Aeon Bundle

Who Really Pulls the Strings at Aeon Company?

Unraveling the ownership of a retail behemoth like AEON CO., LTD. is key to understanding its future. From its humble beginnings as a kimono shop to its current status as a global retail powerhouse, AEON's journey is a testament to strategic evolution. Knowing Aeon SWOT Analysis is crucial to understand its strategic direction.

Understanding the Aeon Company ownership structure is vital for investors and stakeholders alike. This analysis will explore who owns Aeon, from its founding to its current complex framework, including its Aeon Group owner and major shareholders. We'll delve into the Aeon Corporation's history, its Aeon headquarters, and the influence of its diverse Aeon stakeholders on its strategic decisions. This will also touch upon if Aeon is a publicly traded company and provide insights into the Aeon Company stock information.

Who Founded Aeon?

The origins of the retail giant, now known as the Aeon Company, trace back to 1926 when Takuya Okada established Okadaya. The initial ownership structure was primarily within the Okada family, reflecting the traditional family-owned business model prevalent in Japan during that era. This structure provided a foundation for long-term vision and stability.

As Okadaya evolved and expanded, eventually merging with other regional retailers to form JUSCO Co., Ltd. in 1969 and later Aeon Co., Ltd. in 1989, the ownership gradually diversified. However, the Okada family's influence remained significant throughout these transitions. Early backers likely included local financial institutions and business partners, although specific equity stakes from the early periods are not readily available in public records.

The early focus was on providing essential goods and services to communities, a vision deeply embedded in the company's operational and ownership strategies. This emphasis on sustainable growth, rather than rapid external investment, shaped the company's trajectory.

Takuya Okada founded Okadaya in 1926, setting the stage for the future Aeon Corporation. The initial ownership was concentrated within the Okada family.

The company expanded and merged, evolving into JUSCO Co., Ltd. in 1969 and Aeon Co., Ltd. in 1989. This expansion broadened the ownership base.

Early ownership included the Okada family, local financial institutions, and business partners. The family's influence remained significant.

The focus was on providing essential goods and services, emphasizing sustainable growth. This early vision shaped the company's operational and ownership strategies.

Takuya Okada was the key founder, laying the groundwork for Aeon's success. The early stakeholders included the Okada family and local financial institutions.

From Okadaya to JUSCO and finally Aeon, the company's evolution reflects changes in ownership. The Brief History of Aeon provides more details.

Understanding the early ownership of Aeon Company provides insights into its long-term strategy. The initial structure was family-dominated, with the Okada family at the helm. Over time, the ownership broadened to include financial institutions and business partners. The company's focus on sustainable growth and community service has been a constant theme since its inception. As of the latest financial reports, Aeon continues to be a publicly traded company, with a diverse shareholder base. The company's commitment to its founding principles remains evident in its operational and ownership strategies.

- Who owns Aeon is a question that evolves over time.

- The early ownership was primarily the Okada family.

- Aeon Group owner now includes a diverse shareholder base.

- The company is publicly traded.

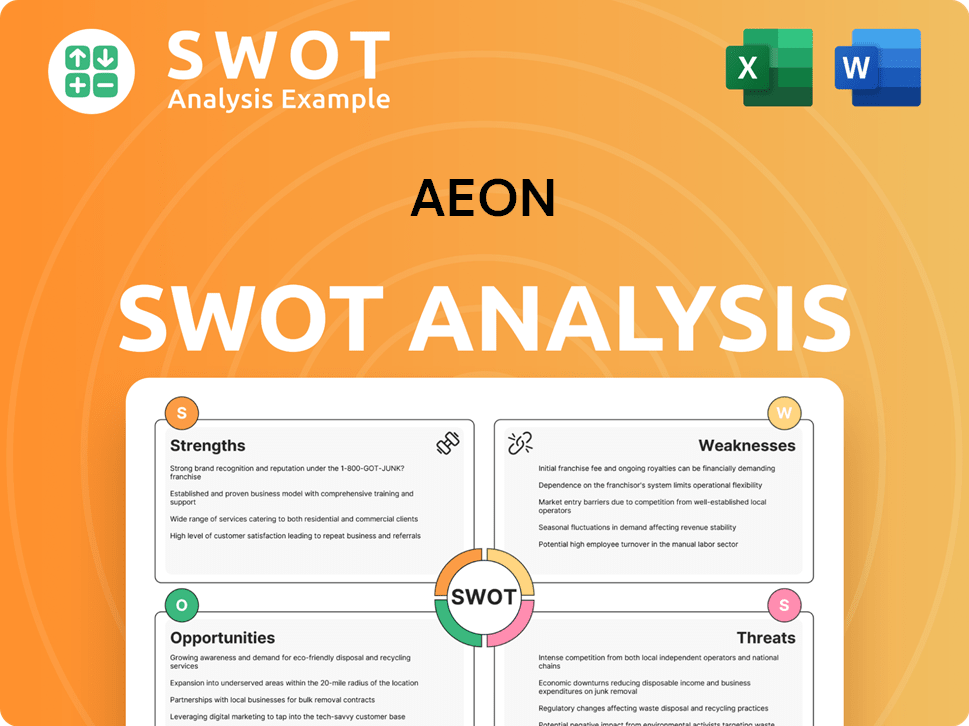

Aeon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Aeon’s Ownership Changed Over Time?

