Symbotic Bundle

Who Really Controls Symbotic?

Unraveling the ownership structure of a company is crucial for understanding its strategic direction and potential for growth. Symbotic Inc. (Nasdaq: SYM), a pioneer in AI-driven warehouse automation, has rapidly transformed the supply chain landscape. This exploration dives deep into the ownership dynamics of Symbotic, revealing who holds the reins of this innovative company.

Understanding the Symbotic SWOT Analysis is essential to understanding the company's position. The company's journey, from its founding by Rick Cohen to its current status as a publicly traded entity, is a testament to its evolution. Analyzing the Symbotic ownership structure, including the roles of Symbotic investors and the Symbotic founder, provides insights into the distribution of influence and the future trajectory of this industry leader. Knowing who owns Symbotic is key for anyone looking to understand the company's potential.

Who Founded Symbotic?

The story of the Symbotic company begins in 2007 with its founder, Rick Cohen, who currently serves as CEO and Chairman. The company's inception was closely linked to Cohen's family-owned C&S Wholesale Grocers. Initially known as CasePick Solutions, Symbotic was created to solve distribution challenges faced by C&S Wholesale Grocers.

The early days saw the development of the first prototype robot using basic materials, highlighting the company's innovative spirit. Symbotic's journey from a private entity to a publicly traded company showcases its evolution and growth. Understanding the company's ownership structure is key to grasping its strategic direction.

Understanding the ownership structure of Symbotic is crucial for investors and anyone interested in the company's trajectory. Key aspects include the founder's role and the influence of early funding.

Rick Cohen, the founder, remains a central figure as CEO and Chairman. His leadership has been instrumental in shaping the company's vision and strategic direction.

Initial funding likely came from Rick Cohen. The specifics of early financial backing as a private company are largely undisclosed.

In 2017, C&S Wholesale Grocers acquired Symbotic, making it a subsidiary. This provided a stable financial base and a major client.

Symbotic has a dual-class share structure, with Class A shares traded publicly and non-economic Class V-1 and V-3 shares holding significant voting rights.

As of fiscal year 2023, the Cohen family controlled 89.8% of the voting power through various trusts and investment vehicles. This structure ensures the founder's lasting influence.

The dual-class structure allows the founder to maintain significant influence over the company's strategic decisions, impacting its long-term direction.

The early ownership and control of Symbotic, particularly through the Cohen family's significant voting power, have been critical in shaping the company's strategy and growth. The acquisition by C&S Wholesale Grocers provided a crucial foundation for refining and scaling its technology. For more insights into the company's strategic approach, consider reading about the Marketing Strategy of Symbotic.

