ACI Worldwide SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACI Worldwide Bundle

What is included in the product

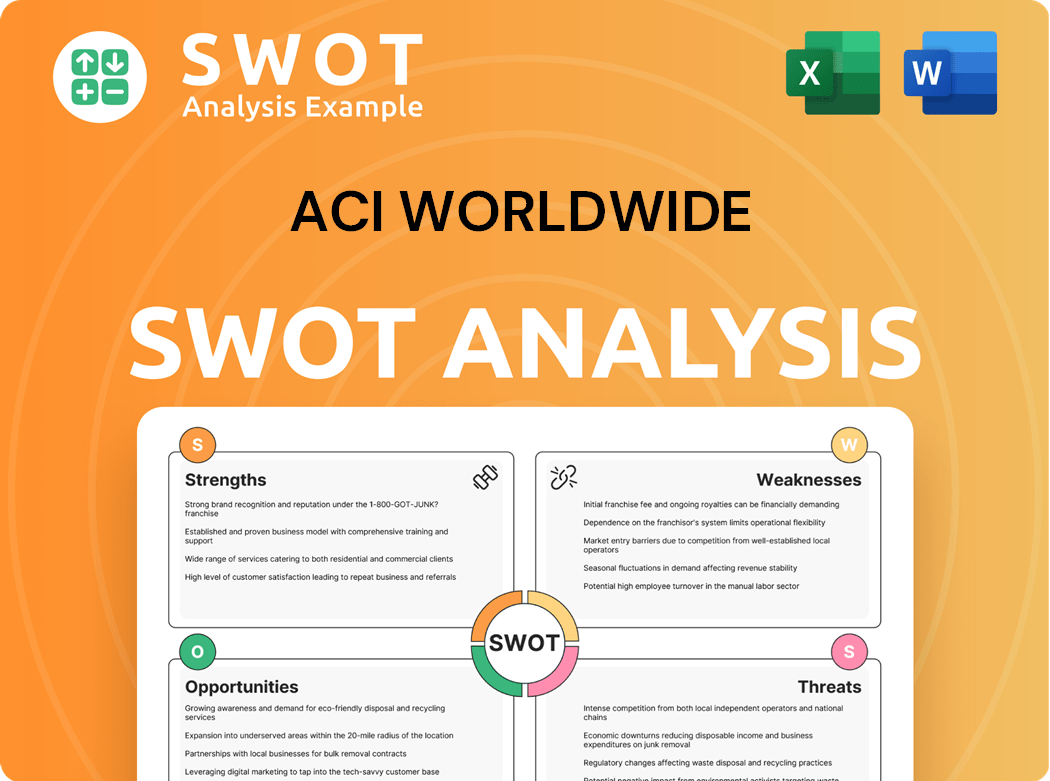

Analyzes ACI Worldwide’s competitive position through key internal and external factors.

Provides structured template for quick strategic planning and evaluation.

Preview Before You Purchase

ACI Worldwide SWOT Analysis

You are viewing the same SWOT analysis the customer receives after purchase.

This isn't a simplified preview, it's a complete section.

Purchase unlocks the entire in-depth report for your use.

The structure and data are identical post-purchase.

Expect the full version to have the same detail.

SWOT Analysis Template

This analysis provides a glimpse into ACI Worldwide's strategic landscape, highlighting key strengths and potential weaknesses. Explore how market opportunities could fuel future growth while threats pose challenges. We've examined their competitive positioning and operational efficiency in detail.

The presented overview is just a starting point, for a deeper dive consider the full SWOT analysis. It offers actionable insights, professional formatting and the editable formats needed for strategizing.

Strengths

ACI Worldwide holds a strong position in digital payments, recognized for reliability and innovation. The company's market share and reputation allow influence on industry trends and partnerships. ACI's long history builds trust; in 2024, revenue was approximately $1.4 billion. This leadership stems from deep expertise.

ACI Worldwide's strength lies in its extensive product offerings. The company provides a broad spectrum of solutions, such as ACI Universal Payments and ACI Fraud Management, addressing varied payment processing demands. This wide-ranging suite supports cross-selling and offers clients integrated solutions. In 2024, ACI's revenue reached $1.4 billion, demonstrating strong demand for its diverse products.

ACI Worldwide's extensive global presence is a key strength, operating in over 80 countries across six continents. This broad reach provides a diversified customer base, reducing vulnerability to market volatility. The company can capitalize on growth in emerging markets, tailoring solutions to regional payment needs. In 2024, ACI generated $1.4 billion in revenue, reflecting its worldwide impact.

Strong R&D Investment

ACI Worldwide's substantial investment in Research and Development (R&D) is a key strength. This commitment fuels the creation of innovative payment solutions, crucial in a fast-evolving market. The company's focus on R&D helps it maintain a competitive edge and adapt to changing customer needs. ACI's R&D spending in 2024 amounted to $200 million, reflecting its dedication to innovation. This investment supports its market-leading position and technological advancements.

