Eli Lilly Bundle

Who Really Controls Eli Lilly?

Delving into the question of "Who Owns Eli Lilly Company?" is essential for anyone tracking the pharmaceutical industry's future. With its massive market capitalization, hovering around $750 billion in early 2025, understanding Eli Lilly's ownership structure is crucial. This knowledge directly impacts how the company navigates critical decisions, from research investments to strategic partnerships.

Eli Lilly's ownership structure, a mix of institutional investors, retail shareholders, and insider holdings, profoundly influences its strategic direction. Knowing who the Eli Lilly SWOT Analysis reveals the interplay of these stakeholders. This exploration of Eli Lilly ownership unveils the forces shaping a pharmaceutical giant, impacting everything from its stock price to its global impact. This deep dive will explore the Eli Lilly shareholders, the Eli Lilly executives, and how these factors influence the company's long-term vision.

Who Founded Eli Lilly?

The foundation of the company, now a global pharmaceutical giant, traces back to 1876 when Colonel Eli Lilly established it. With an initial investment of $1,400, Lilly aimed to revolutionize drug production, which was often unreliable. This marked the beginning of what would become one of the leading pharmaceutical companies in the world.

Early control of the company was firmly within the Lilly family. Eli Lilly's son, Josiah K. Lilly Sr., and later his grandson, Eli Lilly, played crucial roles in the company's growth. Their involvement ensured the continuation of the founder's vision, focusing on quality and scientific advancements.

The company remained privately held by the Lilly family for many years, indicating a concentrated ownership structure. This setup allowed the family to maintain control and guide the company's direction. Early financial backing came from retained earnings and the family's reinvestment, rather than external investors.

Founded in 1876 by Colonel Eli Lilly, a pharmaceutical chemist and Union Army veteran.

Started with an initial investment of $1,400, showing the founder's commitment.

Primarily concentrated within the Lilly family, ensuring family control.

Growth was largely financed through retained earnings and family reinvestment.

Josiah K. Lilly Sr. and Eli Lilly played pivotal roles in the company's development.

Early agreements likely focused on ensuring family control and succession.

Understanding the early ownership of the company provides insight into its long-term strategy and values. The concentrated ownership by the Lilly family set the stage for the company's commitment to quality and innovation. If you want to learn more about the current ownership structure, you can read more about Eli Lilly ownership.

- The company's early success was built on family control and reinvestment.

- The founder's vision for high-quality drugs shaped the company's direction.

- The Lilly family's influence ensured a lasting legacy.

- The company's history shows a commitment to long-term growth and stability.

