Vanquis Banking Group Bundle

Who Does Vanquis Banking Group Serve?

In the complex world of financial services, understanding customer demographics and target market is critical for success. Vanquis Banking Group, a specialist bank, has built its business on serving a specific customer profile often overlooked by traditional lenders. This focus has shaped its evolution since its founding in 1880, driving strategic shifts and product innovations. A deep dive into the company's customer base reveals a fascinating story of adaptation and customer-centricity.

The Vanquis Banking Group SWOT Analysis underscores the importance of understanding its target market. By focusing on the "mid-cost credit market," Vanquis Banking Group caters to individuals seeking to build or rebuild their credit. This approach requires a detailed market analysis, including examining Vanquis Bank customer age range, income levels, and location data. Understanding these customer demographics is key to crafting effective customer acquisition and retention strategies, ultimately driving customer satisfaction and long-term value.

Who Are Vanquis Banking Group’s Main Customers?

Understanding the Customer demographics and target market of financial institutions like the [Company Name] is crucial for strategic planning. The company primarily focuses on the UK and Irish markets, serving a specific segment of consumers. This segment often includes individuals who may be underserved by traditional lenders, particularly those looking to build or rebuild their credit profiles.

The company's core customer base is generally characterized as those with limited access to mainstream credit. This could be due to a variety of factors, including past financial difficulties or a thin credit history. While specific details on age, gender, or income are not publicly available, the company's focus on the 'mid-cost credit market' and 'financially underserved customers' provides insight into its customer profile.

The company's offerings, including credit cards, loans, and vehicle finance, are designed to meet the financial needs of this target market. The credit card segment is a significant revenue generator for the group. In 2024, the company saw an increase in new customer acquisition, projecting modest growth in receivables for the second half of the year. The company has strategically shifted its focus towards second charge mortgages and credit cards, while moderating growth in vehicle finance. This shift reflects a focus on more profitable segments and improved credit quality understanding.

The company's customer base can be segmented based on their credit profiles and financial needs. This segmentation helps tailor products and services to meet specific requirements. The company's approach to credit also indicates a segment that may not be immediately eligible for credit but is provided with financial management support.

The company's product portfolio includes credit cards, personal loans, second charge mortgages, and vehicle finance. The credit card segment is a major revenue driver. The company has been strategically prioritizing growth in second charge mortgages and credit cards.

The company's strategy involves a focus on more profitable growth segments and improved credit quality. This includes a strategic shift towards second charge mortgages and credit cards. The company's approach to credit also indicates a segment that may not be immediately eligible for credit but is provided with financial management support.

The company is anticipating modest growth in receivables for the second half of 2024, driven by increased customer acquisition. The company is also preparing for the launch of a new IT platform in mid-2026. This is part of a broader effort to enhance its financial services offerings and improve operational efficiency.

The company targets a specific segment of the market, focusing on underserved consumers in the UK and Ireland. The company's product offerings are tailored to meet the needs of this target audience analysis, with credit cards being a major revenue source. Strategic shifts and technological upgrades are underway to support future growth and operational efficiency.

- Focus on underserved consumers.

- Emphasis on credit cards and second charge mortgages.

- Strategic shifts towards profitable segments.

- Anticipated growth in receivables in the second half of 2024.

