LG Bundle

Who Really Controls LG?

Understanding the LG SWOT Analysis is crucial, but first, consider this: who truly dictates the path of a global powerhouse like LG? From its humble beginnings as Lak Hui Chemical Industrial Corp. in 1947, to its current status as a multinational conglomerate, LG's journey is a fascinating study in corporate evolution. Unraveling the LG company ownership structure reveals the forces shaping its future.

This exploration into LG ownership will illuminate the intricate web of stakeholders influencing LG corporation. We'll examine the roles of the founding family, institutional investors, and public shareholders to understand how these dynamics impact strategic decisions. Furthermore, we'll address key questions like "Who is the owner of LG Electronics?" and "Who are the major shareholders of LG?" to provide a comprehensive view of Who controls LG.

Who Founded LG?

The origins of the LG corporation, initially known as Lak Hui Chemical Industrial Corp., trace back to 1947. The company was established by Koo In-hwoi, who initially focused on plastics and chemical products. Information regarding the precise equity distribution at its inception is not extensively documented, which is typical for private companies of that period.

Koo In-hwoi's control was paramount in the early stages of the company. The company's early expansion was largely financed through its own resources, with the founder's vision and capital playing a crucial role. There is no widely available information about significant early investors or family members acquiring substantial shares during this initial phase.

The company's early structure likely focused on establishing a foundation for a diversified business group. Vesting schedules or buy-sell clauses, common in modern startups, were less prevalent or publicly disclosed for traditional conglomerates like LG during its early years. The founding team's vision, centered on industrial development and consumer goods, was directly reflected in the concentrated control held by Koo In-hwoi, allowing for swift decision-making and strategic diversification into new industries like electronics, which began with GoldStar (now LG Electronics) in 1958.

Koo In-hwoi founded Lak Hui Chemical Industrial Corp. in 1947, the precursor to LG Corp.

The initial focus was on plastics and chemical products.

Koo In-hwoi held the primary ownership and control.

Early growth was primarily self-financed.

The company diversified into electronics with GoldStar in 1958.

There are no notable public records of initial ownership disputes or buyouts that significantly altered the founding ownership structure during its very early years.

The LG company, including LG Electronics, has a complex LG ownership structure. Understanding who controls LG involves examining the historical context of the LG group. The early years, under Koo In-hwoi, set the stage for the LG corporation's future. The company's history and LG company ownership structure have evolved significantly. For a deeper dive into the financial aspects, consider exploring the Revenue Streams & Business Model of LG. The evolution of LG company ownership details is a critical aspect of its story.

The initial ownership of LG was tightly held by the founder, Koo In-hwoi.

- The company's early growth was self-funded, reflecting a family-centric approach.

- The focus was on plastics and chemicals initially, later expanding into electronics.

- There are no significant records of early ownership disputes or major changes in the initial structure.

- The founding structure allowed for swift decision-making and strategic diversification.