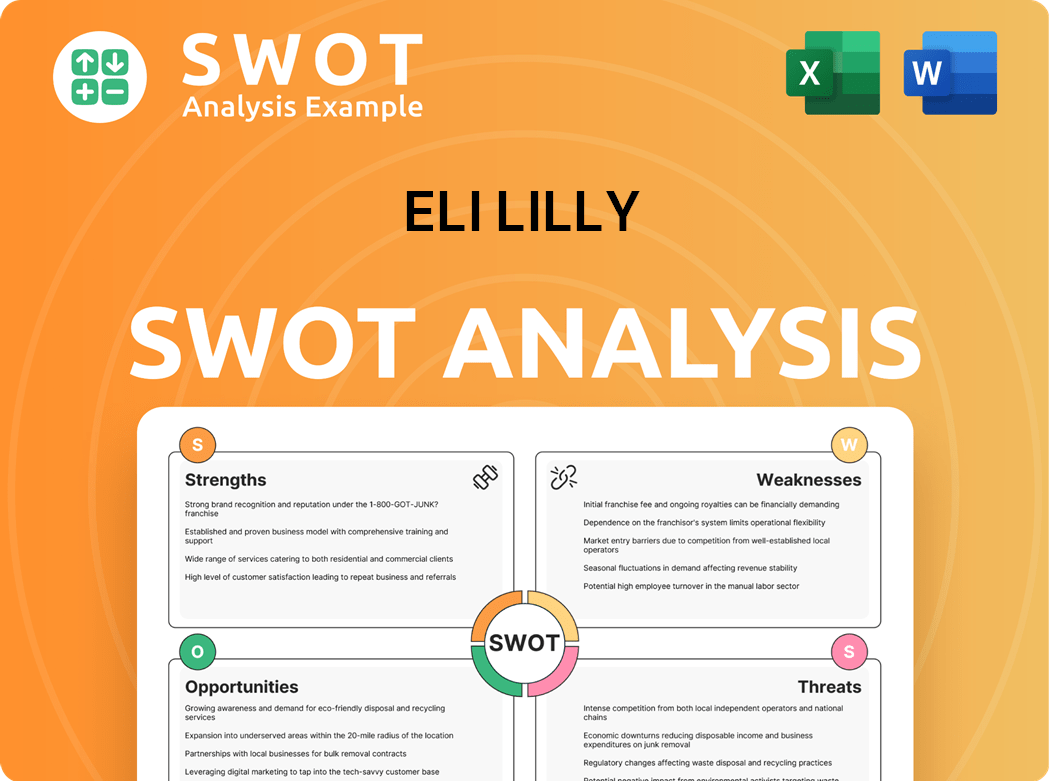

Eli Lilly SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Eli Lilly’s Ownership Changed Over Time?

The evolution of Eli Lilly ownership reflects a significant transformation from its origins as a privately held family business. The pivotal moment came in 1952 with the Initial Public Offering (IPO), which marked a transition to a publicly traded entity. This move opened the door for broader ownership and access to capital markets, fundamentally changing the company's ownership structure.

Over the years, the ownership of Eli Lilly has shifted from a model of concentrated family control to one dominated by institutional investors. This shift has had a profound impact on the company's strategic direction, increasing the emphasis on consistent financial performance and shareholder returns. This change also brought greater scrutiny and adherence to corporate governance best practices.

| Ownership Timeline | Key Events | Impact |

|---|---|---|

| Pre-1952 | Private Family Business | Limited access to capital, concentrated decision-making. |

| 1952 | Initial Public Offering (IPO) | Opened ownership to the public, increased access to capital. |

| Late 20th Century - Early 21st Century | Gradual shift to institutional ownership | Increased focus on shareholder value, enhanced corporate governance. |

As of March 30, 2025, the major shareholders of Eli Lilly include significant institutional investors. The Vanguard Group, Inc. holds approximately 9.53% of the shares, BlackRock Inc. holds about 7.91%, and State Street Corporation holds around 4.54%. Other key institutional holders include Capital Research Global Investors and Fidelity Management & Research Company. These institutional holdings collectively represent a substantial portion of the company's outstanding shares. The company's stock symbol is LLY.

The ownership structure of Eli Lilly is primarily influenced by institutional investors, who hold a significant portion of the company's shares. These large holdings have a substantial impact on the company's strategic decisions and financial performance.

