3M PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

What is included in the product

Analyzes external factors (Political, Economic...) influencing 3M.

Aids in strategic decision-making and opportunity identification.

Simplifies complex market data by visualizing it into clear, actionable components.

What You See Is What You Get

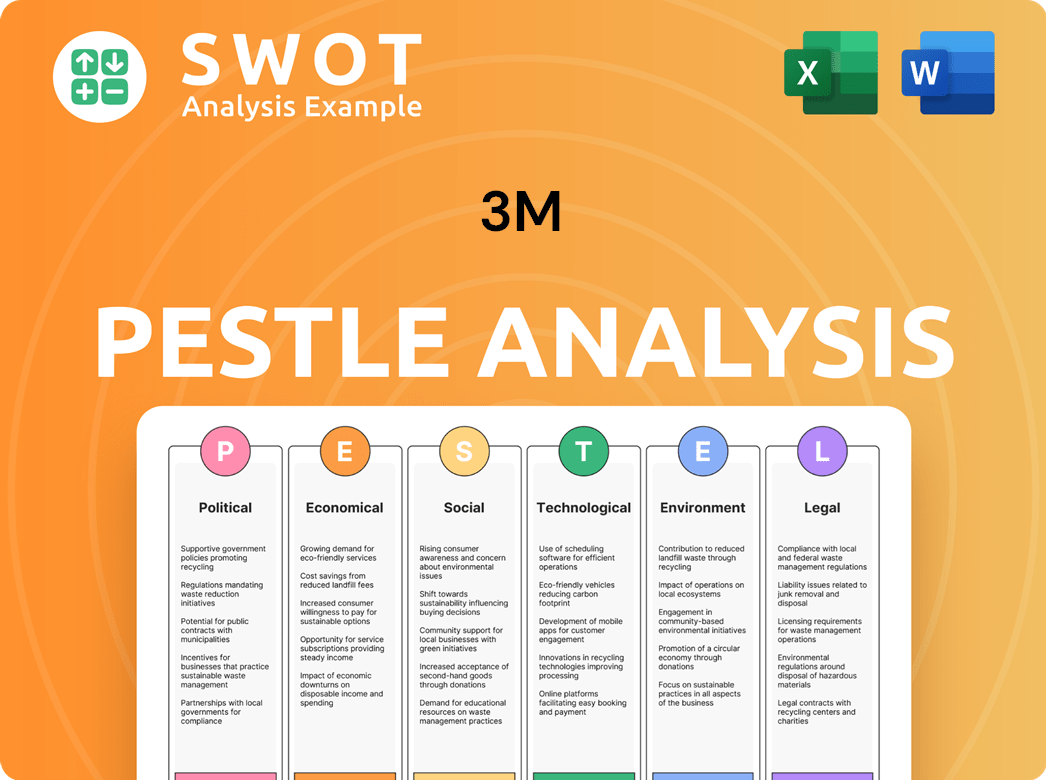

3M PESTLE Analysis

This is a 3M PESTLE Analysis preview.

The analysis examines the Political, Economic, Social, Technological, Legal, and Environmental factors.

The content presented shows a professionally designed format.

What you see is what you’ll download; no changes after purchase.

Receive the exact analysis ready for immediate use.

PESTLE Analysis Template

Navigate 3M's landscape with our expert PESTLE analysis. Uncover political and economic impacts shaping its future. Explore social, technological, legal, and environmental forces. These insights fuel smarter strategies. Download the full report today and gain a competitive advantage.

Political factors

3M faces risks from shifting global trade policies and tariffs. Trade disputes, like those between the US and China, directly affect its operations. For instance, in 2023, 3M's international sales accounted for about 60% of its total revenue, exposing it to various regulatory environments.

Political instability poses risks for 3M, especially in regions with major operations. Disruptions from geopolitical events can hinder manufacturing and sales. For instance, political tensions in certain areas could impact supply chains. In 2024, 3M's international sales accounted for approximately 60% of total revenue, making it susceptible to global political shifts.

Government spending significantly impacts 3M. Infrastructure projects boost demand for 3M's materials and solutions. In 2024, the U.S. government allocated over $100 billion to infrastructure. Renewable energy initiatives also drive demand, with the global renewable energy market projected to reach $2 trillion by 2025, benefiting 3M's clean energy segments.

Healthcare Policy Changes

Healthcare policy shifts are critical for 3M, given its substantial presence in the medical sector. Government regulations and spending directly affect demand for 3M's medical products. For example, in 2024, the U.S. healthcare expenditure reached approximately $4.8 trillion. Policy adjustments regarding reimbursement rates or product approvals can significantly impact 3M's revenue streams. These changes can create both opportunities and challenges for 3M.

