ADM Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADM Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs, ensuring quick decision-making.

What You’re Viewing Is Included

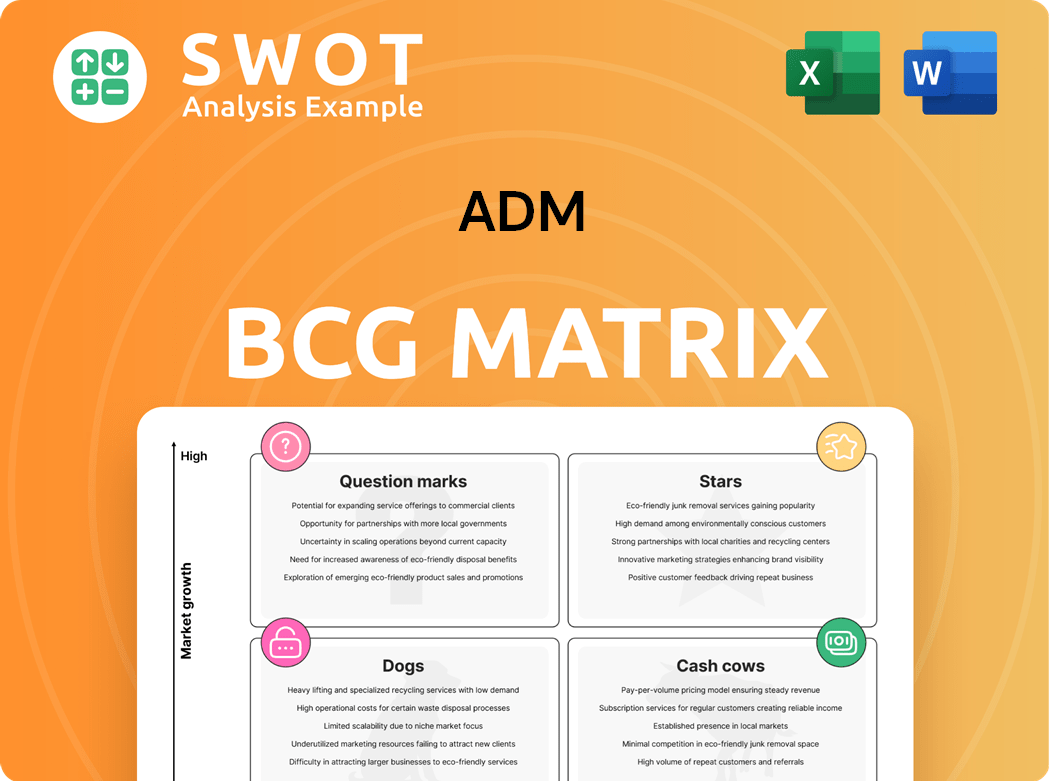

ADM BCG Matrix

This preview accurately represents the complete ADM BCG Matrix report you'll get. It's a ready-to-use document, offering strategic insights for your business.

BCG Matrix Template

The ADM BCG Matrix categorizes its diverse business units into Stars, Cash Cows, Dogs, and Question Marks. This provides a snapshot of their market share and growth rate. Understanding these positions is key to strategic resource allocation. This preview scratches the surface; the full ADM BCG Matrix report offers in-depth analysis, tailored strategies, and actionable insights to boost your decision-making.

Stars

ADM's focus on sustainable solutions positions it as a "Star" in the BCG matrix, indicating high market share in a growing market. The company's investments in regenerative agriculture are a key part of its strategy. In 2024, ADM allocated over $1 billion towards sustainable solutions. This includes initiatives to reduce carbon emissions and promote biodiversity within its supply chains.

The Nutrition segment at ADM has seen substantial growth. Operating profits have increased, reflecting a robust stance in the health and wellness market. In Q3 2024, the segment's revenue hit $2.4 billion. This growth highlights its potential as a "Star" in the ADM BCG matrix. The operating profit rose by 10% year-over-year.

ADM, a global agricultural leader, consistently processes vast quantities of crops. In 2024, ADM's revenues reached approximately $94 billion, reflecting its significant market presence. They link agricultural products to various global markets, handling diverse ingredients. ADM's strategic position in the BCG matrix highlights its strong market share and growth potential.