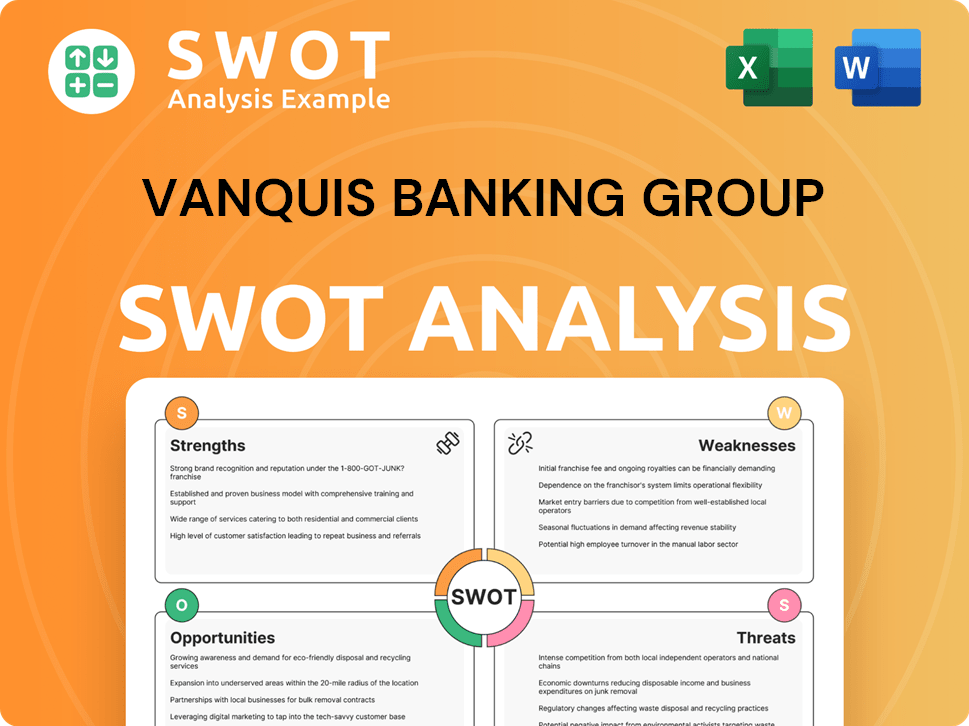

Vanquis Banking Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vanquis Banking Group’s Customers Want?

Understanding the customer needs and preferences of the Vanquis Banking Group is crucial for effective market analysis and strategic planning. The primary focus is on individuals seeking financial stability and accessible credit solutions. This customer profile often includes those with limited financial resources who are looking to manage their expenses and improve their creditworthiness.

The target market for financial services provided by the company is characterized by specific purchasing behaviors and decision-making criteria. Customers are driven by the need for accessible credit and flexible financial options. This includes a desire to build or repair their credit scores, which is a significant motivator for engaging with the company's offerings. The company addresses pain points such as difficulty obtaining credit from mainstream lenders, which helps shape its customer acquisition strategy.

The company's approach is centered around a customer-led strategy, derived from extensive research and data analysis. This involves offering a range of products, including credit builder credit cards, purchase credit cards, and balance transfer options. The company also supports customers through its 'not yet' approach, providing financial management assistance to those not immediately eligible for credit. This personalized approach aims to drive customer loyalty and deepen relationships.

Customers prioritize achieving financial stability and managing everyday expenses. This involves seeking tools and services that help them budget effectively and avoid financial stress. The launch of an Easy Access Savings proposition within the Snoop app in late 2024 supports customers in building a financial safety net.

The need for accessible credit is a key driver. Customers often seek credit options when they have difficulty obtaining credit from mainstream lenders. The availability of credit builder cards and balance transfer options is a significant draw.

Many customers are motivated by the desire to improve their credit scores. Products and services that help build or repair credit are highly valued. This drives customer engagement and loyalty.

Customers prefer tools that facilitate better money management and financial capability. The Snoop app, leveraging AI and open banking, offers personalized insights, potentially saving customers up to £1,500 annually. This demonstrates a preference for proactive financial management solutions.

The demand for flexible financial solutions is significant. This includes credit cards with various features, such as purchase credit and balance transfer options, catering to diverse financial needs. The company's offerings are designed to address these needs.

Customers appreciate personalized support and guidance. The 'not yet' approach, which provides financial management assistance to those not immediately eligible for credit, is a key element in fostering customer loyalty and deepening relationships.

Understanding the customer demographics and preferences is crucial for the company. The company's market analysis reveals specific needs and behaviors that inform product development and marketing strategies. The company focuses on providing accessible and flexible financial solutions.

- Customer Profile: Primarily individuals with low financial resilience, limited disposable income, and minimal savings.

