Sungrow Power Supply Bundle

Who Buys Sungrow's Renewable Energy Solutions?

In the dynamic world of renewable energy, understanding your customer is key to thriving. For Sungrow Power Supply, a global leader in solar and energy storage, knowing its Sungrow Power Supply SWOT Analysis is crucial. This exploration dives deep into Sungrow's customer demographics and target market, revealing the strategies behind its global success.

From its origins in China to its current status as a global powerhouse, Sungrow's Sungrow target market has evolved significantly. This analysis will uncover the Sungrow company profile, including its diverse renewable energy customers across various sectors. We'll explore the Sungrow customer segmentation analysis, examining who are Sungrow's ideal customers and their geographic locations to understand Sungrow's market analysis and Sungrow's target market in the US.

Who Are Sungrow Power Supply’s Main Customers?

Understanding the customer demographics and the Sungrow target market is crucial for grasping the company's strategic direction. Sungrow Power Supply primarily operates in the business-to-business (B2B) sector, focusing on the solar energy, wind energy, and energy storage industries. Their customer base is diverse, encompassing entities involved in large-scale utility projects, commercial and industrial (C&I) businesses, and the residential sector.

The company's revenue streams are diversified, with solar inverters, energy storage systems, and new energy investment and development contributing significantly. In 2024, solar inverters accounted for approximately 37% of Sungrow's revenue, while energy storage systems represented 32%, and new energy investment and development contributed 27%. This diversification reflects a strategic approach to capture growth across various segments of the renewable energy market.

The company's customer acquisition strategy and market analysis are shaped by the evolving dynamics of the renewable energy sector. Sungrow's focus on distributed solar reflects a proactive response to market trends. The acquisition of a small inverter company in 2023, aimed at expanding its share in the distributed photovoltaic power generation market, highlights the company's commitment to capturing growth in smaller-scale installations.

These customers are key for Sungrow, especially given its strong market share in supplying inverters for large-scale solar projects. In 2023, Sungrow held more than 20% market share by shipments. These clients require high-capacity inverters and comprehensive energy solutions.

C&I businesses are a significant segment, increasingly adopting solar and energy storage solutions to reduce energy costs and improve sustainability. These customers often seek integrated solutions tailored to their specific energy needs, driving demand for advanced energy storage systems.

The residential market represents a growing area of focus for Sungrow. The company is expanding its presence in the distributed solar market. This expansion is driven by the increasing adoption of residential solar panels and energy storage systems.

With the energy storage system segment projected to grow to 37% of revenue in 2025, potentially overtaking solar inverters as the largest revenue contributor, customers seeking ESS solutions are becoming increasingly important. This includes utility-scale projects, C&I businesses, and residential applications.

Sungrow's strategic shifts, including the acquisition of a small inverter company, reflect a focus on distributed solar and a broader customer base. This diversification is driven by market research and external trends favoring distributed energy. For more insights, read about the Marketing Strategy of Sungrow Power Supply.

- Market Share: Sungrow's global shipping volume of photovoltaic power inverters reached 147 GW in 2024.

- Energy Storage Growth: The energy storage systems reached 28 GWh in 2024.

- Strategic Expansion: The company increased its share in the distributed photovoltaic power generation market from 30% to 40%, boosting sales of distributed photovoltaic inverter products by 35% in the following year.

- Future Outlook: The energy storage system segment is projected to grow to 37% of revenue in 2025.

