DigitalOcean Bundle

Who Really Controls DigitalOcean?

Understanding a company's ownership structure is critical for investors and strategists alike. DigitalOcean, a cloud computing powerhouse, has transformed from a startup to a publicly traded entity. This shift significantly influences its strategic direction and market performance, making it crucial to understand who DigitalOcean SWOT Analysis.

This article will dissect the complex landscape of DigitalOcean ownership, exploring its journey from its founding to its current status as a public company. We'll uncover the key players, from the initial founders to the major stakeholders, and how their influence shapes the company's future. Discover the impact of the DigitalOcean IPO, the roles of its investors, and the evolution of its leadership team. This deep dive into DigitalOcean's ownership provides a comprehensive understanding of the company's trajectory, governance, and strategic decision-making.

Who Founded DigitalOcean?

The cloud infrastructure provider, DigitalOcean, was established in 2012. The company's inception involved a collaborative effort among its founders, shaping its initial ownership structure. The founders included Ben Uretsky, Moisey Uretsky, Mitch Wainer, Jeff Carr, and Alec Hartman.

Early on, the Uretsky brothers and Mitch Wainer were key in formulating the company's vision and securing initial funding. This early backing came from a mix of angel investors and venture capital firms that recognized the potential of DigitalOcean's simplified cloud offerings. The company's journey began with a clear focus on providing accessible cloud solutions for developers.

In 2013, DigitalOcean secured $3.1 million in seed funding from Andreessen Horowitz, a significant milestone in its early financial backing. The initial ownership structure was designed to reflect the contributions and ongoing commitment of each team member to the company's foundational vision of democratizing cloud infrastructure for developers.

Ben Uretsky, Moisey Uretsky, Mitch Wainer, Jeff Carr, and Alec Hartman founded DigitalOcean in 2012.

DigitalOcean received seed funding from Andreessen Horowitz in 2013.

The initial ownership structure reflected the collaborative efforts of the founders.

The Uretsky brothers and Mitch Wainer played instrumental roles in the early stages.

The company aimed to democratize cloud infrastructure for developers.

Standard startup agreements, such as vesting schedules, were implemented to ensure founder commitment.

The early distribution of control and equity was structured to mirror the contributions and ongoing dedication of each team member. The Brief History of DigitalOcean provides additional insights into the company's evolution. DigitalOcean's journey from its inception to its current status as a public company, with its focus on developer-friendly cloud solutions, showcases its growth and the strategic decisions made by its founders and early investors. The company's success reflects the initial vision and the commitment of its founders to provide accessible cloud services.

