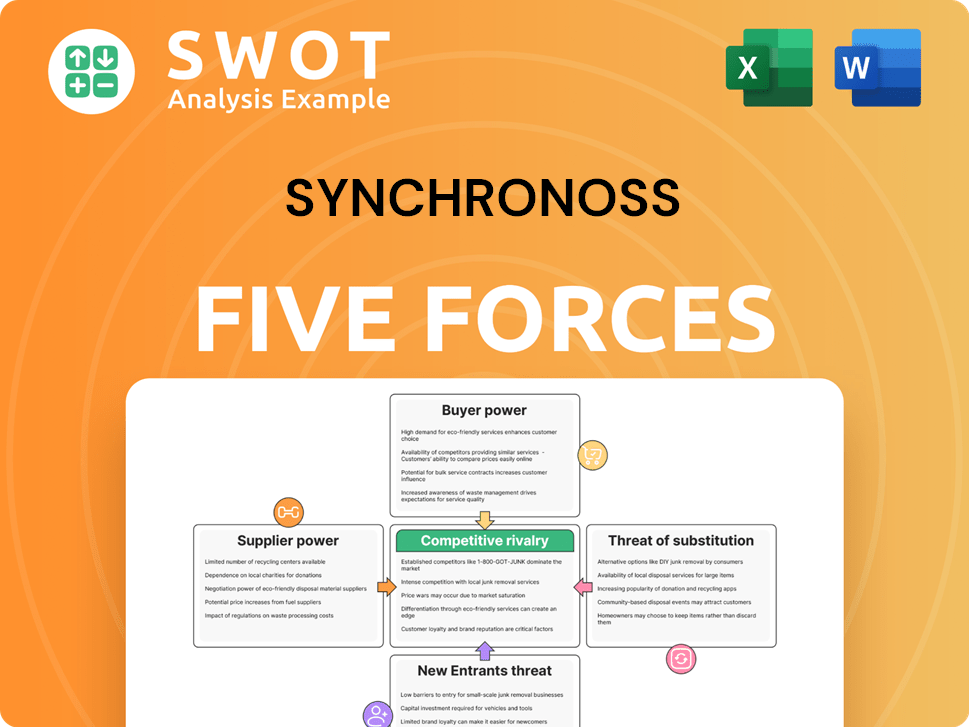

Synchronoss Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synchronoss Company?

- What is Competitive Landscape of Synchronoss Company?

- What is Growth Strategy and Future Prospects of Synchronoss Company?

- How Does Synchronoss Company Work?

- What is Brief History of Synchronoss Company?

- Who Owns Synchronoss Company?

- What is Customer Demographics and Target Market of Synchronoss Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.