Domino's Pizza Bundle

Who Really Calls the Shots at Domino's Pizza?

Ever wondered who truly steers the ship at the world's largest pizza company? From its humble beginnings in 1960 to its global dominance today, Domino's Pizza's journey is a fascinating study in strategic ownership. Understanding the Domino's Pizza SWOT Analysis is key to grasping its competitive advantages.

This article unravels the intricate Domino's Pizza ownership structure, detailing the shift from its founding brothers to its current publicly traded status. We'll explore the influence of major shareholders, the dynamics of its franchise model, and the key players shaping its future. Discover the answers to questions like: Who owns the most Domino's Pizza franchises and where is Domino's Pizza based? Uncover the secrets behind Domino's Pizza's sustained success.

Who Founded Domino's Pizza?

The story of Domino's Pizza ownership begins in 1960 with brothers Tom and James Monaghan. They purchased DomiNick's, a small pizza store, for about $900. This marked the humble start of what would become a global pizza empire.

In 1961, Tom Monaghan bought out his brother's share for $500, becoming the sole owner. This pivotal moment set the stage for the company's future growth. The company's early ownership structure was simple, centered on Tom Monaghan's vision.

By 1965, the company was renamed Domino's Pizza, Inc., establishing the brand identity still recognized today. The company's history is a testament to entrepreneurial spirit and strategic business decisions.

Tom Monaghan's sole proprietorship formed the initial ownership structure. This allowed for a clear focus on expansion and brand building.

The first franchise opened in 1967, which was a key move. This strategy fueled rapid growth and market penetration.

Franchising enabled Domino's to expand without significant external investment. This approach allowed for quick growth across different locations.

The franchising model prioritized widespread brand recognition. This strategy helped Domino's become a household name.

Beyond the initial partnership, details of early backers are not widely publicized. The focus was on franchising.

The aggressive franchising strategy focused on market penetration. This helped Domino's establish a strong presence.

The early years of Domino's Pizza ownership were defined by Tom Monaghan's leadership and the strategic use of franchising. This approach allowed for rapid expansion and brand recognition, setting the stage for the company's future success. For more insights into the business model, consider reading Revenue Streams & Business Model of Domino's Pizza. As of early 2024, Domino's operates in over 90 markets worldwide, with over 20,000 stores, showcasing the effectiveness of its early ownership and franchise model.

Domino's Pizza SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Domino's Pizza’s Ownership Changed Over Time?

The ownership structure of the Domino's Pizza company has evolved significantly since its inception. A pivotal moment occurred in 1998 when founder Tom Monaghan sold a significant portion of his stake to Bain Capital, Inc. for $1 billion. This transaction marked a shift towards corporatization. The company further solidified its position in the public market with its Initial Public Offering (IPO) in 2004, trading on the New York Stock Exchange (NYSE) under the ticker symbol DPZ.

The current ownership of Domino's Pizza is largely distributed among institutional investors. The company's transition to a publicly traded entity has provided access to capital markets, fueling expansion and growth. This shift has also diversified the shareholder base, reflecting the company's growth and market presence.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Sale to Bain Capital | 1998 | Shifted control from founder to private equity, paving the way for future IPO. |

| Initial Public Offering (IPO) | 2004 | Allowed public investment, increased capital for expansion, and diversified the shareholder base. |

| Ongoing Institutional Investment | Ongoing | Institutional investors hold a significant portion of shares, influencing strategic decisions and market performance. |

As of May 2025, major institutional shareholders include Vanguard Group Inc., BlackRock, Inc., and Berkshire Hathaway Inc. These entities, along with others like T. Rowe Price Investment Management, Inc., hold substantial portions of the company's shares. The aggregate market value of voting and non-voting common stock held by non-affiliates as of June 16, 2024, was approximately $18.15 billion. This ownership structure highlights the company's position in the market. For more insights, you can explore the Competitors Landscape of Domino's Pizza.

Domino's Pizza's ownership structure has evolved from founder control to a publicly traded model with significant institutional investment.