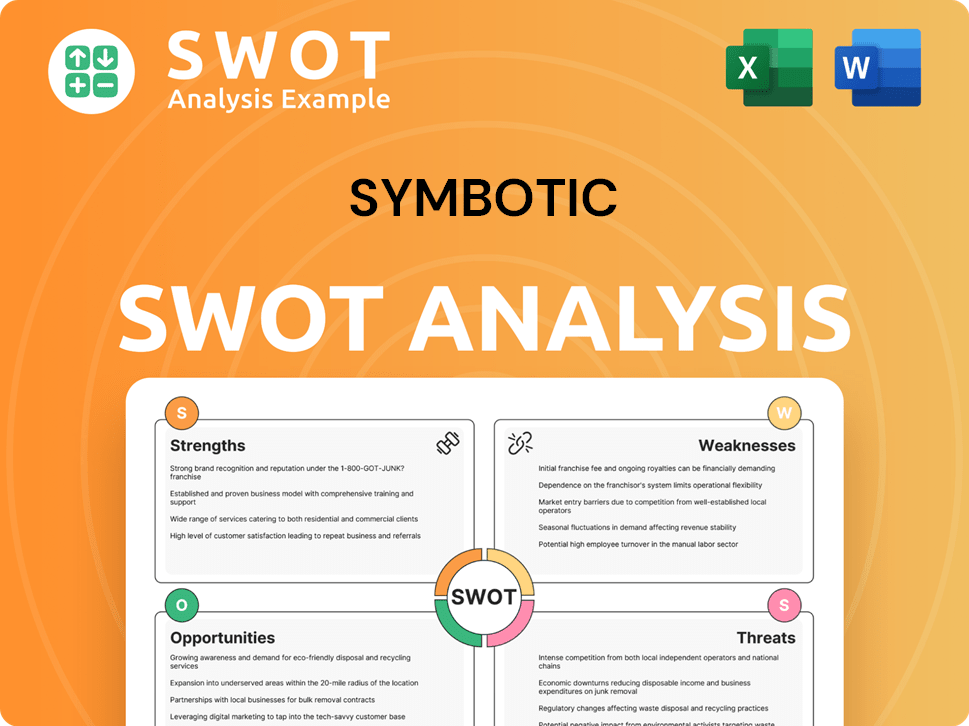

Symbotic SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Symbotic’s Ownership Changed Over Time?

The ownership structure of the company, a key aspect of understanding who owns Symbotic, has seen significant changes, especially with its move to become a public entity. In 2022, the company went public through a Special Purpose Acquisition Company (SPAC) merger with SVF Investment Corp 3, backed by SoftBank Investment Advisers. This deal valued the combined business at roughly $5.5 billion, providing substantial capital for expansion and growth. This transition marked a pivotal moment in the company's history, reshaping its investor base and financial capabilities. Understanding the evolution of the company's ownership is crucial for anyone looking into Symbotic stock or interested in its future.

Following the public offering, assuming no redemptions from public shareholders, existing equity holders were expected to retain a significant portion of the combined entity. Rick Cohen was projected to hold 76% ownership, with Walmart owning 9%, and other holders owning 3%. New investors were slated to own 12%, which included SPAC public shareholders (6%), the SVFC sponsor and its affiliates (5%), and other PIPE investors (1%). This shift in ownership structure, driven by the SPAC merger, has provided the company with the financial resources needed to invest in innovation and growth initiatives. The company's history is marked by strategic financial moves that have shaped its current ownership landscape.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership (approximate) |

|---|---|---|

| SoftBank Group Corp | 39,825,312 | Data Not Available |

| Walmart Inc. | 15,000,000 | Data Not Available |

| Baillie Gifford & Co | Data Not Available | Data Not Available |

| Vanguard Group Inc. | Data Not Available | Data Not Available |

| Rick Cohen | 2,550,765 (as of Q1 2024) | Data Not Available |

As of March 31, 2025, the company has a substantial institutional investor base, with 334 institutional owners and shareholders holding a total of 106,688,760 shares. Key investors include SoftBank Group Corp and Walmart Inc. Walmart's substantial stake of 15,000,000 shares underscores its strategic partnership with the company. SoftBank Group Corp. is also a major shareholder, holding 39,825,312 shares as of March 31, 2025. Institutional ownership accounts for 17.53% of total shares as of March 2025. The company's founder, Rick Cohen, remains a significant individual shareholder, holding 2,550,765 shares as of Q1 2024. These developments are crucial for anyone tracking the company's financial reports and assessing its market share.

The company's ownership structure has evolved significantly, especially after going public through a SPAC merger.

- SoftBank and Walmart are major institutional shareholders.

- The company's founder, Rick Cohen, remains a substantial individual shareholder.

- The strategic partnership with Walmart is a key driver of revenue.

- For more details, check out the Brief History of Symbotic.

