Raiffeisen Bank International Bundle

Who Does Raiffeisen Bank International Serve?

In the ever-evolving landscape of the Raiffeisen Bank International SWOT Analysis, understanding its customer base is crucial. RBI's strategic success hinges on its ability to identify and cater to its target market. This analysis delves into the customer demographics and target market analysis of RBI, revealing the core of its regional dominance.

From its roots in cooperative banking to its current status as a leading financial institution in Central and Eastern Europe, RBI has consistently adapted to the changing needs of its RBI clients. This evolution reflects a deep understanding of its target audience characteristics and the dynamics of the banking industry. This exploration will cover the demographic data of RBI customers, their behaviors, and the strategies RBI uses to maintain its market share.

Who Are Raiffeisen Bank International’s Main Customers?

Understanding the customer demographics and target market of Raiffeisen Bank International (RBI) is crucial for assessing its strategic positioning and growth prospects. RBI's primary focus is on two main customer segments: consumers (B2C) and businesses (B2B). This dual approach allows RBI to serve a wide range of clients across its core markets, particularly in Austria and Central and Eastern Europe (CEE).

For its B2C segment, RBI caters to a diverse group of individuals. These customers seek retail banking services such as savings accounts, loans, and investment products. The specific demographic breakdown varies by country within CEE. However, a significant portion of retail customers are likely middle-income individuals and families. In Austria, RBI's strong corporate and investment banking presence suggests a focus on high-net-worth individuals and sophisticated retail investors as well.

The B2B segment forms a cornerstone of RBI's operations, especially in its corporate and investment banking activities. This segment includes small and medium-sized enterprises (SMEs) and large corporations across various sectors. These business clients require services such as corporate finance, trade finance, and capital markets solutions. RBI's substantial presence in CEE indicates a significant client base among businesses involved in regional trade and economic development. The bank has experienced growth in its corporate lending and investment banking segments, reflecting the economic advancements in its target markets.

RBI's B2C segment includes a broad spectrum of retail customers. These customers use services like savings accounts, loans, and mortgages. The demographic profile varies geographically, with a notable presence of middle-income individuals and families in CEE.

The B2B segment encompasses SMEs and large corporations. These clients require corporate finance, trade finance, and capital markets solutions. Growth in this segment reflects the economic progress in the CEE region, where RBI has a strong presence.

RBI's target market analysis focuses on both retail and corporate clients. The bank strategically tailors its services to meet the diverse needs of its customer base. This includes adapting to the evolving economic landscapes of its operating regions.

RBI's strategic focus includes expanding its services in the CEE region. The bank aims to capitalize on the growing demand for corporate and investment banking services. Digital banking is also a key area for acquiring and serving younger customers.

Over time, RBI has adapted its strategies to capitalize on growth opportunities. For instance, as CEE economies developed, the demand for sophisticated corporate and investment banking services increased, prompting RBI to strengthen its offerings in these areas. Similarly, the rise of digital banking has likely influenced its approach to acquiring and serving younger, digitally-native retail customers. For a deeper dive into RBI's overall growth strategy, consider reading about the Growth Strategy of Raiffeisen Bank International.

RBI's market segmentation strategy is centered on its B2C and B2B customer groups. The bank's ability to cater to both segments is a key driver of its success. Understanding the specific needs of each segment allows RBI to tailor its products and services effectively.

- Retail Banking: Serving individuals with savings, loans, and investment products.

- Corporate Banking: Providing financial solutions to SMEs and large corporations.

- Investment Banking: Offering capital markets solutions and corporate finance services.

- Digital Banking: Focusing on digital channels to reach younger customers.