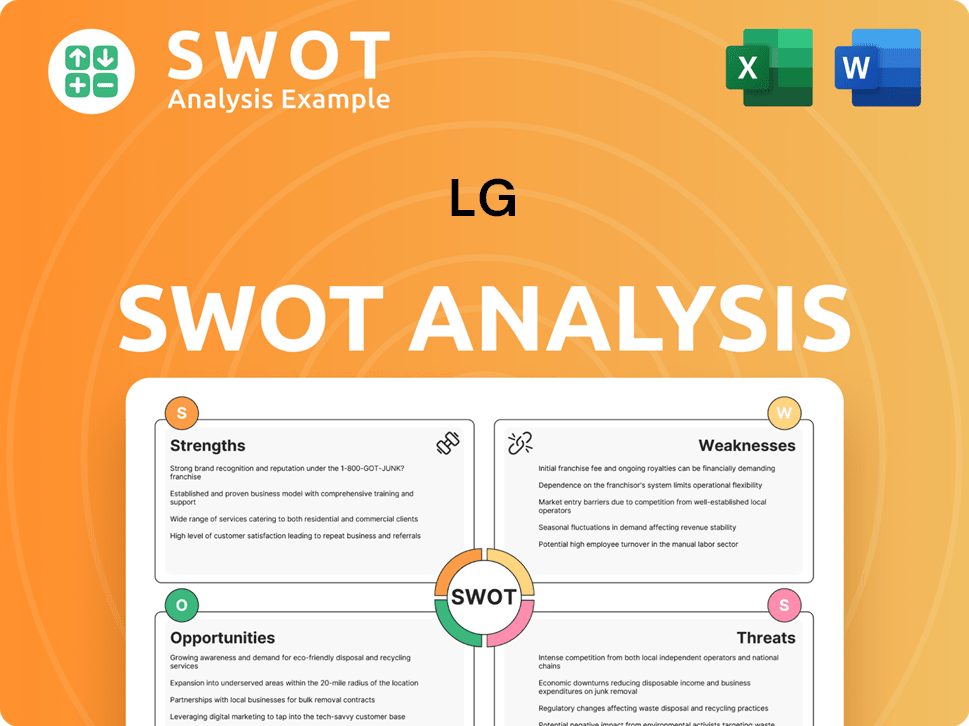

LG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has LG’s Ownership Changed Over Time?

The ownership structure of the LG company, now known as LG Corp., has evolved significantly since its inception. A key event was its transformation into a publicly traded holding company, which allowed for broader investment and increased market visibility. This move was crucial in shaping its current structure and attracting a diverse group of shareholders. The listing on the Korea Exchange marked a pivotal shift, influencing its governance and strategic direction. The Growth Strategy of LG has also been influenced by these ownership changes.

The Koo family's continued influence is another significant factor. Their strategic decisions have been central to LG's trajectory. The family's stake, held through various entities, remains a cornerstone of control. This blend of family leadership and public ownership has shaped LG's approach to innovation and market expansion.

| Year | Key Event | Impact on Ownership |

|---|---|---|

| 1947 | LG founded as Lak-Hui Chemical Industrial Corp. | Initial private ownership by Koo In-hwoi. |

| 1995 | Restructuring into a holding company. | Led to the formation of LG Group, with a more complex ownership structure. |

| 2000s-Present | Public listings and strategic investments. | Increased institutional and public ownership, alongside the Koo family's continued control. |

As of early 2025, the primary shareholders of the LG corporation include the Koo family, with Koo Kwang-mo holding a significant stake. Institutional investors also play a crucial role, with large asset management firms and pension funds collectively holding a substantial portion of the company's shares. For instance, by the end of 2024, institutional investors held approximately 40% of the outstanding shares, contributing to market liquidity. The remaining shares are held by individual investors and other minor shareholders. This mix of ownership ensures a balance between long-term strategic vision and shareholder value, influencing the strategic decisions of the LG group.

The LG company's ownership is a blend of family control and institutional investment.

- Koo family maintains significant control through individual holdings.

- Institutional investors hold a considerable portion of shares.

- Publicly traded on the Korea Exchange.

- Ownership structure impacts strategic decisions.

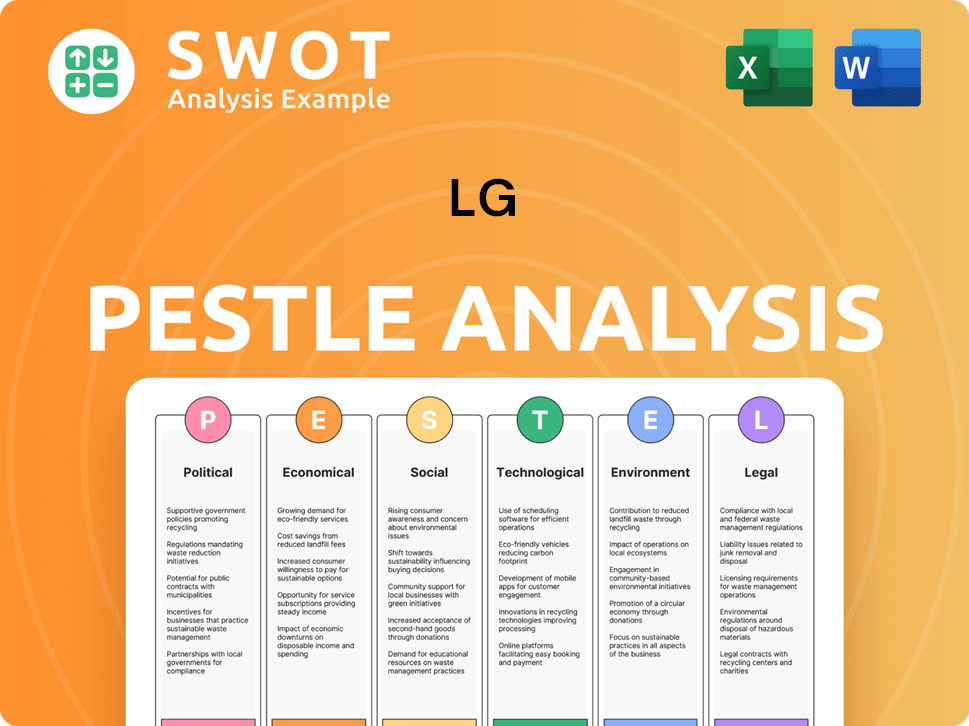

LG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on LG’s Board?