- U.S. healthcare spending in 2024: ~$4.8T

- Policy impact: Reimbursement rates, product approvals

Environmental Regulations and Standards

Environmental regulations are becoming stricter worldwide, especially regarding chemicals like PFAS, which greatly affects 3M. This impacts 3M's production, products, and requires significant investment in compliance and cleanup. 3M faces lawsuits and liabilities related to PFAS contamination, leading to financial strain. The company has committed billions to address these issues, reflecting the high cost of environmental compliance. These regulations force 3M to innovate and change its business practices.

- 3M has allocated $10.3 billion to address PFAS liabilities.

- The EPA has proposed stricter limits on PFAS in drinking water.

- 3M is phasing out PFAS production by the end of 2025.

Shifting global trade policies and tariffs pose risks for 3M, affecting international sales. Political instability and geopolitical events can disrupt operations and supply chains. Government spending, especially on infrastructure and renewable energy, impacts demand.

| Political Factor | Impact on 3M | 2024/2025 Data |

|---|---|---|

| Trade Policies | Affects international sales | 60% of 3M's revenue from international sales |

| Political Instability | Disrupts operations | Geopolitical events impacting supply chains |

| Government Spending | Boosts demand | U.S. infrastructure: $100B+ allocated in 2024, renewable energy market: $2T by 2025 |

Economic factors

Global economic growth and recession risks significantly influence 3M. Slowdowns reduce spending on its products. In 2024, global GDP growth is projected at 3.2% (IMF). Recession risks persist in the US and Europe. Decreased industrial activity and healthcare spending could impact 3M's revenue.

Inflation and rising raw material costs pose challenges for 3M. Increased costs can squeeze profit margins. In 2024, 3M faced supplier price increases. This impacts pricing and profitability. For Q1 2024, 3M's organic sales decreased by 0.8% due to pricing.

Currency exchange rate fluctuations significantly influence 3M's financials, particularly affecting its international sales. In 2024, currency impacts represented a headwind, with a negative impact on sales. For example, a stronger dollar can make 3M's products more expensive for international buyers. This directly affects reported revenue and profitability, a factor constantly monitored by the company.

Interest Rates and Access to Capital

Interest rates are a key factor for 3M, influencing both its borrowing costs and investment decisions. High rates make borrowing more expensive, potentially impacting 3M's ability to fund new projects or acquisitions. Conversely, lower rates can stimulate investment and growth. The Federal Reserve's recent moves, with the federal funds rate currently between 5.25% and 5.50% as of late 2024, directly affect 3M's financial planning. Access to capital at favorable rates is crucial for 3M's strategic initiatives.

- Federal Funds Rate: 5.25% - 5.50% (late 2024)

- 3M's Debt: Approximately $7.5 billion (2024)

- Interest Expense: Roughly $250 million annually (estimated)

- Impact: Higher rates potentially delay investment.

Consumer Spending and Market Demand

Consumer spending and market demand are crucial for 3M's consumer product sales. Consumer confidence significantly impacts purchasing decisions, influencing demand. A decline in consumer confidence can lower spending, directly affecting 3M's revenue streams. For example, in Q1 2024, consumer spending growth slowed to 1.5% in the U.S., impacting various sectors.

- Consumer confidence indexes are closely watched as leading indicators.

- Weak demand can lead to inventory build-up and potential price cuts.

- 3M's product diversification helps mitigate some of these risks.

- Economic downturns can cause consumers to postpone non-essential purchases.

Economic factors heavily impact 3M's performance.

Global growth, currently projected at 3.2% (IMF), and inflation affect sales and costs.

Interest rates, like the late 2024 Federal Funds Rate (5.25% - 5.50%), impact investment and borrowing.

| Metric | Value | Year |

|---|---|---|

| Global GDP Growth | 3.2% (projected) | 2024 |

| Federal Funds Rate | 5.25% - 5.50% | Late 2024 |

| 3M Debt | $7.5 Billion | 2024 |

Sociological factors

Changing consumer preferences significantly impact 3M. There's a rising demand for sustainable products, pushing 3M to innovate. Consumers are increasingly eco-conscious, influencing purchasing choices. In 2024, sustainable product sales grew 10% for many companies. 3M must adapt its product development and marketing.

Shifting demographics, like aging populations, are crucial for 3M. The global elderly population (65+) is projected to hit 1.5 billion by 2050, boosting healthcare demand. This demographic shift influences demand for medical and personal care products. 3M’s healthcare segment saw $8.4 billion in sales in 2023, highlighting this impact.

Increased health and safety awareness boosts 3M's PPE and healthcare product demand. The global PPE market, valued at $70.4 billion in 2023, is projected to reach $104.1 billion by 2029. This growth highlights rising concerns driving demand for 3M's offerings. 3M's healthcare segment saw $8.4 billion in sales in 2023. This shows the impact of health awareness on their business.

