Fox Bundle

Who Really Owns Fox Corporation?

Unraveling the question of "Who owns Fox Company?" is key to grasping the influence and direction of this media behemoth. Established in 2019, Fox Corporation emerged after a significant Disney acquisition, reshaping the media landscape. This streamlined entity, headquartered in New York City, is built upon the legacy of Rupert Murdoch's vision for a powerful media empire.

The Fox SWOT Analysis reveals how the company's ownership structure, largely controlled by the Murdoch family, impacts its strategic decisions. Understanding the current owner of Fox Corporation, its subsidiaries, and the history of Fox Company ownership is vital for anyone seeking to analyze the power dynamics within this media giant. This exploration will delve into the intricate details of Fox Corporation's shareholder structure and the influence of key stakeholders, offering insights into who controls Fox News and Fox Entertainment ownership.

Who Founded Fox?

The roots of Fox Corporation, the media giant, trace back to Rupert Murdoch's vision and the companies he built. The current structure, established in 2019, is a direct descendant of Murdoch's earlier ventures, including News Corporation and 21st Century Fox. Understanding the ownership structure requires looking back at the foundation Murdoch laid.

Rupert Murdoch, a media mogul, significantly shaped the media landscape. He started in newspapers before expanding into television and film. His goal was to create a global media powerhouse. The initial ownership structure of Murdoch's companies was primarily within the Murdoch family.

Murdoch maintained control through a dual-class share structure. This mechanism gave the Murdoch family disproportionate voting power. Early investors often held non-voting or limited-voting shares. The Murdoch family's dominant voting power has been a consistent theme.

Rupert Murdoch's influence is central to understanding Fox Corporation's ownership. He built a media empire from the ground up. His strategic decisions continue to shape the company.

The dual-class share structure was key to Murdoch's control. This structure allowed the family to retain significant voting power. It ensured the family's influence over the company's direction.

Early investors played a role in funding Murdoch's ventures. They often held shares with limited voting rights. This structure allowed Murdoch to maintain control.

News Corporation, founded in 1980, was the starting point. This company formed the foundation for later ventures. It marked the beginning of Murdoch's media empire.

21st Century Fox emerged as a key entity. It built upon the foundation of News Corporation. This company was instrumental in expanding Murdoch's reach.

Fox Corporation, as it exists now, is the result of this evolution. It reflects Murdoch's long-term vision. The current structure is a continuation of his strategy.

Understanding the ownership of Fox Corporation involves looking at its history and the role of the Murdoch family. The Murdoch family's control has been a constant. This control is maintained through a dual-class share structure.

- Fox Company ownership is largely influenced by the Murdoch family's holdings.

- The dual-class share structure gives the Murdoch family significant voting power, even with a smaller economic stake.

- Early investors often held non-voting shares, reflecting the founder's desire for control.

- The evolution from News Corporation to 21st Century Fox to the current Fox Corporation demonstrates the continuity of Murdoch's influence.

- For more insights into the company's audience, consider reading about the Target Market of Fox.

Fox SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Fox’s Ownership Changed Over Time?

The ownership structure of Fox Corporation, a major player in the media industry, has been significantly shaped by a pivotal transaction in 2019. This involved the divestiture of a substantial portion of 21st Century Fox to The Walt Disney Company for roughly $71.3 billion. This deal saw Disney acquire key assets, including film and television studios, as well as cable networks such as FX and National Geographic. The remaining assets, which primarily consisted of Fox News, Fox Sports, and the Fox Broadcasting Company, were then spun off to form the new Fox Corporation.

The Murdoch family continues to hold considerable influence over Fox Corporation. This is primarily achieved through their ownership of Class B common stock, which provides superior voting rights. As of September 30, 2023, K. Rupert Murdoch beneficially owned approximately 39.5% of the Class B Common Stock. Institutional investors also hold significant stakes in the Class A common stock. These shareholders, which include investment management firms and mutual funds, do not typically challenge the Murdoch family's voting control due to the dual-class share structure.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Disney Acquisition of 21st Century Fox Assets | 2019 | Led to the formation of the new Fox Corporation, focusing on news and sports. |

| Spin-off of Fox Corporation | 2019 | Resulted in the creation of a separate, publicly traded company. |

| Murdoch Family Control | Ongoing | Maintains significant voting power through Class B common stock ownership. |

As of early 2025, the market capitalization of Fox Corporation reflects its status as a major media entity. Its Class A shares trade on the Nasdaq Global Select Market under the ticker symbol 'FOXA,' while its Class B shares trade under 'FOX.' Understanding the dynamics of Fox Company ownership is crucial for investors and stakeholders alike. The company's current ownership structure highlights the interplay between family control and institutional investment in the media landscape.