- Institutional investors hold a substantial portion of shares.

- The IPO in 2004 was a major turning point.

- The company's structure includes a franchisor and master franchisees.

- Domino's Pizza Enterprises Ltd. is a key player in international markets.

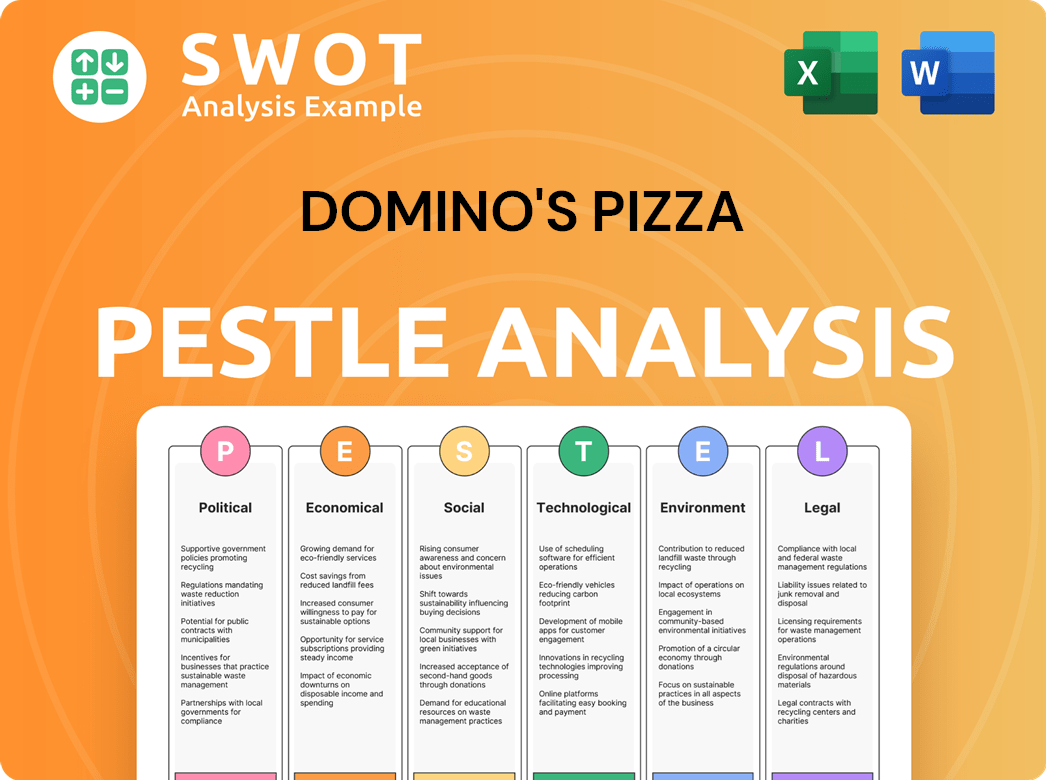

Domino's Pizza PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Domino's Pizza’s Board?

The governing body of Domino's Pizza, Inc., is the Board of Directors, elected by the stockholders. The board typically comprises independent directors and representatives from significant stakeholders. According to the 2025 proxy statement, which was provided to shareholders in connection with the annual meeting on April 23, 2025, there are nine director nominees up for a one-year term. This structure ensures oversight and strategic direction for the company.

The Board of Directors plays a crucial role in overseeing the company's operations and ensuring accountability to shareholders. Their responsibilities include strategic planning, risk management, and the appointment and oversight of key executives. The board's composition and activities are detailed in the company's filings, reflecting its commitment to good corporate governance and transparency. Understanding the board's structure is key to understanding the overall Domino's Pizza ownership and governance.