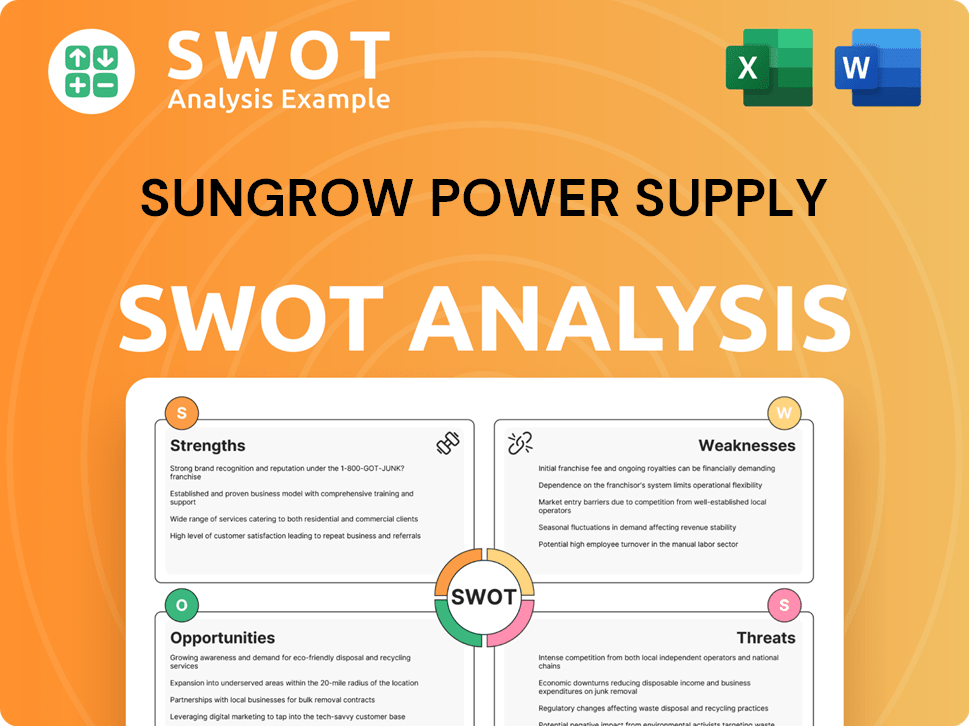

Sungrow Power Supply SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Sungrow Power Supply’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of Sungrow Power Supply. The company's target market spans various sectors, including utility-scale, commercial, industrial (C&I), and residential applications, each with distinct requirements. This customer segmentation allows Sungrow to tailor its offerings effectively, ensuring it meets the specific demands of each segment within the solar energy market.

For large-scale projects, factors such as high integration, safety, reliability, and efficient operation and maintenance (O&M) are paramount. Residential customers, on the other hand, often prioritize maximizing energy output, reducing electricity costs, and embracing a sustainable lifestyle. Sungrow's approach involves providing comprehensive solutions, including PV inverters, energy storage systems (ESS), and monitoring platforms, to address these varied needs. This focus on customer-centric solutions is key to capturing a significant share of the renewable energy customers.

The company's commitment to innovation is evident in its product development and strategic initiatives. For example, in June 2025, Sungrow launched the PowerTitan 3.0 ESS Platform for utility-scale applications, highlighting its focus on flexibility, power density, intelligence, and safety. This commitment to technological advancement and customer satisfaction allows Sungrow to maintain its position in the solar energy market.

For utility-scale and commercial & industrial (C&I) customers, Sungrow prioritizes high integration, safety, and efficient O&M systems. These customers need solutions that maximize green electricity benefits and optimize energy efficiency. Sungrow offers comprehensive PV inverter, ESS, and monitoring solutions to meet these needs.

Residential customers focus on maximizing energy output, reducing electricity costs, and adopting a sustainable lifestyle. Sungrow caters to these preferences with PV string inverters, microinverters, and ESS solutions. The company's offerings are designed to meet the specific needs of homeowners seeking clean energy options.

Sungrow's commitment to innovation is demonstrated through its product development, such as the PowerTitan 3.0 ESS Platform launched in June 2025. This platform is designed for utility-scale applications, focusing on flexibility, power density, intelligence, and safety. This showcases Sungrow's dedication to providing advanced solutions.

Loyalty is built on technical prowess, with substantial investment in R&D. In the first half of 2024, Sungrow's R&D investment increased by 41.65%, totaling US$0.2 billion. This investment underscores Sungrow's commitment to innovation and customer satisfaction.

Sungrow addresses technical challenges in distributed generation, such as flow inversion, by integrating batteries with hybrid inverters. This approach enhances the reliability and efficiency of their solutions, catering to the specific needs of their target market.

Purchasing behaviors are influenced by the desire for advanced energy monitoring and management functionalities, particularly for C&I customers. Sungrow is introducing a new platform for three-phase inverters in 2025 to meet this demand. This focus on advanced features enhances customer experience.