The Board of Directors of LG Corp. oversees the governance of the LG company, balancing family representation, major shareholder interests, and independent oversight. As of early 2025, the board typically includes members of the Koo family, who represent the controlling shareholder group, along with executives from LG's various subsidiaries and independent directors. These independent directors are appointed to ensure transparency and protect the interests of all shareholders, aligning with South Korea's corporate governance best practices. The specific composition of the board, including the full list of members and their affiliations, is regularly disclosed in the company's annual reports and regulatory filings. This structure is crucial for the strategic direction and operational integrity of the LG corporation.

The board's composition reflects a commitment to both family legacy and modern corporate governance. The Koo family's presence ensures continuity and strategic alignment with the long-term vision of the LG group, while independent directors bring diverse expertise and perspectives. This blend is designed to enhance decision-making processes and maintain stakeholder confidence. The board's decisions significantly influence the performance of LG electronics and other subsidiaries, impacting the company's overall financial health and market position. The board's role is vital in navigating the complexities of the global market and ensuring sustainable growth for the LG company.

| Board Member | Affiliation | Role |

|---|---|---|

| Koo Kwang-mo | Koo Family | Chairman |

| Cho Joo-wan | LG Electronics | CEO |

| Lee Jeong-seok | LG Chem | CEO |

LG Corp. operates primarily under a one-share-one-vote structure, where voting power is generally proportional to share ownership. However, the Koo family's significant ownership stake grants substantial control over major corporate decisions, including director appointments and strategic initiatives. While there haven't been major proxy battles, the company faces ongoing scrutiny regarding corporate transparency and shareholder rights. The influence of the founding family is increasingly balanced by the expectations of institutional investors and the market for robust governance frameworks. The Marketing Strategy of LG reflects the board's strategic direction.

The Board of Directors at LG Corp. balances family influence with independent oversight to ensure effective governance.

- The Koo family maintains significant influence through their ownership stake.

- Independent directors are appointed to ensure transparency and protect shareholder interests.

- The company operates under a one-share-one-vote system, but the family's control is substantial.

- Ongoing scrutiny focuses on corporate transparency and shareholder rights.

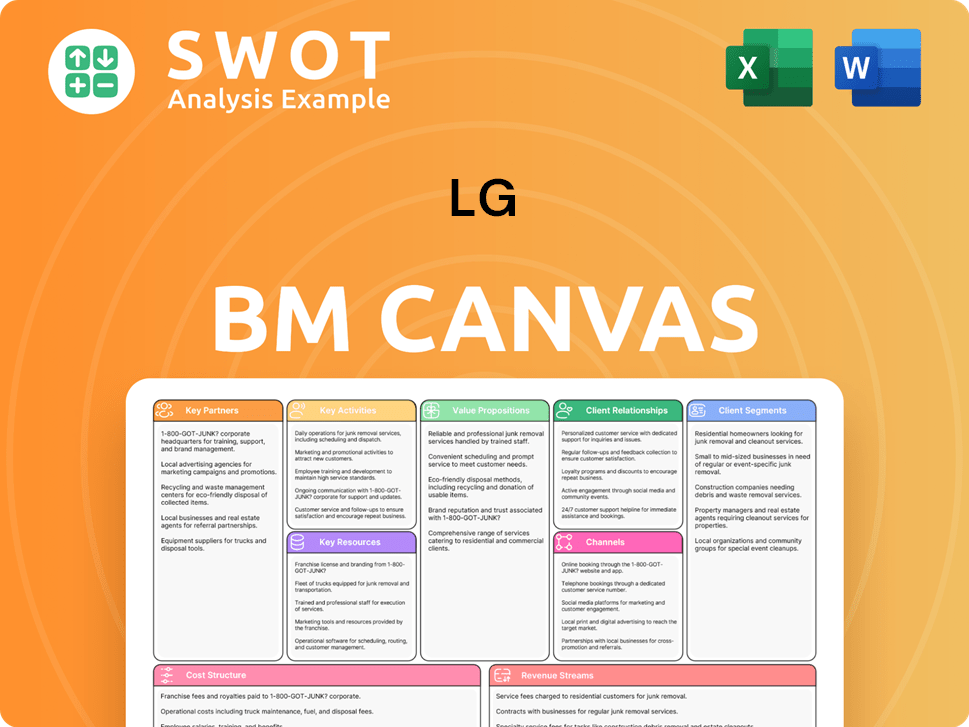

LG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped LG’s Ownership Landscape?

