Bell Food Group Bundle

Who Buys Bell Food Group Products?

In the competitive food industry, understanding your customer is key. For a company like Bell Food Group, a deep dive into customer demographics and its target market is essential for sustained growth. This analysis reveals the core consumer profile driving the success of the European meat processor and convenience food producer. Understanding the Bell Food Group SWOT Analysis can also provide valuable insights.

Bell Food Group's success, including a 5.7% net sales increase in 2024, hinges on its ability to adapt to changing consumer preferences. This exploration delves into the specifics of Bell Food Group's customer base, providing valuable insights into its market share and consumer behavior. By analyzing the demographics of Bell Food Group consumers, we uncover the strategies the Bell company uses to target its audience and maintain its market position. This detailed market analysis will help you understand the company's approach.

Who Are Bell Food Group’s Main Customers?

Understanding the Growth Strategy of Bell Food Group involves a deep dive into its primary customer segments. The company's business model is multifaceted, reaching consumers through both Business-to-Consumer (B2C) and Business-to-Business (B2B) channels. This approach allows the company to cater to a broad spectrum of needs and preferences within the food industry, making it a significant player in the market.

In the B2C sector, the Bell Food Group focuses on end consumers through its core brands: Bell (meat and charcuterie), Hilcona (fresh meals and pasta), Eisberg (salads and fresh convenience), and Hügli (convenience products). This diversification of brands suggests a strategy to capture different consumer profiles and lifestyles. The company's product offerings cater to various tastes and dietary needs, from traditional meat products to convenient, health-conscious options.

The B2B segment includes partnerships with retailers, wholesalers, and the foodservice sector. This strategic approach allows the company to distribute its products widely, ensuring a strong market presence. For instance, supplying retailers like Coop and Migros, which represent roughly 40% of the Swiss retail market, highlights the importance of these large-scale collaborations. This dual approach, targeting both consumers and businesses, is crucial for the company's overall success.

While specific demographic data like age, gender, or income are not explicitly detailed, the product range indicates a broad target market. The company's focus on health-conscious consumers and those seeking convenience is evident through the growth of fresh meals and salads. The company has also adapted its marketing to appeal to younger consumers aged 18-35, who are increasingly concerned with sustainability and health, leading to a 15% increase in sales among this demographic through organic product lines.

The company's strategic acquisitions, such as Hofmetzgerei F. Hölzle GmbH in 2021, reflect a response to the rising demand for high-quality and sustainably sourced meat products. Bell Switzerland alone contributed 47% of the group's net revenue in 2024, emphasizing its strong domestic market position. The focus on organic and sustainable products aligns with current consumer trends, enhancing the company's market share.

The primary customer segments for Bell Food Group include a diverse range of consumers and businesses. This segmentation allows the company to tailor its products and marketing strategies effectively.

- Retail Consumers: Individuals purchasing products through retail channels, targeted by brands like Bell, Hilcona, Eisberg, and Hügli.

- Retail Partners: Large-scale retailers such as Coop and Migros, representing a significant portion of the Swiss retail market.

- Foodservice Sector: Restaurants, caterers, and other businesses that use Bell Food Group products in their operations.

- Food Processing Industry: Companies that use Bell Food Group products as ingredients in their own food production processes.