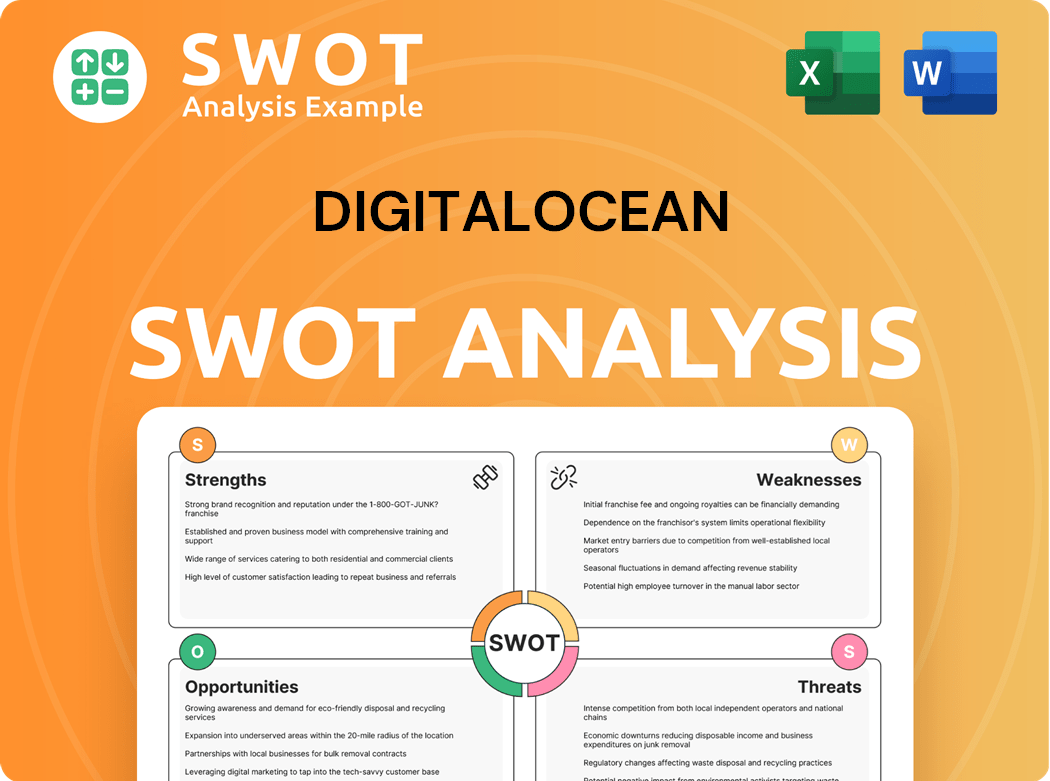

DigitalOcean SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DigitalOcean’s Ownership Changed Over Time?

The ownership of DigitalOcean has transformed significantly since its inception. The company's journey to becoming a publicly traded entity began with various funding rounds from venture capital firms. A pivotal moment arrived on March 24, 2021, when DigitalOcean launched its initial public offering (IPO) on the New York Stock Exchange (NYSE) under the ticker symbol 'DOCN.' This IPO was a major milestone, raising approximately $775 million and valuing the company at over $5 billion at the time. This transition brought a broader base of public shareholders into its ownership.

The IPO marked a shift from private to public ownership, influencing DigitalOcean's strategy and governance. The increased scrutiny from public markets and the need for greater transparency through regular SEC filings became essential. While founders may retain shares, their ownership percentage typically dilutes over time as new shares are issued during funding rounds and the IPO. The influence of major institutional shareholders now plays a critical role in strategic decisions and corporate governance. Understanding the evolution of Growth Strategy of DigitalOcean provides insights into the company's trajectory.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Funding Rounds | Pre-2021 | Venture capital firms and private investors acquired significant stakes. |

| IPO | March 24, 2021 | DigitalOcean became a public company, with shares available on the NYSE. |

| Subsequent Stock Offerings | Post-IPO | Further dilution of existing shareholders, increased public float. |

As of early 2025, the major stakeholders in DigitalOcean include a mix of institutional investors, mutual funds, and individual insiders. Large institutional investors frequently hold substantial portions of the company's stock. For instance, as of March 31, 2025, Vanguard Group Inc. and BlackRock Inc. are often among the top institutional holders, reflecting their broad market index fund strategies. According to recent SEC filings and reports, institutional ownership of DigitalOcean often hovers around 80-90% of the outstanding shares, indicating a strong presence of large investment funds.

DigitalOcean's ownership structure has evolved significantly, from private funding to a public company. Key stakeholders include institutional investors like Vanguard and BlackRock. The IPO in 2021 was a major step in this evolution.

- Institutional ownership often ranges from 80-90%.

- The IPO raised approximately $775 million.

- The company's valuation at IPO was over $5 billion.

- Public listing increased transparency and scrutiny.

