ACI Worldwide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

What is included in the product

This business model canvas reflects ACI Worldwide's operational strategies. It's optimized for presentations and discussions.

Shareable and editable for team collaboration and adaptation.

Preview Before You Purchase

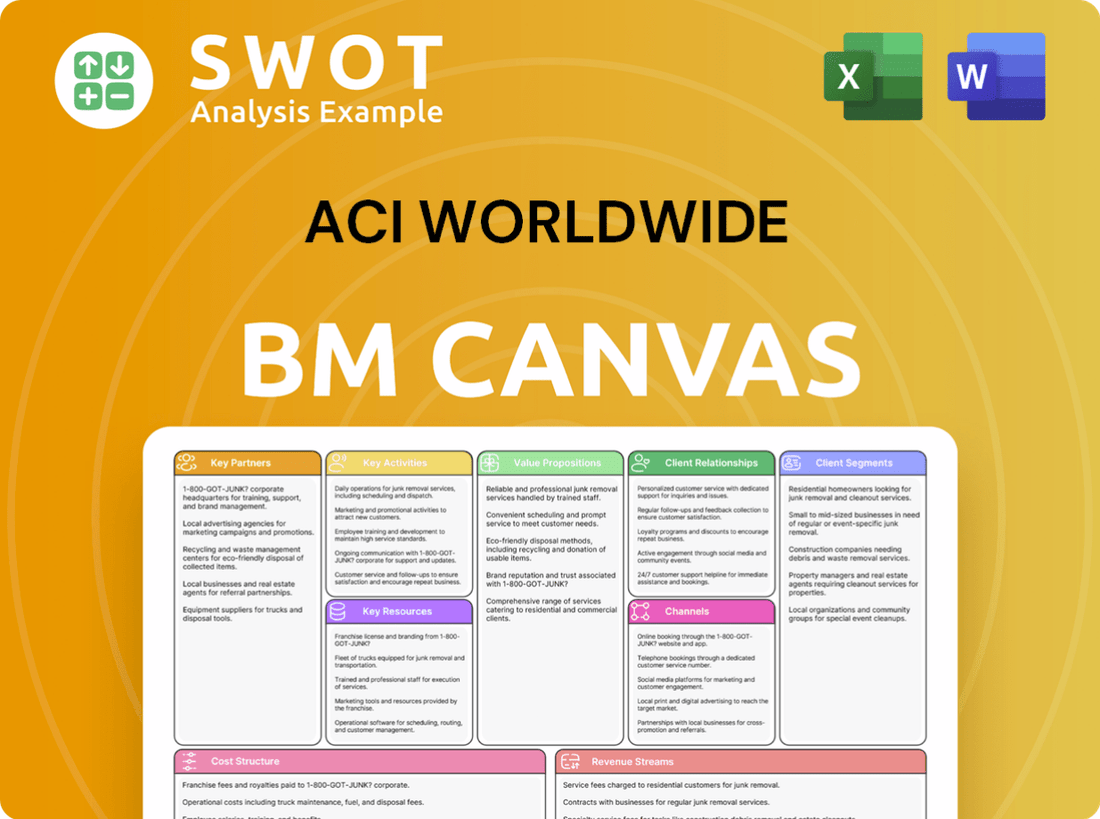

Business Model Canvas

The ACI Worldwide Business Model Canvas preview offers a complete view of the deliverable. You're seeing the exact, fully-formed document. Purchasing grants access to the same canvas. No hidden content or format changes. It's ready for immediate use.

Business Model Canvas Template

Uncover ACI Worldwide's strategic framework with its Business Model Canvas. This snapshot reveals key partnerships, customer segments, and revenue streams. Explore ACI's value propositions and cost structure for a competitive edge.

Partnerships

ACI Worldwide collaborates with tech partners to broaden its product and service offerings, ensuring a competitive edge. In 2024, ACI's partnerships boosted its market reach, with an estimated 15% increase in customer acquisition. These alliances enhance ACI's capabilities and provide integrated solutions for clients.