The Murdoch family retains significant control over Fox Corporation through their Class B shares.

- Disney's acquisition of 21st Century Fox assets reshaped the company's structure.

- Institutional investors hold substantial stakes, primarily in Class A shares.

- The dual-class share structure allows the Murdoch family to maintain voting power.

- Fox Corporation's market capitalization reflects its position as a major media player.

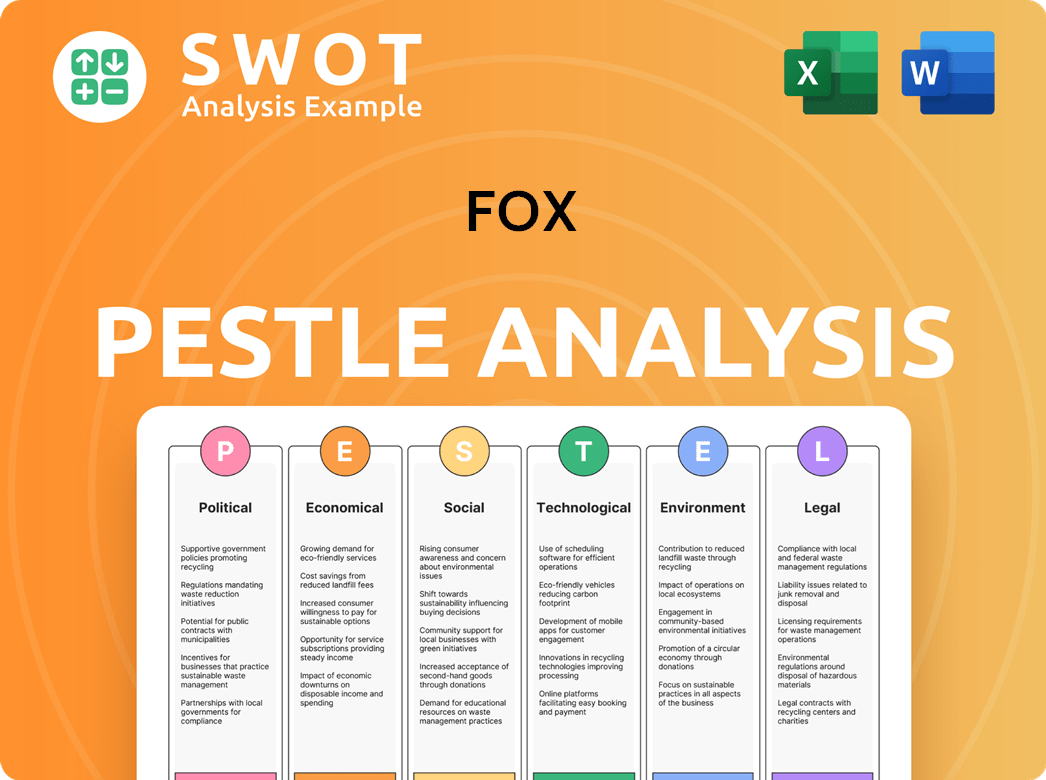

Fox PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Fox’s Board?

The Board of Directors of Fox Corporation oversees the company's operations and strategic direction. The board includes a combination of Murdoch family members, long-term associates, and independent directors. Lachlan Murdoch currently holds the position of Executive Chair and Chief Executive Officer, highlighting the family's significant influence in both the operational and strategic aspects of the company. Understanding the Revenue Streams & Business Model of Fox can further illuminate the board's strategic priorities.

The composition of the board reflects the ownership structure, with key decisions often aligning with the Murdoch family's interests. The board's role is crucial in managing the company's diverse media holdings, including Fox News and Fox Entertainment. The board's decisions directly impact the company's financial performance and strategic direction, making it a central element in understanding Fox Corporation's overall operations.

| Director | Title | Notes |

|---|---|---|

| Lachlan Murdoch | Executive Chair and CEO | Son of Rupert Murdoch, significant voting power |

| Rupert Murdoch | Chairman Emeritus | Founder of the company, significant influence |

| Jaime T. Giglio | Lead Independent Director | Oversees independent board functions |

The voting structure of Fox Corporation is designed with a dual-class share system. Class B shares, largely held by the Murdoch family, possess considerably more voting power per share than the publicly traded Class A shares. This structure ensures that the Murdoch family maintains control over key corporate decisions, such as director elections and major strategic initiatives, even if their economic ownership is less than 50%. This arrangement has been a subject of discussion concerning corporate governance and shareholder rights, as it limits the influence of Class A shareholders.