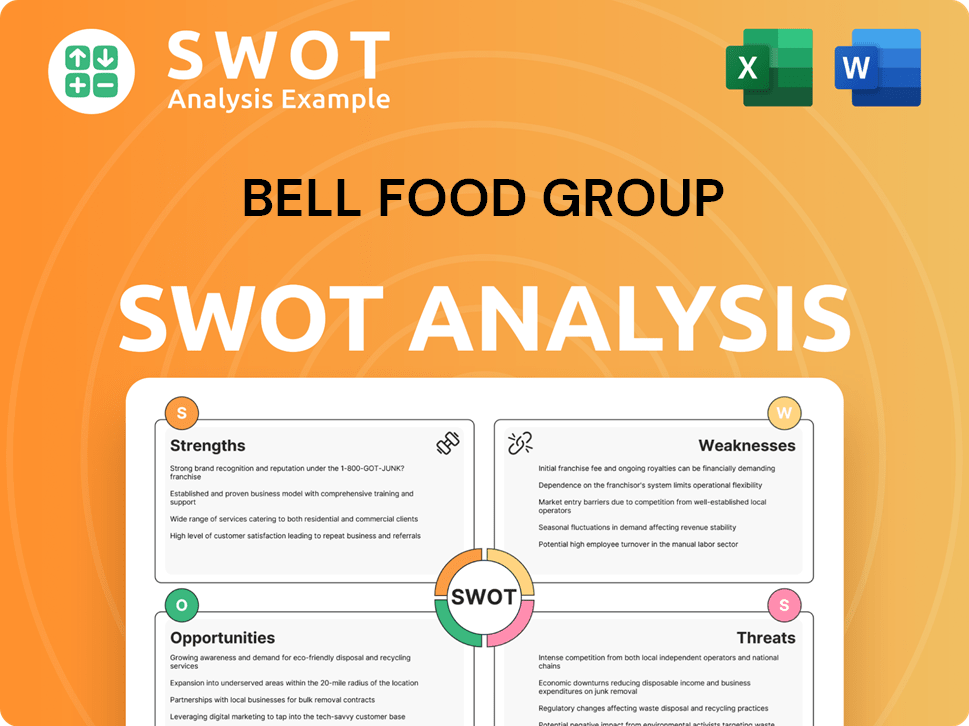

Bell Food Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bell Food Group’s Customers Want?

Understanding the evolving needs and preferences of its diverse customer base is crucial for the success of the company. The company's ability to adapt to these changes, including the growing demand for convenience and health-conscious options, is a key driver of its market performance. This approach is essential for the company to maintain and grow its consumer base.

The company's focus on convenience and health aligns with broader market trends. This includes the ready-to-eat meal sector, which was valued at approximately €37.5 billion in Europe in 2020, with an anticipated annual growth of 5.2%. The company's strategic product development and marketing efforts are tailored to specific consumer segments, driving sales growth and market share.

The company also addresses the growing emphasis on sustainability and animal welfare in consumer purchasing behaviors. By understanding and responding to these trends, the company can maintain its competitive edge and meet the demands of its target market. This includes initiatives like sourcing sustainable meat products and investing in product innovation.

The company has seen growth in its convenience food operations, with fresh meals and tofu from Hilcona and fresh fruit cups from Eisberg contributing to sales revenue growth in 2024. This reflects the increasing demand for ready-to-eat meals.

The Hubers/Sütag business, a leading producer of organic poultry in Europe, has experienced strong demand due to its high animal welfare standards. The company is committed to reducing CO2 emissions and sourcing over 85% of its meat products from sustainable farms by 2024.

In 2023, the company launched 15 new products, including plant-based options, to cater to the growing demand for vegetarian and vegan diets. This demonstrates the company's responsiveness to evolving consumer preferences.

The company has invested in reformulating existing product lines, such as reduced-sodium processed meats launched in 2023. This has led to a 7% increase in sales from this segment.

A 2022 campaign targeting younger consumers (18-35) concerned with sustainability and health resulted in a 15% increase in sales among this group for organic products. This shows the effectiveness of tailored marketing strategies.

The company's success is rooted in its ability to analyze and respond to the evolving needs, motivations, and preferences of its diverse customer base. This includes understanding the demographics of Bell Food Group consumers and their buying habits.

The company's ability to understand and respond to customer needs is critical. Several factors influence customer preferences and drive the company's product development and marketing strategies. This includes a focus on convenience, health, and sustainability.

- Convenience: Ready-to-eat meals and fresh products cater to busy lifestyles.

- Health: Reduced-sodium products and plant-based options meet health-conscious demands.

- Sustainability: Organic poultry and sustainable sourcing appeal to environmentally aware consumers.

- Innovation: New product launches and reformulations address evolving consumer needs.

- Targeted Marketing: Campaigns focused on specific demographics, such as younger consumers, drive sales growth.