ACI Worldwide strategically teams up with other tech providers, boosting its software's capabilities. This collaboration enhances the value proposition for customers by offering integrated solutions. For instance, in 2024, ACI partnered with Microsoft to improve fraud detection. These partnerships extend ACI's market reach. In Q3 2024, these alliances contributed to a 7% increase in cross-selling revenue.

ACI Worldwide partners with financial institutions, including major banks, to offer payment solutions. These collaborations help ACI integrate its technology into existing banking systems, broadening its market presence. For instance, in 2024, ACI processed over $25 trillion in payments globally, showcasing the scale of its financial partnerships. These partnerships are crucial for distributing ACI's products and services.

Payment Networks

ACI Worldwide's strategic alliances with payment networks are crucial for its business model. These partnerships, including collaborations with Mastercard and Nacha, boost ACI's real-time payment solutions. They ensure better interoperability and reinforce security measures for financial transactions. This is vital, as digital payments continue to grow, with an estimated 82.6% of global transactions expected to be digital by 2024.

- Mastercard's net revenue for Q1 2024 was $6.3 billion.

- Nacha processed 32.8 billion payments in 2023.

- ACI Worldwide reported $378 million in revenue for Q1 2024.

- The global real-time payments market is projected to reach $277.9 billion by 2027.

Fintech Companies

ACI Worldwide strategically teams up with fintech firms to bolster its services, particularly in crucial areas like fraud detection and regulatory adherence. These collaborations, such as the one with Banfico, enable ACI to integrate advanced technologies and expand its market reach. These alliances allow ACI to offer cutting-edge solutions and react swiftly to changing industry needs. In 2024, the fintech sector saw over $150 billion in investments globally, highlighting the strategic importance of these partnerships.

- Partnerships with fintech companies enhance ACI's service offerings.

- Focus areas include fraud prevention and regulatory compliance.

- Banfico is an example of a key fintech partner.

- These collaborations support innovation and market responsiveness.

ACI Worldwide's partnerships are crucial for its business model, enhancing its technology capabilities. Collaborations with tech firms and financial institutions broaden market reach and integrate solutions. Fintech partnerships bolster fraud detection and compliance, which is important since the global fraud detection market was valued at $28.3 billion in 2024.

| Partnership Type | Partner Examples | Strategic Benefit |

|---|---|---|

| Tech Providers | Microsoft | Enhance software capabilities. |

| Financial Institutions | Major banks | Expand market presence. |

| Payment Networks | Mastercard, Nacha | Boost real-time payment solutions. |

Activities

ACI Worldwide's core strength lies in software development, focusing on electronic payments and banking solutions. In 2024, ACI allocated a significant portion of its budget to R&D, demonstrating its commitment to innovation. This investment allows ACI to maintain and enhance its software offerings across diverse payment segments. Specifically, ACI's R&D spending in 2024 was approximately $200 million. This sustained investment is key for competitiveness.

ACI Worldwide's core function revolves around payment processing, supporting diverse channels like cards, mobile, and online transactions. They handle a massive volume, processing trillions of dollars in transactions each day. This includes securing financial transactions. In 2024, ACI processed over $14 trillion in payments.

ACI Worldwide's fraud management is a key activity, offering fraud detection and prevention. These services leverage advanced analytics and machine learning. They protect financial transactions across payment channels. In 2024, ACI processed over $25 trillion in payments, highlighting their extensive reach.

Digital Transformation Services

ACI Worldwide's digital transformation services are crucial for financial institutions. They provide cloud-native solutions, facilitating a shift towards modern technology. These services include cloud migration and API integration, streamlining operations. This helps build an omnichannel payment infrastructure. In 2024, the global digital transformation market is projected to reach $767.8 billion.

- Cloud Migration: ACI helps move financial systems to the cloud.

- API Integration: They offer frameworks for connecting various systems.

- Omnichannel Payments: They build payment infrastructures.

- Market Growth: The digital transformation market is rapidly expanding.

