Shelf Drilling Bundle

Can Shelf Drilling Navigate the Shifting Sands of the Offshore Drilling Market?

In the volatile world of offshore drilling, understanding Shelf Drilling SWOT Analysis, customer demographics and the target market are not just strategic considerations—they're survival imperatives. The recent downturn in Saudi Arabia's offshore spending has dramatically reshaped the landscape, forcing companies like Shelf Drilling to reassess their core clientele and operational strategies. This analysis dives into the critical factors shaping Shelf Drilling's customer base and its quest for sustained success.

This exploration will uncover the intricacies of Shelf Drilling's customer profile, from their geographical distribution across the drilling rig market to their evolving needs within the oil and gas industry. We'll examine how Shelf Drilling adapts to attract and retain its offshore drilling customers amidst fierce competition and fluctuating market dynamics. Ultimately, this analysis provides a comprehensive understanding of Shelf Drilling's customer acquisition strategy, revenue sources, and the critical role of customer demographics in shaping its future.

Who Are Shelf Drilling’s Main Customers?

Understanding the Shelf Drilling target market requires a focus on its business-to-business (B2B) customer base within the oil and gas sector. The company's primary customers are those involved in the exploration and production of oil and natural gas. This includes national oil companies (NOCs), integrated major oil companies (IOCs), and independent oil and natural gas companies.

These entities contract Shelf Drilling's jack-up rigs for offshore drilling and related services. Contracts typically span from three months to three years, with pricing based on a day-rate basis. The services provided include drilling, completion, maintenance, and decommissioning of offshore oil and natural gas wells.

While traditional demographic data like age or income aren't relevant for B2B customers, the key characteristics revolve around their operational needs, geographical focus, and strategic goals in the oil and gas industry. The Shelf Drilling target market is defined by these operational and strategic factors.

Shelf Drilling primarily serves NOCs, IOCs, and independent oil and gas companies. These companies are the core of the Shelf Drilling customer profile. They require offshore drilling services for oil and gas exploration and production.

Historically, a significant portion of Shelf Drilling's revenue came from Saudi Arabia. However, the company is now diversifying its geographical focus. Recent contracts in West Africa and Southeast Asia demonstrate a shift in the Shelf Drilling target market.

Contracts typically range from three months to three years. Services include drilling, completion, maintenance, and decommissioning. Day-rate pricing is the standard for these services, which are crucial for offshore drilling customers.

Shelf Drilling is adapting to changes in the global energy sector. The company is focusing on diversifying its customer base. This strategy helps reduce reliance on any single market or client, reflecting a proactive approach to market dynamics.

Shelf Drilling is actively adjusting its strategy to address shifts in the drilling rig market. For instance, the suspension of numerous contracts by Saudi Aramco in 2024 prompted a strategic re-evaluation. As a result, the company is expanding into other regions to maintain and grow its revenue. In Q4 2024, adjusted revenue was $225 million, and full-year 2024 adjusted revenue reached $972 million. The company's strategic pivot is evident in recent contract awards and extensions, such as those in Nigeria and Norway, which contributed to a 40% increase in adjusted EBITDA in Q1 2025 compared to the previous quarter. This demonstrates Shelf Drilling's ability to adapt and secure new contracts, reflecting a proactive approach to the oil and gas industry.

Shelf Drilling's customers are defined by their operational needs and strategic objectives. The company focuses on providing services to NOCs, IOCs, and independent oil and gas companies. These customers require offshore drilling services for exploration and production.

- NOCs, IOCs, and independent oil and gas companies are the primary customers.

- Contracts range from three months to three years.

- Services include drilling, completion, maintenance, and decommissioning.

- The company is diversifying its geographical focus to reduce reliance on any single market.