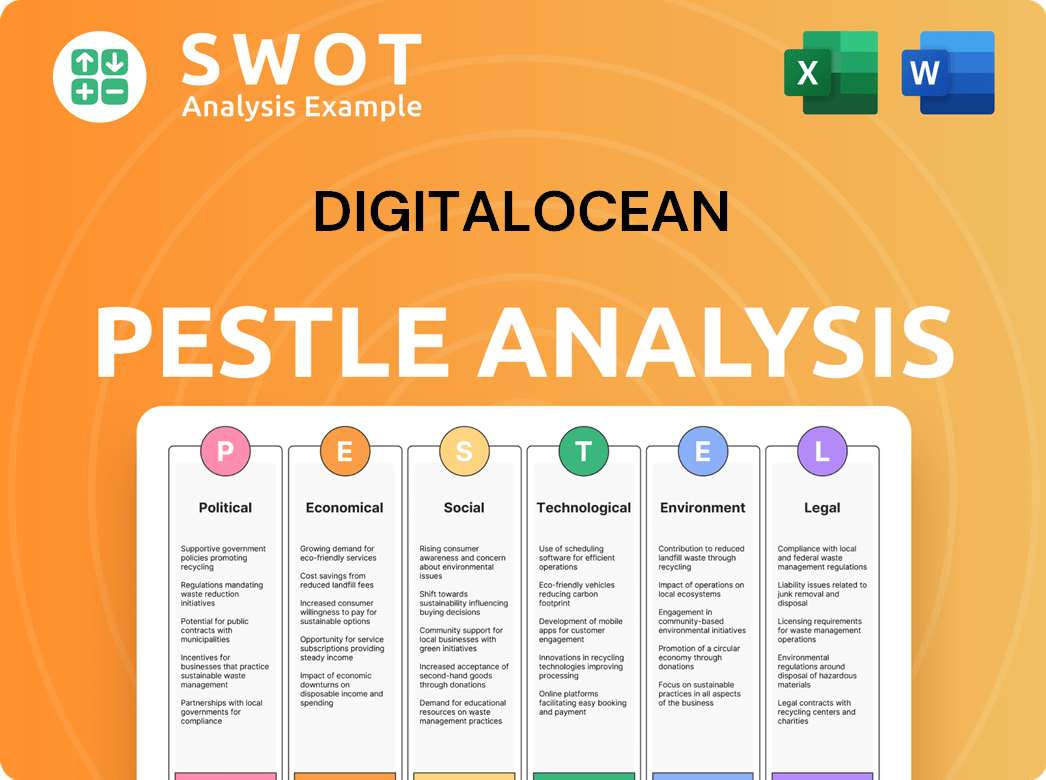

DigitalOcean PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DigitalOcean’s Board?

The Board of Directors at DigitalOcean is pivotal in overseeing the company's operations and ensuring accountability to its shareholders. As of early 2025, the board is typically composed of a combination of executive directors, often including the CEO, representatives from significant investors, and independent directors. This structure is designed to balance the interests of various stakeholders, including major shareholders and independent voices, promoting sound corporate governance. The presence of independent directors is critical for providing unbiased oversight and expertise on strategic decisions.

Major venture capital firms that invested in early rounds may have board seats, reflecting their significant ownership stakes. The board's decisions ultimately impact the company's strategic direction, executive compensation, and other key corporate actions. The board is accountable to the broader shareholder base, ensuring decisions are aligned with the company's long-term goals and financial health. This structure helps maintain a balance between the interests of management, investors, and the overall health of the company. The composition of the board and its voting structure are critical in shaping decision-making.

| Board Member | Title | Affiliation |

|---|---|---|

| Yancey Spruill | CEO & Director | DigitalOcean |

| Bill Bumbernick | Lead Independent Director | Independent |

| Gaurav Chandra | Director | Bessemer Venture Partners |

DigitalOcean operates under a one-share-one-vote structure for its common stock, meaning each share entitles its holder to one vote. This standard voting structure ensures that voting power is directly proportional to equity ownership. There are no publicly disclosed details suggesting the existence of dual-class shares or special voting arrangements. The influence of major institutional shareholders, through their representation on the board or their voting power, can significantly impact the company's strategic direction.

The Board of Directors at DigitalOcean plays a crucial role in overseeing the company's operations and ensuring accountability to its shareholders. The board's structure is designed to balance the interests of various stakeholders. The influence of major institutional shareholders can significantly impact the company's strategic direction.

- The board includes executive directors, investor representatives, and independent directors.

- DigitalOcean operates under a one-share-one-vote structure.

- Major shareholders influence strategic decisions through board representation.

- For more information, you can read about the Target Market of DigitalOcean.