Workforce Trends and Labor Availability

3M faces workforce shifts, including aging populations in key markets. Labor shortages, particularly skilled workers, impact production. These trends necessitate adapting recruitment and training. Automation and reskilling initiatives are crucial.

- US labor force participation rate: 62.5% (2024).

- 3M's employee count: ~85,000 (2024).

- Projected manufacturing skills gap: 2.1 million unfilled jobs by 2030.

Social Expectations and Corporate Responsibility

Social expectations are rising for corporate social responsibility, impacting 3M's reputation. This means investing in community initiatives and ethical sourcing becomes essential. For example, 3M's 2024 Sustainability Report highlights its commitment to reducing environmental impact, which reflects these societal pressures. Failure to meet these expectations could lead to reputational damage and financial repercussions.

- 3M's 2024 Sustainability Report emphasizes environmental commitments.

- Increased focus on ethical sourcing and supply chain transparency is crucial.

- Reputational risks can impact brand value and financial performance.

Growing social responsibility expectations require 3M to enhance its community initiatives and ethical sourcing practices. In 2024, companies with robust CSR programs saw a 15% increase in positive brand perception, crucial for maintaining a strong reputation. 3M's commitment to environmental goals is essential to meet these demands and avoid negative impacts.

| Factor | Impact | Data |

|---|---|---|

| CSR Focus | Reputational Boost | 15% increase in brand perception (2024) |

| Ethical Sourcing | Supply Chain Stability | Increasing demand for transparency |

| Environmental Impact | Compliance & Trust | 3M's 2024 Sustainability Report |

Technological factors

3M's innovation hinges on R&D investments. In 2024, 3M allocated approximately $1.9 billion to research and development. This commitment is vital for launching new products. It ensures 3M stays competitive in evolving markets. Strong R&D boosts future growth.

Automation and manufacturing tech advancements boost 3M's efficiency, cutting costs and boosting output. In 2024, 3M invested heavily in smart factories, aiming for a 10% productivity increase. This led to a 5% reduction in manufacturing expenses by Q3 2024. Further advancements are expected to drive operational improvements through 2025.

3M's digital transformation and e-commerce strategies are critical. In 2024, e-commerce sales represented a significant portion of 3M's revenue, with online sales growing by 10%. The company invests heavily in digital tools. This enhances supply chain efficiency and customer engagement.

Development of New Materials and Technologies

3M benefits from advancements in material science, enabling new product development and market expansion. For instance, in 2024, 3M invested $1.8 billion in R&D, driving innovation. This investment supports the creation of advanced adhesives, films, and abrasives. These technologies are vital for growth in diverse sectors like healthcare and electronics. They provide a competitive edge and boost revenue.

- R&D investment in 2024 reached $1.8 billion.

- New materials enhance product performance.

- Innovation drives market expansion.

- Focus on healthcare and electronics.

Intellectual Property and Patent Protection

3M heavily relies on its intellectual property, including thousands of patents worldwide, to protect its innovations. This protection is vital for preventing competitors from replicating its products and technologies. In 2024, 3M spent about $1.9 billion on research and development, underscoring its commitment to innovation. Licensing agreements, which generated significant revenue, are a key strategy for monetizing its IP portfolio.

- In 2023, 3M held over 100,000 patents globally.

- 3M's legal costs for IP protection were approximately $150 million in 2024.

- Licensing revenue accounted for about 5% of 3M's total revenue in 2024.

Technological advancements heavily influence 3M's strategic moves, fueling innovation and efficiency. 3M's R&D spending reached roughly $1.9 billion in 2024, driving new product development, and also saw smart factory investments.

Digital transformation, with an e-commerce growth of 10% in 2024, supports its global presence.

Furthermore, strong IP protection, reinforced by significant legal costs and licensing, defends 3M’s innovations and generates additional revenue streams.

| Factor | Details (2024) | Impact |

|---|---|---|

| R&D Spending | $1.9B | New Products, Market Expansion |

| E-commerce Growth | 10% | Boosted sales & Customer Engagement |

| IP Legal Costs | $150M | Protects Innovation |

Legal factors

3M is heavily involved in product liability litigation, creating major financial and reputational risks. Lawsuits, including those related to PFAS and Combat Arms Earplugs, are ongoing. In 2024, 3M's legal liabilities were substantial, with settlements and provisions significantly impacting earnings. These legal battles will continue to shape 3M's financial performance.

3M faces substantial legal challenges due to environmental regulations. Compliance with complex and changing laws is crucial. PFAS litigation, a major concern, drives financial risks. In Q1 2024, 3M's environmental liabilities totaled $10.8 billion. These liabilities are expected to increase.

