Raiffeisen Bank International Bundle

Who Really Controls Raiffeisen Bank International?

Unraveling the Raiffeisen Bank International SWOT Analysis reveals more than just its strengths and weaknesses; it also highlights the crucial aspect of its ownership. Understanding the intricate web of RBI ownership is key to grasping its strategic priorities and long-term vision. This deep dive into RBI's structure will illuminate the forces shaping its future in the dynamic financial landscape.

The question of "Who owns Raiffeisen Bank International?" is more than a matter of identifying RBI shareholders; it's about understanding the interplay between its cooperative roots and its current status as a publicly traded entity. Exploring the RBI parent company and the distribution of shares provides insight into the bank's governance and decision-making processes. This analysis will examine the key investors, the influence of the board of directors, and the evolution of RBI's ownership profile, offering a comprehensive view of who truly holds the reins.

Who Founded Raiffeisen Bank International?

The origins of Raiffeisen Bank International (RBI) differ from those of a typical corporation. Instead of individual founders, its roots lie in the Raiffeisen cooperative movement, established in the mid-19th century.

Friedrich Wilhelm Raiffeisen in Germany initiated the cooperative system. His vision was to create self-help organizations, primarily credit cooperatives, to provide financial services to rural communities based on principles of self-help, self-responsibility, and self-administration. This cooperative spirit is the foundational ownership principle.

The evolution of RBI can be traced through Raiffeisen Zentralbank Österreich AG (RZB). RZB was the central institution of the Austrian Raiffeisen banking group, which comprised numerous independent regional Raiffeisen banks and their central organizations.

RBI's origins are deeply tied to the Raiffeisen cooperative movement.

Raiffeisen Zentralbank Österreich AG (RZB) played a crucial role in the development of RBI.

The early ownership structure was cooperative, with regional banks as the primary owners.

Ownership was distributed among member cooperatives based on participation.

Agreements focused on cooperative principles to maintain control within the network.

The cooperative movement aimed to serve the financial needs of its members and the broader Austrian economy.

The initial RBI ownership structure was fundamentally cooperative. The regional Raiffeisen banks owned RZB. This meant there were no individual Raiffeisen shareholders with specific percentages. Instead, ownership was distributed among the member cooperatives based on their involvement. This structure emphasized collective ownership and mutual benefit, rather than individual profit. Early agreements focused on cooperative principles, ensuring control remained within the network of member banks. The vision of the founding cooperative movement was directly reflected in this decentralized yet interconnected ownership, aiming to serve the financial needs of its members and the broader Austrian economy. To understand more about the company's strategy, you can read about the Growth Strategy of Raiffeisen Bank International.

Understanding the early ownership of Raiffeisen Bank International is key to grasping its structure and values.

- RBI's roots are in the Raiffeisen cooperative movement, not individual founders.

- Early ownership was cooperative, with regional banks as the primary owners.

- Ownership was based on participation within the cooperative network.

- The focus was on collective benefit and serving the financial needs of members.

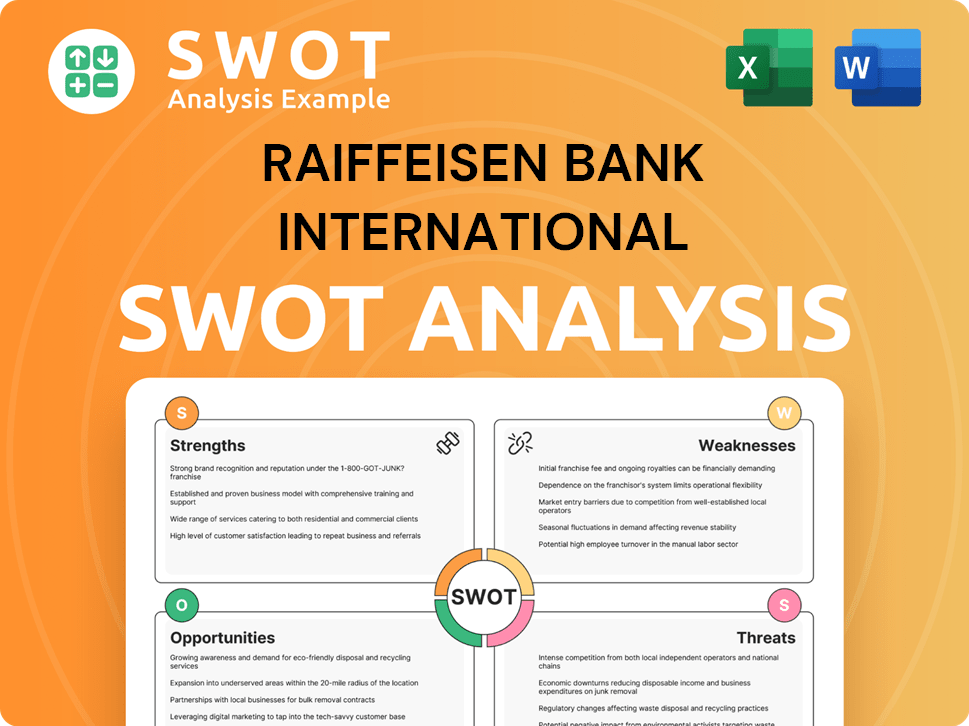

Raiffeisen Bank International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Raiffeisen Bank International’s Ownership Changed Over Time?