For more insights into the competitive landscape, consider exploring the Competitors Landscape of Bell Food Group.

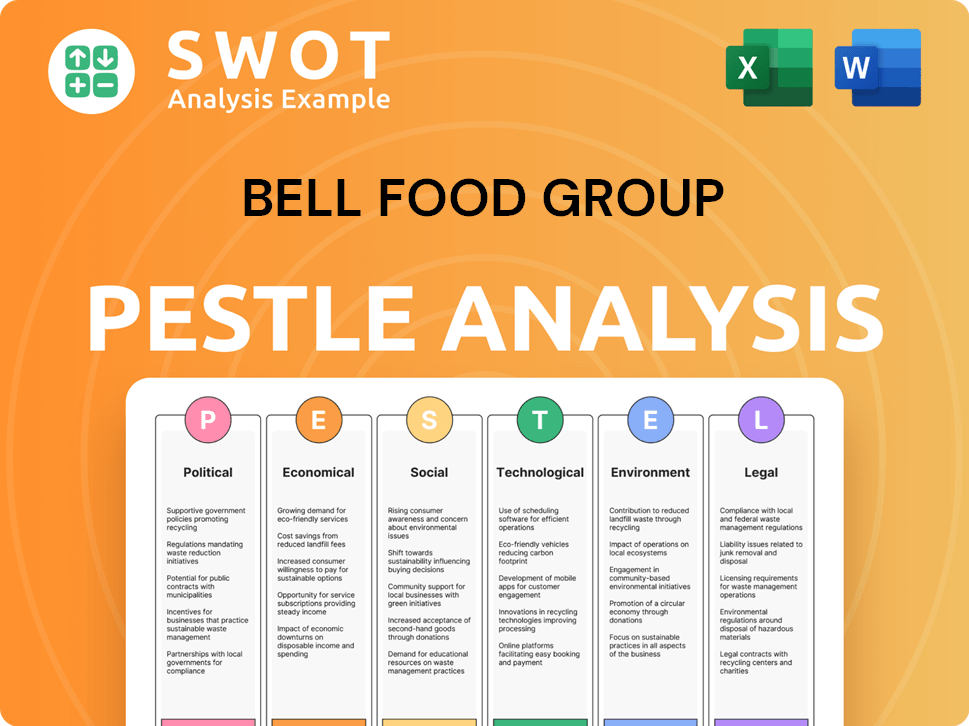

Bell Food Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bell Food Group operate?

The geographical market presence of Bell Food Group is primarily concentrated in Europe, with a strong emphasis on its home market, Switzerland. This strategic focus allows the company to leverage its established brand recognition and distribution networks across key regions. The company's approach involves a mix of organic growth and strategic partnerships to enhance its market share and consumer reach.

Bell Food Group's international operations are significant, with a substantial portion of its revenue generated outside of Switzerland. This diversification strategy helps mitigate risks and capitalize on growth opportunities in various European markets. The company's market analysis indicates a commitment to understanding and adapting to local consumer preferences to drive sales and brand loyalty.

In 2024, Bell Switzerland contributed 47% to the group's net revenue, highlighting its dominant position within the company. Bell International, a key division, generated 11% of the group's revenue in the same year. This demonstrates the importance of both domestic and international markets to the company's overall financial performance.

Bell Food Group's geographical reach extends across several European countries, including Germany, Austria, and France. The company's success is driven by its ability to tailor its products and marketing strategies to meet the specific demands of each market. This approach is crucial for effective customer segmentation and target market strategy.

Recent strategic moves include the spin-off of the international poultry business into Hubers/Sütag in June 2024. This division, operating from three locations, reported net revenue of CHF 660 million in 2024, marking a 6.3% year-on-year increase. Additionally, Bell Food Group has formed strategic alliances with local distributors in countries like Italy and Spain to boost sales.

Bell Germany developed a 'wafer-thin slices' concept for charcuterie to differentiate itself in the market. Hilcona relaunched its 'Pasta Originale' in 2024 with a focus on freshness and craftsmanship, improving consumer orientation. These initiatives demonstrate the company's commitment to understanding and responding to local market preferences, which is vital for analyzing consumer behavior.