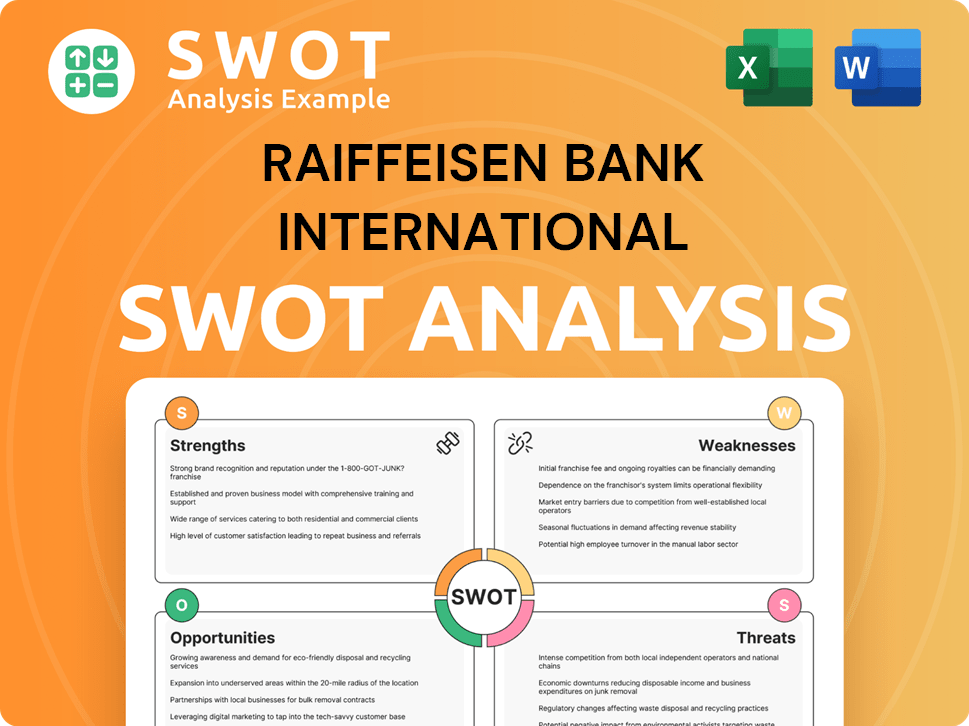

Raiffeisen Bank International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Raiffeisen Bank International’s Customers Want?

Understanding the customer needs and preferences is crucial for Raiffeisen Bank International (RBI) to effectively serve its diverse customer base. This involves a deep dive into the customer demographics and target market analysis to tailor products and services. RBI's success hinges on its ability to meet the varying demands of retail and corporate clients across different regions.

RBI's approach to understanding its customers is multifaceted, considering both universal banking needs and regional specificities. This strategy allows RBI to provide services that resonate with its clients, fostering loyalty and driving business growth. The bank continually adapts its offerings to align with evolving customer expectations and market trends.

For retail customers, convenience, competitive rates, and digital accessibility are key drivers. Many customers prioritize user-friendly mobile banking apps and online platforms for daily transactions. Security and trust are essential, especially in regions with varying financial literacy and economic stability. In 2024, the demand for instant payment solutions continued to grow across Europe, influencing banks like RBI to enhance their digital infrastructure.

Retail customers of RBI prioritize convenience, competitive interest rates, and digital accessibility. They value user-friendly mobile banking apps and online platforms for daily transactions and account management. Security and trust are also paramount for this segment.

Digital accessibility is a critical factor for RBI's retail clients. They seek easy-to-use mobile banking apps and online platforms for various financial activities. The bank's focus on digital infrastructure reflects the growing demand for instant payment solutions.

Security and trust are of utmost importance for RBI's retail customers, especially in regions with varying financial literacy. RBI ensures robust security measures to protect customer data and build confidence in its services.

Corporate clients prioritize efficiency, tailored financial solutions, and expert advisory services. They seek access to capital, risk management tools, international payment capabilities, and specialized sector knowledge. RBI's cross-border services within CEE are a significant draw for these clients.

RBI tailors its offerings based on its regional expertise, for example, offering specific financing options for agricultural businesses in certain CEE countries. Marketing campaigns highlight the bank's strong regional presence and local market understanding.

Feedback from corporate clients drives the development of new financial products and services, such as specialized lending programs for green initiatives or enhanced treasury solutions. This customer-centric approach helps RBI stay competitive.

Corporate clients prioritize efficiency, tailored financial solutions, and expert advisory services. Their decision-making criteria often revolve around access to capital, risk management tools, international payment capabilities, and specialized sector knowledge. RBI's ability to offer cross-border services within CEE is a significant draw for companies operating internationally within the region. Feedback from corporate clients often drives the development of new financial products and services, such as specialized lending programs for green initiatives or enhanced treasury solutions.