- $200 million in R&D investment in 2024.

- Focus on innovation in payment solutions.

- Maintains a competitive edge.

Robust Recurring Revenue Model

ACI Worldwide's strength lies in its robust recurring revenue model, driven by its comprehensive suite of payment solutions. ACI's offerings include ACI Universal Payments, ACI Realtime Payments, and ACI Fraud Management. These solutions provide integrated services and cross-selling opportunities. The company's ability to handle various payment channels is a key advantage.

- In 2023, ACI Worldwide generated $1.4 billion in revenue, with a significant portion derived from recurring sources.

- The company's diverse product portfolio supports a high customer retention rate, contributing to predictable revenue streams.

- ACI's focus on providing solutions across card, mobile, and online transactions enhances its market position.

ACI Worldwide excels due to its solid standing, known for its reliability and innovation in the digital payments sector, reflecting a robust reputation.

The company provides an extensive suite of solutions like ACI Universal Payments, showcasing its wide-ranging, integrated service offerings, improving its position within the market.

ACI’s focus on research and development allows it to maintain a competitive edge with innovation; its strong recurring revenue model reinforces its financial health.

| Feature | Description | Impact |

|---|---|---|

| Market Position | Recognized in digital payments. | Influences industry trends and partnerships. |

| Product Range | Includes ACI Universal Payments and Fraud Management. | Offers integrated and cross-selling chances. |

| R&D Investment | $200 million in 2024. | Drives innovative payment solutions. |

Weaknesses

ACI Worldwide's dependence on a few large clients is a significant weakness. In 2024, a substantial portion of ACI's revenue came from a limited number of key customers. If these major clients reduced spending or switched providers, ACI's financial results could be negatively impacted. Reducing this concentration of risk is vital for ACI's stability.

ACI Worldwide faces high operational costs, including substantial R&D and SG&A expenses. In Q3 2024, SG&A expenses were $118.7 million. These costs can affect profitability and competitiveness. Effective cost management is crucial for margin improvement and a competitive pricing strategy. ACI must balance innovation investments with efficient cost management to optimize financial performance.

ACI Worldwide's significant reliance on the North American market is a notable weakness, making it susceptible to regional economic fluctuations and evolving regulatory landscapes. To mitigate this, geographic diversification is crucial. Expanding into new regions not only diminishes risk but also unlocks potential growth avenues. For example, in 2024, over 60% of ACI's revenue came from North America, highlighting the concentration risk.

Cybersecurity Vulnerability

ACI Worldwide's cybersecurity vulnerabilities present a significant weakness. The company's dependence on a few large clients exposes it to risk. Any security breach could severely damage ACI's reputation. This could lead to contract terminations, affecting revenue.

- 2024: ACI's revenue concentration is around 60% from top 5 clients.

- 2024: Cybersecurity incidents in the financial sector increased by 30%.

- 2024: Average cost of data breach for financial firms is $5.9 million.

Enterprise Solution Scaling Challenges

ACI Worldwide faces enterprise solution scaling challenges, notably high operational costs. R&D and SG&A expenses weigh on profitability and competitiveness. Managing these costs is vital for better margins and competitive pricing. ACI must balance innovation investments with cost efficiency to boost financial results. In 2023, ACI's operating expenses were approximately $1.2 billion, impacting its net income.

- High R&D and SG&A expenses.

- Impact on profitability and competitiveness.

- Need for efficient cost management.

- Balance innovation and cost control.

ACI Worldwide has key weaknesses that affect its financial stability and growth potential. In 2024, the company depends heavily on a few major clients, exposing it to financial risk if these relationships change. High operational expenses, particularly in R&D and SG&A, also hurt profitability, requiring careful cost management. ACI's reliance on the North American market creates regional vulnerabilities. Cybersecurity vulnerabilities and enterprise solution scaling challenges are the weak points.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Client Concentration | Financial Risk | 60% revenue from top 5 clients. |

| High Operational Costs | Reduced Profitability | SG&A expenses: $118.7M in Q3. |

| Regional Dependence | Market Vulnerability | Over 60% revenue from North America. |

| Cybersecurity Risk | Reputational and Financial Damage | Average breach cost: $5.9M for financial firms. |

Opportunities

The digital payment market is expanding, offering ACI Worldwide a key opportunity. This growth is fueled by consumer and business adoption of digital methods, driven by convenience and security. E-commerce's rise further boosts this trend; in 2024, digital payments are projected to reach $8.5 trillion globally. ACI can leverage this with innovative, secure solutions.

ACI Worldwide has an opportunity to expand into emerging markets, where digital payments are booming. These regions, driven by rising smartphone use and a growing middle class, offer significant growth potential. For example, in 2024, mobile payment transactions in India surged, showing a 25% increase. ACI can capitalize on its tech to gain a strong foothold.