In 2022, 56% of Bell Food Group's turnover of CHF 3.5 billion was generated outside Switzerland, highlighting its substantial international reach. Strategic alliances with local distributors in regions like Italy and Spain have led to a 20% increase in sales. These figures underscore the importance of international markets to the company's overall revenue.

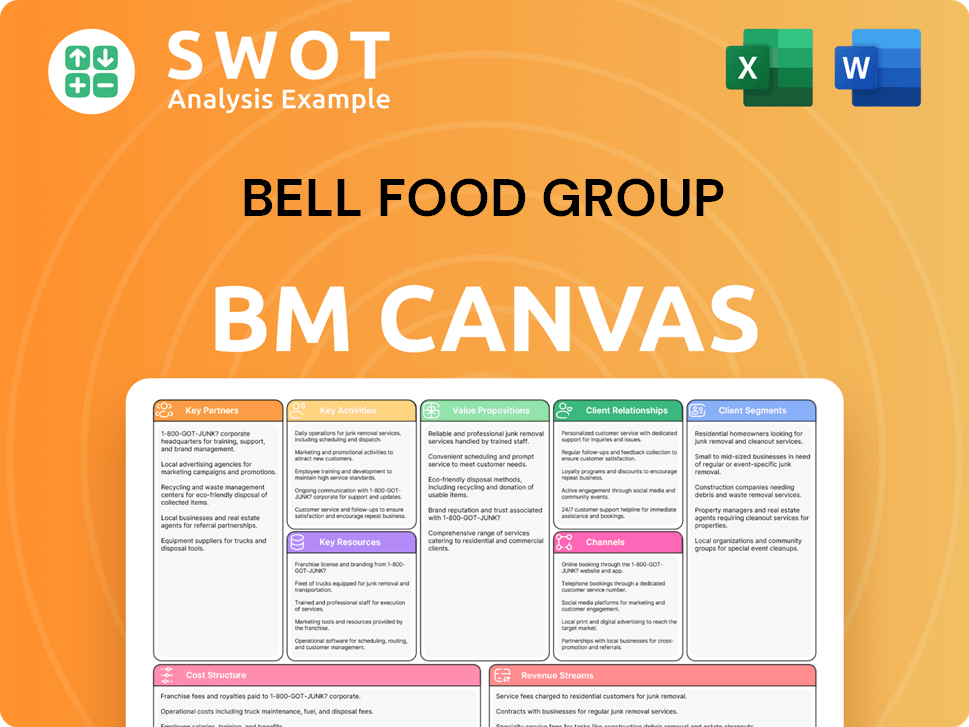

Bell Food Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bell Food Group Win & Keep Customers?

The customer acquisition and retention strategies of the company are multifaceted, focusing on product innovation, targeted marketing, and expanded distribution. These strategies are crucial for attracting new customers and maintaining the existing customer base. The introduction of plant-based products and the expansion of retail points exemplify these efforts.

To acquire new customers, the company emphasizes product diversification and strategic marketing campaigns. For instance, the company's focus on the younger consumer demographic (18-35) interested in organic products resulted in a notable sales increase. The company's strategy also involves expanding its distribution network to reach a wider audience. These initiatives are designed to capture new market segments and increase brand visibility.

Customer retention is a priority, achieved through product quality, customer satisfaction, and loyalty programs. The company invests in high-quality products and leverages customer feedback for product development. Promotional campaigns and data-driven marketing are also essential for retaining and engaging customers, fostering long-term relationships, and driving repeat purchases.

The introduction of plant-based products in 2022 accounted for 15% of total sales in the first half of 2023, attracting new customer segments. This strategy highlights the company's responsiveness to market trends and consumer preferences for healthier and sustainable options. Product innovation is key to capturing new segments.

A 2022 initiative targeting younger consumers (18-35) interested in organic products led to a 15% increase in sales within this demographic. These campaigns are vital for reaching specific customer segments and tailoring messaging to their needs. Effective targeting enhances brand engagement.

