New York Community Bancorp Bundle

Who Does New York Community Bancorp Serve?

Understanding the New York Community Bancorp SWOT Analysis reveals that in the ever-evolving

The

Who Are New York Community Bancorp’s Main Customers?

Understanding the customer base of New York Community Bancorp (NYCB) involves examining its primary customer segments. NYCB focuses on both consumer and business clients, offering a range of financial services tailored to their specific needs. The bank's strategic approach to customer acquisition and retention is heavily influenced by the demographics and characteristics of these key segments.

The target market for NYCB is primarily within the New York metropolitan area. This geographic focus allows the bank to understand and cater to the unique financial needs of this diverse region. The bank's services are designed to meet the demands of both individuals and businesses, reflecting its commitment to serving a broad customer base.

NYCB's ability to adapt to market changes and customer demands is crucial for its long-term success. The bank's customer segmentation strategy is a key element of its overall business model. For detailed information about the company, you can read more about the Owners & Shareholders of New York Community Bancorp.

NYCB's consumer segment includes individuals and families in the New York metropolitan area. These customers seek traditional banking products such as checking and savings accounts, certificates of deposit, and residential mortgage loans. While specific demographic data is not publicly available, the bank's focus on the New York metro area suggests a diverse customer base.

The business segment is a significant part of NYCB's revenue. This segment targets professional real estate investors and developers, particularly in multi-family lending. These customers often have experience in real estate management and require specialized financing solutions. NYCB also serves niche markets through specialty finance.

NYCB strategically emphasizes multi-family and commercial real estate lending. This focus has historically provided more robust returns and growth opportunities. This shift is driven by market demand and the bank's expertise in these specialized lending areas.

Specialty finance further diversifies NYCB's B2B portfolio. This segment serves niche markets that require tailored lending solutions. The bank's ability to cater to these specialized needs helps it maintain a competitive edge in the financial services industry.

NYCB's target market includes a diverse range of customers. The consumer segment includes individuals and families in the New York metro area. The business segment primarily targets real estate investors and developers.

- Consumer Segment: Individuals and families seeking traditional banking products.

- Business Segment: Professional real estate investors and developers, businesses, partnerships, and high-net-worth individuals.

- Geographic Focus: Primarily the New York metropolitan area.

- Income Levels: Spanning various income levels and occupations.

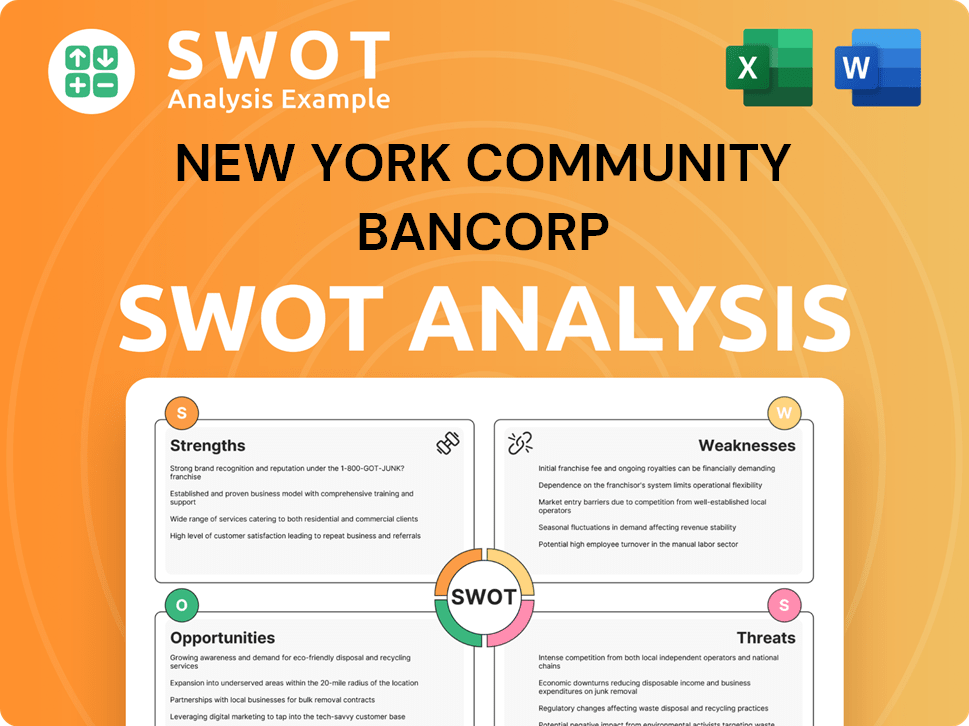

New York Community Bancorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do New York Community Bancorp’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution, and for New York Community Bancorp (NYCB), it's a key element of its strategy. The bank caters to a diverse customer base, each with unique requirements. This includes retail banking clients and those involved in multi-family lending and specialty finance.