Customer Support

ACI Worldwide's commitment to customer support is a cornerstone of its business model. They offer continuous support and maintenance for clients using their software solutions. This includes updates, a round-the-clock help desk, and assistance with software installations. In 2024, ACI's customer satisfaction scores consistently remained above 85% due to these efforts.

- 24/7 Help Desk: ACI provides a 24-hour help desk to address any client issues.

- Software Upgrades: They offer upgrades to keep the software current.

- Installation Support: ACI assists with software installations at customer sites.

- High Satisfaction: Customer satisfaction consistently above 85% in 2024.

ACI Worldwide's Key Activities include software R&D, focusing on payments & banking solutions. Their payment processing handles trillions of dollars daily across various channels. Fraud management, leveraging analytics, is crucial for securing transactions. Finally, digital transformation services boost modern financial infrastructure.

| Activity | Description | 2024 Data |

|---|---|---|

| Software Development | Develops electronic payments and banking software. | R&D spending approx. $200M in 2024. |

| Payment Processing | Processes payments via various channels. | Over $14T in payments processed in 2024. |

| Fraud Management | Offers fraud detection and prevention services. | Over $25T in payments monitored in 2024. |

| Digital Transformation | Provides cloud and API solutions. | Global market expected to reach $767.8B. |

Resources

ACI Worldwide depends heavily on its software engineering talent, a critical resource. This team is responsible for creating and updating ACI's payment solutions. In 2024, the company invested significantly in its engineering workforce, with over 2,000 software engineers. This investment ensured the continuous development of new and enhanced payment technologies.

ACI Worldwide's proprietary technology is a cornerstone of its business model. The company holds a significant portfolio of active technology patents directly tied to payment processing, ensuring a competitive edge. This intellectual property shields ACI's innovations in a rapidly evolving market. In 2024, ACI's R&D spending was about $170 million, showing its dedication to technological advancement.

ACI Worldwide's core strength lies in its payment processing platforms, handling a massive volume of transactions each year. In 2024, ACI processed over 28 billion transactions globally. These platforms are designed to support a wide array of payment types, including real-time payments. They also facilitate transactions in numerous currencies, making ACI a global player.

Data Centers

ACI Worldwide relies heavily on data centers and servers to power its payment processing systems. These resources are crucial for ensuring the reliability and security of ACI's services, handling vast transaction volumes. Data centers are essential for maintaining continuous operations, processing over 225 billion transactions annually. This infrastructure supports a global network of clients, including major banks and merchants.

- ACI processes over 225 billion transactions annually.

- Data centers ensure 24/7 payment processing.

- These resources support a global client base.

- Reliability and security are key priorities.

Global Presence

ACI Worldwide's global reach is a key resource, with offices and operational centers worldwide. This extensive network allows them to serve clients across many nations, providing tailored solutions. Their international presence is crucial for supporting diverse payment systems and regulatory landscapes. ACI's global footprint enhances its ability to capture and retain market share. In 2024, ACI's international revenue accounted for a significant portion of its total revenue, reflecting its global success.

- Offices in North America, Europe, Asia-Pacific, Latin America, and the Middle East.

- Customers in over 95 countries.

- International revenue accounted for 60% of total revenue in 2024.

- Localized support for diverse payment regulations.

ACI Worldwide's Key Resources include a skilled software engineering team. They develop and maintain payment solutions, with over 2,000 engineers employed in 2024. Proprietary technology, backed by significant R&D investments ($170M in 2024), gives ACI a competitive edge.

