Fox SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

What is included in the product

Analyzes Fox's competitive position through key internal and external factors.

Facilitates interactive planning with a structured, at-a-glance view.

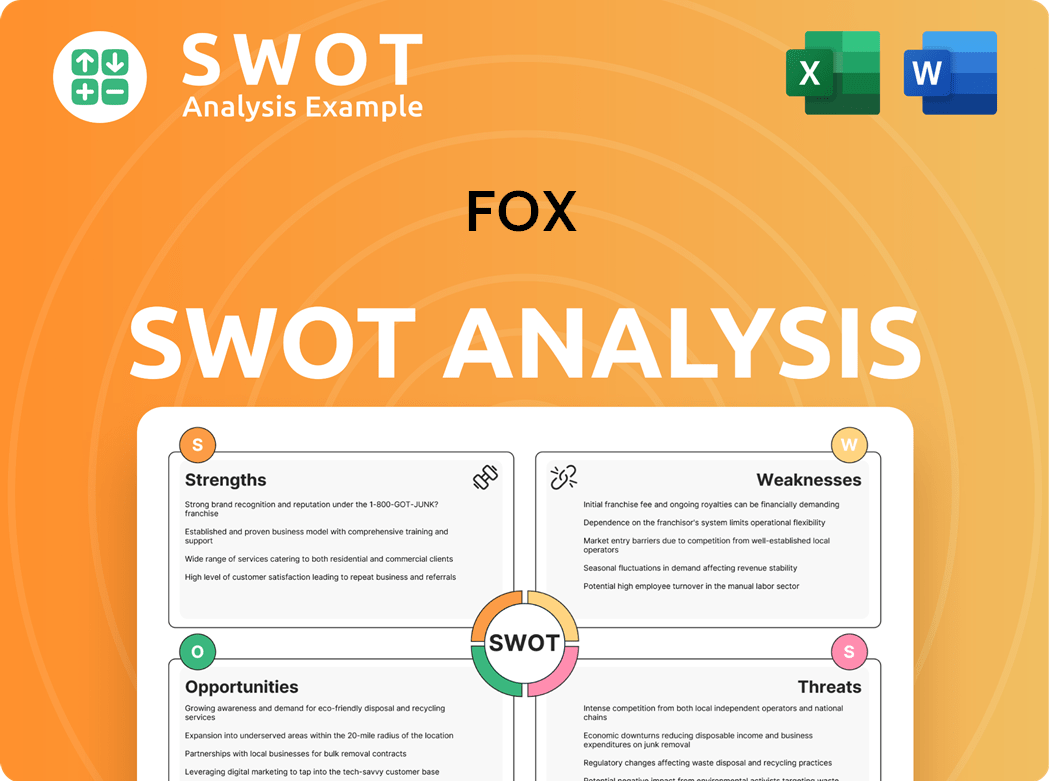

Preview Before You Purchase

Fox SWOT Analysis

Take a look at the actual Fox SWOT analysis document! This preview shows you the same professionally crafted analysis you’ll get upon purchase. Expect the same insightful strengths, weaknesses, opportunities, and threats outlined. Purchase now for full, ready-to-use access.

SWOT Analysis Template

This analysis only scratches the surface of Fox's business landscape. We've touched on some strengths like its content empire and weaknesses such as subscription issues. Consider risks from competition and potential for growth through digital expansion. Understanding these facets is crucial for any market observer. Unlock the complete SWOT analysis for in-depth strategic insights and an editable format to inform smarter planning!

Strengths

Fox Corporation benefits significantly from its strong brand recognition, particularly with Fox News and Fox Sports. These segments attract substantial audiences, giving Fox an advantage in both viewership and advertising revenue. In 2024, Fox News and Fox Sports demonstrated robust viewership, maintaining their positions despite cord-cutting challenges. This strong brand presence is crucial for its market leadership.

Fox Corporation shows resilient financial performance. In Q2 FY2025, revenue hit $5.08B, up 20% year-over-year. Adjusted EBITDA grew 123% to $781M. This highlights a strong business model and effective management, even in a tough media market.

Fox News holds a strong lead in cable news, capturing a significant audience share. In February 2024, the network's viewership was at 62% of cable news viewers. This dominance enables Fox News to charge premium advertising rates. Their market position ensures a steady revenue flow.

Growth in Digital Platforms

Fox's established digital platforms for Fox News and Fox Sports are a major strength. These platforms have a competitive advantage in drawing in viewers and advertisers. Despite cord-cutting, their news and sports divisions maintain sizable audiences. This strong brand recognition supports revenue and market leadership.