The ownership structure of AEON CO., LTD. has evolved significantly since its initial public offering on the Tokyo Stock Exchange. The company's shares are widely held, with a mix of institutional investors, financial institutions, and entities related to the founding family. As of February 20, 2024, the total number of shares issued was 2,367,238,614, reflecting its growth and expansion in the market. This public listing has allowed for broader capital access and has influenced the distribution of ownership over time.

Key events impacting the ownership structure include the company's initial public offering, subsequent capital increases, and the ongoing participation of institutional investors. These events have led to a dilution of the founding family's direct ownership percentage, while simultaneously increasing the influence of institutional shareholders. The presence of these institutional investors often leads to increased scrutiny and a focus on corporate governance and sustainable practices, which can shape the company's strategic direction.

| Shareholder | Shares Held (in thousands) as of Feb 29, 2024 | Percentage of Ownership |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 333,403 | 14.08% |

| Custody Bank of Japan, Ltd. (Trust Account) | 130,551 | 5.51% |

| JPMorgan Chase Bank 385632 | - | 2.49% |

| SSBTC CLIENT OMNIBUS ACCOUNT | - | 1.92% |

The shift towards a more diversified shareholder base, with significant holdings by institutional investors like The Master Trust Bank of Japan, Ltd. and Custody Bank of Japan, Ltd., indicates the company's maturity and its integration into the global financial market. This ownership structure, along with the influence of the Okada family, shapes the strategic direction and operational decisions of the company. For further insights into the competitive landscape, consider exploring the Competitors Landscape of Aeon.

The ownership of AEON CO., LTD. is primarily distributed among institutional investors, financial institutions, and the founding family's related entities. The company is publicly traded on the Tokyo Stock Exchange, ensuring widespread ownership and transparency.

- Major shareholders include The Master Trust Bank of Japan, Ltd. and Custody Bank of Japan, Ltd.

- The Okada family maintains a notable influence.

- Institutional investors often advocate for stronger corporate governance.

- The company's ownership structure reflects its growth and public market financing.

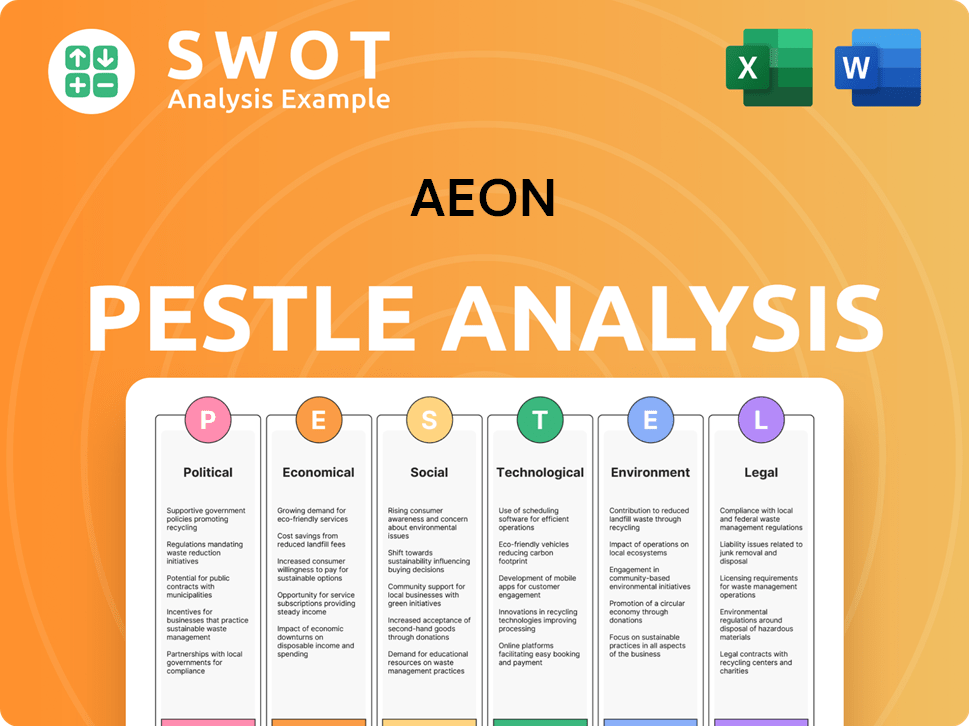

Aeon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Aeon’s Board?