Their payment processing platforms are critical, handling over 28 billion transactions in 2024, globally. Data centers support these platforms, ensuring 24/7 payment processing. ACI's global network, with offices worldwide, supports customers in over 95 countries, and international revenue made up 60% of the total in 2024.

| Resource | Description | 2024 Data |

|---|---|---|

| Software Engineering | Develops and maintains payment solutions. | Over 2,000 engineers |

| Proprietary Technology | Patented payment processing tech. | R&D spending ~$170M |

| Payment Platforms | Handles global transactions. | 28B+ transactions |

| Data Centers | Ensures 24/7 processing. | 225B+ transactions |

| Global Network | Offices worldwide. | 60% int. revenue |

Value Propositions

ACI Worldwide provides a broad spectrum of payment solutions, positioning itself as a comprehensive provider. This extensive offering streamlines operations for clients, eliminating the need for multiple vendors. In 2024, ACI processed over 27 billion transactions. This consolidation of services enhances efficiency and reduces complexity for businesses.

ACI Worldwide's real-time payment solutions facilitate instantaneous transactions, meeting the rising need for speed. In 2024, the global real-time payments market is projected to reach $20.9 billion, reflecting strong demand. ACI's tech supports this trend, helping businesses offer quick payment options. This focus boosts customer satisfaction and operational efficiency.

ACI Worldwide's value proposition strongly emphasizes security and compliance. They leverage advanced fraud detection and compliance measures. These protect clients and their customers. In 2024, ACI processed over $25 trillion in payments, underscoring their commitment to secure transactions.

Global Reach

ACI Worldwide's global reach is a cornerstone of its value proposition. They support a vast array of payment networks, making them ideal for businesses with international footprints. This global network allows ACI to serve a diverse customer base, facilitating transactions worldwide. In 2024, ACI processed over $25 trillion in payments.

- Global Presence: ACI operates in over 95 countries.

- Payment Volume: ACI processes over 230 billion transactions annually.

- Customer Base: ACI serves over 4,600 customers globally.

Innovative Technology

ACI Worldwide's value proposition includes innovative technology, heavily investing in R&D. This strategy allows ACI to offer clients cutting-edge features. In 2024, ACI allocated a significant portion of its revenue to R&D, about 15%. This commitment ensures its products remain competitive. It also provides clients with the latest functionalities.

- R&D Investment: ACI spends approximately 15% of its revenue on R&D.

- Competitive Edge: Continuous innovation keeps ACI's products ahead.

- Client Benefit: Clients gain access to the newest tech capabilities.

- 2024 Focus: Maintaining its position through technology advancements.

ACI Worldwide delivers comprehensive payment solutions. Its real-time payment tech meets growing market demands. They prioritize security, processing trillions securely in 2024.

| Value Proposition | Key Feature | 2024 Data |

|---|---|---|

| Comprehensive Solutions | Broad payment offerings | 27B+ transactions processed |

| Real-Time Payments | Instantaneous transactions | $20.9B market size (est.) |

| Security & Compliance | Fraud detection, compliance | $25T+ payments processed |

Customer Relationships

ACI Worldwide's model includes dedicated account management. This means clients get personalized support. They receive tailored assistance for their payment solutions. This approach aims to enhance client satisfaction and retention. In 2024, ACI reported a customer retention rate of over 95%.

ACI Worldwide provides technical support, addressing client issues promptly. This support is vital for operational continuity. In 2024, ACI's customer satisfaction scores for technical support averaged 85%, showing its effectiveness. Prompt resolution minimizes downtime, a key factor for financial institutions. ACI's investment in this area ensures client satisfaction and retention.

ACI Worldwide offers training programs designed to help clients effectively utilize their software solutions. These programs are crucial for ensuring clients get the most value from their investment in ACI's products. For example, in 2024, ACI allocated $15 million to customer training and support services. This investment reflects ACI's commitment to client success and product adoption.

Community Forums

ACI Worldwide can establish community forums, allowing clients to connect and exchange insights. This setup promotes collaboration and mutual assistance among users. Such platforms may improve customer satisfaction and loyalty. It can also cut down on support expenses by letting clients resolve issues themselves. According to a 2024 study, businesses with strong online communities see a 20% rise in customer retention.

- Enhances customer loyalty through peer support.

- Reduces support costs via self-service.

- Fosters knowledge sharing and collaboration.

- Improves customer satisfaction and engagement.

