Swisscom Bundle

Who Really Owns Swisscom?

Understanding the ownership of a major company is crucial for investors and strategists alike. Swisscom, a cornerstone of the Swiss economy, has a fascinating ownership story that reflects its evolution. From its state-owned roots to its current status, the story of Swisscom SWOT Analysis reveals a dynamic shift in control and influence.

This exploration into Swisscom ownership will unravel the complex web of shareholders, tracing its journey from a government-controlled entity to a publicly traded Telecom company Switzerland. We'll examine the key players, from the initial founders to the current major shareholders, and analyze how this evolution has shaped Swisscom's strategic direction and financial performance. Discover the intricacies of Swisscom's legal structure and uncover who truly controls this Swiss telecommunications giant.

Who Founded Swisscom?

The story of Swisscom's ownership begins with the Swiss Confederation. Unlike many companies that start with individual founders, Swisscom's origins are rooted in a government decision to liberalize the telecommunications market. This move led to the creation of Swisscom AG in 1998, marking a significant shift from its previous state-owned structure.

At its inception, the ownership of Swisscom was entirely held by the Swiss Confederation. There were no private founders or initial investors in the traditional sense. The Swiss government's role was crucial in establishing the company's structure and guiding its early strategic direction. This initial setup reflected Swisscom's importance as a key national infrastructure provider.

Early agreements were primarily governmental decrees and legal frameworks. These documents outlined the transition from a public entity to a public limited company. This set the stage for future partial privatization. The government's vision was to create a modern, competitive telecommunications company. This vision was reflected in the initial complete state ownership, which ensured a smooth transition and maintained control over critical infrastructure.

The Swiss Confederation initially owned 100% of Swisscom. This ownership structure was designed to facilitate the transition from a state-owned entity to a more market-oriented company. The government aimed to maintain control over essential infrastructure while preparing for future market competition. This approach ensured a stable foundation for Swisscom's operations.

- Swisscom was not founded by individual entrepreneurs; it emerged from government restructuring.

- The Swiss Confederation held complete ownership at the outset, reflecting its strategic importance.

- Early agreements were government decrees that set the legal framework for the company.

- The goal was to create a modern, competitive telecom company.