- Motivations: Seeking financial stability, managing everyday expenses, and improving creditworthiness.

- Purchasing Behavior: Driven by the need for accessible credit and flexible financial solutions.

- Decision-Making Criteria: Focused on ease of access, credit-building opportunities, and tools for better money management.

- Product Preferences: Credit builder cards, purchase credit cards, balance transfer options, and savings products.

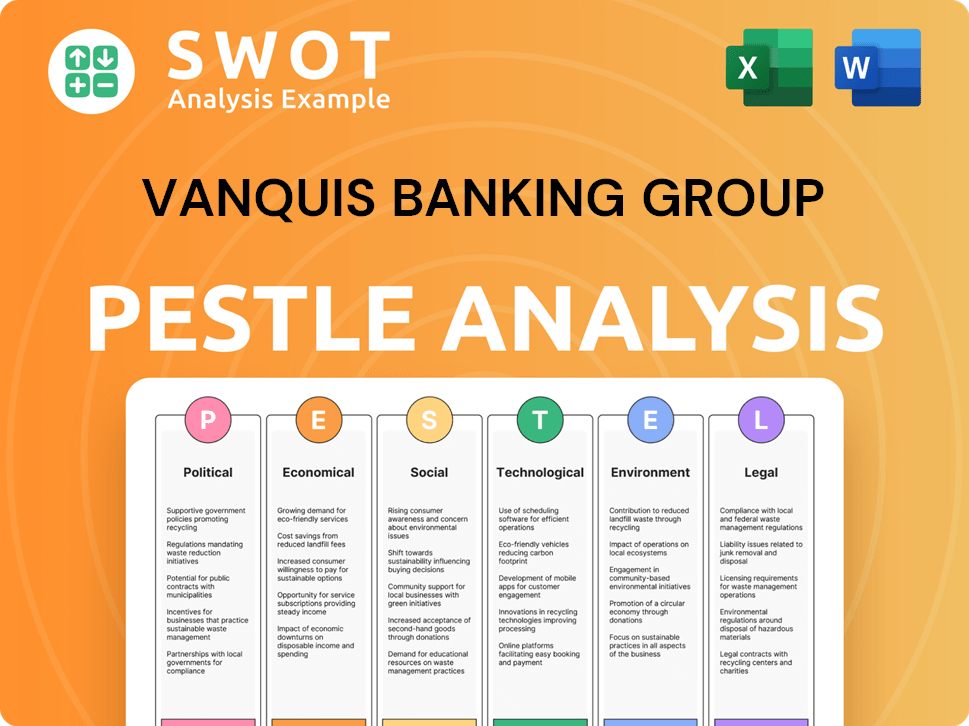

Vanquis Banking Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vanquis Banking Group operate?

The geographical market presence of Vanquis Banking Group is primarily concentrated in the United Kingdom. The company, headquartered in Bradford, England, strategically focuses on the UK market as its primary area of operation. This focus is evident in its efforts to enhance digital banking and expand product offerings.

Vanquis Banking Group also has operations in Ireland, expanding its reach beyond the UK. The company's strategic moves indicate a targeted approach within these established geographical markets. This includes a focus on specific product lines and customer segments.

The company's dedication to the UK market is reflected in its customer-led strategy, designed to meet diverse financial needs. The company's commitment to understanding and serving the UK market is a key aspect of its business model. This includes a focus on financial inclusion and serving the underserved credit market.

Vanquis Banking Group's main focus is the UK, where it has a strong presence as a specialist bank. Its headquarters are in Bradford, England. This strategic concentration allows for a deep understanding of the local market and customer needs.

Besides the UK, Vanquis operates in Ireland, broadening its geographical footprint. This expansion indicates a strategic move to serve a wider customer base. The company's approach includes tailored financial services.

The company is growing its second charge mortgages and credit cards. The gross customer interest-earning balances grew by 0.2% in the first quarter of 2025 to £2,313 million, or 2.4% excluding a personal loan portfolio sale. This shows a focus on specific product lines within its markets.

