Essity Bundle

Who Really Owns Essity?

Ever wondered who steers the ship at Essity, a global leader in hygiene and health? Understanding the Essity SWOT Analysis, and its ownership structure is key to unlocking its strategic moves and future potential. With a history marked by a significant spin-off, Essity's ownership story is far from ordinary. Delving into "Who owns Essity" reveals insights into its governance, market position, and commitment to stakeholders.

The Essity company, a prominent player in the hygiene and health sector, boasts a fascinating ownership narrative. Knowing "Who owns Essity" allows investors and analysts to assess the company's strategic direction and financial health. From its roots as a spin-off to its current status as a publicly traded entity, the Essity ownership structure has evolved significantly. This examination of Essity ownership will provide a comprehensive view of its major stakeholders and their influence.

Who Founded Essity?

The question 'Who owns Essity?' is best answered by understanding its unique origin story. Unlike companies with traditional founders, Essity's ownership structure stems from its spin-off from SCA in 2017. This means there were no individual founders in the conventional sense, nor initial equity distributions.

Instead, the initial ownership of the Essity company was a direct reflection of SCA's shareholder base at the time of the demerger. SCA shareholders received shares in Essity, mirroring their existing holdings in SCA. This setup resulted in major institutional investors and individual shareholders becoming the initial owners of Essity.

This structure highlights that Essity's early ownership was primarily institutional, with significant stakes held by entities that were also major shareholders in SCA. The shift was designed to create a more focused company, dedicated to hygiene and health, with control distributed among a broad base of public shareholders inherited from SCA.

Essity emerged from SCA in 2017, meaning there were no traditional founders.

SCA shareholders received Essity shares, mirroring their SCA holdings.

Major institutional investors from SCA became prominent Essity owners.

There were no 'angel investors' or 'friends and family' in the startup sense.

The spin-off aimed to create a more focused company.

Control was distributed among a broad base of public shareholders.

Understanding the Essity ownership structure begins with its foundation as a spin-off from SCA. The early ownership of Essity, therefore, was a direct transfer from SCA's shareholder base. This means that the initial owners of Essity were the same institutional investors and individual shareholders who held shares in SCA. For example, Industrivärden, a significant shareholder in SCA, automatically became a substantial shareholder in Essity. The spin-off was designed to seamlessly transfer ownership, focusing on hygiene and health. To learn more about the company's financial performance, consider exploring the Revenue Streams & Business Model of Essity.

Essity's ownership structure is unique due to its spin-off from SCA.

- No traditional founders or initial equity splits.

- Early ownership mirrored SCA's shareholder base.

- Major institutional investors from SCA became Essity owners.

- The spin-off aimed for a focused company in hygiene and health.

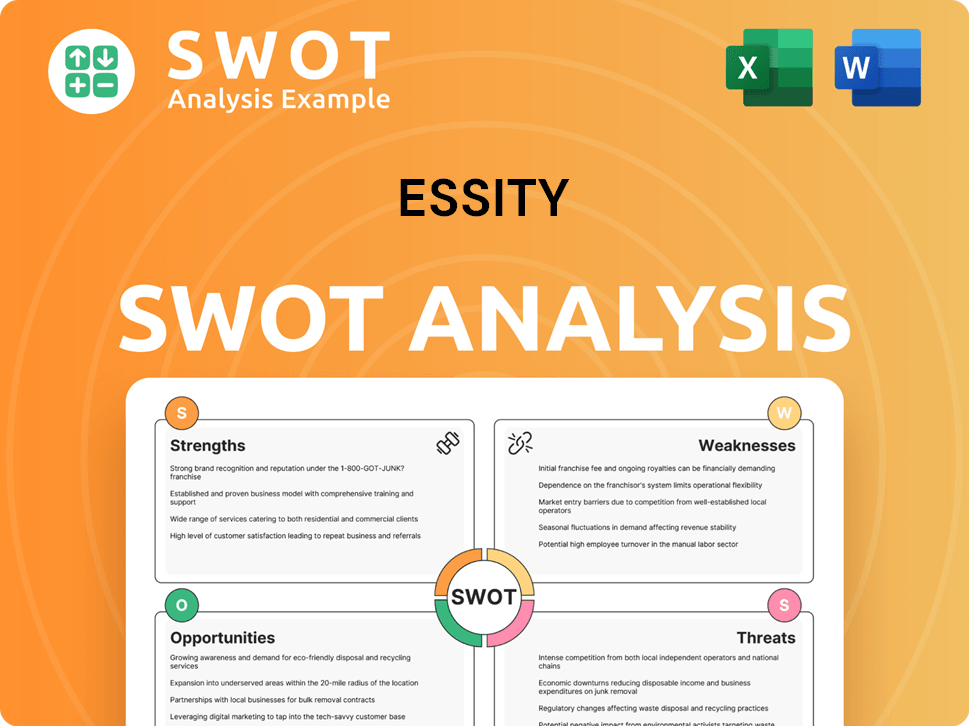

Essity SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Essity’s Ownership Changed Over Time?