Over the past few years (2020-2025), the ownership landscape of the LG company has seen gradual evolution rather than major upheavals. The LG corporation has focused on strategic adjustments within its subsidiaries, rather than large-scale share buybacks or offerings. For example, decisions regarding LG Electronics, a key subsidiary, have influenced the parent company's valuation.

Industry trends, such as the increasing influence of institutional investors and ESG factors, have subtly shaped LG's ownership dynamics. Institutional investors are increasingly focused on corporate governance and sustainability, impacting investment decisions and shareholder composition. The Koo family has maintained a strong, albeit decreasing, controlling stake in LG Group. There have been no public announcements indicating an imminent privatization or significant shift in the core ownership structure.

The ownership structure of the LG company has remained relatively stable, with the Koo family maintaining a significant controlling stake. This continuity suggests a commitment to the current holding company model. This stability is a key factor for investors.

The LG corporation has been actively making strategic adjustments within its subsidiaries. This includes decisions related to LG Electronics, which have influenced the overall financial performance. These adjustments demonstrate proactive management.

Institutional investors are increasingly focused on corporate governance and sustainability factors, influencing investment decisions. This trend impacts LG's shareholder base. This shift reflects broader market trends.

There have been no public statements indicating an imminent privatization or a significant shift in the core ownership structure. This suggests a continued commitment to the current holding company model. This provides investors with a sense of security.

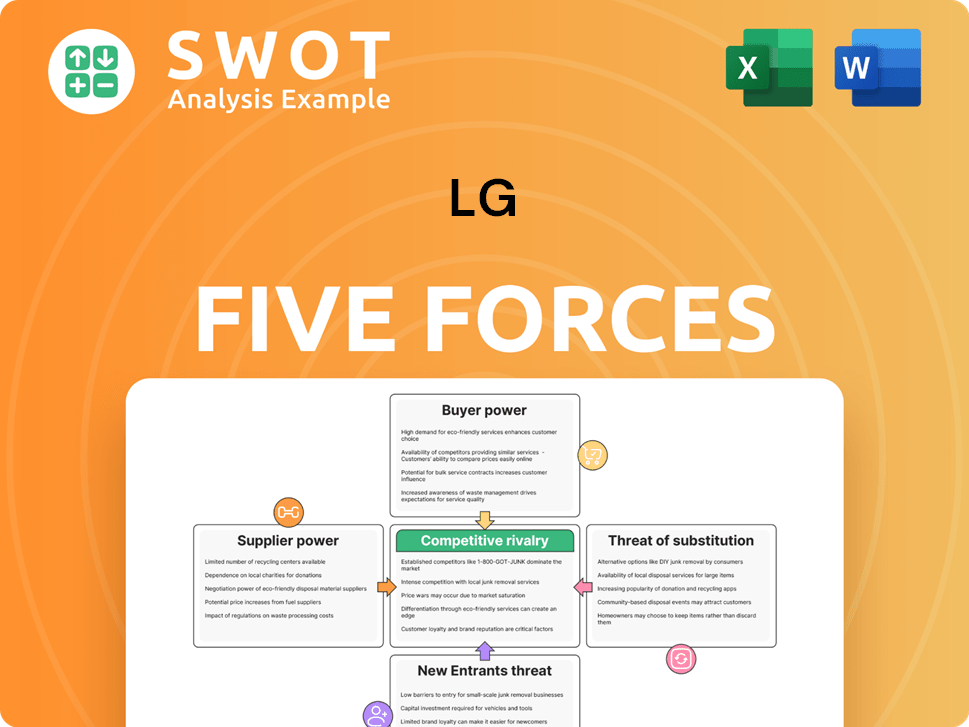

LG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LG Company?

- What is Competitive Landscape of LG Company?

- What is Growth Strategy and Future Prospects of LG Company?

- How Does LG Company Work?

- What is Sales and Marketing Strategy of LG Company?

- What is Brief History of LG Company?

- What is Customer Demographics and Target Market of LG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.