NYCB's approach to customer service and product development is heavily influenced by understanding these varying needs. The bank's success hinges on its ability to meet the specific demands of each segment, from providing convenient banking services to offering complex financial solutions. This customer-centric focus helps drive loyalty and attract new clients.

The Marketing Strategy of New York Community Bancorp reflects the bank's understanding of its customers. This understanding is essential for maintaining a competitive edge in the banking industry.

Retail customers of NYCB prioritize convenience and reliability. They seek easy access to banking services, competitive interest rates, and secure online platforms. The bank's branch network and reputation for trust are also significant factors in attracting and retaining these customers.

- Convenient Access: Accessible branch networks and user-friendly online and mobile banking platforms are essential.

- Competitive Rates: Attractive interest rates on deposits and loans are crucial for attracting and retaining retail customers.

- Security: Ensuring the security of funds and transactions is a top priority.

- Personalized Service: Providing attentive and personalized customer service enhances the overall banking experience.

For multi-family lending and specialty finance clients, NYCB's offerings are more strategic. These clients require tailored financial solutions, competitive loan terms, and industry expertise. The bank's ability to understand the complexities of real estate investment is a key differentiator.

- Competitive Loan Terms: Clients look for favorable interest rates, loan-to-value ratios, and flexible repayment schedules.

- Efficient Underwriting: Streamlined and efficient loan approval processes are highly valued.

- Industry Expertise: Deep understanding of real estate investment and market trends.

- Tailored Solutions: Customized financial products and services to meet specific needs.

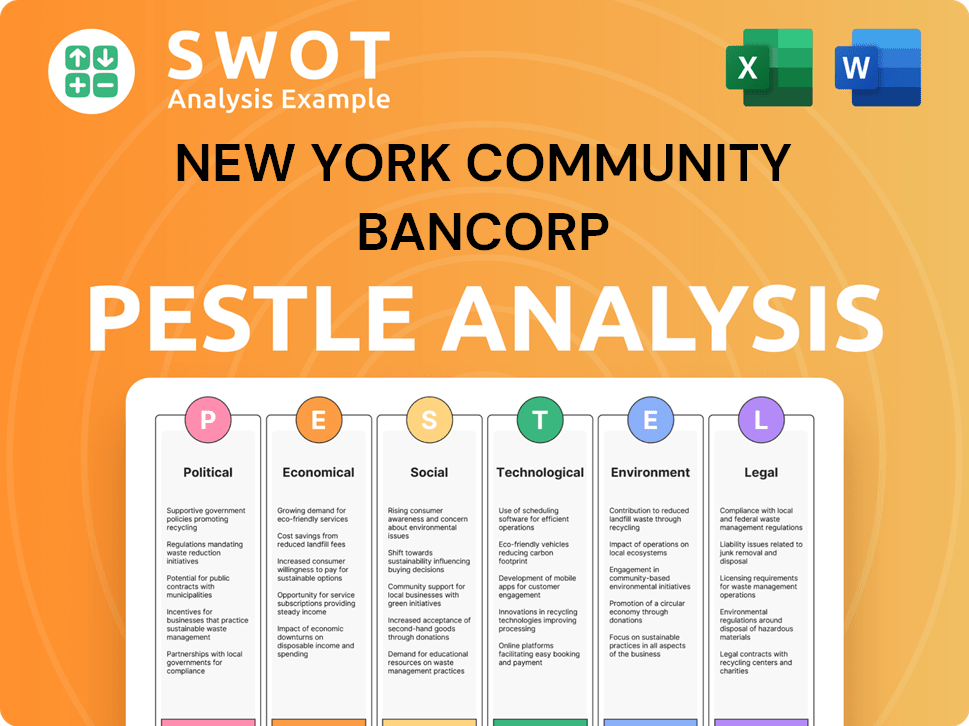

New York Community Bancorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does New York Community Bancorp operate?

The geographical market presence of New York Community Bancorp (NYCB) is primarily concentrated in the New York metropolitan area. This includes New York City, Long Island, and Westchester County, where the company has established a strong market share and brand recognition. This focus aligns with NYCB's core business, particularly its specialization in multi-family lending within a densely populated and active real estate market.

Beyond its New York footprint, NYCB strategically extends its reach into select national markets, especially for specialty finance and residential mortgage loans. This expansion allows the company to diversify its revenue streams and tap into different economic conditions and homeownership trends across various states. The company's approach involves maintaining a strong local presence in the New York metro area while leveraging specialized teams for national lending activities.