The evolution of Essity's ownership structure since its spin-off from SCA in 2017 has been a dynamic process. The initial public offering on Nasdaq Stockholm on June 15, 2017, marked a significant shift, with major institutional investors becoming the primary stakeholders. This transition set the stage for subsequent changes driven by market dynamics and strategic decisions. Understanding who owns Essity is crucial for investors and stakeholders alike.

The ownership structure of Essity has largely been shaped by the trading activities of institutional investors. These investors adjust their portfolios based on market conditions, company performance, and sector outlook, which can influence company strategy and governance. The company's annual reports provide detailed breakdowns of its largest shareholders, offering insights into the evolving ownership landscape. Examining the Essity ownership structure reveals the key players and their influence.

| Event | Date | Impact on Ownership |

|---|---|---|

| Spin-off from SCA | June 15, 2017 | Initial public offering; Institutional investors became primary shareholders. |

| Market Fluctuations | Ongoing | Trading activities of institutional investors lead to shifts in shareholding. |

| Annual Reports | Annually (e.g., early 2025 for 2024 data) | Provide detailed breakdowns of largest shareholders, offering insights into ownership. |

As of April 30, 2025, Essity's ownership is primarily held by institutional investors. Industrivärden remains a significant long-term shareholder, holding a substantial portion of both A and B shares. Other major investors include mutual funds, pension funds, and asset managers like BlackRock and Vanguard. These institutional investors often engage with management on topics such as sustainability and financial performance. The Essity company ownership structure highlights the influence of these key stakeholders.

Essity is primarily owned by institutional investors, with Industrivärden as a major long-term shareholder.

- The ownership structure has evolved since the spin-off from SCA in 2017.

- Major institutional investors include BlackRock and Vanguard.

- Changes in ownership are driven by market activities and investor decisions.

- Understanding who owns Essity is vital for stakeholders.

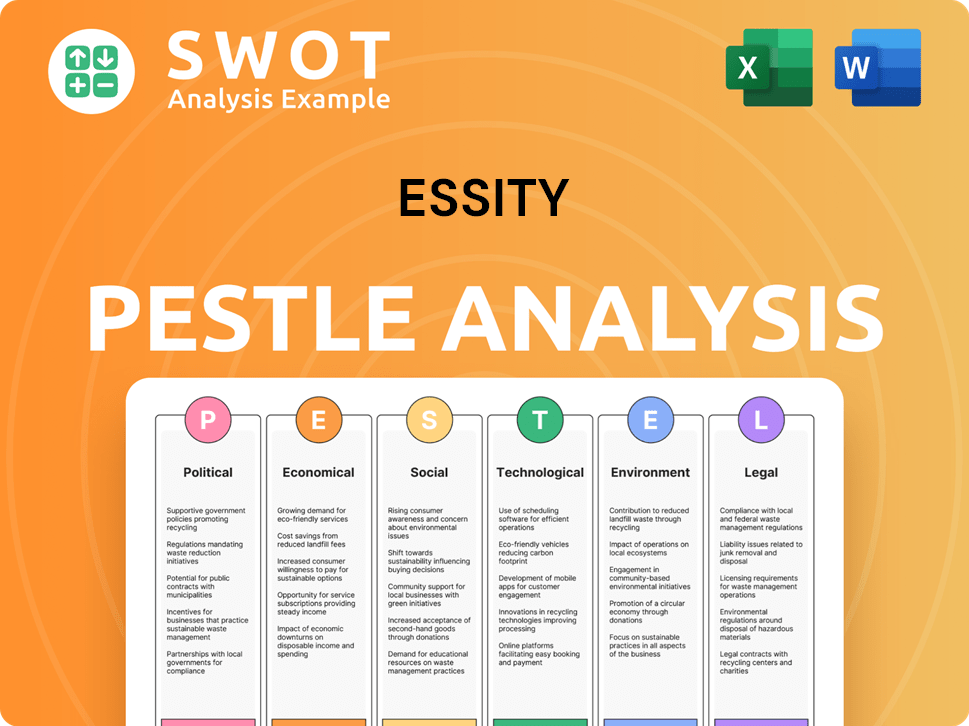

Essity PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Essity’s Board?

Understanding the Essity owner structure is key to grasping its operations. As of early 2025, the Board of Directors at Essity AB (publ) typically includes representatives from major shareholders and independent directors. This composition ensures a blend of perspectives and expertise, crucial for strategic decision-making and effective governance. The Chairman of the Board plays a vital role in guiding strategic decisions.