Strategic partnerships, a key opportunity for ACI Worldwide, involve collaborations with fintechs, banks, and service providers. These alliances boost offerings and market reach. For example, in 2024, ACI partnered with various payment processors to enhance its global transaction capabilities. Collaborations give access to new tech, customers, and distribution channels. ACI can integrate solutions and expand its ecosystem, potentially increasing its market share by 10% by 2025.

Increased Focus on Security

The growing emphasis on security in digital transactions presents a key opportunity for ACI Worldwide. As digital payments expand, so does the need for robust security measures to protect against fraud and data breaches. ACI can leverage its expertise in payment security to provide solutions that meet this demand, securing customer trust. This could include offering advanced fraud detection and prevention tools.

- ACI's fraud detection solutions processed over 1.6 billion transactions daily in 2024.

- The global fraud detection and prevention market is projected to reach $60.7 billion by 2028.

- ACI's revenue from its fraud management segment grew by 15% in 2024.

Real-Time Payments Growth

ACI Worldwide can seize opportunities in real-time payments, especially in emerging markets. These areas are witnessing significant digital payment adoption, creating new revenue possibilities. The increasing use of smartphones and a growing middle class support high growth potential. ACI's tech can establish a strong presence.

- Real-time payments are projected to reach $185.2 billion by 2027.

- Emerging markets show faster digital payment adoption rates.

- Smartphone penetration is a key driver.

- ACI Worldwide's revenue in 2023 was $1.4 billion.

ACI Worldwide sees opportunities in expanding digital payments, projected to reach $8.5 trillion in 2024. They can also tap into emerging markets, where mobile payments surged in India by 25% in 2024. Strategic partnerships can increase market share by 10% by 2025.

Focusing on security in transactions gives ACI an advantage, processing over 1.6 billion daily transactions in 2024. The fraud detection market will hit $60.7 billion by 2028. ACI can capitalize on real-time payment opportunities, with these payments set to reach $185.2 billion by 2027.

| Opportunity | Details | 2024 Data/Projection |

|---|---|---|

| Digital Payment Growth | Expansion through innovative secure solutions | $8.5 Trillion global market |

| Emerging Markets | Capitalize on smartphone use | India's mobile payment transactions +25% |

| Strategic Partnerships | Enhance offerings and reach | Potential market share increase by 10% (2025) |

| Payment Security | Leverage security expertise | Processed 1.6B daily transactions |

| Real-Time Payments | Expand presence | $185.2 Billion by 2027 (projection) |

Threats

The digital payments sector is fiercely competitive, involving established firms and new fintechs. This rivalry could trigger price declines and lower earnings. ACI must innovate, offer top-notch service, and forge strategic alliances to stay ahead. In 2024, the global digital payments market is expected to reach $10 trillion, increasing competition.

ACI Worldwide faces regulatory challenges, especially with evolving data privacy and security rules. Non-compliance risks fines and reputational harm. ACI must invest in compliance, as seen in 2024 with increased cybersecurity spending. The financial industry's regulatory scrutiny has intensified, with fines in 2024 reaching billions globally.

Cybersecurity threats are escalating, posing a major risk to ACI and its clients. Data breaches and sophisticated attacks could disrupt operations and damage ACI's reputation. In 2024, the average cost of a data breach globally was $4.45 million. Advanced cybersecurity measures and incident response are essential. ACI must invest to protect sensitive data.

Economic Instability

Economic instability poses a significant threat to ACI Worldwide. Fluctuations in global economic conditions can impact transaction volumes and spending. Reduced consumer and business spending during economic downturns directly affects ACI's revenue streams. ACI must navigate these challenges by diversifying its revenue sources and managing operational costs effectively.

- Inflation rates in 2024 could impact transaction volumes.

- Economic downturns may lead to decreased IT spending.

- Currency fluctuations can affect international revenue.

Technological Disruption

ACI Worldwide faces threats from technological disruption, especially concerning regulatory compliance. Complex and evolving regulations, like those for data privacy and security, demand significant investment. Non-compliance risks fines and reputational harm, necessitating robust programs. ACI must stay updated on regulatory changes.

- In 2024, cybersecurity breaches cost businesses an average of $4.45 million globally.

- The global fintech market is projected to reach $324 billion by 2026.

- Data privacy regulations, such as GDPR and CCPA, have led to fines totaling billions.

ACI Worldwide faces competitive threats, like price wars, requiring constant innovation. Regulatory pressures increase compliance costs, with substantial fines for breaches. Cybersecurity risks are rising, potentially causing data breaches and operational disruptions. In 2024, cybersecurity breaches cost businesses $4.45 million.

| Threats | Description | Impact |

|---|---|---|

| Competition | Aggressive rivals and price cuts. | Reduced earnings. |

| Regulation | Evolving data privacy & security laws. | Compliance costs & potential fines. |

| Cybersecurity | Rising data breaches & attacks. | Operational disruption & reputational damage. |

SWOT Analysis Data Sources

This analysis is sourced from financial reports, market research, and industry insights to deliver a well-rounded, data-backed SWOT evaluation.