The Board of Directors of the company, as of May 2024, is structured to include a mix of internal and external directors, reflecting a balance between company management and independent oversight. The current Representative Executive Officer, President, and Director is Akio Yoshida. Other key executive directors include Motoyuki Shikata, Executive Vice President, and Mitsugu Konishi, Executive Vice President. This structure helps ensure alignment with management's strategic goals while also providing independent perspectives to protect shareholder interests. Understanding the Aeon Company ownership structure is key to understanding its governance.

The board also includes independent outside directors like Masahiro Yoshitake, who bring external expertise to the decision-making process. While specific individual shareholdings of each board member are not always publicly detailed, the inclusion of executive officers ensures alignment with management's strategic goals. Independent directors are intended to provide oversight and protect the interests of all shareholders. For those interested in Aeon Group owner, the board composition offers insights into the company's governance.

| Board Member | Title | Role |

|---|---|---|

| Akio Yoshida | Representative Executive Officer, President, and Director | Executive |

| Motoyuki Shikata | Executive Vice President | Executive |

| Mitsugu Konishi | Executive Vice President | Executive |

| Masahiro Yoshitake | Independent Outside Director | Independent Oversight |

The company generally operates on a one-share-one-vote structure for its common shares. This means that voting power is directly proportional to the number of shares held. There are no indications of dual-class shares or arrangements granting disproportionate voting rights. The Aeon Corporation governance model emphasizes a straightforward approach to shareholder voting, which is typical for publicly traded companies in Japan. For more details on the Aeon Company stock information, consult the latest financial reports.

The company operates on a one-share-one-vote basis, ensuring voting power is proportional to share ownership. Understanding the governance structure is essential when considering Who owns Aeon. The board includes a mix of executive and independent directors.

- One-share-one-vote structure

- Board includes executive and independent directors

- Focus on shareholder interests

- Stable governance environment

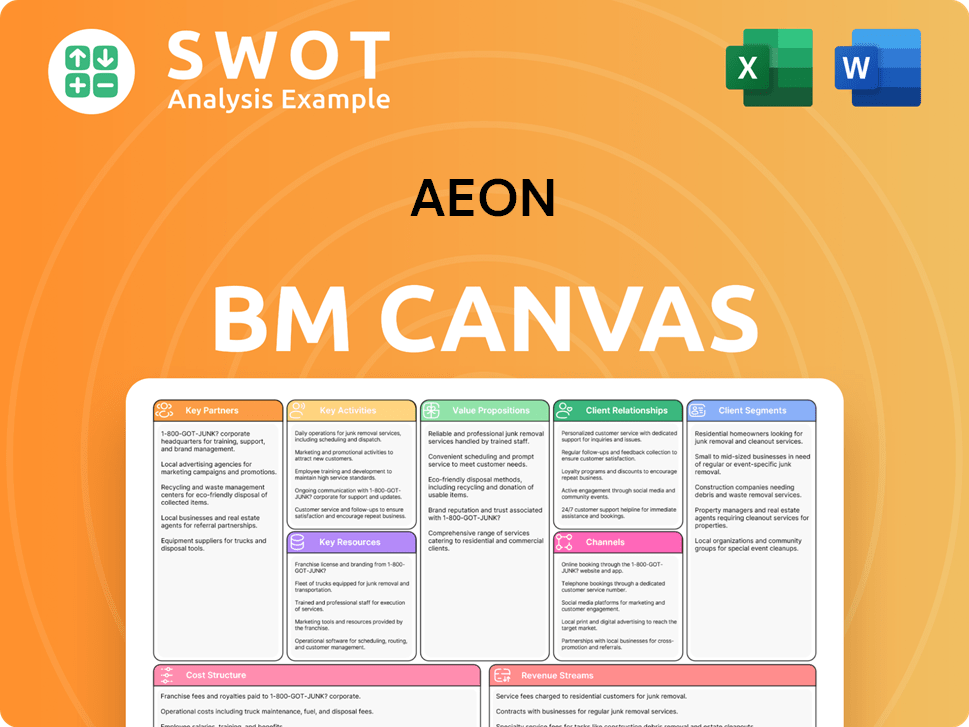

Aeon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Aeon’s Ownership Landscape?