- The Vanguard Group, Inc.: 9.53%

- BlackRock Inc.: 7.91%

- State Street Corporation: 4.54%

- Capital Research Global Investors

- Fidelity Management & Research Company

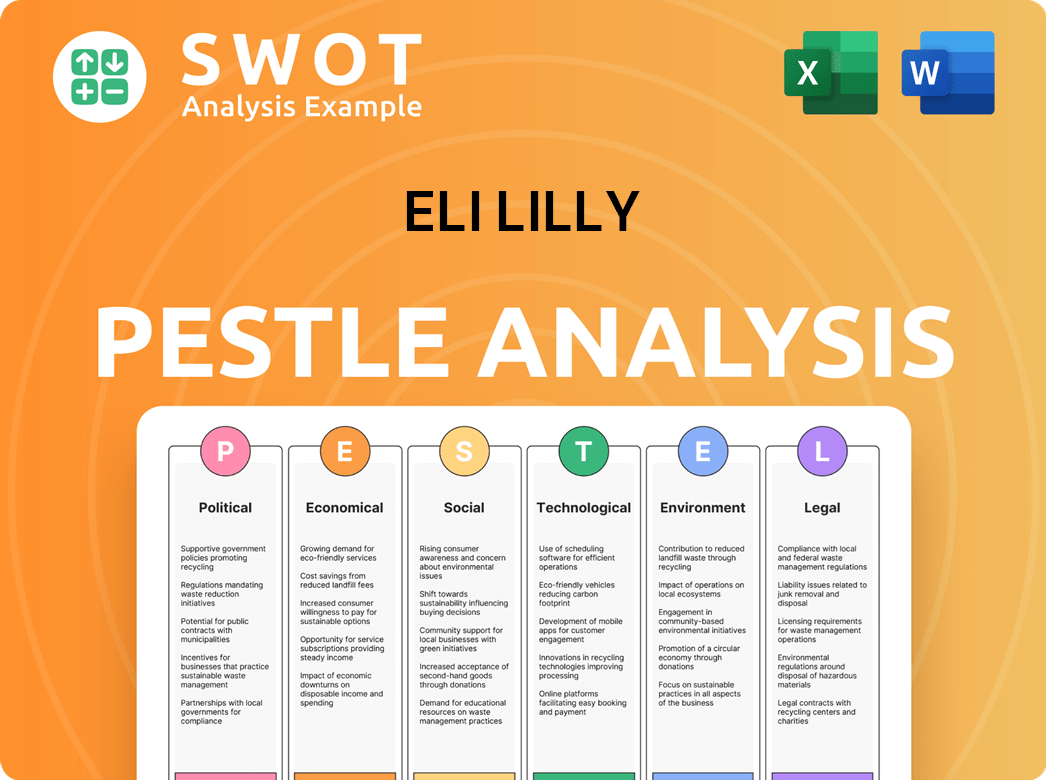

Eli Lilly PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Eli Lilly’s Board?

The current board of directors of the company includes a mix of independent directors and executives. This structure supports corporate governance. Key figures include David A. Ricks, who serves as Chairman of the Board, and David A. Fredrickson, President of Lilly Bio-Medicines. The composition reflects a balance between internal leadership and external oversight, which is common in large public corporations.

The board's role involves strategic oversight and executive compensation. It ensures long-term shareholder value. The board manages critical product launches and pipeline developments. This is a crucial aspect of their responsibilities.

| Board Member | Title | Key Responsibilities |

|---|---|---|

| David A. Ricks | Chairman of the Board | Strategic oversight, shareholder value |

| David A. Fredrickson | President, Lilly Bio-Medicines | Product development, pipeline management |

| Other Independent Directors | Various | Corporate governance, financial oversight |

The voting structure for the company is based on a one-share, one-vote principle. This is typical for publicly traded companies in the United States. There is no public information about dual-class shares or special voting rights. This ensures that voting power aligns with share ownership. This structure helps maintain a stable relationship between ownership and the board. For more information, check out the Competitors Landscape of Eli Lilly.

The board of directors is composed of both executives and independent members, ensuring a balance of perspectives. The company operates under a one-share, one-vote system, which is standard for publicly traded companies. The board focuses on strategic oversight and long-term shareholder value.

- The board structure supports corporate governance.

- Voting rights are proportional to share ownership.

- The board manages strategic initiatives and compensation.

- Major institutional investors exert influence through engagement.