Strategic Partnerships

ADM's strategic partnerships are a key component of its business strategy, especially in the realm of sustainability and community impact. These collaborations often involve initiatives aimed at improving water access and supporting regenerative agriculture, particularly in regions like India. In 2024, ADM increased its investment in these programs by 15%, reflecting a growing emphasis on ESG factors. These partnerships not only boost ADM's reputation but also open new avenues for growth.

- Water.org partnership expanded to reach 1 million more people by 2024.

- Investment in regenerative agriculture programs in India increased by 20% in 2024.

- ADM's ESG score improved by 8% due to these partnerships in 2024.

- Partnerships generated $50 million in new revenue streams in 2024.

Innovation in Bio-based Materials

ADM is actively innovating in bio-based materials, creating sustainable alternatives to traditional petroleum products. This strategic move positions ADM as a key player in the growing bioeconomy sector, focusing on eco-friendly solutions. In 2024, ADM invested significantly in renewable chemicals and materials. Bio-based materials market is expected to reach $1.1 trillion by 2027.

- ADM's investment in renewable chemicals is a major focus.

- Bio-based materials offer sustainable alternatives.

- The bioeconomy sector is experiencing rapid growth.

- Market size is estimated to hit $1.1 trillion by 2027.

ADM's "Stars" like the Nutrition segment, show high market share and growth. The company's robust market presence, with approximately $94 billion in revenues in 2024, supports its star status. ADM's investments in sustainable solutions and bio-based materials also contribute to its "Star" classification within the BCG matrix, highlighting its growth potential.

| Metric | 2024 Data | Growth/Change |

|---|---|---|

| Revenue | $94B | Consistent |

| Nutrition Segment Revenue (Q3) | $2.4B | 10% YoY Increase |

| ESG Investment Increase | 15% | Year-over-year |

Cash Cows

Ag Services & Oilseeds, despite profit dips, is a key ADM segment. It uses ADM's global assets for commodity trading. In Q3 2024, it saw $13.4 billion in revenue. Operating profit was down, yet it remains strategically vital.

The Carbohydrate Solutions segment, especially Starches and Sweeteners, is a cash cow for ADM, showing consistent strength. In 2024, North American sales of sweeteners remained robust, with an estimated $3 billion in revenue. This stability is due to steady demand and ADM's strong market position.

ADM's global reach is a key strength, supporting reliable cash flow. In 2024, ADM operated in over 190 countries, showcasing its widespread presence. This expansive footprint allows ADM to tap into diverse markets and mitigate regional risks.

Essential Supply Chain Role

Archer Daniels Midland (ADM) functions as a crucial agricultural supply chain manager and processor, guaranteeing consistent demand for its offerings. This position allows ADM to capitalize on its established infrastructure and relationships within the agricultural sector, generating stable revenue streams. ADM's strategic focus on essential food and feed ingredients, combined with its global operational footprint, solidifies its cash cow status. In 2024, ADM reported revenues of $66.1 billion, showcasing its financial stability.

- ADM's diverse product portfolio, including biofuels, further stabilizes its revenue.

- The company's significant market share in key agricultural segments reinforces its cash-generating capabilities.

- Strategic investments in processing and logistics enhance efficiency and profitability.

- Focus on sustainable agriculture practices attracts environmentally conscious investors.

Dividend Payouts

Archer Daniels Midland (ADM) exemplifies a cash cow through its consistent dividend payouts, showcasing robust financial stability. The company's commitment to returning value is evident in its long-standing history of uninterrupted dividends. ADM declared a 2% rise in its quarterly dividend, underscoring financial health. This marks 93 years of continuous dividends, reflecting its dependable cash flow generation.

- ADM's consistent dividend payments highlight its ability to generate cash.

- A 2% increase in the quarterly dividend was announced.

- ADM has paid uninterrupted dividends for 93 years.

Cash Cows, like ADM's Carbohydrate Solutions, generate substantial cash with low investment needs. They have high market share in stable markets. ADM's global reach and established infrastructure solidify its cash cow status.

| Characteristic | Description | ADM Example |

|---|---|---|

| Market Position | High market share in mature markets | Starches and Sweeteners |

| Cash Flow | Generates strong, reliable cash flow | Consistent dividend payouts |

| Investment Needs | Low need for additional investment | Established processing and logistics |

Dogs

The Refined Products sector, part of ADM's Ag Services & Oilseeds, saw operating profit decrease. This decline suggests potential issues. In 2024, this segment's performance lagged. Strategic changes or even divestiture may be necessary.