RBI's strategy involves understanding the diverse needs of its customers to offer tailored financial solutions. This includes focusing on digital accessibility, security, and regional expertise. The bank leverages customer feedback to improve its offerings and maintain a competitive edge in the banking industry.

- Digital Transformation: Investing in user-friendly mobile banking apps and online platforms.

- Security Measures: Implementing robust security protocols to protect customer data.

- Regional Focus: Tailoring services to meet local market dynamics and regulatory requirements.

- Product Innovation: Developing new financial products based on customer feedback.

RBI tailors its offerings by leveraging its regional expertise. For example, it might offer specific financing options for agricultural businesses in certain CEE countries or develop digital tools localized to the linguistic and regulatory requirements of each market. Marketing campaigns are often designed to highlight the bank's strong regional presence and its understanding of local market dynamics, appealing to both the practical and aspirational drivers of its customer segments. To learn more about RBI's strategic direction, consider reading about the Growth Strategy of Raiffeisen Bank International.

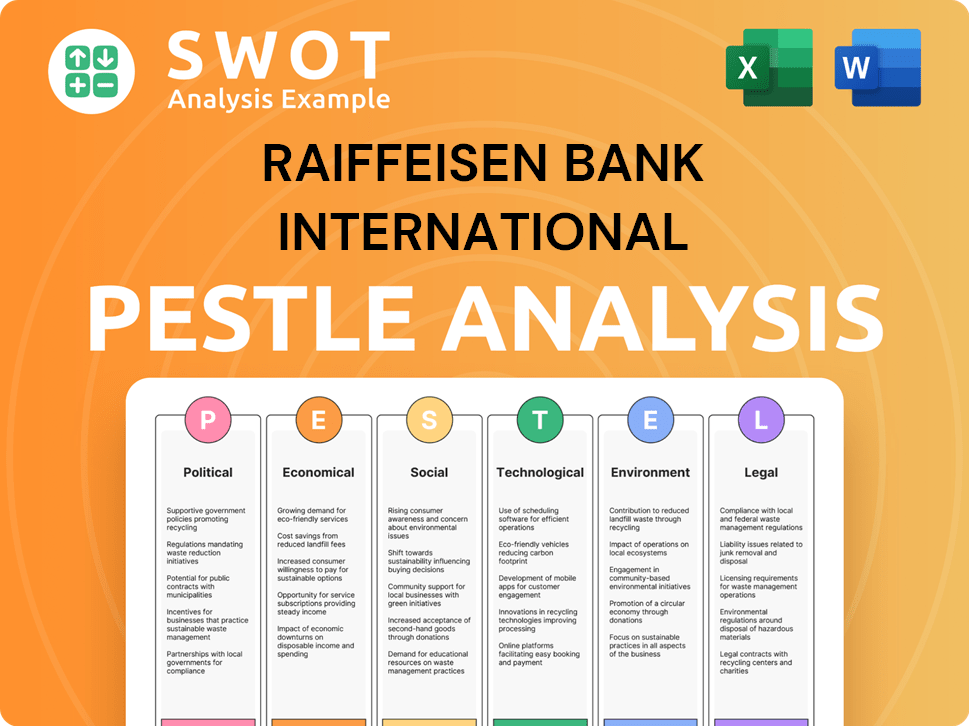

Raiffeisen Bank International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Raiffeisen Bank International operate?

The geographical market presence of the company is primarily concentrated in Austria and Central and Eastern Europe (CEE). This region is considered its home market, with a significant network of subsidiary banks. The company maintains a strong presence and brand recognition in many CEE countries, often ranking among the top banks in these markets.

Key CEE markets include the Czech Republic, Slovakia, Hungary, Romania, Bulgaria, Croatia, Serbia, Bosnia and Herzegovina, Albania, Kosovo, and Ukraine. The company's strategy involves adapting its product offerings, marketing messages, and branch network strategies to meet the specific needs and cultural nuances of each country. This localized approach is crucial due to the varying customer demographics, preferences, and buying power across these regions.

The company's focus on CEE is evident in its sales and growth distribution, with this region consistently contributing a substantial portion of the group's earnings. In 2024, the company continued to optimize its network, potentially through strategic withdrawals from less profitable markets or further investments in high-growth areas, such as strengthening its digital presence or expanding corporate banking services.