- Fox News saw an average of 2.3 million primetime viewers in 2024.

- Fox Sports' digital platforms, like Fox Sports app, saw a rise in users.

- These platforms generate significant advertising revenue.

Valuable Sports Rights

Fox Corporation's ownership of valuable sports rights is a significant strength, contributing to its financial performance. The company's fiscal year 2025 second quarter showed total revenues of $5.08 billion, a 20% increase year-over-year. Adjusted EBITDA reached $781 million, a 123% increase. This demonstrates a strong ability to leverage sports content.

- Resilient earnings even with tough comparisons.

- Revenue increased by 20% in the second quarter of fiscal year 2025.

- Adjusted EBITDA grew by 123% year-over-year.

Fox benefits from strong brand recognition in news and sports, crucial for high viewership and ad revenue. Fox News leads cable news, holding a major audience share and securing premium advertising rates in 2024. Ownership of valuable sports rights contributes significantly to its financial strength.

| Strength | Data | Impact |

|---|---|---|

| Brand Recognition | Fox News primetime viewers in 2024: 2.3 million | Drives revenue |

| Financial Performance | FY2025 Q2 Revenue: $5.08B (+20%) | Shows resilience |

| Digital Platforms | Fox Sports app users increase | Increases user engagement and revenue |

Weaknesses

Fox Corporation's significant reliance on advertising revenue, approximately 40% of its total, presents a key weakness. A downturn in the advertising market could severely affect Fox's financial health. Analysts are projecting potential revenue declines for fiscal year 2026 due to a softening ad environment. Diversifying revenue streams is crucial for mitigating this risk and ensuring sustained financial performance.

Fox's reliance on traditional linear TV faces headwinds from cord-cutting. Cable TV revenue decreased by 8.3% in fiscal year 2023, reflecting this trend. The shift to streaming platforms challenges Fox's existing revenue streams. Adapting the business model is crucial to offset subscription declines.

Fox Corporation confronts persistent legal and regulatory issues. The $787.5 million Dominion settlement in 2023 highlights the financial stakes. Ongoing defamation suits and data misuse claims present further risks. These challenges threaten both reputation and finances, impacting future performance.

Limited International Expansion

Fox Corporation's limited international presence represents a significant weakness, especially given its heavy reliance on advertising revenue. This dependence makes the company vulnerable to fluctuations in the advertising market, which constitutes approximately 40% of its total revenue. A downturn in advertising could severely impact Fox's financial health, with analysts projecting potential revenue declines in fiscal year 2026. Therefore, diversifying revenue streams is essential for mitigating this risk.

- Advertising Dependence: 40% of revenue.

- Projected Revenue Impact: Potential decline in fiscal year 2026.

- Strategic Need: Diversify revenue sources.

Potential Audience Fragmentation

Fox's reliance on traditional linear TV subscriptions presents a weakness. The company is exposed to cord-cutting, with cable television revenue declining. In fiscal year 2023, cable revenue decreased by 8.3%. Adapting to streaming is crucial to offset the decline in traditional TV subscriptions.

- Cord-cutting trends impact traditional TV.

- Cable revenue decreased by 8.3% in 2023.

- Adaptation to streaming is essential.

Fox faces weaknesses due to reliance on advertising, representing about 40% of its revenue. It is subject to declines like the projected revenue impact in 2026. Legal challenges also pose financial risks, exemplified by the $787.5 million Dominion settlement in 2023.

| Weakness | Impact | Data |

|---|---|---|

| Advertising Dependence | Revenue Volatility | 40% of revenue |

| Cord-cutting | Revenue decline | Cable TV down 8.3% in 2023 |

| Legal Issues | Financial Risk | $787.5M Dominion settlement (2023) |

Opportunities

Tubi, Fox's free streaming service, presents a major opportunity. The FAST market is expected to hit $4.1 billion by 2025. Investing in originals and broadening Tubi's reach can boost revenue. In 2024, Tubi's revenue grew significantly.

Fox can grow its digital advertising by capitalizing on its reliable news reputation. As social media shifts, Fox's trustworthy content becomes even more valuable. Data-driven ads and first-party data can boost revenue. In 2024, digital ad spending is projected to reach $246.3 billion in the U.S.

Fox has opportunities for strategic partnerships and acquisitions. For example, in February 2025, Fox acquired Red Seat Ventures to enter the podcast market. Forming partnerships with media or tech companies can boost content and distribution. In 2024, Fox's revenue was approximately $14 billion, showing its financial strength to support such moves. Such strategic moves could potentially increase its market share by 5% within the next year.