The acquisition of Flagstar Bank in 2022 significantly broadened NYCB's national presence, particularly in the Midwest and West Coast. This strategic move aimed to enhance the geographic distribution of sales and growth by tapping into new markets. This expansion diversified its business mix, incorporating a larger retail banking presence and a mortgage origination platform.

NYCB's primary target market is the New York metropolitan area, focusing on multi-family lending. This region offers a high density of population and a robust real estate market, which is ideal for their core business. The company's strong market share and brand recognition are key advantages in this area.

NYCB also serves select national markets, especially for specialty finance and residential mortgage loans. The residential mortgage division operates across various states, indicating a broader, albeit more distributed, national presence. This expansion strategy helps diversify revenue streams.

Customer demographics and preferences vary across regions. The New York metro area has a diverse customer base with strong demand for multi-family housing. National markets for residential mortgages may have different regional economic conditions and homeownership trends. Competitors Landscape of New York Community Bancorp can provide further context on the competitive environment.

The acquisition of Flagstar Bank in 2022 expanded NYCB's national presence, particularly in the Midwest and West Coast. This move diversified the business mix, including a larger retail banking presence and mortgage origination platform. This strategic expansion enhanced geographic distribution and growth.

NYCB holds a significant market share in the New York metropolitan area, particularly in multi-family lending. This strong local presence is a key factor in its success. The company's focus on this area allows for a deep understanding of local market dynamics.

NYCB maintains a strong branch network in the New York metro area to provide community-focused retail banking services. This local presence helps maintain customer relationships and support the company's lending activities. The branch network is crucial for serving the local customer base.

For its national lending activities, NYCB leverages specialized teams with expertise in those specific markets. These teams are essential for navigating different regional economic conditions and homeownership trends. The specialized teams drive the national expansion strategy.

The Flagstar Bank acquisition significantly increased NYCB's presence in the Midwest and West Coast. This expansion broadened the company's customer base and diversified its business lines. The acquisition has been a key driver of geographic expansion.

NYCB's customer base is segmented based on geographic location and product needs. The company tailors its offerings to meet the specific demands of each market segment. Understanding customer demographics is crucial for effective market strategies.

Recent expansions and strategic withdrawals are often driven by market opportunities and the company's risk appetite. NYCB continuously evaluates market conditions to identify growth prospects. This proactive approach helps maintain a competitive edge.

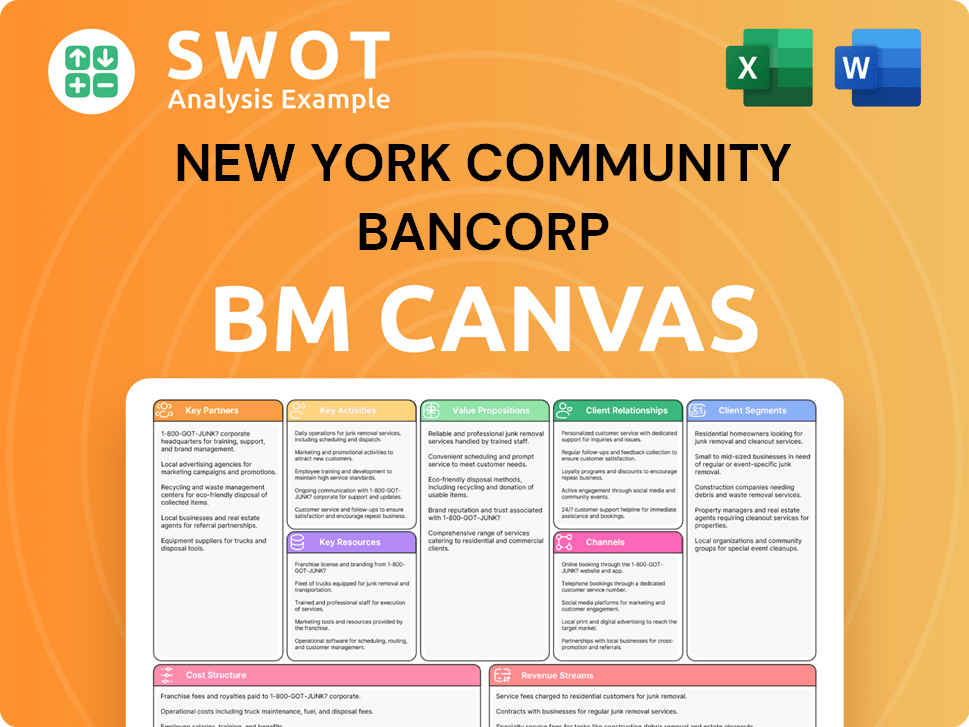

New York Community Bancorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does New York Community Bancorp Win & Keep Customers?