Sungrow's success hinges on understanding and addressing the diverse needs of its customer base. These needs vary across different segments, including utility-scale, C&I, and residential customers. By focusing on these key areas, Sungrow aims to strengthen its market position and drive growth within the solar energy market.

- Utility-Scale: High integration, safety, reliability, and efficient O&M systems.

- C&I: Advanced energy monitoring and management functionalities.

- Residential: Maximizing energy output, reducing electricity costs, and embracing sustainability.

- Innovation: Continuous product development, such as the PowerTitan 3.0 ESS Platform.

- R&D: Significant investment in research and development, increasing by 41.65% in the first half of 2024.

- Solutions: Comprehensive PV inverters, ESS, and monitoring solutions tailored to specific needs.

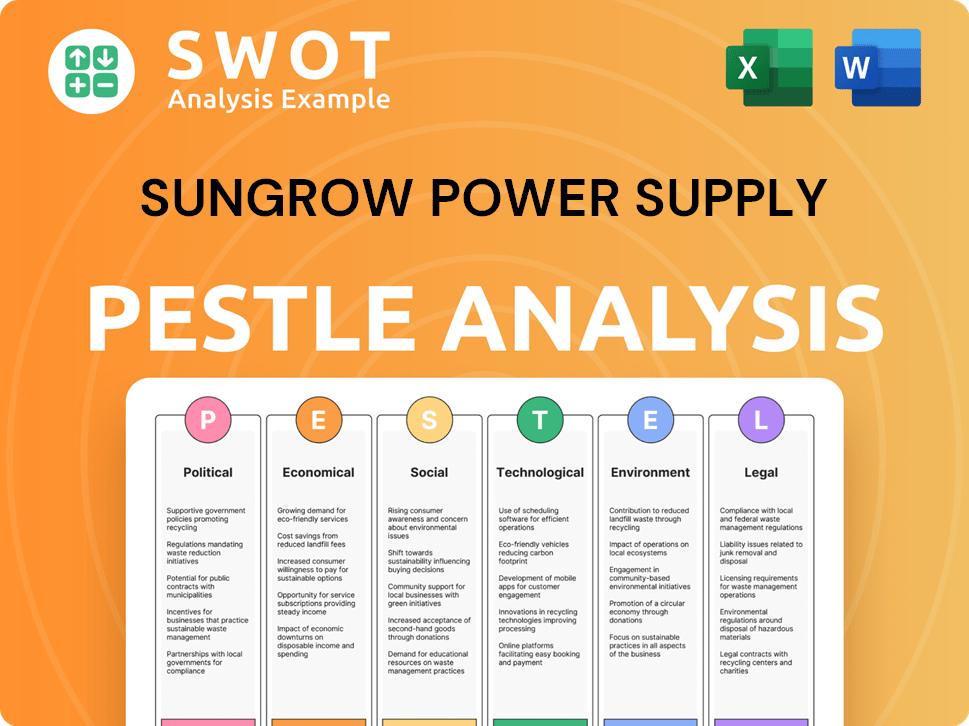

Sungrow Power Supply PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Sungrow Power Supply operate?

Understanding the geographical market presence of Sungrow is crucial for assessing its customer demographics and target market. The company has established a significant global footprint, with its innovations powering clean energy projects across more than 180 countries. This widespread presence is a key factor in reaching a diverse range of renewable energy customers.

In 2024, overseas markets accounted for a substantial 47% of Sungrow's revenue, with the United States contributing approximately 16%. While China remains a major market, international sales are gaining traction, especially in Europe, where revenue grew by 30% in 2022 due to favorable regulatory environments and increased investments in renewable energy infrastructure. This expansion strategy is vital for capturing a broader customer base within the solar energy market.

Sungrow's ability to adapt to regional challenges and opportunities is evident in its market strategies. For example, the company is aiming to consolidate its position in the Brazilian market for distributed generation and expand into battery integration for residential, commercial, and industrial projects. Furthermore, Sungrow's deployment of over 3.3GW of PV inverters and 350MWh of BESS in Thailand by December 2024 highlights its leadership in that region. For a deeper dive into the competitive landscape, consider exploring the Competitors Landscape of Sungrow Power Supply.