The evolution of Raiffeisen Bank International's (RBI) ownership reflects a shift from its cooperative origins to a publicly listed entity. A pivotal moment was the Initial Public Offering (IPO) of Raiffeisen International Bank-Holding AG in 2005. This strategic move provided access to capital markets, supporting expansion, particularly in Central and Eastern Europe (CEE).

In 2010, Raiffeisen International Bank-Holding AG merged with the commercial banking business of Raiffeisen Zentralbank Österreich AG (RZB), creating the current Raiffeisen Bank International AG. This restructuring aimed to streamline the group and improve operational efficiency, setting the stage for its current ownership structure.

| Event | Date | Impact |

|---|---|---|

| IPO of Raiffeisen International Bank-Holding AG | 2005 | Provided access to capital markets, enabling expansion. |

| Merger of Raiffeisen International Bank-Holding AG and RZB's commercial banking business | 2010 | Simplified group structure and enhanced efficiency. |

| Ongoing Public Trading | Ongoing | Allows for wider investor participation and market valuation. |

As of the latest available data in early 2025, the primary major shareholder of Raiffeisen Bank International is Raiffeisen Zentralbank Österreich AG (RZB). RZB's stake typically hovers around 58.8% as of December 31, 2024, underscoring the continued influence of the Raiffeisen cooperative sector. The remaining shares are publicly traded on the Vienna Stock Exchange, held by institutional investors, mutual funds, and individual shareholders. This ownership structure has allowed RBI to pursue growth in its core CEE markets and improve transparency.

Understanding the RBI ownership structure is crucial for investors and stakeholders. The majority stake held by RZB signifies the continued influence of the cooperative model. Public trading allows for wider investor participation and market valuation.

- Raiffeisen Zentralbank Österreich AG (RZB) is the primary shareholder.

- The IPO in 2005 and the 2010 merger were key events.

- Remaining shares are publicly traded on the Vienna Stock Exchange.

- This structure supports growth and transparency.

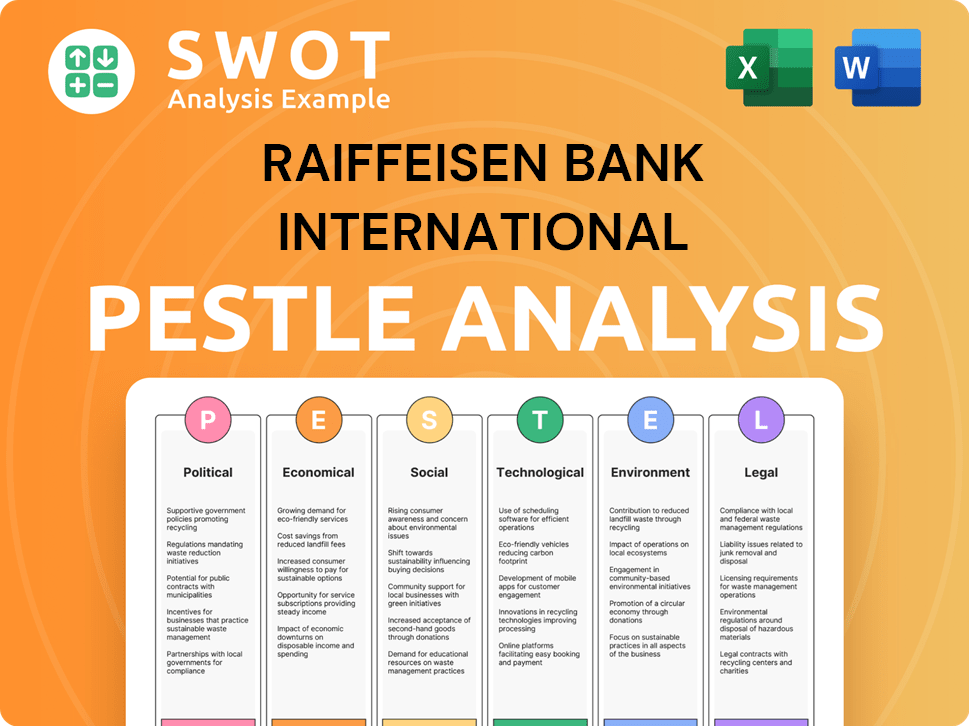

Raiffeisen Bank International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Raiffeisen Bank International’s Board?

