Volvo Group Bundle

Who Are Volvo Group's Customers, Really?

Understanding who buys from Volvo Group is key to its success. From heavy-duty trucks to construction equipment, the company's customer base is as diverse as its product line. This article dives deep into the Volvo Group SWOT Analysis to uncover the intricacies of Volvo's target market. We'll explore the customer demographics, buyer personas, and the strategic shifts that have shaped Volvo's customer profile over time.

Volvo Group's evolution from passenger cars to commercial vehicles has redefined its audience. This shift has created a need to analyze the Volvo customer age range, income levels, and location analysis. We will explore the Volvo truck customer demographics, Volvo construction equipment target market, and Volvo bus customer segmentation to understand the company's market share by customer type and customer satisfaction factors.

Who Are Volvo Group’s Main Customers?

The primary customer segments for the Volvo Group are predominantly business-to-business (B2B), focusing on commercial transport and infrastructure. This includes a diverse range of companies, such as transportation providers, construction firms, and mining operations. The success of these businesses often hinges on the reliability and productivity of the products and services provided by the Volvo Group.

Understanding the Volvo Group's customer base is crucial for analyzing its market position and strategic direction. Key customer groups vary across different vehicle and equipment segments, reflecting the diverse needs of the industries it serves. The Volvo Group's ability to meet these specific demands is a key factor in its market performance and customer loyalty.

By focusing on these core segments, the Volvo Group aims to maintain and strengthen its market position. This customer-centric approach is reflected in the company's product development, sales strategies, and after-sales services, ensuring that it meets the evolving needs of its diverse customer base. For more insights, you can explore the Growth Strategy of Volvo Group.

In the truck segment, key customers include large logistics and freight companies, individual owner-operators, and specialized transport providers. These customers rely on the durability and performance of Volvo trucks for their daily operations. The Volvo Group has maintained a strong market presence in this segment.

The construction equipment sector includes large infrastructure developers and smaller construction businesses. These customers require robust and efficient machinery for various construction projects. The Volvo Group provides a range of equipment to meet these diverse needs.

Customers in the marine and industrial engine segments include shipbuilders, power generation companies, and various industrial applications. These customers depend on reliable engines for their operations. While the marine leisure market faced challenges, the commercial market showed resilience.

A growing segment includes customers committed to sustainable transport solutions. By April 2025, Volvo Trucks had delivered over 5,000 battery-electric trucks to customers across 50 countries. Volvo is leading the electric truck market in Europe and North America.

The Volvo Group's market performance is reflected in its strong market share and customer base. Volvo Trucks is a market leader in several regions, demonstrating its appeal to various customer segments. The company continues to innovate and adapt to meet evolving customer needs, particularly in sustainable transport.

- In Europe, Volvo Trucks held a 17.9% market share in the heavy truck segment in 2024.

- In Brazil, Volvo maintained its market leadership in heavy trucks with a 23.7% market share in 2024.

- In North America, Volvo Trucks held a 10.5% market share in 2024.

- In Europe, Volvo Trucks held a 47% segment share in heavy electric trucks at the end of 2024.