The company increased its retail points across Europe to over 3,500 by 2023, a 20% increase in product reach. Expanding distribution through partnerships with major supermarket chains increases product accessibility. Wider distribution supports customer acquisition.

The company consistently invests in state-of-the-art facilities and technologies to ensure high-quality products. This commitment to quality is a core component of its mission. This is crucial for customer satisfaction and retention.

Promotional campaigns in Q1 2023 offered discounts and bundled offers to existing customers, leading to a 15% increase in the average transaction size. This strategy incentivizes repeat purchases.

The industry generally uses loyalty points, VIP experiences, and birthday rewards to foster repeat purchases. Such programs help to build customer loyalty and drive repeat business. While specific loyalty program details are not provided, the company likely utilizes similar strategies.

The company uses customer feedback and market research to influence product development. This ensures that offerings remain relevant to evolving consumer needs and preferences. Understanding customer needs drives innovation.

Increased marketing expenditure, particularly on digital channels, saw a 15% increase in ROI, indicating a focus on data-driven targeting campaigns. Data-driven strategies allow for more effective and efficient marketing efforts.

These strategies collectively aim to reduce customer churn and boost customer lifetime value. Reducing churn is essential for sustainable growth. Retention efforts focus on long-term customer relationships.

The company aims to cultivate brand advocates through these initiatives. Loyal customers often become advocates, promoting the brand. This organic promotion is crucial for sustainable growth. Read more about this in Growth Strategy of Bell Food Group.

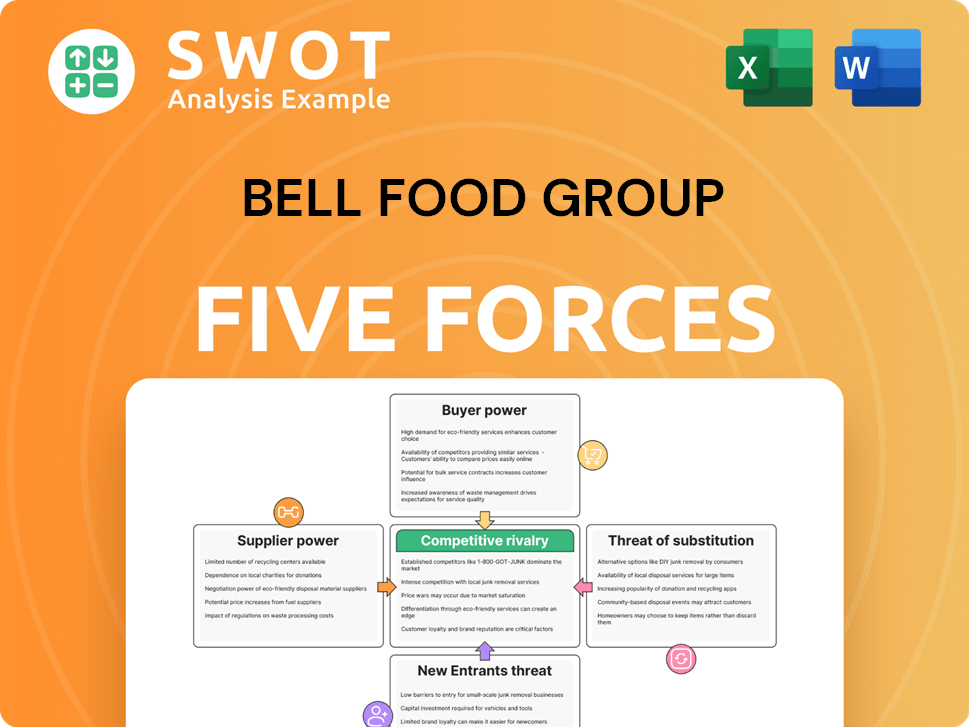

Bell Food Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bell Food Group Company?

- What is Competitive Landscape of Bell Food Group Company?

- What is Growth Strategy and Future Prospects of Bell Food Group Company?

- How Does Bell Food Group Company Work?

- What is Sales and Marketing Strategy of Bell Food Group Company?

- What is Brief History of Bell Food Group Company?

- Who Owns Bell Food Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.