The company segments its market to tailor its services effectively. This involves understanding the specific needs and behaviors of different customer groups within the CEE region. Brief History of Raiffeisen Bank International provides insights into the company's evolution and its strategic focus on these markets.

Understanding the customer demographics is critical for the company. This includes factors such as age, income, and geographic location. The company analyzes these factors to customize its products and services, ensuring they meet the specific needs of its RBI clients.

A thorough target market analysis helps the company to identify and focus on the most profitable customer segments. This analysis includes evaluating market size, growth potential, and competitive landscape. This helps the company to refine its market segmentation strategies.

The primary geographic focus remains on CEE, where the company has built a strong presence. This strategic focus allows the company to leverage its existing infrastructure and expertise in these markets. The company's success is closely tied to its ability to navigate the diverse economic conditions of CEE.

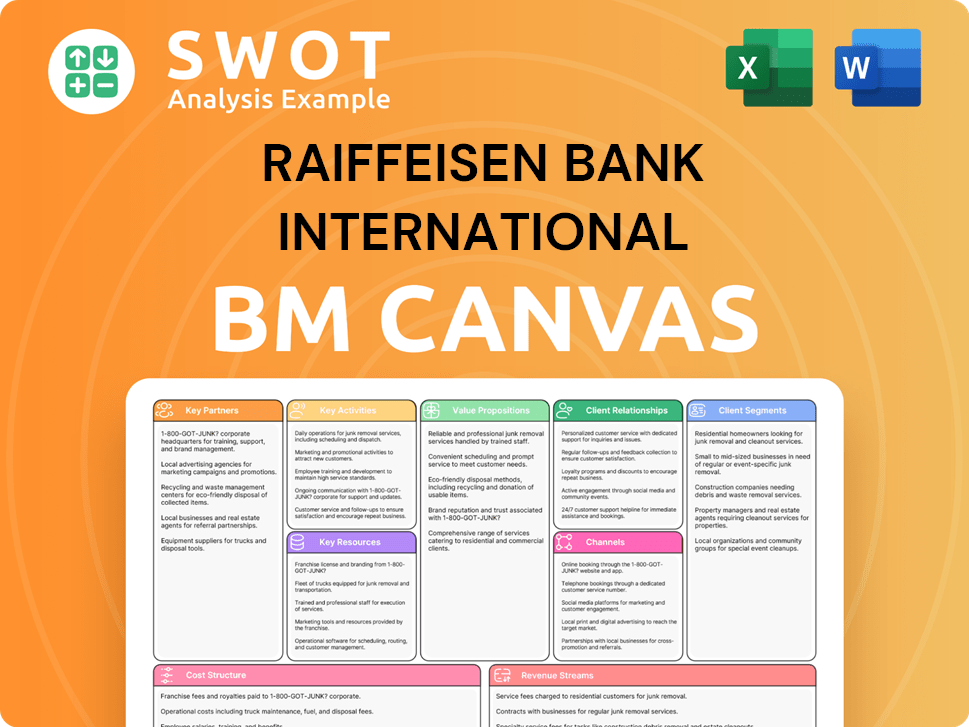

Raiffeisen Bank International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Raiffeisen Bank International Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any financial institution. For Marketing Strategy of Raiffeisen Bank International, this involves a blend of traditional and digital methods to attract and keep customers. Understanding customer demographics and the target market is essential for tailoring these strategies effectively.

RBI's approach to acquiring new customers includes leveraging traditional media, such as television and print, particularly in markets where these channels remain influential. Simultaneously, there's a growing emphasis on digital marketing, incorporating search engine marketing, social media campaigns, and online advertising to reach specific customer segments. Direct sales forces and branch networks continue to play a significant role, especially for complex products like mortgages and corporate loans. Referral programs and partnerships are also likely used to expand the customer base.

Retention strategies at RBI focus on building long-term relationships and enhancing customer loyalty. This involves providing personalized experiences, such as dedicated relationship managers for corporate clients and tailored product recommendations for retail customers. Loyalty programs, in the form of bundled services or preferential rates, may also be offered. After-sales service, including efficient complaint resolution and proactive customer support, is critical for maintaining customer satisfaction and reducing churn.