New York Community Bancorp (NYCB) employs a multifaceted approach to customer acquisition and retention, utilizing both traditional and digital channels to reach its target market. The strategies vary across its retail banking, multi-family, and specialty finance segments, each tailored to the specific needs and preferences of the customer demographics. The focus is on building long-term relationships through competitive offerings and excellent service, which is crucial in the competitive banking industry.

In the retail segment, NYCB focuses on local branch presence, community engagement, and targeted digital advertising. Customer service representatives and relationship managers play a key role in building personalized interactions. Loyalty programs, which include competitive interest rates on deposits and convenient services, are designed to retain customers. The approach aims to increase customer lifetime value and reduce churn, offering comprehensive financial solutions.

The acquisition of Flagstar Bank in 2022 significantly expanded NYCB's reach and product offerings, especially in mortgage banking. This integration enabled cross-selling of a broader range of products, which aimed to increase customer lifetime value and reduce churn. The company's strategic growth and customer-centric approach are detailed further in an analysis of the Growth Strategy of New York Community Bancorp.

NYCB uses local branch presence, community involvement, and targeted digital advertising. Sales tactics include personalized interactions within branches and through customer service representatives. These efforts help attract new depositors and loan applicants, focusing on building relationships.

Retention strategies include competitive interest rates on deposits and convenient banking services. These loyalty programs foster long-term customer relationships. The goal is to increase customer lifetime value through comprehensive financial solutions.

NYCB relies on relationship banking, referrals, and direct outreach to real estate professionals. Industry conferences and networking events are key for building relationships. CRM systems help identify potential clients and tailor solutions.

Retention is driven by competitive loan terms, efficient loan servicing, and proactive relationship management. NYCB's expertise in real estate financing and customized solutions are key. These efforts aim to maintain strong client relationships.

The acquisition of Flagstar Bank in 2022 expanded NYCB's product offerings and geographic reach. This integration allowed cross-selling and increased customer lifetime value. The goal was to reduce churn by providing a more comprehensive financial solution.

- Expanded product offerings, particularly in mortgage banking.

- Increased geographic footprint, reaching more customers.

- Enhanced ability to cross-sell products and services.

- Strengthened customer relationships through comprehensive solutions.

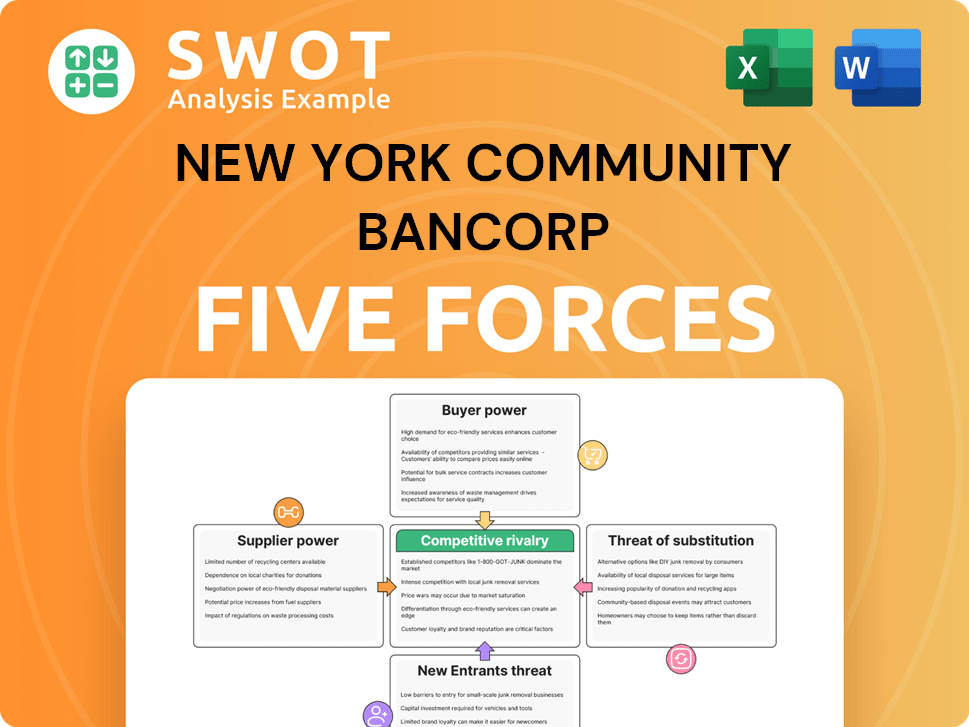

New York Community Bancorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of New York Community Bancorp Company?

- What is Competitive Landscape of New York Community Bancorp Company?

- What is Growth Strategy and Future Prospects of New York Community Bancorp Company?

- How Does New York Community Bancorp Company Work?

- What is Sales and Marketing Strategy of New York Community Bancorp Company?

- What is Brief History of New York Community Bancorp Company?

- Who Owns New York Community Bancorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.