Scholastic Bundle

Who Really Owns Scholastic?

Unraveling the Scholastic SWOT Analysis is just the beginning. Understanding the Scholastic company ownership is key to grasping its future. The passing of Richard Robinson in 2021 marked a pivotal moment, reshaping the company's control. This exploration dives deep into the evolving ownership landscape of this publishing giant.

From its humble beginnings in 1920, Scholastic corporation has grown into a global force, and understanding its ownership structure is crucial. This analysis goes beyond the headlines, examining the influence of major shareholders and the impact of key decisions on Scholastic's trajectory. Discover the details of Scholastic ownership, including its market capitalization and financial performance, for a comprehensive understanding of this educational powerhouse.

Who Founded Scholastic?

The story of Scholastic Corporation begins in 1920 with Maurice R. Robinson, who founded the company in Wilkinsburg, Pennsylvania. His initial investment of $600 launched 'The Western Pennsylvania Scholastic,' a four-page magazine distributed to high schools, marking the start of what would become a significant educational publisher.

From its inception, the company's mission was clear: to support children's literacy and education. This focus has remained a core value throughout its history, guiding its expansion and development of educational resources.

In the 1940s, Scholastic broadened its offerings by introducing school book clubs. This expansion provided students and schools with affordable access to books, further solidifying its role in the educational landscape.

Maurice R. Robinson started Scholastic with a clear vision to support education through accessible publications.

The company remained a family business for many years, with leadership passing from Maurice to his son, Richard Robinson.

The introduction of school book clubs in the 1940s significantly expanded Scholastic's reach and impact.

Richard Robinson secured agreements for popular series like 'Harry Potter' and 'The Hunger Games,' boosting the company's profile.

Richard Robinson took over as CEO in either 1974 or 1975, continuing the company's growth.

The core mission of Scholastic has always been to advance children's literacy and education.

Understanding the history of Scholastic company reveals its evolution from a small magazine publisher to a global leader in children's books and educational materials. The company's ownership structure has evolved over time, but its commitment to education has remained constant. Key milestones include the founding by Maurice R. Robinson, the expansion through book clubs, and the leadership of Richard Robinson, who secured rights to major book series. Scholastic's financial performance and market capitalization reflect its significant impact on the publishing industry. In 2024, Scholastic's revenue was reported at $1.6 billion.

- Maurice R. Robinson founded Scholastic in 1920.

- School book clubs were introduced in the 1940s, expanding reach.

- Richard Robinson became CEO in 1974 or 1975.

- Scholastic secured rights to 'Harry Potter' and 'The Hunger Games.'

Scholastic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Scholastic’s Ownership Changed Over Time?

The Scholastic ownership structure has evolved significantly since the company went public on May 12, 1987. Initially, the Robinson family maintained control through super-voting Class A shares. This allowed them to steer the company's direction despite being publicly traded. The Scholastic company has seen its market capitalization fluctuate over time, with a peak of $2.7 billion in 2002. More recently, as of May 12, 2025, the market capitalization was $457.69 million, and as of June 2025, it is approximately $507 million.

A pivotal moment in the Scholastic history occurred in 2021 with the passing of Richard Robinson. His super-voting shares were transferred to Iole Lucchese, then the Chief Strategy Officer, effectively making her the controlling owner. This shift signals potential changes in the company's future, as Lucchese has shown a willingness to sell some of her stock. Understanding the Scholastic corporation ownership structure is key for anyone looking into the company's trajectory.

| Metric | December 2023 | May 12, 2025 | June 2025 (approximate) |

|---|---|---|---|

| Market Capitalization | $1.2 billion | $457.69 million | $507 million |

The ownership of Scholastic books is a mix of institutional and individual investors, along with company insiders. Institutional investors hold a significant portion, ranging from approximately 39.41% to 69.25%. Insiders own about 4.34%, while public companies and individual investors hold around 26.41% to 29.84%. Key institutional holders include BlackRock Fund Advisors, Vanguard Group Inc., and Dimensional Fund Advisors LP. To learn more, read about the Growth Strategy of Scholastic.

The ownership of Scholastic has changed significantly over time, transitioning from family control to a more diverse structure.

- Iole Lucchese now controls the company following Richard Robinson's death.

- Institutional investors are major shareholders.

- The market capitalization has fluctuated, with recent figures reflecting current market conditions.

- Scholastic's financial performance in fiscal year 2024 saw a decrease in revenue and earnings.

Scholastic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Scholastic’s Board?

The current Board of Directors of the Scholastic Corporation plays a crucial role in the company's governance. As of the latest filings, the board is responsible for overseeing the management of the business. The board's composition and the distribution of voting power are key factors in understanding the dynamics of Scholastic's history and its current operational structure.

The Board of Directors is empowered to manage the business of the corporation. Recent changes in the company's bylaws, effective May 15, 2024, confirm that holders of both Class A Stock and Common Stock will vote together (each share entitled to a single vote) for the removal of a director for cause, requiring a majority vote of all shares entitled to vote. This reflects an ongoing evolution in the company's governance practices.

| Director | Title | Age |

|---|---|---|

| Iole Lucchese | Chair of the Board | 75 |

| Richard Sarnoff | Lead Independent Director | 66 |

| Kenneth M. Freeman | Director | 79 |

The Scholastic Corporation's ownership structure, particularly the dual-class share system, has historically concentrated voting power. Iole Lucchese's significant holdings of Class A shares give her substantial control over the company, influencing decisions related to Scholastic ownership and the direction of the business. This structure impacts how the company responds to external influences, such as activist investors or potential buyout offers, solidifying the family's control.