Sungrow has a strong presence in Europe, with over 18 years of operation. The company has over 750 employees, more than 25 local offices, and two R&D teams dedicated to serving the renewable energy customers in the region.

The company faces challenges in the US market, primarily due to tariffs on energy storage systems. These tariffs have significantly impacted the growth rate, with a sharp decrease in the overseas market growth to 8.76% in 2024, compared to 75.05% in 2023.

Sungrow is adapting to market conditions by introducing hybrid solutions with locally manufactured models in Brazil. This strategic move aims to optimize sales and after-sales services, ensuring better customer satisfaction and market penetration.

Despite current challenges, Sungrow anticipates a recovery in the US market by 2026. This is due to the expected operational launch of their overseas ESS factory by the end of 2025. This expansion will help them to reach their Sungrow target market for energy storage.

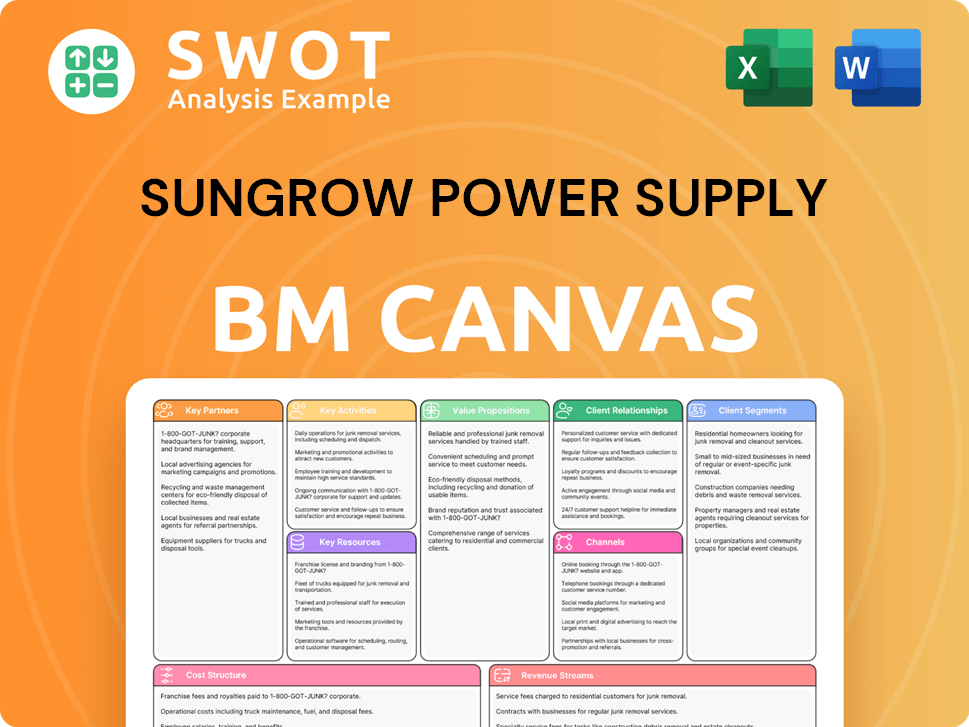

Sungrow Power Supply Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Sungrow Power Supply Win & Keep Customers?

The strategies employed by Sungrow for customer acquisition and retention are multifaceted, focusing on strategic partnerships, technological innovation, and comprehensive service offerings. These approaches are critical for capturing market share and maintaining a strong customer base in the competitive solar energy market. Understanding the Brief History of Sungrow Power Supply provides context for these strategies.

Sungrow's customer acquisition strategy emphasizes building long-term, large-scale relationships, as demonstrated by its partnerships with major players in the renewable energy sector. Simultaneously, the company actively expands its market presence through strategic acquisitions to broaden its product offerings and reach new customer segments. These dual approaches are designed to ensure both market penetration and sustained growth.

Customer retention is a core focus for Sungrow, achieved through excellent after-sales service, advanced monitoring platforms, and continuous investment in research and development. By prioritizing customer satisfaction and adapting to evolving needs, Sungrow aims to build lasting relationships and maintain a competitive edge in the solar energy market.