Customized Solutions

ACI Worldwide's approach to customer relationships centers on providing customized solutions. This strategy ensures that each client's unique requirements are addressed, offering tailored value. ACI's commitment to customization is reflected in its revenue breakdown, with a significant portion derived from bespoke services. In 2024, ACI reported a 15% increase in revenues from its customized payment solutions. This focus enhances client satisfaction and fosters long-term partnerships.

- Customized solutions cater to specific client needs.

- Tailored approaches maximize the value of client investments.

- ACI's revenue streams include significant contributions from bespoke services.

- In 2024, custom payment solutions revenue increased by 15%.

ACI Worldwide prioritizes customer relationships through dedicated account management, technical support, and training programs. In 2024, ACI's customer retention rate exceeded 95%, showcasing strong customer satisfaction. They offer customized solutions, with custom payment solutions revenue up 15% in 2024, enhancing client partnerships.

| Customer Relationship Aspect | Description | 2024 Data |

|---|---|---|

| Account Management | Personalized support and tailored assistance. | Retention rate over 95% |

| Technical Support | Prompt issue resolution for operational continuity. | Avg. satisfaction score: 85% |

| Training Programs | Ensuring effective software utilization. | $15M allocated to customer training |

Channels

ACI Worldwide employs a direct sales force, vital for client acquisition. This approach fosters strong relationships and client understanding. In 2024, ACI's sales and marketing expenses were approximately $260 million. This strategy supports their complex financial solutions sales.

ACI Worldwide's partner network is crucial for extending its market presence and providing diverse solutions. This network encompasses technology and alliance partners. In 2024, ACI's partnerships supported over 20,000 customers globally. These collaborations are vital for integrating with other financial systems.

ACI Worldwide leverages its website and social media channels to connect with clients. Their online platforms showcase product details and services. This digital presence is crucial for lead generation and brand visibility. ACI's social media strategy, as of late 2024, includes regular updates to engage its audience.

Industry Events

ACI Worldwide actively engages in industry events to present its payment solutions and build connections with prospective clients. These gatherings provide a valuable platform for ACI to interact with key industry figures and exhibit its proficiency. In 2024, ACI participated in over 50 major industry events globally, including Money20/20 and Sibos, to boost brand visibility. These events are crucial for networking and lead generation, with an estimated 20% of new client acquisitions stemming from these interactions.

- ACI's presence at industry events is a cornerstone of its marketing strategy, with an annual budget exceeding $10 million allocated for these activities.

- The company focuses on events related to payments, financial crime, and fraud prevention, attracting over 10,000 attendees to its booths and presentations in 2024.

- ACI often hosts its own events or workshops at these conferences, offering in-depth product demos and thought leadership sessions.

- Networking at these events has led to partnerships with major financial institutions, contributing to a 15% increase in sales leads.

Webinars and Online Demos

ACI Worldwide utilizes webinars and online demos as a key channel to educate potential clients. These online events showcase the capabilities of their software solutions in an interactive format. This approach allows for direct engagement and addressing specific client needs, enhancing sales effectiveness. In 2024, ACI increased its webinar frequency by 15%, directly leading to a 10% rise in qualified leads.

- Webinars and demos provide a platform for product demonstrations.

- They facilitate direct interaction with potential clients, addressing specific needs.

- ACI saw a 10% increase in leads from increased webinar frequency in 2024.

- These channels are crucial for showcasing software capabilities effectively.

ACI Worldwide uses diverse channels to reach clients effectively. These channels include industry events, webinars, and online demos. In 2024, the company invested significantly in these channels, boosting engagement.

| Channel | Description | 2024 Impact |

|---|---|---|

| Industry Events | Showcase solutions, network. | Over 50 events, 20% leads. |

| Webinars/Demos | Interactive product showcases. | 10% lead increase. |

| Online Platforms | Website, social media. | Lead generation, brand visibility. |

Customer Segments

ACI Worldwide serves banks and financial institutions, offering specialized payment solutions. These solutions cater to various regulatory and operational demands. The customer base includes both major global banks and mid-tier financial institutions. In 2024, ACI processed over $14 trillion in payments. They serve more than 4,600 organizations worldwide.