3M faces legal challenges regarding intellectual property. Patent disputes and infringement claims are common. 3M's R&D spending was roughly $2 billion in 2023. Protecting its own patents is crucial for its diverse product portfolio. Recent legal battles could affect profitability.

Compliance with International and Local Laws

3M, as a global entity, faces complex legal landscapes. It must adhere to diverse international and local laws. These include labor standards, tax regulations, and ethical business practices. Non-compliance risks significant penalties and reputational damage.

- In 2024, 3M faced legal challenges, including environmental liabilities.

- The company's legal and compliance costs can fluctuate significantly.

- Tax laws vary globally, impacting 3M's financial strategies.

Changes in Regulatory Landscape

3M faces a complex web of regulations globally, demanding continuous adaptation. This includes adhering to environmental standards, product safety rules, and international trade laws. Compliance costs are significant; in 2024, 3M spent approximately $1.2 billion on environmental remediation. Non-compliance can lead to hefty fines and legal battles, impacting profitability. Therefore, understanding and responding to evolving regulations is crucial for 3M's long-term financial health and operational success.

- 3M faces evolving regulations.

- Compliance costs are substantial.

- Non-compliance can harm finances.

- Adaptation is essential.

3M's legal landscape in 2024 involved environmental and product liability lawsuits. PFAS litigation remains a key concern, impacting finances. R&D spending was around $2B in 2023 to protect patents. Compliance and changing global laws present ongoing challenges.

| Aspect | Details | Financial Impact (2024) |

|---|---|---|

| Environmental Liabilities | PFAS and other remediation efforts | $10.8B Q1 Liabilities |

| Product Liability | Earplugs and other cases | Significant Settlements |

| Compliance Costs | Meeting Global Standards | $1.2B on remediation |

Environmental factors

3M faces stringent environmental regulations globally, particularly concerning emissions, waste management, and chemical usage. These regulations heavily impact manufacturing processes and product development. For instance, 3M has committed $5.5 billion to address PFAS litigation and remediation as of 2024. Compliance costs and potential liabilities for environmental damages are substantial.

3M faces growing pressure to enhance sustainability. This involves efficient resource management, especially water and energy. In 2024, 3M's goal is to cut water use by 10%. They aim to lower greenhouse gas emissions by 50% by 2030. This is crucial for long-term viability.

Climate change is a major concern, pushing companies to cut emissions and adopt renewables. 3M has committed to carbon neutrality. In 2023, 3M's Scope 1 and 2 emissions were 291,000 metric tons of CO2e. They aim to cut these by 50% by 2030. This impacts their operations and product design.

Waste Reduction and Circular Economy

3M is focusing on waste reduction and circular economy to minimize environmental impact. The company is implementing initiatives to reduce waste in its manufacturing processes. These efforts are driven by both environmental concerns and cost-saving opportunities, aligning with sustainable business practices. 3M aims to design products for recyclability and reuse, contributing to a circular economy model. In 2024, 3M reported a 15% reduction in waste sent to landfills compared to 2023.

- 3M aims to reduce waste sent to landfills.

- The company is focusing on designing products for recyclability.

- Circular economy principles are being integrated into business practices.

PFAS Remediation and Stewardship

3M faces significant environmental and financial challenges due to its past and present use of per- and polyfluoroalkyl substances (PFAS). The company is actively engaged in remediation efforts to address PFAS contamination across various sites. 3M is committed to phasing out PFAS production by the end of 2025, which impacts its product portfolio and revenue streams. This transition requires substantial investment in alternative technologies and materials.

- In 2024, 3M allocated approximately $1.2 billion for PFAS-related liabilities.

- 3M's estimated total liability for PFAS is between $10.5 billion and $12.5 billion.

- The phase-out of PFAS is expected to affect approximately $1.3 billion in annual sales.

3M navigates strict global environmental regulations and growing sustainability pressures. They face considerable expenses, like the $5.5 billion earmarked for PFAS remediation. Key focuses include emissions reductions, waste management, and transitioning to renewable resources.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| PFAS Liabilities | Financial & Operational | $1.2B allocated in 2024; Total liability estimated $10.5B-$12.5B. Production to cease by end of 2025. |

| Sustainability Goals | Resource Use & Climate | 10% water reduction by 2024; 50% GHG emission reduction by 2030. 291,000 metric tons CO2e in Scope 1 and 2 emissions. |

| Waste & Circularity | Operational & Regulatory | 15% waste reduction in landfills in 2024. Focus on recyclability and circular economy principles. |

PESTLE Analysis Data Sources

The 3M PESTLE relies on data from government, market research, and industry reports, coupled with economic and regulatory databases. Data accuracy is ensured through multiple reliable sources.