Vanquis Banking Group uses a customer-led strategy to meet diverse financial needs. This approach is designed to cater to the specific requirements of its target market. This strategy is crucial for effective market analysis.

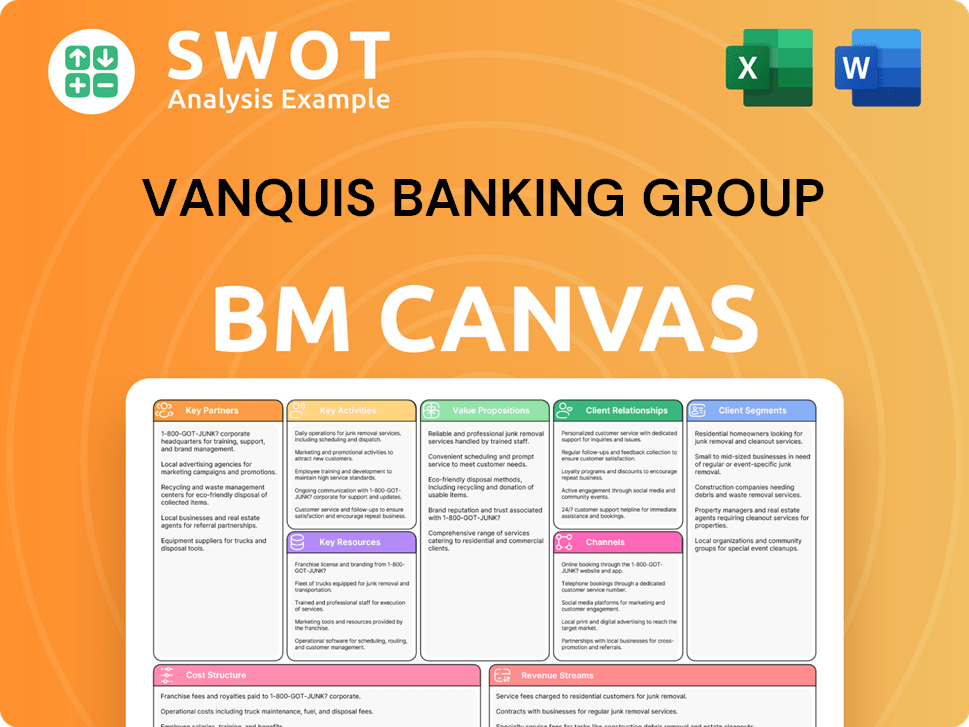

Vanquis Banking Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vanquis Banking Group Win & Keep Customers?

Customer acquisition and retention strategies at Vanquis Banking Group focus on a multi-channel approach, emphasizing digital platforms and data-driven insights. The company aims to continuously develop its customer proposition and expand its lending offerings. A key element of this strategy is leveraging technology and personalization to enhance the customer experience.

The company utilizes a range of marketing channels and sales tactics, with a strong emphasis on digital platforms for delivering its credit products. Initiatives include the ongoing development of customer propositions and the expansion of lending offers. The goal is to attract and retain customers through a combination of effective marketing, innovative product offerings, and superior customer service.

A significant tool for both customer acquisition and retention is the Snoop app. This app uses AI and open banking to provide personalized financial insights, helping customers manage their finances and save money. Snoop's cost-effectiveness and value in money management make it a key component of the Group's strategy.

All credit products are delivered online, reflecting a digital-first approach. This strategy allows for efficient customer acquisition and service delivery. Digital channels are crucial for reaching the target market and providing convenient access to financial services.

The Snoop app serves as a cost-effective acquisition channel, with origination costs around 10% of other channels. It also functions as a valuable money management tool. Active Snoop users reached 322,000 as of March 31, 2025.

Vanquis emphasizes personalized experiences and improved customer service. The 'Gateway' technology transformation program, expected to complete by mid-2026, is central to this. This program aims to centralize customer data.