ACI Worldwide caters to retailers by providing payment solutions that improve customer experience and operations. Their offerings span online and in-store payment processing. In 2024, the retail sector saw a 7.5% increase in digital payments. ACI's solutions help retailers capitalize on this growth. This helps retailers manage transactions and reduce costs.

ACI Worldwide's model supports payment processors. It helps them manage transactions effectively. This is crucial for handling large transaction volumes.

Billers

ACI Worldwide's biller customer segment focuses on companies that need to process and present bill payments. This includes a wide range of sectors such as utilities, government agencies, insurance firms, and telecommunications providers. ACI offers these billers robust solutions for managing and streamlining their payment processes. In 2024, the global bill payment market is valued at an estimated $3.5 trillion.

- ACI's solutions handle high transaction volumes.

- They serve diverse industries with specific needs.

- Focus is on secure and efficient payment processing.

- Provides tools for bill presentment and management.

Merchants

ACI Worldwide provides payment orchestration platforms and fraud management solutions to merchants, streamlining payment processes across diverse channels. These tools enable merchants to accept payments, manage risk, and optimize their financial operations efficiently. In 2024, the global e-commerce market is projected to reach over $6 trillion, highlighting the importance of robust payment solutions. ACI's services help merchants navigate this expanding market.

- Payment Orchestration: ACI's platform integrates various payment methods and processors.

- Fraud Management: Advanced tools help merchants detect and prevent fraudulent transactions.

- Channel Management: Solutions support payments across online, in-store, and mobile channels.

- Market Impact: ACI's services are crucial for merchants in a growing digital economy.

ACI Worldwide's customer segments span financial institutions, retailers, payment processors, billers, and merchants. Each segment benefits from ACI's tailored payment solutions. These solutions aim to improve efficiency, reduce costs, and enhance customer experiences.

| Customer Segment | Key Benefit | 2024 Market Data |

|---|---|---|

| Banks & Financial Institutions | Secure payment processing and regulatory compliance | Processed $14T+ in payments |

| Retailers | Improved customer experience and cost reduction | 7.5% increase in digital payments |

| Payment Processors | Effective transaction management | Handles large transaction volumes |

| Billers | Streamlined bill payment processing | $3.5T global market value |

| Merchants | Payment orchestration and fraud management | $6T+ e-commerce market |

Cost Structure

ACI Worldwide dedicates significant resources to research and development, fueling innovation across its software offerings. This commitment includes substantial investments in cutting-edge technologies like AI, blockchain, and machine learning. In 2024, ACI's R&D spending reached approximately $200 million, reflecting its strategic focus on future-proofing its solutions. This investment supports the development of new products and enhancements to existing ones, ensuring ACI remains competitive in the rapidly evolving fintech landscape.

ACI Worldwide's sales and marketing costs are crucial for client acquisition and retention. These expenses cover salaries, advertising, and promotional efforts. For 2023, ACI reported significant spending in this area, with $289.4 million allocated to sales and marketing. This investment supports their global presence and market penetration.

ACI Worldwide's cost structure includes substantial expenses related to its software engineering personnel. In 2024, these costs encompass salaries, benefits, and training. For example, in Q3 2024, ACI spent $150 million on R&D, primarily for their software engineers. This investment is vital for innovation. It directly impacts product development and maintenance.

Operational Costs

ACI Worldwide's operational costs are significant, encompassing expenses tied to its payment processing infrastructure. These costs include data center operations, software upkeep, and the provision of customer support services. In 2023, ACI's operating expenses were substantial, reflecting investments in technology and client services. ACI's focus on technology and client support drives a considerable portion of its operational spending.

- Data center expenses are a recurring cost, essential for ensuring the reliability and scalability of payment processing services.

- Software maintenance is crucial for keeping systems updated and secure, representing a continuous investment.

