Mixi Bundle

Who Really Owns Mixi?

Ever wondered about the forces steering the ship at Mixi, the Japanese tech giant behind the hit mobile game 'Monster Strike' and the social network 'mixi'? Understanding Mixi SWOT Analysis is key to grasping its market position. The ownership structure of a company like Mixi, Inc. is crucial for grasping its strategic direction, influence, and accountability in the dynamic digital entertainment and social networking landscape. A pivotal event that often shapes a company's trajectory is its initial public offering (IPO), which significantly alters its ownership.

This article will dissect the Mixi owner landscape, exploring the Mixi company ownership, including its Mixi shareholders and the Mixi parent company. We'll examine the key stakeholders and how their influence shapes Mixi's future, providing insights for investors and business strategists alike. Knowing who owns Mixi is vital for anyone interested in the company's trajectory and the broader digital entertainment market.

Who Founded Mixi?

The Mixi owner, Kenji Kasahara, founded the company in 1999. Initially, it was established as a limited liability company named E-Mercury, Inc. Kasahara later became the CEO and has been involved in founding other ventures.

In 2000, the company transitioned into a Japanese corporation. Batara Eto played a key role as the sole developer of the social networking site in its early stages. The company's history is rooted in a vision of community entertainment and connections.

Understanding the Mixi company ownership structure involves looking at its origins. While specific equity splits from the founding aren't widely detailed, Kenji Kasahara remains a significant shareholder. Early financial backers and angel investors aren't explicitly named in recent reports.

Founded in 1999 as E-Mercury, Inc., later becoming a Japanese corporation in 2000.

Kenji Kasahara, the founder and CEO, with Batara Eto as the initial developer.

Utilized open-source technologies, including Linux, Apache, MySQL, and Perl.

Specific equity splits at inception are not publicly available, but Kasahara remains a significant shareholder.

Focused on creating a platform for community entertainment and meaningful connections.

Early backers and angel investors are not explicitly named with their initial stakes in the available recent information.

The early days of the company highlight the focus on building a community-driven platform. For more details on the company's evolution, you can refer to this article about the history of the company. The company's early reliance on open-source technologies was crucial to its initial development.

Understanding the Mixi parent company and Mixi shareholders involves knowing its origins and key figures.

- Founded by Kenji Kasahara.

- Early development involved Batara Eto.

- Utilized open-source technology.

- Focus on community and connections.

Mixi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Mixi’s Ownership Changed Over Time?

The ownership structure of Mixi, Inc., has seen several key shifts since its inception. Initially listed on the Mothers section of the Tokyo Stock Exchange in September 2006, the company's listing progressed to the First section and then to the Prime section in April 2022. These moves often reflect the company's growth and increasing adherence to higher regulatory standards.

The company's evolution includes strategic decisions like share buybacks, which have influenced its ownership. These actions, along with the founder's substantial stake, highlight a focus on shareholder value and financial health. Understanding the Growth Strategy of Mixi helps to understand the company's approach to ownership and financial planning.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | September 2006 | Transition from private to public ownership, increased shareholder base. |

| Listing on Prime Section, Tokyo Stock Exchange | April 2022 | Signaled maturity and adherence to stricter regulatory standards. |

| Share Buyback Program | May 10, 2024 | Reduction in outstanding shares, potentially increasing earnings per share and shareholder value. |

As of March 31, 2024, Kenji Kasahara, the founder, held the largest stake in the company, owning 46.26% of the shares. Other significant shareholders included The Master Trust Bank of Japan, Ltd. with 11.64%, and The Bank of New York Mellon 140051 holding 2.94%. Foreign corporations collectively held 19.32% of shares, while individuals and others held 61.98%. The share buyback program announced on May 10, 2024, aimed to repurchase up to 3,750,000 shares by March 31, 2025, demonstrating a commitment to enhancing shareholder returns.

The ownership of Mixi is primarily shaped by its founder and key institutional investors.

- Kenji Kasahara remains the largest shareholder.

- Institutional investors hold significant portions of the company's shares.

- Share buyback programs are used to improve shareholder value.

- Mixi is a publicly traded company on the Tokyo Stock Exchange.

Mixi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Mixi’s Board?

As of June 27, 2024, the board of directors for the company consists of seven members. This includes four internal directors and three outside directors. The presence of outside directors constitutes 42.9% of the board, with the same percentage representing independent directors. The board meets approximately once a month to discuss business strategies and oversee the execution of duties. The term of service for each director is set at one year.

Key figures on the board include Koki Kimura, who serves as President and Representative Director, and Kenji Kasahara, a Director. The company operates under the principle of one share, one vote, for shareholder voting rights. The Brief History of Mixi reveals that Kenji Kasahara holds a significant individual shareholding of 46.26% as of March 31, 2024, which provides him with substantial voting power and influence over company decisions. The board also includes independent outside directors like Satoshi Shima, Akihisa Fujita, and Hiromi Watase, who contribute to audit and supervisory functions.

| Director | Title | Details |

|---|---|---|

| Koki Kimura | President and Representative Director | Key internal director |

| Kenji Kasahara | Director | Significant individual shareholding |

| Satoshi Shima | Independent Outside Director | Contributes to audit and supervisory functions |

A Nomination and Compensation Committee, comprised of outside directors, is in place to enhance transparency and objectivity in director nominations and compensation. In the fiscal year ending March 31, 2024, this committee convened three times to review director evaluations, individual director proposals, and compensation structures. This structure helps to clarify the company's corporate structure and who owns the company, ensuring accountability and strategic oversight. The company's ownership structure is designed to balance internal leadership with external oversight, promoting effective governance.