The Board of Directors of Raiffeisen Bank International (RBI) oversees the management and strategic direction of the company. As of early 2025, the Supervisory Board, which is responsible for supervising the Management Board, includes representatives from Raiffeisen Zentralbank Österreich AG (RZB), the major shareholder, as well as independent members. The Chairman often has ties to the Raiffeisen cooperative sector, ensuring alignment with the core values and long-term vision. Other board members bring expertise in finance, technology, and international business.

The structure of the board aims to balance the interests of a publicly listed company with the cooperative principles and strategic guidance from its dominant shareholder. The board's composition reflects the bank's unique ownership model and its commitment to both financial performance and the values of the Raiffeisen cooperative system. This structure helps ensure that RBI operates in a way that benefits all stakeholders, including shareholders, customers, and the broader community.

| Board Member | Role | Affiliation |

|---|---|---|

| Johann Strobl | Chairman of the Supervisory Board | Raiffeisen Zentralbank Österreich AG (RZB) |

| Martin Grüll | Deputy Chairman of the Supervisory Board | Raiffeisenlandesbank Niederösterreich-Wien AG |

| Hannes Mösenbacher | Member of the Supervisory Board | Independent |

RBI operates under a one-share-one-vote principle. However, RZB's significant majority stake (approximately 58.8% as of December 31, 2024) grants it substantial control over major decisions. This includes electing Supervisory Board members and approving strategic initiatives. The RBI parent company, RZB, holds considerable influence. This concentration of voting power means that, while there are public Raiffeisen shareholders, RZB maintains outsized control. For more insights into the bank's approach, consider reading about the Marketing Strategy of Raiffeisen Bank International.

RZB's majority ownership gives it significant control over RBI's strategic direction. This ownership structure ensures stability and aligns with the cooperative principles.

- RZB holds approximately 58.8% of the shares.

- One-share-one-vote principle applies to ordinary shares.

- RZB has substantial control over major decisions.

- The governance structure balances public and cooperative interests.

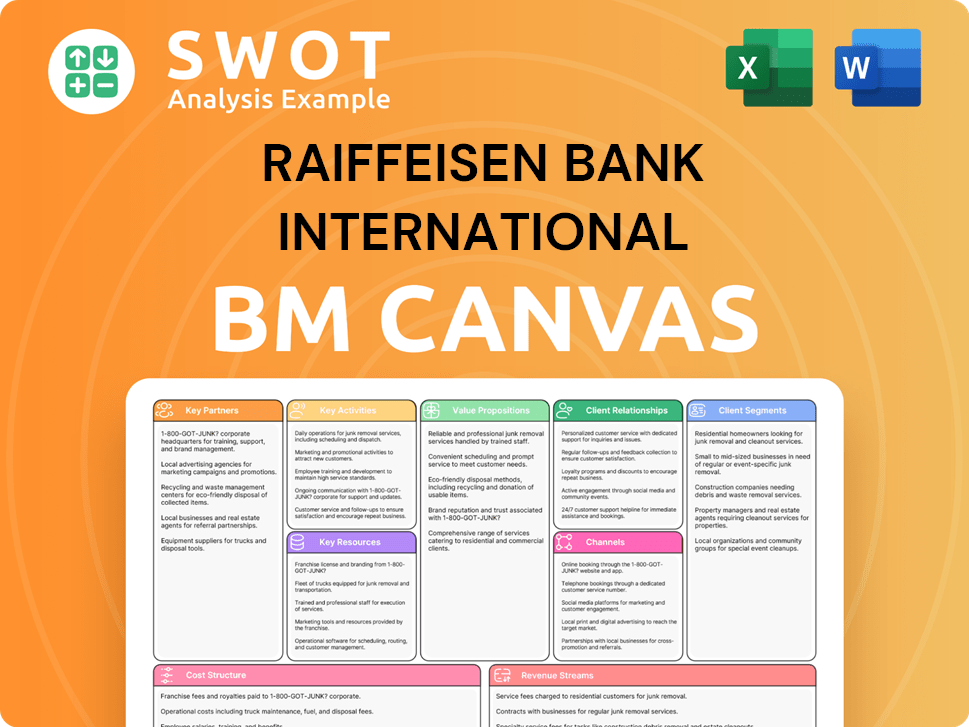

Raiffeisen Bank International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Raiffeisen Bank International’s Ownership Landscape?