The Murdoch family's control over Fox Corporation is substantial due to the dual-class share structure. This structure gives the family significant voting power, influencing all major decisions. The current owner of Fox Corporation is primarily the Murdoch family, through their significant holdings of Class B shares.

- The Murdoch family controls the majority of voting rights.

- Class B shares have more voting power than Class A shares.

- Lachlan Murdoch is the current CEO, reflecting family influence.

- The board composition reflects the ownership structure.

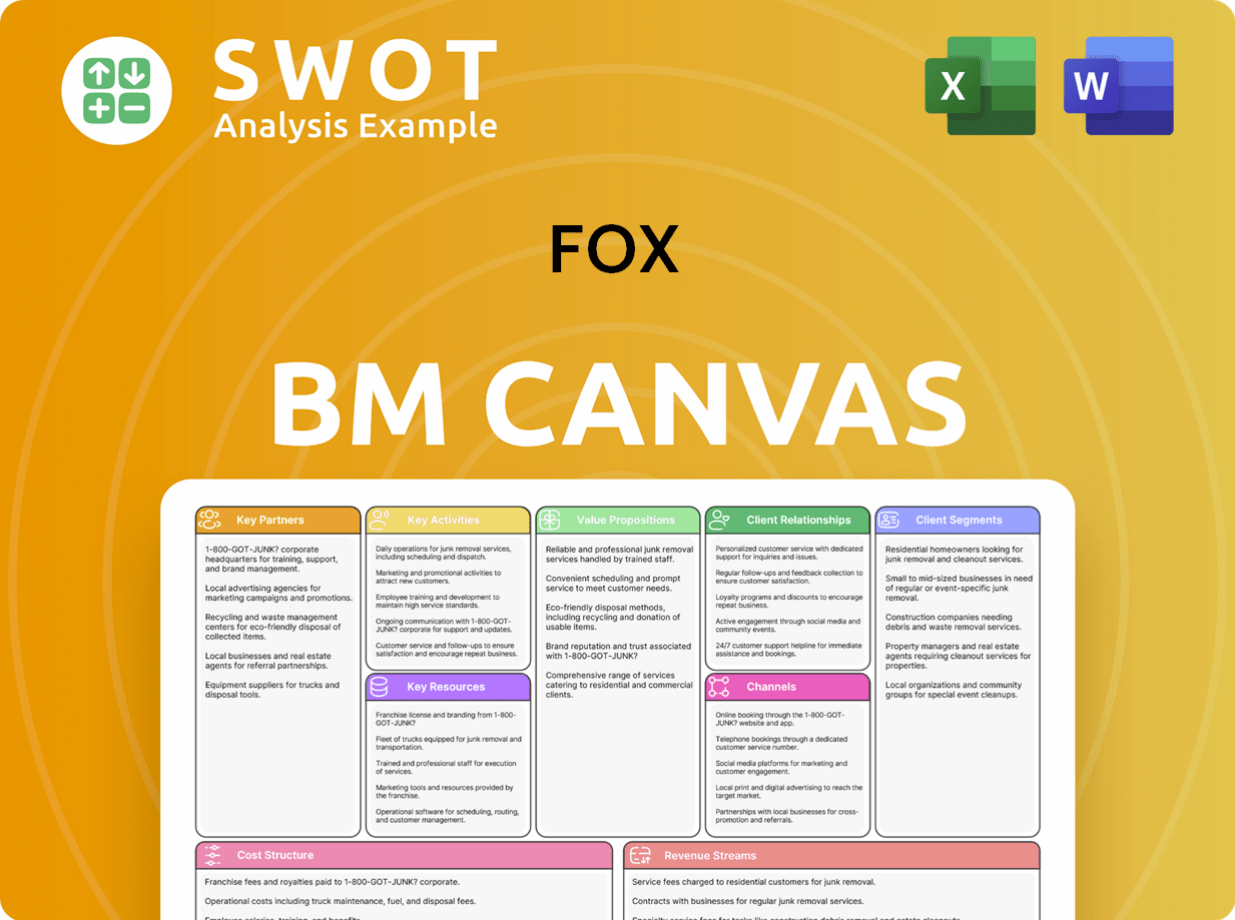

Fox Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Fox’s Ownership Landscape?