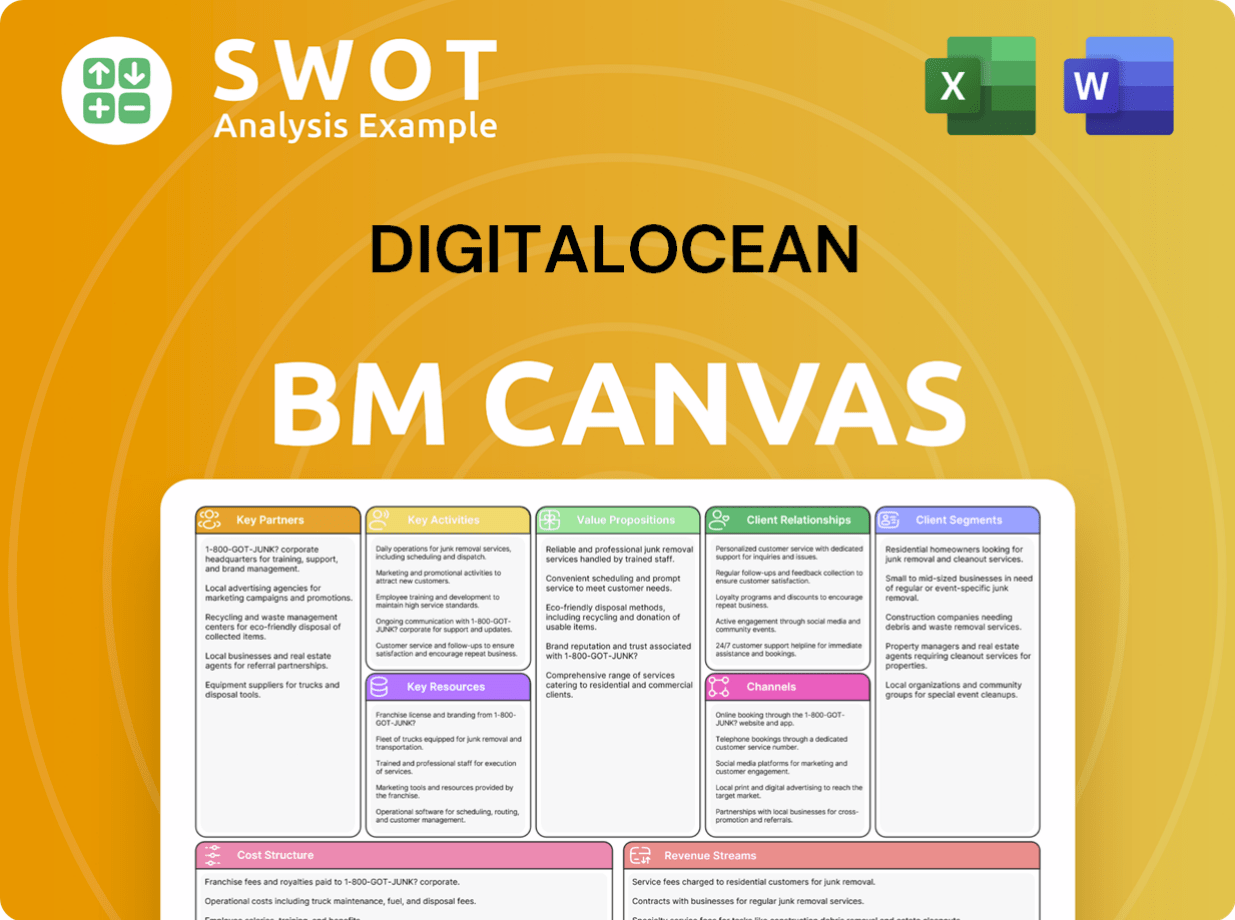

DigitalOcean Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DigitalOcean’s Ownership Landscape?

Over the past few years (2022-2025), the ownership structure of DigitalOcean has evolved, primarily due to market dynamics and strategic corporate actions. Following its 2021 IPO, the company has navigated a fluctuating macroeconomic environment, impacting its stock performance and shareholder holdings. Although there haven't been large-scale share buybacks or secondary offerings beyond standard employee stock programs, institutional investment in the company remains strong, reflecting its financial health and growth prospects. This is a key aspect of understanding who owns DigitalOcean.

A notable trend in the tech sector, affecting DigitalOcean, is the rise in institutional ownership and the dilution of founder shares as companies mature. The founders' ownership percentage has naturally decreased since the IPO, a common pattern for successful tech firms. This shift sees control gradually moving from founders to a more diverse base of institutional and public shareholders. Understanding the DigitalOcean owner involves tracking these changes over time.

| Metric | Details | Data Source (Approximate, as of Early 2025) |

|---|---|---|

| Market Capitalization | Reflects the total value of outstanding shares. | Around $4.5 billion (fluctuating). |

| Institutional Ownership | Percentage of shares held by institutional investors. | Approximately 70-80%. |

| Public Float | The portion of shares available for trading. | Around 80-85% of total shares outstanding. |

Industry trends in cloud computing, like a focus on profitability, influence investor sentiment. DigitalOcean, serving developers and SMBs, may see shifts in its ownership landscape through strategic acquisitions or partnerships. Public statements emphasize growth, product expansion, and financial performance, crucial for investors. As of early 2025, scaling operations and profitability are key focuses, closely monitored by the diverse ownership base. For more context, consider exploring the Competitors Landscape of DigitalOcean.