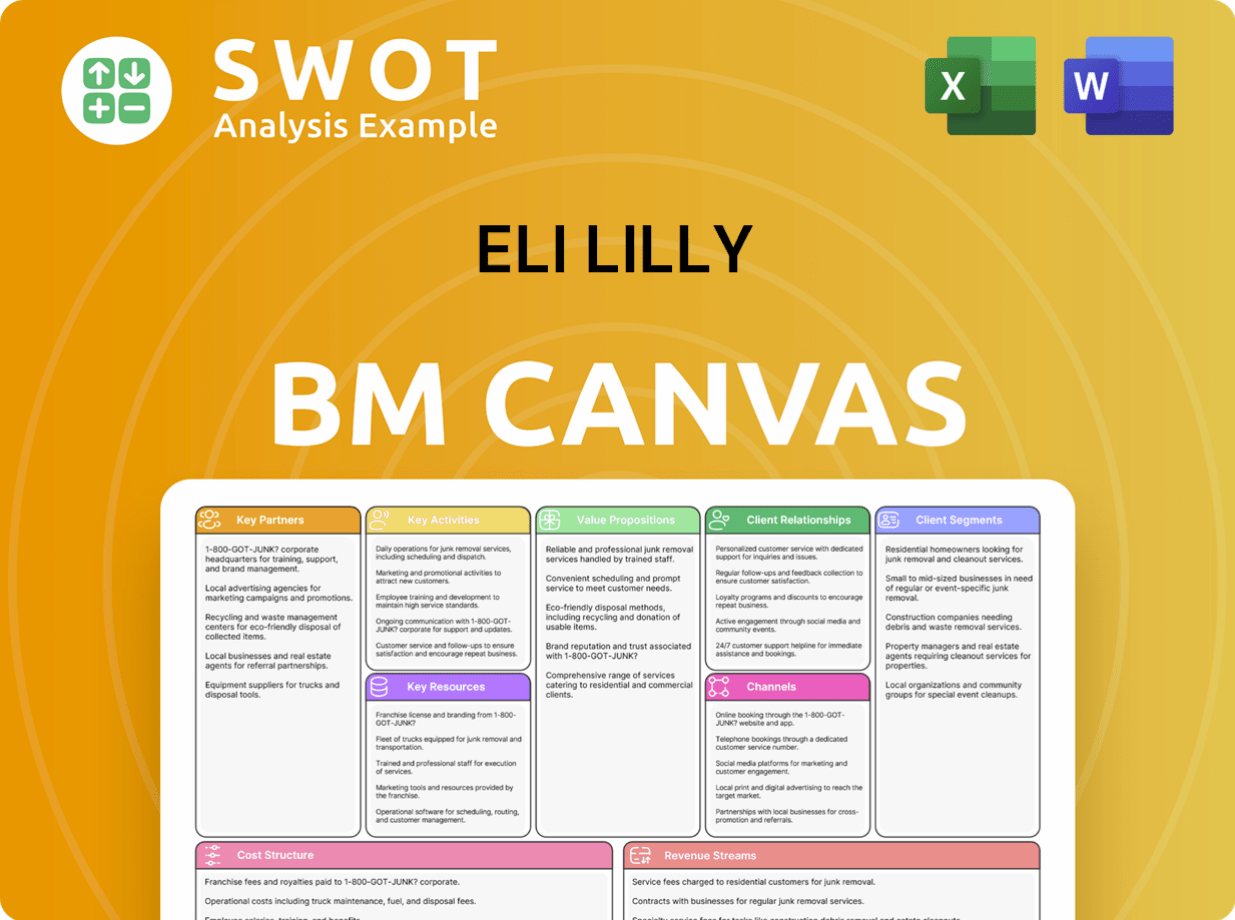

Eli Lilly Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Eli Lilly’s Ownership Landscape?

Over the past few years, the ownership of the company has largely been shaped by consistent trends. The company's strong financial performance and promising drug pipeline, particularly in areas like diabetes and obesity, have driven increased institutional ownership. This has led to significant stock appreciation and inclusion in numerous institutional portfolios and index funds. The company's market capitalization surged to over $750 billion in early 2025, reflecting investor confidence in its growth prospects. This is a testament to the company's strong position in the market and its ability to attract significant investment.

Major asset managers like Vanguard, BlackRock, and State Street continue to be the defining characteristics of the company's ownership. While there haven't been major share buybacks or secondary offerings that drastically altered the ownership structure, these firms have consistently accumulated shares. Leadership changes, such as the continued tenure of CEO David Ricks, have reinforced investor confidence. Industry trends, such as the increasing influence of ESG (Environmental, Social, and Governance) investing, also subtly impact ownership, as institutional investors increasingly consider these factors in their portfolio allocations. For more information, you can read the Brief History of Eli Lilly.

| Ownership Category | Approximate Percentage (2024-2025) | Key Holders |

|---|---|---|

| Institutional Investors | Approximately 75-80% | Vanguard, BlackRock, State Street |

| Individual Investors | Approximately 15-20% | Various retail investors |

| Insiders (Executives & Board) | Less than 1% | David Ricks and other key executives |

The future ownership trends are likely to reflect continued institutional dominance. These large shareholders will continue to scrutinize R&D investment, drug pricing, and global market expansion. The company has not publicly stated plans for privatization, and its strong market position suggests it will remain a prominent public company. Understanding the company's ownership structure is crucial for anyone looking to invest in or analyze the company.

Institutional investors hold the majority of shares, with Vanguard, BlackRock, and State Street being key players. Individual investors and insiders also have a stake in the company. The company's market capitalization is over $750 billion, showing strong investor confidence.

There has been a consistent increase in institutional ownership driven by strong financial performance. The company's drug pipeline and market position contribute to its appeal. ESG investing is also influencing ownership decisions.

David Ricks is the current CEO. The leadership team's strategic vision reinforces investor confidence. The board of directors plays a crucial role in overseeing the company's direction.

Institutional dominance is expected to continue, with ongoing scrutiny from major shareholders. The company is likely to remain a public company. Investors should monitor R&D investment, drug pricing, and global market expansion.

Eli Lilly Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eli Lilly Company?

- What is Competitive Landscape of Eli Lilly Company?

- What is Growth Strategy and Future Prospects of Eli Lilly Company?

- How Does Eli Lilly Company Work?

- What is Sales and Marketing Strategy of Eli Lilly Company?

- What is Brief History of Eli Lilly Company?

- What is Customer Demographics and Target Market of Eli Lilly Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.