Over the past few years, the ownership of Raiffeisen Bank International (RBI) has remained relatively stable. The main driver of this stability is the consistent majority stake held by Raiffeisen Zentralbank Österreich AG (RZB). While there haven't been major shifts in ownership, the bank has engaged in capital management activities. For example, in 2024, RBI announced a share buyback program, which can slightly increase the ownership percentage of the remaining shareholders, including RZB. Furthermore, RBI regularly distributes dividends, reflecting its financial performance and commitment to shareholder returns.

Industry trends have also subtly influenced RBI. Increased institutional ownership and a focus on Environmental, Social, and Governance (ESG) factors are notable. Although RZB's dominant stake limits the direct impact of activist investors, institutional shareholders are increasingly engaging on governance and sustainability issues. There is no public indication of a planned privatization or significant dilution of RZB's stake. Public statements from RBI and analysts emphasize the continued strategic importance of the Raiffeisen cooperative network to the bank's long-term vision and operations in Central and Eastern Europe. The ownership structure is expected to continue reflecting this balance between cooperative heritage and public market participation.

The current RBI ownership structure reflects a blend of cooperative roots and public market participation. RZB's significant holding ensures stability, while other shareholders benefit from the bank's performance through dividends and potential share appreciation. The bank's commitment to capital management, including share buybacks and dividend distributions, is a key aspect of its strategy. As of the latest financial reports, the exact percentage held by RZB and other major shareholders can be found in RBI's official financial statements, which are regularly updated. Understanding the RBI ownership is crucial for anyone interested in the bank's strategic direction and financial performance.

The primary shareholder is Raiffeisen Zentralbank Österreich AG (RZB). Other significant shareholders include institutional investors and retail investors.

The structure balances the cooperative heritage of Raiffeisen with public market participation. RZB's majority stake provides stability.

Share buyback programs and dividend distributions are recent activities that impact shareholder value. Institutional investor engagement is increasing.

The ownership structure is expected to remain relatively stable, with continued focus on capital management and shareholder returns. ESG factors are increasingly important.

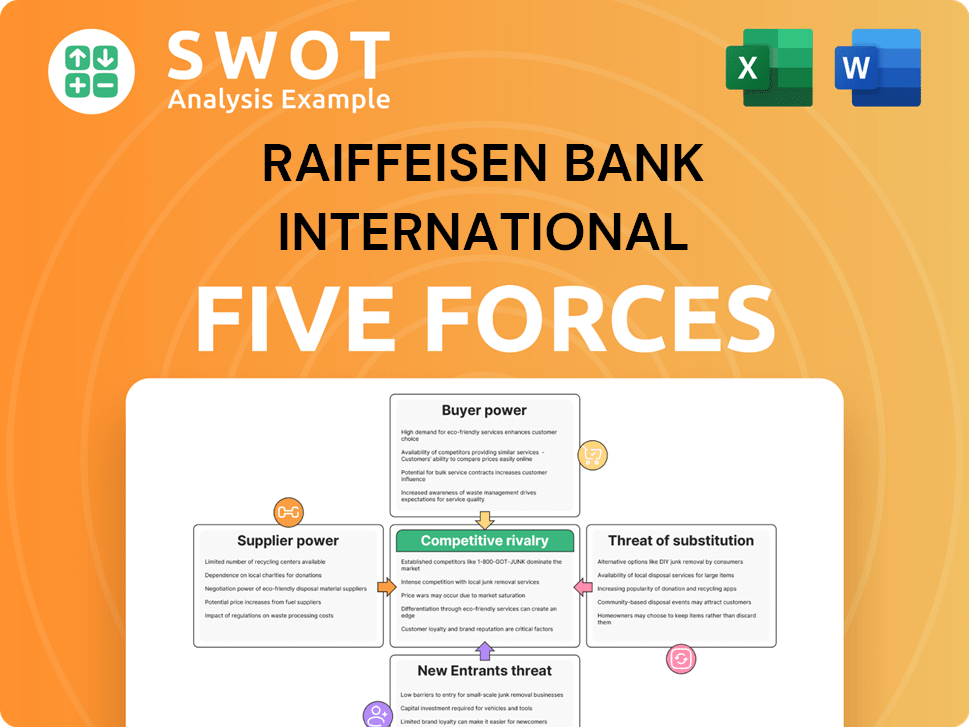

Raiffeisen Bank International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Raiffeisen Bank International Company?

- What is Competitive Landscape of Raiffeisen Bank International Company?

- What is Growth Strategy and Future Prospects of Raiffeisen Bank International Company?

- How Does Raiffeisen Bank International Company Work?

- What is Sales and Marketing Strategy of Raiffeisen Bank International Company?

- What is Brief History of Raiffeisen Bank International Company?

- What is Customer Demographics and Target Market of Raiffeisen Bank International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.