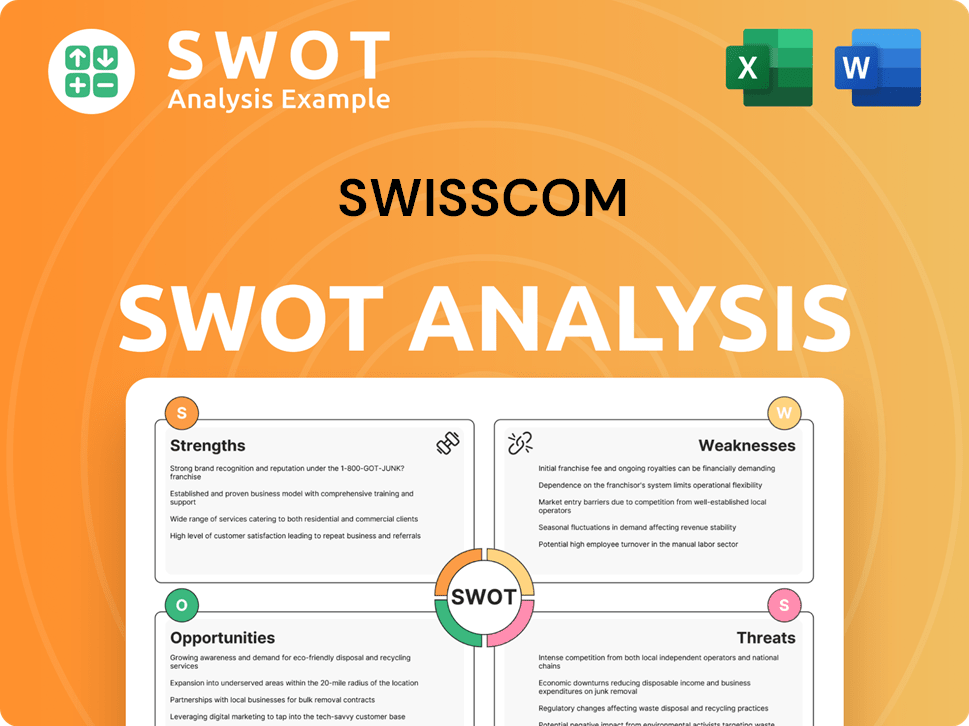

Swisscom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Swisscom’s Ownership Changed Over Time?

The evolution of Swisscom ownership has been marked by a significant shift from complete state control to partial privatization. The most pivotal event in this transformation was the Initial Public Offering (IPO) in 1998. This move allowed for the introduction of private investment while maintaining a controlling stake for the Swiss Confederation. The Swiss telecommunications landscape was forever changed by these actions.

The Swiss Confederation has maintained a majority stake in Swisscom AG. This ensures that the company's strategic direction aligns with national interests and public service obligations. The Telecommunications Enterprise Act mandates that the Confederation holds at least 51% of the share capital. This legal framework has solidified the Confederation's position as the primary shareholder. This differs from other European telecom companies. The company's history is closely tied to the Swiss government's involvement.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | 1998 | Partial privatization; introduction of private shareholders. |

| Telecommunications Enterprise Act | Ongoing | Mandates the Swiss Confederation's majority ownership (at least 51%). |

| Subsequent Years | 1998-2024 | Swiss Confederation maintains control; shares held by institutional and individual investors. |

The remaining shares of Swisscom are widely distributed among institutional investors, mutual funds, index funds, and individual shareholders. Major institutional investors often include large asset managers and pension funds, both Swiss and international. The consistent majority ownership by the Swiss Confederation has ensured stability in the Swiss telecom market. If you want to know more about the Telecom company Switzerland, you can read the Competitors Landscape of Swisscom.

The Swiss Confederation holds approximately 51.0% of Swisscom AG's shares, as of the latest available information. This majority stake is legally mandated. The remaining shares are held by various institutional and individual investors.

- Swisscom's ownership structure is a blend of public and private interests.

- The Swiss Confederation's control ensures alignment with national interests.

- Major institutional investors and individual shareholders also play a role.

- The structure has remained relatively stable in recent years.