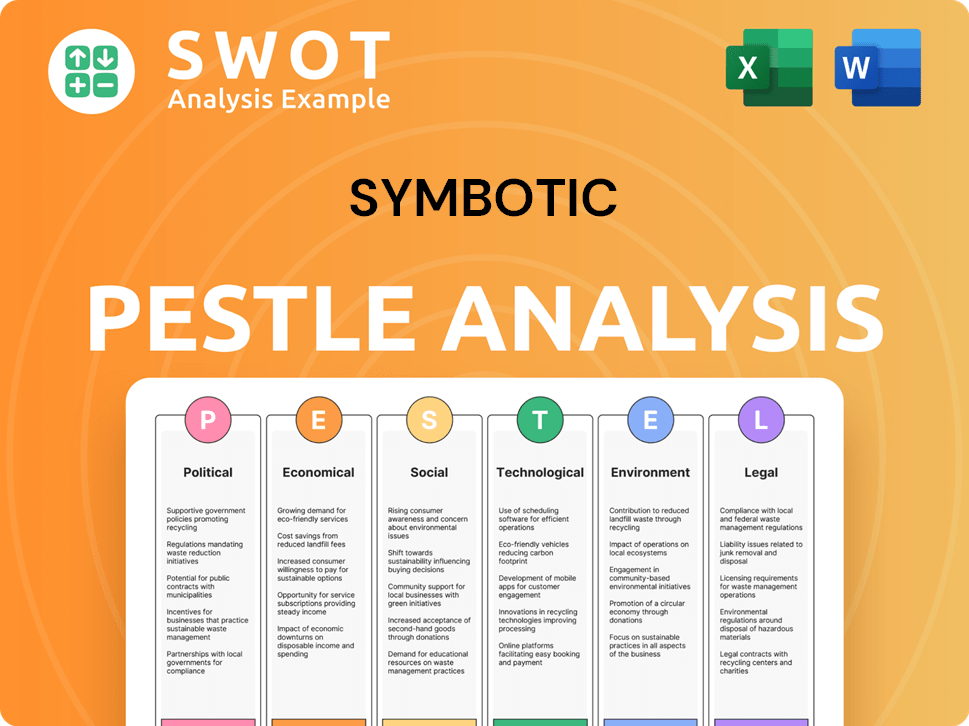

Symbotic PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Symbotic’s Board?

The leadership of the Symbotic company is currently spearheaded by a seasoned executive team. As of April 2025, the key figures include Richard B. Cohen as Chairman and Chief Executive Officer, and Yossi Cohen also serving as Chief Executive Officer. Tom Ernst and Carol Hibbard both hold the position of Chief Financial Officer. James Kuffner was appointed Chief Technology Officer in late 2024. This team, along with the Board of Directors, guides the strategic direction of the company.

The Board of Directors at Symbotic includes representatives from major shareholders and independent members, ensuring a mix of perspectives in decision-making. This structure reflects the company's commitment to a balanced approach to governance, integrating the interests of both significant stakeholders and independent oversight. The composition of the board is crucial in overseeing the company's operations and strategic initiatives.

| Leadership Position | Name | Title |

|---|---|---|

| Chairman & CEO | Richard B. Cohen | Chairman and Chief Executive Officer |

| CEO | Yossi Cohen | Chief Executive Officer |

| CFO | Tom Ernst | Chief Financial Officer |

| CFO | Carol Hibbard | Chief Financial Officer |

| CTO | James Kuffner | Chief Technology Officer |

The Symbotic company operates with a dual-class share structure, which significantly impacts the distribution of voting power. The Cohen family, through various trusts and investment vehicles, held a considerable amount of voting power. This structure grants the founding family substantial control over corporate decisions, even though the company is publicly listed. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Symbotic.

The Symbotic company's ownership structure is primarily influenced by its dual-class share system. This structure concentrates voting power within the Cohen family. This concentration of voting power affects the influence of other Symbotic investors.

- Class A shares are publicly traded.

- Class V-1 shares grant one vote per share.

- Class V-3 shares grant three votes per share.

- The Cohen family controls a significant portion of the voting power.