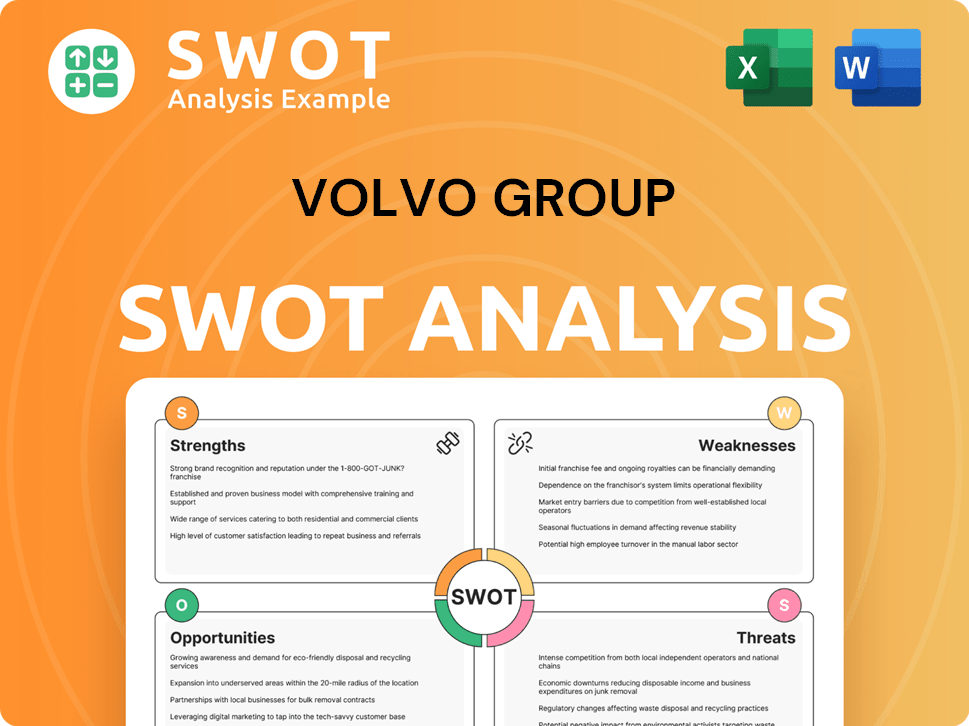

Volvo Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Volvo Group’s Customers Want?

Understanding customer needs and preferences is crucial for the success of the Volvo Group. As a business-to-business (B2B) company, Volvo focuses on providing solutions that meet the specific demands of its diverse customer base. This involves a deep dive into what drives their purchasing decisions and how Volvo can best serve their operational and financial goals.

Volvo Group's customer base is primarily composed of entities that prioritize efficiency, safety, and sustainability. This includes transport companies, construction firms, and other businesses that rely on commercial vehicles and equipment. These customers are increasingly concerned about the total cost of ownership, operational efficiency, and compliance with environmental regulations, making these factors key drivers in their purchasing decisions.

The company's approach to meeting customer needs involves a combination of product innovation, service offerings, and a commitment to sustainability. By focusing on these areas, Volvo aims to maintain its market position and build strong, long-term relationships with its customers. This strategy is reflected in its product development, service offerings, and overall business model.

Customers highly value solutions that maximize uptime and enhance productivity. This is a critical factor in the operational efficiency of their businesses. Volvo's focus on reliability and efficient fleet management directly addresses this need.

Fuel efficiency is a major concern for customers, impacting both operational costs and environmental impact. Volvo's vehicles are designed to optimize fuel consumption, helping customers reduce expenses and meet sustainability goals.

Safety is a core value for Volvo, and customers recognize this commitment. Volvo's vehicles incorporate advanced safety features, providing peace of mind and protecting drivers and other road users.

Sustainability is increasingly important, with customers seeking to reduce their carbon footprint. Volvo's investments in electric and hydrogen-powered vehicles align with this trend, offering environmentally friendly options.

Customers carefully evaluate the total cost of ownership, including purchase price, fuel costs, maintenance, and resale value. Volvo's offerings are designed to provide a competitive TCO, making them attractive investments.

Reliable after-sales service and support are essential for minimizing downtime and ensuring operational efficiency. Volvo's comprehensive service network and solutions are designed to meet these needs.

The decision-making process for Volvo Group's customers often involves detailed financial analysis and long-term investment considerations. The Marketing Strategy of Volvo Group emphasizes the importance of providing financing and service solutions to improve customer uptime and productivity. The company's service business is a key area for growth, helping to balance sales fluctuations and improve profitability. The psychological drivers for choosing Volvo include the brand's reputation for quality, durability, and innovation. Volvo's commitment to safety remains a crucial differentiator, while aspirational drivers are increasingly linked to sustainability and environmental responsibility. Volvo is actively investing in electrification and hydrogen-powered vehicles to reduce carbon emissions, with a goal of achieving net-zero greenhouse gas emissions by 2040. This aligns with the growing number of transport companies aiming to reduce their CO2 footprint, as evidenced by the over 25% increase in sales of gas-powered trucks in 2024.

Volvo Group's ability to meet customer needs is central to its market success. Here are some key aspects of their customer focus:

- Reliability and Uptime: Customers need equipment that minimizes downtime.

- Efficiency: Solutions for efficient fleet management are crucial.

- Compliance: Meeting stringent emission regulations is a priority.

- Sustainability: Demand for environmentally friendly options is growing.

- Total Cost of Ownership: Customers focus on the overall cost, including fuel, maintenance, and resale value.

- After-Sales Support: Reliable service and support are essential.