The company refines its targeted customer propositions based on data analysis. This includes growing customer engagement to drive credit card utilization. Data helps in understanding the Growth Strategy of Vanquis Banking Group and the needs of the target market.

Vanquis customers using Snoop rose by 15% to 46,000 as of March 31, 2025. The launch of an Easy Access Savings proposition within the Snoop app in late 2024 aims to further enhance customer engagement and retention.

The 'Gateway' program aims to centralize customer data. It is designed to improve service, reduce costs, and enable faster, more personalized interactions. The program is expected to be completed by mid-2026.

The company focuses on operational efficiencies and customer satisfaction despite challenges like increased complaint costs. The new Financial Ombudsman Service (FOS) fee structure, implemented on April 1, 2025, is expected to reduce unmerited Claims Management Company (CMC) complaint referrals.

The new FOS fee structure is expected to positively impact complaint costs in 2025. This initiative is part of the company's broader effort to manage costs and improve customer service. The goal is to streamline complaint processes.

Growing customer engagement to drive credit card utilization is a key objective. This involves refining targeted customer propositions and enhancing the overall customer experience. The focus is on understanding customer needs.

The company prioritizes operational efficiencies to manage costs. This includes the implementation of the 'Gateway' program and leveraging the Snoop app for cost-effective customer acquisition. The aim is to improve profitability.

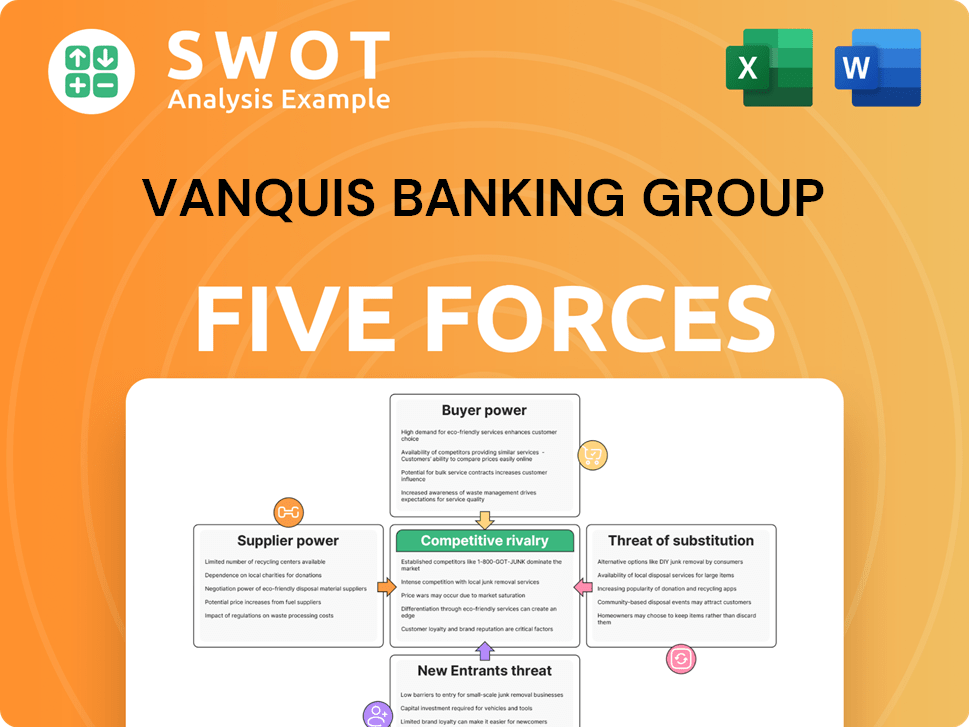

Vanquis Banking Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vanquis Banking Group Company?

- What is Competitive Landscape of Vanquis Banking Group Company?

- What is Growth Strategy and Future Prospects of Vanquis Banking Group Company?

- How Does Vanquis Banking Group Company Work?

- What is Sales and Marketing Strategy of Vanquis Banking Group Company?

- What is Brief History of Vanquis Banking Group Company?

- Who Owns Vanquis Banking Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.