Dogs represent business units with low market share in a slow-growing market, often generating low profits or losses. ADM's move to potentially divest $2 billion in underperforming assets indicates a strategic shift. This aligns with the goal to improve profitability and focus on core, high-growth areas. In 2024, ADM's strategic actions have been focused on optimizing its portfolio.

ADM's Global Cocoa Business is a dog. Historically, ADM has divested businesses like the Global Cocoa Business. In 2024, ADM's strategic focus shifted away from cocoa. This indicates a willingness to exit markets that don't align with its goals.

Areas Facing Demand Challenges

Demand fulfillment issues, particularly in EMEA flavors and pet nutrition, pose significant challenges. These areas need substantial improvements to prevent them from becoming "dogs" within the ADM BCG Matrix. ADM's 2023 annual report highlighted these specific areas as needing strategic focus for growth. The company's 2024 outlook emphasizes operational efficiency to address these challenges, aiming to improve profitability and market position.

- EMEA flavors saw revenue declines in 2023.

- Pet nutrition faces increased competition.

- Operational improvements are key to turning around these areas.

- ADM's 2024 strategy focuses on these improvements.

Businesses with Negative Timing Impacts

Segments like Refined Products with persistent negative timing impacts are potential "Dogs" in the ADM BCG Matrix. If these issues remain unaddressed, they can drain resources. ADM faced a net negative timing impact of about $430 million year-over-year. This financial strain suggests a need for strategic reassessment.

- Refined Products is one of the segments.

- Persistent negative timing impacts can be a red flag.

- $430 million net negative timing impact (year-over-year).

- Strategic reassessment is needed.

Dogs in the ADM BCG Matrix are struggling business units. They typically have low market share in slow-growing markets. ADM has actively divested such segments, like its Global Cocoa Business.

| Category | Example | 2024 Status |

|---|---|---|

| Low Growth/Share | Global Cocoa | Divested |

| Demand Issues | EMEA Flavors | Revenue Decline |

| Financial Strain | Refined Products | $430M Negative Impact |

Question Marks

ADM's plant-based protein ventures position it as a "Question Mark" in the BCG Matrix. The global plant-based food market is projected to reach $77.8 billion by 2025. ADM has invested heavily in this area, with 2024 seeing increased focus on soy and pea protein. These investments aim to capture market share within the rapidly expanding plant-based sector.

ADM's specialty ingredients, catering to health and wellness trends, are crucial. The company's focus on areas like gut health and healthy aging is strategic. In 2024, ADM's Health & Wellness segment saw significant growth. ADM's revenue from these ingredients shows its commitment to innovation. This positions ADM well for future market opportunities.

ADM's regenerative agriculture programs are still evolving, aiming to reshape supply chains. These programs focus on carbon sequestration and soil health improvements. In 2024, ADM invested $15 million in these initiatives. This could lead to new revenue streams.

BioSolutions

ADM's BioSolutions is a "Question Mark" in the BCG matrix. It represents a business unit with high growth potential but a low market share. To scale, ADM can invest in R&D for innovative and sustainable products. This could lead to significant future growth in various sectors. For example, the global bio-based chemicals market was valued at $98.8 billion in 2023.

- Focus on sustainable solutions to meet growing demand.

- Invest in research and development for new product lines.

- Explore strategic partnerships to boost market presence.

- Monitor market trends to adapt to consumer needs.

Personalized Nutrition

Personalized nutrition is gaining traction, and ADM can utilize its ingredient knowledge to create customized products. This involves tailoring food and supplements based on individual needs, such as genetics and lifestyle. The personalized nutrition market was valued at $7.9 billion in 2024. ADM's strategic approach in this area can position them as a key player.

- Market growth is projected to reach $16.4 billion by 2030.

- ADM can develop products for specific health goals.

- Focus on consumer-centric solutions.

- Leverage data and technology for customized offerings.

ADM’s plant-based protein ventures are "Question Marks." These ventures capitalize on the growing plant-based food market. ADM invested in soy and pea protein in 2024. The strategy aims to capture market share.

| Category | Details |

|---|---|

| Market Size (2025 Proj.) | $77.8B (Global Plant-Based Food) |

| ADM Focus (2024) | Soy & Pea Protein Investments |

| Goal | Increase Market Share |

BCG Matrix Data Sources

This ADM BCG Matrix leverages financial statements, market analyses, and competitor evaluations for a data-driven perspective.