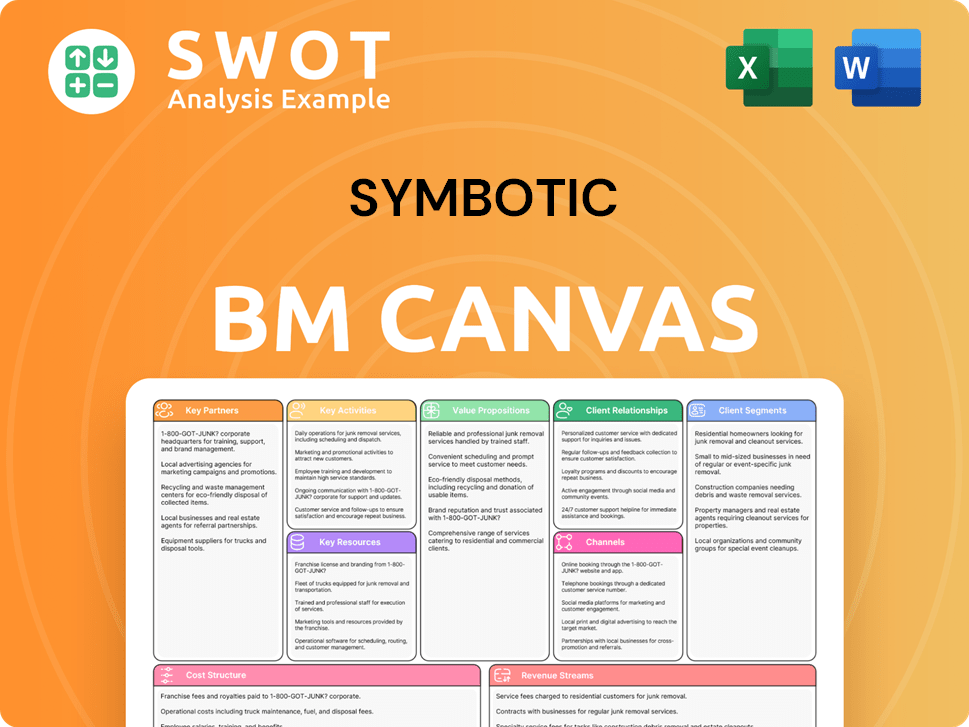

Symbotic Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Symbotic’s Ownership Landscape?

Over the past few years, the Symbotic company has seen significant shifts in its ownership and strategic alliances. A notable event was its public listing in 2022 through a SPAC merger, which provided substantial capital and broadened its investor base. The company's ownership structure now includes a mix of institutional and individual investors, reflecting its growth and market position. As of March 31, 2025, institutional ownership stood at 17.53% of total shares, with 334 institutional owners holding over 106 million shares. This indicates a strong level of confidence from institutional Symbotic investors.

Key Symbotic investors include SoftBank Group Corp, Walmart Inc., Baillie Gifford & Co, and Vanguard Group Inc. SoftBank Group Corp held 39,825,312 shares, and Walmart Inc. held 15,000,000 shares as of March 31, 2025. These major shareholders play a crucial role in the company's strategic direction and financial stability. The diverse group of shareholders showcases the company's appeal to various types of investors, from large institutional players to individual investors interested in the Symbotic stock.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership |

|---|---|---|

| SoftBank Group Corp | 39,825,312 | Not specified |

| Walmart Inc. | 15,000,000 | Not specified |

| Baillie Gifford & Co | Data not available | Not specified |

| Vanguard Group Inc. | Data not available | Not specified |

Symbotic has actively pursued strategic acquisitions to expand its capabilities. In August 2024, it acquired Veo Robotics, followed by OhmniLabs in December 2024. Most notably, in January 2025, Symbotic completed the acquisition of Walmart's Advanced Systems and Robotics business for $520 million, which included a $200 million cash payment at closing and up to $350 million in contingent consideration. This acquisition further deepened its long-standing relationship with Walmart, a key customer responsible for 87% of Symbotic's sales in fiscal year 2024. Walmart also committed to investing $520 million in Symbotic's AI-powered robotics platform for the development and deployment of systems for 400 Accelerated Pickup and Delivery (APD) centers over multiple years, with options for additional deployments, potentially increasing Symbotic's backlog by over $5 billion. These moves highlight the company's commitment to innovation and its strategic focus on warehouse automation.

Symbotic has cultivated strong partnerships, most notably with Walmart. These collaborations are vital for expanding its market reach and deploying its automation systems. The Walmart deal, including a significant investment, underscores the importance of these relationships.

In fiscal year 2024, Symbotic's sales were significantly driven by its relationship with Walmart, which accounted for 87% of total sales. The company's R&D spending reached $140.1 million, showing its commitment to innovation.

The warehouse automation market is experiencing substantial growth, with projections to reach $41 billion by 2027. Symbotic's focus on this sector aligns with this trend. This positions the company for continued expansion and success.

The company's strategy emphasizes continued investment in R&D and strategic partnerships. The joint venture with SoftBank, GreenBox, aims for global deployment of Symbotic's systems. These plans suggest a focus on market penetration.

Symbotic Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Symbotic Company?

- What is Competitive Landscape of Symbotic Company?

- What is Growth Strategy and Future Prospects of Symbotic Company?

- How Does Symbotic Company Work?

- What is Sales and Marketing Strategy of Symbotic Company?

- What is Brief History of Symbotic Company?

- What is Customer Demographics and Target Market of Symbotic Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.