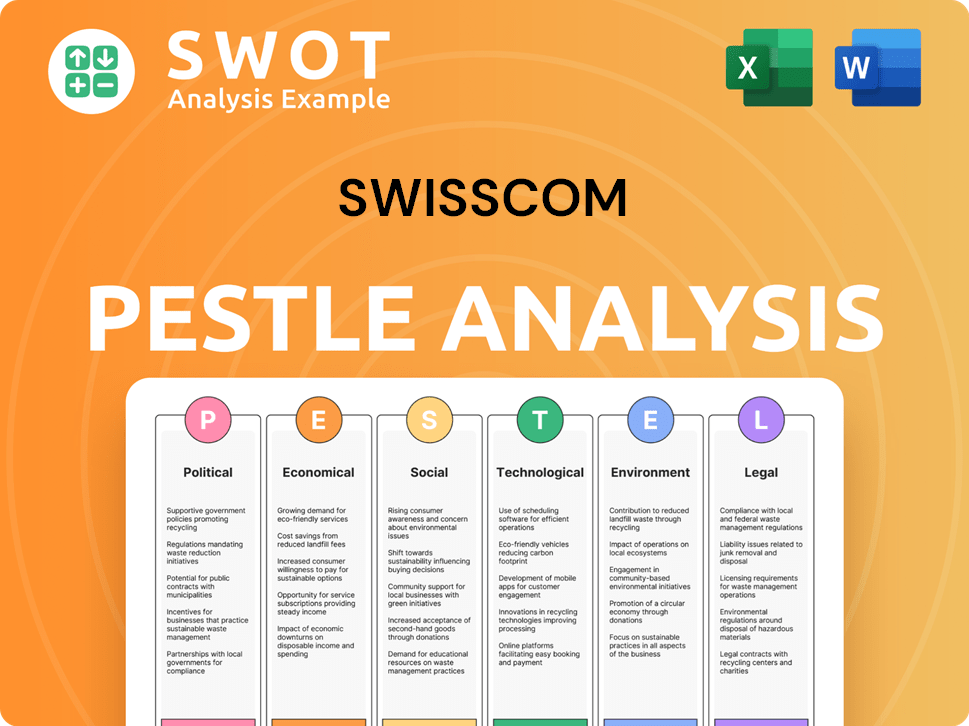

Swisscom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Swisscom’s Board?

The current Board of Directors of Swisscom, also known as Swisscom AG, includes a mix of experienced individuals. As of the latest reports, Michael Rechsteiner serves as Chairman. Other board members include Renzo Brunett, Barbara Frei-Spreiter, Roland Iff, Nadine Kühne, Alain Nicodet, and Valérie Scheidegger. These individuals bring a range of expertise to the company, helping guide its strategic direction in the competitive Swiss telecommunications market.

The board's composition reflects a balance between representatives aligned with major shareholders and independent directors. While the Swiss Confederation is the majority shareholder, its influence is often exerted through individuals who share its strategic vision. This ensures that the company aligns with both commercial interests and the broader public good, given Swisscom's importance as a key telecom company in Switzerland.

| Board Member | Role | Notes |

|---|---|---|

| Michael Rechsteiner | Chairman | Oversees the board's activities and strategic direction. |

| Renzo Brunett | Board Member | Contributes expertise and perspective. |

| Barbara Frei-Spreiter | Board Member | Brings diverse experience to the board. |

| Roland Iff | Board Member | Provides insights and guidance. |

| Nadine Kühne | Board Member | Offers valuable contributions. |

| Alain Nicodet | Board Member | Shares expertise and perspective. |

| Valérie Scheidegger | Board Member | Contributes to the board's oversight. |

Swisscom operates on a one-share-one-vote principle, ensuring that each share has equal voting rights. The Swiss Confederation's ownership of 51.0% gives it controlling voting power, allowing it to influence key decisions. This ownership structure means the government has significant influence over the company's strategic direction, board appointments, and major corporate actions. There have been no recent public proxy battles or activist investor campaigns that have significantly challenged this established voting structure.

The Swiss Confederation's majority ownership of Swisscom grants it significant voting power. This enables the government to shape major corporate decisions, board appointments, and strategic directions. Understanding the ownership structure is crucial for anyone interested in Swisscom ownership and its operations.

- One-share-one-vote principle.

- The Swiss Confederation holds 51.0% of the shares.

- Government influence over strategic decisions.

- No known dual-class shares or special voting rights.