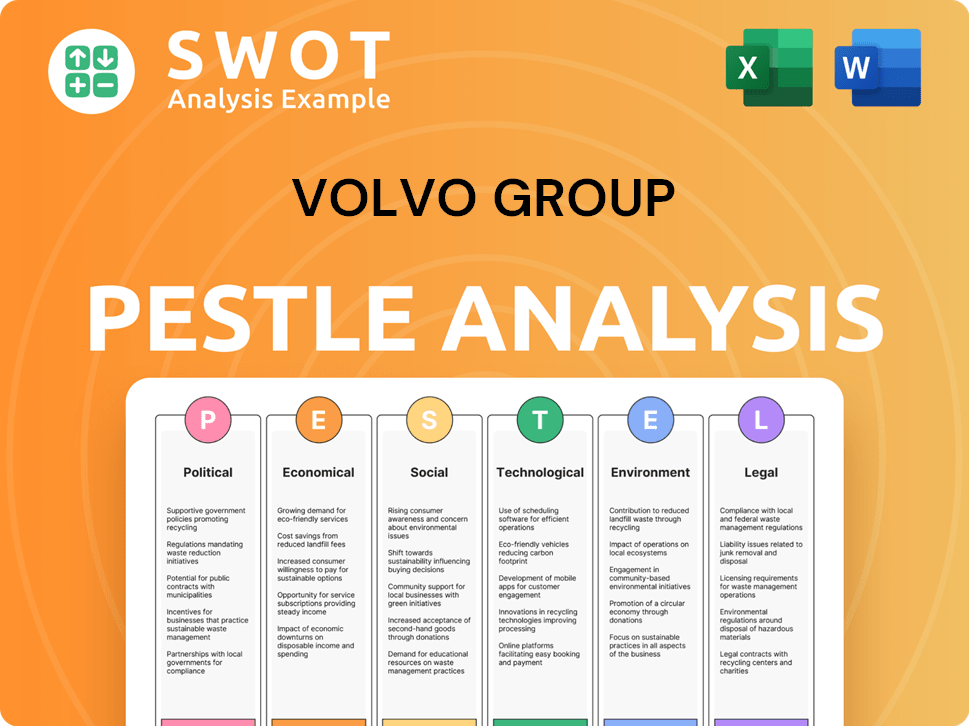

Volvo Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Volvo Group operate?

The geographical market presence of the [Company Name] is extensive, with operations spanning across nearly 180 to 190 markets globally. The company supports its customer base through a network that includes production facilities in 17 countries and approximately 2,200 service points. This wide-reaching infrastructure allows [Company Name] to serve a diverse customer base and maintain a strong presence in key regions.

Europe, North America, South America, and Australia are crucial markets for [Company Name], each presenting unique opportunities and challenges. The company's strategic focus on these regions is evident through its market share, product launches, and investments in local manufacturing capabilities. By tailoring its offerings and strategies to meet the specific needs of each market, [Company Name] aims to strengthen its position and drive sustainable growth.

The company's global strategy involves localizing offerings, marketing, and partnerships to succeed in diverse markets. For instance, the new VNL truck is specifically designed for the North American market. Despite a 12% decrease in global truck deliveries to 48,833 units in Q1 2025, and a 9% drop in global net sales for the truck segment to SEK 82.2 billion (EUR 7.53 billion), the service business showed improved performance. This demonstrates the company's resilience and ability to adapt to changing market conditions.

In 2024, [Company Name] Trucks achieved market leadership in Europe for heavy trucks (16 tonnes and above), with a 17.9% market share. The UK, France, Germany, Poland, and Spain were the top markets for registered trucks in Europe.

At the end of 2024, [Company Name] Trucks held a 47% market share in the electric heavy-duty truck segment in Europe. Germany, the Netherlands, Sweden, Norway, and Switzerland were the top five markets for electric trucks.

In 2024, [Company Name] Trucks held a 10.5% market share in North America (US and Canada), up from 10.2% in 2023. The company leads the heavy electric truck segment in North America, with over 40% market share in 2024.

In Brazil, [Company Name] led the heavy truck market for the third consecutive year in 2024, with a 23.7% market share. The Volvo FH was the best-selling truck model in Brazil in 2024.

Australia's market share for [Company Name] was 18.2% in 2024. [Company Name] Group Australia will build the first Australian-made heavy-duty electric trucks at its Wacol facility in Brisbane in 2025.

The company has lowered its forecast for North America's heavy-duty truck market to 275,000 units for 2025, down from an earlier projection of 300,000, reflecting market uncertainties.

Understanding the Growth Strategy of Volvo Group is crucial for analyzing its customer demographics and market share. The company's diverse customer base includes businesses of all sizes, from individual owner-operators to large fleet operators, across various industries.

The company conducts a thorough customer needs analysis to tailor its products and services effectively. This includes understanding factors such as Volvo customer age range, Volvo customer income levels, and Volvo customer location analysis.

The Volvo target market is segmented by vehicle segments, including trucks, buses, construction equipment, and engines. This segmentation helps the company focus its marketing and product development efforts.

The Volvo customer profile varies depending on the vehicle segment. For example, the Volvo truck customer demographics differ from those of the Volvo construction equipment target market. Understanding the Volvo buyer persona is key.