The board includes both internal and external directors, with a significant shareholder holding substantial voting power. The company's structure focuses on transparency and effective governance. This structure clarifies who owns Mixi and how decisions are made.

- 42.9% of the board are outside directors.

- Kenji Kasahara holds 46.26% of shares.

- The Nomination and Compensation Committee meets to review director compensation.

- The company adheres to a one-share, one-vote principle.

Mixi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Mixi’s Ownership Landscape?

Over the past few years, the focus of the company has been on strategic investments and enhancing shareholder returns. The company had an M&A and business investment program with a budget ranging from ¥30 billion to ¥50 billion from FY3/23 to FY3/25. Actual M&A and investment spend up to FY3/24 totaled ¥5 billion, while ¥15 billion was allocated to share buybacks during the same period. These actions highlight the company's commitment to capital efficiency and shareholder value.

A key trend in the company's ownership is the ongoing share repurchase programs. On May 10, 2024, the company resolved to repurchase up to 3,750,000 shares, representing 5.14% of its total outstanding shares, for up to ¥7,500 million, with the repurchase period ending March 31, 2025. As of July 31, 2024, 147,000 shares had been repurchased under this program. Another buyback program concluded on March 31, 2025, with 5,300 shares acquired for ¥17.47 million. These buybacks are aimed at improving capital efficiency and enhancing shareholder returns. The company's recent moves reflect a dynamic approach to its corporate structure and shareholder relations.

| Date | Action | Details |

|---|---|---|

| May 31, 2024 | Dissolution | Dissolved and liquidated Tech Growth Capital LLP, a specified subsidiary. |

| February 2025 | M&A | PointsBet's board approved a takeover bid from MIXI Australia. |

| March 31, 2025 | Share Repurchase | Concluded a buyback program, acquiring 5,300 shares for ¥17.47 million. |

The company's ownership profile continues to evolve, with an increasing presence of institutional investors. Currently, there are 64 institutional owners, holding over 4 million shares. Major institutional investors include Vanguard Total International Stock Index Fund, Goldman Sachs International Small Cap Insights Fund, and Vanguard Developed Markets Index Fund. The founder's stake remains substantial, but the combination of share buybacks and strategic acquisitions indicates an ongoing evolution in the company's capital allocation strategy. To understand the broader market context, consider exploring the Competitors Landscape of Mixi.

The company's ownership structure is influenced by both founder holdings and institutional investors. Key stakeholders include the founder and major institutional investors.

The ownership of the company is a mix of individual and institutional investors. Share repurchase programs and strategic acquisitions are key factors.

The company’s ownership is evolving, with strategic investments and share buybacks as key components. The company's legal structure impacts ownership.

Major shareholders include institutional investors such as Vanguard and Goldman Sachs. Shareholder returns are a focus of the company's strategy.

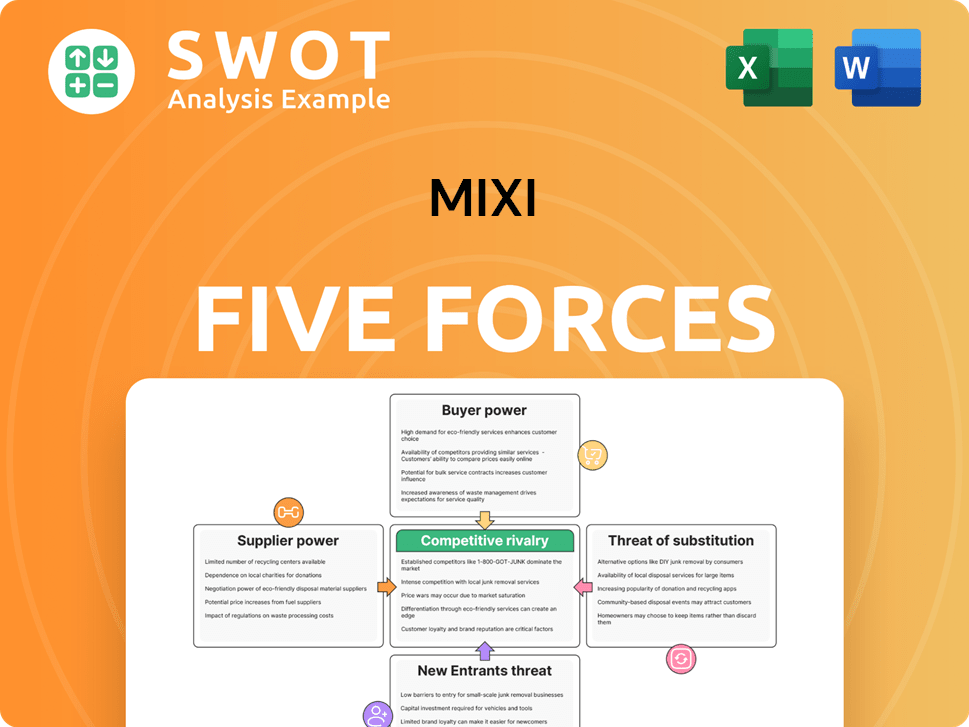

Mixi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mixi Company?

- What is Competitive Landscape of Mixi Company?

- What is Growth Strategy and Future Prospects of Mixi Company?

- How Does Mixi Company Work?

- What is Sales and Marketing Strategy of Mixi Company?

- What is Brief History of Mixi Company?

- What is Customer Demographics and Target Market of Mixi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.