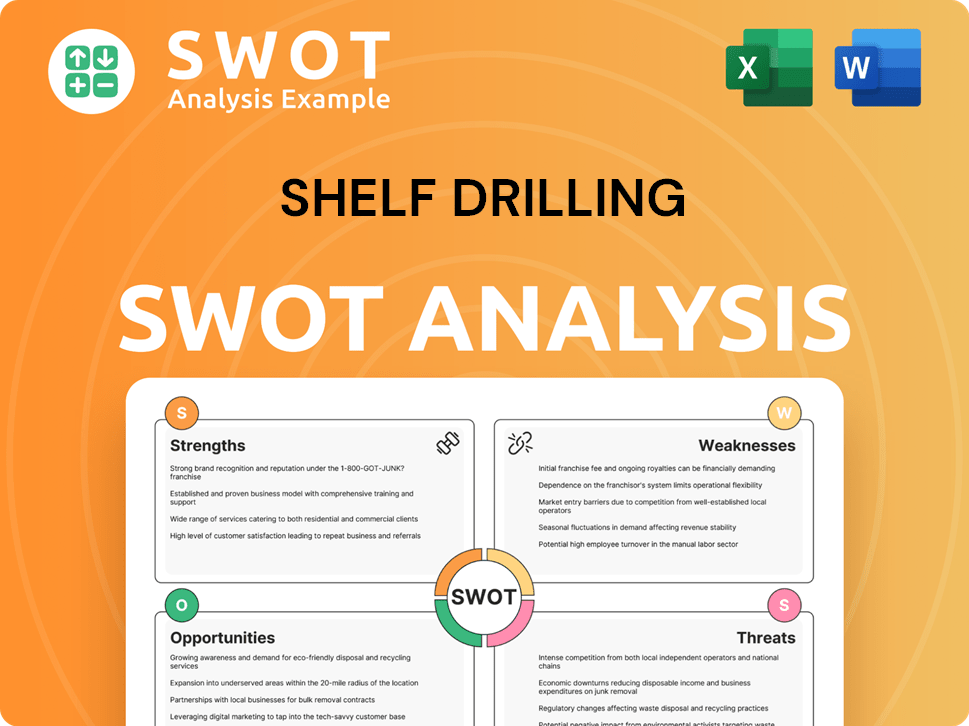

Shelf Drilling SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Shelf Drilling’s Customers Want?

The key needs and preferences of Shelf Drilling's customers, primarily oil and gas companies, revolve around operational efficiency, safety, and cost-effectiveness in shallow water drilling. These companies seek drilling services that minimize downtime and maximize productivity to ensure the timely extraction of hydrocarbons. Shelf Drilling's 'fit-for-purpose' strategy and high-performing fleet are designed to meet these critical demands.

Customers' decision-making is significantly influenced by rig specifications, safety records, and the ability to deliver projects on schedule and within budget. Shelf Drilling's ability to customize rigs, such as the Shelf Drilling Chaophraya and Shelf Drilling Krathong, for specific client needs, demonstrates its commitment to meeting unique operational requirements. The company aims to minimize operational risks, optimize production timelines, and ensure regulatory compliance for its clients.

Shelf Drilling addresses common pain points by providing advanced drilling technology, experienced crews, and flexible contract terms. Market trends, such as day rate pressures and contract suspensions in 2024, have influenced the company's strategic decisions to optimize its cost structure and pursue opportunities in diverse markets. The proactive mobilization of rigs to West Africa and ongoing demand in emerging markets reflect its adaptation to evolving customer needs and regional opportunities.

Customers prioritize drilling services that minimize downtime and maximize productivity. This ensures the timely and efficient extraction of hydrocarbons. Shelf Drilling's focus on high fleet uptime directly addresses this need.

Customers require safe and reliable drilling operations to minimize risks and ensure regulatory compliance. Shelf Drilling's strong operational performance, with a fleetwide uptime of 99.4% in Q1 2025, is a key factor.

Customers seek cost-effective drilling solutions that deliver projects on schedule and within budget. Shelf Drilling's focus on optimizing its cost structure and adapting to market conditions, as seen in 2024, supports this need.

The technical capabilities of drilling rigs are a major factor in customer decisions. The ability to tailor rigs, like the Shelf Drilling Chaophraya, to specific project requirements is crucial.

Flexible contract terms that can adapt to fluctuating market conditions are important. Shelf Drilling's ability to respond to market pressures and pursue opportunities in diverse markets is a key advantage.

Customers need experienced crews to ensure efficient and safe operations. Shelf Drilling's focus on providing experienced crews is a key factor in its success.

The Shelf Drilling target market consists primarily of oil and gas companies operating in shallow water environments. These companies require offshore drilling services for exploration, development, and production activities. The company's customer profile includes both established and emerging oil and gas producers. The company's ability to adapt to changing market dynamics and regional opportunities is crucial for attracting and retaining customers. For more details on the company's strategic direction, consider reading about the Growth Strategy of Shelf Drilling.

Shelf Drilling's customers, the offshore drilling customers, prioritize operational efficiency, safety, and cost-effectiveness. They seek reliable services that minimize downtime and maximize productivity. The company's focus on these areas helps it attract and retain clients in the competitive drilling rig market.

- Operational Efficiency: Minimizing downtime and maximizing productivity.