The board's composition reflects a balance, often including members from significant shareholders such as Industrivärden. This setup aims to balance various interests and maintain a long-term focus, which is essential for the sustained success of Essity brands.

| Board Member | Role | Notes |

|---|---|---|

| Magnus Groth | Chairman of the Board | Oversees strategic direction and governance. |

| (To be updated with current board members as of early 2025) | Board Member | Represents major shareholders or independent expertise. |

| (To be updated with current board members as of early 2025) | Board Member | Contributes to diverse perspectives and expertise. |

Essity company ownership structure involves a dual-class share system, common in Sweden. A-shares have more voting power than B-shares. This structure allows significant shareholders like Industrivärden to maintain control over strategic decisions, even if their capital percentage is lower than combined B-shareholders. This setup supports long-term strategic planning.

Who owns Essity is a question answered by looking at its board and share structure.

- The board includes representatives from major shareholders and independent directors.

- A-shares have more voting power than B-shares.

- This structure supports long-term strategic planning.

- The company prioritizes transparency and adheres to corporate governance codes.

Essity Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Essity’s Ownership Landscape?

Over the past few years, the ownership of the Essity company has seen gradual evolution, driven mainly by institutional investment trends. The focus on sustainable growth and innovation has kept the company attractive to investors. The 2024 Annual Report, released in early 2025, provides the most current details on the shareholder base, including the largest institutional holders and their ownership percentages. This indicates a stable ownership structure, with no significant shifts in control.

Industry trends, such as the rise of ESG investing, have likely played a role in attracting and retaining investors for Essity, given its commitment to sustainability. This aligns with the growing demand from institutional investors for companies with strong ESG profiles. While mergers and acquisitions in the hygiene and health sector could potentially lead to ownership changes, no major events have significantly impacted Essity's overall ownership structure recently. The company's consistent performance and dividend policy also contribute to its attractiveness to long-term investors.

Essity's ownership structure has remained relatively stable, with institutional investors holding a significant portion of the shares. This stability is typical for a large, publicly traded company. The company's focus on sustainable practices and financial performance attracts and retains investors.

The 2024 Annual Report will provide the most current details on Essity's major shareholders. Typically, these include large institutional investors. The ownership percentages of these key shareholders are crucial for understanding the control and direction of the company.

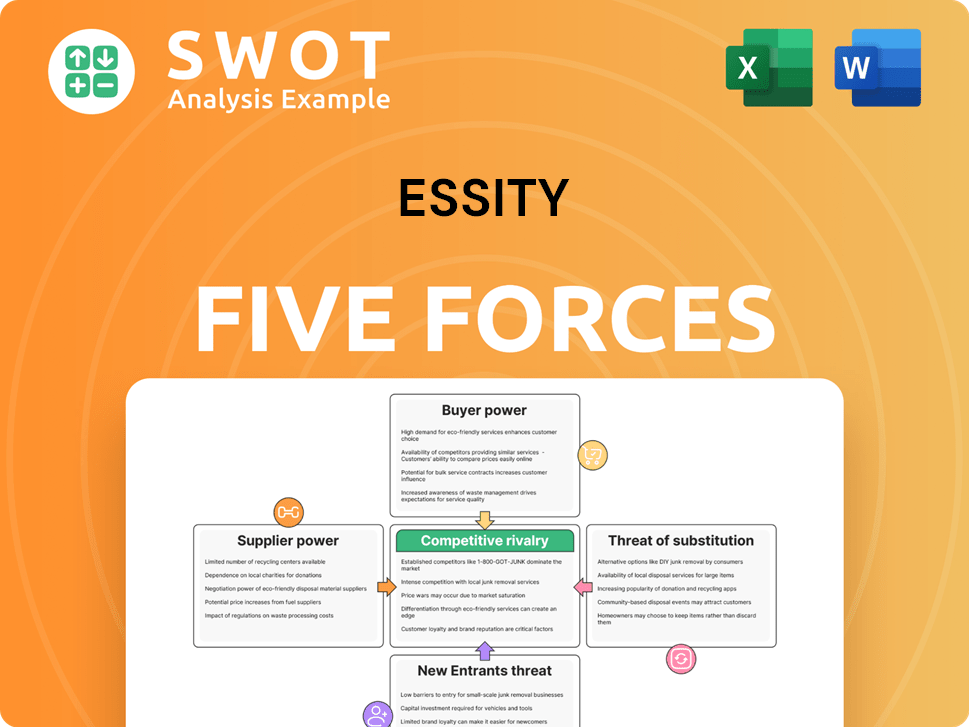

Essity Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Essity Company?

- What is Competitive Landscape of Essity Company?

- What is Growth Strategy and Future Prospects of Essity Company?

- How Does Essity Company Work?

- What is Sales and Marketing Strategy of Essity Company?

- What is Brief History of Essity Company?

- What is Customer Demographics and Target Market of Essity Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.