In the past few years, the ownership structure of Fox Corporation has remained largely consistent. The Murdoch family continues to exert significant control through a dual-class share structure. This structure grants the family considerable voting power, ensuring their influence over major decisions. Since the 2019 spin-off, the company has focused on its core assets, including news, sports, and broadcast entertainment, without any major shifts in ownership percentages among the primary stakeholders. The Brief History of Fox details the company's evolution.

Industry trends show a general increase in institutional ownership across many public companies, and Fox Corporation's Class A shares reflect this. However, the dual-class structure helps to mitigate the impact of activist investors, a growing trend in other sectors. Discussions around leadership succession within the Murdoch family are ongoing, but these typically revolve around operational roles rather than fundamental changes in ownership control. There have been no public announcements suggesting a privatization or major alteration in the ownership structure, reinforcing the family's long-term commitment.

The Murdoch family retains control of Fox Corporation. The dual-class share structure ensures their significant voting power. This structure helps maintain ownership stability.

Institutional ownership is increasing in Fox Corporation's Class A shares. The dual-class structure limits the influence of activist investors. This trend aligns with broader market patterns.

Discussions about leadership succession are internal to the Murdoch family. These discussions focus on operational roles. There are no indications of ownership structure changes.

No public statements suggest privatization or ownership changes. The Murdoch family's commitment remains strong. The current ownership structure is expected to persist.

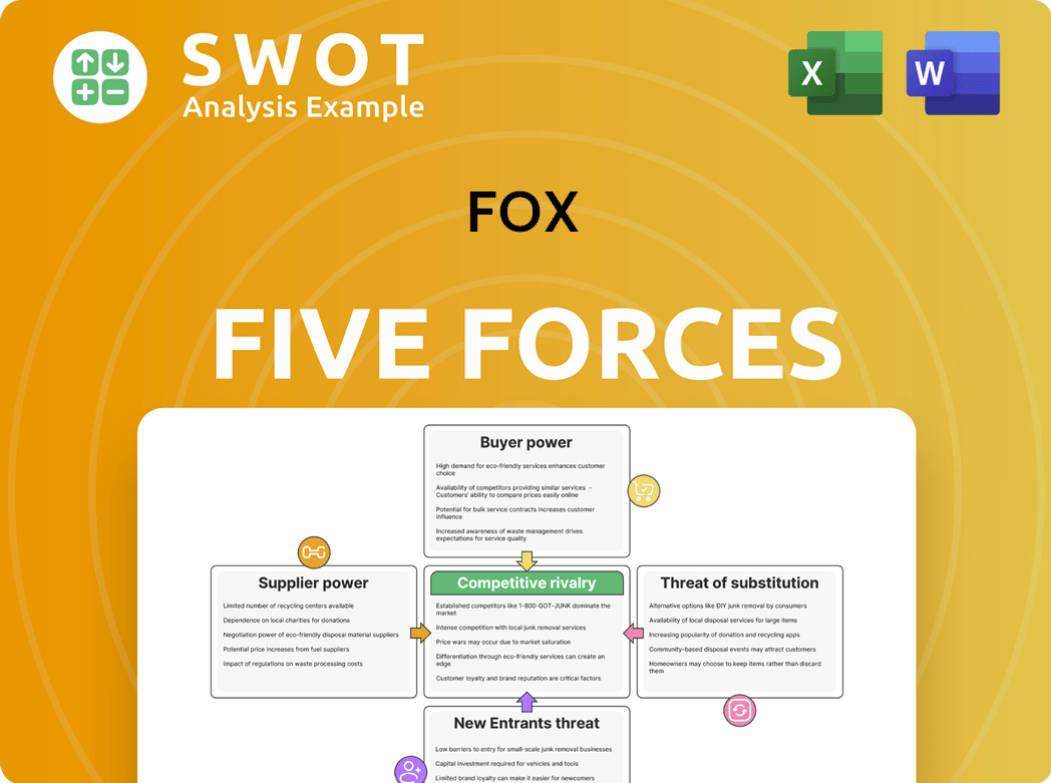

Fox Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fox Company?

- What is Competitive Landscape of Fox Company?

- What is Growth Strategy and Future Prospects of Fox Company?

- How Does Fox Company Work?

- What is Sales and Marketing Strategy of Fox Company?

- What is Brief History of Fox Company?

- What is Customer Demographics and Target Market of Fox Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.