Sungrow forms strategic alliances to acquire customers, such as the March 2024 agreement with Gulf Energy Development Plc. This partnership is for battery energy storage systems (BESS) and solar inverter systems. The agreement covers solar farm projects with a total of 3,500 MWp capacity from 2024 to 2030.

The company expands its market share through targeted acquisitions. In 2023, Sungrow acquired a small inverter company. This acquisition boosted its presence in the distributed photovoltaic power generation market. Consequently, the company increased its market share in the distributed photovoltaic inverter market from 30% to 40%.

Sungrow prioritizes strong after-sales service to retain customers. They maintain a global network of 520 service outlets across over 180 countries. This network ensures excellent customer experience from installation to long-term maintenance, supporting customer satisfaction.

The iSolarCloud platform enhances operational efficiency. It features one-click rapid plant setup and intelligent monitoring. The company increased its R&D expenditures by 41.65% in the first half of 2024. This investment totaled US$0.2 billion, ensuring competitive products.

Sungrow targets diverse customer segments within the solar energy market. This includes utility-scale projects, commercial installations, and residential applications. Understanding the demographics of solar panel buyers is essential for effective marketing.

- Utility-Scale Projects: Strategic partnerships and large-scale projects, such as the agreement with GULF, are key.

- Commercial Installations: Focus on providing efficient and scalable solutions for businesses.

- Residential Applications: Offering user-friendly products and strong after-sales support for homeowners.

- Market Share: The company aims to increase its market share in residential solar.

- Customer Satisfaction: The iSolarCloud platform and global service network are designed to enhance customer satisfaction.

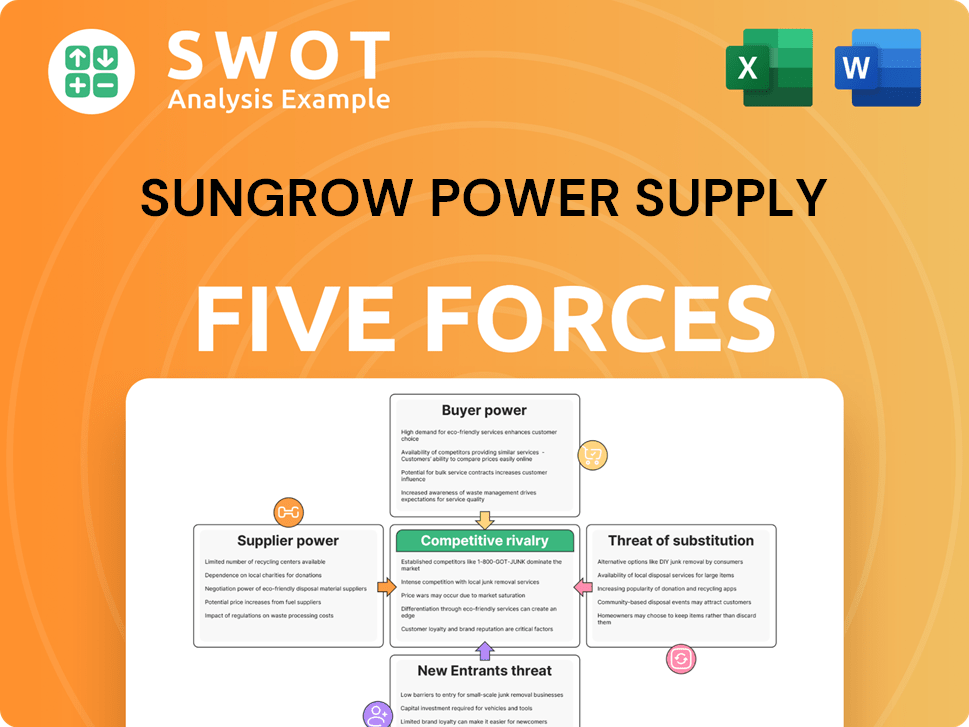

Sungrow Power Supply Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sungrow Power Supply Company?

- What is Competitive Landscape of Sungrow Power Supply Company?

- What is Growth Strategy and Future Prospects of Sungrow Power Supply Company?

- How Does Sungrow Power Supply Company Work?

- What is Sales and Marketing Strategy of Sungrow Power Supply Company?

- What is Brief History of Sungrow Power Supply Company?

- Who Owns Sungrow Power Supply Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.