The dual-class share structure gives significant voting power to Class A shareholders, primarily Iole Lucchese. This structure affects who owns Scholastic and influences strategic decisions.

- Class A stockholders elect the majority of the board members.

- Common stockholders elect a portion of the board.

- Changes in bylaws affect voting procedures, such as director removal.

- The Board of Directors manages the corporation's business.

Scholastic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Scholastic’s Ownership Landscape?

In the past few years, the ownership of the Scholastic Corporation has seen significant shifts. Following the death of CEO Richard Robinson in 2021, Iole Lucchese inherited his super-voting Class A shares, making her the controlling owner. This transition has opened possibilities for changes in control, as Lucchese has shown interest in selling some of her equity. This has led to questions about who owns Scholastic and the future of the company.

Scholastic company has been actively pursuing strategic investments. A key move was the March 2024 announcement to acquire 9 Story Media Group for approximately $186 million, a deal that closed on June 20, 2024. This acquisition is aimed at expanding Scholastic's footprint in media and entertainment, leveraging its intellectual property across different platforms. The integration of 9 Story Media Group and Scholastic Entertainment Inc. into a new Entertainment reporting segment is planned for fiscal year 2025.

| Fiscal Year | Dividends Paid to Shareholders | Share Repurchases |

|---|---|---|

| 2024 | Over $181 million | N/A |

| Q2 2025 (ended Nov 30, 2024) | $5.6 million | 185,378 shares for $5.0 million |

| Q4 2025 (declared) | $0.20 per share | N/A |

The company is also focused on returning capital to shareholders. In fiscal year 2024, over $181 million was returned to shareholders. For the fourth quarter of fiscal 2025, a quarterly cash dividend of $0.20 per share has been declared, payable on June 16, 2025. Moreover, in the second quarter of fiscal 2025, Scholastic repurchased 185,378 shares of its common stock for $5.0 million, and distributed $5.6 million in dividends. The company plans to continue buying back shares in the open market or through private transactions. These actions reflect the company's commitment to its shareholders and its financial strategy. For more insights, check out the Revenue Streams & Business Model of Scholastic.

The passing of Richard Robinson led to Iole Lucchese becoming the controlling owner, potentially impacting the future of Scholastic's ownership.

The acquisition of 9 Story Media Group is a key step for Scholastic to expand into media and entertainment.

Scholastic is actively returning capital to shareholders through dividends and share repurchases.

For fiscal year 2025, the company targets modest revenue growth and adjusted EBITDA between $140 million and $150 million.

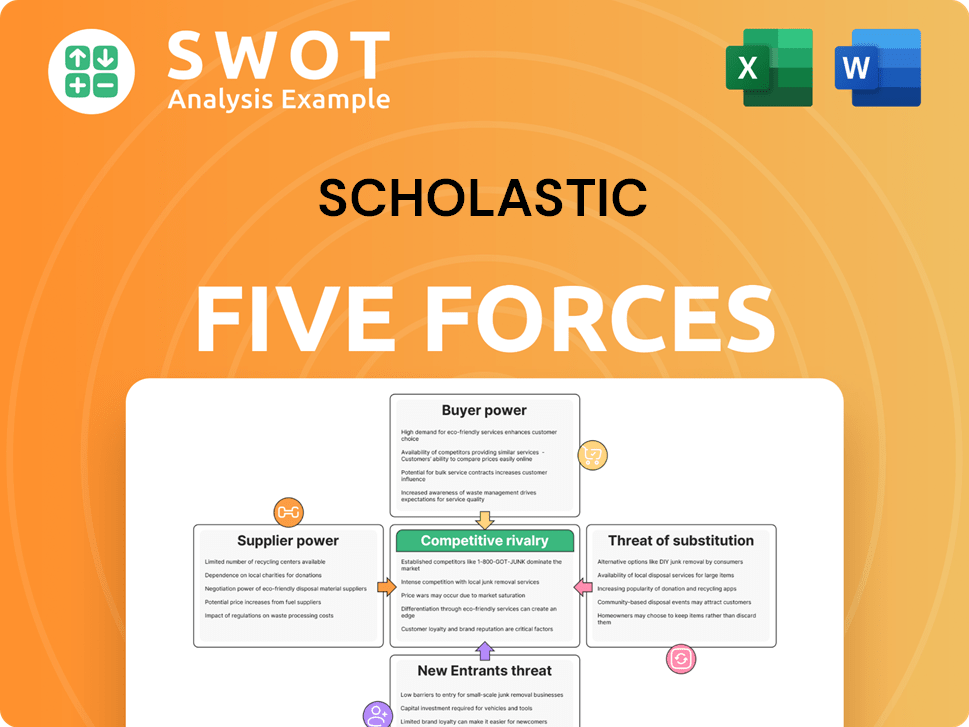

Scholastic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Scholastic Company?

- What is Competitive Landscape of Scholastic Company?

- What is Growth Strategy and Future Prospects of Scholastic Company?

- How Does Scholastic Company Work?

- What is Sales and Marketing Strategy of Scholastic Company?

- What is Brief History of Scholastic Company?

- What is Customer Demographics and Target Market of Scholastic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.