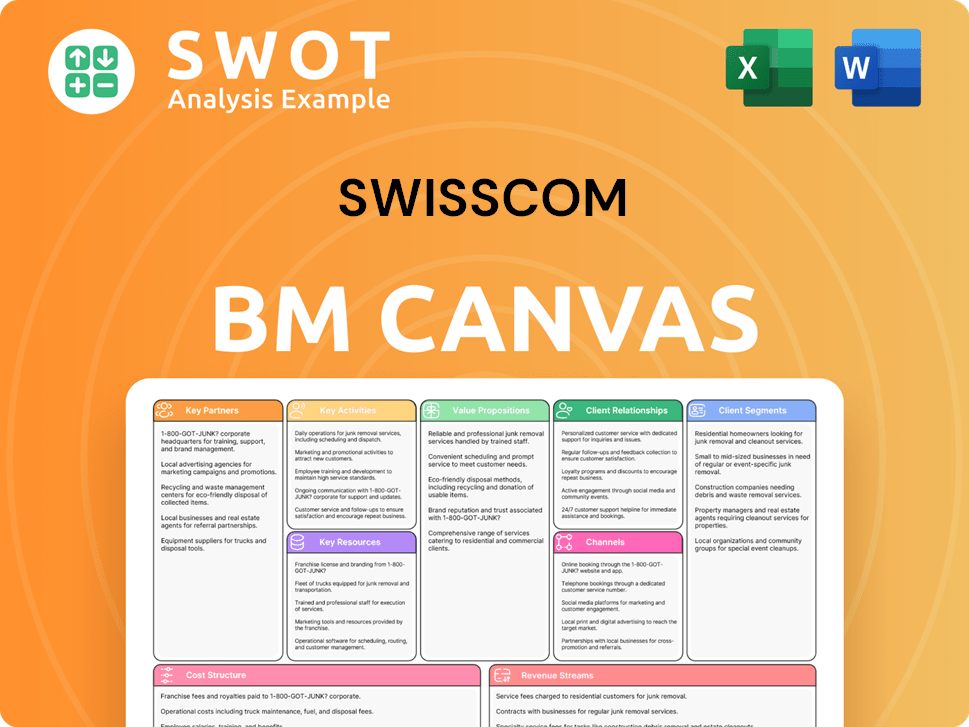

Swisscom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Swisscom’s Ownership Landscape?

Over the past few years, the ownership structure of Swisscom has remained relatively steady. The Swiss Confederation holds a mandated majority stake of 51.0%, which is a key factor in maintaining this stability. This legal requirement significantly limits the potential for major shifts in the core ownership of the company. However, Swisscom has been actively involved in strategic mergers and acquisitions to boost its market presence.

A notable example is the agreement to acquire Vodafone Italia for €8 billion, which will expand its Fastweb subsidiary's footprint in Italy. While this does not directly affect Swisscom's ownership, it reflects its strategic growth initiatives and capital allocation. These actions indirectly influence shareholder value and future financial performance. For more insights, you can explore the Marketing Strategy of Swisscom.

| Metric | Value | Year |

|---|---|---|

| Swiss Confederation Ownership | 51.0% | 2024 |

| Market Capitalization (approx.) | CHF 25 Billion | 2024 |

| Vodafone Italia Acquisition Value | €8 Billion | 2024 |

Industry trends in telecommunications ownership include increased institutional ownership and consolidation. Although Swisscom has institutional ownership for its publicly traded shares, the government's majority stake largely protects it from aggressive activist investor campaigns. Public statements from Swisscom and analysts typically focus on market performance, strategic investments, and regulatory developments rather than major ownership changes. The Swiss Confederation has consistently reaffirmed its commitment to its majority stake.

The Swiss Confederation's 51% stake ensures stability in Swisscom's ownership structure. This legal mandate prevents significant fluctuations, maintaining a consistent shareholder base. Strategic acquisitions, such as the Vodafone Italia deal, influence future financial performance.

Swisscom actively pursues strategic growth through mergers and acquisitions. These moves, like the Vodafone Italia acquisition, expand its market presence. Such initiatives impact shareholder value and future financial results, showing a proactive approach.

The telecommunications sector sees trends like institutional ownership and consolidation. Swisscom is somewhat insulated from activist investors due to government control. Market performance and strategic investments are key focus areas for the company.

The Swiss Confederation remains committed to maintaining its majority stake in Swisscom. This commitment signals no immediate plans for further privatization or a full public listing. The government's involvement provides long-term stability.

Swisscom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Swisscom Company?

- What is Competitive Landscape of Swisscom Company?

- What is Growth Strategy and Future Prospects of Swisscom Company?

- How Does Swisscom Company Work?

- What is Sales and Marketing Strategy of Swisscom Company?

- What is Brief History of Swisscom Company?

- What is Customer Demographics and Target Market of Swisscom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.