DigitalOcean's ownership is primarily composed of institutional investors and public shareholders. The founders' stake has decreased over time. The company's financial performance and strategic moves greatly influence investor interest.

Institutional ownership has been increasing. Founder ownership has diluted since the IPO. Market capitalization and stock performance are key factors. Growth strategies and profitability are closely watched by investors.

The IPO in 2021 marked a significant shift in ownership. The company's performance post-IPO has influenced investor confidence. Public market dynamics continue to shape the ownership structure.

Strategic acquisitions could alter the ownership landscape. Continued focus on profitability may attract new investors. The company's growth trajectory is a key factor for future ownership.

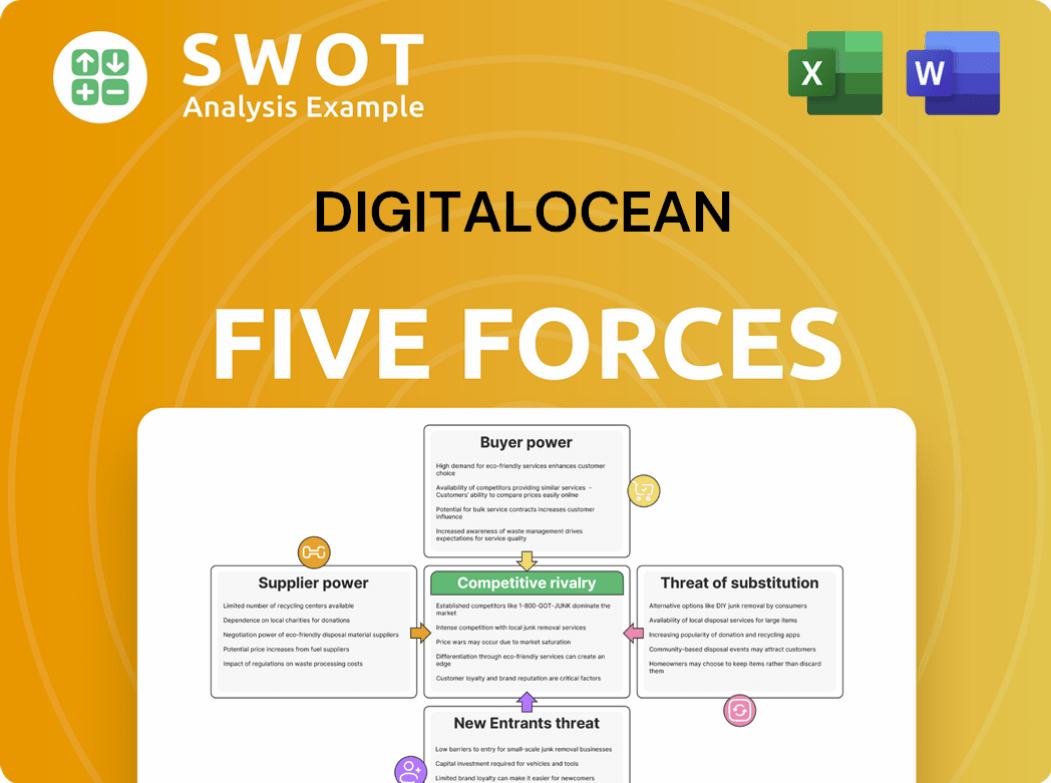

DigitalOcean Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DigitalOcean Company?

- What is Competitive Landscape of DigitalOcean Company?

- What is Growth Strategy and Future Prospects of DigitalOcean Company?

- How Does DigitalOcean Company Work?

- What is Sales and Marketing Strategy of DigitalOcean Company?

- What is Brief History of DigitalOcean Company?

- What is Customer Demographics and Target Market of DigitalOcean Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.