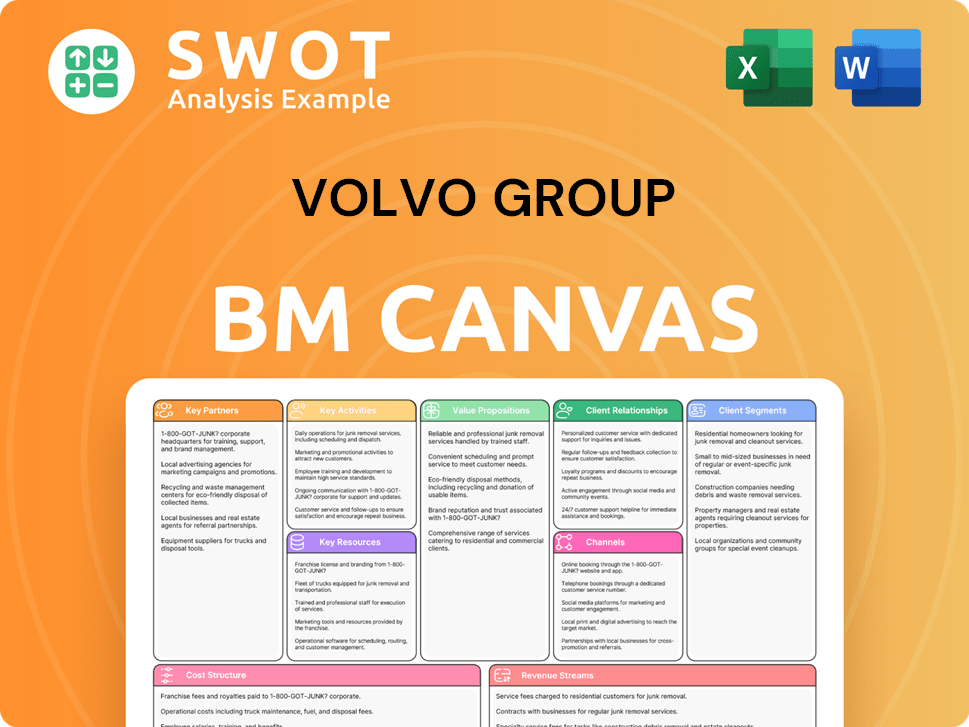

Volvo Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Volvo Group Win & Keep Customers?

The strategy of the Volvo Group for customer acquisition and retention is built on a foundation of product innovation, a robust service offering, strategic partnerships, and a strong global presence. Their approach is guided by the 'Perform and Transform' strategy, which emphasizes continuous improvement and a shift towards sustainable transport solutions. This dual focus allows the company to meet current customer needs while simultaneously preparing for future market demands.

For customer acquisition, the company highlights its reputation for quality, safety, and fuel efficiency. The launch of new product lines, such as the FH Aero trucks in 2024, is a key driver, as these trucks have quickly gained popularity. The company is also actively promoting its electric truck portfolio, with over 5,000 battery-electric trucks delivered to customers across 50 countries by April 2025. Marketing strategies include traditional industry events, digital platforms, and direct sales through its dealer network.

Customer retention at the Volvo Group is heavily reliant on its comprehensive service business, which includes financing, insurance, rentals, spare parts, repairs, preventive maintenance, uptime services, and assistance. This service portfolio has shown strong growth, with net sales from services increasing by more than 40% since 2020, now constituting 19% of net sales compared to 14% in 2020. These services help balance fluctuations in new product sales and improve profitability. The company is also exploring future business models like 'equipment as a service' and 'service pay-per-use' to enhance retention and loyalty.

New product launches, such as the FH Aero truck, are key for attracting new customers. These products are designed to meet evolving market demands and offer enhanced features. The focus on electric vehicles is also a major acquisition strategy, attracting customers looking for sustainable transport solutions.

The service business is a critical component of the customer retention strategy. This includes financing, insurance, and maintenance services. The growing service sector, which has increased by over 40% since 2020, contributes significantly to overall revenue and customer loyalty.

The company leverages partnerships to expand its market reach and enhance its service offerings. These collaborations help to address specific customer needs and provide integrated solutions. Partnerships are essential for navigating the complexities of the global market.

A strong global presence allows the company to serve a diverse customer base. This presence ensures that the company can provide localized services and support. The extensive dealer network is critical for direct sales and customer interaction.

The company focuses on providing solutions tailored to each customer to ensure uptime and productivity. Close cooperation and strong relationships with customers are prioritized, especially in uncertain times. Customer data and CRM systems are vital for tailoring solutions and targeting campaigns.