- Safety: Ensuring safe operations and regulatory compliance.

- Cost-Effectiveness: Delivering projects on time and within budget.

- Technical Capabilities: Utilizing advanced drilling technology.

- Experienced Crews: Providing skilled personnel for efficient operations.

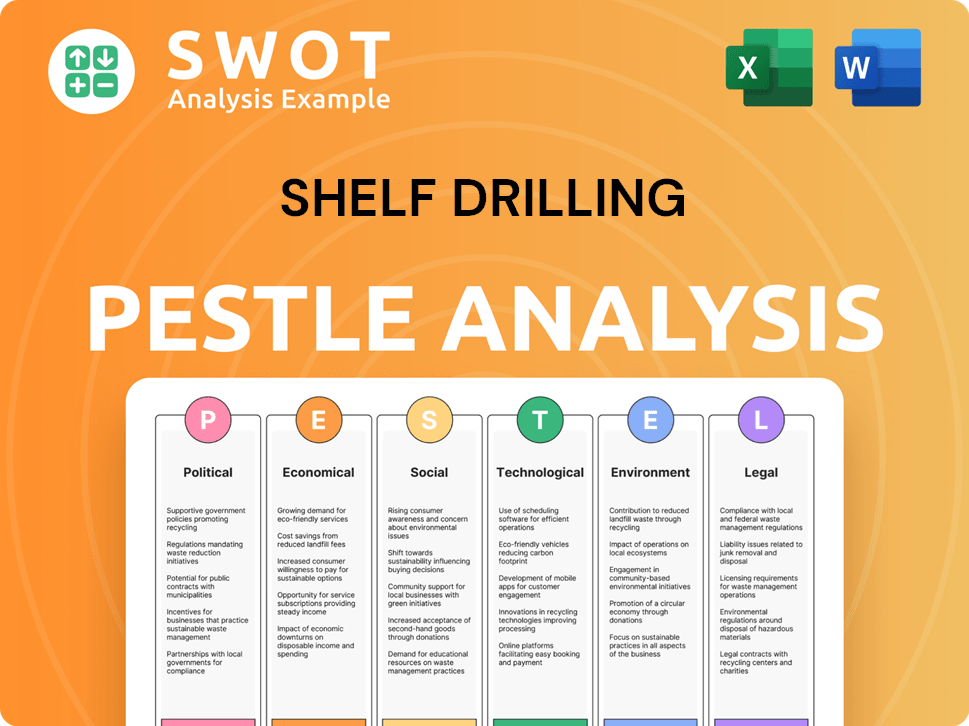

Shelf Drilling PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Shelf Drilling operate?

The geographical market presence of Shelf Drilling is primarily focused on shallow water offshore drilling operations, with a strong emphasis on emerging markets. The company strategically positions its rigs across Southeast Asia, the Middle East, India, West Africa, the North Sea, and the North Africa/Mediterranean regions. This diverse footprint allows it to tap into various regional demands within the drilling rig market.

Historically, Saudi Arabia has been a significant revenue source for Shelf Drilling. However, market dynamics shifted in 2024, when Saudi Aramco's decision to reduce offshore capital spending led to the suspension or release of several rigs. As of April 2025, the number of active rigs in Saudi Arabia has decreased significantly, impacting the company's revenue streams.

In response to these changes, Shelf Drilling has proactively expanded its focus on other regions. West Africa and Southeast Asia are key areas of growth, although competition remains high. This strategic diversification and localization of the company's fleet and contracts demonstrate its adaptability to succeed in evolving global markets, ensuring resilience and sustained operations.

Saudi Arabia was a major market for Shelf Drilling, contributing a significant portion of its revenue. In 2024, due to reduced offshore spending by Saudi Aramco, seven out of nine shallow-water rigs were suspended or released. As of April 2025, only two rigs are actively operating in this region, reflecting a substantial market shift.

Shelf Drilling is actively expanding its presence in West Africa. In May 2025, two additional rigs, High Island 11 and Shelf Drilling Victory, were mobilized to this region. High Island 11 is scheduled to commence a two-well contract in Nigeria by late May 2025. Several other rigs, including Main Pass IV, Adriatic 1, Shelf Drilling Scepter, Shelf Drilling Mentor, and Shelf Drilling Achiever, are also under contract in Nigeria.

Southeast Asia is another key area where Shelf Drilling is focusing its efforts. The company is actively seeking to deploy its rigs and secure contracts in this region. The demand for offshore drilling services in Southeast Asia provides opportunities for Shelf Drilling to expand its operations and revenue streams.