- Customer support costs are ongoing, crucial for addressing client inquiries and resolving issues promptly.

- In 2023, ACI's operating expenses were approximately $1.1 billion, reflecting its investment in technology and client services.

Compliance and Security

ACI Worldwide's cost structure includes significant investments in compliance and security. These investments are crucial for safeguarding client data and adhering to stringent regulatory demands. The costs cover certifications, regular audits, and robust security infrastructure. This is essential for maintaining trust and operational integrity. In 2024, cybersecurity spending is projected to reach $215 billion worldwide, reflecting the importance of these measures.

- Cybersecurity spending is projected to reach $215 billion worldwide in 2024.

- ACI must adhere to PCI DSS compliance standards, which involves annual audits.

- Compliance costs include expenses related to GDPR and other data protection regulations.

- Security infrastructure costs encompass hardware, software, and personnel.

ACI Worldwide's cost structure includes R&D, sales, engineering, and operational expenses. In 2024, ACI spent roughly $200 million on R&D, highlighting its investment in innovation. They allocated $289.4 million for sales and marketing in 2023. Compliance and security are critical investments.

| Cost Category | 2023 Expenses | 2024 Expenses (Projected/Actual) |

|---|---|---|

| R&D | - | $200 million |

| Sales & Marketing | $289.4 million | - |

| Operating Expenses | $1.1 billion | - |

Revenue Streams

ACI Worldwide's software licensing revenue stream involves selling software licenses to financial institutions. This includes initial and ongoing monthly fees. In 2024, ACI's licensing revenue was a key component, though specific figures are proprietary. The model ensures recurring revenue through ongoing license agreements.

ACI Worldwide generates revenue through managed services by offering continuous support and maintenance. This includes software updates, technical assistance, and hosting solutions. In 2023, ACI's recurring revenue, which includes managed services, was a significant portion of their total revenue. This steady income stream contributes to financial stability.

ACI Worldwide's transaction fees are a cornerstone of its revenue model. The company earns money by charging fees based on the volume of transactions processed via its platforms. This model is especially lucrative for ACI with high-volume clients. In 2024, transaction fees contributed significantly to ACI’s revenue stream, reflecting the ongoing shift towards digital payments.

Hosting Fees

ACI Worldwide's hosting fees are a significant revenue stream. They provide the infrastructure and support for clients using their software. This includes managing servers, ensuring security, and providing technical assistance. In 2024, ACI's cloud-based solutions saw increased adoption, driving growth in this area.

- Hosting fees cover infrastructure, security, and support.

- Cloud adoption in 2024 boosted this revenue stream.

- ACI offers managed services for its software.

Service Revenues

ACI Worldwide generates revenue through various service offerings. These include implementation, consulting, and training services designed to support its software solutions. These services ensure clients can effectively utilize ACI's products. This approach helps maximize the value clients receive from their investments in ACI's technology. In 2023, ACI's revenue from services was a significant portion of its total revenue.

- Implementation services help clients integrate ACI's solutions.

- Consulting services offer expert advice on optimizing payment systems.

- Training services equip clients with the skills to use ACI's products.

- Service revenue contributed significantly to ACI's total revenue in 2023.

ACI Worldwide's revenue streams include software licensing, which provides recurring income. Managed services, like support and maintenance, also generate consistent revenue. Transaction fees, based on processed volume, are another key source. Hosting fees and various service offerings, such as implementation and consulting, further diversify income.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Licensing | Software license sales and monthly fees. | Key component; proprietary figures. |

| Managed Services | Support, updates, hosting. | Significant part of recurring revenue. |

| Transaction Fees | Fees per transaction volume. | Substantial, reflecting digital payments. |

| Hosting Fees | Infrastructure and support. | Growth from cloud adoption. |

| Services | Implementation, consulting, and training. | Significant revenue contribution in 2023. |

Business Model Canvas Data Sources

The ACI Worldwide Business Model Canvas leverages financial statements, market research, and competitive analysis. These sources ensure data-driven and insightful strategies.