Exploiting Sports Betting

Tubi, Fox Corporation's free ad-supported streaming service, presents a major opportunity. The FAST market is expected to hit $4.1 billion by 2025, offering substantial growth potential for Tubi. Investing in original content and expanding Tubi's reach can drive revenue and boost market share. This strategic focus aligns with the evolving media consumption landscape.

- FAST market is projected to reach $4.1 billion by 2025.

- Tubi's expansion can drive revenue and increase market share.

Leveraging Election Year Tailwinds

Fox can capitalize on election-year tailwinds by boosting its digital advertising. With social media shifting from news distribution, Fox's reliable content becomes crucial. Enhancing data-driven advertising and using first-party data will attract more advertisers. This could significantly increase digital advertising revenue. For instance, in 2024, digital ad spending is projected to reach $257 billion.

- Expand digital advertising capabilities.

- Leverage trusted news for content.

- Improve data-driven advertising.

- Increase digital advertising revenue.

Fox's expansion in the FAST market through Tubi is a major opportunity, as this sector is set to reach $4.1B by 2025. Focusing on originals and broadening Tubi's reach boosts revenue and market share.

Digital advertising, driven by reliable news, provides another key opportunity. With $257B in 2024 ad spend projected, data-driven strategies are crucial for increasing revenue. Strategic partnerships and acquisitions offer potential for content and distribution enhancements, supported by Fox's robust financials.

| Opportunity | Strategic Focus | 2024 Data Point |

|---|---|---|

| Tubi Expansion | FAST Market Growth | Projected $4.1B market value |

| Digital Advertising | Data-Driven Ads, Reliable Content | $257B US digital ad spend |

| Strategic Partnerships | Content and Distribution Boost | Fox 2024 Revenue: $14B |

Threats

Fox encounters fierce competition from industry giants like Disney, Comcast, and Warner Bros. Discovery. These rivals vie for audience attention, advertising revenue, and content rights, intensifying market pressures. To stay ahead, Fox must constantly innovate and invest substantially in premium content. In 2024, the media and entertainment sector saw a 5% increase in overall competition.

The cord-cutting trend threatens Fox's cable TV revenue. Streaming's rise demands business model adaptation. Fox faces potential revenue and market share declines. In Q3 2024, Fox's cable revenue decreased by 7% year-over-year. Adapting is crucial for survival.

Regulatory intervention and legal challenges present significant threats to Fox. The company settled for $787.5 million in 2023 due to content disputes. Ongoing legal battles and regulatory shifts could harm finances and reputation. Compliance costs and potential fines are ongoing concerns for Fox. These issues demand careful management to mitigate risks.

Cybersecurity and Data Breaches

Cybersecurity threats pose a significant risk to Fox, potentially leading to data breaches and operational disruptions. Such incidents could compromise sensitive information, including subscriber data and financial records. Data breaches can result in substantial financial losses, damage to reputation, and legal liabilities. The media company needs to invest heavily in robust cybersecurity measures to protect its assets and maintain consumer trust.

- Ransomware attacks increased by 13% in 2023, according to a report by Palo Alto Networks.

- The average cost of a data breach in 2023 was $4.45 million, as reported by IBM.

Economic Uncertainties and Market Volatility

Economic uncertainties and market volatility present substantial threats to Fox. The cord-cutting trend, with consumers favoring streaming, challenges Fox's cable TV. Adapting its business model is crucial to avoid revenue and market share decline. Failing to innovate and meet changing preferences could severely impact Fox.

- Fox's shares fell 6.5% in 2024, reflecting market volatility.

- Cord-cutting accelerated in 2024, impacting traditional TV revenues.

- Streaming services continue to gain market share, posing a threat.

Fox faces fierce competition, with rivals like Disney and Warner Bros. constantly vying for market share. The cord-cutting trend continues, decreasing cable TV revenues and necessitating streaming model adjustments. Regulatory actions and cybersecurity threats also present significant financial and operational risks. Market volatility adds to the uncertainty.

| Threat | Impact | 2024 Data |

|---|---|---|

| Competition | Market share erosion | Media sector competition up 5% |

| Cord-cutting | Revenue decline | Cable revenue down 7% in Q3 |

| Cybersecurity | Data breaches & Financial loss | Average data breach cost: $4.45M |

SWOT Analysis Data Sources

This SWOT draws on financial reports, market data, expert analyses, and news media for data-driven accuracy.