Shelf Drilling continues to operate in the North Sea. The Shelf Drilling Barsk commenced drilling operations in Norway in early May 2025, with a firm term expected until December 2026. This demonstrates the company's commitment to maintaining its presence in established markets.

Shelf Drilling has secured contract extensions for its Shelf Drilling Chaophraya and Shelf Drilling Krathong jack-up rigs with Chevron Thailand Exploration and Production. These extensions, for two years, are set to commence in the second half of 2025, ensuring operational continuity.

Activity levels in India declined from late 2023. Shelf Drilling is actively pursuing redeployment opportunities for its suspended rigs in India, aiming to mitigate the impact of reduced activity and capitalize on potential market recovery.

Shelf Drilling's strategic approach includes diversifying its fleet and contracts to navigate the dynamic offshore drilling market. This adaptability is crucial for maintaining a competitive edge, as the company actively adjusts to changing customer needs and geographical opportunities.

Shelf Drilling primarily focuses on shallow water offshore drilling. This specialization allows the company to target specific customer segments within the Shelf Drilling target market, optimizing its resources and expertise for these operations.

The company's customer base includes major oil and gas companies operating in the regions where Shelf Drilling has a presence. Understanding the specific needs and requirements of these customers is key to their success in the competitive offshore drilling market.

Shelf Drilling's revenue is primarily derived from its drilling contracts. The company's market share is influenced by its ability to secure and maintain contracts in key regions. The company's market share is influenced by its ability to secure and maintain contracts in key regions.

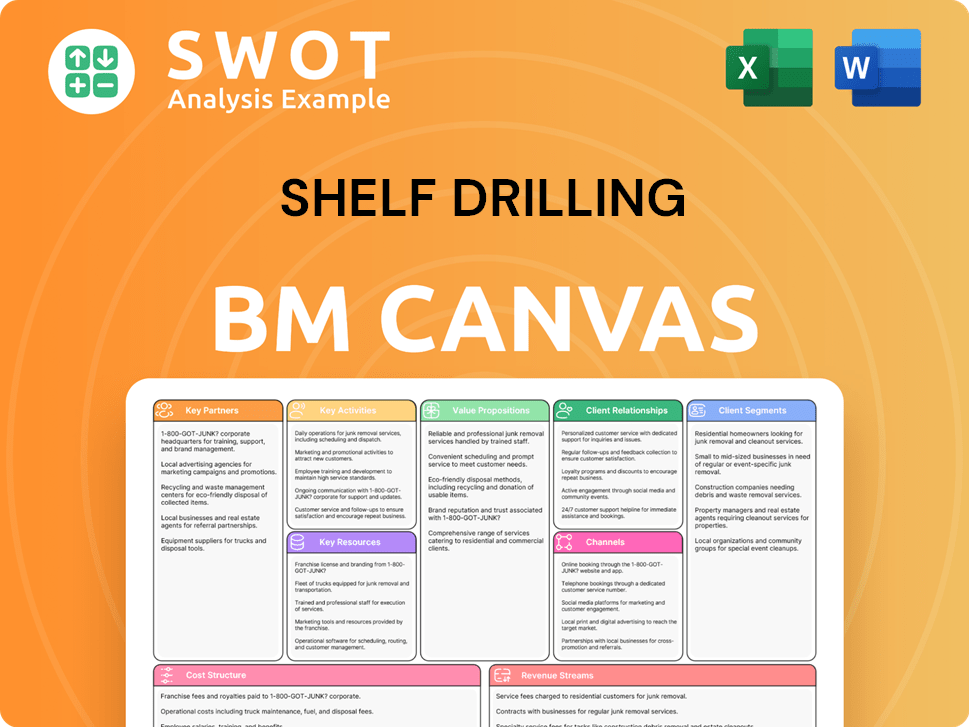

Shelf Drilling Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Shelf Drilling Win & Keep Customers?

The customer acquisition and retention strategies of Shelf Drilling within the B2B offshore drilling sector hinge on strong, lasting relationships, operational excellence, and market adaptability. The company's approach is centered on delivering safe and reliable services, leveraging its experienced management team and a fleet of jack-up rigs designed for specific purposes. This strategy is crucial in the competitive Revenue Streams & Business Model of Shelf Drilling.

Shelf Drilling's customer acquisition efforts primarily involve securing new contracts and extensions for its drilling rigs. This is achieved through active engagement with multiple operators to capture near-term opportunities and extend operational coverage. Recent successes include new contracts and extensions in regions such as Nigeria and Thailand, which are key areas for the company's operations and customer base. This proactive approach helps to maintain a steady flow of projects, supporting revenue and market presence.