The decentralized structure empowers local teams to make decisions, increasing responsiveness. This approach enhances customer satisfaction by allowing for quick and tailored solutions. Local teams understand customer needs and can act accordingly.

Investments in battery energy storage systems (BESS), like the Volvo PU500, provide mobile power solutions. These innovations cater to the evolving needs of customers for flexible and reliable power. The company’s commitment to sustainability is also a key retention strategy.

The company's commitment to sustainability, as highlighted in its 2024 Sustainability Report, aligns with customers' increasing focus on environmental responsibility. This focus enhances customer loyalty. This commitment is a key factor in attracting and retaining customers.

Utilizing customer data and CRM systems is crucial for targeting campaigns and personalizing solutions. This approach allows for efficient resource allocation and improved customer engagement. Data-driven strategies enhance the effectiveness of marketing and service efforts.

The company prioritizes close cooperation and strong relationships with its customers, particularly during times of uncertainty. This approach fosters trust and long-term partnerships. The customer-centric approach ensures that the company remains competitive.

To effectively acquire and retain customers, it is crucial to understand the Volvo target market and Volvo customer profile. This involves analyzing Volvo customer demographics, including factors like age, income, and location. Knowing who buys Volvo cars, trucks, buses, and construction equipment helps tailor marketing efforts.

- Volvo vehicle segments cater to diverse needs, from individual car owners to large fleet operators.

- Volvo Group customer preferences are often centered around safety, reliability, and sustainability.

- Volvo customer buying behavior is influenced by factors such as brand loyalty and the total cost of ownership.

- The Volvo Group market share by customer type varies across different regions and vehicle segments.

- Understanding Volvo Group customer needs analysis is essential for developing products and services that meet their expectations.

For more insights, consider exploring the Owners & Shareholders of Volvo Group, which provides a deeper understanding of the company's stakeholders and their interests. By focusing on these strategies, the Volvo Group aims to maintain and strengthen its position in the market.

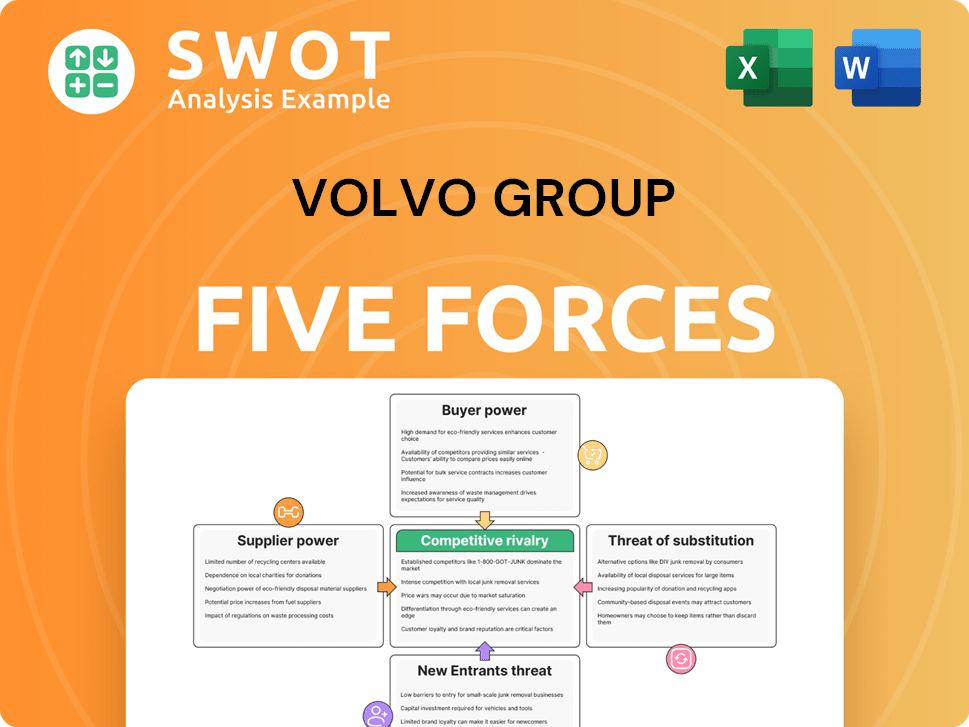

Volvo Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Volvo Group Company?

- What is Competitive Landscape of Volvo Group Company?

- What is Growth Strategy and Future Prospects of Volvo Group Company?

- How Does Volvo Group Company Work?

- What is Sales and Marketing Strategy of Volvo Group Company?

- What is Brief History of Volvo Group Company?

- Who Owns Volvo Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.