Over the past few years, the ownership profile of AEON CO., LTD. has remained relatively stable, despite the dynamic shifts in the retail industry. The company's strategic focus on digital transformation and sustainability has potentially attracted new institutional investors. This includes those focused on technology and ESG (Environmental, Social, and Governance) factors. This shift aligns with broader industry trends, where institutional ownership is increasing across major corporations. The company's commitment to these areas may influence the types of investors attracted to the company.

While there haven't been drastic changes, such as a complete privatization, there's a natural dilution of founder ownership in a publicly traded company. The direct family ownership, while still significant, is a smaller percentage compared to the company's early days. AEON continues to concentrate on organic growth, strategic alliances, and potential mergers and acquisitions. These actions could result in minor ownership adjustments through share exchanges or new equity issuances. The company's focus on financial services and retail ecosystems may lead to small changes in the shareholder base.

| Ownership Category | Approximate Percentage | Notes |

|---|---|---|

| Institutional Investors | Varies, but a significant portion | Includes trust banks and asset managers. |

| Family Ownership | Significant, but diluted over time | Reflects the company's history and evolution. |

| Public Shareholders | Remainder | Represents the shares held by the public. |

The Growth Strategy of Aeon includes focusing on digital transformation and sustainability. These efforts may attract investors interested in ESG factors and technology. The company's focus on organic growth and strategic alliances could lead to minor adjustments in ownership. The company has not announced any major changes in ownership structure, such as privatization or significant secondary offerings.

AEON's ownership structure is primarily composed of institutional investors, family ownership, and public shareholders. Institutional investors hold a significant portion of the shares. Family ownership, while still present, has decreased over time. Public shareholders own the remaining shares.

Recent trends indicate a continued focus on digital transformation and sustainability. These initiatives have attracted new investors. The company has not announced any major shifts in ownership. The company focuses on organic growth and strategic alliances.

The main stakeholders of AEON include institutional investors, the founding family, and public shareholders. The company is publicly traded. The company's financial performance influences investor interest.

AEON's ownership structure is diverse, with no single controlling entity. The company is publicly traded. The founding family still holds a significant stake. Institutional investors also hold substantial shares.

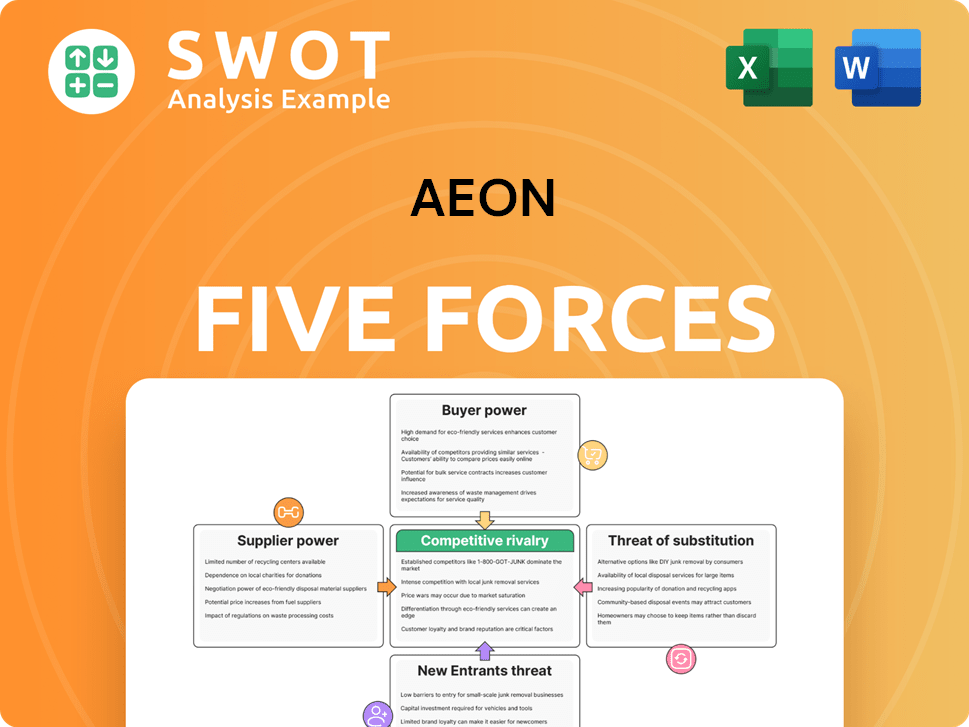

Aeon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aeon Company?

- What is Competitive Landscape of Aeon Company?

- What is Growth Strategy and Future Prospects of Aeon Company?

- How Does Aeon Company Work?

- What is Sales and Marketing Strategy of Aeon Company?

- What is Brief History of Aeon Company?

- What is Customer Demographics and Target Market of Aeon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.