Customer retention is fostered through consistent high fleet uptime, which was at 99.4% in Q1 2025, demonstrating strong operational efficiency. This reliability is crucial for retaining long-term clients. Shelf Drilling also adapts its strategy to market changes, such as rig suspensions, by redeploying rigs to other regions. This proactive repositioning, coupled with a focus on optimizing cost structures, aims to maintain customer loyalty and long-term value despite short-term market challenges.

Shelf Drilling actively pursues new contracts and extensions to expand its customer base and secure revenue. Recent contract wins include the Shelf Drilling Achiever in Nigeria, with a three-year contract starting October 2024 and a two-year option. The Main Pass IV also secured a two-year contract in Nigeria, commencing December 2024, showcasing the company's success in acquiring new projects.

Retention strategies focus on maintaining high fleet uptime, which was at 99.4% in Q1 2025, and adapting to market changes. Extensions for the Adriatic I rig in Nigeria and the Shelf Drilling Scepter further demonstrate the company's ability to retain customers. These efforts are vital for ensuring long-term relationships and stability within the offshore drilling industry.

Shelf Drilling collaborates with strategic partners, such as Arabian Drilling, to expand its reach and secure new opportunities. This collaboration allows the company to leverage the partner's resources and market presence. Strategic alliances are a key component of the company's approach to both customer acquisition and market penetration within the drilling rig market.

The company adjusts its strategy to respond to market shifts, such as rig suspensions in Saudi Arabia. By redeploying rigs to regions like West Africa, Shelf Drilling aims to maintain operational efficiency and secure new contracts. This adaptability is critical for maintaining customer loyalty and long-term value in the dynamic oil and gas industry.

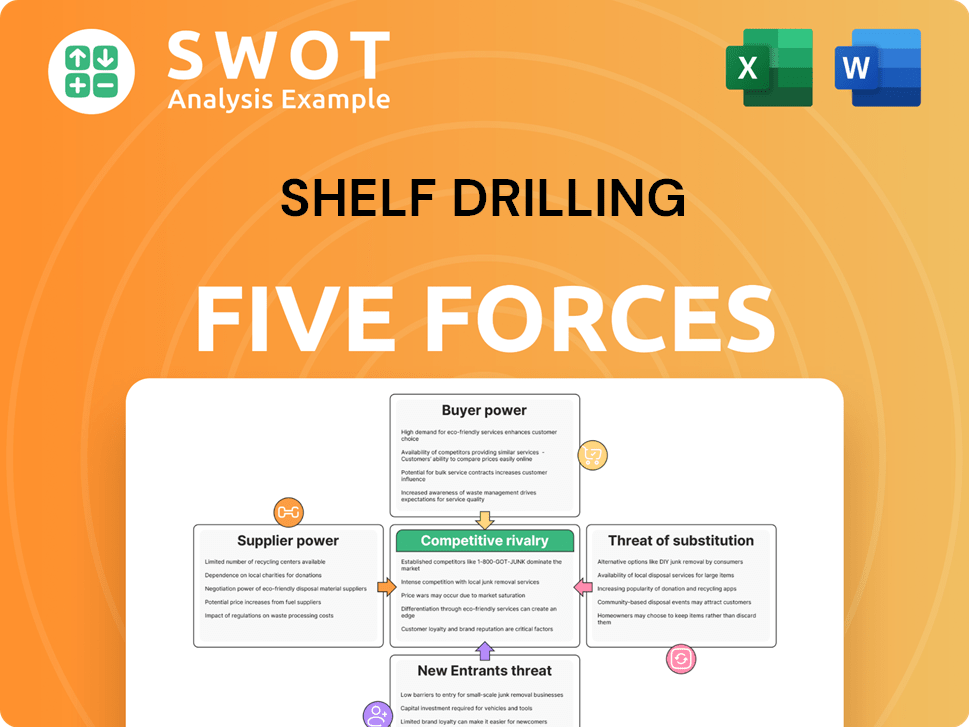

Shelf Drilling Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shelf Drilling Company?

- What is Competitive Landscape of Shelf Drilling Company?

- What is Growth Strategy and Future Prospects of Shelf Drilling Company?

- How Does Shelf Drilling Company Work?

- What is Sales and Marketing Strategy of Shelf Drilling Company?

- What is Brief History of Shelf Drilling Company?

- Who Owns Shelf Drilling Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.