| Director Nominee | Title | Other Relevant Information |

|---|---|---|

| Ritch Allison | Chairman of the Board | Former CEO of Domino's Pizza, Inc. |

| Russell Weiner | Chief Executive Officer | Current CEO of Domino's Pizza, Inc. |

| Christopher J. Bair | Independent Director | Serves on the Audit Committee. |

| Richard E. Allison | Independent Director | Serves on the Compensation Committee. |

| Diana L. Taylor | Independent Director | Serves on the Nominating and Corporate Governance Committee. |

| Jeffrey Lawrence | Independent Director | Serves on the Audit Committee. |

| James D. Goldman | Independent Director | Serves on the Compensation Committee. |

| John B. Wilson | Independent Director | Serves on the Nominating and Corporate Governance Committee. |

| Mary E. Wagner | Independent Director | Serves on the Audit Committee. |

The voting structure for Domino's Pizza, Inc. common stock is generally one-share-one-vote, which is common for companies listed on the NYSE. As of February 17, 2025, there were 34,296,712 shares of common stock outstanding. There is no publicly available information to suggest the existence of dual-class shares or other mechanisms that would grant outsized control to specific individuals beyond their proportional equity ownership. For additional insights into the company's strategic direction, consider reading about the Growth Strategy of Domino's Pizza.

The Board of Directors oversees Domino's Pizza, Inc., ensuring good governance.

- The board is composed of independent directors and representatives.

- Voting is typically one-share-one-vote.

- A class action lawsuit was filed in November 2024, impacting governance.

- Understanding the board is essential for comprehending Domino's Pizza owner structure.

Domino's Pizza Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Domino's Pizza’s Ownership Landscape?

Over the past few years, the ownership landscape of the Domino's Pizza company has shown stability with a strong presence of institutional investors. As of March 31, 2025, institutional holdings represented a significant portion of the company's shares. Notable shifts in Q1 2025 included Vanguard Group Inc. reducing its holdings slightly, while BlackRock, Inc. increased its shares. Berkshire Hathaway Inc., led by Warren Buffett, notably increased its stake, signaling continued confidence in the company's future. As of May 31, 2025, institutional ownership was reported at 101.52%, with insider ownership at 1.71%.

These ownership trends reflect the company's strategic direction and investor perception. The continued backing from major institutional investors, including the initiation of a position by Berkshire Hathaway in late 2024, underscores the company's established market position. For more insights into the company's strategic positioning, consider exploring the Target Market of Domino's Pizza.

| Shareholder Type | As of May 31, 2025 | Change in Q1 2025 |

|---|---|---|

| Institutional Ownership | 101.52% | Various changes, including increases by BlackRock, Inc. and Berkshire Hathaway Inc. |

| Insider Ownership | 1.71% | Minimal changes |

| Vanguard Group Inc. | Holdings decreased by 0.811% | |

| BlackRock, Inc. | Holdings increased by 1.441% | |

| Berkshire Hathaway Inc. | Holdings increased by 10.017% |

In April 2025, Domino's Pizza announced a partnership with Uber Technologies, Inc., integrating its products into Uber's marketplace. This strategic move aims to expand sales channels and leverage digital platforms. The company's 'Hungry for MORE' strategy, focused on sales growth and store expansion, is a key component of its plans. The company aims to open over 50 stores in the 2025 financial year, following the 54 opened in 2024.

Partnership with Uber Technologies, Inc. to integrate products into their marketplace, aiming to expand sales channels and leverage digital platforms.

Targeting over 50 new store openings in the 2025 financial year, building on the 54 stores opened in 2024.

Mark van Dyck succeeded Don Meij as CEO of Domino's Pizza Enterprises (DPE) in November 2024, with Meij supporting the transition.

DPE reported a net loss and announced the closure of 205 restaurants, including 172 in Japan, as part of a strategy to reinvest in sustainable long-term growth.

Domino's Pizza Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Domino's Pizza Company?

- What is Competitive Landscape of Domino's Pizza Company?

- What is Growth Strategy and Future Prospects of Domino's Pizza Company?

- How Does Domino's Pizza Company Work?

- What is Sales and Marketing Strategy of Domino's Pizza Company?

- What is Brief History of Domino's Pizza Company?

- What is Customer Demographics and Target Market of Domino's Pizza Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.