RBI likely invests heavily in digital channels and data analytics to refine targeting and personalize customer interactions. This includes search engine optimization (SEO), pay-per-click (PPC) advertising, and social media campaigns. The goal is to reach potential customers where they spend their time online and to deliver relevant content.

Personalization is key to customer retention. RBI likely uses customer data to segment its audience and deliver relevant offers and communications. This might involve tailored product recommendations, personalized financial advice, and proactive customer support. This approach aims to increase customer lifetime value.

Successful acquisition campaigns often highlight RBI's regional expertise and strong network in Central and Eastern Europe (CEE). This is particularly appealing to both individuals and businesses seeking a reliable banking partner with local understanding. RBI's deep roots in CEE are a key differentiator in the banking industry.

Retention initiatives likely focus on digital self-service options, improving the user experience of mobile banking apps, and offering proactive financial advice. This includes online account management, mobile payments, and access to financial tools. The aim is to make banking convenient and accessible.

Changes in strategy over time have likely seen a shift towards more data-driven marketing and the integration of digital tools to improve customer lifetime value and reduce churn rates. In 2024, RBI reported a strong financial performance, with a net profit of EUR 1.8 billion, reflecting the effectiveness of its customer-centric strategies. This is a testament to the success of their acquisition and retention efforts. The bank's focus on digital transformation and customer experience continues to be central to its growth strategy. This includes a focus on improving the user experience of mobile banking apps and offering proactive financial advice to customers. These efforts are aimed at increasing customer lifetime value and reducing churn rates. Recent data shows that banks with robust digital platforms see a 15-20% increase in customer engagement.

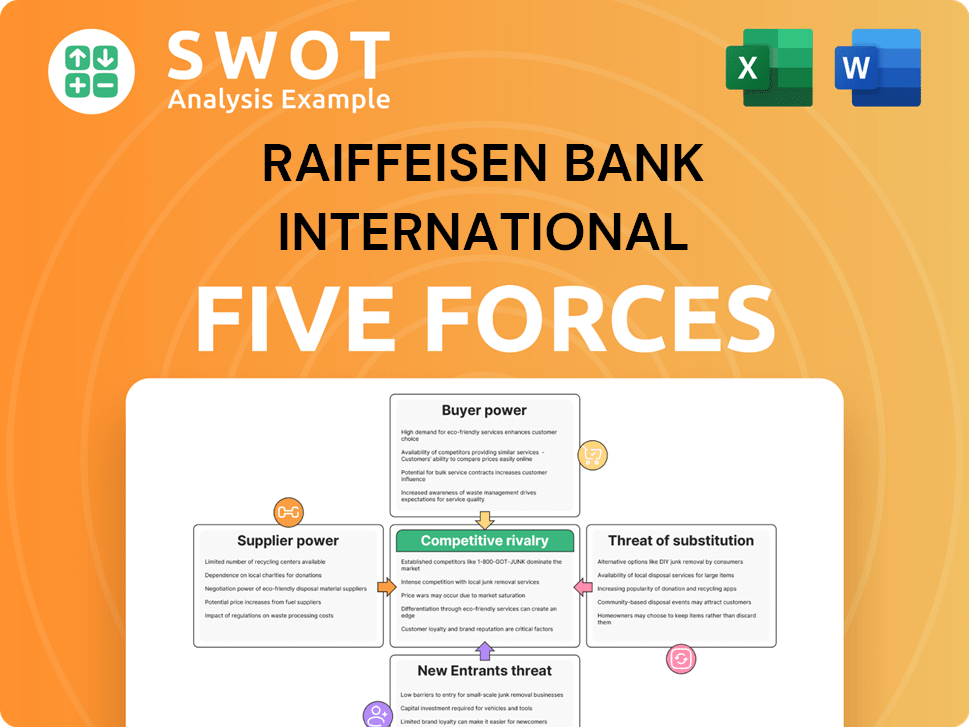

Raiffeisen Bank International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Raiffeisen Bank International Company?

- What is Competitive Landscape of Raiffeisen Bank International Company?

- What is Growth Strategy and Future Prospects of Raiffeisen Bank International Company?

- How Does Raiffeisen Bank International Company Work?

- What is Sales and Marketing Strategy of Raiffeisen Bank International Company?

- What is Brief History of Raiffeisen Bank International Company?

- Who Owns Raiffeisen Bank International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.